Cold Chain Packaging Market Synopsis

The Global Market for Cold Chain Packaging Estimated at USD 27130 Million In the Year 2022, Is Projected To Reach A Revised Size Of USD 115100 Million By 2030, Growing At A CAGR Of 19.90% Over The Forecast Period 2022-2030.

The term "cold chain packaging" refers to a method of transporting and storing goods that maintains a constant temperature from the point of production all the way to their final destination.

- The term "cold chain packaging" refers to a form of packaging that has been developed in order to keep temperature-sensitive goods within a constant temperature range while they are being transported, stored, and distributed. This type of packaging is known as "cold chain packaging."

- This sort of packaging is crucial for items such as vaccines, biologics, and perishable foods, which need to be stored at a specified temperature range to retain their quality and efficacy. Cold chain packaging often consists of insulated materials and refrigerants that serve to regulate and maintain the temperature within a certain range, protecting the goods from temperature extremes that could damage it.

- Cold chain packaging is an essential component of the supply chain for temperature-sensitive products, as it ensures that these products remain safe and effective throughout their journey from manufacturer to end-user.

- Cold chain packaging is very necessary in order to ensure the quality, effectiveness, and safety of temperature-sensitive goods. It is possible for improper temperature regulation to cause the decomposition, deterioration, or loss of efficacy of a product, all of which can be harmful to consumers and result in large financial losses for businesses.

The Cold Chain Packaging Market Trend Analysis

Stronger Demand from Pharmaceutical Industry

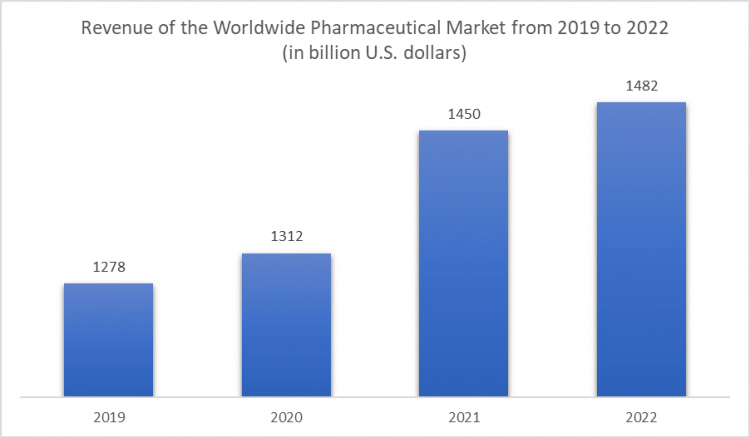

- Over the past few years, there has been a consistent increase in the demand for cold chain packaging, which has been predominantly driven by the pharmaceutical industry. This is due to the fact that a lot of drugs and vaccinations are extremely temperature sensitive, and if they are subjected to temperatures that are outside of their prescribed range, they can lose their effectiveness or even become harmful. As a direct consequence of this, pharmaceutical firms are in dire need of specialized packaging that is able to preserve the necessary temperature all the way through the supply chain, from the point of manufacture all the way through to the point where the product is stored.

- Cold chain packaging is produced to maintain items within a certain temperature range. This temperature range is often between 2 and 8 degrees Celsius, although it may vary anywhere from -80 degrees Celsius to 25 degrees Celsius, depending on the product. This type of packing often consists of insulated containers, refrigerants such as gel packs or dry ice, and temperature monitoring equipment to ensure that the temperature is maintained throughout the process of transporting the product.

- In addition to pharmaceuticals, other industries such as food and beverages, and biotechnology also require cold chain packaging for their products. With the increasing importance of temperature-sensitive products, the demand for cold chain packaging is expected to continue to grow in the coming years.

- The increasing total revenue of the global pharmaceutical industry has the potential to promote growth in the market for cold chain packaging. This is due to the fact that pharmaceutical goods, particularly biologics, vaccines, and other temperature-sensitive medications, need to be packaged in a cold chain in order to keep their efficacy and quality maintained while being transported and kept in storage.

