Broth Market Synopsis

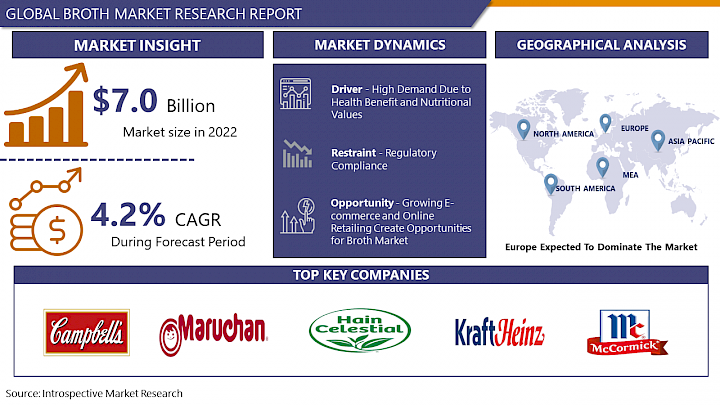

Broth Market Size Was Valued at USD 7.0 Billion in 2022, and is Projected to Reach USD 9.7 Billion by 2030, Growing at a CAGR of 4.2% From 2023-2030.

The broth is referred to as the liquid, which is produced by mixing simmered meat or vegetables in it. It is thick in texture and is utilized as an important substance in the preparation of various dishes. Broth consists of various flavors and thus enriches the taste of dishes in which it is being used. These flavors come from aromatic vegetables, herbs, and spices. In addition, it does not get chilled when refrigerated, which makes it available to be used even after a few days.

- As the broth is seasoned and salted, it is even compared to be a dish. Bone broth is a soupy composition of bone and bone cartilage of chicken or beef. Bone broth is consumed owing to its numerous nutritional compositions and its rich protein content. The bone broth is slow cooked for more than half a day to form a uniform broth and its taste is received over the globe.

- There is a growing awareness of the health benefits associated with consuming broth. Broths, especially those made from bones, are rich in essential nutrients such as collagen, amino acids, and minerals. These nutrients are believed to contribute to improved joint health, gut function, and overall well-being. As more consumers prioritize health and wellness, they are turning to nutrient-dense foods like broth to support their dietary goals.

- Moreover, the popularity of various diets, such as paleo and keto, has contributed to the surge in demand for broth. Broths are often considered compatible with these diets due to their high protein content and low carbohydrate levels. Additionally, broth is frequently used as a base for soups and stews, making it a versatile and convenient choice for those following specific dietary plans.

- The culinary world's increased focus on traditional cooking methods and artisanal products has also propelled the broth market forward. Consumers are becoming more interested in authentic, slow-cooked, and flavorful foods, and broth fits perfectly into this trend. Artisanal broth producers, often using high-quality, locally sourced ingredients, have gained popularity as consumers seek out products with a focus on craftsmanship and authenticity.

Broth Market Trend Analysis

High Demand Due to Health Benefit and Nutritional Values

- The broth market has experienced a significant surge in demand attributed to the increasing awareness and emphasis on health benefits and nutritional values associated with broth consumption. As consumers become more health-conscious and seek wholesome, nutrient-dense food options, broths have emerged as a popular choice due to their numerous health benefits.

- Broths, whether made from bone, vegetables, or other ingredients, are known to be packed with essential nutrients such as vitamins, minerals, and amino acids. Bone broth, in particular, is prized for its collagen content, which supports joint health, skin elasticity, and overall well-being. These nutritional properties have positioned broths as a functional food, appealing to a diverse consumer base looking to enhance their diet with natural, nutrient-packed options.

- The rise of wellness trends and the increasing adoption of holistic approaches to health have further fueled the growth of the broth market. Consumers are seeking products that not only satisfy their taste buds but also contribute positively to their overall health. Broths are often perceived as a convenient and versatile way to incorporate beneficial nutrients into daily diets, making them a go-to choose for health-conscious individuals.

- Moreover, the demand for broths has been bolstered by the growing popularity of specialized diets such as paleo, keto, and gut-friendly regimens. Broths align well with these dietary preferences, as they are often low in carbs, high in protein, and supportive of gut health. As more people embrace these lifestyle choices, the broth market continues to expand to meet the evolving needs of discerning consumers.

Growing E-commerce and Online Retailing Create Opportunities for Broth Market

- One of the primary advantages of entering the e-commerce space is the potential to reach a global audience. Online retailing eliminates geographical limitations, allowing broth producers to connect with customers beyond their local markets. This expanded reach opens up new avenues for sales and brand recognition, enabling broth manufacturers to target diverse consumer preferences and dietary trends.

