Smart Homes Systems Market Synopsis

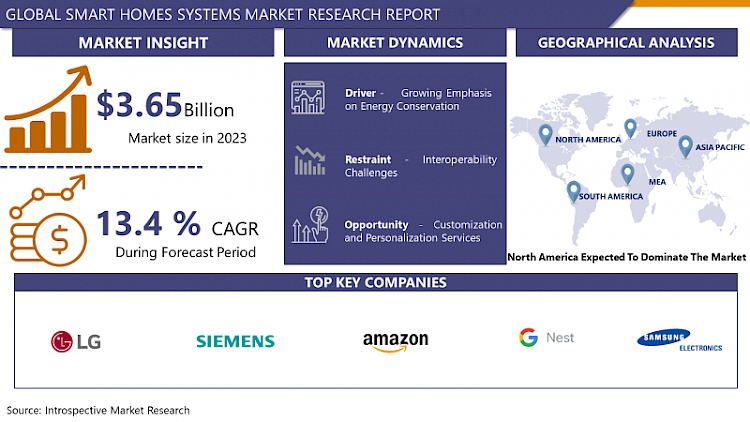

Smart Homes Systems Market Size Was Valued at USD 133.20 Million in 2023, and is Projected to Reach USD 413.07 Million by 2032, Growing at a CAGR of 13.4% From 2024-2032.

The term smart home systems means the network of machines of and household appliances that are operated remotely through the control and automation of the monitoring process. In such systems we observe that most of the time they share an access to internet and sensors to boost the comfort, efficiency, and safety within the home environment. For instance, smart thermostats, lighting, cameras, and voice-controlled assisants like Amazon Alexa or Google Home can be mentioned as examples.

- The last decade has witnessed the smart home systems market to be in a rapid growth mode, by the advancements in the technology, the increasing awareness by the consumers as well as the growing demand for convenience, comfort and efficiency in power usage.

- The scope of smart home systems is very diverse and they consist of various devices and different technologies which are used to automate and improve things like security, switching on the lights, heating & cooling systems (HVAC), entertainment and kitchen appliances.

- The fast disease of IoT gadgets and connectivity technology is one of the main reasons that the smart home systems market growth is driven forward.

- Now that sensors have become versatile and cost-substantial, the convenience and efficiency of Wi-Fi, Zigbee, and Z-Wave communication protocols, as well as widely available high-speed internet connectivity, have furnished a platform for the prompted cooperation and interoperability of smart devices within the household.

- This interconnectivity permits users worldwide to access and manipulate their in-home systems using mobile devices, tablets, or voice-activated aides remotely from anywhere, which offers unmatched comfort and power over users' current residences.

- Security and surveillance accounts for the biggest part of smart home systems industry.

- Its share is one of the highest in the market. Anchor to security at home coupled with rising home burglaries, consumers are committed to installing smart video cameras, doorbell cameras, motion sensors, and smart locks to help them keep watch and safely secure their homes.

- Besides these gizmos are usually complemented with attributes like real time alerts, two way communication and linking to your phones applications which makes users to watch their households wherever they are

- The smart home automation systems, in turn, constitute a major part of the industry where various household items and integrated systems are designed with a goal of offering the utmost comfort and conservation.

- Smart lighting systems, thermostats, and motorized window blinds are programmable to trigger settings automatically as the user operates them, the system detect occupancy patterns, or environmental conditions according the which it consumes less energy which in turn reduces utility bills.

- Another advantage resulting from the fact that voice assistants like Amazon Alexa and Google Assistant were integrated into the smart devices and voice commands made it even easier for users to control the devices is to increase the satisfaction of the user with the system.

- In addition to automation and multimedia solutions, the smart home easley affects the operating of devices like smart TVs, speakers, and streaming gadgets that offer uninterrupted connection and integration with other smart home devices.

- Consumers can select videos from their favorite services, activate resources with voices and design home cinema systems to have multi-room sound and image setup.

- The smart home systems market is the arena where a merciless struggle and outrageous inventions reach its peak, and this fact is reflected in the struggles of the entrepreneurs including the top-of-the-world digital companies and the startups who are competing for the part of the pie.

- The major players in this sector are the companies which have been comprised of Google (Nest), Amazon (Ring), Apple (HomeKit), Samsung (SmartThings) and Philips (Hue), including other companies as well.

- They keep on extending their R&D to unveil new features, services, complaints and more tools for the users which make path easier for further progress in adoption and advancement of AI.

