Global Retort Packaging Market Overview

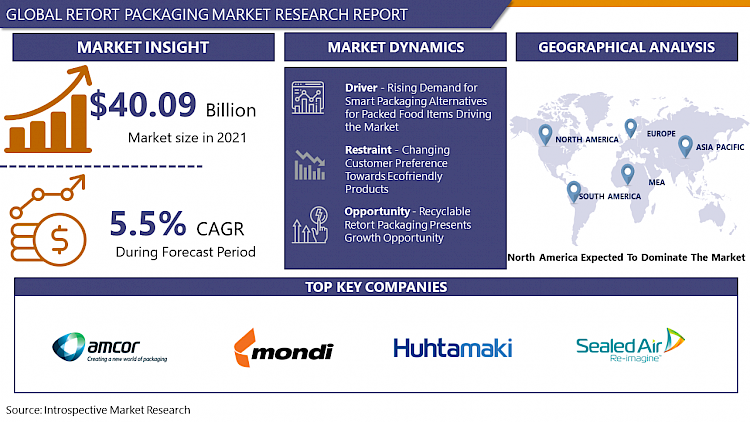

Global Retort Packaging Market Size Was Valued at USD 40.09 Billion In 2022 And Is Projected to Reach USD 64.91 Billion By 2030, Growing at A CAGR of 5.5% From 2023 To 2030.

Retort packaging is made up of many layers of flexible polymers and metal laminated together. Retort packaging assists in the packaging of a wide range of goods and drinks that may be kept fresh for longer. Retorts are a form of thermal food processing equipment that sterilizes food using heat and pressure. They are one of the most often used thermal food processing technologies. Retort packaging is a sort of semi-rigid and flexible packaging with a characteristic stand-up pouch for cook-in-a-bag meals such as soups, cereals, sauces, and pasta dishes. The necessity for retort packaging can be linked to the quick growth and increase in demand for ready-to-eat or ready meals throughout the world. Factors such as demanding work schedules, expanding single-household populations, and increased consumer purchasing power has boosted the market for ready-to-eat meals, resulting in a greater need for retort packaging.

Market Dynamics And Factors For Retort Packaging Market

Drivers:

Rising Demand For Smart Packaging Alternatives For Packed Food Items Driving The Market

Because cans and jars are large and bulky, retort packaging is a superior alternative to traditional canning processes. They take up a lot of shelf space, which raises storage and shipping expenses, whereas retort pouches are light and take up less room. The packed items are sterilized using a fast heat transfer method. The retort pouches' small shape helps to speed up the sterilizing process. These characteristics of retort pouches may help them gain traction as food storage alternatives to cans and jars. These factors are expected to enhance demand for retort pouches in the food and beverage sector, which will support the retort packaging market's growth in the future years. Globally, the demand for packaged food that is either raw or cooked inside a retort pouch is rapidly increasing. Customers' lives are changing as a result of their demanding schedules, and an increasing number of consumers do not want to spend much time cooking. These factors are likely to boost demand for processed foods, resulting in increased demand and favorable growth for the retort packaging market throughout the forecast period.

Restraints:

Changing preference of customers towards eco-friendly packaging alternatives as a sustainable product which are either made from recycled material or bio-degradable solutions. As developed economies focus on the sustainable goals to meet the environmental pact, plastic-free products including sustainable packaging and polyamide free products taking the grip on the market, which is a restraining factor for the retort packaging market, Although eco-friendly reusable packaging material is being introduced by companies such as Mondi Inc and Amcor. Therefore, such factors are expected to restrain the growth of the Retort Packaging Market.

Opportunities:

Recyclable Retort Packaging possesses bright growth opportunities as sustainability norm is getting popular in the market. Many of the market leaders are pumping the money into a recyclable product lineup. The cyclos-HTP Institute, an independent testing lab, has certified AmLite HeatFlex Recyclable as ecological, and it complies with the CEFLEX Consortium's recently issued packaging requirements for a circular economy. It may be readily recycled in numerous European nations, including Germany, Austria, Italy, Norway, and the Netherlands, where plastic collecting systems already exist. With recyclable products are getting popular, related raw material selection has become crucial. Because aluminum was not a possibility and paper couldn't endure the steam retort process, companies are switching to a complete polyolefin construction. PP and PE are polyolefins, and bags and pouches constructed of these materials are recycled in many countries nowadays. The challenge in switching to polyolefins for retort processing is that only PP has a melting point greater than 130 degrees Celsius, which is easily attained for retort processing. Therefore, the use of PP and PE with recyclable products creates major opportunities for Retort Packaging Market.

