Global Blood Urea Nitrogen Diagnostics Market Overview

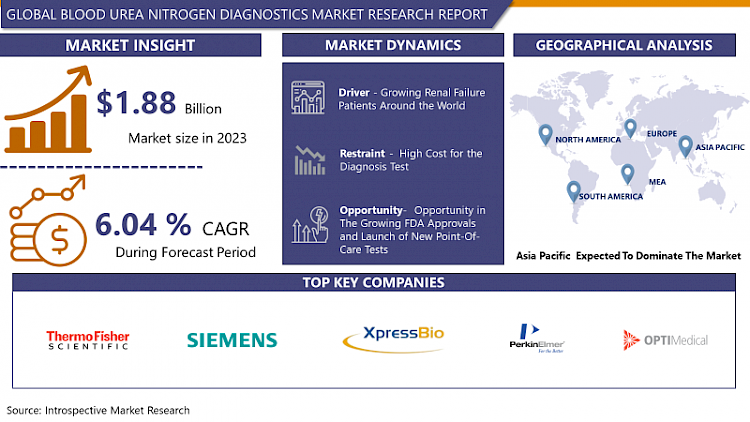

The Global Blood Urea Nitrogen Diagnostics Market size is expected to grow from USD 1.88 billion in 2023 to USD 3.19 billion by 2032, at a CAGR of 6.04 % during the forecast period (2024-2032).

- A blood urea nitrogen (BUN) test assesses the concentration of urea nitrogen in the bloodstream. Urea nitrogen is a byproduct resulting from the breakdown of proteins in the diet, synthesized in the liver, and transported through the blood to the kidneys for filtration and elimination. This test is frequently included in a comprehensive metabolic panel, a set of diagnostic tests. Its primary purpose is to aid in the detection and monitoring of kidney diseases or disorders.

- By measuring the BUN levels, healthcare providers can gather valuable insights into kidney function. Elevated BUN levels may indicate conditions such as acute or chronic kidney disease, dehydration, or heart failure, where kidneys may not effectively filter waste from the blood. Conversely, abnormally low BUN levels could suggest liver disease or malnutrition.

- During the BUN test, a blood sample is typically drawn from a vein in the arm. Results are interpreted alongside other tests to provide a comprehensive view of metabolic health. Monitoring BUN levels over time helps healthcare professionals assess kidney function stability or progression of kidney-related conditions, guiding treatment decisions and adjustments in patient care.

- In addition to its role in diagnosing and monitoring kidney function, the BUN test also serves as an indicator of overall health and hydration status. Since urea nitrogen is produced from protein breakdown and cleared by the kidneys, abnormal BUN levels can reflect issues beyond kidney function alone.

Market Dynamics And Factors For Blood Urea Nitrogen Diagnostics Market

Drivers:

Growing Renal Failure Patients Around the World

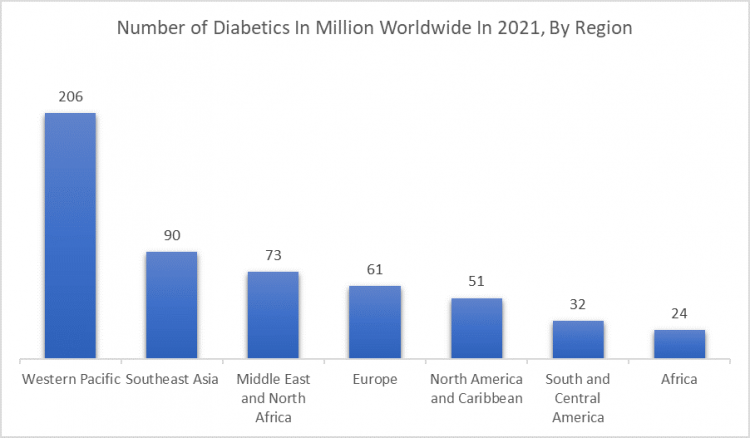

In the last few decades increasing the number of kidney failure and kidney disease patients is the major factor that drives the growth of the blood urea nitrogen diagnostic market. Kidney disease includes Fabry disease, cystinosis, glomerulonephritis, IgA nephropathy, lupus nephritis, atypical hemolytic uremic syndrome, and polycystic kidney disease. The blood urea nitrogen diagnostic test is prescribed when any kidney disease suspect in people. This test helps to understand if there is any need to carry out dialysis or not. Owing to rising noncommunicable diseases, changing lifestyles, and habits, growing aging population the cases of kidney-diseased patients increased. For instance, about 200,000-350,000 people are affected per year by IgA nephropathy is a common form of primary glomerulonephritis. In the year 2020, 431,288 people were diagnosed with kidney cancer in the world. Diabetes is the leading cause of chronic kidney diseases. In recent years, the prevalence of diabetes is increased. The following figure shows the number of diabetics in the world.

