Propane Market Synopsis

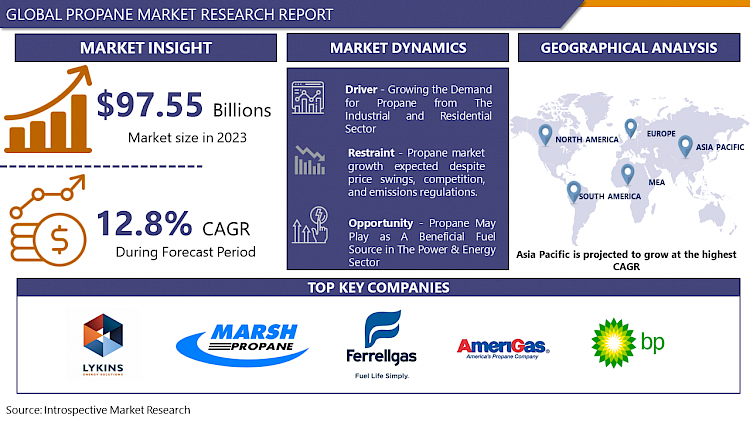

Propane Market Size Was Valued at USD 97.55 Billion in 2023, and is Projected to Reach USD 288.41 Billion by 2032, Growing at a CAGR of 12.8% From 2024-2032.

The global propane market is poised for steady growth, with Asia and the Middle East driving the surge in demand, especially in China where an 8% annual increase is projected from 2018 to 2023. Despite challenges like the pandemic and geopolitical tensions, propane prices have hit record highs, with indications of stability in 2023. Factors such as lingering COVID-19 effects and rising agricultural usage suggest prices may remain stable or even rise further. Amidst historically high prices for oil, natural gas, coal, and electricity, propane stands out as a comparatively affordable option for home appliances, making it an attractive choice for consumers looking to make the switch to a reliable and cost-effective energy source.

- One major driver for the growth of the propane market is its cleaner-burning nature compared to traditional fossil fuels such as coal and oil. As global awareness of environmental issues, particularly climate change, has increased, there is a growing demand for cleaner and more sustainable energy sources. Propane produces fewer greenhouse gas emissions and air pollutants, making it an attractive option for industries, businesses, and households aiming to reduce their carbon footprint.

- Moreover, propane is a reliable and efficient energy source with diverse applications. It is widely used for heating purposes in residential and commercial settings, as well as for cooking, hot water systems, and even as fuel for vehicles. The versatility of propane contributes to its increasing market share, as industries find innovative ways to incorporate it into their operations.

- The growth of the propane market is also influenced by economic factors. Propane is often more cost-effective than other energy sources, making it an appealing option for businesses and consumers looking to manage energy expenses. Additionally, the abundance of propane production, often as a byproduct of natural gas and crude oil refining, contributes to its affordability and availability in the market.

Propane Market Trend Analysis

Growing the Demand for Propane from The Industrial and Residential Sector

- In the industrial sector, propane is utilized for various purposes, contributing to the increasing demand. Industries such as manufacturing, agriculture, and construction rely on propane for processes such as heating, cutting, brazing, and welding. The efficiency and reliability of propane as an energy source make it a preferred choice for industrial applications. Additionally, propane-powered forklifts and vehicles are becoming more prevalent in warehouses and manufacturing facilities, further propelling the demand for propane.

- The residential sector has witnessed a surge in propane usage, primarily driven by its applications in heating, cooking, and other household activities. Propane is a popular choice for home heating due to its cost-effectiveness and lower environmental impact compared to some traditional fuels. Moreover, propane stoves and grills are widely used for cooking purposes, providing a convenient and efficient alternative to electric appliances.

- The versatility of propane as a fuel adds to its appeal. Its easy storage and transport, combined with the ability to use it in various applications, make it a flexible energy solution for both industrial and residential users. Propane is also considered a reliable energy source, as it is less susceptible to supply chain disruptions compared to other fuels.

- Government initiatives and incentives promoting the use of clean energy further support the growth of the propane market. Incentives for adopting propane in industrial and residential settings encourage businesses and homeowners to consider propane as a viable and eco-friendly alternative.

Propane May Play as A Beneficial Fuel Source in The Power & Energy Sector

- Propane is a cleaner-burning alternative compared to traditional fossil fuels like coal and oil. When combusted, propane produces lower levels of greenhouse gases and particulate matter, contributing to reduced air pollution and mitigating climate change concerns. As the world increasingly focuses on sustainable energy solutions, propane's cleaner combustion profile positions it as a promising candidate for meeting stringent environmental regulations.

