Food Packaging Market Synopsis

Food Packaging Market Size Was Valued at USD 458.3 Billion in 2023 and is Projected to Reach USD 723.26 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.

Food packaging refers to the process of enclosing food products in containers or materials for protection, preservation, distribution, and marketing purposes. It involves the use of various packaging materials such as plastics, paper, glass, and metal, as well as techniques like sealing, wrapping, and labeling. Food packaging serves multiple functions, including maintaining product freshness, preventing contamination, extending shelf life, providing information to consumers, and enhancing the visual appeal of the product. It plays a crucial role in ensuring the safety and quality of food products throughout the supply chain, from production to consumption.

- Food packaging is a crucial component in the food industry, providing protection, preservation, and convenience throughout the supply chain. It shields food products from damage, contamination, and exposure to external elements, extending their shelf life and maintaining freshness. Packaging materials and technologies preserve the quality, flavor, texture, and nutritional value of food products over time. It enhances the convenience of handling, storage, transportation, and consumption of food products through formats like resealable bags, single-serve portions, microwaveable containers, and ready-to-eat.

- Packaging also conveys important information to consumers, such as ingredients, nutritional content, allergen warnings, cooking instructions, expiration dates, and brand identity. It plays a crucial role in brand differentiation and marketing, showcasing companies' logos, design elements, and promotional messages. It also allows portion control and standardization, reducing food waste. Packaging facilitates the safe and efficient transportation and distribution of food products. It must comply with government regulations to ensure food safety, hygiene, and labeling accuracy.

- Food packaging is crucial for preserving the freshness and quality of food products by protecting them from various factors. It extends the shelf life of perishable items, reduces food waste, and ensures food safety. It also enhances convenience by providing portion control and easy handling, catering to busy lifestyles. Packaging serves as a communication tool, conveying essential information like ingredients, nutritional content, allergen warnings, and expiration dates.

- Packaging also maintains the hygienic integrity of food products, reducing the risk of contamination and foodborne illnesses. Regulatory compliance is essential for food packaging, including regulations governing materials, manufacturing processes, labeling claims, and environmental sustainability initiatives. The increasing demand for sustainable packaging solutions in the food industry is driven by increasing consumer awareness and environmental concerns.

Food Packaging Market Trend Analysis

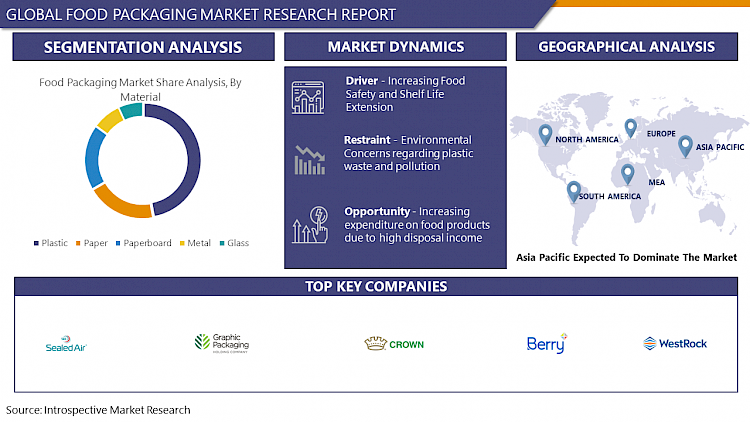

Increasing Food Safety and Shelf Life Extension

- The "Increasing Food Safety and Shelf Life Extension" in the Food Packaging market is driven by consumer preferences, regulatory compliance, globalization of supply chains, technological advancements, and sustainability concerns. Consumers are seeking assurances about food safety and quality, seeking packaging solutions that protect food from external contaminants.

- Regulatory compliance mandates the use of packaging materials and technologies that minimize the risk of food contamination and spoilage. Globalization of supply chains has led to longer transit times and greater distances between production and consumption points, requiring packaging solutions that preserve food freshness and quality during transportation and storage.

