Satellite Manufacturing Market Synopsis

Satellite Manufacturing Market Size Was Valued at USD 17.2 Billion in 2022 and is Projected to Reach USD 27.83 Billion by 2030, Growing at a CAGR of 6.2 % From 2023-2030.

The global satellite manufacturing market is a dynamic and rapidly changing industry that plays an important role in modern society. This industry includes a wide range of satellites, from small cubes to large Earth observation and communication satellites, and is driven by the increasing demand for satellite services such as communications, navigation, and Earth observation.

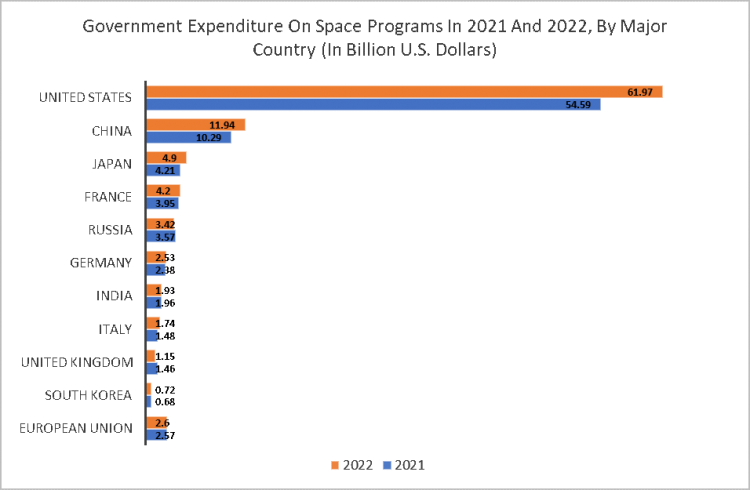

- The global satellite manufacturing market is experiencing significant growth, driven by a combination of commercial sector expansion and increased government spending on space programs. In 2022, the commercial space sector saw a 6.4% increase in revenues, with over $224 billion generated from products and services, and nearly $138 billion invested in infrastructure and support. This surge is partly attributed to a 19% increase in global government spending on military and civil space programs, including significant hikes by the U.S. (18%), China (23%), and India (36%).

- The Space Report provides insights into spending by major spacefaring nations and regional revenue analysis from Europe, Latin America, and Africa, emphasizing the booming commercial space industry. Key segments capitalizing on this growth, investor trends, and the performance of space firms on Wall Street are also covered.

- A record-breaking pace of successful launches in the first half of 2022, with 72 rockets deploying 1,022 spacecraft, highlights the industry's dynamism. The majority of these satellites, 958 in total, were from the commercial sector, surpassing the total number launched in the first 52 years of the Space Age.

- The surge in private sector involvement, marked by $7.6 billion in investment deals for space startups in 2020, is a significant contributor to the market's growth. SpaceX, a prominent player, launched 31 Falcon 9 rockets in 2021, with 29 being reused, demonstrating advancements in sustainable space exploration. the global satellite manufacturing market is characterized by robust growth, innovative technological advancements, and a blend of government and private sector investment, signaling a vibrant and rapidly evolving industry.

- The report also delves into the potential of the James Webb Space Telescope and NASA's exploration of nuclear fission for propulsion and power in space missions. Additionally, it analyzes the development of hypersonic missiles and the consequent space asset roles. In terms of government expenditure, 2022 saw a record $103 billion globally, with the U.S. leading at almost $62 billion. The key government space agencies (NASA, CNSA, ROSCOSMOS, ESA, ISRO, JAXA) play a crucial role in space exploration and research. NASA's FY 2022 budget was $24 billion, mainly allocated to science and exploration.

Satellite Manufacturing Market Trend Analysis

Increasing Demand for Satellite-Based Communication Services

- The increasing demand for satellite-based communication services is a significant driver of the satellite manufacturing market, primarily due to advancements in technology and changing consumer needs. As of 2024, there's a concerted effort to liberate connectivity from geographical constraints, aiming to provide uninterrupted coverage to mobile devices, including smartphones and IoT devices, globally. This ambitious goal is being pursued by an ecosystem comprising satellite and mobile network operators, handset manufacturers, semiconductor companies, and global regulators.

- Deloitte's prediction that over 200 million smartphones with satellite connectivity will be sold in 2024 underscores the market potential. These phones, equipped with special chips worth about US$2 billion, signify a significant shift towards integrating satellite and terrestrial networks. This integration is pivotal in expanding coverage to remote areas without terrestrial cellular coverage, thus filling in service gaps and maximizing geographic coverage. The market for these devices and services is expected to attract more than US$3 billion in technology investment in 2024 alone.

