Prediabetes Market Synopsis

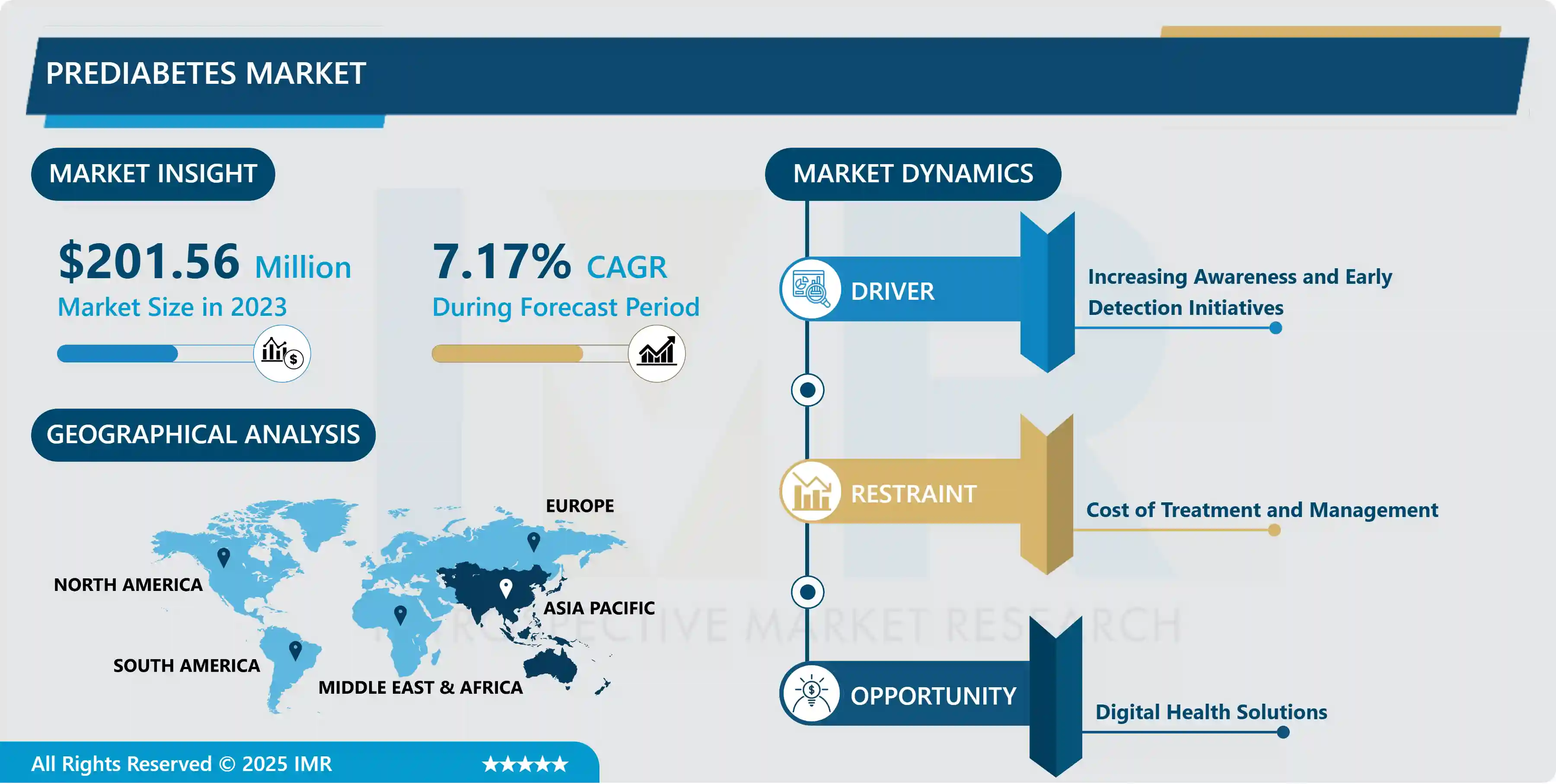

Prediabetes Market Size Was Valued at USD 201.56 Million in 2023 and is Projected to Reach USD 375.89 Million by 2032, Growing at a CAGR of 7.17% From 2024-2032.

