Global Financial Wellness Benefits Market Overview

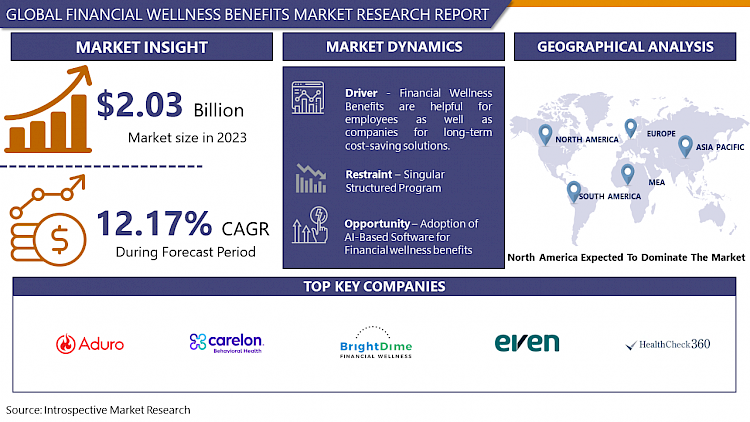

The global market for Financial Wellness Benefits estimated at USD 2.03 Billion in 2023 is projected to reach a revised size of USD 5.71 Billion by 2032, growing at a CAGR of 12.17% over the period 2024-2032.

Financial wellness programs are frequently included as part of a company's benefits package, which may also include group life insurance or disability coverage. Wellness benefits linked to health insurance plans have become increasingly widespread as these programs have evolved. Individual life insurance companies are likewise concerned about health. Several have made investments in start-ups and formed strategic partnerships to tap into the market and connect policyholders to user-friendly digital financial wellness tools and fintech platforms that provide educational information and resources to help people proactively save, invest, pay off debt, manage a budget, and build resilience to unexpected events. Financial security is the underpinning notion of financial wellbeing, and it is one of the most prevalent aspirations mentioned by employees across all industries. However, just a small percentage of people say they have access to the financial services and benefits they need. Millennials make up the majority of new employees in today's world. And 21% of them stated they want assistance with saving, which will help them construct a secure future. Employers must now include a financial wellness program in their benefits package. Employees are the most important investment for the company’s growth. By giving them financial health resources, the company increases the overall productivity and environment of the company.

Market Dynamics and Factors:

Drivers

Financial Wellness Benefits are helpful for employees as well as companies for long-term cost-saving solutions.

Financial wellness benefits not only help employees to make sound financial decisions but it is also advantageous for companies to save millions of dollars. With effective financial wellness programs, growth in the retention rate increases largely. With a stress-free employee, productivity and morale are affected positively. Both the top and bottom lines can benefit from an employer-sponsored financial wellness program. When financial health is offered and monitored as part of an enterprise-wide program is as important as having a good financial wellness program in place might save a firm with several thousand employees more than $1 million a year.

Diversified financial wellness benefits programs provide financial relief according to the need of an employee.

Every employee's to-do list should contain a plan for saving money for the future. They see a future when they don't have to worry about money. The 401(K) plans are an example of such a scheme. This program can be sponsored by a company, and employees can save and spend a portion of their earnings before filing taxes. The retirement programs are significantly more efficient. Furthermore, offering retirement plans as a perk will ensure their financial security in the future. Budget planning, Student loan and repayment planning, Retirement financial planning and consulting as well as personalized counseling are some of the diversified programs which come under the Financial Wellness Benefits Market. To opt for the program according to need and other services at disposal, there has been a sharp spike in the demand for such solutions and is expected to propel the market substantially.

Restraints

Financial wellness initiatives must also account for the reality that various employees may require varying degrees of assistance. Women trail behind their male counterparts in terms of financial well-being, which is worsened by the fact that women frequently earn less than men and are more likely to leave the profession to raise a child or care for a family member. Younger workers fall behind their elder colleagues, owing to fewer years in the job and less experience pursuing financial objectives. Currently, companies with a large workforce may face the challenge of personalized the financial wellness program according to the need of the employees. A singular structured program in the company may hamper the growth of the market.