- Technological advancements in packaging materials, such as barrier films, antimicrobial coatings, and active packaging technologies, enable the development of packaging solutions that enhance food safety and prolong shelf life. Sustainable packaging solutions not only minimize environmental impact but also contribute to food safety and shelf life extension by protecting food from external contaminants and preserving its quality without compromising sustainability.

Restraint

Environmental Concerns regarding plastic waste and pollution

- Plastic packaging, including food wrappers, bottles, and containers, is a major contributor to environmental pollution. Single-use plastics, such as food wrappers, often end up in landfills or the natural environment, where they degrade slowly, releasing harmful chemicals and microplastics into the soil and water. This poses a significant threat to marine ecosystems, as marine animals ingest or become entangled in plastic debris, leading to injuries, suffocation, and death.

- Improper disposal of plastic packaging also contributes to land pollution, affecting soil fertility and contaminating terrestrial environments. Microplastics, which degrade into smaller particles, infiltrate the environment and food chain, posing health risks to consumers and raising concerns about food safety. The production of plastic packaging relies on finite fossil fuel resources, contributing to carbon emissions and exacerbating climate change.

- Governments and regulatory bodies worldwide are implementing measures to address plastic pollution and promote sustainable packaging alternatives, such as restricting the use of certain types of plastics, imposing taxes or levies on plastic packaging, or mandating recycling and waste management practices.

Opportunity

Increasing expenditure on food products due to high disposal income

- The food packaging market is experiencing growth due to the increasing expenditure on food products driven by high disposable income. Consumers are increasingly willing to pay for premium food products, leading to a demand for packaging that preserves quality and appeals to affluent consumers. Food packaging companies can capitalize on this trend by developing convenient packaging formats like single-serve portions, resealable pouches, and microwaveable packaging.

- Health and sustainability are also becoming more important to high-income consumers, who are willing to invest in organic, natural, and sustainably sourced food products. This demand for eco-friendly and recyclable packaging options aligns with consumers' values and contributes to reducing environmental impact. Food packaging companies can capitalize on this opportunity by offering sustainable packaging solutions that appeal to environmentally conscious consumers. Convenience and portability are also growing, with consumers seeking easy-to-store, transport, and consume food options.

- Market expansion and premiumization are also driving growth in the food packaging market. As consumers become more affluent, they are more likely to explore new and exotic food offerings, including imported and specialty foods. This presents an opportunity for food packaging companies to innovate and develop packaging solutions tailored to unique product categories, catering to the diverse preferences of upscale consumers.

Challenge

Continuous adaptation and investment in research and development of food packaging

- The food industry is constantly evolving, with consumers increasingly concerned about sustainability, food safety, convenience, and environmental impact. To meet these demands, food packaging companies must invest in R&D to develop packaging solutions that align with consumer expectations.

- Technological advancements, such as smart packaging, active packaging, and nanotechnology, present opportunities for enhancing food packaging functionalities. To remain competitive, companies must invest in R&D to develop innovative packaging solutions that offer improved performance, shelf life extension, and enhanced consumer experiences.

- Sustainability initiatives are also driving demand for eco-friendly packaging alternatives. Food packaging companies must develop sustainable packaging solutions that minimize environmental impact while maintaining product integrity and safety. This requires ongoing investment in R&D to explore new materials, recycling technologies, and packaging designs that reduce waste and promote circularity.

- In a highly competitive market, companies must invest in R&D to develop proprietary technologies, innovative packaging designs, and sustainable solutions that address emerging market needs and trends. Regulatory requirements for food packaging are subject to change due to scientific knowledge, environmental concerns, and public health considerations.

Food Packaging Market Segment Analysis:

Food Packaging Market Segmented on the basis of material, packaging type, and application.

