Global Liver Cancer Diagnostics Market Overview

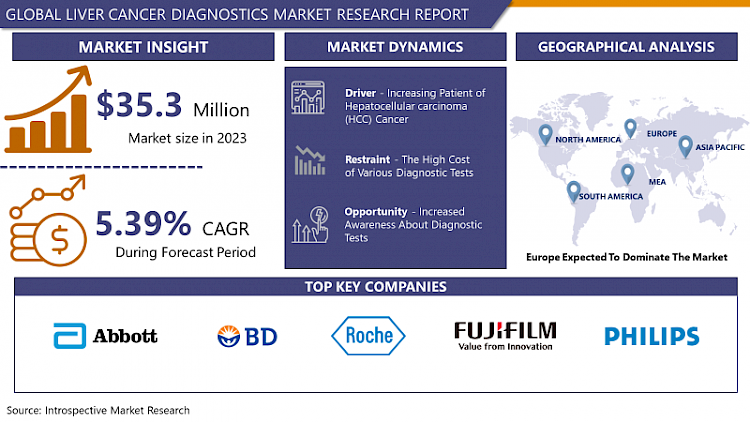

Global Liver Cancer Diagnostics Market was valued at USD 35.3 Million in 2023 and is expected to reach USD 56.62 Million by the year 2032, at a CAGR of 5.39%.

The liver is the largest organ in the human body. It plays a vital role in removing toxins from the body’s blood supply, maintaining healthy blood sugar levels, and regulating blood clots. The liver regulates most chemical levels in the blood and excretes bile juice which helps in the digestion of fats. The liver processes all of the blood that leaves the stomach and intestines. It breaks down complex substances into simpler substances, and releases nutrients from the blood. The liver also metabolizes drugs into simpler forms that can be absorbed by the rest of the body parts. Moreover, more than 500 vital functions have been identified to be associated with the liver. Several types of cancer can form in the liver but the most predominant type of liver cancer is hepatocellular carcinoma, which originates in the main type of liver cell (hepatocyte). Other types of liver cancer, such as intrahepatic cholangiocarcinoma and hepatoblastoma, are rarely reported. Liver cancer is a result of mutations in the cells of the liver. When these cells begin to grow out of control a tumor is formed which may result in abdominal swelling, white, chalky stools, and localized pain in the upper abdominal. Thus, to detect liver cancer in its early stage and prevent it from spreading to other parts of the body, diagnosis of liver cancer is very important thereby, supporting the growth of the market over the forecast period.

Market Dynamics and Key Factors of Liver Cancer Diagnostics Market

Drivers:

Hepatocellular carcinoma (HCC) is the sixth most diagnosed cancer in the world, which accounts for approximately 6% of all cancer incidences. Approximately 1.5 billion people worldwide have chronic liver disease, mainly due to viral hepatitis and alcoholic, non-alcoholic fatty liver disease. The growing consumption of alcohol and tobacco and sedentary lifestyle are the main factors responsible for the prognosis of liver cancer in many individuals. The accurate detection of liver cancer type and its progression are very essential for the determination of appropriate treatment. Moreover, the rise in the number of programs to spread awareness among individuals about the early detection of liver cancer and the supportive government initiatives to provide affordable healthcare services to individuals are the prime factors consolidating the expansion of liver cancer diagnostics over the forecast period.

Hepatocellular carcinoma (HCC) diagnostics and liver carcinoma diagnostics are the two main diagnostics procedures that are currently in demand and are expected to have high demand in the analysis period. According to Statista, the per capita worldwide alcohol consumption is projected to reach 8.1 liters by 2025. In addition, the annual report of WHO states that 830,000 cancer deaths in 2020 were from liver cancer. Furthermore, Hepatitis B is a type of human papillomavirus (HPV) that increases the risk of liver cancer. All these factors are pointing towards the upcoming rise in the number of individuals getting diagnosed with liver cancer thus, the demand for liver cancer diagnostic is going to increase in the forecast period, thereby strengthening the expansion of the market.