Opportunities

AI-based software or application presents a bright opportunity for the Financial Wellness Benefits Market. AI-based solutions can be integrated into the employee's salary account which can track the essential and non-essential spending as well as income flow which can determine the data-based solution and planning for the employees. The financial wellness app solutions are crowded with mobile solutions aimed at relieving the financial stress of American workers. For example, LearnLux combines fiduciary digital planning with one-on-one advice from Certified Financial Planners. Tapcheck, on the other hand, is a mobile app that interfaces with current payroll software. AI-based apps are expected to lift the market during the forecasted period.

Market Segmentation

By Program, Financial planning is dominating the Financial Wellness Benefits Market. Employers are hiring financial planning experts and asset managers as they become more aware of the influence it may have on company success, driving the segment's growth. The epidemic is also fueling the desire for pre-planning to stockpile funds in case of future disasters. Most employees in the United States consider financial wellness to be a way of life, and monetary issues are unlikely to go away anytime soon, making the industry attractive. Repayment of Student Loans- Fending off debts, Flexible Paydays, Personalized Financial Advice Programs, Budget consulting, and Debt Reduction Programs may all assist employees in becoming more financially educated and making better financial decisions.

By Enterprise, Large enterprise dominates the Financial Wellness Benefits Market. To give comprehensive assistance to their employees, many corporations are combining physical, emotional, and financial initiatives. Because both are substantially interrelated, and healthcare expenses are continuing to grow, the notion of "health meets wealth" is getting a lot of support in the market. However, a big difficulty for large businesses is that over 35% of employees are unaware that their firm provides financial wellness benefits. Participation rates are frequently low. The category is predicted to rise due to businesses' rising recognition of the relationship between financially successful workers and how they work – termed employee productivity. Almost 40% of firms now provide wellness programs, with around 30% citing "differentiation from other employers" as a motivator. Nearly 70% of firms give perks to keep their employees happy, indicating that they are becoming more popular as a cost-effective approach to recruit and retain staff. In these organizations, digital and information platforms are converging to deliver comprehensive advice and function independently of other financial service providers.

By Delivery, Personalized program anticipated dominating the Financial Wellness Benefits Market. Personalized financial wellness services are predicted to develop at the fastest pace, but online/digital wellness programs will not be far behind. Because advisers can quickly adjust to the demands of the employee, personalized financial advising is expanding at a rapid rate. They're especially popular in workplaces with a wide range of personnel. Employees are requesting one-on-one contacts more than ever before to assist them in navigating their finances, prompting advisers to meet with employees frequently, resulting in increased revenue for one-on-one programs. Employees can engage meaningfully with these initiatives since online or digital deliveries minimize the difficulties of manual methods. Employees are opting to remain with the procedure rather than abandon it entirely because of fast access. Applications are doing more than just distributing information or functioning as a budgeting tool; they're also saving lives in emergency circumstances. Fintech apps are on-demand programs that enable employees to withdraw funds as needed for minimal charges. When it comes to online wellness, though, poor involvement is a common issue.

By Industry, the Healthcare sector is expected to be dominating the Financial Wellness Benefits Market. Workplace financial wellness initiatives in healthcare organizations have been gaining traction in the United States since the industry is particularly vulnerable to negative results owing to workforce instability in a system where regular and dependable service is a top concern. Budgeting, investment guidance, debt management, student loan repayment, retirement income planning, college expenditure planning, special needs planning, and protection are all topics that Gen Z and millennial employees are interested in. The coronavirus epidemic has skewed the financial services business in the United States, pressuring companies to retain profits in a low-interest-rate environment. As a result, firms are limited in their ability to contribute funding to wellness initiatives. The finance business, on the other hand, is infamous for its high turnover rates. Because work-life balance is often thrown out the window in this area, with experts such as fintech analysts working up to 70 hours per week, organizations in this field have shifted their attention to holistic health programs.

