Rental Housing Market Synopsis

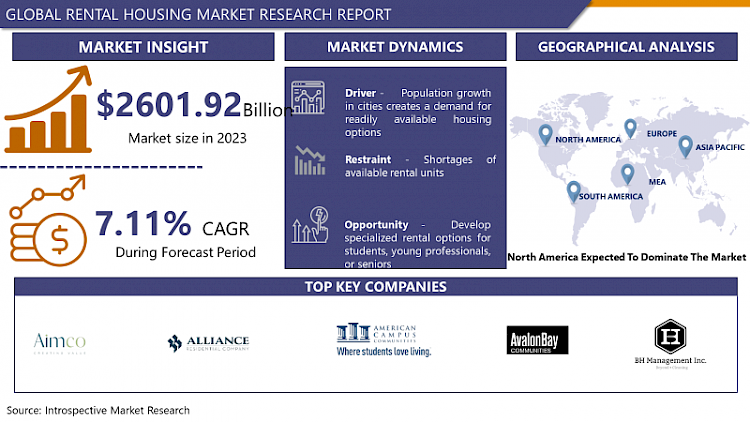

Rental Housing Market Size Was Valued at USD 2601.92 Billion in 2023, and is Projected to Reach USD 4827.97 Billion by 2032, Growing at a CAGR of 7.11 % From 2024-2032.

Rental housing is a segment in the real estate market that involves buildings or units that are rented out to tenants by their owners or managing companies. This often includes an understanding that the tenant is to pay a monthly fee for the privilege of occupying the property, irrespective of the type of the property being a house, an apartment, a duplex, or a townhome.

- Apartment and house renting is a widely known type of accommodation found in big and small cities allowing temporary living because of no possibility, desire, or necessity to buy a house or apartment.

- Rental housing is one of the most important segments of the housing market as it offers affordable units for consumers that include students, the young working population, families, and consumers with a low income. it is dependent on other factors like economic factors, government policies on housing and Demographic factors.

- In recent years, the amount of people who would rather rent a home rather than own a house has grown significantly as home prices are high, economic calamities are unpredictable, people feel the need to constantly move from one place to the other and rent is much cheaper than owning a home. Beyond providing basic shelter that is crucial to human life, this segment also plays a major role within the context of the overall real estate industry and the economy.

Rental Housing Market Trend Analysis

Rise of Renting

- Housing tenure shift towards renting is another evident trend in the rental housing market registering notable changes in economic environments, population characteristics, and social attitudes. Many middle-income Americans have found it increasingly difficult to own a home in the last decade given high food and real estate prices, declining wages, and credit crunch on Mortgage. Therefore, the current trend reveals that many people and families prefer living in rented premises rather than owning one.

- This trend is especially significant among the young generation, especially millennials who desire mobility, flexibility, and more crucially, freedom that comes with renting hence deciding to remain tenants rather than being a homeowner. Also, it enables people to reside in cities that are considered Furious giants in all aspects such as commercial, social, and retail by being able to afford basic needs such as house mortgages and maintenance costs.

- This is also brought about by social and economic patterns of population today, individuals’ preferences to rent rather than own houses are being facilitated by social and economic forces. As more workers engage in work from home more often, people find themselves having to move around more and go as far as renting houses more suited to their working style. In addition, the aging factor plays its part in this regard as many parents opt for simpler lifestyles and find renting a home more manageable as they prefer not to burden themselves with mortgage responsibilities.

- The increasing popularity of renting has not gone unnoticed, investors and developers have taken the opportunity to increase the housing stock in the rental segment which include; high-end apartments, and retailed commercial space, which made rent even more attractive. This transition towards a more rental-based age of housing is a change in perspective regarding the housing situation, adapting more to the shortcomings of flexibility, sheer convenience, and cost-efficiency..

