Global Blood Transfusion Diagnostics Market Overview

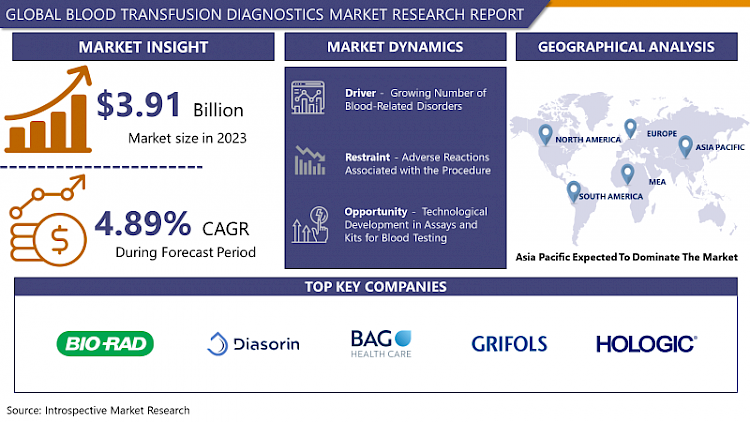

Global market for Blood Transfusion Diagnostics was estimated at USD 3.91 Billion in 2023 and is projected to reach USD 6.01 Billion by 2032, growing at a CAGR of 4.89% during the forecast period (2024-2032)

A blood transfusion is a medical treatment in which the recipient receives donated blood through a small tube inserted into a vein of the arm. This is a life-saving procedure that can help, replace blood lost due to surgery or injury or can replenish blood components lost due to chronic health conditions. Blood transfusion can also make up for the diseases that prevent the body from synthesizing blood or other blood components. The main purpose of blood transfusion diagnostics is to minimize the possibility of transmitting an infectious agent from a unit of donated blood to the recipient. Blood transfusion diagnostics got impedance in mid to late 1980s, when the first case of AIDS was reported in hemophiliacs and the first possible case of transfusion-associated AIDS was reported in an infant. To avoid such situations, governments around the world amended regulations for blood screening to prevent future infections through blood transfusion procedures. The advancement in technologies led to the production of kits & reagents that can detect the presence of contagious elements within minutes. The rise in the number of individuals suffering from health conditions that require blood transfusion is stimulating the growth of the blood transfusion diagnostics market over the forecast period.

Key Factors And Market Dynamics of Blood Transfusion Diagnostics Market

Drivers:

Transfusion-Transmissible Infections (TTI) markers (HIV antigen-antibody, HBsAg, anti-HCV, and syphilis) are regularly screened in blood transfusion facilities. The primary cause for this is to shorten the screening process so that blood or blood components, particularly labile components like platelets, can be delivered quickly. Reactive contributions are first separated and eliminated thus, reducing the chances of disease transfer through blood transfusion. There has been a significant rise in the number of individuals suffering from chronic conditions that require a routine blood supply to maintain the standard level of blood components. Moreover, accident cases require more blood units than normal transfusion methods thereby, propelling the demand for blood transfusion diagnostics market in the forecast period.

There has been a rise in the number of blood donations across the globe. According to WHO, about 118.4 million blood donations are collected worldwide. Compared to 82 percent in lower-middle-income countries and 80.3 percent in low-income countries, 99.8 percent of samples are screened in high-income countries and 99.9 percent in upper-middle-income countries, following basic quality standards. Thus, this large-scale screening of donated blood has fueled the demand for blood transfusion diagnostics equipments.

Restraints:

The negligence shown by some blood banks and hospitals regarding blood screening in low-income countries is the main factor hampering the development of the blood transfusion diagnostics market. Less spending on healthcare infrastructure and the lack of skilled professionals to handle automated diagnostics solutions in low- and middle-income countries has restrained the growth of the market in these regions. Moreover, the high costs of tests, instruments, and reagents utilized in blood screening methods are hindering the expansion of the blood transfusion diagnostics market.