By Material, Plastic segment is expected to dominate the market during the forecast period

- Plastic packaging is a versatile and cost-effective material that can be used to package a wide range of food items, from liquids to solids. Its lightweight nature and efficient manufacturing processes make it a cost-effective alternative to glass or metal. Plastic packaging also offers excellent barrier properties against moisture, oxygen, and other contaminants, extending the shelf life of food products and maintaining their freshness.

- It is also resistant to breakage, reducing the risk of damage during handling and transportation. It is often resealable or easy, enhancing usability and usability. Despite concerns about plastic waste and environmental impact, ongoing innovations in plastic packaging technology focus on developing sustainable alternatives, improving recycling infrastructure, and enabling the circular economy approach.

- Consumer preferences for convenience, portability, and lightweight packaging options drive the demand for plastic packaging in the food industry, particularly in ready-to-eat meals, snacks, and on-the-go food products. Convenience is another advantage of plastic packaging, as it is easy to handle, store, and stack, optimizing storage space and logistics efficiency.

By Packaging Type, Pouches segment held the largest share of 41.9% in 2023

- Content in bulletins format Pouch packaging is a popular and versatile option for food packaging due to its lightweight and easy-to-handle nature. It is easier to carry, store, and dispose of than traditional rigid packaging formats like cans or glass jars. Pouches can be designed in various shapes and sizes to accommodate various food products, such as liquids, powders, snacks, and ready-to-eat meals. They often include features like barrier films and resealable closures, which extend the shelf life of food products, enhancing food safety and reducing waste.

- Pouch packaging also offers sustainability, as many materials require fewer resources and are recyclable and compostable. The pouch packaging industry continues to innovate with new technologies and materials, such as stand-up pouches, spouted pouches, and pouches with enhanced barrier properties, addressing consumer preferences for convenience, portability, and sustainability.

Food Packaging Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region's growing population and urbanization rates have led to a higher demand for packaged food products due to busy lifestyles, convenience, and changing dietary preferences. Economic development has resulted in rising disposable incomes and an expanding middle class, resulting in consumers spending more on packaged foods.

- Governments in the region are implementing stricter food safety and hygiene regulations, driving the adoption of advanced packaging technologies. The region is also witnessing significant advancements in packaging technologies, such as active and intelligent solutions, which extend the shelf life of perishable foods, reduce food waste, and enhance the quality and freshness of packaged products.

- The expansion of retail infrastructure, including supermarkets, hypermarkets, convenience stores, and online grocery platforms, provides a wide distribution network for packaged food products, fueling the demand for food packaging materials and solutions. The growing food and beverage industry in the Asia Pacific region also contributes to the demand for food packaging materials and technologies.

Food Packaging Market Top Key Players:

- Sealed Air Corporation (US)

- Ball Corporation (US)

- Crown Holdings, Inc. (US)

- Berry Global Group, Inc. (US)

- Bemis Company, Inc. (US)

- WestRock Company (US)

- Graphic Packaging Holding Company (US)

- Sonoco Products Company (US)

- Coveris Holdings S.A. (US)

- AptarGroup, Inc. (US)

- Printpack, Inc. (US)

- Silgan Holdings Inc. (US)

- Interflex Group Inc. (US)

- Winpak Ltd. (Canada)

- Mondi plc (UK)

- DS Smith plc (UK)

- RPC Group plc (UK)

- Amcor plc (Switzerland)

- Tetra Pak (Switzerland)

- SIG Combibloc Group AG (Switzerland)

- Huhtamaki Group (Finland)

- Uflex Ltd (India)

- Toyo Seikan Group Holdings, Ltd. (Japan)

- Constantia Flexibles Group GmbH (Austria)

- Reynolds Group Holdings Limited (New Zealand), and other major players

Key Industry Developments in the Food Packaging Market:

- In May 2023, Sealed Air Corporation announced it has officially changed its corporate brand to SEE®, taking the next step in reinventing the company. Sealed Air has evolved its corporate and iconic brands to SEE, showcasing a market-driven, customer-first, solutions company. SEE partners with customers to deliver packaging solutions integrating Automation, Digital, and Sustainability, creating significant value for their businesses.

