Sea Freight Forwarding Market Synopsis

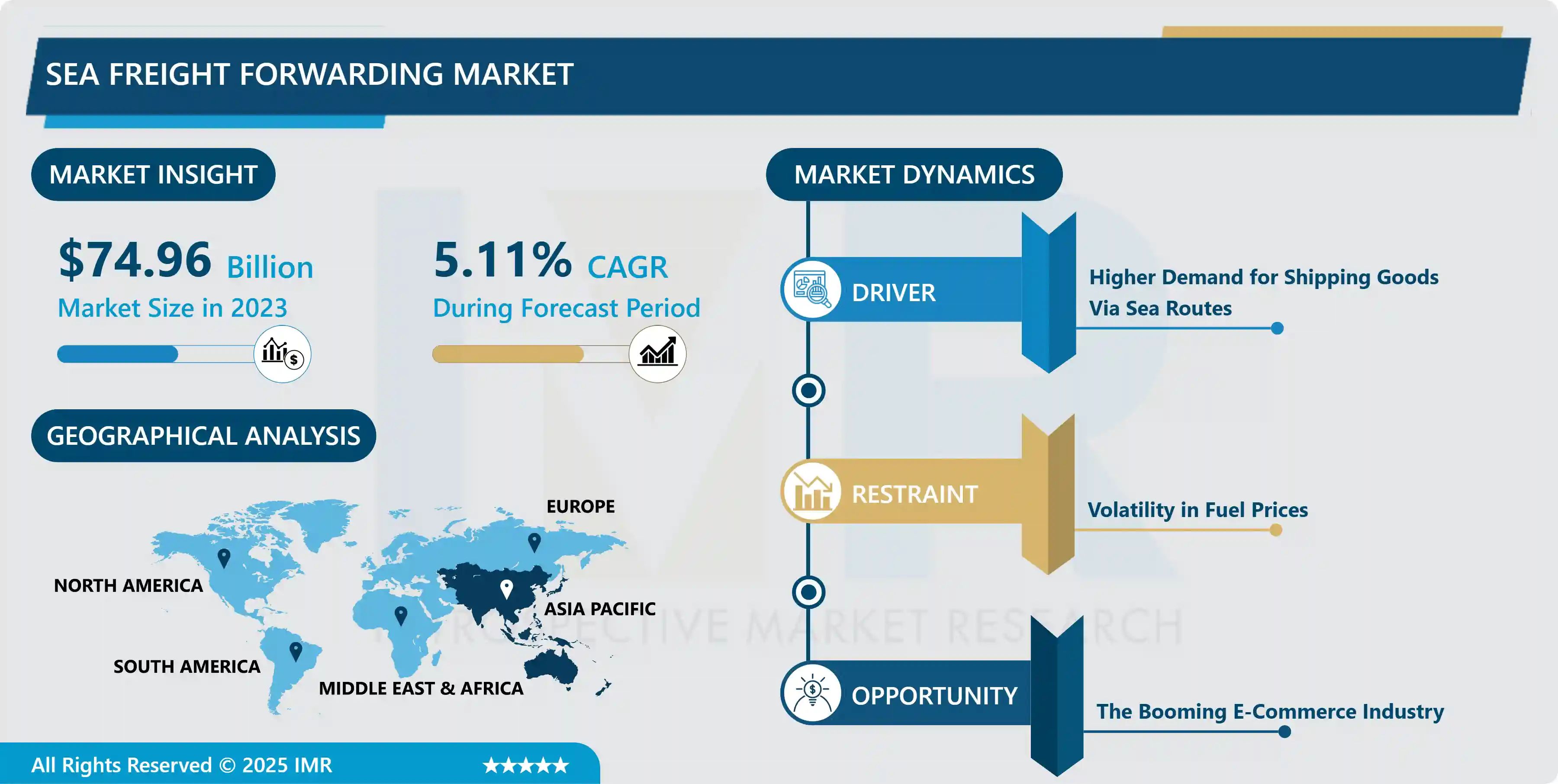

The Sea Freight Forwarding Market was valued at USD 74.96 Billion in 2023 and is projected to reach USD 117.39 Billion by 2032, growing at a CAGR of 5.11% from 2024 to 2032.

