Ready-To-Drink Market Synopsis

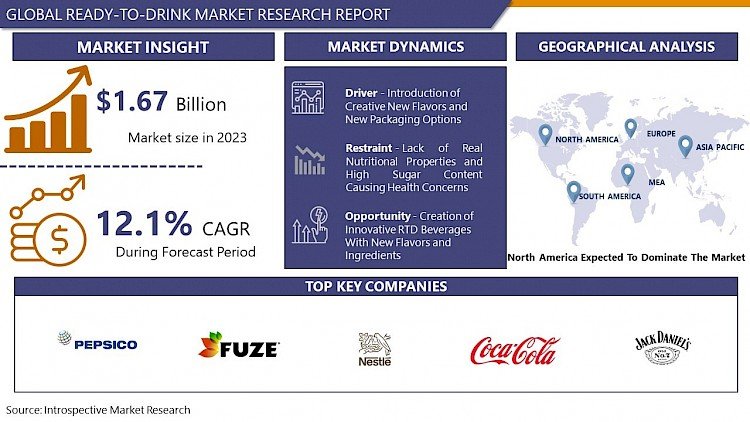

Ready-To-Drink Market Size Was Valued at USD 1.67 Billion in 2023 and is Projected to Reach USD 4.67 Billion by 2032, Growing at a CAGR of 12.1 % From 2024-2032.

Ready-to-drink beverages also called RTDs are single-use packaged beverages that are packaged and sold in a prepared form ready for immediate consumption upon purchase. Such Beverages do not need any further processing and can be consumed directly through the package. Ready-to-drink (RTD) beverages have gained a lot of popularity due to their functionality, especially in the summer. Consumers’ enjoyment of the fortified drinks and alcohols and the easiness of the product is the unique characteristic offered by the RTDs.

- Ready-to-drink beverages are developed to provide immunity and fun benefits to consumers these products have even stirred up the alcoholic beverage market. Today, there is an infinite range of flavors made with several ingredients individually or by mixing them up. Many varieties like a bottled mojito, lemonades, and craft beer are available across several stores. This potentiality of consumption of ready-to-drink beverages and finished drinks will grow in the future helping the newest market players to experiment with their productions.

- Currently, the market for RTDs is broader than ever, ranging from RTD iced coffees and teas to new yogurt drinks to canned whiskeys, wines and cocktails. In the past few years, the ready-to-drink (RTD) was growing in a one-sided way with not many companies entering the industry, products like White Claw in the past period addressed a number of drinkers and sold SKUs at a rapid rate. But now, with the help of innovation and development, the category has burst open, expanding right from hard seltzers to canned cocktails to niche products like non-alcoholic spritzers and port-and-tonics.

- Other than alcohol-contained drinks, consumers’ demand for more non-alcoholic and organic products with contributing factors like awareness for health and wellness, demand for clean label foods and beverages, and functionality are leading the entire market towards success in achieving the market goal of becoming of more than USD 1 trillion coming 5-7 years

The Ready-To-Drink Market Trend Analysis

Introduction of Creative New Flavors and New Packaging Options

- Consumer motivation to buy the product is the primary thing that acts effectively behind the sales of RTD Beverages. Many producers today are moving towards more herbal, botanical, and organic flavors that create the taste of natural ingredients along with some health benefits. Such Creative New Flavors with colorful ready-to-drink beverages are getting perfect to satisfy the desire that is widespread in the adventure society for new and exciting taste experiences. Taste is the most important factor, according to Nielsen, today, consumers expect more than ever that products are particularly rich in flavors, and 42% of consumers worldwide say they enjoy trying new tastes.

- The fulfilling ready-to-drink creations are just the right thing for the growth of the market, other than consumers’ favorite tastes, the transformation of certain types of alcohol, and the availability of RTD Beverages at supermarkets for special offers, are also some influential growth driving factors for the Global Ready-To-Drink Market.