Increasing Adoption Of More Advanced Manufacturing Processes

- The cold chain packaging business has an excellent opportunity to expand as advanced production methods become the norm. Specialized packaging solutions that can fulfill the demands of more complicated and sensitive products are becoming more and more important in the industrial sector as time goes on.

- Biologics and customized medicine are two examples of goods that require specific cold chain packaging to ensure their quality and safety during shipping. There are typically extremely specific temperature requirements for these items that must be met from the time they are first conceived of in the design phase all the way through to the time they are delivered to the customer. Therefore, there is a high need for innovative cold-chain packaging options that can cater to these specifications.

- Additionally, new opportunities for cold chain packaging are emerging due to the growing prevalence of automation and robots in the production process. The improved precision and accuracy made possible by these technologies is crucial for the manufacture of high-quality temperature-sensitive goods.

- In summary, the increasing adoption of more advanced manufacturing processes presents a significant opportunity for the cold chain packaging market. As manufacturers continue to produce more complex and sensitive products, the demand for specialized cold-chain packaging solutions will continue to grow.

Segmentation Analysis Of The Cold Chain Packaging Market

Cold Chain Packaging market segments cover the Product Type, Application. By Product Type, the Pallet Shippers are Anticipated to Dominate the Market Over the Forecast period.

- According to Research, the pallet shippers’ segment would lead the market by accounting for more than 36% of the market share.

- These products are used for seasonal and universal temperature protection coverage, thereby giving them an advantage over other cold packaging solutions. These are generally large-capacity shipping systems that are both effective and reusable. Besides, they are compact and light, which further reduces transport costs. Due to their exceptional occupancy capacity ratio and low volumetric weight, these containers are prominently used for frozen, refrigerated, or controlled room temperature shipments, transporting farm produce, processed agricultural products, pharmaceutical drugs, and many others.

Regional Analysis of The Cold Chain Packaging Market

Europe is Expected to Dominate the Market Over the Forecast Period.

- Europe is expected to dominate the cold chain packaging market in the coming years. This is due to several factors, including the region's strong pharmaceutical and biotech industries, strict regulatory requirements, and growing demand for temperature-controlled logistics solutions.

- Additionally, there are significant differences in the temperature profile from nation to country across Europe. Transporting items that must be kept at a specific temperature necessitates the use of sophisticated temperature monitoring and packing technologies. As a result of their economies' growth and development, the nations of Central and Eastern Europe are predicted to provide numerous expansion chances in comparison to the West. Frozen and chilled varieties of fruits, vegetables, meat, fish, and milk products make up a significant portion of Germany's total food imports. Thanks to rising consumer awareness of the need for a balanced diet and an overall improvement in their health, the packaged food business continues to grow in the country.

- Moreover, Germany is regarded as the leader in the food and beverage market in Europe, which strongly supports the growth of the cold packaging business in the region.

Covid-19 Impact Analysis On Cold Chain Packaging Market

The pharmaceutical and food industries were designated important services by all regional governments during the COVID-19 epidemic. During this time, the cold supply chain's ability to protect temperature-sensitive goods became even more crucial. Restrictions on trade slowed the expansion of the market because of the falling demand for perishable food goods and specialized industrial resources.

For instance, as per the United States Department of Agriculture GAIN report, in 2020, leading milk producers in Europe, such as Germany, France, Denmark, and the Netherlands, experienced a negative impact on milk production and milk consumption. As milk is one of the most important uses of cold chain logistics, a recent decline in consumption has had an effect on the European market's need for packaging materials.

However, cold chain packaging associations are undertaking all the essential precautions to combat the situation incurred by the outbreak. For instance, the Global Cold Chain Alliance (GCCA) implemented precautionary measures to cope with the impact. The GCCA is continuously updating guidelines and routes frequently as per the instructions from the regional government.

Top Key Players Covered in The Cold Chain Packaging Market

- Cold Chain Technologies (U.S.)

- Peli BioThermal (U.S.)

- Orora Group (Australia)

- Sonoco ThermoSafe (U.S.)