Restraints:

The high cost of various diagnostic tests is the key impediment to the growth of the liver cancer diagnostic market during the forecast period. Certain diagnostics options are expensive in developing countries such as Brazil, Africa, Bangladesh, Pakistan, and India. Furthermore, many insurance companies do not fund the diagnostic tests that are used to diagnose cancer. As a result, patients from the middle class cannot easily afford these tests, thus stifling the growth of the liver cancer diagnostic market in these regions. The lack of public awareness about the benefits of liver cancer diagnostic procedures, as well as certain people's refusal to undergo diagnostic tests, would negatively impact the market growth over the analyzed period.

Opportunities:

The rising frequency of liver cancer and increased awareness of diagnostic tests in developed nations is generating a profitable opportunity for liver cancer diagnostics market participants. There has been an upsurge in funding for research and development activities focused on developing innovative diagnostic methods for the early detection of liver cancer. For instance, technologies such as fluorescent in situ hybridization (FISH), comparative genomic hybridization (CGH), and immunohistochemical (IHC) have modified the way liver cancer is detected. Furthermore, numerous governments have collaborated with service providers to provide affordable diagnostic tests for people with low-income, thus creating a profitable opportunity for market participants.

Market Segmentation

Segmentation Analysis of Liver Cancer Diagnostics Market:

Depending on diagnosis technique, the imaging segment is forecasted to have the highest share of the liver cancer diagnostics market. This segment is projected to reach US$ 14 million by the end of the forecast period. The imaging techniques utilized in liver cancer diagnostics are ultrasonography (US), computed tomography (CT), magnetic resonance imaging (MRI), and positron emission tomography (PET). Hepatocellular carcinoma (HCC) is unique cancer that is mostly diagnosed radiographically without histological confirmation when demonstrating distinctive qualities such as arterial phase hyperenhancement and delayed phase washout. HCC can be detected in its early stage with the help of imaging techniques where pathological evidence can give a fake negative test. This characteristic of imaging technique can help healthcare professionals to detect and eliminate liver cancer in its early stage thus, supporting the development of the imaging segment during the analysis period.

Depending on end-users, the hospital segment is anticipated to lead the liver cancer diagnostics market in the projected period. Hospitals are the primary healthcare services in each economy. Moreover, in several countries these hospitals are backed by governments thus, helping every individual to avail healthcare facilities in affordable prices. For instance, the Central Government of India has launched a plan to support the efforts of State Government programs like the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS) under the commission of the National Health Mission (NHM). The main focus of this program will be infrastructure development, health promotion and awareness generation, early diagnosis, management, and referral to an appropriate level institution/hospital for treatment. The Indian Government has also planned to set up 19 State Cancer Institutes (SCIs) and 20 Tertiary Care Cancer Centers (TCCCs). Similar initiatives are taken by other economies in this region, thus consolidating the expansion of the hospital segment.

Regional Analysis of Liver Cancer Diagnostics Market:

The European region is anticipated to have the highest share of the liver cancer diagnostics market in the projected period, attributed to the rise in the alcohol-consuming population. According to WHO, the European region accounts for the highest proportion of total ill health and premature death due to alcohol consumption globally. Additionally, the European region is the heaviest-drinking region across the globe, with over one-fifth of the European population aged 15 years and above reporting heavy episodic drinking at least once a week. Heavy episodic drinking is widespread across all of Europe and in almost all age groups, thus these populations are at higher risk of developing liver cancer in their lifetime thereby, supporting the expansion of the liver cancer diagnostics market over the forecast period.

The North American region is expected to have the second-highest share of the liver cancer diagnostics market during the analysis period attributed to the increasing prevalence of liver cancer among individuals. According to CDC, in the United States, approximately 24,500 men and 10,000 women are diagnosed with liver cancer every year, and about 18,600 men and 9,000 women die from it every year. Moreover, to develop diagnostics tests that can detect the presence of liver cancer in its early stage, there has been a rise in government fundings to promote the research and development activities. The rise in alcohol consumption in countries such as the US, Canada, and Mexico are increasing the chances of liver cancer among individuals thus, strengthening the expansion of the liver cancer diagnostic market in this region.

The Asia-Pacific region is forecasted to develop at the highest CAGR in the timespan of the forecast. The growing technological advancement and the ready adoption of these technologies by healthcare sectors of several economies are stimulating the growth of the liver cancer diagnostics market in this region. In China, more than 410,000 individuals are diagnosed with liver cancer every year and approximately 391,000 individuals die from it. Additionally, China experiences almost half of all new liver cancer cases diagnosed globally. Furthermore, the increasing prevalence of liver cancer in India, and Japan is promoting the development of the liver cancer market in this region.