Challenges:

Initial machinery costs and process complexity are two main hurdles in retort packing. Filling, heat treatment, and tensile strength testing equipment are all required. These devices are both expensive to buy and to keep running. Another possible stumbling block is production complexity. Manufacturers must consider various factors when heat treating sealed pouches, including residual air and package thickness. Slower filling speeds and the necessity for additional protection while transportation is two other possible issues. Filling procedures are slower than those used in canning. You may need to give extra wrapping during distribution depending on the type of container you choose to reduce the risks of unintentional puncture.

Segmentation Analysis of Retort Packaging Market

By Type, Pouches segment dominating the Retort Packaging Market. Because of various advantages such as aesthetics, performance, and cost, the pouch packaging type is expected to increase at the fastest pace throughout the projection period. The overall design and aesthetics of pouches make them a fantastic product promotion tool, and demand is projected to grow in the future years. Pouches help to differentiate products by providing wide surfaces on which high-quality images may be printed, enticing customers, particularly in supermarkets and convenience stores where people make rapid purchase decisions. These pouches also have convenience and usefulness elements such as spouts, rip notches, and zippers. Flat retort pouches come in a variety of shapes and sizes, including pillow pouches, four-side-seal pouches, and three-side-seal pouches.

By Material, Polypropylene is expected to be dominating the retort packaging market. As companies are opting for more sustainable alternatives to use raw materials. Polypropylene acts as a sealing layer and provides flexibility and strength to the pouch. Polypropylene is a tough and robust plastic material that assists in retaining the freshness of various food items owing to which it is widely used in manufacturing retort pouches. On the inside of the pack, PP film is in direct contact with the food product and provides an exceptionally strong heat seal that can withstand all of the pressure and temperature demands of retorting, flexibility, strength, and inertness on the packaged cooked meat product in contact contributing to a product shelf-life at least equal to that of retorted cans, and packages.

By End User, the Food segment is dominating the Retort Packaging Market. The packaging market has grown significantly in the food sector. Soups, sauces, infant food, dry-ready meals, frozen ready meals, chilled ready meals, meal replacement products, and dairy products are among the many foods packaged in retort pouches. The application of pet food is also widely employed in the market. The rising popularity of the notion of "humanizing" pets has increased the number of individuals who own pets and provide them high-quality food. Furthermore, the growing trend of pet adoption, particularly among households with one kid and working parents, is expected to boost demand for pet food, favouring market expansion.

Regional Analysis of Retort Packaging Market:

North America is dominating the retort packaging market. Increased urbanization, hectic work lives, rising single-household populations, and rising consumer buying power have accelerated the expansion of pre-packaged products, which are often packaged in stand-up retort pouches, hence acting as significant drivers for the retort pouch sector. Because it is a highly handy and portable packaging option, retort packaging is quickly gaining favor. Many consumers in the nation prefer flexible, stand-up pouches to rigid packaging. Whether for snack food, beverage, baby food, or industrial oils and lubricants, consumers have increased demand for stand-up pouches tremendously over the last decade. Food, pharmaceutical, and nutraceutical goods ingested by people and animals are regulated by the Department of Health and Human Services in the United States. The Food and Drug Administration (FDA) or the United States Department of Agriculture (USDA) is in charge of this (USDA). Under the most extreme temperatures, the retort package regulation is fairly stringent, requiring the components and procedures to be listed under FDA rule 21 CFR 177.1390. The usage of retort pouches is increasing in Canada because of the growing acceptance of flexible packaging techniques in a variety of industries, including retail, pharmaceuticals, food and beverage, and pet food. Approximately 75% of the country's food supply is made up of packaged, processed foods. There has also been a shift in eating patterns, with a rise in the intake of ultra-processed, ready-to-eat meals, which are often energy-dense and rich in fat, sugar, and salt. These meals are commonly packaged in retort pouches, which are an efficient method of packaging food goods with a long shelf life.