- CREOPACK (Canada)

- Sofrigam (France)

- Intelsius (U.K.)

- Nordic Cold Chain Solutions (U.S.)

- Tempack (Spain)

- Cryopak (U.S.)

- Softbox Systems (U.K.)

- Sealed Air Corporation (U.S.) And Other Major Players

Key Industry Developments in the Cold Chain Packaging Market

In December2023: Isobox, a leading provider of cold chain packaging solutions, announced the launch of its new line of reusable thermal containers specifically designed for the pharmaceutical industry. These containers offer enhanced temperature control and extended shelf life for sensitive drug products, catering to the growing demand for sustainable cold chain solutions in healthcare.

In December 2023, Sonoco, a global packaging leader, unveiled its new TempShield® ClimaCell™ liners engineered with advanced insulation materials and phase change technology. These liners provide superior temperature stability and extended product protection for perishable goods during transportation and storage, ideal for applications like food and beverage, and life sciences.

In December 2023, Nefab, a provider of customized protective packaging solutions, announced a strategic partnership with Vafotherm, a manufacturer of high-performance vacuum insulation panels (VIPs). This collaboration will integrate Vafotherm's VIPs into Nefab's cold chain packaging offerings, enabling significant reductions in package size and weight while maintaining optimal temperature control for temperature-sensitive cargo.

|

Global Cold Chain Packaging Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2030 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2022: |

USD 27130 Mn. |

|

Forecast Period 2022-30 CAGR: |

19.90% |

Market Size in 2030: |

USD 115100 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Cold Chain Packaging Market by Product Type

5.1 Cold Chain Packaging Market Overview Snapshot and Growth Engine

5.2 Cold Chain Packaging Market Overview

5.3 EPS Containers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2030F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 EPS Containers: Geographic Segmentation

5.4 PUR Containers

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2030F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 PUR Containers: Geographic Segmentation

5.5 Pallet Shippers

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2030F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Pallet Shippers: Geographic Segmentation

5.6 Vacuum Insulated Panels

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2030F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Vacuum Insulated Panels: Geographic Segmentation

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2030F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation

Chapter 6: Cold Chain Packaging Market by Application

6.1 Cold Chain Packaging Market Overview Snapshot and Growth Engine

6.2 Cold Chain Packaging Market Overview

6.3 Food

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2030F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Food: Geographic Segmentation

6.4 Dairy

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2030F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Dairy: Geographic Segmentation

6.5 Pharmaceutical

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2030F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Pharmaceutical: Geographic Segmentation

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2030F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Cold Chain Packaging Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Cold Chain Packaging Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Cold Chain Packaging Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 COLD CHAIN TECHNOLOGIES (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 PELI BIOTHERMAL (U.S.)

7.4 ORORA GROUP (AUSTRALIA)

7.5 SONOCO THERMOSAFE (U.S.)

7.6 CREOPACK (CANADA)

7.7 SOFRIGAM (FRANCE)

7.8 INTELSIUS (U.K.)

7.9 NORDIC COLD CHAIN SOLUTIONS (U.S.)

7.10 TEMPACK (SPAIN)

7.11 CRYOPAK (U.S.)

7.12 SOFTBOX SYSTEMS (U.K.)

7.13 SEALED AIR CORPORATION (U.S.)

7.14 OTHER MAJOR PLAYERS

Chapter 8: Global Cold Chain Packaging Market Analysis, Insights and Forecast, 2016-2030

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Product Type

8.2.1 EPS Containers

8.2.2 PUR Containers

8.2.3 Pallet Shippers

8.2.4 Vacuum Insulated Panels

8.2.5 Others

8.3 Historic and Forecasted Market Size By Application

8.3.1 Food

8.3.2 Dairy

8.3.3 Pharmaceutical

8.3.4 Others

Chapter 9: North America Cold Chain Packaging Market Analysis, Insights and Forecast, 2016-2030

