Ridesharing Services Market Synopsis

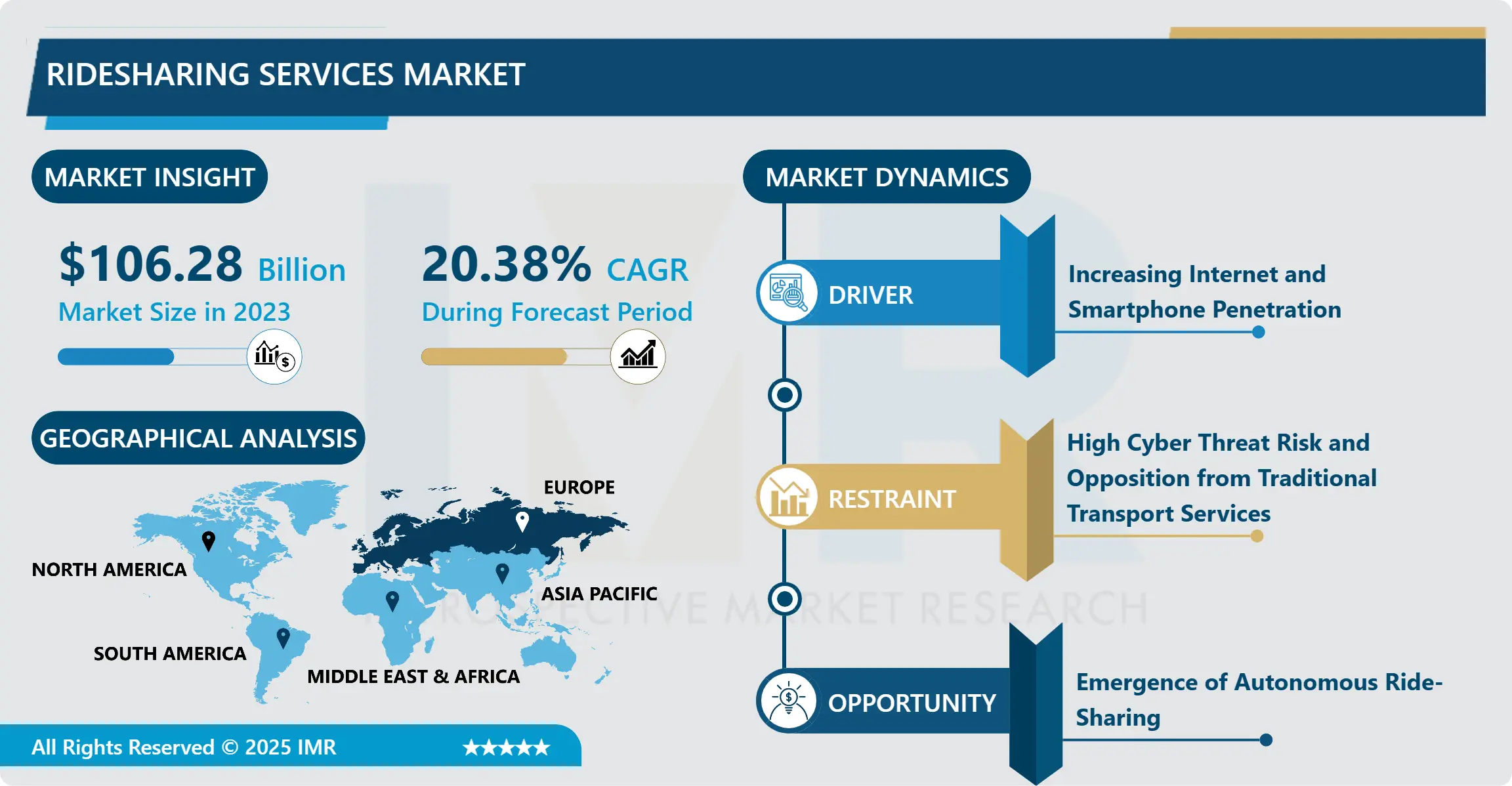

Ridesharing Services Market Size Was Valued at USD 106.28 Billion in 2023 and is Projected to Reach USD 564.21 Billion by 2032, Growing at a CAGR of 20.38% From 2024-2032.