The Asia Pacific is the fastest-growing region in retort packaging due to the strong demand from countries such as China, Australia, South Korea, and Japan. The region has more than half of the world's population and there has been an increase in the demand for convenient products due to hectic work life and increasing per capita income. The Indian market has seen a sudden boost in the demand for retort packaging as the growing urban population creates significant demand for packaged food items for which local food manufacturers opt the retort packaging to give high standard products. Floeter, Foodpropack is the local Indian retort packaging company that satisfies the regional demand and is expected to contribute the market growth. Consumers in the region are looking for ready meal products that can be consumed without much work; hence the demand for retort packages is growing in the region.

Covid-19 Impact Analysis on Retort Packaging Market

The COVID-19 pandemic has had devastating effects on several industry verticals globally. To constrain the number of cases and slow the coronavirus spread, various public health guidelines were implemented in different countries across the globe. COVID-19 protocols range from declaring national emergency states, enforcing stay-at-home orders, closing nonessential business operations and schools, banning public gatherings, imposing curfews, distributing digital passes, and allowing police to restrict citizen movements within a country, as well as closing international borders. With the growing vaccination rate, governments are uplifting the protocols to give a boost to the stagnant economy. Retort packaging makers have been experiencing supply chain interruptions as a result of the COVID 19 outbreak, as well as decreased manufacturing at numerous locations throughout the world. Companies like Amcor and Tetra Pak have continued to operate while taking cautious measures to fulfill the retort packaging industry's demand, however, the market is expected to bounce back as restrictions are being lifted by governments across the globe.

Key Players Covered In Retort Packaging Market:

- Amcor plc.

- Mondi Group

- Huhtamaki Oyj

- Sealed Air Corporation

- Winpak Ltd

- Sonoco Products Company

- Coveris Holdings S.A.

- Proampac LLC

- Tredegar Corporation

- Avonflex

- ALLIEDFLEX Technologies Inc.

- DNP America LLC.

- Clifton Packaging Group Ltd

- Printpack Inc.

- Paharpur 3P

- Constantia Flexibles Group GmbH

- Flair Flexible Packaging Corporation

- HPM Global Inc.

- LD PACK Co. Ltd and other major players.

Key Industry Developments In Retort Packaging Market

- October 2021, With the introduction of RetortPouch Recyclable, Mondi, a global pioneer in packaging and paper, has expanded its portfolio of sustainable luxury food and pet food packaging.

- October 2020, the world's first recyclable flexible retort pouch was launched by Amcor, a worldwide packaging pioneer, in collaboration with Nestlé. This month, the new high-barrier pouch, which uses Amcor's AmLite HeatFlex Recyclable solution, will be available in Dutch retailers for the first time.

|

Global Retort Packaging Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 40.09 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.5% |

Market Size in 2030: |

USD 64.91 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Material

3.3 By End-Use

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Retort Packaging Market by Type

4.1 Retort Packaging Market Overview Snapshot and Growth Engine

4.2 Retort Packaging Market Overview

4.3 Pouches

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Pouches: Grographic Segmentation

4.4 Trays

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Trays: Grographic Segmentation

4.5 Cartons

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Cartons: Grographic Segmentation

Chapter 5: Retort Packaging Market by Material

5.1 Retort Packaging Market Overview Snapshot and Growth Engine

5.2 Retort Packaging Market Overview

5.3 PET

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 PET: Grographic Segmentation

5.4 Polypropylene

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Polypropylene: Grographic Segmentation

5.5 Aluminium Foil

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Aluminium Foil: Grographic Segmentation

5.6 PA

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 PA: Grographic Segmentation

5.7 PE

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 PE: Grographic Segmentation

5.8 Paperboard

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Paperboard: Grographic Segmentation

Chapter 6: Retort Packaging Market by End-Use

6.1 Retort Packaging Market Overview Snapshot and Growth Engine

6.2 Retort Packaging Market Overview

6.3 Food

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Food: Grographic Segmentation

6.4 Beverages

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Beverages: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Retort Packaging Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Retort Packaging Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Retort Packaging Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 AMCOR PLC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 MONDI GROUP

7.4 HUHTAMAKI OYJ

7.5 SEALED AIR CORPORATION

7.6 WINPAK LTD

7.7 SONOCO PRODUCTS COMPANY

7.8 COVERIS HOLDINGS S.A.

7.9 PROAMPAC LLC

7.10 TREDEGAR CORPORATION

7.11 AVONFLEX

7.12 ALLIEDFLEX TECHNOLOGIES INC.

7.13 DNP AMERICA LLC.

7.14 CLIFTON PACKAGING GROUP LTD

7.15 PRINTPACK INC.

7.16 PAHARPUR 3P

7.17 CONSTANTIA FLEXIBLES GROUP GMBH

7.18 FLAIR FLEXIBLE PACKAGING CORPORATION

7.19 HPM GLOBAL INC.

7.20 LD PACK CO. LTD

Chapter 8: Global Retort Packaging Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Pouches