Thus, the growing number of kidney disease patients supports the growth of the blood urea nitrogen diagnostics market.

Restraints:

High Cost for the Diagnosis Test

The cost associated with the testing equipment is high is the key factor responsible for restricting the market growth. The prices of the kits, chemical reagents, and other instruments required for the blood urea nitrogen diagnostic test are high. Moreover, to perform the diagnostic test, there is a requirement for extra training for technicians which increases the prices of the diagnostic test. The new advanced techniques used in the laboratory for the detection of blood urea nitrogen also increase the cost of tests which may hamper the growth of the market.

Opportunity:

Opportunity in The Growing FDA Approvals and Launch of New Point-Of-Care Tests

With the rising FDA approvals of the diagnostic test and launching of the novel, point-of-care diagnostics tests will provide a lucrative opportunity for the blood urea nitrogen diagnostics market during the forecast periods. Due to the growing prevalence of renal chronic diseases, the manufacturers of the healthcare sector rising their investment in the research and development of new point-of-care tests for diagnosis. For instance, in 2022 Bloom Diagnostic, a manufacturer of medical devices launched a new kidney test product named bloom kidney test. Additionally, the FDA approvals of such a diagnostic test are also increased. For instance, FDA approved the blood urea nitrogen point-of-care tests of Siemens Healthineers. Thus, the rising R&D of point-of-care tests and FDA approvals offers a profitable opportunity for the market in the analysis period.

Segmentation Analysis Of Blood Urea Nitrogen Diagnostics Market

By Test Type, the ELISA test (Enzyme-linked immunosorbent assay) is expected to account for the largest market share in the forecasted period. ELISA is the most ideal test for the detection of urea nitrogen in the blood and it is commonly used in laboratories. The ELISA test has several benefits such as, it has a simple procedure, high specificity, and sensitivity, and high efficiency and cost-effectiveness. Moreover, this test is safe and eco-friendly because there is no requirement for any radioactive substance and a large number of organic solvents. Additionally, the growing research and development investment in the ELISA kit, the rising geriatric population, and growth in the biopharmaceutical and biotechnology industries increase the market share of the ELISA test in the blood urea nitrogen diagnostics.

By Application, the laboratory segment is predicted to have the maximum market share in blood urea nitrogen diagnostics. The blood urea nitrogen diagnostic test is mostly performed in the laboratory. According to the Centers for disease control and prevention, 70% of the decisions of medical are based on the result of the laboratory and nearly 14 billion laboratory tests are ordered annually. Statista stated that in 2020 there were 331 million laboratory tests conducted in Russia’s public as well as private organizations. Owing to the growing prevalence of various chronic diseases the number of diagnostic laboratories and clinical laboratories is increasing. The test performed in the laboratories is safe, accurate, and cost-effective. Thus, the laboratory has the highest market share in blood urea nitrogen diagnostics.

Regional Analysis Of Blood Urea Nitrogen Diagnostics Market

Asia Pacific region is expected to have the largest market share of the Blood Urea Nitrogen Diagnostics market in the projected period. In this region, the largest population suffers from chronic kidney disease. This is due to the growing prevalence of diabetes. Diabetes is the main cause of chronic kidney disease. For instance, according to Statista, in 2021 there were 206 million people in the western pacific and 90 million people in Southeast Asia suffering from diabetes. China and India in this region have the highest population with the fastest aging population. Chronic kidney diseases mostly affected aged people. In addition to this, geographic, climatic, cultural, social, and environmental diversity in this region is higher than in other regions of the world. The large population in this region experienced the climate-related burden of infectious disease. These infectious diseases are the cause of chronic kidney disease. Thus, in the APAC region, the highest number of kidney failure patients and hence require to test urea nitrogen in the blood which supports the growth of the market of this region.