- Furthermore, packaging and distribution have certainly been key factors in the success of this kind of product, and many market players are continuously innovating when it comes to packaging. Sustainable packaging for healthy and organic RTD juices and ice ad coffee plus packaging of RTD cocktails in plastic balls to pouches and beyond are further driving the market growth. For instance, the Brookly-based brand St. Agrestis in 2020 released the “Negroni Fountain” product which packages a classic cocktail in a 1.75-liter bag-in-box. This product gained a great success from the very beginning. And finally, low prices and well-known brands are helping the market to achieve greater highs.

Creation of Innovative RTD Beverages With New Flavors and Ingredients

- The RTD beverage category for the last few years is growing very fast. To make the most out of the trend the brands are going to need to work effectively on their development and marketing to stand out of others and establish a strong sense of Meaningful to gain huge profits.

- Opportunity to innovate is been served by the consumers of the ever-changing world Several brands worldwide have the opportunity to innovate in themselves and innovate in a different way to grab the market attention. This is even more beneficial in times of crisis as the companies that are perceived as innovative grow at a very faster rate by figuring out creative business practices.

- Consumers nowadays are becoming health conscious and they are aware of the importance of nutritious food and beverages. Several global disorders like high blood pressure, Obesity, high blood sugar, and other disease are on the rise, forcing customers to restrict unhealthy products and switch to more healthy and nutritious foods even if it’s a snack. This provides companies with an opportunity to serve consumers the right way by providing organic and natural items that are preferred by consumers who want to live healthy lifestyles.

- Sugar-free, Organic, gluten-free, and vegan ready-to-drink beverages are now widely available across all the markets, and their popularity is continuously growing. Other than this, the convenience of an RTD with availability in single-can and carton and their low prices are expected to boost the market growth in the upcoming period.

Segmentation Analysis Of The Ready-To-Drink Market

Ready-To-Drink market segments cover the Type, Packaging Type, and Sales Channel. By Packaging Type, the Bottles segment is Expected to Dominate the Market Over the Forecast period.

- With the ever-expanding variety of RTD products both in-store and online, the packaging has an important part in the decision-making of consumers whether to buy or not the product. Packaging needs to feel more unique to the brand, should be attractive to consumers, and consequently should help to convert sales. Sustainability and innovation are two major features of packaging that are deciding factors for the sale of the product.

- In the Packaging of RTDs, Bottles made from glass or polyethylene terephthalate (PET) bottle hold the largest share of the market. The current market trend to improve conventional containers to extend the shelf-life of the products, to provide greater safety and consumer convenience, and ultimately to produce economic cost-saving packages are necessary to grab profits such benefits provide by bottle containers is the reason behind the success of the segment.

- Features like leak-proof and preventing contamination, Protecting the contents against chemical deterioration, not picking up external flavors, being hygienic and safe, economical, easy to use and dispose of, and finally good aesthetic appearance are further expected to drive the application of bottles in the packaging of the RTD Beverages. However other containers like metal tin cans, plastic pouches, aseptic cartons, and Bag-in-Box packages are gaining a lot of popularity these days, of which the Bag-in-Box System is anticipated to gain considerable growth owning to consumer preference.

Regional Analysis of The Ready-To-Drink Market

North America is Estimated to Dominate the Market During the Forecast period.

- The North American region remains the largest market for functional foods and beverages, which makes a promising point for the growth of the market in the region. North American Countries like the United States and Canada can be said to have the widest consumer base for such nutritious and functional products. Due to this, RTD beverage consumers in these countries want to buy a beverage with the purpose of healthiness which is serving as an opportunity for the RTD Beverage manufacturers. For instance, according to a consumer survey by FMCG Gurus in early 2021, 58% of US consumers indicated that they would continue to turn to beverages to boost their immune health after the pandemic, and a custom nutrient premix was demanded to offer such utility.

- Additionally, the region has the largest number of operating RTD Beverage manufacturers scattered across developed countries this influential presence with the continued growth and innovation in beverage making and packaging, the Ready-To-Drink Markets across North America are driven by the health and wellness trend. Several fortifications are gaining fame, even people have started shifting towards fortified water from soda which can provide them with added Vitamins, Minerals, Probiotics, Prebiotic fibers, Antioxidants, Natural energy boosters, and many other healthy nutrients.