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Product Type

9.4.1 EPS Containers

9.4.2 PUR Containers

9.4.3 Pallet Shippers

9.4.4 Vacuum Insulated Panels

9.4.5 Others

9.5 Historic and Forecasted Market Size By Application

9.5.1 Food

9.5.2 Dairy

9.5.3 Pharmaceutical

9.5.4 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 US

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Eastern Europe Cold Chain Packaging Market Analysis, Insights and Forecast, 2016-2030

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product Type

10.4.1 EPS Containers

10.4.2 PUR Containers

10.4.3 Pallet Shippers

10.4.4 Vacuum Insulated Panels

10.4.5 Others

10.5 Historic and Forecasted Market Size By Application

10.5.1 Food

10.5.2 Dairy

10.5.3 Pharmaceutical

10.5.4 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Bulgaria

10.6.2 The Czech Republic

10.6.3 Hungary

10.6.4 Poland

10.6.5 Romania

10.6.6 Rest of Eastern Europe

Chapter 11: Western Europe Cold Chain Packaging Market Analysis, Insights and Forecast, 2016-2030

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product Type

11.4.1 EPS Containers

11.4.2 PUR Containers

11.4.3 Pallet Shippers

11.4.4 Vacuum Insulated Panels

11.4.5 Others

11.5 Historic and Forecasted Market Size By Application

11.5.1 Food

11.5.2 Dairy

11.5.3 Pharmaceutical

11.5.4 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 Germany

11.6.2 UK

11.6.3 France

11.6.4 Netherlands

11.6.5 Italy

11.6.6 Russia

11.6.7 Spain

11.6.8 Rest of Western Europe

Chapter 12: Asia Pacific Cold Chain Packaging Market Analysis, Insights and Forecast, 2016-2030

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product Type

12.4.1 EPS Containers

12.4.2 PUR Containers

12.4.3 Pallet Shippers

12.4.4 Vacuum Insulated Panels

12.4.5 Others

12.5 Historic and Forecasted Market Size By Application

12.5.1 Food

12.5.2 Dairy

12.5.3 Pharmaceutical

12.5.4 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 China

12.6.2 India

12.6.3 Japan

12.6.4 South Korea

12.6.5 Malaysia

12.6.6 Thailand

12.6.7 Vietnam

12.6.8 The Philippines

12.6.9 Australia

12.6.10 New Zealand

12.6.11 Rest of APAC

Chapter 13: Middle East & Africa Cold Chain Packaging Market Analysis, Insights and Forecast, 2016-2030

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product Type

13.4.1 EPS Containers

13.4.2 PUR Containers

13.4.3 Pallet Shippers

13.4.4 Vacuum Insulated Panels

13.4.5 Others

13.5 Historic and Forecasted Market Size By Application

13.5.1 Food

13.5.2 Dairy

13.5.3 Pharmaceutical

13.5.4 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Turkey

13.6.2 Bahrain

13.6.3 Kuwait

13.6.4 Saudi Arabia

13.6.5 Qatar

13.6.6 UAE

13.6.7 Israel

13.6.8 South Africa

Chapter 14: South America Cold Chain Packaging Market Analysis, Insights and Forecast, 2016-2030

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product Type

14.4.1 EPS Containers

14.4.2 PUR Containers

14.4.3 Pallet Shippers

14.4.4 Vacuum Insulated Panels

14.4.5 Others

14.5 Historic and Forecasted Market Size By Application

14.5.1 Food

14.5.2 Dairy

14.5.3 Pharmaceutical

14.5.4 Others

14.6 Historic and Forecast Market Size by Country

14.6.1 Brazil

14.6.2 Argentina

14.6.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Cold Chain Packaging Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2030 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2022: |

USD 27130 Mn. |

|

Forecast Period 2022-30 CAGR: |

19.90% |

Market Size in 2030: |

USD 115100 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. COLD CHAIN PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. COLD CHAIN PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. COLD CHAIN PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. COLD CHAIN PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. COLD CHAIN PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. COLD CHAIN PACKAGING MARKET BY PRODUCT TYPE

TABLE 008. EPS CONTAINERS MARKET OVERVIEW (2016-2030)

TABLE 009. PUR CONTAINERS MARKET OVERVIEW (2016-2030)