Players Covered in Financial Wellness Benefits market are :

- Aduro

- Ayco

- Beacon Health Options

- Best Money Moves

- BrightDime

- DHS Group

- Edukate

- Enrich Financial Wellness

- Even

- Financial Fitness Group

- HealthCheck360

- Health Advocate

- Money Starts Here

- PayActive

- Purchasing Power

- Ramsey Solutions

- Sum180

- Transamerica and other major players.

Regional Analysis of Financial Wellness Benefits Market

North America is Dominating the Financial Wellness Benefits Market. Nationals of the United States are not financially savvy. This has created a barrier to the adoption of financial wellness benefits. The COVID epidemic has highlighted the need for financial literacy as a survival skill in challenging conditions. The education and counseling area are projected to see a lot of interest since counseling and education may help employees create greater mobility and provide them with the information, skills, and confidence to navigate complicated financial problems. Nearly 26% of employees desire access to neutral counselors, making it one of the most common requests in the industry. Because of the flexibility of the contemporary pandemic-affected landscape, financial planning programs have become increasingly important among employees. Employers are hiring financial planning experts and asset managers as they become more aware of the influence it may have on company success, driving the segment's growth. The epidemic is also fuelling the desire for pre-planning to stockpile funds in case of future disasters. Most employees in the United States consider financial wellness to be a way of life, and monetary issues are unlikely to go away anytime soon, making the industry attractive.

Key Developments of Financial Wellness Benefits Market

- November 2020, PayPal has established a partnership with Even, a responsible on-demand payment platform, as part of its ongoing efforts to enhance the financial health of its employees. Through an easy-to-use mobile app, all PayPal workers in the United States may now utilize Even to be paid early, automatically budget and increase their savings, and have complete insight into their profits.

Covid19 Impact on Financial Wellness Benefits Market

The Pandemic has prompted wellness perks like forward-thinking planning, flexible pay, and employer-backed debt payback plans. COVID-19 has resulted in new market realities and developments. As organizations confront unstable income streams and budgets, pay rises in the predictable future have been impacted. Employers are increasingly willing to provide customized plans as they know that monetary perks are not the only method to keep staff. Wellness initiatives are being offered by larger corporations in conjunction with retirement plans. During the pandemic, companies increasingly focused on additional advantages like debt counseling and emergency savings accounts. Because millennials and the senior workers approaching retirement age are the most vulnerable, wellness programs that cater to them are projected to see an increase in enrolment. Pandemic has been a cautionary call for employees as well as companies which to map out the financial wellness solutions to ensure the employee's service period in the company by relieving them from financial stress. Pandemic has especially accelerated the market and is expected to grow promisingly in the coming year.

The Asia Pacific is likely to witness an impressive growth rate over the forecast period from 2021 to 2028. The growth of the working population in the Asia Pacific and growing awareness about the Financial health management of employees are responsible for the need for corporate wellness programs in the region. Countries like India, Singapore, China, Japan, South Korea are the major contributor to the IT and manufacturing sector. A large number of populations in these countries opt for a stable job as long-term employment, Therefore, it offers tremendous opportunity for the growth of the Financial Wellness Benefits Market in the APAC region.

|

Global Financial Wellness Benefits Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.03 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.17% |

Market Size in 2032: |

USD 5.71 Bn. |

|

Segments Covered: |

By Program |

|

|

|

By Enterprise |

|

||

|

By Delivery |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Program

3.2 By Enterprise

3.3 By Delivery

3.4 By Industry

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Financial Wellness Benefits Market by Program

5.1 Financial Wellness Benefits Market Overview Snapshot and Growth Engine

5.2 Financial Wellness Benefits Market Overview

5.3 Financial Planning

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Financial Planning: Grographic Segmentation

5.4 Financial Education & Counselling Services

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Financial Education & Counselling Services: Grographic Segmentation

5.5 Retirement Planning

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Retirement Planning: Grographic Segmentation

5.6 Debt Management

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Debt Management: Grographic Segmentation

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Grographic Segmentation

Chapter 6: Financial Wellness Benefits Market by Enterprise

6.1 Financial Wellness Benefits Market Overview Snapshot and Growth Engine

6.2 Financial Wellness Benefits Market Overview

6.3 Large Businesses

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Large Businesses: Grographic Segmentation