Smart Homes Systems Market Trend Analysis

Expansion of IoT Ecosystem and Interconnectivity

- The growth of IoT technology architecture has changed the various areas with smart home systems becoming a major glory. Toting up IoT gizmos in smart apartments are intermesh systems that make lives easier, less hard, and safer for home dwellers.

- Various components of such kinds of systems are intelligent thermostats, lights, security cameras, and appliances, that are connected via the internet, and communicate with each other.

- The boom of IoT has produced competent home automation devices, which allow a user to remotely regulate and supervise his home through his cell-phone apps or voice-patterns.

- With the advancement of platforms for connectivity, sensors, and artificial intelligence, further growth of the Internet of Things system can be expected. It is predicted that this process might accelerate and potential customers and investors will become more engaged and permanently set up their smart homes ecosystems.

- Interconnectedness in today's smart home system technologies is advancing at a fast pace, as a result of the accelerating interest in both the users as well as the providers to make their devices and platforms compatible.

- Production and service providing professionals are today working together to bring standardization and protocols that bring different devices into communication and work perfectly together.

- These interrelations aid in the formation of a total and complete smart home ecosystem which is extremely elaborate and easy to use and at the same time suits the lifestyle of users to the full.

- A combination of the newer technologies like machine learning and edge computing together makes the capabilities of such connected smart homes more efficient by means of functions such as prediction of failure, energy efficiency and contextual automation.

- When the market grows and the standards are being determined, integrated smart home systems then take a toll among smart household devices, which increases the number of devices and the development of the IoT ecosystem too.

Customization and Personalization Services

- The arena of close rendezvous and personalization services related to smart home systems has seen a remarkable elevation in growth fed by customers in the quest for customized services matching their individual lifestyle preferences and needs.

- Due to the diffusion of things-of-IoT and smart-home technologies, consumers are more and more eager to integrate these technologies in a way they can coordinate these routines daily.

- The company provides customer service in the tailoring of smart home systems, which serve the consumers by making the lighting, the temperature, and other features to be controlled by the voice, and which are personalized based on individual preferences.

- This phenomenon has provided an optimal environment for the smart homes companies to come up and work towards creating unique ways that better the life of the user in the quest for satisfaction.

- Furthermore, as smart home market keeps growing, companies holding specialization and personalization services will most likely stand synonymously with this concept and will be winners in this market.

- Utilizing data analytics and artificial intelligence, service suppliers give people the chance to individually configure the functions and features depending on the taste of users in advance, and the equipment change underground automatically. This level of personalization not only features convenience but also contributes to efficiency in terms of energy and home security operations.

- As consumers get more skilled and purchasing product that meet their specific needs in other areas of their lives, the demand for personalized smart home solutions are anticipated to increase, thus bringing about market competition and technological developments.

Smart Homes Systems Market Segment Analysis:

Micro Irrigation System Market is Segmented based on Type, and Application.

By Type, Security & Access Control segment is expected to dominate the market during the forecast period

- Energy Management Systems:These systems in fact improve the way energy is consumed in smart home scenarios; they usually include sensors, smart thermostats, and energy monitoring instruments in addition to devices for controlling heating, cooling, lighting, and appliances.

- Security & Access Control:The security and access control system uses technologies like smart locks, surveillance cameras, motion sensors, and alarms as the most visible facial features. Doubles ensure that homeowners are having enhanced security measures and remote monitoring facilities.

- Lighting Control:By incorporating lighting control systems, inhabitants are capable to make their lighting system to work automatically and to adjust it based on their personal needs, eventually resulting in energy savings and smartphone applications or voice control.

- Home Appliances Control:These networks allow to connect various home appliances including refrigerators, ovens, washing machines, and dishwashers, just to name a few, to the internet, thereby enabling their users to remotely monitor and control their tasks for increased convenience and efficiency.

- Entertainment Control:Smart control of entertainment systems entail the integration of the audiovisual equipment, streaming devices, and home theatres into a single platform. Through the medium of central interfaces, users are able to easily control an array of entertainment functions.

- Others: This sub-category incorporates many more options of additional smart home technologies and solutions, such as smart irrigation systems, home health monitoring devices, home automation central control units, and smart home integration platforms that link and manage different smart devices inside the home as well.

By Application, Dwelling segment held the largest share in 2023

- Dwelling:The ecosystems in smart houses exist in large enclosures, where they provide automation, power management, security, and diminished engagement of house-owner. Examples are the thermostats, light systems, mobility devices, security cameras, smart locks, and entertainment systems. More and more consumers are knowledgeable of newer technologies and can afford them while indulging their preference for energy efficiency and convenience. This, in turn, leads the market growth in this section.