- In October 2023, Ball Corporation a leading global provider of infinitely recyclable aluminum beverage packaging as well as aerospace and other technologies, announced the availability of two new sizes of its infinitely recyclable Ball Aluminum Cup®, therefore broadening the opportunity for venues, concessionaires, and more to offer consumers a full portfolio of sustainable cup options. The Ball Aluminum Cup® that is available for food service customers is now composed of 90% recycled content, making it the cup with the highest recycled content rate of any beverage packaging in its category.

|

Global Food Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

458.3 Bn |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

723.26 Bn |

|

Segments Covered: |

By Material |

|

|

|

By Packaging Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FOOD PACKAGING MARKET BY MATERIAL (2017-2032)

- FOOD PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLASTIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- METAL

- GLASS

- PAPER

- PAPERBOARD

- FOOD PACKAGING MARKET BY PACKAGING TYPE (2017-2032)

- FOOD PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BOTTLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CANS

- POUCHES

- BOXES

- FLEXIBLE

- FOOD PACKAGING MARKET BY APPLICATION (2017-2032)

- FOOD PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DAIRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POULTRY & MEAT

- FRUITS & VEGETABLES

- BAKERY & CONFECTIONERY

- CONVENIENCE FOODS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Food Packaging Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SEALED AIR CORPORATION (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BALL CORPORATION (US)

- CROWN HOLDINGS, INC. (US)

- BERRY GLOBAL GROUP, INC. (US)

- BEMIS COMPANY, INC. (US)

- WESTROCK COMPANY (US)

- GRAPHIC PACKAGING HOLDING COMPANY (US)

- SONOCO PRODUCTS COMPANY (US)

- COVERIS HOLDINGS S.A. (US)

- APTARGROUP, INC. (US)

- PRINTPACK, INC. (US)

- SILGAN HOLDINGS INC. (US)

- INTERFLEX GROUP INC. (US)

- WINPAK LTD. (CANADA)

- MONDI PLC (UK)

- DS SMITH PLC (UK)

- RPC GROUP PLC (UK)

- AMCOR PLC (SWITZERLAND)

- TETRA PAK (SWITZERLAND)

- SIG COMBIBLOC GROUP AG (SWITZERLAND)

- HUHTAMAKI GROUP (FINLAND)

- UFLEX LTD (INDIA)

- TOYO SEIKAN GROUP HOLDINGS, LTD. (JAPAN)

- CONSTANTIA FLEXIBLES GROUP GMBH (AUSTRIA)

- REYNOLDS GROUP HOLDINGS LIMITED (NEW ZEALAND)

- COMPETITIVE LANDSCAPE

- GLOBAL FOOD PACKAGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By Packaging Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Food Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

458.3 Bn |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

723.26 Bn |

|

Segments Covered: |

By Material |

|

|

|

By Packaging Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FOOD PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FOOD PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FOOD PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. FOOD PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. FOOD PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. FOOD PACKAGING MARKET BY TYPE

TABLE 008. RIGID MARKET OVERVIEW (2016-2028)

TABLE 009. SEMI-RIGID MARKET OVERVIEW (2016-2028)

TABLE 010. FLEXIBLE MARKET OVERVIEW (2016-2028)

TABLE 011. FOOD PACKAGING MARKET BY MATERIAL

TABLE 012. PLASTIC MARKET OVERVIEW (2016-2028)

TABLE 013. METAL MARKET OVERVIEW (2016-2028)

TABLE 014. ALUMINIUM MARKET OVERVIEW (2016-2028)

TABLE 015. PAPERBOARD MARKET OVERVIEW (2016-2028)

TABLE 016. MOLDED FIBERS MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. FOOD PACKAGING MARKET BY APPLICATION

TABLE 019. BAKERY & CONFECTIONERY MARKET OVERVIEW (2016-2028)