The Prediabetes Market refers to the commercial landscape surrounding the diagnosis, prevention, management, and treatment of prediabetes, a condition characterized by blood sugar levels that are higher than normal but not yet high enough to be classified as type 2 diabetes. This market includes various products and services, such as diagnostic tools, medications, lifestyle intervention programs, and healthcare services aimed at delaying or preventing the progression of prediabetes to full-blown diabetes.

The global incidence of prediabetes is on the rise, fueled by unhealthy diets, sedentary lifestyles, and increasing obesity rates. As more people are diagnosed with prediabetes, the market for diagnosis and management tools is rapidly expanding, creating significant growth potential. Early detection of prediabetes is critical for effective intervention. With the advent of advanced diagnostic tools and increased awareness, there is a growing demand for early diagnosis solutions. This trend is driving innovation and investments in more accessible and affordable screening technologies.

Lifestyle modification programs that include diet, exercise, and behavioral counseling have proven to be effective in managing prediabetes. The market is witnessing a shift toward non-pharmaceutical interventions as consumers and healthcare providers seek to address the root causes of the condition rather than just treat symptoms. The adoption of digital health tools, such as mobile apps, wearable devices, and telemedicine platforms, has revolutionized how prediabetes is managed. These technologies allow for real-time monitoring of glucose levels, personalized diet and exercise recommendations, and remote consultations, enhancing patient engagement and outcomes.

Prediabetes Market Trend Analysis

Increasing Awareness and Early Detection Initiatives:

- One of the major drivers of the prediabetes market is the growing awareness surrounding the condition and the importance of early detection. Governments, healthcare organizations, and private companies have been launching awareness campaigns to educate the public about the risks of prediabetes and the steps they can take to prevent it. These initiatives emphasize the importance of regular blood glucose monitoring, early screening, and lifestyle changes to prevent the progression of type 2 diabetes.

- As a result, more people are seeking medical advice and getting tested for prediabetes, leading to a higher demand for diagnostic tools and monitoring devices. The availability of easy-to-use home testing kits and point-of-care devices has made early detection more accessible, even in rural and underserved communities. Early diagnosis allows for timely intervention, which is crucial in preventing diabetes, thus bolstering the market for both diagnostic products and lifestyle management programs.

- The rise of digital health technologies, such as apps and wearable devices, has also played a significant role in driving early detection. These tools enable continuous monitoring of glucose levels and other health parameters, encouraging individuals to take charge of their health and make informed decisions. The combination of greater awareness and technological advancements is creating a favorable environment for market growth.

- Healthcare providers are increasingly focused on preventive care, advocating for more frequent screenings and routine health checkups, especially for individuals at high risk of developing prediabetes. This shift toward preventive healthcare is another contributing factor to the rising demand for diagnostic and therapeutic solutions in the prediabetes market.

Digital Health Solutions:

- The rise of digital health solutions presents a significant opportunity in the prediabetes market. Mobile health apps, particularly digital therapeutics, are transforming how individuals manage their health. Apps focusing on lifestyle changes, such as diet tracking, exercise planning, and glucose monitoring, are playing a crucial role in prediabetes management. Companies like Omada Health and Livongo are already leading the way, providing patients with tools to take control of their condition and prevent the progression of type 2 diabetes.

- Another key opportunity lies in telemedicine. Telehealth platforms enable continuous monitoring and provide remote consultations with healthcare providers, making prediabetes management more convenient and accessible. The COVID-19 pandemic has dramatically accelerated the adoption of telemedicine, as many patients and healthcare systems shifted to remote care models. This trend is expected to continue, offering sustained growth in the market and improved patient outcomes through consistent monitoring.

- As digital health solutions advance, the potential for integration with wearable technology, personalized treatment plans, and AI-driven data insights will further expand the prediabetes market. By leveraging these tools, companies can help individuals manage their condition more effectively, reducing healthcare costs and improving quality of life. The demand for innovative, user-friendly solutions in prediabetes care is set to grow, offering lucrative opportunities for both healthcare providers and tech companies.

Prediabetes Market Segment Analysis:

Prediabetes Market Segmented based on Drug Class and Age Group.