- Business Buildings:Smat building technologies are awareto be introduced more and more in commercial buildings by many organizations aiming at energy conservation, enhanced safety, and better process management as a whole. These systems are usually equipped with complex HVAC (Heating, Ventilation, and Air-conditioning) control, light automatic systems, occupancy sensors, access management systems, and the building manager’s software. The intelligent building software market is influenced by factors like rapid cost savings, regulatory requirements and getting the sustainable way towards environment.

- Hotel:Smart home technologies are emerging now in the hotel industry by increasing the level of guest experience, increasing operational efficiency, and reducing energy costs. The intelligent hotel troubleshooting is composed can digital check-in/check-out procedures, in-room incandescence, temperature, and entertainment controls and can intelligent energy controls. Hotels implement these technologies as a method to stand up against each other, to attract tech users, and to make their work smoother.

- Others:This category not only covers applications that used to be only in dwellings, business buildings, and hotels but also the new applications that are now an emerging trend. It might comprise of smart home systems such as healthcare facilities that are smart home systems, educational institutions that are smart home systems, government building as smart home systems as well as retail spaces that are smart home systems. For example, in healthcare, the importance of smart home systems cannot be underestimated as they can play a critical role in remote patient monitoring as well as standard approach which is suitable for hospitals. Smotr buildings of institutions may be employed for smart educational technologies to boost energy efficiency and create conditions appropriate for learning.

Smart Homes Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American smart home system environment is classifying as a powerful dominator, aiming at keeping its supreme role in the next five years. Several contributing factors for this probable dominance are listed as follows:

- First, the rich infrastructure and ubiquitous network provided by more and more progressive technologies in the area will certainly ensure a perfect environment for the rapid increase in the number of smart homes. Hence, tech-savvy consumers and increased disposable incomes provide the market with a bottom-up driver for bringing innovative technologies into consumer life.

- To add to these, the existence of key participants in the smart home world in North America, the detection of changes in the IoT and artificial intelligence developments increases the possibility that North America will remain the leading region in the smart home industry.

- Moreover, a growing consciousness in home owners about energy efficiency, security, and convenience make the adoption of smart home systems gain ground in North American region.

- These systems are the ones which are responsible for providing ease of integrated various devices and equipment in the home thus enabling the user in being able to control and monitor his home remotely.

- Eco-friendly attitudes and more and more people expecting their lifestyle to be seamless with any device contribute to the need for smart home solutions.

- With new improved technologies and smart infrastructures that are surely going to be the future of smart home systems in North America, the market is likely to be the leader showing the world the model of advanced living.

Active Key Players in the Smart Homes Systems Market

- LG Electronics, Inc.( South Korea)

- Siemens AG(Germany)

- Amazon.com, Inc(US).

- Google Nest (Google LLC)(US)

- Samsung Electronics Co., Ltd.( South Korea)

- Schneider Electric SE(France)

- Legrand S.A.( France)

- Robert Bosch GmbH(Germany)

- Assa Abloy AB(Sweden)

- Sony Group Corp.( Japan)

- ABB, Ltd.( Switzerland)

- Philips Lighting B.V.( Netherlands)

- Honeywell International, Inc.(US)

- Other Key Players

Key Industry Developments in the Smart Homes Systems Market

- In January 2023, Schneider Electric acquired AVEVA plc to use AVEVA plc’s advanced software capabilities to introduce modern automation solutions for residential, commercial, and building complexes. The acquisition is expected to grow Schneider Electric’s home automation offering.

|

Global Smart Homes Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 133.20 Mn. |

|

Forecast Period 2024-32 CAGR: |

13.4 % |

Market Size in 2032: |

USD 413.07 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SMART HOMES SYSTEMS MARKET BY TYPE (2017-2032)

- SMART HOMES SYSTEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENERGY MANAGEMENT SYSTEMS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SECURITY & ACCESS CONTROL

- LIGHTING CONTROL

- HOME APPLIANCES CONTROL

- ENTERTAINMENT CONTROL

- OTHERS

- SMART HOMES SYSTEMS MARKET BY APPLICATION (2017-2032)

- SMART HOMES SYSTEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DWELLING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BUSINESS BUILDING

- HOTEL

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- LG ELECTRONICS, INC. (SOUTH KOREA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SIEMENS AG(GERMANY)

- AMAZON.COM, INC (US).