Opportunities:

The growing prevalence of chronic diseases such as anemia, cancer, liver & kidney disorders, hemophilia, sickle cell disease, and thrombocytopenia are creating a huge demand for blood components. According to WHO, anemia affects 1.62 billion people worldwide and most of them require blood to maintain healthy levels of red blood cell count. This increasing number of anemic individuals is surging the demand for blood transfusion diagnostics to prevent the transfer of infectious diseases. Furthermore, developed as well as developing countries are spreading awareness among individuals, regarding blood safety from infectious diseases through several campaigns. With the growing number of individuals suffering from cancer, and liver & kidney disorders the demand for blood is going to upsurge and so does for screening tests thereby, creating a profitable opportunity for the market players involved in the blood transfusion diagnostics market.

Market Segmentation

Segmentation Analysis of Blood Transfusion Diagnostics Market:

Depending on the application, the disease screening segment is anticipated to have the highest share of the blood transfusion diagnostics market. Screening of blood plays an important role, as it eliminates or discards the blood that has the potential to pose a threat to the receiver's health conditions. An upsurge in the number of individuals undergoing surgical operations, and medical disorders that requires blood transfusion are the main factors creating a huge demand for blood screening procedures. Moreover, R&D activities to develop a single technique that can detect the presence of multiple pathogens are promoting the development of this segment over the analysis period.

Depending on the technology, the nucleic acid amplification segment is predicted to lead the blood transfusion diagnostics market over the analysis period. Most of the blood banks worldwide utilize Nucleic acid testing (NAT), as these are fast and reliable as compared to other tests. NAT is 99.9 specific for the agent for which they are employed. Moreover, real-time PCR techniques have been widely utilized to detect the presence of flu viruses, and most recently for the detection of the SARS CoV-2 virus. The increasing popularity of the NAT test over the ELISA test due to the high specificity and sensitivity for viral pathogens is promoting the expansion of the NAT segment over the projected period.

Depending on product type, the kits & reagents segment is expected to dominate the blood transfusion diagnostics market in the projected period. Screening of blood samples of different individuals can be done more efficiently with the usage of screening kits. Moreover, there are many kits available in the market that can detect multiple pathogens at a single time thus, the demand for kits & reagents is going to rise in the projected period.

Depending on end-users, the hospital & blood banks segment is projected to lead the blood transfusion diagnostics market in the forecast period. The large number of individuals visiting blood banks and hospitals for blood donation is the major cause driving the growth of this segment. In these facilities before transfusion therapy, several diseases screening procedures are performed according to the regulatory standards set by the local governments. Standard tests such as HIV & syphilis screening, Rh & blood type, and hepatitis C are performed on the donated blood.

Regional Analysis of Blood Transfusion Diagnostics Market:

The North American region is anticipated to have the highest share of the blood transfusion diagnostics market during the projected period. The market in the United States was estimated at US$ 912.8 million in the year 2020. The statistics reported by Community Blood Center show that 4.5 million Americans will need blood transfusion each year, and about 43,000 pints of blood donated is transfused each day in the U.S. and Canada. The rise in the number of individuals donating blood and the growing requirement for blood are the main factors stimulating the development of the blood transfusion diagnostics market in the forecast period.

The European region is expected to have the second-highest share of the blood transfusion diagnostics market over the analysis period attributed to the rise in the number of blood donations campaign by private and government organizations. According to European Commission, 20 million units of blood were collected in the European region in the year 2019. With more population voluntarily donating blood, there has been a significant rise in the usage of blood screening tools to prevent the transfer of infectious diseases from donor to recipient. Furthermore, the increasing prevalence of liver and kidney disorders is fueling the demand for blood thereby, supporting the growth of the blood transfusion diagnostics market over the analysis period.

The blood transfusion diagnostic market in the Asia-Pacific region is expected to have developed at the highest CAGR owing to the high prevalence of transfusion-transmissible infections in low-income countries. Initiatives are being taken by the government and private organizations to spread awareness about the importance of blood donations and to promote individuals to voluntarily donate blood. Asia-Pacific being the most densely populated region, the demand for blood screening is expected to rise in the coming years thus, consolidating the expansion of the blood transfusion diagnostics market in this region during the projected period.

