Private Banking Market Synopsis

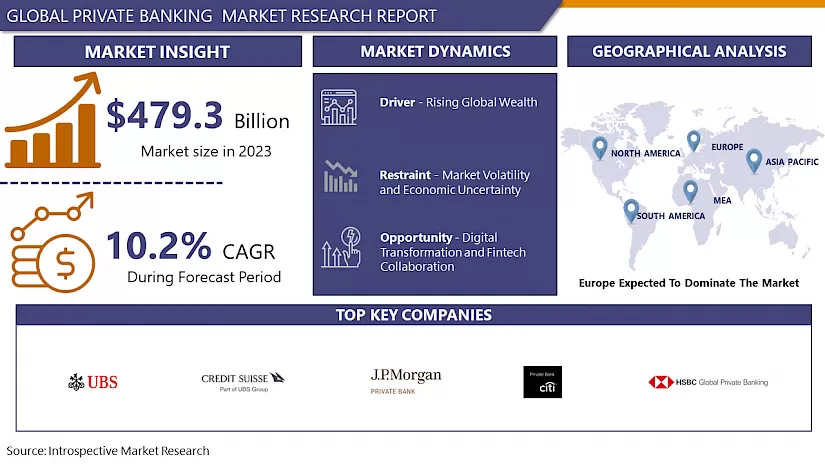

Private Banking Market Size Was Valued at USD 479.3 Billion in 2023, and is Projected to Reach USD 1148.79 Billion by 2032, Growing at a CAGR of 10.2% From 2024-2032.

Private banking is a trendy description for banking, funding and different economic offerings supplied via way of means of banks and economic establishments often serving excessive-net-well worth individuals (HNWIs) – people with very excessive earnings and/or massive assets. Private banking is provided via way of means of folks who offer such offerings as a special subset of wealth control offerings, supplied to especially prosperous clients.

- The term "private" refers to customer support rendered on an extra non-public foundation than in mass-marketplace retail banking, normally supplied through committed financial institution advisers. It has normally consisted of banking offerings (deposit taking and payments), discretionary asset control, brokerage, confined tax advisory offerings and a few fundamental concierge offerings, normally provided thru a gateway supplied via way of means of an unmarried distinct courting manager.

- Private banking includes customized monetary products and services provided to the high-net-well worth individual (HNWI) customers of a retail financial institution or different monetary institution. It consists of an extensive variety of wealth control services, and all furnished below one roof.

- Services encompass making an investment and portfolio control, tax services, insurance, and believe and property planning. While non-public banking is aimed toward a distinct clientele, patron banks and brokerages of each length provide it. This supplying is typically via unique departments, dubbed "non-public banking" or "wealth control" divisions.

Private Banking Market Trend Analysis

Rising Global Wealth

- The wonder of rising worldwide riches, characterized by an expanding number of high-net-worth people (HNWIs), could be a noteworthy driver of development within the private managing an account advertise. This slant is generally fueled by vigorous financial development in both created and developing markets, alongside the development of worldwide venture openings. As economies develop and broaden, they make a ripe environment for riches creation, especially through enterprise and development in divisions like innovation, fund, and genuine domain. Also, the expansion of cross-border ventures has empowered HNWIs to get to a more extensive cluster of Assests and monetary markets, advance boosting riches aggregation. As people amass more noteworthy riches, their monetary needs ended up more complex and expanded.

- This makes a request for advanced money related administration and counselling administrations that can address issues such as portfolio broadening, chance administration, assess optimization, domain arranging, and charity. Private keeping money administrations cater specifically to these needs by advertising personalized and comprehensive arrangements that go past the capabilities of standard retail keeping money.

- The capacity to supply custom fitted speculation methodologies, select venture openings, and bespoke monetary counsel makes private keeping money an fundamental benefit for HNWIs looking for to oversee and develop their riches productively. As a result, the persistent rise in worldwide riches straightforwardly connects with an expanded request for private keeping money administrations, driving the sector's expansion and development.

Opportunity

Digital Transformation and Fintech Collaboration

- Digital transformation and partnerships with fintech companies are revolutionizing the private banking industry by improving service delivery and operational efficiency. The integration of digital solutions, such as mobile and online banking platforms, allows private banks to provide customers with convenient, real-time access to their accounts and financial information. This digital transformation not only improves the customer experience, but also allows banks to streamline operations and reduce costs through automation and more efficient processes. One of the key innovations driving this transformation is the use of robo-advisors, which leverage algorithms to provide automated, data-driven investment advice.

- This technology allows private banks to provide more cost-effective investment management solutions, making personalized financial advice accessible to more customers. Additionally, blockchain technology is being explored for its potential to improve the security and transparency of financial transactions, as well as streamline processes such as cross-border payments and asset management.AI-driven analytics is another essential part of this digital evolution, providing powerful tools to analyze large amounts of financial data to uncover insights and trends. The technology can provide highly personalized investment recommendations, predict market movements, and identify potential risks, allowing private banks to provide more proactive and personalized services to their clients.