8.2.2 Trays

8.2.3 Cartons

8.3 Historic and Forecasted Market Size By Material

8.3.1 PET

8.3.2 Polypropylene

8.3.3 Aluminium Foil

8.3.4 PA

8.3.5 PE

8.3.6 Paperboard

8.4 Historic and Forecasted Market Size By End-Use

8.4.1 Food

8.4.2 Beverages

Chapter 9: North America Retort Packaging Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Pouches

9.4.2 Trays

9.4.3 Cartons

9.5 Historic and Forecasted Market Size By Material

9.5.1 PET

9.5.2 Polypropylene

9.5.3 Aluminium Foil

9.5.4 PA

9.5.5 PE

9.5.6 Paperboard

9.6 Historic and Forecasted Market Size By End-Use

9.6.1 Food

9.6.2 Beverages

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Retort Packaging Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Pouches

10.4.2 Trays

10.4.3 Cartons

10.5 Historic and Forecasted Market Size By Material

10.5.1 PET

10.5.2 Polypropylene

10.5.3 Aluminium Foil

10.5.4 PA

10.5.5 PE

10.5.6 Paperboard

10.6 Historic and Forecasted Market Size By End-Use

10.6.1 Food

10.6.2 Beverages

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Retort Packaging Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Pouches

11.4.2 Trays

11.4.3 Cartons

11.5 Historic and Forecasted Market Size By Material

11.5.1 PET

11.5.2 Polypropylene

11.5.3 Aluminium Foil

11.5.4 PA

11.5.5 PE

11.5.6 Paperboard

11.6 Historic and Forecasted Market Size By End-Use

11.6.1 Food

11.6.2 Beverages

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Retort Packaging Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Pouches

12.4.2 Trays

12.4.3 Cartons

12.5 Historic and Forecasted Market Size By Material

12.5.1 PET

12.5.2 Polypropylene

12.5.3 Aluminium Foil

12.5.4 PA

12.5.5 PE

12.5.6 Paperboard

12.6 Historic and Forecasted Market Size By End-Use

12.6.1 Food

12.6.2 Beverages

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Retort Packaging Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Pouches

13.4.2 Trays

13.4.3 Cartons

13.5 Historic and Forecasted Market Size By Material

13.5.1 PET

13.5.2 Polypropylene

13.5.3 Aluminium Foil

13.5.4 PA

13.5.5 PE

13.5.6 Paperboard

13.6 Historic and Forecasted Market Size By End-Use

13.6.1 Food

13.6.2 Beverages

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Retort Packaging Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 40.09 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.5% |

Market Size in 2030: |

USD 64.91 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. RETORT PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. RETORT PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. RETORT PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. RETORT PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. RETORT PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. RETORT PACKAGING MARKET BY TYPE

TABLE 008. POUCHES MARKET OVERVIEW (2016-2028)

TABLE 009. TRAYS MARKET OVERVIEW (2016-2028)

TABLE 010. CARTONS MARKET OVERVIEW (2016-2028)

TABLE 011. RETORT PACKAGING MARKET BY MATERIAL

TABLE 012. PET MARKET OVERVIEW (2016-2028)

TABLE 013. POLYPROPYLENE MARKET OVERVIEW (2016-2028)

TABLE 014. ALUMINIUM FOIL MARKET OVERVIEW (2016-2028)

TABLE 015. PA MARKET OVERVIEW (2016-2028)

TABLE 016. PE MARKET OVERVIEW (2016-2028)

TABLE 017. PAPERBOARD MARKET OVERVIEW (2016-2028)

TABLE 018. RETORT PACKAGING MARKET BY END-USE

TABLE 019. FOOD MARKET OVERVIEW (2016-2028)

TABLE 020. BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA RETORT PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 022. NORTH AMERICA RETORT PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 023. NORTH AMERICA RETORT PACKAGING MARKET, BY END-USE (2016-2028)

TABLE 024. N RETORT PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE RETORT PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 026. EUROPE RETORT PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 027. EUROPE RETORT PACKAGING MARKET, BY END-USE (2016-2028)