Players Covered in Blood Transfusion Diagnostics Market are:

- Bio-Rad Laboratories Inc. (US) DiaSorin SpA (Italy)Bag Health Care GmbH (Germany)

- Grifols International SA (Spain)

- Hologic Inc. (the US)

- Immucor Inc. (the US)

- Abbott Laboratories (US)

- Ortho Clinical Diagnostics Inc. (the US)

- Quotient Ltd (Switzerland)

- F. Hoffmann-La Roche AG (Switzerland)

Recent Industry Developments In Blood Transfusion Diagnostics Market

- In January 2024, Bio-Rad Laboratories, Inc. a global leader in life science research and clinical diagnostic products, announced the launch of its first ultrasensitive multiplexed digital PCR assay, the ddPLEX ESR1 Mutation Detection Kit. The assay expands the company’s Droplet Digital PCR (ddPCR™) offering for the oncology market, where highly sensitive and multiplexed mutation detection assays aid translational research, therapy selection, and disease monitoring.

- In November 2023, Grifols one of the world’s leading producers of plasma-derived medicines and innovative diagnostic solutions, announced the launch of its new Grifols sCD38 solution, the industry’s first-ever soluble recombinant protein designed to block anti-CD38 antibodies in multiple myeloma patients receiving daratumumab therapy, ensuring quick and accurate blood transfusion tests that are critical for proper treatment.

|

Global Blood Transfusion Diagnostics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.89% |

Market Size in 2032: |

USD 6.01 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Product Type |

|

||

|

|

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Application

3.2 By Technology

3.3 By Product Type

3.4 By End-Use

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Blood Transfusion Diagnostics Market by Application

4.1 Blood Transfusion Diagnostics Market Overview Snapshot and Growth Engine

4.2 Blood Transfusion Diagnostics Market Overview

4.3 Blood Grouping

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Blood Grouping: Grographic Segmentation

4.4 Disease Screening

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Disease Screening: Grographic Segmentation

4.5 Research Studies

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Research Studies: Grographic Segmentation

Chapter 5: Blood Transfusion Diagnostics Market by Technology

5.1 Blood Transfusion Diagnostics Market Overview Snapshot and Growth Engine

5.2 Blood Transfusion Diagnostics Market Overview

5.3 Nucleic Acid Amplification {Real-Time Pcr}

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Nucleic Acid Amplification {Real-Time Pcr}: Grographic Segmentation

5.4 Elisa {Chemiluminescence Immunoassay}

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Elisa {Chemiluminescence Immunoassay}: Grographic Segmentation

5.5 Rapid Test

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Rapid Test: Grographic Segmentation

5.6 Western Blot

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Western Blot: Grographic Segmentation

Chapter 6: Blood Transfusion Diagnostics Market by Product Type

6.1 Blood Transfusion Diagnostics Market Overview Snapshot and Growth Engine

6.2 Blood Transfusion Diagnostics Market Overview

6.3 Instruments

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Instruments: Grographic Segmentation

6.4 Kits & Reagents

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Kits & Reagents: Grographic Segmentation

Chapter 7: Blood Transfusion Diagnostics Market by End-Use

7.1 Blood Transfusion Diagnostics Market Overview Snapshot and Growth Engine

7.2 Blood Transfusion Diagnostics Market Overview

7.3 Hospitals And Blood Banks

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals And Blood Banks: Grographic Segmentation

7.4 Diagnostic Laboratories

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Diagnostic Laboratories: Grographic Segmentation

7.5 Plasma Fractionation Companies

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Plasma Fractionation Companies: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Blood Transfusion Diagnostics Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Blood Transfusion Diagnostics Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Blood Transfusion Diagnostics Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 BIO-RAD LABORATORIES INC. (US) DIASORIN SPA (ITALY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 GRIFOLS INTERNATIONAL SA (SPAIN)

8.4 HOLOGIC INC. (THE US)

8.5 IMMUCOR INC. (THE US)

8.6 BAG HEALTH CARE GMBH (GERMANY)

8.7 ABBOTT LABORATORIES (US)

8.8 ORTHO CLINICAL DIAGNOSTICS INC. (THE US)

8.9 QUOTIENT LTD (SWITZERLAND)

8.10 F. HOFFMANN-LA ROCHE AG (SWITZERLAND)

8.11

Chapter 9: Global Blood Transfusion Diagnostics Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Application

9.2.1 Blood Grouping

9.2.2 Disease Screening

9.2.3 Research Studies

9.3 Historic and Forecasted Market Size By Technology

9.3.1 Nucleic Acid Amplification {Real-Time Pcr}

9.3.2 Elisa {Chemiluminescence Immunoassay}

9.3.3 Rapid Test

9.3.4 Western Blot

9.4 Historic and Forecasted Market Size By Product Type

9.4.1 Instruments

9.4.2 Kits & Reagents

9.5 Historic and Forecasted Market Size By End-Use

9.5.1 Hospitals And Blood Banks

9.5.2 Diagnostic Laboratories

9.5.3 Plasma Fractionation Companies

Chapter 10: North America Blood Transfusion Diagnostics Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Application