By Age Group, Adult Segment Is Expected to Dominate the Market During the Forecast Period

- The adults (18-49) age group emerged as the dominating segment in the prediabetes market, holding the largest revenue share in 2023. This demographic, comprising individuals aged between 18 and 49, represents a significant portion of the population with rising health concerns. The prevalence of prediabetes within this age group has been notably high, with the Centers for Disease Control and Prevention (CDC) reporting that approximately 42% of all U.S. adults had prediabetes by 2023. Such alarming figures reflect the increasing health risks associated with this age bracket.

- One of the primary drivers for the dominance of the adult segment in the prediabetes market is the growing adoption of unhealthy lifestyle habits, such as poor dietary choices and lack of physical activity. These behaviors, common among younger and middle-aged adults, contribute significantly to the rising rates of insulin resistance, weight gain, and eventually, prediabetes. The resulting surge in demand for early diagnosis, monitoring, and intervention has led to this age group becoming a focal point for healthcare providers and product manufacturers.

- The high prevalence of prediabetes among adults, coupled with their increased engagement with healthcare services, underscores the growth potential of this segment. As awareness of the condition grows, adults in this age range are more likely to seek preventive measures, driving market demand for diabetes-related products, services, and solutions.

By Drug Class, the Diguanide Segment Held the Largest Share In 2023

- The biguanides segment dominated the prediabetes market in 2023. Biguanides, a class of drugs widely used for managing prediabetes and type 2 diabetes, have maintained their leading position due to their efficacy and extensive usage. Among these, metformin stands out as the most commonly prescribed medication, solidifying its role in the market. Its popularity is driven by its effectiveness in controlling blood glucose levels and preventing the progression of prediabetes to type 2 diabetes.

- Metformin, in particular, has become the cornerstone treatment for prediabetes, as recommended by the American Diabetes Association (ADA). In August 2023, the National Center for Biotechnology Information (NCBI) emphasized metformin as the only ADA-approved medication for treating prediabetes in both adults and pediatric patients aged 10 and older. This endorsement has bolstered its demand in the market, further securing Biguanides' dominance.

- The Standards of Medical Care in Diabetes 2022 highlights the importance of early detection and intervention in prediabetes management. The glycated hemoglobin A1C test, with a recommended range of 5.7% to 6.4% (39-47 mmol/mol), serves as a key diagnostic tool for identifying individuals at risk. This focus on early diagnosis and treatment has propelled the use of metformin, reinforcing the biguanides segment's leadership in the prediabetes market.

Prediabetes Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- North America led the prediabetes market in 2023. This growth is driven primarily by increasing awareness regarding the importance of early detection and intervention for prediabetes, which has significantly raised demand for diagnostic and management solutions. The rising prevalence of prediabetes in the region is also a key factor. According to the American Diabetes Association (ADA), in 2021, 97.6 million adults aged 18 and above in the U.S. were diagnosed with prediabetes, underscoring the urgent need for effective management strategies.

- In addition to growing awareness, advancements in diagnostic technologies are playing a crucial role in the expansion of the prediabetes market in North America. Enhanced screening tools and therapeutic options have improved the accuracy and efficiency of prediabetes management, allowing healthcare providers to better address the condition in its early stages. These technological advancements are not only improving patient outcomes but are also driving market expansion by enabling more comprehensive care.

- Supportive healthcare policies and initiatives in North America are further boosting market growth. Government programs and public health campaigns aimed at addressing key prediabetes risk factors, such as obesity and sedentary lifestyles, are encouraging early testing and intervention. These efforts, coupled with advancements in healthcare infrastructure, are positioning North America as a leading region in the global prediabetes market.

Prediabetes Market Active Players

- Abbott (USA)

- Johnson & Johnson (USA)

- Medtronic (USA)

- Roche (Switzerland)

- Dexcom (USA)

- Sanofi (France)

- Eli Lilly (USA)

- AstraZeneca (UK)

- GlaxoSmithKline (UK)

- Pfizer (USA)

- Merck (USA)

- Bayer (Germany)

- Novartis (Switzerland)

- Novo Nordisk (Denmark)

- Boehringer Ingelheim (Germany)

- Takeda (Japan)

- Becton, Dickinson and Company (USA)

- Ascensia Diabetes Care (Switzerland)

- Tandem Diabetes Care (USA)

- Livongo (USA)

- Insulet Corporation (USA)

- Omron Healthcare (Japan)

- Aetna (USA)

- WellDoc (USA)

- SciMar (Canada), and Other Active Players.