Develop Affordable Housing

- The availability of affordable homes has the potential to unlock the rental housing market; it is therefore essential to especially target the development of affordable homes for the increasing number of people in need of affordable homes to meet their housing needs. With the constantly growing prices for housing today, people and households often face the challenge of finding affordable rentals.

- Well-intentioned affordable housing development seeks to give quality rental accommodation at a relatively cheap rate as compared to other privately developed and marketed quality units to enable low to moderate income earners to access decent and quality housing. It also reduces the amount of money renters have to spend every month, thus letting them save more of their income; it also helps increase and diversify the economy base among the different communities.

- The development of affordable rental housing also provides a multitude of positive impacts in and for the rest of the real estate industry and financial systems. Developers can target this large and unmet market by creating more entry-level investment opportunities for people and maintain occupancy levels for the created new supply. Moreover, the affordable housing projects are made financially feasible and attractive to investors given that such projects can secure backing from a government program, tax preference, and collaboration between the private and public sector.

- The residential projects incite community redevelopment, addresses the crisis of homelessness, and promote sustainability by helping teachers, medical professionals, service industry workers afford affordable homes for living. Therefore, it is my contention that dedicating resources towards the creation of affordable rental structures goes beyond meeting the needs of vulnerable populations but also fosters the development of viable business prospects of the rental housing industry.

Rental Housing Market Segment Analysis:

Rental Housing Market is segmented based on Type, Property Type, and Location.

By Type, Standalone Spaces segment is expected to dominate the market during the forecast period

- The structures occupied by renters are predominantly of associational type with society-oriented solutions in comparison with individual spaces. These include the community, or society-based rentals, usually in places like new estates in towns or specially designated residential areas, or apartment buildings, and they provide various forms of additional facilities and services because they appeal to so many people.

- They are mostly equipped with resource-sharing amenities like swimming pools, gyms, clubhouses, and security & surveillance systems that provide comfort to the occupants. The social nature of housing appeals more to the users in the urban areas because of quick access, security and social nature in living. Moreover, these properties afford social relatedness especially due to vintage and modern designs that attract families, often single young professionals, and the aged clients.

- Independent lots that encompass the single house or a single property lot still has high demand but these are more focused and cater to a specific and select market only. These rentals are larger, offer more private outdoor space and might come with a yard, often preferred by extended families or individuals with busy lifestyles who want to be separately, away from others.

- However, standalone spaces may not come with common areas like societies, alongside security provisions that may be a drawback or downside for some of the occupants. In addition, the single lettings are basically more in suburban or rural settings, given that the areas allow individual houses. However, more number of societies based accommodations are found in bigger cities due to their efficient utilization of services hence it occupies the largest slice of the rental accommodation pie.

By Property Type, the unfurnished segment held the largest share

- In the rental housing areas, unfurnished homes are more common than the fully furnished or semi-furnished homes. Unfurnished lettings are popular with people of all types, primarily because such individuals have their own furniture which they wish to use rather than buy. These properties are usually cheaper to the landlords as well as the tenant since these do not involve the costs incurred in procuring and maintaining furniture. Unfurnished units are highly sought after in long-term leasing since the lessees want to set up homes that will be for a long time perhaps due to new employment or business, etc.

- As already mentioned, unfurnished rentals offer more flexibility and are relatively cheaper than the furnished ones, and its supply status places it as one of the market basics to supply the need of families, young professionals, and individuals who seek affordable homes to rent. While fully furnished and semi furnished renting services in contrast meet more definite requirements found in large population concentrated areas with high tenant turnover, for instance, universities hostels, expatriate compounds, and other business institutes filled with transitory resumes workers such as in big cities.

- Expanding the stock of furnished apartments ensures that renting an apartment is highly convenient, containing all the necessary furniture and appliances to make it a home as soon as the tenant moves in, perfect for people who need an apartment for rent quickly or who do not want to think about having to buy furniture and appliances to fill an apartment. Semi furnished ones are a good midway so that the landlord provides equipment like refrigerator or a bed and other amenities have to be arranged by the tenant.