10.4.1 Blood Grouping

10.4.2 Disease Screening

10.4.3 Research Studies

10.5 Historic and Forecasted Market Size By Technology

10.5.1 Nucleic Acid Amplification {Real-Time Pcr}

10.5.2 Elisa {Chemiluminescence Immunoassay}

10.5.3 Rapid Test

10.5.4 Western Blot

10.6 Historic and Forecasted Market Size By Product Type

10.6.1 Instruments

10.6.2 Kits & Reagents

10.7 Historic and Forecasted Market Size By End-Use

10.7.1 Hospitals And Blood Banks

10.7.2 Diagnostic Laboratories

10.7.3 Plasma Fractionation Companies

10.8 Historic and Forecast Market Size by Country

10.8.1 U.S.

10.8.2 Canada

10.8.3 Mexico

Chapter 11: Europe Blood Transfusion Diagnostics Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Application

11.4.1 Blood Grouping

11.4.2 Disease Screening

11.4.3 Research Studies

11.5 Historic and Forecasted Market Size By Technology

11.5.1 Nucleic Acid Amplification {Real-Time Pcr}

11.5.2 Elisa {Chemiluminescence Immunoassay}

11.5.3 Rapid Test

11.5.4 Western Blot

11.6 Historic and Forecasted Market Size By Product Type

11.6.1 Instruments

11.6.2 Kits & Reagents

11.7 Historic and Forecasted Market Size By End-Use

11.7.1 Hospitals And Blood Banks

11.7.2 Diagnostic Laboratories

11.7.3 Plasma Fractionation Companies

11.8 Historic and Forecast Market Size by Country

11.8.1 Germany

11.8.2 U.K.

11.8.3 France

11.8.4 Italy

11.8.5 Russia

11.8.6 Spain

Chapter 12: Asia-Pacific Blood Transfusion Diagnostics Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Application

12.4.1 Blood Grouping

12.4.2 Disease Screening

12.4.3 Research Studies

12.5 Historic and Forecasted Market Size By Technology

12.5.1 Nucleic Acid Amplification {Real-Time Pcr}

12.5.2 Elisa {Chemiluminescence Immunoassay}

12.5.3 Rapid Test

12.5.4 Western Blot

12.6 Historic and Forecasted Market Size By Product Type

12.6.1 Instruments

12.6.2 Kits & Reagents

12.7 Historic and Forecasted Market Size By End-Use

12.7.1 Hospitals And Blood Banks

12.7.2 Diagnostic Laboratories

12.7.3 Plasma Fractionation Companies

12.8 Historic and Forecast Market Size by Country

12.8.1 China

12.8.2 India

12.8.3 Japan

12.8.4 Southeast Asia

Chapter 13: South America Blood Transfusion Diagnostics Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Application

13.4.1 Blood Grouping

13.4.2 Disease Screening

13.4.3 Research Studies

13.5 Historic and Forecasted Market Size By Technology

13.5.1 Nucleic Acid Amplification {Real-Time Pcr}

13.5.2 Elisa {Chemiluminescence Immunoassay}

13.5.3 Rapid Test

13.5.4 Western Blot

13.6 Historic and Forecasted Market Size By Product Type

13.6.1 Instruments

13.6.2 Kits & Reagents

13.7 Historic and Forecasted Market Size By End-Use

13.7.1 Hospitals And Blood Banks

13.7.2 Diagnostic Laboratories

13.7.3 Plasma Fractionation Companies

13.8 Historic and Forecast Market Size by Country

13.8.1 Brazil

13.8.2 Argentina

Chapter 14: Middle East & Africa Blood Transfusion Diagnostics Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Application