An ocean freight forwarder specializes in moving freight via cargo ships. This specialization enables ocean forwarders to know precisely how to complete any shipment and build the relationships necessary to get the best ocean rates, which they can then pass on to their customers.

Sea freight forwarding is fundamental for importing and exporting goods across borders, enabling businesses to access markets worldwide. It forms an integral part of supply chain logistics, ensuring the timely and cost-effective movement of goods from manufacturers to distributors and retailers. It is ideal for transporting large volumes of bulk commodities such as grains, ores, and petroleum products, efficiently accommodating the high capacity requirements of these shipments.

Sea freight forwarding manages the transportation of perishable goods like fruits, vegetables, and pharmaceuticals, ensuring proper temperature control throughout the journey.

The sea freight forwarding market facilitates the transportation of goods via ocean vessels. It encompasses a range of services including booking cargo space, customs clearance, documentation, and cargo tracking. Key players in the market include freight forwarders, shipping lines, and logistics companies. The market is highly competitive with a focus on efficiency, cost-effectiveness, and sustainability. Emerging trends include digitalization, blockchain integration, and green initiatives to reduce carbon emissions. In 2022, Kuehne + Nagel was ranked the world's leading ocean freight forwarder, with almost 4.4 million twenty-foot equivalent units of ocean freight. The sea freight forwarding market remains integral to global trade logistics, connecting businesses worldwide.

Sea Freight Forwarding Market Trend Analysis

Higher Demand for Shipping Goods Via Sea Routes

- Globalization has led to an increase in international trade, with businesses sourcing materials and selling products across borders. Sea freight offers a cost-effective and efficient mode of transportation for large quantities of goods over long distances, making it a preferred choice for businesses seeking to optimize their supply chains.

- The expansion of manufacturing industries, particularly in regions like Asia, has fuelled demand for raw materials and finished goods to be transported globally. Sea routes provide the infrastructure to accommodate the bulk transportation needs of these industries.

- Additionally, advancements in technology and logistics have enhanced the efficiency and reliability of sea freight forwarding services. Real-time tracking, containerization, and automated systems streamline operations, reducing transit times and improving overall service quality. Environmental concerns and regulations aimed at reducing carbon emissions have encouraged the use of sea transport, which is inherently eco-friendlier compared to air or road transport.

- In 2020, the global commercial shipping fleet grew by 3 percent, reaching 99,800 ships of 100 gross tons and above. By January 2021, capacity was equivalent to 2,13 billion deadweight tons. During 2020, delivery of ships declined by 12 percent, partly due to lockdown-induced labor shortages that disrupted marine-industrial activity. The ships delivered were mostly bulk carriers, followed by oil tankers and container ships.

|

World fleet by principal vessel type, 2020–2021 (thousand dead-weight tons and percentage) |

|||

|

Principal types |

2020 |

2021 |

Percentage change 2021 over 2020 |

|

Bulk carriers |

879 725 |

913 032 |

3.79% |

|

Oil tankers |

601 342 |

619 148 |

2.96% |

|

Container ships |

274 973 |

281 784 |

2.48% |

|

Other types of ships: |

238 705 |

243 922 |

2.19% |

|

Offshore supply |

84 049 |

84 094 |

0.05% |

|

Gas carriers |

73 685 |

77 455 |

5.12% |

|

Chemical tankers |

47 480 |

48 858 |

2.90% |

|

Ferries and passenger ships |

7 992 |

8 109 |

1.46% |

The Booming E-Commerce Industry Creates an Opportunity for Global Sea Freight Forwarding Market

- The exponential growth of the e-commerce industry creates an opportunity for the global sea freight forwarding market. As consumers increasingly turn to online platforms for their shopping needs, businesses are compelled to optimize their supply chains to meet growing demands efficiently. Sea freight forwarding emerges as a critical component in this process due to its cost-effectiveness, reliability, and ability to handle large volumes of goods.

- E-commerce giants and smaller retailers alike are leveraging sea freight forwarding services to transport goods across international borders. By partnering with experienced freight forwarders, businesses can ensure timely delivery, streamline customs clearance processes, and reduce transportation costs. Moreover, advancements in technology have enhanced visibility and tracking capabilities, allowing stakeholders to monitor shipments in real time and mitigate potential disruptions.