- Also, taste has a very important role to play along with nutrition, which can be achieved through research and formulation of a new variety of drinks, and the development of such splendid products will cover the wide desires of the modern population residing in North America.

Covid-19 Impact Analysis On Ready-To-Drink Market

- The Global Market of Ready-To-Drink Beverages has not experienced much of an adverse impact of the pandemic, this is due to the continuous launch of new products helped with huge potential for sales even during the pandemic period. With the help of consistent penetration growth, even beyond the covid-induced spike in 2020 and 2021, several market players continued to focus on the betterment of the product and its safe and proper distribution. For instance, in GB Drinks over past year we have seen a 6% growth in value for the off-trade RTD category with the category showing strong potential for growth in the next few years also.

- With the advent of the COVID-19 pandemic, consumers started preferring healthy options containing premium ingredients and new creative flavors. Reducing sugar, and providing gluten-free and vegan RTD Beverages will ensure to serve health- and ingredient-conscious consumers, and hence by addressing such health challenges and finding new ways aided the market players to maintain their sales throughout the globe. RTD Industry has shown huge success over the last few years in the pandemic situation too, registering around 24% growth. Categories seeing a lot of of new product development in the crisis time were pre-mixed cocktails, spirits, and hard seltzers, and these RTD cocktail products with no alcohol feature are expected to maintain their popularity in the coming years also.

Top Key Players Covered in The Ready-To-Drink Market

- PepsiCo Inc.(US)

- Fuze Beverage (US)

- Nestle S.A. (Switzerland)

- The Coca-Cola Company(US)

- Jack Daniel's (US)

- Suntory Beverages & Food Ltd. (Japan)

- Kirin Brewery Company, Limited (Japan)

- Red Bull GmbH (Austria)

- Monster Beverage Corporation (US)

- NZMP (New Zealand)

- Zevia (US)

- White Claw Hard Seltzer (US)

- Southeast Bottling & Beverage (US)

- Gehl Foods LLC (US)

- Tropical Bottling Corporation (US) and Other Major Players

Key Industry Developments

- In January 2024: Systm Foods, a joint-venture beverage brand, acquired Humm Kombucha, a producer of zero-sugar and low kombucha and gut-health beverages. The acquisition would help Systm Foods to strengthen its position in the ready-to-drink beverage market.

- In September 2023: BODYARMOR, an American sports drink brand owned by The Coca-Cola Company, expanded and distributed its premium sports drink products internationally. The new products would be available across Canada, including in cities such as Ottawa, Vancouver, Calgary, and others.

- In September 2023: Gatorade expanded its sports drink brand by launching the new Gatorade Water. The new product is zero-calorie and unflavored alkaline water and other minerals.

|

Global Ready-To-Drink Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.22 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.19 % |

Market Size in 2032: |

USD 2.85 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging Type |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Packaging Type

3.3 By Sales Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Ready-To-Drink Market by Type

5.1 Ready-To-Drink Market Overview Snapshot and Growth Engine

5.2 Ready-To-Drink Market Overview

5.3 Tea & Coffee

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Tea & Coffee: Geographic Segmentation

5.4 Sports & Energy Drinks

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Sports & Energy Drinks: Geographic Segmentation

5.5 Dairy-Based Beverages

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Dairy-Based Beverages: Geographic Segmentation

5.6 Juices & Nectars

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Juices & Nectars: Geographic Segmentation

5.7 Fortified Water

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Fortified Water: Geographic Segmentation

5.8 Alcopops

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Alcopops: Geographic Segmentation

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size (2016-2028F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others: Geographic Segmentation

Chapter 6: Ready-To-Drink Market by Packaging Type

6.1 Ready-To-Drink Market Overview Snapshot and Growth Engine

6.2 Ready-To-Drink Market Overview

6.3 Bottles

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Bottles: Geographic Segmentation

6.4 Cans

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Cans: Geographic Segmentation

6.5 Cartons

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Cartons: Geographic Segmentation

6.6 Other

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Other: Geographic Segmentation