14.4.1 Blood Grouping

14.4.2 Disease Screening

14.4.3 Research Studies

14.5 Historic and Forecasted Market Size By Technology

14.5.1 Nucleic Acid Amplification {Real-Time Pcr}

14.5.2 Elisa {Chemiluminescence Immunoassay}

14.5.3 Rapid Test

14.5.4 Western Blot

14.6 Historic and Forecasted Market Size By Product Type

14.6.1 Instruments

14.6.2 Kits & Reagents

14.7 Historic and Forecasted Market Size By End-Use

14.7.1 Hospitals And Blood Banks

14.7.2 Diagnostic Laboratories

14.7.3 Plasma Fractionation Companies

14.8 Historic and Forecast Market Size by Country

14.8.1 Saudi Arabia

14.8.2 South Africa

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Blood Transfusion Diagnostics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.89% |

Market Size in 2032: |

USD 6.01 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Product Type |

|

||

|

|

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BLOOD TRANSFUSION DIAGNOSTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BLOOD TRANSFUSION DIAGNOSTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BLOOD TRANSFUSION DIAGNOSTICS MARKET COMPETITIVE RIVALRY

TABLE 005. BLOOD TRANSFUSION DIAGNOSTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BLOOD TRANSFUSION DIAGNOSTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. BLOOD TRANSFUSION DIAGNOSTICS MARKET BY APPLICATION

TABLE 008. BLOOD GROUPING MARKET OVERVIEW (2016-2028)

TABLE 009. DISEASE SCREENING MARKET OVERVIEW (2016-2028)

TABLE 010. RESEARCH STUDIES MARKET OVERVIEW (2016-2028)

TABLE 011. BLOOD TRANSFUSION DIAGNOSTICS MARKET BY TECHNOLOGY

TABLE 012. NUCLEIC ACID AMPLIFICATION {REAL-TIME PCR} MARKET OVERVIEW (2016-2028)

TABLE 013. ELISA {CHEMILUMINESCENCE IMMUNOASSAY} MARKET OVERVIEW (2016-2028)

TABLE 014. RAPID TEST MARKET OVERVIEW (2016-2028)

TABLE 015. WESTERN BLOT MARKET OVERVIEW (2016-2028)

TABLE 016. BLOOD TRANSFUSION DIAGNOSTICS MARKET BY PRODUCT TYPE

TABLE 017. INSTRUMENTS MARKET OVERVIEW (2016-2028)

TABLE 018. KITS & REAGENTS MARKET OVERVIEW (2016-2028)

TABLE 019. BLOOD TRANSFUSION DIAGNOSTICS MARKET BY END-USE

TABLE 020. HOSPITALS AND BLOOD BANKS MARKET OVERVIEW (2016-2028)

TABLE 021. DIAGNOSTIC LABORATORIES MARKET OVERVIEW (2016-2028)

TABLE 022. PLASMA FRACTIONATION COMPANIES MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 025. NORTH AMERICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 026. NORTH AMERICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY END-USE (2016-2028)

TABLE 027. N BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 029. EUROPE BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 030. EUROPE BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 031. EUROPE BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY END-USE (2016-2028)

TABLE 032. BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 034. ASIA PACIFIC BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 035. ASIA PACIFIC BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 036. ASIA PACIFIC BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY END-USE (2016-2028)

TABLE 037. BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY END-USE (2016-2028)

TABLE 042. BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 043. SOUTH AMERICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 044. SOUTH AMERICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 045. SOUTH AMERICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 046. SOUTH AMERICA BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY END-USE (2016-2028)

TABLE 047. BLOOD TRANSFUSION DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 048. BIO-RAD LABORATORIES INC. (US) DIASORIN SPA (ITALY): SNAPSHOT

TABLE 049. BIO-RAD LABORATORIES INC. (US) DIASORIN SPA (ITALY): BUSINESS PERFORMANCE

TABLE 050. BIO-RAD LABORATORIES INC. (US) DIASORIN SPA (ITALY): PRODUCT PORTFOLIO

TABLE 051. BIO-RAD LABORATORIES INC. (US) DIASORIN SPA (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. GRIFOLS INTERNATIONAL SA (SPAIN): SNAPSHOT

TABLE 052. GRIFOLS INTERNATIONAL SA (SPAIN): BUSINESS PERFORMANCE

TABLE 053. GRIFOLS INTERNATIONAL SA (SPAIN): PRODUCT PORTFOLIO

TABLE 054. GRIFOLS INTERNATIONAL SA (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. HOLOGIC INC. (THE US): SNAPSHOT