- Forward-thinking logistics companies are investing in digitalization, automation, and sustainable practices to stay competitive in this dynamic landscape. By innovation and adapting to evolving consumer preferences, sea freight forwarders can capitalize on the growth of e-commerce and forge stronger partnerships with businesses worldwide.

Sea Freight Forwarding Market Segment Analysis:

Global Sea Freight Forwarding Market is Segmented into the Service and Application.

By Service, Full Container Load Segment Is Expected to Dominate the Market During the Forecast Period.

- The full Container Load (FCL) segment is anticipated to assert dominance by service. FCL involves the shipment of goods in fully packed containers, typically by a single consignee. This method offers several advantages, including lower risk of damage or loss, greater security, and faster transit times compared to less-than-container-load (LCL) shipments.

- The dominance of FCL in the sea freight forwarding market is its suitability for businesses with large shipment volumes or bulky items that require dedicated container space. Additionally, FCL shipments are often preferred for their simplicity in documentation and customs clearance processes, contributing to smoother logistics operations.

By Application, Agricultural Segment Held the Largest Share Of 22.3% In 2022.

- The agricultural segment is anticipated to assert dominance in the sea freight forwarding market. Agriculture is a fundamental sector in many economies, with a constant demand for efficient transportation of products across borders. Sea freight offers a cost-effective and reliable solution for the global transportation of agricultural goods, including grains, fruits, vegetables, and other perishable items.

- Moreover, the agricultural industry often deals with large volumes of goods requiring transportation over long distances. Sea freight provides the capacity needed to accommodate such bulk shipments efficiently. Additionally, advancements in refrigeration and storage technologies have enabled sea freight forwarding companies to cater to the specific requirements of perishable agricultural products, ensuring their freshness and quality are maintained throughout transit.

Sea Freight Forwarding Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is poised to dominate the sea freight forwarding market, the region's robust economic growth and burgeoning trade volumes have created significant demand for efficient shipping services. As countries like China, India, and Southeast Asian nations continue to experience rapid industrialization and globalization, the need for reliable and cost-effective transportation of goods across borders becomes paramount.

- The strategic investments in infrastructure development, including ports, terminals, and transportation networks, have enhanced the region's connectivity and logistics capabilities. This infrastructure modernization facilitates smoother cargo movement and attracts international trade flows and investment.

- Additionally, the Asia Pacific region benefits from its geographic advantage as a gateway between major global trade routes, serving as a vital link for maritime trade between East Asia, Europe, and the Americas. In 2022, Asia Pacific overtook Europe as the largest market for global freight forwarding, with a share of 34.9 percent. International trade is one of the main drivers of growth in the freight forwarding market.

Sea Freight Forwarding Market Top Key Players:

- Kuehne + Nagel (Switzerland)

- DHL Global Forwarding (Germany)

- DB Schenker (Germany)

- Expeditors International (United States)

- Panalpina (Switzerland)

- DSV (Denmark)

- Sinotrans (China)

- Nippon Express (Japan)

- CEVA Logistics (Switzerland)

- Hellmann Worldwide Logistics (Germany)

- Yusen Logistics (Japan)

- Agility (Kuwait)

- Kerry Logistics (Hong Kong)

- C.H. Robinson (United States)

- Bolloré Logistics (France)

- Damco (Netherlands)

- Geodis (France)

- Ceva Freight Management (Switzerland)

- UTi Worldwide (United States)

- Dachser (Germany)

- Kintetsu World Express (Japan)

- Schenker (Germany)

- Expeditors (United States)

- Hitachi Transport System (Japan)

- Yusen (Japan)

- and Other Major Players.

|

Sea Freight Forwarding Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 74.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.11% |

Market Size in 2032: |

USD 117.39 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sea Freight Forwarding Market by Service (2018-2032)

4.1 Sea Freight Forwarding Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Full Container Load

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Less-than Container Load

4.5 Specialized Services

Chapter 5: Sea Freight Forwarding Market by Application (2018-2032)

5.1 Sea Freight Forwarding Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Automotive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Retail

5.5 Electronics

5.6 Pharmaceuticals

5.7 Agriculture

5.8 Others (FMCG

5.9 Chemicals

5.10 Construction)

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Sea Freight Forwarding Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AEROJET ROCKETDYNE (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SPACEX (UNITED STATES)