6.4 Medium-sized Businesses

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Medium-sized Businesses: Grographic Segmentation

6.5 Small-sized Businesses

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Small-sized Businesses: Grographic Segmentation

Chapter 7: Financial Wellness Benefits Market by Delivery

7.1 Financial Wellness Benefits Market Overview Snapshot and Growth Engine

7.2 Financial Wellness Benefits Market Overview

7.3 One-on-One

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 One-on-One: Grographic Segmentation

7.4 Online/Digital

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Online/Digital: Grographic Segmentation

7.5 Group

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Group: Grographic Segmentation

Chapter 8: Financial Wellness Benefits Market by Industry

8.1 Financial Wellness Benefits Market Overview Snapshot and Growth Engine

8.2 Financial Wellness Benefits Market Overview

8.3 Healthcare

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Healthcare: Grographic Segmentation

8.4 Financial Services

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Financial Services: Grographic Segmentation

8.5 Education

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Education: Grographic Segmentation

8.6 Manufacturing

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Manufacturing: Grographic Segmentation

8.7 Public Sector

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2016-2028F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Public Sector: Grographic Segmentation

8.8 Other

8.8.1 Introduction and Market Overview

8.8.2 Historic and Forecasted Market Size (2016-2028F)

8.8.3 Key Market Trends, Growth Factors and Opportunities

8.8.4 Other: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Financial Wellness Benefits Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Financial Wellness Benefits Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Financial Wellness Benefits Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 ADURO

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 AYCO

9.4 BEACON HEALTH OPTIONS

9.5 BEST MONEY MOVES

9.6 BRIGHTDIME

9.7 DHS GROUP

9.8 EDUKATE

9.9 ENRICH FINANCIAL WELLNESS

9.10 EVEN

9.11 FINANCIAL FITNESS GROUP

9.12 HEALTHCHECK360

9.13 HEALTH ADVOCATE

9.14 MONEY STARTS HERE

9.15 PAYACTIVE

9.16 PURCHASING POWER

9.17 RAMSEY SOLUTIONS

9.18 SUM180

9.19 TRANSAMERICA

9.20 OTHER MAJOR PLAYERS

Chapter 10: Global Financial Wellness Benefits Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Program

10.2.1 Financial Planning

10.2.2 Financial Education & Counselling Services

10.2.3 Retirement Planning

10.2.4 Debt Management

10.2.5 Others

10.3 Historic and Forecasted Market Size By Enterprise

10.3.1 Large Businesses

10.3.2 Medium-sized Businesses

10.3.3 Small-sized Businesses

10.4 Historic and Forecasted Market Size By Delivery

10.4.1 One-on-One

10.4.2 Online/Digital

10.4.3 Group

10.5 Historic and Forecasted Market Size By Industry

10.5.1 Healthcare

10.5.2 Financial Services

10.5.3 Education

10.5.4 Manufacturing

10.5.5 Public Sector

10.5.6 Other

Chapter 11: North America Financial Wellness Benefits Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Program

11.4.1 Financial Planning

11.4.2 Financial Education & Counselling Services

11.4.3 Retirement Planning

11.4.4 Debt Management

11.4.5 Others

11.5 Historic and Forecasted Market Size By Enterprise

11.5.1 Large Businesses

11.5.2 Medium-sized Businesses

11.5.3 Small-sized Businesses

11.6 Historic and Forecasted Market Size By Delivery

11.6.1 One-on-One

11.6.2 Online/Digital

11.6.3 Group

11.7 Historic and Forecasted Market Size By Industry

11.7.1 Healthcare

11.7.2 Financial Services

11.7.3 Education

11.7.4 Manufacturing

11.7.5 Public Sector

11.7.6 Other

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Financial Wellness Benefits Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Program