TABLE 055. HOLOGIC INC. (THE US): BUSINESS PERFORMANCE

TABLE 056. HOLOGIC INC. (THE US): PRODUCT PORTFOLIO

TABLE 057. HOLOGIC INC. (THE US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. IMMUCOR INC. (THE US): SNAPSHOT

TABLE 058. IMMUCOR INC. (THE US): BUSINESS PERFORMANCE

TABLE 059. IMMUCOR INC. (THE US): PRODUCT PORTFOLIO

TABLE 060. IMMUCOR INC. (THE US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. BAG HEALTH CARE GMBH (GERMANY): SNAPSHOT

TABLE 061. BAG HEALTH CARE GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 062. BAG HEALTH CARE GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 063. BAG HEALTH CARE GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ABBOTT LABORATORIES (US): SNAPSHOT

TABLE 064. ABBOTT LABORATORIES (US): BUSINESS PERFORMANCE

TABLE 065. ABBOTT LABORATORIES (US): PRODUCT PORTFOLIO

TABLE 066. ABBOTT LABORATORIES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. ORTHO CLINICAL DIAGNOSTICS INC. (THE US): SNAPSHOT

TABLE 067. ORTHO CLINICAL DIAGNOSTICS INC. (THE US): BUSINESS PERFORMANCE

TABLE 068. ORTHO CLINICAL DIAGNOSTICS INC. (THE US): PRODUCT PORTFOLIO

TABLE 069. ORTHO CLINICAL DIAGNOSTICS INC. (THE US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. QUOTIENT LTD (SWITZERLAND): SNAPSHOT

TABLE 070. QUOTIENT LTD (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 071. QUOTIENT LTD (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 072. QUOTIENT LTD (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. F. HOFFMANN-LA ROCHE AG (SWITZERLAND): SNAPSHOT

TABLE 073. F. HOFFMANN-LA ROCHE AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 074. F. HOFFMANN-LA ROCHE AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 075. F. HOFFMANN-LA ROCHE AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. : SNAPSHOT

TABLE 076. : BUSINESS PERFORMANCE

TABLE 077. : PRODUCT PORTFOLIO

TABLE 078. : KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BLOOD TRANSFUSION DIAGNOSTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BLOOD TRANSFUSION DIAGNOSTICS MARKET OVERVIEW BY APPLICATION

FIGURE 012. BLOOD GROUPING MARKET OVERVIEW (2016-2028)

FIGURE 013. DISEASE SCREENING MARKET OVERVIEW (2016-2028)

FIGURE 014. RESEARCH STUDIES MARKET OVERVIEW (2016-2028)

FIGURE 015. BLOOD TRANSFUSION DIAGNOSTICS MARKET OVERVIEW BY TECHNOLOGY

FIGURE 016. NUCLEIC ACID AMPLIFICATION {REAL-TIME PCR} MARKET OVERVIEW (2016-2028)

FIGURE 017. ELISA {CHEMILUMINESCENCE IMMUNOASSAY} MARKET OVERVIEW (2016-2028)

FIGURE 018. RAPID TEST MARKET OVERVIEW (2016-2028)

FIGURE 019. WESTERN BLOT MARKET OVERVIEW (2016-2028)

FIGURE 020. BLOOD TRANSFUSION DIAGNOSTICS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 021. INSTRUMENTS MARKET OVERVIEW (2016-2028)

FIGURE 022. KITS & REAGENTS MARKET OVERVIEW (2016-2028)

FIGURE 023. BLOOD TRANSFUSION DIAGNOSTICS MARKET OVERVIEW BY END-USE

FIGURE 024. HOSPITALS AND BLOOD BANKS MARKET OVERVIEW (2016-2028)

FIGURE 025. DIAGNOSTIC LABORATORIES MARKET OVERVIEW (2016-2028)

FIGURE 026. PLASMA FRACTIONATION COMPANIES MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA BLOOD TRANSFUSION DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE BLOOD TRANSFUSION DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC BLOOD TRANSFUSION DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA BLOOD TRANSFUSION DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA BLOOD TRANSFUSION DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the market research report is 2024-2032.

Global market for Blood Transfusion Diagnostics was estimated at USD 3.91 Billion in 2023 and is projected to reach USD 6.01 Billion by 2032, growing at a CAGR of 4.89% during the forecast period (2024-2032)