Key Industry Developments in the Prediabetes Market:

- In January 2024, Novo Nordisk announced the launch of Wegovy, a GLP-1 analog, in the U.K. This innovative drug received approval for a prescription to individuals with prediabetes and weight loss purposes. Wegovy aimed to provide a new treatment option for those struggling with weight management and metabolic health. The launch marked a significant advancement in diabetes care and obesity treatment, reflecting Novo Nordisk's commitment to improving patient outcomes. Health professionals welcomed the introduction of Wegovy, anticipating its potential to positively impact the lives of many individuals facing weight-related health challenges.

|

Prediabetes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 201.56 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.17 % |

Market Size in 2032: |

USD 375.89 Mn. |

|

Segments Covered: |

By Drug Class |

|

|

|

By Age Group |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Prediabetes Market by Drug Class (2018-2032)

4.1 Prediabetes Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Diguanide

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Thiazolidinediones

Chapter 5: Prediabetes Market by Age Group (2018-2032)

5.1 Prediabetes Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Children

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Adult

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Prediabetes Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBOTT (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 JOHNSON & JOHNSON (USA)

6.4 MEDTRONIC (USA)

6.5 ROCHE (SWITZERLAND)

6.6 DEXCOM (USA)

6.7 SANOFI (FRANCE)

6.8 ELI LILLY (USA)

6.9 ASTRAZENECA (UK)

6.10 GLAXOSMITHKLINE (UK)

6.11 PFIZER (USA)

6.12 MERCK (USA)

6.13 BAYER (GERMANY)

6.14 NOVARTIS (SWITZERLAND)

6.15 NOVO NORDISK (DENMARK)

6.16 BOEHRINGER INGELHEIM (GERMANY)

6.17 TAKEDA (JAPAN)

6.18 BECTON

6.19 DICKINSON AND COMPANY (USA)

6.20 ASCENSIA DIABETES CARE (SWITZERLAND)

6.21 TANDEM DIABETES CARE (USA)

6.22 LIVONGO (USA)

6.23 INSULET CORPORATION (USA)

6.24 OMRON HEALTHCARE (JAPAN)

6.25 AETNA (USA)

6.26 WELLDOC (USA)

6.27 SCIMAR (CANADA)

6.28 AND OTHER ACTIVE PLAYERS.

Chapter 7: Global Prediabetes Market By Region

7.1 Overview

7.2. North America Prediabetes Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Drug Class

7.2.4.1 Diguanide

7.2.4.2 Thiazolidinediones

7.2.5 Historic and Forecasted Market Size by Age Group

7.2.5.1 Children

7.2.5.2 Adult

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Prediabetes Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Drug Class

7.3.4.1 Diguanide

7.3.4.2 Thiazolidinediones

7.3.5 Historic and Forecasted Market Size by Age Group

7.3.5.1 Children

7.3.5.2 Adult

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Prediabetes Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Drug Class

7.4.4.1 Diguanide

7.4.4.2 Thiazolidinediones

7.4.5 Historic and Forecasted Market Size by Age Group

7.4.5.1 Children

7.4.5.2 Adult

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Prediabetes Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Drug Class

7.5.4.1 Diguanide

7.5.4.2 Thiazolidinediones

7.5.5 Historic and Forecasted Market Size by Age Group

7.5.5.1 Children

7.5.5.2 Adult

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Prediabetes Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Drug Class

7.6.4.1 Diguanide

7.6.4.2 Thiazolidinediones

7.6.5 Historic and Forecasted Market Size by Age Group

7.6.5.1 Children

7.6.5.2 Adult

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Prediabetes Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Drug Class

7.7.4.1 Diguanide

7.7.4.2 Thiazolidinediones

7.7.5 Historic and Forecasted Market Size by Age Group

7.7.5.1 Children

7.7.5.2 Adult

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Prediabetes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 201.56 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.17 % |

Market Size in 2032: |

USD 375.89 Mn. |

|

Segments Covered: |

By Drug Class |

|

|

|

By Age Group |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||