Chapter 7: Ready-To-Drink Market by Sales Channel

7.1 Ready-To-Drink Market Overview Snapshot and Growth Engine

7.2 Ready-To-Drink Market Overview

7.3 Supermarkets & Hypermarkets

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Supermarkets & Hypermarkets: Geographic Segmentation

7.4 Specialty Stores

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Specialty Stores: Geographic Segmentation

7.5 Convenience Stores

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Convenience Stores: Geographic Segmentation

7.6 Online Stores

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Online Stores: Geographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Ready-To-Drink Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Ready-To-Drink Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Ready-To-Drink Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 PEPSICO INC. (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 FUZE BEVERAGE (US)

8.4 NESTLE S.A. (SWITZERLAND)

8.5 THE COCA-COLA COMPANY (US)

8.6 JACK DANIEL'S (US)

8.7 SUNTORY BEVERAGES & FOOD LTD. (JAPAN)

8.8 KIRIN BREWERY COMPANY LIMITED (JAPAN)

8.9 RED BULL GMBH (AUSTRIA)

8.10 MONSTER BEVERAGE CORPORATION (US)

8.11 NZMP (NEW ZEALAND)

8.12 ZEVIA (US)

8.13 WHITE CLAW HARD SELTZER (US)

8.14 SOUTHEAST BOTTLING & BEVERAGE (US)

8.15 GEHL FOODS LLC (US)

8.16 TROPICAL BOTTLING CORPORATION (US)

8.17 OTHER MAJOR PLAYERS

Chapter 9: Global Ready-To-Drink Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Tea & Coffee

9.2.2 Sports & Energy Drinks

9.2.3 Dairy-Based Beverages

9.2.4 Juices & Nectars

9.2.5 Fortified Water

9.2.6 Alcopops

9.2.7 Others

9.3 Historic and Forecasted Market Size By Packaging Type

9.3.1 Bottles

9.3.2 Cans

9.3.3 Cartons

9.3.4 Other

9.4 Historic and Forecasted Market Size By Sales Channel

9.4.1 Supermarkets & Hypermarkets

9.4.2 Specialty Stores

9.4.3 Convenience Stores

9.4.4 Online Stores

Chapter 10: North America Ready-To-Drink Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Tea & Coffee

10.4.2 Sports & Energy Drinks

10.4.3 Dairy-Based Beverages

10.4.4 Juices & Nectars

10.4.5 Fortified Water

10.4.6 Alcopops

10.4.7 Others

10.5 Historic and Forecasted Market Size By Packaging Type

10.5.1 Bottles

10.5.2 Cans

10.5.3 Cartons

10.5.4 Other

10.6 Historic and Forecasted Market Size By Sales Channel

10.6.1 Supermarkets & Hypermarkets

10.6.2 Specialty Stores

10.6.3 Convenience Stores

10.6.4 Online Stores

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Ready-To-Drink Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Tea & Coffee

11.4.2 Sports & Energy Drinks

11.4.3 Dairy-Based Beverages

11.4.4 Juices & Nectars

11.4.5 Fortified Water

11.4.6 Alcopops

11.4.7 Others

11.5 Historic and Forecasted Market Size By Packaging Type

11.5.1 Bottles

11.5.2 Cans

11.5.3 Cartons

11.5.4 Other

11.6 Historic and Forecasted Market Size By Sales Channel

11.6.1 Supermarkets & Hypermarkets

11.6.2 Specialty Stores

11.6.3 Convenience Stores

11.6.4 Online Stores

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Ready-To-Drink Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Tea & Coffee

12.4.2 Sports & Energy Drinks

12.4.3 Dairy-Based Beverages

12.4.4 Juices & Nectars

12.4.5 Fortified Water

12.4.6 Alcopops

12.4.7 Others

12.5 Historic and Forecasted Market Size By Packaging Type

12.5.1 Bottles

12.5.2 Cans

12.5.3 Cartons

12.5.4 Other

12.6 Historic and Forecasted Market Size By Sales Channel

12.6.1 Supermarkets & Hypermarkets

12.6.2 Specialty Stores

12.6.3 Convenience Stores

12.6.4 Online Stores

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Ready-To-Drink Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Tea & Coffee