TABLE 020. CONVENIENCE FOODS MARKET OVERVIEW (2016-2028)

TABLE 021. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 022. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 023. SAUCES MARKET OVERVIEW (2016-2028)

TABLE 024. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 025. NORTH AMERICA FOOD PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 026. NORTH AMERICA FOOD PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 027. NORTH AMERICA FOOD PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 028. N FOOD PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE FOOD PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 030. EUROPE FOOD PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 031. EUROPE FOOD PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 032. FOOD PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC FOOD PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 034. ASIA PACIFIC FOOD PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 035. ASIA PACIFIC FOOD PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 036. FOOD PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA FOOD PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA FOOD PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA FOOD PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 040. FOOD PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 041. SOUTH AMERICA FOOD PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 042. SOUTH AMERICA FOOD PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 043. SOUTH AMERICA FOOD PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 044. FOOD PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 045. AMCOR LTD.: SNAPSHOT

TABLE 046. AMCOR LTD.: BUSINESS PERFORMANCE

TABLE 047. AMCOR LTD.: PRODUCT PORTFOLIO

TABLE 048. AMCOR LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ROCK-TENN COMPANY: SNAPSHOT

TABLE 049. ROCK-TENN COMPANY: BUSINESS PERFORMANCE

TABLE 050. ROCK-TENN COMPANY: PRODUCT PORTFOLIO

TABLE 051. ROCK-TENN COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SEALED AIR CORP.: SNAPSHOT

TABLE 052. SEALED AIR CORP.: BUSINESS PERFORMANCE

TABLE 053. SEALED AIR CORP.: PRODUCT PORTFOLIO

TABLE 054. SEALED AIR CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. NUCONIC PACKAGING LLC: SNAPSHOT

TABLE 055. NUCONIC PACKAGING LLC: BUSINESS PERFORMANCE

TABLE 056. NUCONIC PACKAGING LLC: PRODUCT PORTFOLIO

TABLE 057. NUCONIC PACKAGING LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. TETRA PAK INTERNATIONAL S.A.: SNAPSHOT

TABLE 058. TETRA PAK INTERNATIONAL S.A.: BUSINESS PERFORMANCE

TABLE 059. TETRA PAK INTERNATIONAL S.A.: PRODUCT PORTFOLIO

TABLE 060. TETRA PAK INTERNATIONAL S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. CROWN HOLDINGS INC.: SNAPSHOT

TABLE 061. CROWN HOLDINGS INC.: BUSINESS PERFORMANCE

TABLE 062. CROWN HOLDINGS INC.: PRODUCT PORTFOLIO

TABLE 063. CROWN HOLDINGS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. BALL CORPORATION: SNAPSHOT

TABLE 064. BALL CORPORATION: BUSINESS PERFORMANCE

TABLE 065. BALL CORPORATION: PRODUCT PORTFOLIO

TABLE 066. BALL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. BERRY GLOBAL INC: SNAPSHOT

TABLE 067. BERRY GLOBAL INC: BUSINESS PERFORMANCE

TABLE 068. BERRY GLOBAL INC: PRODUCT PORTFOLIO

TABLE 069. BERRY GLOBAL INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. DS SMITH PLC: SNAPSHOT

TABLE 070. DS SMITH PLC: BUSINESS PERFORMANCE

TABLE 071. DS SMITH PLC: PRODUCT PORTFOLIO

TABLE 072. DS SMITH PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. GENPAK LLC: SNAPSHOT

TABLE 073. GENPAK LLC: BUSINESS PERFORMANCE

TABLE 074. GENPAK LLC: PRODUCT PORTFOLIO

TABLE 075. GENPAK LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. HUHTAMÄKI OYJ: SNAPSHOT