Europe is the second-dominated region in the blood urea nitrogen diagnostic market. This is owing to the high number of diabetes people suffering from chronic kidney diseases. For instance, according to Statista, there were 61 million people had diabetes in 2021 in the Europe region. Spain had the highest number of kidney transplant population in 2021 and the population was 63.2 per million. Due to economic and environmental changes in this region, the prevalence of infectious diseases is increased. Moreover, the manufacturers in the healthcare sector and also the government increase their investment in the research and development of new diagnostic products. These all factors are expected to increase the blood urea diagnostic market during the forecast periods.

North America has the fastest growth in blood urea nitrogen diagnostics due to growing awareness about the diagnosis of chronic diseases. The changing lifestyle, habits, and environmental changes are susceptible to an increase in the prevalence of infectious diseases which cause chronic kidney disease. For instance, according to the Centers for disease control and prevention report 2021, there were 37 million peoples in the United States have Chronic kidney disease. North American region is financially well developed, thus there is a high investment in the development of new diagnostic products. Due to the growing prevalence of chronic diseases, the government of this region also increases its investments in R&D activities in the healthcare sector. Thus, it is predicted that the market of blood urea nitrogen diagnostics in North America will be increased during the projection period.

Top Key Players Covered In Blood Urea Nitrogen Diagnostics Market

- Siemens AG (Germany)

- StressMarq Biosciences Inc (Columbia)

- Thermo Fisher Scientific (US)

- Xpress Bio Life Science (US)

- PerkinElmer, Inc. (US)

- OPTI Medical Systems, Inc. (USA)

- Abbott Laboratories (US)

- F. Hoffmann-La Roche AG (Switzerland)

- Danaher Corporation (US)

- Bio-Rad Laboratories, Inc. (US)

- Sysmex Corporation (Japan)

- BioVision Inc. (US)

- Randox Laboratories Ltd. (UK)

- HORIBA, Ltd. (Japan)

- Cutera (USA), and other major players.

Key Industry Development In The Blood Urea Nitrogen Diagnostics Market

- In July 2022, the world's leading provider of scientific services, Thermo Fisher Scientific Inc., is presenting cutting-edge diagnostic technologies, assays, and a full range of solutions for researchers creating new diagnostics. Thermo Fisher is exhibiting in booth #1413 at the 74th American Association for Clinical Chemistry Annual Scientific Meeting and Clinical Laboratory Exposition (AACC 2022), which takes place at the McCormick Place Convention Center in Chicago, July 24-28.

|

Global Blood Urea Nitrogen Diagnostics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024 - 2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.88 Bn. |

|

Forecast Period 2024 - 32CAGR: |

6.04 % |

Market Size in 2032: |

USD 3.19 Bn. |

|

Segments Covered: |

By Test Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Test Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Blood Urea Nitrogen Diagnostics Market by Test Type

5.1 Blood Urea Nitrogen Diagnostics Market Overview Snapshot and Growth Engine

5.2 Blood Urea Nitrogen Diagnostics Market Overview

5.3 ELISA

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 ELISA: Geographic Segmentation

5.4 Colorimetric

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Colorimetric: Geographic Segmentation

5.5 Spectrophotometric

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Spectrophotometric: Geographic Segmentation

Chapter 6: Blood Urea Nitrogen Diagnostics Market by Application

6.1 Blood Urea Nitrogen Diagnostics Market Overview Snapshot and Growth Engine

6.2 Blood Urea Nitrogen Diagnostics Market Overview

6.3 Hospital

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital: Geographic Segmentation

6.4 Laboratory

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Laboratory: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Blood Urea Nitrogen Diagnostics Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Blood Urea Nitrogen Diagnostics Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Blood Urea Nitrogen Diagnostics Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 SIEMENS AG

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 STRESSMARQ BIOSCIENCES INC.