- GOOGLE NEST (GOOGLE LLC) (US)

- SAMSUNG ELECTRONICS CO., LTD. (SOUTH KOREA)

- SCHNEIDER ELECTRIC SE(FRANCE)

- LEGRAND S.A.(FRANCE)

- ROBERT BOSCH GMBH (GERMANY)

- ASSA ABLOY AB(SWEDEN)

- SONY GROUP CORP. (JAPAN)

- ABB, LTD. (SWITZERLAND)

- PHILIPS LIGHTING B.V.(NETHERLANDS)

- HONEYWELL INTERNATIONAL, INC. (US)

- COMPETITIVE LANDSCAPE

- GLOBAL SMART HOMES SYSTEMS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Smart Homes Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 133.20 Mn. |

|

Forecast Period 2024-32 CAGR: |

13.4 % |

Market Size in 2032: |

USD 413.07 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SMART HOMES SYSTEMS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SMART HOMES SYSTEMS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SMART HOMES SYSTEMS MARKET COMPETITIVE RIVALRY

TABLE 005. SMART HOMES SYSTEMS MARKET THREAT OF NEW ENTRANTS

TABLE 006. SMART HOMES SYSTEMS MARKET THREAT OF SUBSTITUTES

TABLE 007. SMART HOMES SYSTEMS MARKET BY TYPE

TABLE 008. ENERGY MANAGEMENT SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 009. SECURITY & ACCESS CONTROL MARKET OVERVIEW (2016-2028)

TABLE 010. LIGHTING CONTROL MARKET OVERVIEW (2016-2028)

TABLE 011. HOME APPLIANCES CONTROL MARKET OVERVIEW (2016-2028)

TABLE 012. ENTERTAINMENT CONTROL MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. SMART HOMES SYSTEMS MARKET BY APPLICATION

TABLE 015. DWELLING MARKET OVERVIEW (2016-2028)

TABLE 016. BUSINESS BUILDING MARKET OVERVIEW (2016-2028)

TABLE 017. HOTEL MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA SMART HOMES SYSTEMS MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA SMART HOMES SYSTEMS MARKET, BY APPLICATION (2016-2028)

TABLE 021. N SMART HOMES SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE SMART HOMES SYSTEMS MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE SMART HOMES SYSTEMS MARKET, BY APPLICATION (2016-2028)

TABLE 024. SMART HOMES SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC SMART HOMES SYSTEMS MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC SMART HOMES SYSTEMS MARKET, BY APPLICATION (2016-2028)

TABLE 027. SMART HOMES SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA SMART HOMES SYSTEMS MARKET, BY TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA SMART HOMES SYSTEMS MARKET, BY APPLICATION (2016-2028)

TABLE 030. SMART HOMES SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA SMART HOMES SYSTEMS MARKET, BY TYPE (2016-2028)

TABLE 032. SOUTH AMERICA SMART HOMES SYSTEMS MARKET, BY APPLICATION (2016-2028)

TABLE 033. SMART HOMES SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 034. ADT: SNAPSHOT

TABLE 035. ADT: BUSINESS PERFORMANCE

TABLE 036. ADT: PRODUCT PORTFOLIO

TABLE 037. ADT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. HONEYWELL: SNAPSHOT

TABLE 038. HONEYWELL: BUSINESS PERFORMANCE

TABLE 039. HONEYWELL: PRODUCT PORTFOLIO

TABLE 040. HONEYWELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. VIVINT: SNAPSHOT

TABLE 041. VIVINT: BUSINESS PERFORMANCE

TABLE 042. VIVINT: PRODUCT PORTFOLIO

TABLE 043. VIVINT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. NORTEK: SNAPSHOT

TABLE 044. NORTEK: BUSINESS PERFORMANCE

TABLE 045. NORTEK: PRODUCT PORTFOLIO

TABLE 046. NORTEK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. CRESTRON: SNAPSHOT

TABLE 047. CRESTRON: BUSINESS PERFORMANCE

TABLE 048. CRESTRON: PRODUCT PORTFOLIO

TABLE 049. CRESTRON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. LUTRON: SNAPSHOT

TABLE 050. LUTRON: BUSINESS PERFORMANCE

TABLE 051. LUTRON: PRODUCT PORTFOLIO

TABLE 052. LUTRON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. LEVITON: SNAPSHOT

TABLE 053. LEVITON: BUSINESS PERFORMANCE

TABLE 054. LEVITON: PRODUCT PORTFOLIO

TABLE 055. LEVITON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. COMCAST: SNAPSHOT

TABLE 056. COMCAST: BUSINESS PERFORMANCE

TABLE 057. COMCAST: PRODUCT PORTFOLIO

TABLE 058. COMCAST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ABB: SNAPSHOT