TABLE 010. PALLET SHIPPERS MARKET OVERVIEW (2016-2030)

TABLE 011. VACUUM INSULATED PANELS MARKET OVERVIEW (2016-2030)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 013. COLD CHAIN PACKAGING MARKET BY APPLICATION

TABLE 014. FOOD MARKET OVERVIEW (2016-2030)

TABLE 015. DAIRY MARKET OVERVIEW (2016-2030)

TABLE 016. PHARMACEUTICAL MARKET OVERVIEW (2016-2030)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 018. NORTH AMERICA COLD CHAIN PACKAGING MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 019. NORTH AMERICA COLD CHAIN PACKAGING MARKET, BY APPLICATION (2016-2030)

TABLE 020. N COLD CHAIN PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 021. EASTERN EUROPE COLD CHAIN PACKAGING MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 022. EASTERN EUROPE COLD CHAIN PACKAGING MARKET, BY APPLICATION (2016-2030)

TABLE 023. COLD CHAIN PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 024. WESTERN EUROPE COLD CHAIN PACKAGING MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 025. WESTERN EUROPE COLD CHAIN PACKAGING MARKET, BY APPLICATION (2016-2030)

TABLE 026. COLD CHAIN PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 027. ASIA PACIFIC COLD CHAIN PACKAGING MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 028. ASIA PACIFIC COLD CHAIN PACKAGING MARKET, BY APPLICATION (2016-2030)

TABLE 029. COLD CHAIN PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 030. MIDDLE EAST & AFRICA COLD CHAIN PACKAGING MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 031. MIDDLE EAST & AFRICA COLD CHAIN PACKAGING MARKET, BY APPLICATION (2016-2030)

TABLE 032. COLD CHAIN PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 033. SOUTH AMERICA COLD CHAIN PACKAGING MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 034. SOUTH AMERICA COLD CHAIN PACKAGING MARKET, BY APPLICATION (2016-2030)

TABLE 035. COLD CHAIN PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 036. COLD CHAIN TECHNOLOGIES (U.S.): SNAPSHOT

TABLE 037. COLD CHAIN TECHNOLOGIES (U.S.): BUSINESS PERFORMANCE

TABLE 038. COLD CHAIN TECHNOLOGIES (U.S.): PRODUCT PORTFOLIO

TABLE 039. COLD CHAIN TECHNOLOGIES (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. PELI BIOTHERMAL (U.S.): SNAPSHOT

TABLE 040. PELI BIOTHERMAL (U.S.): BUSINESS PERFORMANCE

TABLE 041. PELI BIOTHERMAL (U.S.): PRODUCT PORTFOLIO

TABLE 042. PELI BIOTHERMAL (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ORORA GROUP (AUSTRALIA): SNAPSHOT

TABLE 043. ORORA GROUP (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 044. ORORA GROUP (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 045. ORORA GROUP (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. SONOCO THERMOSAFE (U.S.): SNAPSHOT

TABLE 046. SONOCO THERMOSAFE (U.S.): BUSINESS PERFORMANCE

TABLE 047. SONOCO THERMOSAFE (U.S.): PRODUCT PORTFOLIO

TABLE 048. SONOCO THERMOSAFE (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. CREOPACK (CANADA): SNAPSHOT

TABLE 049. CREOPACK (CANADA): BUSINESS PERFORMANCE

TABLE 050. CREOPACK (CANADA): PRODUCT PORTFOLIO

TABLE 051. CREOPACK (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SOFRIGAM (FRANCE): SNAPSHOT

TABLE 052. SOFRIGAM (FRANCE): BUSINESS PERFORMANCE

TABLE 053. SOFRIGAM (FRANCE): PRODUCT PORTFOLIO

TABLE 054. SOFRIGAM (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. INTELSIUS (U.K.): SNAPSHOT

TABLE 055. INTELSIUS (U.K.): BUSINESS PERFORMANCE

TABLE 056. INTELSIUS (U.K.): PRODUCT PORTFOLIO

TABLE 057. INTELSIUS (U.K.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. NORDIC COLD CHAIN SOLUTIONS (U.S.): SNAPSHOT