- Furthermore, the convenience factor plays a crucial role in the success of online retailing for broth. Consumers can browse through a variety of broth products, compare prices, and read reviews from the comfort of their homes. This accessibility encourages impulse purchases and facilitates the exploration of new and niche broth products. With the convenience of doorstep delivery, customers are more likely to make repeat purchases, contributing to brand loyalty.

- E-commerce platforms also provide a space for targeted marketing and personalized recommendations. Broth producers can utilize data analytics to understand consumer behavior, preferences, and purchase patterns. This valuable information allows for the creation of targeted marketing campaigns, promotions, and product bundles, tailoring the online shopping experience to individual tastes.

Broth Market Segment Analysis:

Broth Market Segmented on the basis of type, nature, and distribution channel.

By Type, Vegetables Broth segment is expected to dominate the market during the forecast period

- Health and wellness trends play a pivotal role in driving the popularity of Vegetable Broth. Consumers are becoming increasingly aware of the importance of a balanced diet and are seeking products that contribute to their overall well-being. Vegetable broths, rich in vitamins, minerals, and antioxidants derived from various vegetables, align with these health-conscious consumer choices. Additionally, vegetable broths are often perceived as lower in calories and fat, making them an appealing option for those looking to manage their weight and maintain a healthy lifestyle.

By Nature, Organic segment held the largest share of 35% in 2022

- The growing awareness of health and wellness has spurred a demand for organic products. Consumers are becoming more discerning about the quality of ingredients in their food, opting for products that are free from synthetic chemicals, pesticides, and genetically modified organisms (GMOs). Organic broths, made from ingredients cultivated without the use of synthetic pesticides or fertilizers, resonate with individuals seeking a clean and wholesome diet.

Broth Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- The Europe region for broth market is witnessing growth and dominates the market due to the presence of leading key players such as Bare Bone Broth Company, Paleo Broth Company, and others in this region. the growing interest in alternative diets, such as paleo and keto, has boosted the demand for broth in Europe. Broths, particularly bone broths, align with these dietary preferences as they are low in carbohydrates and can be included in various recipes suitable for these lifestyles. The versatility of broths as a base for soups, stews, and other dishes appeals to consumers looking for nutritious and convenient meal options.

- The culinary landscape in Europe is also witnessing a revival of traditional cooking practices, with broth playing a central role in many classic recipes. The appreciation for artisanal and homemade food has led to an increased interest in preparing broths from scratch.

Broth Market Top Key Players:

- Campbell Soup Company (USA)

- Pacific Coast Producers (USA)

- Kettle & Fire (USA)

- Maruchan Inc. (USA)

- Hain Celestial Group, Inc. (USA)

- Kraft Heinz Company (USA)

- McCormick & Company, Inc. (USA)

- Blue Diamond Growers (USA)

- Unilever (Netherlands)

- Nestlé(Switzerland)

- Ajinomoto Co., Inc. (Japan)

- Kewpie Corporation (Japan)

- Premier Foods Group (UK)

- Meiji Holdings Co., Ltd. (Japan)

- Edward & Sons Trading Company (Japan)

- Masan Group Corporation (Vietnam)

- Kikkoman Corporation (Japan)

- Paleo Broth Company (UK)

- Bonafide Broths (Australia)

- Kettle Cuisine Ltd. (UK) and Other Major Players

Key Industry Developments in the Broth Market:

In January 2023 - Campbell Soup Company Launched its "Plant-Powered Broths" featuring three organic, plant-based broths made with vegetables, herbs, and spices. This caters to the growing demand for vegan and plant-based options.

In April 2023 - Pacific Foods Introduced its "Organic Creamy Coconut Broth" in offering a dairy-free and flavorful alternative for soups, curries, and stews. This taps into the popularity of coconut-based products and ethnic flavors.

|

Global Broth Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 7.0 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.2 % |

Market Size in 2030: |

USD 9.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

|

Global Broth Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 7.0 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.2 % |

Market Size in 2030: |

USD 9.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BROTH MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BROTH MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BROTH MARKET COMPETITIVE RIVALRY

TABLE 005. BROTH MARKET THREAT OF NEW ENTRANTS

TABLE 006. BROTH MARKET THREAT OF SUBSTITUTES

TABLE 007. BROTH MARKET BY TYPE

TABLE 008. CHICKEN BROTH MARKET OVERVIEW (2016-2028)

TABLE 009. BEEF BROTH MARKET OVERVIEW (2016-2028)