12.4.1 Financial Planning

12.4.2 Financial Education & Counselling Services

12.4.3 Retirement Planning

12.4.4 Debt Management

12.4.5 Others

12.5 Historic and Forecasted Market Size By Enterprise

12.5.1 Large Businesses

12.5.2 Medium-sized Businesses

12.5.3 Small-sized Businesses

12.6 Historic and Forecasted Market Size By Delivery

12.6.1 One-on-One

12.6.2 Online/Digital

12.6.3 Group

12.7 Historic and Forecasted Market Size By Industry

12.7.1 Healthcare

12.7.2 Financial Services

12.7.3 Education

12.7.4 Manufacturing

12.7.5 Public Sector

12.7.6 Other

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Financial Wellness Benefits Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Program

13.4.1 Financial Planning

13.4.2 Financial Education & Counselling Services

13.4.3 Retirement Planning

13.4.4 Debt Management

13.4.5 Others

13.5 Historic and Forecasted Market Size By Enterprise

13.5.1 Large Businesses

13.5.2 Medium-sized Businesses

13.5.3 Small-sized Businesses

13.6 Historic and Forecasted Market Size By Delivery

13.6.1 One-on-One

13.6.2 Online/Digital

13.6.3 Group

13.7 Historic and Forecasted Market Size By Industry

13.7.1 Healthcare

13.7.2 Financial Services

13.7.3 Education

13.7.4 Manufacturing

13.7.5 Public Sector

13.7.6 Other

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Financial Wellness Benefits Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Program

14.4.1 Financial Planning

14.4.2 Financial Education & Counselling Services

14.4.3 Retirement Planning

14.4.4 Debt Management

14.4.5 Others

14.5 Historic and Forecasted Market Size By Enterprise

14.5.1 Large Businesses

14.5.2 Medium-sized Businesses

14.5.3 Small-sized Businesses

14.6 Historic and Forecasted Market Size By Delivery

14.6.1 One-on-One

14.6.2 Online/Digital

14.6.3 Group

14.7 Historic and Forecasted Market Size By Industry

14.7.1 Healthcare

14.7.2 Financial Services

14.7.3 Education

14.7.4 Manufacturing

14.7.5 Public Sector

14.7.6 Other

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Financial Wellness Benefits Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Program

15.4.1 Financial Planning

15.4.2 Financial Education & Counselling Services

15.4.3 Retirement Planning

15.4.4 Debt Management

15.4.5 Others

15.5 Historic and Forecasted Market Size By Enterprise

15.5.1 Large Businesses

15.5.2 Medium-sized Businesses

15.5.3 Small-sized Businesses

15.6 Historic and Forecasted Market Size By Delivery

15.6.1 One-on-One

15.6.2 Online/Digital

15.6.3 Group

15.7 Historic and Forecasted Market Size By Industry

15.7.1 Healthcare

15.7.2 Financial Services

15.7.3 Education

15.7.4 Manufacturing

15.7.5 Public Sector

15.7.6 Other

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Financial Wellness Benefits Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.03 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.17% |

Market Size in 2032: |

USD 5.71 Bn. |

|

Segments Covered: |

By Program |

|

|

|

By Enterprise |

|

||

|

By Delivery |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FINANCIAL WELLNESS BENEFITS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FINANCIAL WELLNESS BENEFITS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FINANCIAL WELLNESS BENEFITS MARKET COMPETITIVE RIVALRY

TABLE 005. FINANCIAL WELLNESS BENEFITS MARKET THREAT OF NEW ENTRANTS

TABLE 006. FINANCIAL WELLNESS BENEFITS MARKET THREAT OF SUBSTITUTES

TABLE 007. FINANCIAL WELLNESS BENEFITS MARKET BY PROGRAM

TABLE 008. FINANCIAL PLANNING MARKET OVERVIEW (2016-2028)

TABLE 009. FINANCIAL EDUCATION & COUNSELLING SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. RETIREMENT PLANNING MARKET OVERVIEW (2016-2028)

TABLE 011. DEBT MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. FINANCIAL WELLNESS BENEFITS MARKET BY ENTERPRISE

TABLE 014. LARGE BUSINESSES MARKET OVERVIEW (2016-2028)

TABLE 015. MEDIUM-SIZED BUSINESSES MARKET OVERVIEW (2016-2028)