- Propane is a highly efficient and cost-effective energy source. It boasts a high energy density, meaning that a small amount of propane can produce a significant amount of heat or power. This efficiency translates into cost savings for end-users, making propane an attractive option for various applications within the power and energy sector. Additionally, propane infrastructure is relatively easy and cost-effective to establish, providing a practical solution for energy distribution and storage.

- Propane offers versatility in applications, making it suitable for a wide range of power generation methods. It can be utilized in combined heat and power (CHP) systems, distributed generation, and backup power applications. This versatility enhances energy reliability and resilience, addressing the intermittent nature of some renewable energy sources. Propane's compatibility with emerging technologies such as fuel cells further expands its potential applications in the evolving energy landscape.

Propane Market Segment Analysis:

Propane Market Segmented on the basis of type, grade, application, and end-users.

By Type, Gas segment is expected to dominate the market during the forecast period

- The increasing awareness and concern for environmental sustainability have prompted a shift towards cleaner energy alternatives. Propane is considered a relatively clean-burning fuel compared to traditional fossil fuels like coal and oil. It produces fewer greenhouse gas emissions, sulfur, and particulate matter, making it an attractive option for industries and households aiming to reduce their carbon footprint.

- The versatility of propane contributes to its growing market share. Propane is used for various purposes, including heating, cooking, transportation, and industrial processes. Its adaptability makes it a preferred choice for consumers and businesses seeking a reliable and multipurpose energy solution. In the residential sector, for example, propane is commonly used for heating homes, cooking, and even powering backup generators.

- Additionally, the propane market's growth in the gas type segment can be attributed to its cost-effectiveness and efficiency. Propane is often more economical than other energy sources, providing a cost-effective solution for both urban and rural areas. Its efficiency in delivering energy, along with a well-established distribution infrastructure, enhances its appeal to a wide range of consumers.

By Grade, HD10 Propane segment held the largest share of 58.4% in 2022

- HD10 Propane is a high-purity propane grade that meets stringent specifications, making it suitable for a wide range of industrial applications. This grade of propane is characterized by its exceptionally low levels of impurities, including moisture, sulfur, and other contaminants. Industries such as petrochemicals, plastics, and manufacturing require a reliable and clean fuel source, and HD10 Propane fulfills these requirements, driving its increasing demand.

- Moreover, the global focus on environmental sustainability has contributed to the growth of HD10 Propane. As industries strive to reduce their carbon footprint and adhere to strict emissions regulations, cleaner-burning fuels like HD10 Propane become more appealing. Propane is known for its lower greenhouse gas emissions compared to traditional fossil fuels, making it an attractive option for companies aiming to improve their environmental performance.

- The versatility of HD10 Propane is another factor contributing to its growth. It is used in various applications, including heating, cutting, and as a fuel for engines. Its high purity ensures optimal performance in these diverse applications, making it a preferred choice for businesses seeking a reliable and efficient energy source.

Propane Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is expected to register the maximum market share over the forecast period. The regional major economies such as India, Japan, and China held a major share of the Asia Pacific market. This dominance is expected to continue in the upcoming years, due to the rise in the demand for cooking fuel in the form of LPG. Furthermore, China has become a top propane-importing nation globally, owing to growing local fuel utilization in the country. The propane market in China is expected to build at a rapid pace throughout the projected period.

- North America held a considerable share of the global propane market during the forecast period. The market in the region is estimated to build at a significant pace over the projected period. The U.S. held a distinguished share of the propane market in North America in the year, owing to the large production and supply of propane over the globe. Growth in the demand for propane for use in the industrial sector in the country is a key factor that turns the propane market in the U.S.

Propane Market Top Key Players:

- Lykins Energy Solutions (U.S.)

- Marsh L.P. Gas Co. Inc. (U.S.)

- Suburban (U.S.)

- Ferrellgas (U.S.)

- AmeriGas Propane Inc. (U.S.)

- BP Plc (U.K.)

- Chevron Corporation (U.S.)

- Royal Dutch Shell Plc (U.K.)

- Exxon Mobil Corporation (U.S.)

- ConocoPhillips (U.S)

- Reliance Industries Ltd. (India)

- PetroChina Company Limited (China)

- Sinopec (China)

- Total S A (France)

- Ferrellgas Partners L.P. (U.S.)