TABLE 010. BONE BROTH MARKET OVERVIEW (2016-2028)

TABLE 011. VEGETABLES BROTH MARKET OVERVIEW (2016-2028)

TABLE 012. BROTH MARKET BY NATURE

TABLE 013. ORGANIC MARKET OVERVIEW (2016-2028)

TABLE 014. CONVENTIONAL MARKET OVERVIEW (2016-2028)

TABLE 015. BROTH MARKET BY DISTRIBUTION CHANNEL

TABLE 016. SPECIALTY STORE MARKET OVERVIEW (2016-2028)

TABLE 017. MASS MARKET RETAILERS MARKET OVERVIEW (2016-2028)

TABLE 018. FOOD SERVICE MARKET OVERVIEW (2016-2028)

TABLE 019. CONVENTIONAL GROCERY RETAILERS MARKET OVERVIEW (2016-2028)

TABLE 020. MULTI OUTLET MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA BROTH MARKET, BY TYPE (2016-2028)

TABLE 022. NORTH AMERICA BROTH MARKET, BY NATURE (2016-2028)

TABLE 023. NORTH AMERICA BROTH MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 024. N BROTH MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE BROTH MARKET, BY TYPE (2016-2028)

TABLE 026. EUROPE BROTH MARKET, BY NATURE (2016-2028)

TABLE 027. EUROPE BROTH MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 028. BROTH MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC BROTH MARKET, BY TYPE (2016-2028)

TABLE 030. ASIA PACIFIC BROTH MARKET, BY NATURE (2016-2028)

TABLE 031. ASIA PACIFIC BROTH MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 032. BROTH MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA BROTH MARKET, BY TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA BROTH MARKET, BY NATURE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA BROTH MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 036. BROTH MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA BROTH MARKET, BY TYPE (2016-2028)

TABLE 038. SOUTH AMERICA BROTH MARKET, BY NATURE (2016-2028)

TABLE 039. SOUTH AMERICA BROTH MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 040. BROTH MARKET, BY COUNTRY (2016-2028)

TABLE 041. UNILEVER: SNAPSHOT

TABLE 042. UNILEVER: BUSINESS PERFORMANCE

TABLE 043. UNILEVER: PRODUCT PORTFOLIO

TABLE 044. UNILEVER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. BARE BONE BROTH: SNAPSHOT

TABLE 045. BARE BONE BROTH: BUSINESS PERFORMANCE

TABLE 046. BARE BONE BROTH: PRODUCT PORTFOLIO

TABLE 047. BARE BONE BROTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. DEL MONTE FOOD INC.: SNAPSHOT

TABLE 048. DEL MONTE FOOD INC.: BUSINESS PERFORMANCE

TABLE 049. DEL MONTE FOOD INC.: PRODUCT PORTFOLIO

TABLE 050. DEL MONTE FOOD INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. HAIN CELESTIAL GROUP.: SNAPSHOT

TABLE 051. HAIN CELESTIAL GROUP.: BUSINESS PERFORMANCE

TABLE 052. HAIN CELESTIAL GROUP.: PRODUCT PORTFOLIO

TABLE 053. HAIN CELESTIAL GROUP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. EPIC PROVISION LLC.: SNAPSHOT

TABLE 054. EPIC PROVISION LLC.: BUSINESS PERFORMANCE

TABLE 055. EPIC PROVISION LLC.: PRODUCT PORTFOLIO

TABLE 056. EPIC PROVISION LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. KETTLE AND FIRE INC.: SNAPSHOT

TABLE 057. KETTLE AND FIRE INC.: BUSINESS PERFORMANCE

TABLE 058. KETTLE AND FIRE INC.: PRODUCT PORTFOLIO

TABLE 059. KETTLE AND FIRE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. LONOLIFE: SNAPSHOT

TABLE 060. LONOLIFE: BUSINESS PERFORMANCE

TABLE 061. LONOLIFE: PRODUCT PORTFOLIO

TABLE 062. LONOLIFE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. THE MANISCHEWITZ COMPANY: SNAPSHOT

TABLE 063. THE MANISCHEWITZ COMPANY: BUSINESS PERFORMANCE

TABLE 064. THE MANISCHEWITZ COMPANY: PRODUCT PORTFOLIO

TABLE 065. THE MANISCHEWITZ COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. PALEO BROTH COMPANY: SNAPSHOT

TABLE 066. PALEO BROTH COMPANY: BUSINESS PERFORMANCE

TABLE 067. PALEO BROTH COMPANY: PRODUCT PORTFOLIO

TABLE 068. PALEO BROTH COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. CAMPBELL SOUP COMPANY: SNAPSHOT

TABLE 069. CAMPBELL SOUP COMPANY: BUSINESS PERFORMANCE

TABLE 070. CAMPBELL SOUP COMPANY: PRODUCT PORTFOLIO

TABLE 071. CAMPBELL SOUP COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. BONAFIDE: SNAPSHOT