TABLE 076. HUHTAMÄKI OYJ: BUSINESS PERFORMANCE

TABLE 077. HUHTAMÄKI OYJ: PRODUCT PORTFOLIO

TABLE 078. HUHTAMÄKI OYJ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. REYNOLDS GROUP HOLDINGS LIMITED: SNAPSHOT

TABLE 079. REYNOLDS GROUP HOLDINGS LIMITED: BUSINESS PERFORMANCE

TABLE 080. REYNOLDS GROUP HOLDINGS LIMITED: PRODUCT PORTFOLIO

TABLE 081. REYNOLDS GROUP HOLDINGS LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 082. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 083. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 084. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FOOD PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FOOD PACKAGING MARKET OVERVIEW BY TYPE

FIGURE 012. RIGID MARKET OVERVIEW (2016-2028)

FIGURE 013. SEMI-RIGID MARKET OVERVIEW (2016-2028)

FIGURE 014. FLEXIBLE MARKET OVERVIEW (2016-2028)

FIGURE 015. FOOD PACKAGING MARKET OVERVIEW BY MATERIAL

FIGURE 016. PLASTIC MARKET OVERVIEW (2016-2028)

FIGURE 017. METAL MARKET OVERVIEW (2016-2028)

FIGURE 018. ALUMINIUM MARKET OVERVIEW (2016-2028)

FIGURE 019. PAPERBOARD MARKET OVERVIEW (2016-2028)

FIGURE 020. MOLDED FIBERS MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. FOOD PACKAGING MARKET OVERVIEW BY APPLICATION

FIGURE 023. BAKERY & CONFECTIONERY MARKET OVERVIEW (2016-2028)

FIGURE 024. CONVENIENCE FOODS MARKET OVERVIEW (2016-2028)

FIGURE 025. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 026. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 027. SAUCES MARKET OVERVIEW (2016-2028)

FIGURE 028. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 029. NORTH AMERICA FOOD PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. EUROPE FOOD PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. ASIA PACIFIC FOOD PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. MIDDLE EAST & AFRICA FOOD PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. SOUTH AMERICA FOOD PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Food Packaging Market research report is 2024-2032.

Sealed Air Corporation (US), Ball Corporation (US), Crown Holdings, Inc. (US), Berry Global Group, Inc. (US), Bemis Company, Inc. (US), WestRock Company (US), Graphic Packaging Holding Company (US), Sonoco Products Company (US), Coveris Holdings S.A. (US), AptarGroup, Inc. (US), Printpack, Inc. (US), Silgan Holdings Inc. (US), Interflex Group Inc. (US), Winpak Ltd. (Canada), Mondi plc (UK), DS Smith plc (UK), RPC Group plc (UK), Amcor plc (Switzerland), Tetra Pak (Switzerland), SIG Combibloc Group AG (Switzerland), Huhtamaki Group (Finland), Uflex Ltd (India), Toyo Seikan Group Holdings, Ltd. (Japan), Constantia Flexibles Group GmbH (Austria), Reynolds Group Holdings Limited (New Zealand), and Other Major Players.

The Food Packaging Market is segmented into Material, Packaging Type, Application, and region. By Material, the market is categorized into Plastic, Metal, Glass, Paper, and Paperboard. By Packaging Type, the market is categorized into Bottles, Cans, Pouches, Boxes, and Flexible. By Application, the market is categorized into Dairy, Poultry & Meat, Fruits & Vegetables, Bakery & Confectionery, and Convenience Foods. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Food Packaging Market encompasses the global industry involved in the design, production, and distribution of packaging materials and solutions specifically for food products. This market addresses the need to preserve, protect, and transport food items from manufacturers to consumers while ensuring quality, safety, and freshness. Food packaging includes various types of materials such as plastics, paper and cardboard, metal, glass, and flexible films, as well as specialized packaging technologies such as modified atmosphere packaging and active packaging.

Food Packaging Market Size Was Valued at USD 458.3 Billion in 2023 and is Projected to Reach USD 723.26 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.