TABLE 016. SMALL-SIZED BUSINESSES MARKET OVERVIEW (2016-2028)

TABLE 017. FINANCIAL WELLNESS BENEFITS MARKET BY DELIVERY

TABLE 018. ONE-ON-ONE MARKET OVERVIEW (2016-2028)

TABLE 019. ONLINE/DIGITAL MARKET OVERVIEW (2016-2028)

TABLE 020. GROUP MARKET OVERVIEW (2016-2028)

TABLE 021. FINANCIAL WELLNESS BENEFITS MARKET BY INDUSTRY

TABLE 022. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 023. FINANCIAL SERVICES MARKET OVERVIEW (2016-2028)

TABLE 024. EDUCATION MARKET OVERVIEW (2016-2028)

TABLE 025. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 026. PUBLIC SECTOR MARKET OVERVIEW (2016-2028)

TABLE 027. OTHER MARKET OVERVIEW (2016-2028)

TABLE 028. NORTH AMERICA FINANCIAL WELLNESS BENEFITS MARKET, BY PROGRAM (2016-2028)

TABLE 029. NORTH AMERICA FINANCIAL WELLNESS BENEFITS MARKET, BY ENTERPRISE (2016-2028)

TABLE 030. NORTH AMERICA FINANCIAL WELLNESS BENEFITS MARKET, BY DELIVERY (2016-2028)

TABLE 031. NORTH AMERICA FINANCIAL WELLNESS BENEFITS MARKET, BY INDUSTRY (2016-2028)

TABLE 032. N FINANCIAL WELLNESS BENEFITS MARKET, BY COUNTRY (2016-2028)

TABLE 033. EUROPE FINANCIAL WELLNESS BENEFITS MARKET, BY PROGRAM (2016-2028)

TABLE 034. EUROPE FINANCIAL WELLNESS BENEFITS MARKET, BY ENTERPRISE (2016-2028)

TABLE 035. EUROPE FINANCIAL WELLNESS BENEFITS MARKET, BY DELIVERY (2016-2028)

TABLE 036. EUROPE FINANCIAL WELLNESS BENEFITS MARKET, BY INDUSTRY (2016-2028)

TABLE 037. FINANCIAL WELLNESS BENEFITS MARKET, BY COUNTRY (2016-2028)

TABLE 038. ASIA PACIFIC FINANCIAL WELLNESS BENEFITS MARKET, BY PROGRAM (2016-2028)

TABLE 039. ASIA PACIFIC FINANCIAL WELLNESS BENEFITS MARKET, BY ENTERPRISE (2016-2028)

TABLE 040. ASIA PACIFIC FINANCIAL WELLNESS BENEFITS MARKET, BY DELIVERY (2016-2028)

TABLE 041. ASIA PACIFIC FINANCIAL WELLNESS BENEFITS MARKET, BY INDUSTRY (2016-2028)

TABLE 042. FINANCIAL WELLNESS BENEFITS MARKET, BY COUNTRY (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA FINANCIAL WELLNESS BENEFITS MARKET, BY PROGRAM (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA FINANCIAL WELLNESS BENEFITS MARKET, BY ENTERPRISE (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA FINANCIAL WELLNESS BENEFITS MARKET, BY DELIVERY (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA FINANCIAL WELLNESS BENEFITS MARKET, BY INDUSTRY (2016-2028)

TABLE 047. FINANCIAL WELLNESS BENEFITS MARKET, BY COUNTRY (2016-2028)

TABLE 048. SOUTH AMERICA FINANCIAL WELLNESS BENEFITS MARKET, BY PROGRAM (2016-2028)

TABLE 049. SOUTH AMERICA FINANCIAL WELLNESS BENEFITS MARKET, BY ENTERPRISE (2016-2028)

TABLE 050. SOUTH AMERICA FINANCIAL WELLNESS BENEFITS MARKET, BY DELIVERY (2016-2028)

TABLE 051. SOUTH AMERICA FINANCIAL WELLNESS BENEFITS MARKET, BY INDUSTRY (2016-2028)