- The development of direct-to-device (D2D) communication technologies is also a key factor. Companies like Apple, SpaceX, and others are investing heavily in D2D services. These services enable standard smartphones to directly receive satellite signals, making satellite connectivity more accessible than ever before. The aim is to provide basic services like emergency communication and IoT monitoring, which have already started showing potential to save lives during emergencies.

- Furthermore, the commercial and government sectors also contribute significantly to this growing demand. For example, satellite-based IoT services are increasingly being adopted in industries like healthcare, industrial, and transportation, with Globalstar and Iridium reporting gains in their commercial IoT subscriber base.

- The graph shows that the increasing demand for satellite-based communication services, driven by high per capita spending on mobile and fixed data ($79.55 and $54.46 respectively in 2023), acts as a major driver for the satellite manufacturing market. As consumers globally allocate more resources to data services, the need for enhanced and widespread connectivity grows. The increasing demand for satellite-based communication services is expanding global connectivity and also driving significant growth in the satellite manufacturing market. This growth is fueled by technological advancements, the integration of satellite and terrestrial networks, and the expanding role of satellite services in various commercial and governmental applications.

Increasing Investment in Space Exploration

- The surge in investment in space exploration presents a significant opportunity for the satellite manufacturing market. The decrease in launch costs, largely due to technological advancements like reUSble rocketry, and the miniaturization of satellites, has democratized access to space. This has opened the door for a broader range of players, from private companies to government agencies, to participate in space exploration. The year 2022 marked a record in the space sector with 186 successful rocket launches, reflecting this rapid transformation.

- Increased private sector investment, particularly from venture capital and private equity firms, has incited innovation and competition, facilitating new business models like mega-constellations. These constellations, consisting of hundreds to thoUSnds of satellites in Low Earth Orbit, aim to provide services such as low-latency broadband, dramatically expanding the potential user base for satellite services.

- This influx of capital and interest in space technologies has also led to a rise in demand for satellite data and related products and services, further driving the satellite manufacturing market. The emergence of small satellite constellations, offering global coverage, has created a need for more satellite integration, components, and launch vehicles. The German Space Agency at DLR, recognizing the potential of small satellites, has awarded a significant contract, nearly 18 million euros, to Exolaunch, a Berlin-based company. This contract encompasses a comprehensive range of services including the procurement of flights on small launch vehicles, coordination of launch campaigns, and procurement of small satellites for payloads. Additionally, Exolaunch will oversee various tests and manufacturing activities. This move by the German government signifies a strong commitment to advancing small satellite technology for commercial services and scientific research.

- In another major development, Lockheed Martin, a key player in the aerospace industry, has opened a new facility dedicated to the rapid development of small satellites. Located in Littleton, Colorado, this facility is equipped to handle the delivery of up to 180 spacecraft per year. Spanning 20,000 square feet, it features a low bay clean room with six scalable parallel assembly lines, allowing for the concurrent handling of different mission classifications. This strategic investment by Lockheed Martin underscores the industry's shift towards higher production rates and diverse satellite capabilities, meeting the growing demand for small satellites across various sectors, including telecommunications and earth observation.

- These initiatives from both government and private sectors reflect a clear trend towards increased investment in small satellite technology, driven by the demand for more versatile, flexible, and cost-effective satellite solutions. Moreover, the increasing investment in space exploration is catalyzing the growth of the satellite manufacturing market, making it an opportune time for both legacy players and new entrants to innovate and expand their offerings in this rapidly evolving sector.

Satellite Manufacturing Market Segment Analysis:

Satellite Manufacturing Market Segmented on the basis of type, application, and end-users.

By Type, Low Earth Orbit (LEO) segment is expected to dominate the market during the forecast period

- The Low Earth Orbit (LEO) segment of the satellite manufacturing market is set for dominant growth in the coming years, fueled by a combination of technological advancements and increasing market demand. LEO, characterized by its proximity to Earth at altitudes of up to 2,000 km, is a prime area for various space-based activities due to its convenience for transportation, communication, observation, and resupply. This orbit houses the International Space Station and is likely to host many future platforms.

- The growing LEO economy, encompassing the production, distribution, and trade of goods and services within this orbit, reflects the diverse participation of governmental, commercial, and academic groups. Its expansion is critical for fostering technological innovation and advancing human benefits derived from space research and operations. NASA's strategy to become one of many customers in a robust LEO economy further highlights the sector's potential.

- For instance, SpaceX's launch of 49 Starlink spacecraft in February 2022 from NASA's Kennedy Space Center in Florida added to its extensive LEO satellite constellation, aimed at providing faster satellite internet. Additionally, Surrey Satellite Technology Ltd (SSTL) has been involved in several projects, including leading a UK Space Agency study for a mission to de-orbit space debris and signing a contract with Satellite Vu for a Mid Wave Infra-Red (MWIR) thermal imaging satellite, which will form part of a planned constellation of seven MWIR spacecraft.