- GAIL (India) Limited (India)

- Indian Oil Corporation Ltd. (India)

- DCC Plc (Ireland)

- SINOPEC (China Petroleum & Chemical Corporation) (China)

- Saudi Arabian Oil Co. (Saudi Aramco) (Saudi Arabia)

- Gazprom (Russia)

- Air Liquide (France)

Key Industry Developments in the Propane Market:

- In January 2023, UGI Corporation (UGI) and AmeriGas Propane, LLC (AmeriGas) announced a definitive agreement for UGI to acquire AmeriGas in an all-cash transaction valued at approximately $8.2 billion. This merger creates one of the largest LPG distributors in the United States, with a strong presence in the Northeast, Mid-Atlantic, Southeast, and West regions.

- In April 2023, Superior Plus Corp. (SPB) acquired Suburban Propane Partners, L.P. (SPLP) for $5.8 billion in cash and stock. This merger combines two of the largest propane distributors in the United States, expanding Superior Plus's reach to 41 states and solidifying its position as the leading retail propane provider in North America.

|

Global Propane Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 97.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.8% |

Market Size in 2032: |

USD 288.41 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Grade |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PROPANE MARKET BY TYPE (2017-2032)

- PROPANE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LIQUID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GAS

- PROPANE MARKET BY GRADE (2016-2030)

- PROPANE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HD5 PROPANE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HD10 PROPANE

- PROPANE MARKET BY APPLICATION (2017-2032)

- PROPANE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MOTOR FUEL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INDUSTRIAL & DOMESTIC FUEL

- REFRIGERATION

- SOLVENT

- PROPANE MARKET BY END USER (2016-2030)

- PROPANE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRANSPORTATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RESIDENTIAL

- AGRICULTURE

- COMMERCIAL

- INDUSTRIAL

- CHEMICALS & REFINERIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- PROPANE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- LYKINS ENERGY SOLUTIONS (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MARSH L.P. GAS CO. INC. (U.S.)

- SUBURBAN (U.S.)

- FERRELLGAS (U.S.)

- AMERIGAS PROPANE INC. (U.S.)

- BP PLC (U.K.)

- CHEVRON CORPORATION (U.S.)

- ROYAL DUTCH SHELL PLC (U.K.)

- EXXON MOBIL CORPORATION (U.S.)

- CONOCOPHILLIPS (U.S)

- RELIANCE INDUSTRIES LTD. (INDIA)

- PETROCHINA COMPANY LIMITED (CHINA)

- SINOPEC (CHINA)

- TOTAL S A (FRANCE)

- FERRELLGAS PARTNERS L.P. (U.S.)

- GAIL (INDIA) LIMITED (INDIA)

- INDIAN OIL CORPORATION LTD. (INDIA)

- DCC PLC (IRELAND)

- SINOPEC (CHINA PETROLEUM & CHEMICAL CORPORATION) (CHINA)

- SAUDI ARABIAN OIL CO. (SAUDI ARAMCO) (SAUDI ARABIA)

- GAZPROM (RUSSIA)

- AIR LIQUIDE (FRANCE)

- COMPETITIVE LANDSCAPE

- GLOBAL PROPANE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Garde

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Propane Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 97.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.8% |

Market Size in 2032: |

USD 288.41 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Grade |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PROPANE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PROPANE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PROPANE MARKET COMPETITIVE RIVALRY

TABLE 005. PROPANE MARKET THREAT OF NEW ENTRANTS

TABLE 006. PROPANE MARKET THREAT OF SUBSTITUTES

TABLE 007. PROPANE MARKET BY TYPE

TABLE 008. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 009. GAS MARKET OVERVIEW (2016-2028)

TABLE 010. PROPANE MARKET BY GRADE

TABLE 011. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 012. HD5 PROPANE MARKET OVERVIEW (2016-2028)

TABLE 013. HD10 PROPANE MARKET OVERVIEW (2016-2028)

TABLE 014. PROPANE MARKET BY APPLICATION

TABLE 015. MOTOR FUEL MARKET OVERVIEW (2016-2028)

TABLE 016. INDUSTRIAL & DOMESTIC FUEL MARKET OVERVIEW (2016-2028)

TABLE 017. REFRIGERATION MARKET OVERVIEW (2016-2028)

TABLE 018. SOLVENT MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. PROPANE MARKET BY END USER

TABLE 021. TRANSPORTATION MARKET OVERVIEW (2016-2028)

TABLE 022. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 023. AGRICULTURE MARKET OVERVIEW (2016-2028)

TABLE 024. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 025. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 026. CHEMICALS AND REFINERIES MARKET OVERVIEW (2016-2028)