Driven by technological advancements and expanding urbanization, the ridesharing services market has experienced considerable growth in recent years. By providing cost-effective and convenient alternatives to traditional taxi services, platforms such as Uber, Lyft, and Didi Chuxing have transformed urban transportation. The proliferation of smartphones and the ease of app-based bookings, which cater to the on-demand economy, are the primary factors contributing to this transition.

The expanding consumer base in emergent markets and the growing acceptance of shared mobility solutions are the driving forces behind this growth. Furthermore, we anticipate that the integration of autonomous driving technologies and electric vehicles (EVs) will further stimulate the market.

Convenience, cost, and the availability of a variety of transport options are the factors that influence consumer behavior in the ridesharing market. Users appreciate the ability to select from a variety of services, including premium services and budget-friendly shared transportation. The primary adopters of shared mobility are the younger demographic, particularly millennials and Gen Z, who appreciate the environmental benefits and simplicity of use.

In the future, the ridesharing market will be on the verge of sustained growth and innovation. The integration of autonomous vehicles and the adoption of ecological technologies, such as EVs, are among the most significant trends. Nevertheless, the industry faces a variety of obstacles, such as the pursuit of sustainable business models, regulatory obstacles, and data privacy concerns. The long-term viability and success of ridesharing services will depend on these issues being resolved.

In summary, the ridesharing services market is a sector that is rapidly evolving and dynamic, with substantial potential for future development. In order to capitalize on emerging opportunities, companies in this sector must navigate a complex landscape of regulatory environments, technological advancements, and changing consumer preferences.

Ridesharing Services Market Trend Analysis

Technological Advancements and Autonomous Vehicles

- The market for autonomous vehicles and ridesharing services is undergoing a rapid transformation as a result of substantial technological advancements. Self-driving technology, advanced sensor systems, and AI algorithms are transforming our perception of transportation. Waymo, Tesla, and Uber are among the companies that are leading the charge in the research and development of autonomous vehicles.

- We anticipate that these developments will generate substantial advantages for ridesharing services. Autonomous fleets have the potential to enhance safety, reduce operational costs, and increase efficiency. We anticipate that this transition will lead to a reduction in traffic congestion and emissions, while also providing consumers with more affordable transportation options.

- Furthermore, the integration of advanced technologies like 5G connectivity and IoT, which enable real-time data exchange, can optimize route planning and vehicle maintenance. The widespread implementation of autonomous vehicles in ridesharing services appears to be inevitable as regulatory frameworks adapt, thereby establishing a transformative era in urban mobility.

Sustainability and Electric Vehicles (EVs)

- The market for autonomous vehicles and ridesharing services is undergoing a rapid transformation as a result of substantial technological advancements. Self-driving technology, advanced sensor systems, and AI algorithms are transforming our perception of transportation. Waymo, Tesla, and Uber are among the companies that are leading the charge in the research and development of autonomous vehicles.

- We anticipate that these developments will generate substantial advantages for ridesharing services. Autonomous fleets have the potential to enhance safety, reduce operational costs, and increase efficiency. We anticipate that this transition will lead to a reduction in traffic congestion and emissions, while also providing consumers with more affordable transportation options.

- Furthermore, the integration of advanced technologies like 5G connectivity and IoT, which enable real-time data exchange, can optimize route planning and vehicle maintenance. The widespread implementation of autonomous vehicles in ridesharing services appears to be inevitable as regulatory frameworks adapt, thereby establishing a transformative era in urban mobility.

Ridesharing Services Market Segment Analysis:

Ridesharing Services Market Segmented on the basis of By Service Type, By Sharing Type, By Vehicle Type, By Travel Mode and By Data Science

By Service Type, E-Hailing is expected to dominate the market during the forecast period.