TABLE 059. ABB: BUSINESS PERFORMANCE

TABLE 060. ABB: PRODUCT PORTFOLIO

TABLE 061. ABB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ACUITY BRANDS: SNAPSHOT

TABLE 062. ACUITY BRANDS: BUSINESS PERFORMANCE

TABLE 063. ACUITY BRANDS: PRODUCT PORTFOLIO

TABLE 064. ACUITY BRANDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ALARM.COM: SNAPSHOT

TABLE 065. ALARM.COM: BUSINESS PERFORMANCE

TABLE 066. ALARM.COM: PRODUCT PORTFOLIO

TABLE 067. ALARM.COM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CONTROL4: SNAPSHOT

TABLE 068. CONTROL4: BUSINESS PERFORMANCE

TABLE 069. CONTROL4: PRODUCT PORTFOLIO

TABLE 070. CONTROL4: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. SCHNEIDER ELECTRIC: SNAPSHOT

TABLE 071. SCHNEIDER ELECTRIC: BUSINESS PERFORMANCE

TABLE 072. SCHNEIDER ELECTRIC: PRODUCT PORTFOLIO

TABLE 073. SCHNEIDER ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. TIME WARNER CABLE: SNAPSHOT

TABLE 074. TIME WARNER CABLE: BUSINESS PERFORMANCE

TABLE 075. TIME WARNER CABLE: PRODUCT PORTFOLIO

TABLE 076. TIME WARNER CABLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. SIEMENS AG: SNAPSHOT

TABLE 077. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 078. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 079. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. SONY: SNAPSHOT

TABLE 080. SONY: BUSINESS PERFORMANCE

TABLE 081. SONY: PRODUCT PORTFOLIO

TABLE 082. SONY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. SAVANT: SNAPSHOT

TABLE 083. SAVANT: BUSINESS PERFORMANCE

TABLE 084. SAVANT: PRODUCT PORTFOLIO

TABLE 085. SAVANT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. NEST: SNAPSHOT

TABLE 086. NEST: BUSINESS PERFORMANCE

TABLE 087. NEST: PRODUCT PORTFOLIO

TABLE 088. NEST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. AMX: SNAPSHOT

TABLE 089. AMX: BUSINESS PERFORMANCE

TABLE 090. AMX: PRODUCT PORTFOLIO

TABLE 091. AMX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. LEGRAND: SNAPSHOT

TABLE 092. LEGRAND: BUSINESS PERFORMANCE

TABLE 093. LEGRAND: PRODUCT PORTFOLIO

TABLE 094. LEGRAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SMART HOMES SYSTEMS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SMART HOMES SYSTEMS MARKET OVERVIEW BY TYPE

FIGURE 012. ENERGY MANAGEMENT SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 013. SECURITY & ACCESS CONTROL MARKET OVERVIEW (2016-2028)

FIGURE 014. LIGHTING CONTROL MARKET OVERVIEW (2016-2028)

FIGURE 015. HOME APPLIANCES CONTROL MARKET OVERVIEW (2016-2028)

FIGURE 016. ENTERTAINMENT CONTROL MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. SMART HOMES SYSTEMS MARKET OVERVIEW BY APPLICATION

FIGURE 019. DWELLING MARKET OVERVIEW (2016-2028)

FIGURE 020. BUSINESS BUILDING MARKET OVERVIEW (2016-2028)

FIGURE 021. HOTEL MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA SMART HOMES SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE SMART HOMES SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC SMART HOMES SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA SMART HOMES SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA SMART HOMES SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Smart Homes Systems Market research report is 2024-2032.

LG Electronics, Inc.( South Korea), Siemens AG(Germany), Amazon.com, Inc(US)., Google Nest (Google LLC)(US), Samsung Electronics Co., Ltd.( South Korea), Schneider Electric SE(France), Legrand S.A.( France),and Other Major Players.

The Smart Homes Systems Market is segmented into Type, Application and Region. By Type, the market is categorized into Energy Management Systems, Security & Access control, Lighting Control, Home appliances control, Entertainment Control, Others Irrigation System. By Application, the market is categorized into Dwelling, Business Building, Hotel, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Smart home systems refer to integrated networks of devices and appliances that can be remotely monitored, controlled, and automated. These systems typically utilize internet connectivity and sensors to enhance convenience, efficiency, and security within the home environment. Examples include smart thermostats, lighting, security cameras, and voice-controlled assistants like Amazon Alexa or Google Home.

Smart Homes Systems Market Size Was Valued at USD 133.20 Million in 2023, and is Projected to Reach USD 413.07 Million by 2032, Growing at a CAGR of 13.4% From 2024-2032.