7.4 THERMO FISHER SCIENTIFIC

7.5 XPRESS BIO LIFE SCIENCE

7.6 PERKINELMER INC.

7.7 OPTI MEDICAL SYSTEMS INC.

7.8 ABBOTT LABORATORIES

7.9 F. HOFFMANN-LA ROCHE AG

7.10 DANAHER CORPORATION

7.11 CUTERA

7.12 OTHER MAJOR PLAYERS

Chapter 8: Global Blood Urea Nitrogen Diagnostics Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Test Type

8.2.1 ELISA

8.2.2 Colorimetric

8.2.3 Spectrophotometric

8.3 Historic and Forecasted Market Size By Application

8.3.1 Hospital

8.3.2 Laboratory

Chapter 9: North America Blood Urea Nitrogen Diagnostics Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Test Type

9.4.1 ELISA

9.4.2 Colorimetric

9.4.3 Spectrophotometric

9.5 Historic and Forecasted Market Size By Application

9.5.1 Hospital

9.5.2 Laboratory

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Blood Urea Nitrogen Diagnostics Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Test Type

10.4.1 ELISA

10.4.2 Colorimetric

10.4.3 Spectrophotometric

10.5 Historic and Forecasted Market Size By Application

10.5.1 Hospital

10.5.2 Laboratory

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Blood Urea Nitrogen Diagnostics Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Test Type

11.4.1 ELISA

11.4.2 Colorimetric

11.4.3 Spectrophotometric

11.5 Historic and Forecasted Market Size By Application

11.5.1 Hospital

11.5.2 Laboratory

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Blood Urea Nitrogen Diagnostics Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Test Type

12.4.1 ELISA

12.4.2 Colorimetric

12.4.3 Spectrophotometric

12.5 Historic and Forecasted Market Size By Application

12.5.1 Hospital

12.5.2 Laboratory

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Blood Urea Nitrogen Diagnostics Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Test Type

13.4.1 ELISA

13.4.2 Colorimetric

13.4.3 Spectrophotometric

13.5 Historic and Forecasted Market Size By Application

13.5.1 Hospital

13.5.2 Laboratory

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Blood Urea Nitrogen Diagnostics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024 - 2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.88 Bn. |

|

Forecast Period 2024 - 32CAGR: |

6.04 % |

Market Size in 2032: |

USD 3.19 Bn. |

|

Segments Covered: |

By Test Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BLOOD UREA NITROGEN DIAGNOSTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BLOOD UREA NITROGEN DIAGNOSTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BLOOD UREA NITROGEN DIAGNOSTICS MARKET COMPETITIVE RIVALRY

TABLE 005. BLOOD UREA NITROGEN DIAGNOSTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BLOOD UREA NITROGEN DIAGNOSTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. BLOOD UREA NITROGEN DIAGNOSTICS MARKET BY TEST TYPE

TABLE 008. ELISA MARKET OVERVIEW (2016-2028)

TABLE 009. COLORIMETRIC MARKET OVERVIEW (2016-2028)

TABLE 010. SPECTROPHOTOMETRIC MARKET OVERVIEW (2016-2028)

TABLE 011. BLOOD UREA NITROGEN DIAGNOSTICS MARKET BY APPLICATION

TABLE 012. HOSPITAL MARKET OVERVIEW (2016-2028)

TABLE 013. LABORATORY MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY TEST TYPE (2016-2028)

TABLE 015. NORTH AMERICA BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 016. N BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY TEST TYPE (2016-2028)

TABLE 018. EUROPE BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 019. BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY TEST TYPE (2016-2028)

TABLE 021. ASIA PACIFIC BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 022. BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY TEST TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 025. BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY TEST TYPE (2016-2028)

TABLE 027. SOUTH AMERICA BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY APPLICATION (2016-2028)

TABLE 028. BLOOD UREA NITROGEN DIAGNOSTICS MARKET, BY COUNTRY (2016-2028)

TABLE 029. SIEMENS AG: SNAPSHOT

TABLE 030. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 031. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 032. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. STRESSMARQ BIOSCIENCES INC.: SNAPSHOT

TABLE 033. STRESSMARQ BIOSCIENCES INC.: BUSINESS PERFORMANCE

TABLE 034. STRESSMARQ BIOSCIENCES INC.: PRODUCT PORTFOLIO

TABLE 035. STRESSMARQ BIOSCIENCES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. THERMO FISHER SCIENTIFIC: SNAPSHOT

TABLE 036. THERMO FISHER SCIENTIFIC: BUSINESS PERFORMANCE

TABLE 037. THERMO FISHER SCIENTIFIC: PRODUCT PORTFOLIO

TABLE 038. THERMO FISHER SCIENTIFIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. XPRESS BIO LIFE SCIENCE: SNAPSHOT