6.4 BLUE ORIGIN (UNITED STATES)

6.5 NORTHROP GRUMMAN INNOVATION SYSTEMS (UNITED STATES)

6.6 MITSUBISHI HEAVY INDUSTRIES (JAPAN)

6.7 IHI CORPORATION (JAPAN)

6.8 SAFRAN S.A. (FRANCE)

6.9 ARIANE GROUP (FRANCE)

6.10 ROCKET LAB (NEW ZEALAND)

6.11 YUZHNOYE DESIGN OFFICE (UKRAINE)

6.12 KBKHA (RUSSIA)

6.13 NPO ENERGOMASH (RUSSIA)

6.14 EUROPROPULSION (ITALY/FRANCE)

6.15 AVIO S.P.A (ITALY)

6.16 ISRO (INDIA)

6.17 CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION (CHINA)

6.18 CHINA ACADEMY OF LAUNCH VEHICLE TECHNOLOGY (CHINA)

6.19 CASIC (CHINA)

6.20 IRAN AVIATION INDUSTRIES ORGANIZATION (IRAN)

6.21 RKK ENERGIA (RUSSIA)

6.22 SPACEX (UNITED STATES)

6.23 ROCKET CRAFTERS INC. (UNITED STATES)

6.24 FIREFLY AEROSPACE (UNITED STATES)

6.25 RELATIVITY SPACE (UNITED STATES)

6.26

Chapter 7: Global Sea Freight Forwarding Market By Region

7.1 Overview

7.2. North America Sea Freight Forwarding Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Service

7.2.4.1 Full Container Load

7.2.4.2 Less-than Container Load

7.2.4.3 Specialized Services

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Automotive

7.2.5.2 Retail

7.2.5.3 Electronics

7.2.5.4 Pharmaceuticals

7.2.5.5 Agriculture

7.2.5.6 Others (FMCG

7.2.5.7 Chemicals

7.2.5.8 Construction)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Sea Freight Forwarding Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Service

7.3.4.1 Full Container Load

7.3.4.2 Less-than Container Load

7.3.4.3 Specialized Services

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Automotive

7.3.5.2 Retail

7.3.5.3 Electronics

7.3.5.4 Pharmaceuticals

7.3.5.5 Agriculture

7.3.5.6 Others (FMCG

7.3.5.7 Chemicals

7.3.5.8 Construction)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Sea Freight Forwarding Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Service

7.4.4.1 Full Container Load

7.4.4.2 Less-than Container Load

7.4.4.3 Specialized Services

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Automotive

7.4.5.2 Retail

7.4.5.3 Electronics

7.4.5.4 Pharmaceuticals

7.4.5.5 Agriculture

7.4.5.6 Others (FMCG

7.4.5.7 Chemicals

7.4.5.8 Construction)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Sea Freight Forwarding Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Service

7.5.4.1 Full Container Load

7.5.4.2 Less-than Container Load

7.5.4.3 Specialized Services

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Automotive

7.5.5.2 Retail

7.5.5.3 Electronics

7.5.5.4 Pharmaceuticals

7.5.5.5 Agriculture

7.5.5.6 Others (FMCG

7.5.5.7 Chemicals

7.5.5.8 Construction)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Sea Freight Forwarding Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Service

7.6.4.1 Full Container Load

7.6.4.2 Less-than Container Load

7.6.4.3 Specialized Services

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Automotive

7.6.5.2 Retail

7.6.5.3 Electronics

7.6.5.4 Pharmaceuticals

7.6.5.5 Agriculture

7.6.5.6 Others (FMCG

7.6.5.7 Chemicals

7.6.5.8 Construction)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Sea Freight Forwarding Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Service

7.7.4.1 Full Container Load

7.7.4.2 Less-than Container Load

7.7.4.3 Specialized Services

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Automotive

7.7.5.2 Retail

7.7.5.3 Electronics

7.7.5.4 Pharmaceuticals

7.7.5.5 Agriculture

7.7.5.6 Others (FMCG

7.7.5.7 Chemicals

7.7.5.8 Construction)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Sea Freight Forwarding Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 74.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.11% |

Market Size in 2032: |

USD 117.39 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||