TABLE 027. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 028. NORTH AMERICA PROPANE MARKET, BY TYPE (2016-2028)

TABLE 029. NORTH AMERICA PROPANE MARKET, BY GRADE (2016-2028)

TABLE 030. NORTH AMERICA PROPANE MARKET, BY APPLICATION (2016-2028)

TABLE 031. NORTH AMERICA PROPANE MARKET, BY END USER (2016-2028)

TABLE 032. N PROPANE MARKET, BY COUNTRY (2016-2028)

TABLE 033. EUROPE PROPANE MARKET, BY TYPE (2016-2028)

TABLE 034. EUROPE PROPANE MARKET, BY GRADE (2016-2028)

TABLE 035. EUROPE PROPANE MARKET, BY APPLICATION (2016-2028)

TABLE 036. EUROPE PROPANE MARKET, BY END USER (2016-2028)

TABLE 037. PROPANE MARKET, BY COUNTRY (2016-2028)

TABLE 038. ASIA PACIFIC PROPANE MARKET, BY TYPE (2016-2028)

TABLE 039. ASIA PACIFIC PROPANE MARKET, BY GRADE (2016-2028)

TABLE 040. ASIA PACIFIC PROPANE MARKET, BY APPLICATION (2016-2028)

TABLE 041. ASIA PACIFIC PROPANE MARKET, BY END USER (2016-2028)

TABLE 042. PROPANE MARKET, BY COUNTRY (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA PROPANE MARKET, BY TYPE (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA PROPANE MARKET, BY GRADE (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA PROPANE MARKET, BY APPLICATION (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA PROPANE MARKET, BY END USER (2016-2028)

TABLE 047. PROPANE MARKET, BY COUNTRY (2016-2028)

TABLE 048. SOUTH AMERICA PROPANE MARKET, BY TYPE (2016-2028)

TABLE 049. SOUTH AMERICA PROPANE MARKET, BY GRADE (2016-2028)

TABLE 050. SOUTH AMERICA PROPANE MARKET, BY APPLICATION (2016-2028)

TABLE 051. SOUTH AMERICA PROPANE MARKET, BY END USER (2016-2028)

TABLE 052. PROPANE MARKET, BY COUNTRY (2016-2028)

TABLE 053. DCC PLC: SNAPSHOT

TABLE 054. DCC PLC: BUSINESS PERFORMANCE

TABLE 055. DCC PLC: PRODUCT PORTFOLIO

TABLE 056. DCC PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. SINOPEC: SNAPSHOT

TABLE 057. SINOPEC: BUSINESS PERFORMANCE

TABLE 058. SINOPEC: PRODUCT PORTFOLIO

TABLE 059. SINOPEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. SAUDI ARABIAN OIL CO.: SNAPSHOT

TABLE 060. SAUDI ARABIAN OIL CO.: BUSINESS PERFORMANCE

TABLE 061. SAUDI ARABIAN OIL CO.: PRODUCT PORTFOLIO

TABLE 062. SAUDI ARABIAN OIL CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. SUBURBAN: SNAPSHOT

TABLE 063. SUBURBAN: BUSINESS PERFORMANCE

TABLE 064. SUBURBAN: PRODUCT PORTFOLIO

TABLE 065. SUBURBAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. FERRELLGAS: SNAPSHOT

TABLE 066. FERRELLGAS: BUSINESS PERFORMANCE

TABLE 067. FERRELLGAS: PRODUCT PORTFOLIO

TABLE 068. FERRELLGAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. GAZPROM: SNAPSHOT

TABLE 069. GAZPROM: BUSINESS PERFORMANCE

TABLE 070. GAZPROM: PRODUCT PORTFOLIO

TABLE 071. GAZPROM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. AMERIGAS PROPANE INC.: SNAPSHOT

TABLE 072. AMERIGAS PROPANE INC.: BUSINESS PERFORMANCE

TABLE 073. AMERIGAS PROPANE INC.: PRODUCT PORTFOLIO

TABLE 074. AMERIGAS PROPANE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. AIR LIQUIDE: SNAPSHOT

TABLE 075. AIR LIQUIDE: BUSINESS PERFORMANCE

TABLE 076. AIR LIQUIDE: PRODUCT PORTFOLIO

TABLE 077. AIR LIQUIDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. GAIL (INDIA) LIMITED: SNAPSHOT

TABLE 078. GAIL (INDIA) LIMITED: BUSINESS PERFORMANCE

TABLE 079. GAIL (INDIA) LIMITED: PRODUCT PORTFOLIO

TABLE 080. GAIL (INDIA) LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. INDIAN OIL CORPORATION LTD.: SNAPSHOT

TABLE 081. INDIAN OIL CORPORATION LTD.: BUSINESS PERFORMANCE

TABLE 082. INDIAN OIL CORPORATION LTD.: PRODUCT PORTFOLIO

TABLE 083. INDIAN OIL CORPORATION LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. LYKINS ENERGY SOLUTIONS: SNAPSHOT