- Additionally, partnering with fintech companies allows traditional private banks to innovate faster and adopt cutting-edge technologies without the need for significant in-house development. These partnerships can lead to the co-creation of new products and services that meet evolving customer needs, thereby improving the overall value proposition of the private bank. Digital transformation and fintech collaboration are therefore essential to position private banks as modern, agile and customer-centric institutions in an increasingly digital financial landscape.

Private Banking Market Segment Analysis:

Private Banking market is segmented based on Type, Application, Segment3, Segment4, Segment5, And Segment6.

By Type, Asset Management Service Segment Is Expected to Dominate the Market During the Forecast Period

By Type it is segmented as Asset Management Service, Insurance Service, Trust Service, Tax Consulting, Real Estate Consulting

- Within the private keeping money division Asset Management Service hold a overwhelming position due to their basic part in satisfying the essential needs of high-net-worth people (HNWIs). These administrations cater to the fundamental prerequisite of overseeing and growing wealth, which could be a central concern for affluent clients.

- Asset administration includes a comprehensive suite of offerings, counting speculation portfolio administration, budgetary arranging, and counseling administrations. These administrations are crucial for both protecting existing riches and creating modern development, guaranteeing that clients' money related objectives are met. The request of Asset administration administrations lies in their capacity to supply customized speculation methodologies that consider each client's particular monetary destinations, hazard tolerance, and time skyline.

- This level of personalization is pivotal for viably overseeing noteworthy Assets, because it makes a difference optimize returns whereas minimizing dangers. Asset directors bring specialized skill and advertise information that's invaluable in exploring the complexities of worldwide monetary markets. Their understanding of speculation items, financial patterns, and showcase flow permits them to form well-informed choices, advertising clients high-quality counsel that can improve their budgetary results. Moreover, Asset administration administrations emphasize enhancement and hazard administration, advertising clients get to a wide cluster of Asset classes and speculation openings.

- This diversified approach makes a difference spread chance and stabilize returns, which is especially imperative for protecting capital in unstable markets. Asset administration administrations frequently incorporate all-encompassing budgetary arranging, tending to broader angles such as retirement arranging, domain arranging, and philanthropy. This comprehensive approach guarantees that clients' long-term money related security and bequest objectives are completely arranged and overseen.

- Whereas other private managing an account administrations like protections, believe, assess counselling, and genuine domain counselling are moreover critical, they tend to cater to more particular needs. In differentiate, Asset administration specifically addresses the overarching objective of riches conservation and growth, making it the foremost dominant and crucial benefit within the private managing an account division.

- As of 2023, the value of brokerage assets of Bank of America's clients amounted to almost 1.69 trillion U.S. dollars. In the same year, the value of the bank's assets under management was around 1.62 trillion U.S. dollars approximately.

By Application, Enterprise Segment Held the Largest Share In 2023

By Application it is segmented as Personal, Enterprise.

- Within the private keeping money segment, the Enterprise section tends to be more overwhelming than the Individual portion. This dominance is due to the reality that venture clients, such as family workplaces, trusts, and corporate substances, frequently require more complex and comprehensive budgetary administrations than person clients. These undertakings ordinarily oversee bigger entireties of cash and more diverse Assets, requiring a better level of ability, customization, and assets from private banks.

- Undertaking clients look for private keeping money administrations for a assortment of reasons, counting the require for modern venture administration, key money related arranging, and specialized admonitory administrations. They frequently have complex monetary structures and legitimate contemplations, requiring progressed assess optimization, bequest arranging, and progression arranging arrangements. Also, undertakings may require specialized administrations such as corporate fund, merger and procurement counselling, and chance administration, which are past the scope of commonplace individual managing an account need. Moreover, the endeavour section regularly includes organization financial specialists, large-scale financial specialists, and family-owned businesses, which depend on private banks for their profound advertise information and capacity to oversee expansive and broadened portfolios.

- The level of benefit required for venture clients is regularly more seriously and requires a more noteworthy degree of customization and individual consideration. Private banks give these clients with committed relationship directors, specialized venture procedures, and select monetary items that cater to their interesting needs. As a result, whereas person individual managing an account client are basic and various, the undertaking section frequently creates the next volume of Assets beneath administration (AUM) and brings in more income for private banks. This makes the endeavour fragment a prevailing drive inside the private managing an account industry, driving development, asset assignment, and the advancement of specialized administrations.

Private Banking Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

- The European locale, especially Switzerland, overwhelms the worldwide private keeping money advertise. This dominance can be credited to a few variables. Switzerland includes a long-standing convention of monetary administrations greatness and is eminent for its political and financial steadiness, strict bank mystery laws, and favourable charge environment. These components have generally pulled in high-net-worth people (HNWIs) and ultra-high-net-worth people (UHNWIs) looking for watchfulness and vigorous riches security.

- Swiss private banks, such as UBS and Credit Suisse, are worldwide pioneers known for their mastery in riches administration, private managing an account, and Asset assurance. Also, the region's key area in Europe makes it a perfect money related centre, encouraging simple get to international markets. Other European nations just like the UK, France, and Germany too contribute essentially to the advertise, facilitating major monetary educate that offer specialized administrations to princely clients.