TABLE 028. RETORT PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC RETORT PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 030. ASIA PACIFIC RETORT PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 031. ASIA PACIFIC RETORT PACKAGING MARKET, BY END-USE (2016-2028)

TABLE 032. RETORT PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE (2016-2028)

TABLE 036. RETORT PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA RETORT PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 038. SOUTH AMERICA RETORT PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 039. SOUTH AMERICA RETORT PACKAGING MARKET, BY END-USE (2016-2028)

TABLE 040. RETORT PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 041. AMCOR PLC.: SNAPSHOT

TABLE 042. AMCOR PLC.: BUSINESS PERFORMANCE

TABLE 043. AMCOR PLC.: PRODUCT PORTFOLIO

TABLE 044. AMCOR PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. MONDI GROUP: SNAPSHOT

TABLE 045. MONDI GROUP: BUSINESS PERFORMANCE

TABLE 046. MONDI GROUP: PRODUCT PORTFOLIO

TABLE 047. MONDI GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. HUHTAMAKI OYJ: SNAPSHOT

TABLE 048. HUHTAMAKI OYJ: BUSINESS PERFORMANCE

TABLE 049. HUHTAMAKI OYJ: PRODUCT PORTFOLIO

TABLE 050. HUHTAMAKI OYJ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. SEALED AIR CORPORATION: SNAPSHOT

TABLE 051. SEALED AIR CORPORATION: BUSINESS PERFORMANCE

TABLE 052. SEALED AIR CORPORATION: PRODUCT PORTFOLIO

TABLE 053. SEALED AIR CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. WINPAK LTD: SNAPSHOT

TABLE 054. WINPAK LTD: BUSINESS PERFORMANCE

TABLE 055. WINPAK LTD: PRODUCT PORTFOLIO

TABLE 056. WINPAK LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. SONOCO PRODUCTS COMPANY: SNAPSHOT

TABLE 057. SONOCO PRODUCTS COMPANY: BUSINESS PERFORMANCE

TABLE 058. SONOCO PRODUCTS COMPANY: PRODUCT PORTFOLIO

TABLE 059. SONOCO PRODUCTS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. COVERIS HOLDINGS S.A.: SNAPSHOT

TABLE 060. COVERIS HOLDINGS S.A.: BUSINESS PERFORMANCE

TABLE 061. COVERIS HOLDINGS S.A.: PRODUCT PORTFOLIO

TABLE 062. COVERIS HOLDINGS S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. PROAMPAC LLC: SNAPSHOT

TABLE 063. PROAMPAC LLC: BUSINESS PERFORMANCE

TABLE 064. PROAMPAC LLC: PRODUCT PORTFOLIO

TABLE 065. PROAMPAC LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. TREDEGAR CORPORATION: SNAPSHOT

TABLE 066. TREDEGAR CORPORATION: BUSINESS PERFORMANCE

TABLE 067. TREDEGAR CORPORATION: PRODUCT PORTFOLIO

TABLE 068. TREDEGAR CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. AVONFLEX: SNAPSHOT

TABLE 069. AVONFLEX: BUSINESS PERFORMANCE

TABLE 070. AVONFLEX: PRODUCT PORTFOLIO

TABLE 071. AVONFLEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ALLIEDFLEX TECHNOLOGIES INC.: SNAPSHOT

TABLE 072. ALLIEDFLEX TECHNOLOGIES INC.: BUSINESS PERFORMANCE

TABLE 073. ALLIEDFLEX TECHNOLOGIES INC.: PRODUCT PORTFOLIO

TABLE 074. ALLIEDFLEX TECHNOLOGIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. DNP AMERICA LLC.: SNAPSHOT

TABLE 075. DNP AMERICA LLC.: BUSINESS PERFORMANCE

TABLE 076. DNP AMERICA LLC.: PRODUCT PORTFOLIO

TABLE 077. DNP AMERICA LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. CLIFTON PACKAGING GROUP LTD: SNAPSHOT

TABLE 078. CLIFTON PACKAGING GROUP LTD: BUSINESS PERFORMANCE

TABLE 079. CLIFTON PACKAGING GROUP LTD: PRODUCT PORTFOLIO

TABLE 080. CLIFTON PACKAGING GROUP LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. PRINTPACK INC.: SNAPSHOT

TABLE 081. PRINTPACK INC.: BUSINESS PERFORMANCE

TABLE 082. PRINTPACK INC.: PRODUCT PORTFOLIO

TABLE 083. PRINTPACK INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. PAHARPUR 3P: SNAPSHOT