TABLE 058. NORDIC COLD CHAIN SOLUTIONS (U.S.): BUSINESS PERFORMANCE

TABLE 059. NORDIC COLD CHAIN SOLUTIONS (U.S.): PRODUCT PORTFOLIO

TABLE 060. NORDIC COLD CHAIN SOLUTIONS (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. TEMPACK (SPAIN): SNAPSHOT

TABLE 061. TEMPACK (SPAIN): BUSINESS PERFORMANCE

TABLE 062. TEMPACK (SPAIN): PRODUCT PORTFOLIO

TABLE 063. TEMPACK (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. CRYOPAK (U.S.): SNAPSHOT

TABLE 064. CRYOPAK (U.S.): BUSINESS PERFORMANCE

TABLE 065. CRYOPAK (U.S.): PRODUCT PORTFOLIO

TABLE 066. CRYOPAK (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. SOFTBOX SYSTEMS (U.K.): SNAPSHOT

TABLE 067. SOFTBOX SYSTEMS (U.K.): BUSINESS PERFORMANCE

TABLE 068. SOFTBOX SYSTEMS (U.K.): PRODUCT PORTFOLIO

TABLE 069. SOFTBOX SYSTEMS (U.K.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. SEALED AIR CORPORATION (U.S.): SNAPSHOT

TABLE 070. SEALED AIR CORPORATION (U.S.): BUSINESS PERFORMANCE

TABLE 071. SEALED AIR CORPORATION (U.S.): PRODUCT PORTFOLIO

TABLE 072. SEALED AIR CORPORATION (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 073. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 074. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 075. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. COLD CHAIN PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. COLD CHAIN PACKAGING MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. EPS CONTAINERS MARKET OVERVIEW (2016-2030)

FIGURE 013. PUR CONTAINERS MARKET OVERVIEW (2016-2030)

FIGURE 014. PALLET SHIPPERS MARKET OVERVIEW (2016-2030)

FIGURE 015. VACUUM INSULATED PANELS MARKET OVERVIEW (2016-2030)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 017. COLD CHAIN PACKAGING MARKET OVERVIEW BY APPLICATION

FIGURE 018. FOOD MARKET OVERVIEW (2016-2030)

FIGURE 019. DAIRY MARKET OVERVIEW (2016-2030)

FIGURE 020. PHARMACEUTICAL MARKET OVERVIEW (2016-2030)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 022. NORTH AMERICA COLD CHAIN PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. EASTERN EUROPE COLD CHAIN PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. WESTERN EUROPE COLD CHAIN PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. ASIA PACIFIC COLD CHAIN PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. MIDDLE EAST & AFRICA COLD CHAIN PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. SOUTH AMERICA COLD CHAIN PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Cold Chain Packaging Market research report is 2022-2028.

Cold Chain Technologies (U.S.), Peli BioThermal (U.S.), Orora Group (Australia), Sonoco ThermoSafe (U.S.), CREOPACK (Canada), Sofrigam (France), Intelsius (U.K.), Nordic Cold Chain Solutions (U.S.), Tempack (Spain), Cryopak (U.S.), Softbox Systems (U.K.), Sealed Air Corporation (U.S.) And Other Major Players.

The Cold Chain Packaging Market has been segmented into Product Type, Application, and region. By Product Type, the market is categorized into EPS Containers, PUR Containers, Pallet Shippers, Vacuum Insulated Panels, and Others. By Application, the market is categorized into Food, Dairy, Pharmaceutical, and Others. By region, it is analyzed across North America (US, Canada, Mexico), Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The term "cold chain packaging" refers to a form of packaging that has been developed in order to keep temperature-sensitive goods within a constant temperature range while they are being transported, stored, and distributed. This type of packaging is known as "cold chain packaging.

The Global Market for Cold Chain Packaging Estimated at USD 27130 Million In the Year 2022, Is Projected To Reach A Revised Size Of USD 115100 Million By 2030, Growing At A CAGR Of 19.90% Over The Forecast Period 2022-2030.