- Consequently, these three segments will be somewhat less formal than the others, as they are more costly due to furnishings, and therefore attract only those who will rent them for short periods, or who are willing to pay higher rent. While these properties may be valuable in selected markets, the existing market demand, and the cost-deferred unfurnished rental houses ensure they remain the popular segment in the rental apartments market.

Rental Housing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America remains the largest rental market globally following the economic factors, population densities as well as the increase in urbanization. The high cost of credit together with mergers resulting in higher real estate costs and credit constraints rendered homeownership unaffordable to many tenants thus opting to rent as a more feasible solution. For instance, in cities like New York, Los Angeles or Toronto, one will realize that the cost of house rental is relatively low when compared with that of home buying.

- This economic environment explains why the rental market is so active since more and more individuals are considering renting than buying, especially in the urban environment where the prices of all essential commodities including houses are relatively high and the population density is high, hence the high demand for houses.

- Furthermore, the constantly changing nature of the population base together with the ethnically diversified nature of the North American region fosters the rental sector. They decided to rent because young professionals, students and immigrants want to change its place of living frequently and renting is cheaper than own a house. This factor combined with the advancement in the education sector and job employment also enhance the demand for the rental houses since many people today prefer to live in urban areas.

- Through daily interactions with the population, rental business in cities with economic activities and learning institutions harmonize well with high demand for housing hence high density in rented accommodations. In addition, better infrastructures in North America, with diverse quality rental housing including luxury and affordable apartments and supportive governmental policies towards rental housing sector, also enhancing its demand in rental housing market. All these factors combine to give the rental market the capacity to adapt and to sustain growth that serves a wide cross section of the population’s needs.

Active Key Players in the Rental Housing Market

- Aimco (Apartment Investment and Management Company) (USA)

- Alliance Residential Company (USA)

- American Campus Communities, Inc. (USA)

- AvalonBay Communities, Inc. (USA)

- BH Management Services, LLC (USA)

- Bozzuto Group (Greenbelt, Maryland, USA)

- Camden Property Trust (USA)

- Cortland (USA)

- Equity Residential (USA)

- Essex Property Trust, Inc. (USA)

- Fairfield Residential (USA)

- GID (General Investment and Development Companies) (USA)

- Greystar Real Estate Partners (USA)

- Invitation Homes Inc. (USA)

- Mid-America Apartment Communities, Inc. (MAA) (USA)

- Pinnacle Property Management Services (USA)

- Related Companies (USA)

- Tricon Residential (Canada)

- UDR, Inc. (USA)

- Other Key Players

|

Global Rental Housing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2601.92 Bn. |

|

Forecast Period 2023-34 CAGR: |

7.11% |

Market Size in 2032: |

USD 4827.97 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Property Type |

|

||

|

By Location |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- RENTAL HOUSING MARKET BY Type (2017-2032)

- RENTAL HOUSING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STANDALONE SPACES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOCIETY BASED

- RENTAL HOUSING MARKET BY PROPERTY TYPE (2017-2032)

- RENTAL HOUSING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FULLY FURNISHED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEMI-FURNISHED

- UNFURNISHED

- RENTAL HOUSING MARKET BY LOCATION (2017-2032)

- RENTAL HOUSING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- METRO

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-METRO

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AIMCO (APARTMENT INVESTMENT AND MANAGEMENT COMPANY) (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ALLIANCE RESIDENTIAL COMPANY (USA)

- AMERICAN CAMPUS COMMUNITIES, INC. (USA)

- AVALONBAY COMMUNITIES, INC. (USA)

- BH MANAGEMENT SERVICES, LLC (USA)

- BOZZUTO GROUP (GREENBELT, MARYLAND, USA)

- CAMDEN PROPERTY TRUST (USA)

- CORTLAND (USA)

- EQUITY RESIDENTIAL (USA)