- The nearness of well-established budgetary markets, a solid administrative framework, and a profound pool of budgetary ability encourage set Europe's driving position within the private managing an account division. This combination of verifiable bequest, administrative focal points, and ability has situated Europe as the prevailing locale in private managing an account all inclusive.

Private Banking Market Active Players

- UBS Group AG (Switzerland)

- Credit Suisse Group AG (Switzerland)

- J.P. Morgan Private Bank (USA)

- Morgan Stanley Private Wealth Management (USA)

- Goldman Sachs Private Wealth Management (USA)

- Bank of America Private Bank (USA)

- Citibank Private Bank (USA)

- HSBC Private Banking (UK)

- Barclays Private Bank (UK)

- Deutsche Bank Wealth Management (Germany)

- BNP Paribas Wealth Management (France)

- Société Générale Private Banking (France)

- UBP (Union Bancaire Privée) (Switzerland)

- Pictet & Cie (Switzerland)

- Julius Baer Group (Switzerland)

- Lombard Odier (Switzerland)

- Rothschild & Co (France)

- Northern Trust (USA)

- Wells Fargo Private Bank (USA)

- BMO Private Bank (Canada)

- Royal Bank of Canada Wealth Management (Canada)

|

Global Private Banking Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 479.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.2 % |

Market Size in 2032: |

USD 1148.79 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Private Banking Market by Type (2018-2032)

4.1 Private Banking Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Asset Management Service

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Insurance Service

4.5 Trust Service

4.6 Tax Consulting

4.7 Real Estate Consulting

Chapter 5: Private Banking Market by Application (2018-2032)

5.1 Private Banking Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Personal

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Enterprise

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Private Banking Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 UBS GROUP AG (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CREDIT SUISSE GROUP AG (SWITZERLAND)

6.4 J.P. MORGAN PRIVATE BANK (USA)

6.5 MORGAN STANLEY PRIVATE WEALTH MANAGEMENT (USA)

6.6 GOLDMAN SACHS PRIVATE WEALTH MANAGEMENT (USA)

6.7 BANK OF AMERICA PRIVATE BANK (USA)

6.8 CITIBANK PRIVATE BANK (USA)

6.9 HSBC PRIVATE BANKING (UK)

6.10 BARCLAYS PRIVATE BANK (UK)

6.11 DEUTSCHE BANK WEALTH MANAGEMENT (GERMANY)

6.12 BNP PARIBAS WEALTH MANAGEMENT (FRANCE)

6.13 SOCIÉTÉ GÉNÉRALE PRIVATE BANKING (FRANCE)

6.14 UBP (UNION BANCAIRE PRIVÉE) (SWITZERLAND)

6.15 PICTET & CIE (SWITZERLAND)

6.16 JULIUS BAER GROUP (SWITZERLAND)

6.17 LOMBARD ODIER (SWITZERLAND)

6.18 ROTHSCHILD & CO (FRANCE)

6.19 NORTHERN TRUST (USA)

6.20 WELLS FARGO PRIVATE BANK (USA)

6.21 BMO PRIVATE BANK (CANADA)

6.22 ROYAL BANK OF CANADA WEALTH MANAGEMENT (CANADA)

6.23 STANDARD CHARTERED PRIVATE BANK (UK)

6.24 DBS PRIVATE BANK (SINGAPORE)

6.25 OCBC PRIVATE BANKING (SINGAPORE)

6.26 ANZ PRIVATE BANK (AUSTRALIA)

Chapter 7: Global Private Banking Market By Region

7.1 Overview

7.2. North America Private Banking Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Asset Management Service

7.2.4.2 Insurance Service

7.2.4.3 Trust Service

7.2.4.4 Tax Consulting

7.2.4.5 Real Estate Consulting

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Personal

7.2.5.2 Enterprise

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Private Banking Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Asset Management Service

7.3.4.2 Insurance Service

7.3.4.3 Trust Service

7.3.4.4 Tax Consulting

7.3.4.5 Real Estate Consulting

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Personal

7.3.5.2 Enterprise

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Private Banking Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Asset Management Service

7.4.4.2 Insurance Service

7.4.4.3 Trust Service

7.4.4.4 Tax Consulting

7.4.4.5 Real Estate Consulting

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Personal

7.4.5.2 Enterprise

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Private Banking Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Asset Management Service

7.5.4.2 Insurance Service

7.5.4.3 Trust Service

7.5.4.4 Tax Consulting

7.5.4.5 Real Estate Consulting

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Personal

7.5.5.2 Enterprise

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Private Banking Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Asset Management Service

7.6.4.2 Insurance Service

7.6.4.3 Trust Service

7.6.4.4 Tax Consulting

7.6.4.5 Real Estate Consulting

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Personal

7.6.5.2 Enterprise

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Private Banking Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Asset Management Service

7.7.4.2 Insurance Service

7.7.4.3 Trust Service

7.7.4.4 Tax Consulting

7.7.4.5 Real Estate Consulting

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Personal

7.7.5.2 Enterprise

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Private Banking Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 479.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.2 % |

Market Size in 2032: |

USD 1148.79 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||