TABLE 052. FINANCIAL WELLNESS BENEFITS MARKET, BY COUNTRY (2016-2028)

TABLE 053. ADURO: SNAPSHOT

TABLE 054. ADURO: BUSINESS PERFORMANCE

TABLE 055. ADURO: PRODUCT PORTFOLIO

TABLE 056. ADURO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. AYCO: SNAPSHOT

TABLE 057. AYCO: BUSINESS PERFORMANCE

TABLE 058. AYCO: PRODUCT PORTFOLIO

TABLE 059. AYCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. BEACON HEALTH OPTIONS: SNAPSHOT

TABLE 060. BEACON HEALTH OPTIONS: BUSINESS PERFORMANCE

TABLE 061. BEACON HEALTH OPTIONS: PRODUCT PORTFOLIO

TABLE 062. BEACON HEALTH OPTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BEST MONEY MOVES: SNAPSHOT

TABLE 063. BEST MONEY MOVES: BUSINESS PERFORMANCE

TABLE 064. BEST MONEY MOVES: PRODUCT PORTFOLIO

TABLE 065. BEST MONEY MOVES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. BRIGHTDIME: SNAPSHOT

TABLE 066. BRIGHTDIME: BUSINESS PERFORMANCE

TABLE 067. BRIGHTDIME: PRODUCT PORTFOLIO

TABLE 068. BRIGHTDIME: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. DHS GROUP: SNAPSHOT

TABLE 069. DHS GROUP: BUSINESS PERFORMANCE

TABLE 070. DHS GROUP: PRODUCT PORTFOLIO

TABLE 071. DHS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. EDUKATE: SNAPSHOT

TABLE 072. EDUKATE: BUSINESS PERFORMANCE

TABLE 073. EDUKATE: PRODUCT PORTFOLIO

TABLE 074. EDUKATE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. ENRICH FINANCIAL WELLNESS: SNAPSHOT

TABLE 075. ENRICH FINANCIAL WELLNESS: BUSINESS PERFORMANCE

TABLE 076. ENRICH FINANCIAL WELLNESS: PRODUCT PORTFOLIO

TABLE 077. ENRICH FINANCIAL WELLNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. EVEN: SNAPSHOT

TABLE 078. EVEN: BUSINESS PERFORMANCE

TABLE 079. EVEN: PRODUCT PORTFOLIO

TABLE 080. EVEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. FINANCIAL FITNESS GROUP: SNAPSHOT

TABLE 081. FINANCIAL FITNESS GROUP: BUSINESS PERFORMANCE

TABLE 082. FINANCIAL FITNESS GROUP: PRODUCT PORTFOLIO

TABLE 083. FINANCIAL FITNESS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. HEALTHCHECK360: SNAPSHOT

TABLE 084. HEALTHCHECK360: BUSINESS PERFORMANCE

TABLE 085. HEALTHCHECK360: PRODUCT PORTFOLIO

TABLE 086. HEALTHCHECK360: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. HEALTH ADVOCATE: SNAPSHOT

TABLE 087. HEALTH ADVOCATE: BUSINESS PERFORMANCE

TABLE 088. HEALTH ADVOCATE: PRODUCT PORTFOLIO

TABLE 089. HEALTH ADVOCATE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. MONEY STARTS HERE: SNAPSHOT

TABLE 090. MONEY STARTS HERE: BUSINESS PERFORMANCE

TABLE 091. MONEY STARTS HERE: PRODUCT PORTFOLIO

TABLE 092. MONEY STARTS HERE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. PAYACTIVE: SNAPSHOT

TABLE 093. PAYACTIVE: BUSINESS PERFORMANCE

TABLE 094. PAYACTIVE: PRODUCT PORTFOLIO

TABLE 095. PAYACTIVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. PURCHASING POWER: SNAPSHOT

TABLE 096. PURCHASING POWER: BUSINESS PERFORMANCE

TABLE 097. PURCHASING POWER: PRODUCT PORTFOLIO

TABLE 098. PURCHASING POWER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. RAMSEY SOLUTIONS: SNAPSHOT

TABLE 099. RAMSEY SOLUTIONS: BUSINESS PERFORMANCE

TABLE 100. RAMSEY SOLUTIONS: PRODUCT PORTFOLIO

TABLE 101. RAMSEY SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. SUM180: SNAPSHOT