TABLE 039. XPRESS BIO LIFE SCIENCE: BUSINESS PERFORMANCE

TABLE 040. XPRESS BIO LIFE SCIENCE: PRODUCT PORTFOLIO

TABLE 041. XPRESS BIO LIFE SCIENCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. PERKINELMER INC.: SNAPSHOT

TABLE 042. PERKINELMER INC.: BUSINESS PERFORMANCE

TABLE 043. PERKINELMER INC.: PRODUCT PORTFOLIO

TABLE 044. PERKINELMER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. OPTI MEDICAL SYSTEMS INC.: SNAPSHOT

TABLE 045. OPTI MEDICAL SYSTEMS INC.: BUSINESS PERFORMANCE

TABLE 046. OPTI MEDICAL SYSTEMS INC.: PRODUCT PORTFOLIO

TABLE 047. OPTI MEDICAL SYSTEMS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ABBOTT LABORATORIES: SNAPSHOT

TABLE 048. ABBOTT LABORATORIES: BUSINESS PERFORMANCE

TABLE 049. ABBOTT LABORATORIES: PRODUCT PORTFOLIO

TABLE 050. ABBOTT LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. F. HOFFMANN-LA ROCHE AG: SNAPSHOT

TABLE 051. F. HOFFMANN-LA ROCHE AG: BUSINESS PERFORMANCE

TABLE 052. F. HOFFMANN-LA ROCHE AG: PRODUCT PORTFOLIO

TABLE 053. F. HOFFMANN-LA ROCHE AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. DANAHER CORPORATION: SNAPSHOT

TABLE 054. DANAHER CORPORATION: BUSINESS PERFORMANCE

TABLE 055. DANAHER CORPORATION: PRODUCT PORTFOLIO

TABLE 056. DANAHER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. CUTERA: SNAPSHOT

TABLE 057. CUTERA: BUSINESS PERFORMANCE

TABLE 058. CUTERA: PRODUCT PORTFOLIO

TABLE 059. CUTERA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 060. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 061. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 062. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BLOOD UREA NITROGEN DIAGNOSTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BLOOD UREA NITROGEN DIAGNOSTICS MARKET OVERVIEW BY TEST TYPE

FIGURE 012. ELISA MARKET OVERVIEW (2016-2028)

FIGURE 013. COLORIMETRIC MARKET OVERVIEW (2016-2028)

FIGURE 014. SPECTROPHOTOMETRIC MARKET OVERVIEW (2016-2028)

FIGURE 015. BLOOD UREA NITROGEN DIAGNOSTICS MARKET OVERVIEW BY APPLICATION

FIGURE 016. HOSPITAL MARKET OVERVIEW (2016-2028)

FIGURE 017. LABORATORY MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA BLOOD UREA NITROGEN DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE BLOOD UREA NITROGEN DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC BLOOD UREA NITROGEN DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA BLOOD UREA NITROGEN DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA BLOOD UREA NITROGEN DIAGNOSTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Blood Urea Nitrogen Diagnostics Market research report is 2024-2032.

Siemens AG (Germany), StressMarq Biosciences Inc (Columbia), Thermo Fisher Scientific (US), Xpress Bio Life Science (US), PerkinElmer, Inc. (US), OPTI Medical Systems, Inc. (USA), Abbott Laboratories (US), F. Hoffmann-La Roche AG (Switzerland), Danaher Corporation (US), Cutera (USA), and other major players.

The Blood Urea Nitrogen Diagnostics Market is segmented into Test Type, Application, and region. By Test Type the market is categorized into ELISA, Colorimetric, and Spectrophotometric. By Application, the market is categorized into Hospital, Laboratory. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Urea nitrogen is the waste product formed in the liver and removed from the blood by the kidneys. The normal level of urea nitrogen in the blood is 6-24mg/dl. If the level of urea nitrogen is increased than normal, it is a sign of the kidneys aren’t working well. The blood urea nitrogen test is referred to as the BUN diagnostic test which is used to measure the urea nitrogen amount in the blood.

The Global Blood Urea Nitrogen Diagnostics Market size is expected to grow from USD 1.88 billion in 2023 to USD 3.19 billion by 2032, at a CAGR of 6.04 % during the forecast period (2024-2032).