- Due to the LEO segment's growth is fueled by technological advancements, increasing demand for applications requiring real-time data, and significant investments by major industry players, positioning it to lead the satellite manufacturing market during the forecast period.

By Application, Communication segment held the largest share of 48.05% in 2022

- The significant share of the communication segment in the satellite manufacturing market is a direct response to the escalating need for global connectivity. This trend, which is crucial in the era of 5G and the upcoming 6G technologies, has seen satellites becoming indispensable in providing seamless coverage, especially in areas where terrestrial networks fall short. As part of the Non-Terrestrial Networks (NTNs), satellites are being increasingly integrated into these advanced mobile networks, playing a pivotal role in ensuring coverage even in the most remote and underserved regions.

- This growing demand has spurred numerous innovations in satellite technology. For example, the advent of High Throughput Satellites (HTS) and Very High Throughput Satellites (VHTS) has greatly enhanced system throughput. The burgeoning sector of Low-Earth Orbit (LEO) satellite constellations, exemplified by initiatives like SpaceX's Starlink, aims to deliver lower latency and more cost-effective production, thus aligning closely with the requirements of 5G and 6G networks.

- Moreover, the technological evolution in satellite payloads and antenna technologies, such as software-defined payloads and digital beamforming, has been critical. These advancements have transformed satellites into more integral components of communication networks, capable of supporting a diverse array of applications, ranging from broadband communication to the Internet of Things (IoT). the communication segment's dominance in the satellite manufacturing market is attached to the increasing global demand for connectivity, continuous technological advancements in satellite systems, and the critical role satellites are poised to play in the future of mobile networks.

Satellite Manufacturing Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is poised to dominate the satellite manufacturing market in the coming years, driven by several key developments and strategic partnerships. For instance, Panasonic Avionics Corporation's collaboration with Singapore Airlines to offer free high-speed in-flight Wi-Fi from July 2023 exemplifies the region's commitment to enhancing connectivity services. This service, powered by a global network of high-speed, high-bandwidth satellites, demonstrates the growing demand for in-flight Wi-Fi and roaming services post-COVID-19, particularly in Southeast Asian markets.

- Additionally, Intelsat's partnership with Indonesian ICT company Lintasarta, and its mobile network operator subsidiary Indosat Ooredoo Hutchison, highlights the focus on expanding broadband connectivity in remote areas of Indonesia. This project has successfully provided broadband connectivity to nearly 400 sites across Indonesia, leveraging satellite technology for areas where terrestrial networks are insufficient.

- Furthermore, the nanosatellite segment's significant contribution to the small satellite market in Asia Pacific, with increasing launches from countries like China, Japan, and India, reinforces the region's leading position in satellite manufacturing. The partnership between Myriota and Tyvak Nano-Satellite Systems Inc. to develop and launch multiple satellites for expanding the nanosatellite constellation emphasizes the region's growing capabilities in satellite technology.

- The graph shows that The Asia Pacific region, led by initiatives from organizations like the Indian Space Research Organisation (ISRO), is expected to dominate the satellite manufacturing market. With around 40% of ISRO's spacecraft launches dedicated to earth observation and a significant focus on communication satellites, the emphasis on advanced space applications in the region is clear. These developments collectively indicate a robust and expanding satellite manufacturing market in the Asia Pacific region, driven by increasing demand for connectivity, strategic partnerships, and technological advancements in satellite communication.

Satellite Manufacturing Market Top Key Players:

- Boeing (US)

- Lockheed Martin (US)

- Northrop Grumman (US)

- SpaceX (US)

- SSL (Space Systems Loral) - Maxar Technologies (US)

- Ball Aerospace (US) Airbus (France)

- Thales Alenia Space (France)

- RUAG Space (Switzerland)

- Safran (France)

- Arianespace (France)

- Harris Corporation (US)

- NovaWurks (US)

- Raytheon Technologies (US)

- Orbital Sciences Corporation - Northrop Grumman Innovation Systems (US)

- Blue Origin (US)

- ISRO (India)

- Mitsubishi Electric Corporation (Japan)

- Israel Aerospace Industries (IAI) (Israel)

- China Aerospace Corporation (CASC) (China), And Other Major Players.

Key Industry Developments in the Satellite Manufacturing Market:

In January 2024, Pixxel, a leading spacetech startup, inaugurated MegaPixxel, its flagship spacecraft manufacturing facility in Bengaluru. Spanning 30,000 sq. ft., MegaPixxel consolidates satellite manufacturing services, offering comprehensive spacecraft assembly, integration, and testing. With plans to launch six satellites in 2024 and 18 by 2025, Pixxel solidifies its commitment to advancing space exploration.