TABLE 102. SUM180: BUSINESS PERFORMANCE

TABLE 103. SUM180: PRODUCT PORTFOLIO

TABLE 104. SUM180: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. TRANSAMERICA: SNAPSHOT

TABLE 105. TRANSAMERICA: BUSINESS PERFORMANCE

TABLE 106. TRANSAMERICA: PRODUCT PORTFOLIO

TABLE 107. TRANSAMERICA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 108. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 109. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 110. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FINANCIAL WELLNESS BENEFITS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FINANCIAL WELLNESS BENEFITS MARKET OVERVIEW BY PROGRAM

FIGURE 012. FINANCIAL PLANNING MARKET OVERVIEW (2016-2028)

FIGURE 013. FINANCIAL EDUCATION & COUNSELLING SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. RETIREMENT PLANNING MARKET OVERVIEW (2016-2028)

FIGURE 015. DEBT MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. FINANCIAL WELLNESS BENEFITS MARKET OVERVIEW BY ENTERPRISE

FIGURE 018. LARGE BUSINESSES MARKET OVERVIEW (2016-2028)

FIGURE 019. MEDIUM-SIZED BUSINESSES MARKET OVERVIEW (2016-2028)

FIGURE 020. SMALL-SIZED BUSINESSES MARKET OVERVIEW (2016-2028)

FIGURE 021. FINANCIAL WELLNESS BENEFITS MARKET OVERVIEW BY DELIVERY

FIGURE 022. ONE-ON-ONE MARKET OVERVIEW (2016-2028)

FIGURE 023. ONLINE/DIGITAL MARKET OVERVIEW (2016-2028)

FIGURE 024. GROUP MARKET OVERVIEW (2016-2028)

FIGURE 025. FINANCIAL WELLNESS BENEFITS MARKET OVERVIEW BY INDUSTRY

FIGURE 026. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 027. FINANCIAL SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 028. EDUCATION MARKET OVERVIEW (2016-2028)

FIGURE 029. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 030. PUBLIC SECTOR MARKET OVERVIEW (2016-2028)

FIGURE 031. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 032. NORTH AMERICA FINANCIAL WELLNESS BENEFITS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. EUROPE FINANCIAL WELLNESS BENEFITS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. ASIA PACIFIC FINANCIAL WELLNESS BENEFITS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. MIDDLE EAST & AFRICA FINANCIAL WELLNESS BENEFITS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. SOUTH AMERICA FINANCIAL WELLNESS BENEFITS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Financial Wellness Benefits Market research report is 2024-2032.

Aduro, Ayco, Beacon Health Options, Best Money Moves, BrightDime, DHS Group, Edukate, Enrich Financial Wellness, Even, Financial Fitness Group, HealthCheck360, Health Advocate, Money Starts Here, PayActive, Purchasing Power, Ramsey Solutions, Sum180, Transamerica, and other major players.

The Financial Wellness Benefits Market is segmented into Program, Enterprise, Delivery, Industry, and region. By Program, the market is categorized into Financial Planning, Financial Education and Counselling Services, Retirement Planning, Debt Management, and Others. By Enterprise, the market is categorized into Large Businesses, Medium-sized Businesses, and Small-sized Businesses. By Delivery, the market is categorized into One-on-One, Online/Digital, and Group. By Delivery, the market is categorized into Healthcare, Financial Services, Education, Manufacturing, Public Sector, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Financial wellness programs are frequently included as part of a company's benefits package, which may also include group life insurance or disability coverage. Wellness benefits linked to health insurance plans have become increasingly widespread as these programs have evolved. Individual life insurance companies are likewise concerned about health.

The global market for Financial Wellness Benefits estimated at USD 2.03 Billion in 2023 is projected to reach a revised size of USD 5.71 Billion by 2032, growing at a CAGR of 12.17% over the period 2024-2032.