- ESSEX PROPERTY TRUST, INC. (USA)

- FAIRFIELD RESIDENTIAL (USA)

- GID (GENERAL INVESTMENT AND DEVELOPMENT COMPANIES) (USA)

- GREYSTAR REAL ESTATE PARTNERS (USA)

- INVITATION HOMES INC. (USA)

- MID-AMERICA APARTMENT COMMUNITIES, INC. (MAA) (USA)

- PINNACLE PROPERTY MANAGEMENT SERVICES (USA)

- RELATED COMPANIES (USA)

- TRICON RESIDENTIAL (CANADA)

- UDR, INC. (USA)

- COMPETITIVE LANDSCAPE

- GLOBAL RENTAL HOUSING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Property

- Historic And Forecasted Market Size By Location

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Rental Housing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2601.92 Bn. |

|

Forecast Period 2023-34 CAGR: |

7.11% |

Market Size in 2032: |

USD 4827.97 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Property Type |

|

||

|

By Location |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. RENTAL HOUSING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. RENTAL HOUSING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. RENTAL HOUSING MARKET COMPETITIVE RIVALRY

TABLE 005. RENTAL HOUSING MARKET THREAT OF NEW ENTRANTS

TABLE 006. RENTAL HOUSING MARKET THREAT OF SUBSTITUTES

TABLE 007. RENTAL HOUSING MARKET BY TYPE

TABLE 008. HOTEL MARKET OVERVIEW (2016-2028)

TABLE 009. APARTMENT MARKET OVERVIEW (2016-2028)

TABLE 010. CIVIL ACCOMMODATION MARKET OVERVIEW (2016-2028)

TABLE 011. RENTAL HOUSING MARKET BY APPLICATION

TABLE 012. LONG-TERM LEASE MARKET OVERVIEW (2016-2028)

TABLE 013. TOURIST SHORT-TERM RENTAL MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA RENTAL HOUSING MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA RENTAL HOUSING MARKET, BY APPLICATION (2016-2028)

TABLE 016. N RENTAL HOUSING MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE RENTAL HOUSING MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE RENTAL HOUSING MARKET, BY APPLICATION (2016-2028)

TABLE 019. RENTAL HOUSING MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC RENTAL HOUSING MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC RENTAL HOUSING MARKET, BY APPLICATION (2016-2028)

TABLE 022. RENTAL HOUSING MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA RENTAL HOUSING MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA RENTAL HOUSING MARKET, BY APPLICATION (2016-2028)

TABLE 025. RENTAL HOUSING MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA RENTAL HOUSING MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA RENTAL HOUSING MARKET, BY APPLICATION (2016-2028)

TABLE 028. RENTAL HOUSING MARKET, BY COUNTRY (2016-2028)

TABLE 029. ZIRU: SNAPSHOT

TABLE 030. ZIRU: BUSINESS PERFORMANCE

TABLE 031. ZIRU: PRODUCT PORTFOLIO

TABLE 032. ZIRU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. BOYU: SNAPSHOT

TABLE 033. BOYU: BUSINESS PERFORMANCE

TABLE 034. BOYU: PRODUCT PORTFOLIO

TABLE 035. BOYU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. AIRBNB: SNAPSHOT

TABLE 036. AIRBNB: BUSINESS PERFORMANCE

TABLE 037. AIRBNB: PRODUCT PORTFOLIO

TABLE 038. AIRBNB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. LIANJIA: SNAPSHOT

TABLE 039. LIANJIA: BUSINESS PERFORMANCE

TABLE 040. LIANJIA: PRODUCT PORTFOLIO

TABLE 041. LIANJIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. DOUBAN: SNAPSHOT

TABLE 042. DOUBAN: BUSINESS PERFORMANCE

TABLE 043. DOUBAN: PRODUCT PORTFOLIO

TABLE 044. DOUBAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. GUANYU: SNAPSHOT