Players Covered in Liver Cancer Diagnostics Market are:

- Abbott Laboratories (US)

- Becton Dickinson and Company (US)

- F. Hoffmann-La Roche Ltd (Switzerland)

- FUJIFILM Wako Diagnostics U.S.A. Corporation (US)

- Hologic (US)

- Illumina Inc. (US)

- Koninklijke Philips (Netherlands)

- Oncimmune Holdings Plc (UK)

- Qiagen (Germany)

- Siemens Healthineers (Germany)

- Sirtex Medical Ltd. (US)

- Thermo Fischer Scientific Inc. (US)

- BDR Pharmaceuticals Internationals Pvt. Ltd. (India) and others major players.

Key Industry Developments in Liver Cancer Diagnostics Market

- In June 2023, Royal Philips awarded a USD 25.76 million Innovative Health Initiative (IHI) grant to the IMAGIO consortium of clinical partners, consisting of approximately 30 partners. The funding will be used to improve clinical outcomes with interventional oncology innovations focused on lung cancer, liver cancer, and soft tissue sarcomas, aiming to develop less invasive cancer treatments.

- In December 2022, Fujifilm Corporation agreed to acquire Inspirata's digital pathology technology assets, integrating their offerings, customers, and employees. The acquisition aims to strengthen Fujifilm's healthcare partnership by bridging the technological gap between pathology, radiology, and oncology, facilitating a more collaborative approach to care delivery across the enterprise.

|

Global Liver Cancer Diagnostics Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023 -2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 35.3 Mn. |

|

Forecast Period 2023-32 CAGR: |

5.39% |

Market Size in 2032: |

USD 56.62 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Liver Cancer Diagnostics Market by Type

5.1 Liver Cancer Diagnostics Market Overview Snapshot and Growth Engine

5.2 Liver Cancer Diagnostics Market Overview

5.3 Imaging

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Imaging: Grographic Segmentation

5.4 Laboratory Test

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Laboratory Test: Grographic Segmentation

5.5 Endoscopy

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Endoscopy: Grographic Segmentation

5.6 Biopsy

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Biopsy: Grographic Segmentation

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Grographic Segmentation

Chapter 6: Liver Cancer Diagnostics Market by Application

6.1 Liver Cancer Diagnostics Market Overview Snapshot and Growth Engine

6.2 Liver Cancer Diagnostics Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Grographic Segmentation

6.4 Laboratories

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Laboratories: Grographic Segmentation

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Liver Cancer Diagnostics Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Liver Cancer Diagnostics Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Liver Cancer Diagnostics Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 ABBOTT LABORATORIES

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 BECTON DICKINSON AND COMPANY

7.4 F. HOFFMANN-LA ROCHE LTD

7.5 FUJIFILM WAKO DIAGNOSTICS U.S.A. CORPORATION

7.6 HOLOGIC

7.7 ILLUMINA INC

7.8 KONINKLIJKE PHILIPS

7.9 ONCIMMUNE HOLDINGS PLC

7.10 QIAGEN

7.11 SIEMENS HEALTHINEERS

7.12 SIRTEX MEDICAL LTD.

7.13 THERMO FISCHER SCIENTIFIC INC.

7.14 BDR PHARMACEUTICALS INTERNATIONALS PVT. LTD

7.15 OTHER MAJOR PLAYERS

Chapter 8: Global Liver Cancer Diagnostics Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Imaging

8.2.2 Laboratory Test

8.2.3 Endoscopy

8.2.4 Biopsy

8.2.5 Others

8.3 Historic and Forecasted Market Size By Application

8.3.1 Hospitals

8.3.2 Laboratories

8.3.3 Others

Chapter 9: North America Liver Cancer Diagnostics Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Imaging

9.4.2 Laboratory Test

9.4.3 Endoscopy

9.4.4 Biopsy

9.4.5 Others

9.5 Historic and Forecasted Market Size By Application

9.5.1 Hospitals

9.5.2 Laboratories

9.5.3 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Liver Cancer Diagnostics Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Imaging

10.4.2 Laboratory Test

10.4.3 Endoscopy

10.4.4 Biopsy

10.4.5 Others

10.5 Historic and Forecasted Market Size By Application

10.5.1 Hospitals

10.5.2 Laboratories

10.5.3 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Liver Cancer Diagnostics Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Imaging