TABLE 084. LYKINS ENERGY SOLUTIONS: BUSINESS PERFORMANCE

TABLE 085. LYKINS ENERGY SOLUTIONS: PRODUCT PORTFOLIO

TABLE 086. LYKINS ENERGY SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. AND MARSH L.P. GAS CO. INC.: SNAPSHOT

TABLE 087. AND MARSH L.P. GAS CO. INC.: BUSINESS PERFORMANCE

TABLE 088. AND MARSH L.P. GAS CO. INC.: PRODUCT PORTFOLIO

TABLE 089. AND MARSH L.P. GAS CO. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PROPANE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PROPANE MARKET OVERVIEW BY TYPE

FIGURE 012. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 013. GAS MARKET OVERVIEW (2016-2028)

FIGURE 014. PROPANE MARKET OVERVIEW BY GRADE

FIGURE 015. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 016. HD5 PROPANE MARKET OVERVIEW (2016-2028)

FIGURE 017. HD10 PROPANE MARKET OVERVIEW (2016-2028)

FIGURE 018. PROPANE MARKET OVERVIEW BY APPLICATION

FIGURE 019. MOTOR FUEL MARKET OVERVIEW (2016-2028)

FIGURE 020. INDUSTRIAL & DOMESTIC FUEL MARKET OVERVIEW (2016-2028)

FIGURE 021. REFRIGERATION MARKET OVERVIEW (2016-2028)

FIGURE 022. SOLVENT MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. PROPANE MARKET OVERVIEW BY END USER

FIGURE 025. TRANSPORTATION MARKET OVERVIEW (2016-2028)

FIGURE 026. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 027. AGRICULTURE MARKET OVERVIEW (2016-2028)

FIGURE 028. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 029. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 030. CHEMICALS AND REFINERIES MARKET OVERVIEW (2016-2028)

FIGURE 031. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 032. NORTH AMERICA PROPANE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. EUROPE PROPANE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. ASIA PACIFIC PROPANE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. MIDDLE EAST & AFRICA PROPANE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. SOUTH AMERICA PROPANE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Propane Market research report is 2024-2032.

Lykins Energy Solutions (U.S.), Marsh L.P. Gas Co. Inc. (U.S.), Suburban (U.S.), Ferrellgas (U.S.), AmeriGas Propane Inc. (U.S.), BP Plc (U.K.), Chevron Corporation (U.S.), Royal Dutch Shell Plc (U.K.), Exxon Mobil Corporation (U.S.), ConocoPhillips (U.S), Reliance Industries Ltd. (India), PetroChina Company Limited (China), Sinopec (China), Total S A (France), Ferrellgas Partners L.P. (U.S.), GAIL (India) Limited (India), Indian Oil Corporation Ltd. (India), DCC Plc (Ireland), SINOPEC (China Petroleum & Chemical Corporation) (China), Saudi Arabian Oil Co. (Saudi Aramco) (Saudi Arabia), Gazprom (Russia), Air Liquide (France), and Other Major Players.

The Propane Market is segmented into Type, Garde, Application, End User, and region. By Type, the market is categorized into Liquid, Gas. By Grade, the market is categorized into Commercial, HD5 Propane, HD10 Propane. By Application, the market is categorized into Motor Fuel, Industrial & Domestic Fuel, Refrigeration, Solvent. By End User, the market is categorized into Transportation, Residential, Agriculture, Commercial, Industrial, Chemicals & Refineries. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Propane is derived as a by-product of natural gas processing and crude oil refining. It is a three-carbon alkane classified as one of the liquefied petroleum gases with the molecular formula C3H8. There are two ways in which propane is processed refining and natural gas production. Propane, alongside butane, is acquired from liquid components by natural gas processing to avoid condensation in natural gas pipelines. The propane is thicker than gas, so the blended propane is stored and transported in a liquid state. The next step is to mix odorant and propane since it is naturally colorless and odourless.

Propane Market Size Was Valued at USD 97.55 Billion in 2023, and is Projected to Reach USD 288.41 Billion by 2032, Growing at a CAGR of 12.8% From 2024-2032.