TABLE 072. BONAFIDE: BUSINESS PERFORMANCE

TABLE 073. BONAFIDE: PRODUCT PORTFOLIO

TABLE 074. BONAFIDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. MCCORMICK AND COMPANY INC.: SNAPSHOT

TABLE 075. MCCORMICK AND COMPANY INC.: BUSINESS PERFORMANCE

TABLE 076. MCCORMICK AND COMPANY INC.: PRODUCT PORTFOLIO

TABLE 077. MCCORMICK AND COMPANY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. ZOUP SPECIALTY PRODUCTS: SNAPSHOT

TABLE 078. ZOUP SPECIALTY PRODUCTS: BUSINESS PERFORMANCE

TABLE 079. ZOUP SPECIALTY PRODUCTS: PRODUCT PORTFOLIO

TABLE 080. ZOUP SPECIALTY PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 081. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 082. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 083. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BROTH MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BROTH MARKET OVERVIEW BY TYPE

FIGURE 012. CHICKEN BROTH MARKET OVERVIEW (2016-2028)

FIGURE 013. BEEF BROTH MARKET OVERVIEW (2016-2028)

FIGURE 014. BONE BROTH MARKET OVERVIEW (2016-2028)

FIGURE 015. VEGETABLES BROTH MARKET OVERVIEW (2016-2028)

FIGURE 016. BROTH MARKET OVERVIEW BY NATURE

FIGURE 017. ORGANIC MARKET OVERVIEW (2016-2028)

FIGURE 018. CONVENTIONAL MARKET OVERVIEW (2016-2028)

FIGURE 019. BROTH MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 020. SPECIALTY STORE MARKET OVERVIEW (2016-2028)

FIGURE 021. MASS MARKET RETAILERS MARKET OVERVIEW (2016-2028)

FIGURE 022. FOOD SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 023. CONVENTIONAL GROCERY RETAILERS MARKET OVERVIEW (2016-2028)

FIGURE 024. MULTI OUTLET MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA BROTH MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE BROTH MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC BROTH MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA BROTH MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA BROTH MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Broth Market research report is 2023-2030.

Campbell Soup Company (USA), Pacific Coast Producers (USA), Kettle & Fire (USA), Maruchan Inc. (USA), Hain Celestial Group, Inc. (USA), Kraft Heinz Company (USA), McCormick & Company, Inc. (USA), Blue Diamond Growers (USA), Unilever (Netherlands), Nestlé (Switzerland), Ajinomoto Co., Inc. (Japan), Kewpie Corporation (Japan), Premier Foods Group (UK), Meiji Holdings Co., Ltd. (Japan), Edward & Sons Trading Company (Japan), Masan Group Corporation (Vietnam), Kikkoman Corporation (Japan), Paleo Broth Company (UK), Bonafide Broths (Australia), Kettle Cuisine Ltd. (UK), and Other Major Players.

The Broth Market is segmented into Type, Nature, Application, and region. By Type, the market is categorized into Chicken Broth, Beef Broth, Bone Broth, and Vegetables Broth. By Nature, the market is categorized into Organic, Conventional. By Distribution Channel, the market is categorized into Specialty Stores, Mass Market Retailers, Food Service, Conventional Grocery Retailers, Multi Outlet. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The broth is referred to as the liquid, which is produced by mixing simmered meat or vegetables in it. It is thick in texture and is utilized as an important substance in the preparation of various dishes. Broth consists of various flavors and thus enriches the taste of dishes in which it is being used. These flavors come from aromatic vegetables, herbs, and spices. In addition, it does not get chilled when refrigerated, which makes it available to be used even after a few days. As the broth is seasoned and salted, it is even compared to be a dish in itself. Bone broth is a soupy composition of bone and bone cartilage of chicken or beef. Bone broth is consumed owing to its numerous nutritional compositions and its rich protein content. The bone broth is slow-cooked for more than half a day to form a uniform broth and its taste is received over the globe.

Broth Market Size Was Valued at USD 7.0 Billion in 2022, and is Projected to Reach USD 9.7 Billion by 2030, Growing at a CAGR of 4.2% From 2023-2030.