13.4.2 Sports & Energy Drinks

13.4.3 Dairy-Based Beverages

13.4.4 Juices & Nectars

13.4.5 Fortified Water

13.4.6 Alcopops

13.4.7 Others

13.5 Historic and Forecasted Market Size By Packaging Type

13.5.1 Bottles

13.5.2 Cans

13.5.3 Cartons

13.5.4 Other

13.6 Historic and Forecasted Market Size By Sales Channel

13.6.1 Supermarkets & Hypermarkets

13.6.2 Specialty Stores

13.6.3 Convenience Stores

13.6.4 Online Stores

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Ready-To-Drink Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Tea & Coffee

14.4.2 Sports & Energy Drinks

14.4.3 Dairy-Based Beverages

14.4.4 Juices & Nectars

14.4.5 Fortified Water

14.4.6 Alcopops

14.4.7 Others

14.5 Historic and Forecasted Market Size By Packaging Type

14.5.1 Bottles

14.5.2 Cans

14.5.3 Cartons

14.5.4 Other

14.6 Historic and Forecasted Market Size By Sales Channel

14.6.1 Supermarkets & Hypermarkets

14.6.2 Specialty Stores

14.6.3 Convenience Stores

14.6.4 Online Stores

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Ready-To-Drink Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.22 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.19 % |

Market Size in 2032: |

USD 2.85 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging Type |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. READY-TO-DRINK MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. READY-TO-DRINK MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. READY-TO-DRINK MARKET COMPETITIVE RIVALRY

TABLE 005. READY-TO-DRINK MARKET THREAT OF NEW ENTRANTS

TABLE 006. READY-TO-DRINK MARKET THREAT OF SUBSTITUTES

TABLE 007. READY-TO-DRINK MARKET BY TYPE

TABLE 008. TEA & COFFEE MARKET OVERVIEW (2016-2028)

TABLE 009. SPORTS & ENERGY DRINKS MARKET OVERVIEW (2016-2028)

TABLE 010. DAIRY-BASED BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 011. JUICES & NECTARS MARKET OVERVIEW (2016-2028)

TABLE 012. FORTIFIED WATER MARKET OVERVIEW (2016-2028)

TABLE 013. ALCOPOPS MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. READY-TO-DRINK MARKET BY PACKAGING TYPE

TABLE 016. BOTTLES MARKET OVERVIEW (2016-2028)

TABLE 017. CANS MARKET OVERVIEW (2016-2028)

TABLE 018. CARTONS MARKET OVERVIEW (2016-2028)

TABLE 019. OTHER MARKET OVERVIEW (2016-2028)

TABLE 020. READY-TO-DRINK MARKET BY SALES CHANNEL

TABLE 021. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 022. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 023. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 024. ONLINE STORES MARKET OVERVIEW (2016-2028)

TABLE 025. NORTH AMERICA READY-TO-DRINK MARKET, BY TYPE (2016-2028)

TABLE 026. NORTH AMERICA READY-TO-DRINK MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 027. NORTH AMERICA READY-TO-DRINK MARKET, BY SALES CHANNEL (2016-2028)

TABLE 028. N READY-TO-DRINK MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE READY-TO-DRINK MARKET, BY TYPE (2016-2028)

TABLE 030. EUROPE READY-TO-DRINK MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 031. EUROPE READY-TO-DRINK MARKET, BY SALES CHANNEL (2016-2028)

TABLE 032. READY-TO-DRINK MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC READY-TO-DRINK MARKET, BY TYPE (2016-2028)

TABLE 034. ASIA PACIFIC READY-TO-DRINK MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 035. ASIA PACIFIC READY-TO-DRINK MARKET, BY SALES CHANNEL (2016-2028)

TABLE 036. READY-TO-DRINK MARKET, BY COUNTRY (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA READY-TO-DRINK MARKET, BY TYPE (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA READY-TO-DRINK MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA READY-TO-DRINK MARKET, BY SALES CHANNEL (2016-2028)

TABLE 040. READY-TO-DRINK MARKET, BY COUNTRY (2016-2028)