- The ridesharing services market is undergoing rapid growth across a variety of service categories, such as e-hailing, ridesharing, car rental, and station-based mobility. Companies such as Uber and Lyft have been at the forefront of the e-hailing industry, which provides on-demand transportation through mobile applications. This service enables users to reserve journeys from nearby drivers. This segment, which thrives on accessibility and convenience, equally serves urban commuters and travelers.

- Riding By connecting drivers with passengers who are traveling in the same direction, sharing platforms like BlaBlaCar enable cost-effective long-distance travel. By promoting resource efficiency and affordability, this service type aims to appeal to budget-conscious travelers and reduce overall vehicle emissions. Zipcar and Turo are examples of car rental services that offer short-term vehicle access, allowing users to rent cars on an hourly or daily basis. This model is well-suited for tourists, business travellers, and locals who require intermittent vehicle use, as it promotes flexibility and autonomy in transportation options.

- Station-based mobility services, like electric scooter rentals and municipal bike-sharing systems, enhance urban mobility by offering convenient access points across city centers. These services support last-mile connectivity in public transit networks, reduce congestion, and promote sustainable transportation options.

- Technological advancements, evolving consumer preferences, and growing urbanization are the driving forces behind the global expansion of the ridesharing services market. In the contemporary interconnected world, each service type plays a unique role in the transformation of how individuals perceive and utilize transportation.

By Vehicle Type, ICE Vehicle segment held the largest share in 2023

- The ridesharing services market has experienced substantial diversification in terms of vehicle varieties, including internal combustion engine (ICE) vehicles, compressed natural gas (CNG) or liquefied petroleum gas (LPG) vehicles, and electric vehicles (EVs). The distinct advantages and considerations of each vehicle type influence the market dynamics.

- ICE vehicles continue to be a popular choice for ridesharing services in numerous regions due to their extensive availability of fueling stations and established infrastructure. Their reduced initial cost and familiarity among drivers also contribute to their continued popularity.

- Environmentally conscious consumers and regulatory environments find CNG/LPG vehicles attractive due to their reduced emissions compared to conventional ICE vehicles, thereby fostering greener transportation solutions. In order to comply with regulatory mandates and sustainability objectives, ridesharing organizations are progressively implementing these vehicles.

- In the ridesharing industry, electric vehicles are at the vanguard of innovation due to their zero-emission profiles and reduced operating costs over time. Advancements in battery technology and supportive infrastructure development are expediting their adoption, despite obstacles such as range anxiety and higher initial costs.

- In summary, the ridesharing services market's adoption of a variety of vehicle types is indicative of a sophisticated strategy for balancing consumer preferences, environmental impact, and operational efficacy. As technology advances, the landscape of vehicle selection within this dynamic sector will continue to evolve.

Ridesharing Services Market Regional Insights:

Europe is expected to grow during the forecast period

- During the forecast period, we anticipate the ridesharing services market in Europe to expand. There are a number of factors that contribute to this optimistic outlook. Initially, the growing urbanization and congestion in major cities drive the demand for efficient and adaptable transportation solutions. We encourage urban residents seeking affordable and reliable transportation alternatives to embrace ridesharing services, which offer convenient alternatives to traditional taxis.

- Secondly, the widespread use of smartphones and technological advancements have facilitated simple access to ridesharing platforms, thereby expanding the market reach and enhancing the user experience. The integration of real-time tracking systems and GPS navigation ensures prompt service delivery, thereby enhancing customer satisfaction and loyalty.

- Regulatory support and favourable government policies significantly encourage the market by promoting the implementation of shared mobility solutions. In an effort to alleviate traffic congestion, reduce emissions, and enhance air quality, numerous European cities are promoting ridesharing initiatives.

Active Key Players in the Ridesharing Services Market

- Uber Technologies Inc.

- BlaBlaCar Inc.

- ANI Technologies Pvt. Ltd. (OLA)

- Wingz

- Lyft Inc.