11.4.2 Laboratory Test

11.4.3 Endoscopy

11.4.4 Biopsy

11.4.5 Others

11.5 Historic and Forecasted Market Size By Application

11.5.1 Hospitals

11.5.2 Laboratories

11.5.3 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Liver Cancer Diagnostics Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Imaging

12.4.2 Laboratory Test

12.4.3 Endoscopy

12.4.4 Biopsy

12.4.5 Others

12.5 Historic and Forecasted Market Size By Application

12.5.1 Hospitals

12.5.2 Laboratories

12.5.3 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Liver Cancer Diagnostics Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Imaging

13.4.2 Laboratory Test

13.4.3 Endoscopy

13.4.4 Biopsy

13.4.5 Others

13.5 Historic and Forecasted Market Size By Application

13.5.1 Hospitals

13.5.2 Laboratories

13.5.3 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Liver Cancer Diagnostics Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023 -2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 35.3 Mn. |

|

Forecast Period 2023-32 CAGR: |

5.39% |

Market Size in 2032: |

USD 56.62 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LIVER CANCER DIAGNOSTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LIVER CANCER DIAGNOSTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LIVER CANCER DIAGNOSTICS MARKET COMPETITIVE RIVALRY

TABLE 005. LIVER CANCER DIAGNOSTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. LIVER CANCER DIAGNOSTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. LIVER CANCER DIAGNOSTICS MARKET BY TYPE

TABLE 008. IMAGING MARKET OVERVIEW (2016-2028)

TABLE 009. LABORATORY TEST MARKET OVERVIEW (2016-2028)

TABLE 010. ENDOSCOPY MARKET OVERVIEW (2016-2028)

TABLE 011. BIOPSY MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. LIVER CANCER DIAGNOSTICS MARKET BY APPLICATION

TABLE 014. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 015. LABORATORIES MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 019. N LIVER CANCER DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE LIVER CANCER DIAGNOSTICS MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 022. LIVER CANCER DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC LIVER CANCER DIAGNOSTICS MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 025. LIVER CANCER DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA LIVER CANCER DIAGNOSTICS MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 028. LIVER CANCER DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 031. LIVER CANCER DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 032. ABBOTT LABORATORIES: SNAPSHOT

TABLE 033. ABBOTT LABORATORIES: BUSINESS PERFORMANCE

TABLE 034. ABBOTT LABORATORIES: PRODUCT PORTFOLIO

TABLE 035. ABBOTT LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. BECTON DICKINSON AND COMPANY: SNAPSHOT

TABLE 036. BECTON DICKINSON AND COMPANY: BUSINESS PERFORMANCE

TABLE 037. BECTON DICKINSON AND COMPANY: PRODUCT PORTFOLIO

TABLE 038. BECTON DICKINSON AND COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. F. HOFFMANN-LA ROCHE LTD: SNAPSHOT

TABLE 039. F. HOFFMANN-LA ROCHE LTD: BUSINESS PERFORMANCE

TABLE 040. F. HOFFMANN-LA ROCHE LTD: PRODUCT PORTFOLIO

TABLE 041. F. HOFFMANN-LA ROCHE LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. FUJIFILM WAKO DIAGNOSTICS U.S.A. CORPORATION: SNAPSHOT

TABLE 042. FUJIFILM WAKO DIAGNOSTICS U.S.A. CORPORATION: BUSINESS PERFORMANCE

TABLE 043. FUJIFILM WAKO DIAGNOSTICS U.S.A. CORPORATION: PRODUCT PORTFOLIO

TABLE 044. FUJIFILM WAKO DIAGNOSTICS U.S.A. CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. HOLOGIC: SNAPSHOT

TABLE 045. HOLOGIC: BUSINESS PERFORMANCE

TABLE 046. HOLOGIC: PRODUCT PORTFOLIO

TABLE 047. HOLOGIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ILLUMINA INC: SNAPSHOT