TABLE 045. GUANYU: BUSINESS PERFORMANCE

TABLE 046. GUANYU: PRODUCT PORTFOLIO

TABLE 047. GUANYU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. APARTMENT LIST: SNAPSHOT

TABLE 048. APARTMENT LIST: BUSINESS PERFORMANCE

TABLE 049. APARTMENT LIST: PRODUCT PORTFOLIO

TABLE 050. APARTMENT LIST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. TRULIA: SNAPSHOT

TABLE 051. TRULIA: BUSINESS PERFORMANCE

TABLE 052. TRULIA: PRODUCT PORTFOLIO

TABLE 053. TRULIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ZILLOW: SNAPSHOT

TABLE 054. ZILLOW: BUSINESS PERFORMANCE

TABLE 055. ZILLOW: PRODUCT PORTFOLIO

TABLE 056. ZILLOW: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. RENTAL HOUSING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. RENTAL HOUSING MARKET OVERVIEW BY TYPE

FIGURE 012. HOTEL MARKET OVERVIEW (2016-2028)

FIGURE 013. APARTMENT MARKET OVERVIEW (2016-2028)

FIGURE 014. CIVIL ACCOMMODATION MARKET OVERVIEW (2016-2028)

FIGURE 015. RENTAL HOUSING MARKET OVERVIEW BY APPLICATION

FIGURE 016. LONG-TERM LEASE MARKET OVERVIEW (2016-2028)

FIGURE 017. TOURIST SHORT-TERM RENTAL MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA RENTAL HOUSING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE RENTAL HOUSING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC RENTAL HOUSING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA RENTAL HOUSING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA RENTAL HOUSING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Rental Housing Market research report is 2024-2032.

AvalonBay Communities, Inc. (Arlington, Virginia, USA), Equity Residential (Chicago, Illinois, USA), Essex Property Trust, Inc. (San Mateo, California, USA), UDR, Inc. (Highlands Ranch, Colorado, USA), Camden Property Trust (Houston, Texas, USA), Mid-America Apartment Communities, Inc. (MAA) (Memphis, Tennessee, USA), American Campus Communities, Inc. (Austin, Texas, USA), Invitation Homes Inc. (Dallas, Texas, USA), Greystar Real Estate Partners (Charleston, South Carolina, USA), Aimco (Apartment Investment and Management Company) (Denver, Colorado, USA), AvalonBay Communities, Inc. (Arlington, Virginia, USA), Cortland (Atlanta, Georgia, USA), Tricon Residential (Toronto, Ontario, Canada), Related Companies (New York, New York, USA), Fairfield Residential (San Diego, California, USA), GID (General Investment and Development Companies) (Boston, Massachusetts, USA), Pinnacle Property Management Services (Addison, Texas, USA), Bozzuto Group (Greenbelt, Maryland, USA), BH Management Services, LLC (Des Moines, Iowa, USA), Alliance Residential Company (Phoenix, Arizona, USA)and Other Major Players.

The Rental Housing Market is segmented into Type, Property Type, Locations, and region. By Type, the market is categorized into Standalone Spaces, and Society Based. By Property Type, the market is categorized into Fully Furnished, Semi-Furnished, and Unfurnished. By Locations, the market is categorized into Metro, Non-Metro By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.)

Rental housing can be defined as residential units within structures that are offered for lease or rent by the owners, landlords, or property managers. It covers a broad range of residential units such as apartment, house, dual occupancy, terrace houses, townhouse, unit and apartment or villa in a complex and others. Others say that renting makes people mobile and enables them to live in a house, apartment or unit without having to go through a mortgage process, which they cannot afford financially. This is an important part of the real estate segments that serves different population and responds to the different level of their activity and different types of life’s requirements.

Rental Housing Market Size Was Valued at USD 2601.92 Billion in 2023, and is Projected to Reach USD 4827.97 Billion by 2032, Growing at a CAGR of 7.11 % From 2024-2032.