TABLE 084. PAHARPUR 3P: BUSINESS PERFORMANCE

TABLE 085. PAHARPUR 3P: PRODUCT PORTFOLIO

TABLE 086. PAHARPUR 3P: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. CONSTANTIA FLEXIBLES GROUP GMBH: SNAPSHOT

TABLE 087. CONSTANTIA FLEXIBLES GROUP GMBH: BUSINESS PERFORMANCE

TABLE 088. CONSTANTIA FLEXIBLES GROUP GMBH: PRODUCT PORTFOLIO

TABLE 089. CONSTANTIA FLEXIBLES GROUP GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. FLAIR FLEXIBLE PACKAGING CORPORATION: SNAPSHOT

TABLE 090. FLAIR FLEXIBLE PACKAGING CORPORATION: BUSINESS PERFORMANCE

TABLE 091. FLAIR FLEXIBLE PACKAGING CORPORATION: PRODUCT PORTFOLIO

TABLE 092. FLAIR FLEXIBLE PACKAGING CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. HPM GLOBAL INC.: SNAPSHOT

TABLE 093. HPM GLOBAL INC.: BUSINESS PERFORMANCE

TABLE 094. HPM GLOBAL INC.: PRODUCT PORTFOLIO

TABLE 095. HPM GLOBAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. LD PACK CO. LTD: SNAPSHOT

TABLE 096. LD PACK CO. LTD: BUSINESS PERFORMANCE

TABLE 097. LD PACK CO. LTD: PRODUCT PORTFOLIO

TABLE 098. LD PACK CO. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. RETORT PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. RETORT PACKAGING MARKET OVERVIEW BY TYPE

FIGURE 012. POUCHES MARKET OVERVIEW (2016-2028)

FIGURE 013. TRAYS MARKET OVERVIEW (2016-2028)

FIGURE 014. CARTONS MARKET OVERVIEW (2016-2028)

FIGURE 015. RETORT PACKAGING MARKET OVERVIEW BY MATERIAL

FIGURE 016. PET MARKET OVERVIEW (2016-2028)

FIGURE 017. POLYPROPYLENE MARKET OVERVIEW (2016-2028)

FIGURE 018. ALUMINIUM FOIL MARKET OVERVIEW (2016-2028)

FIGURE 019. PA MARKET OVERVIEW (2016-2028)

FIGURE 020. PE MARKET OVERVIEW (2016-2028)

FIGURE 021. PAPERBOARD MARKET OVERVIEW (2016-2028)

FIGURE 022. RETORT PACKAGING MARKET OVERVIEW BY END-USE

FIGURE 023. FOOD MARKET OVERVIEW (2016-2028)

FIGURE 024. BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA RETORT PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE RETORT PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC RETORT PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA RETORT PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA RETORT PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Retort Packaging Market research report is 2023-2030.

Amcor plc., Mondi Group, Huhtamaki Oyj, Sealed Air Corporation, Winpak Ltd, Sonoco Products Company, Coveris Holdings S.A., Proampac LLC, Tredegar Corporation, Avonflex, ALLIEDFLEX Technologies Inc., DNP America LLC., Clifton Packaging Group Ltd, Printpack Inc., Paharpur 3P, Constantia Flexibles Group GmbH, Flair Flexible Packaging Corporation, HPM Global Inc., LD PACK Co. Ltd and Others major players.

The Retort Packaging Market is segmented into Type, Material, End-Use and Region. By Type, the market is categorized into Pouches, Trays, Cartons. By Material, the market is categorized into PET, Polypropylene and Aluminium Foil, PA, PE, Paperboard. By End-Use, the market is categorized into Food, Beverages. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A type of food packaging known as a retort pouch or retortable pouch is constructed from a laminate of flexible plastic and metal foils. It is utilized as an alternative to conventional industrial canning techniques and enables the sterile packing of a variety of foods and beverages handled by aseptic processing.

Global Retort Packaging Market Size Was Valued at USD 40.09 Billion In 2022 And Is Projected to Reach USD 64.91 Billion By 2030, Growing at A CAGR of 5.5% From 2023 To 2030.