TABLE 041. SOUTH AMERICA READY-TO-DRINK MARKET, BY TYPE (2016-2028)

TABLE 042. SOUTH AMERICA READY-TO-DRINK MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 043. SOUTH AMERICA READY-TO-DRINK MARKET, BY SALES CHANNEL (2016-2028)

TABLE 044. READY-TO-DRINK MARKET, BY COUNTRY (2016-2028)

TABLE 045. PEPSICO INC. (US): SNAPSHOT

TABLE 046. PEPSICO INC. (US): BUSINESS PERFORMANCE

TABLE 047. PEPSICO INC. (US): PRODUCT PORTFOLIO

TABLE 048. PEPSICO INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. FUZE BEVERAGE (US): SNAPSHOT

TABLE 049. FUZE BEVERAGE (US): BUSINESS PERFORMANCE

TABLE 050. FUZE BEVERAGE (US): PRODUCT PORTFOLIO

TABLE 051. FUZE BEVERAGE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. NESTLE S.A. (SWITZERLAND): SNAPSHOT

TABLE 052. NESTLE S.A. (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 053. NESTLE S.A. (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 054. NESTLE S.A. (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. THE COCA-COLA COMPANY (US): SNAPSHOT

TABLE 055. THE COCA-COLA COMPANY (US): BUSINESS PERFORMANCE

TABLE 056. THE COCA-COLA COMPANY (US): PRODUCT PORTFOLIO

TABLE 057. THE COCA-COLA COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. JACK DANIEL'S (US): SNAPSHOT

TABLE 058. JACK DANIEL'S (US): BUSINESS PERFORMANCE

TABLE 059. JACK DANIEL'S (US): PRODUCT PORTFOLIO

TABLE 060. JACK DANIEL'S (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SUNTORY BEVERAGES & FOOD LTD. (JAPAN): SNAPSHOT

TABLE 061. SUNTORY BEVERAGES & FOOD LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 062. SUNTORY BEVERAGES & FOOD LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 063. SUNTORY BEVERAGES & FOOD LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. KIRIN BREWERY COMPANY LIMITED (JAPAN): SNAPSHOT

TABLE 064. KIRIN BREWERY COMPANY LIMITED (JAPAN): BUSINESS PERFORMANCE

TABLE 065. KIRIN BREWERY COMPANY LIMITED (JAPAN): PRODUCT PORTFOLIO

TABLE 066. KIRIN BREWERY COMPANY LIMITED (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. RED BULL GMBH (AUSTRIA): SNAPSHOT

TABLE 067. RED BULL GMBH (AUSTRIA): BUSINESS PERFORMANCE

TABLE 068. RED BULL GMBH (AUSTRIA): PRODUCT PORTFOLIO

TABLE 069. RED BULL GMBH (AUSTRIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. MONSTER BEVERAGE CORPORATION (US): SNAPSHOT

TABLE 070. MONSTER BEVERAGE CORPORATION (US): BUSINESS PERFORMANCE

TABLE 071. MONSTER BEVERAGE CORPORATION (US): PRODUCT PORTFOLIO

TABLE 072. MONSTER BEVERAGE CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. NZMP (NEW ZEALAND): SNAPSHOT

TABLE 073. NZMP (NEW ZEALAND): BUSINESS PERFORMANCE

TABLE 074. NZMP (NEW ZEALAND): PRODUCT PORTFOLIO

TABLE 075. NZMP (NEW ZEALAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. ZEVIA (US): SNAPSHOT

TABLE 076. ZEVIA (US): BUSINESS PERFORMANCE

TABLE 077. ZEVIA (US): PRODUCT PORTFOLIO

TABLE 078. ZEVIA (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. WHITE CLAW HARD SELTZER (US): SNAPSHOT

TABLE 079. WHITE CLAW HARD SELTZER (US): BUSINESS PERFORMANCE

TABLE 080. WHITE CLAW HARD SELTZER (US): PRODUCT PORTFOLIO

TABLE 081. WHITE CLAW HARD SELTZER (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. SOUTHEAST BOTTLING & BEVERAGE (US): SNAPSHOT