TABLE 048. ILLUMINA INC: BUSINESS PERFORMANCE

TABLE 049. ILLUMINA INC: PRODUCT PORTFOLIO

TABLE 050. ILLUMINA INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. KONINKLIJKE PHILIPS: SNAPSHOT

TABLE 051. KONINKLIJKE PHILIPS: BUSINESS PERFORMANCE

TABLE 052. KONINKLIJKE PHILIPS: PRODUCT PORTFOLIO

TABLE 053. KONINKLIJKE PHILIPS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ONCIMMUNE HOLDINGS PLC: SNAPSHOT

TABLE 054. ONCIMMUNE HOLDINGS PLC: BUSINESS PERFORMANCE

TABLE 055. ONCIMMUNE HOLDINGS PLC: PRODUCT PORTFOLIO

TABLE 056. ONCIMMUNE HOLDINGS PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. QIAGEN: SNAPSHOT

TABLE 057. QIAGEN: BUSINESS PERFORMANCE

TABLE 058. QIAGEN: PRODUCT PORTFOLIO

TABLE 059. QIAGEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. SIEMENS HEALTHINEERS: SNAPSHOT

TABLE 060. SIEMENS HEALTHINEERS: BUSINESS PERFORMANCE

TABLE 061. SIEMENS HEALTHINEERS: PRODUCT PORTFOLIO

TABLE 062. SIEMENS HEALTHINEERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. SIRTEX MEDICAL LTD.: SNAPSHOT

TABLE 063. SIRTEX MEDICAL LTD.: BUSINESS PERFORMANCE

TABLE 064. SIRTEX MEDICAL LTD.: PRODUCT PORTFOLIO

TABLE 065. SIRTEX MEDICAL LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. THERMO FISCHER SCIENTIFIC INC.: SNAPSHOT

TABLE 066. THERMO FISCHER SCIENTIFIC INC.: BUSINESS PERFORMANCE

TABLE 067. THERMO FISCHER SCIENTIFIC INC.: PRODUCT PORTFOLIO

TABLE 068. THERMO FISCHER SCIENTIFIC INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. BDR PHARMACEUTICALS INTERNATIONALS PVT. LTD: SNAPSHOT

TABLE 069. BDR PHARMACEUTICALS INTERNATIONALS PVT. LTD: BUSINESS PERFORMANCE

TABLE 070. BDR PHARMACEUTICALS INTERNATIONALS PVT. LTD: PRODUCT PORTFOLIO

TABLE 071. BDR PHARMACEUTICALS INTERNATIONALS PVT. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 072. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 073. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 074. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LIVER CANCER DIAGNOSTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LIVER CANCER DIAGNOSTICS MARKET OVERVIEW BY TYPE

FIGURE 012. IMAGING MARKET OVERVIEW (2016-2028)

FIGURE 013. LABORATORY TEST MARKET OVERVIEW (2016-2028)

FIGURE 014. ENDOSCOPY MARKET OVERVIEW (2016-2028)

FIGURE 015. BIOPSY MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. LIVER CANCER DIAGNOSTICS MARKET OVERVIEW BY APPLICATION

FIGURE 018. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 019. LABORATORIES MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE LIVER CANCER DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC LIVER CANCER DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA LIVER CANCER DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA LIVER CANCER DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Liver Cancer Diagnostics Market research report is 2023-2032.

Abbott Laboratories (US), Becton Dickinson and Company (US), F. Hoffmann-La Roche Ltd (Switzerland), FUJIFILM Wako Diagnostics U.S.A. Corporation (US), Hologic (US), Illumina Inc. (US), Koninklijke Philips (Netherlands), Oncimmune Holdings Plc (UK), Qiagen (Germany), Siemens Healthineers (Germany), Sirtex Medical Ltd. (US), Thermo Fischer Scientific Inc. (US), BDR Pharmaceuticals Internationals Pvt. Ltd. (India), and Other Major Players.

Liver Cancer Diagnostics Market is segmented into Type, Application, and region. By Type, the market is categorized into Imaging, Laboratory Test, Endoscopy, Biopsy, Others. By Application, the market is categorized into Hospitals, Laboratories, Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The liver is the largest organ in the human body. It plays a vital role in removing toxins from the body’s blood supply, maintaining healthy blood sugar levels, and regulating blood clots. The liver regulates most chemical levels in the blood and excretes bile juice which helps in the digestion of fats

Global Liver Cancer Diagnostics Market was valued at USD 35.3 Million in 2023 and is expected to reach USD 56.62 Million by the year 2032, at a CAGR of 5.39%.