- Grab

- Careem

- Curb Mobility

- Taxify OÜ

- Gett

- Beijing Xiaoju Technology Co Ltd. (Didi Chuxing)

- Cabify, Others key players.

|

Ridesharing Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 106.28 Bn. |

|

Forecast Period 2023-30 CAGR: |

20.38% |

Market Size in 2032: |

USD 564.21 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ridesharing Services Market by Product Type (2018-2032)

4.1 Ridesharing Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pineapple Leather

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cactus Leather

4.5 Mushroom Leather

4.6 Apple Leather

4.7 Other Product Types

Chapter 5: Ridesharing Services Market by Application (2018-2032)

5.1 Ridesharing Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fashion

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Clothing

5.5 Accessories

5.6 Footwear

5.7 Automotive Interior

5.8 Home

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Ridesharing Services Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 UBER TECHNOLOGIES INC.

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BLABLACAR INC.

6.4 ANI TECHNOLOGIES PVT. LTD. (OLA)

6.5 WINGZ

6.6 LYFT INC.

6.7 GRAB

6.8 CAREEM

6.9 CURB MOBILITY

6.10 TAXIFY OÜ

6.11 GETT

6.12 BEIJING XIAOJU TECHNOLOGY CO LTD. (DIDI CHUXING)

6.13 CABIFY

6.14 OTHERS KEY PLAYERS

Chapter 7: Global Ridesharing Services Market By Region

7.1 Overview

7.2. North America Ridesharing Services Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Pineapple Leather

7.2.4.2 Cactus Leather

7.2.4.3 Mushroom Leather

7.2.4.4 Apple Leather

7.2.4.5 Other Product Types

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Fashion

7.2.5.2 Clothing

7.2.5.3 Accessories

7.2.5.4 Footwear

7.2.5.5 Automotive Interior

7.2.5.6 Home

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Ridesharing Services Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Pineapple Leather

7.3.4.2 Cactus Leather

7.3.4.3 Mushroom Leather

7.3.4.4 Apple Leather

7.3.4.5 Other Product Types

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Fashion

7.3.5.2 Clothing

7.3.5.3 Accessories

7.3.5.4 Footwear

7.3.5.5 Automotive Interior

7.3.5.6 Home

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Ridesharing Services Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Pineapple Leather

7.4.4.2 Cactus Leather

7.4.4.3 Mushroom Leather

7.4.4.4 Apple Leather

7.4.4.5 Other Product Types

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Fashion

7.4.5.2 Clothing

7.4.5.3 Accessories

7.4.5.4 Footwear

7.4.5.5 Automotive Interior

7.4.5.6 Home

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Ridesharing Services Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Pineapple Leather

7.5.4.2 Cactus Leather

7.5.4.3 Mushroom Leather

7.5.4.4 Apple Leather

7.5.4.5 Other Product Types

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Fashion

7.5.5.2 Clothing

7.5.5.3 Accessories

7.5.5.4 Footwear

7.5.5.5 Automotive Interior

7.5.5.6 Home

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Ridesharing Services Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Pineapple Leather

7.6.4.2 Cactus Leather

7.6.4.3 Mushroom Leather

7.6.4.4 Apple Leather

7.6.4.5 Other Product Types

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Fashion

7.6.5.2 Clothing

7.6.5.3 Accessories

7.6.5.4 Footwear

7.6.5.5 Automotive Interior

7.6.5.6 Home

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Ridesharing Services Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Pineapple Leather

7.7.4.2 Cactus Leather

7.7.4.3 Mushroom Leather

7.7.4.4 Apple Leather

7.7.4.5 Other Product Types

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Fashion

7.7.5.2 Clothing

7.7.5.3 Accessories

7.7.5.4 Footwear

7.7.5.5 Automotive Interior

7.7.5.6 Home

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Ridesharing Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 106.28 Bn. |

|

Forecast Period 2023-30 CAGR: |

20.38% |

Market Size in 2032: |

USD 564.21 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||