TABLE 082. SOUTHEAST BOTTLING & BEVERAGE (US): BUSINESS PERFORMANCE

TABLE 083. SOUTHEAST BOTTLING & BEVERAGE (US): PRODUCT PORTFOLIO

TABLE 084. SOUTHEAST BOTTLING & BEVERAGE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. GEHL FOODS LLC (US): SNAPSHOT

TABLE 085. GEHL FOODS LLC (US): BUSINESS PERFORMANCE

TABLE 086. GEHL FOODS LLC (US): PRODUCT PORTFOLIO

TABLE 087. GEHL FOODS LLC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. TROPICAL BOTTLING CORPORATION (US): SNAPSHOT

TABLE 088. TROPICAL BOTTLING CORPORATION (US): BUSINESS PERFORMANCE

TABLE 089. TROPICAL BOTTLING CORPORATION (US): PRODUCT PORTFOLIO

TABLE 090. TROPICAL BOTTLING CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 091. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 092. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 093. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. READY-TO-DRINK MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. READY-TO-DRINK MARKET OVERVIEW BY TYPE

FIGURE 012. TEA & COFFEE MARKET OVERVIEW (2016-2028)

FIGURE 013. SPORTS & ENERGY DRINKS MARKET OVERVIEW (2016-2028)

FIGURE 014. DAIRY-BASED BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 015. JUICES & NECTARS MARKET OVERVIEW (2016-2028)

FIGURE 016. FORTIFIED WATER MARKET OVERVIEW (2016-2028)

FIGURE 017. ALCOPOPS MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. READY-TO-DRINK MARKET OVERVIEW BY PACKAGING TYPE

FIGURE 020. BOTTLES MARKET OVERVIEW (2016-2028)

FIGURE 021. CANS MARKET OVERVIEW (2016-2028)

FIGURE 022. CARTONS MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 024. READY-TO-DRINK MARKET OVERVIEW BY SALES CHANNEL

FIGURE 025. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 026. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 027. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 028. ONLINE STORES MARKET OVERVIEW (2016-2028)

FIGURE 029. NORTH AMERICA READY-TO-DRINK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. EUROPE READY-TO-DRINK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. ASIA PACIFIC READY-TO-DRINK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. MIDDLE EAST & AFRICA READY-TO-DRINK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. SOUTH AMERICA READY-TO-DRINK MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Ready-To-Drink Market research report is 2024-2032.

PepsiCo Inc. (US), Fuze Beverage (US), Nestle S.A. (Switzerland), The Coca-Cola Company (US), Jack Daniel's (US), Suntory Beverages & Food Ltd. (Japan), Kirin Brewery Company, Limited (Japan), Red Bull GmbH (Austria), Monster Beverage Corporation (US), NZMP (New Zealand), Zevia (US), White Claw Hard Seltzer (US), Southeast Bottling & Beverage (US), Gehl Foods LLC (US), Tropical Bottling Corporation (US) and Other Major Players.

The Ready-To-Drink Market is segmented into Type, Packaging Type, Sales Channel, and region. By Type, the market is categorized into Tea & Coffee, Sports & Energy Drinks, Dairy-Based Beverages, Juices & Nectars, Fortified Water, Alcopops, and Others. By Packaging Type, the market is categorized into Bottles, Cans, Cartons, Other. By Sales Channel, the market is categorized into Supermarkets & Hypermarkets, Specialty Stores, Convenience Stores, and Online Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Ready-to-drink beverages also called RTDs are single-use packaged beverages that are packaged and sold in a prepared form ready for immediate consumption upon purchase. Such Beverages do not need any further processing and can be consumed directly through the package. Ready-to-drink (RTD) beverages have gained a lot of popularity due to their functionality, especially in the summer. Consumers’ enjoyment of the fortified drinks and alcohols and the easiness of the product is the unique characteristic offered by the RTDs.

Ready-To-Drink Market Size Was Valued at USD 1.67 Billion in 2023 and is Projected to Reach USD 4.67 Billion by 2032, Growing at a CAGR of 12.1 % From 2024-2032.