In December 2023, SpaceX successfully launched 23 Starlink satellites from Florida's Cape Canaveral Space Force Station. The Falcon 9 rocket completed its sixth launch and vertical landing, with the first stage touching down on the droneship "A Shortfall of Gravitas" in the Atlantic Ocean. This milestone further solidifies SpaceX's commitment to revolutionizing global communications through its Starlink constellation.

In November 2023, China launches its inaugural high-orbit satellite communication network, poised to revolutionize internet service across its borders and in Belt and Road nations. Developed by China Aerospace Science and Technology Corporation, the network promises swift connectivity for various industries. With broader coverage per satellite, it poses a competitive challenge to SpaceX's Starlink. This milestone underscores China's advancement in satellite technology.

|

Global Satellite Manufacturing Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 17.2 Bn. |

|

Forecast Period 2023-32 CAGR: |

6.2 % |

Market Size in 2030: |

USD 27.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Size |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SATELLITE MANUFACTURING MARKET BY TYPE (2017-2030)

- SATELLITE MANUFACTURING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LOW EARTH ORBIT (LEO)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDIUM EARTH ORBIT (MEO)

- GEOSTATIONARY ORBIT (GEO)

- SATELLITE MANUFACTURING MARKET BY SIZE (2017-2030)

- SATELLITE MANUFACTURING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDIUM

- SATELLITE MANUFACTURING MARKET BY APPLICATION (2017-2030)

- SATELLITE MANUFACTURING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COMMUNICATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- EARTH OBSERVATION

- SCIENTIFIC RESEARCH

- NAVIGATION

- MILITARY SURVEILLANCE

- SATELLITE MANUFACTURING MARKET BY END-USER (2017-2030)

- SATELLITE MANUFACTURING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GOVERNMENT AND MILITARY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- SCIENTIFIC RESEARCH INSTITUTIONS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SATELLITE MANUFACTURING Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BOEING (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- LOCKHEED MARTIN (US)

- NORTHROP GRUMMAN (US)

- SPACEX (US)

- SSL (SPACE SYSTEMS LORAL) - MAXAR TECHNOLOGIES (US)

- BALL AEROSPACE (US) AIRBUS (FRANCE)

- THALES ALENIA SPACE (FRANCE)

- RUAG SPACE (SWITZERLAND)

- SAFRAN (FRANCE)

- ARIANESPACE (FRANCE)

- HARRIS CORPORATION (US)

- NOVAWURKS (US)

- RAYTHEON TECHNOLOGIES (US)

- ORBITAL SCIENCES CORPORATION - NORTHROP GRUMMAN INNOVATION SYSTEMS (US)

- BLUE ORIGIN (US)

- ISRO (INDIA)

- MITSUBISHI ELECTRIC CORPORATION (JAPAN)

- ISRAEL AEROSPACE INDUSTRIES (IAI) (ISRAEL)

- CHINA AEROSPACE CORPORATION (CASC) (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL SATELLITE MANUFACTURING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Size

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Satellite Manufacturing Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 17.2 Bn. |

|

Forecast Period 2023-32 CAGR: |

6.2 % |

Market Size in 2030: |

USD 27.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Size |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Satellite Manufacturing Market research report is 2023-2030.

Boeing (US), Lockheed Martin (US), Northrop Grumman (US), SpaceX (US), SSL (Space Systems Loral) - Maxar Technologies (US), Ball Aerospace (US), Airbus (France), Thales Alenia Space (France), RUAG Space (Switzerland), Safran (France), Arianespace (France), Harris Corporation (US), NovaWurks (US), Raytheon Technologies (US), Orbital Sciences Corporation - Northrop Grumman Innovation Systems (US), Blue Origin (US), ISRO (India), Mitsubishi Electric Corporation (Japan), Israel Aerospace Industries (IAI) (Israel), China Aerospace Corporation (CASC) (China), and Other Major Players.

The Satellite Manufacturing Market is segmented into Type, Size, Application, End-User and Region. By Type, the market is categorized into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO). By size, the market is categorized into Small and medium. By Application, the market is categorized into Communication, Earth Observation, Scientific Research, Navigation, and Military Surveillance. By End-user, the market is categorized into Government and Military, Commercial, and Scientific Research Institutions. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The global satellite manufacturing market is a dynamic and rapidly changing industry that plays an important role in modern society. This industry includes a wide range of satellites, from small cubes to large Earth observation and communication satellites, and is driven by the increasing demand for satellite services such as communications, navigation, and Earth observation. The global satellite manufacturing market is experiencing significant growth, driven by a combination of commercial sector expansion and increased government spending on space programs

Satellite Manufacturing Market Size Was Valued at USD 17.2 Billion in 2022 and is Projected to Reach USD 27.83 Billion by 2030, Growing at a CAGR of 6.2 % From 2023-2030.