Osteoporosis Treatment Market Synopsis

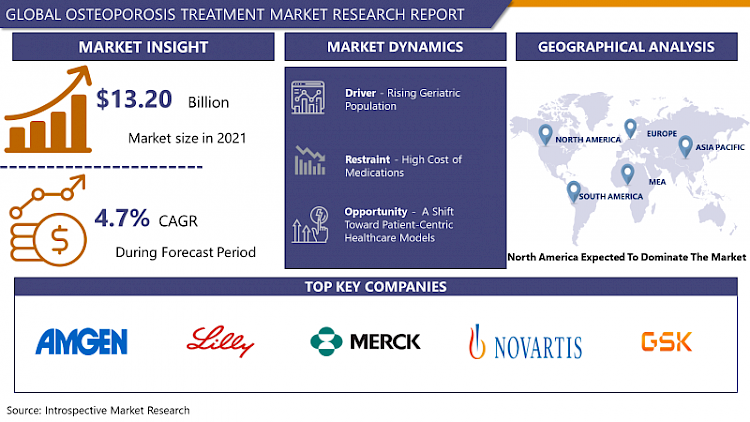

The Osteoporosis Treatment Market Size Was Valued at USD 13.20 Billion in 2022 and is Projected to Reach USD 19.06 Billion by 2030, Growing at a CAGR of 4.7% From 2023-2030.

Osteoporosis treatment refers to therapeutic interventions aimed at managing and preventing the progression of osteoporosis, a medical condition characterized by weakened bones and increased susceptibility to fractures. The primary goal of treatment is to enhance bone density and strength, reducing the risk of fractures and improving overall bone health.

- Current treatment modalities include medications such as bisphosphonates, hormone replacement therapy, and selective estrogen receptor modulators. These drugs help regulate bone remodeling processes and maintain bone density. Additionally, lifestyle modifications, including adequate calcium and vitamin D intake, weight-bearing exercises, and fall prevention strategies, are integral components of osteoporosis management.

- In recent years, advancements in osteoporosis treatment have seen the emergence of novel therapies, including monoclonal antibodies targeting specific bone-related pathways. These newer options aim to provide more targeted and effective approaches with potentially fewer side effects.

- The market for osteoporosis treatment is influenced by an aging population, increased awareness, and ongoing research in bone health. The trend towards personalized medicine and the development of innovative therapeutics continue to shape the landscape, offering hope for improved outcomes and quality of life for individuals affected by osteoporosis.

Osteoporosis Treatment Market Trend Analysis

Rising Geriatric Population

- As individuals age, there is a natural decline in bone density and an increased susceptibility to fractures, making the elderly more prone to osteoporosis. With a global demographic shift towards an aging population, the prevalence of osteoporosis is on the rise.

- The elderly is particularly vulnerable to osteoporosis-related complications, such as fractures, which can lead to a significant decline in quality of life and increased healthcare costs. As life expectancy increases, the proportion of elderly individuals in the population grows, creating a sustained demand for effective osteoporosis treatments.

- Healthcare systems worldwide are grappling with the challenges posed by age-related bone disorders, necessitating the development and adoption of targeted therapies to address osteoporosis in the aging demographic. This demographic trend underscores the importance of ongoing research, innovative treatment options, and comprehensive healthcare strategies tailored to the unique needs of the elderly. The osteoporosis treatment market is, therefore, positioned to expand in response to the escalating healthcare requirements associated with the rising geriatric population.

A Shift Toward Patient-Centric Healthcare Models

- Patient-centric approaches in osteoporosis care involve tailoring treatments to individual patient needs, preferences, and lifestyles. This not only enhances treatment adherence but also fosters better communication between healthcare providers and patients, leading to improved outcomes. The emphasis on shared decision-making empowers patients to play a more active role in managing their bone health, contributing to overall treatment effectiveness.

- Furthermore, patient-centric healthcare models encourage the development of more user-friendly drug formulations, innovative delivery methods, and supportive services that enhance the patient experience. As individuals become more informed and involved in their healthcare journeys, there is an increased demand for educational resources, digital tools, and personalized interventions related to osteoporosis prevention and management.

- Pharmaceutical companies, healthcare providers, and other stakeholders have the opportunity to capitalize on this paradigm shift by developing solutions that prioritize patient needs, preferences, and overall well-being. In doing so, the osteoporosis treatment market can not only address the unique challenges of individual patients but also foster a more sustainable and patient-focused healthcare ecosystem.

Osteoporosis Treatment Market Segment Analysis:

The Osteoporosis Treatment Market is Segmented based on drug class, route of administration, and distribution channel.

By Drug Class, the Bisphosphonates segment is expected to dominate the market during the forecast period

- The Bisphosphonates segment is anticipated to maintain dominance in the osteoporosis treatment market throughout the forecast period. Bisphosphonates, including widely used drugs such as alendronate and zoledronic acid, are established as primary agents for inhibiting bone resorption and preserving bone density. Their efficacy in reducing fracture risk and their well-established safety profile contribute to their sustained prominence in osteoporosis management.

- The long-standing market presence of bisphosphonates, coupled with their cost-effectiveness, makes them a preferred choice for both physicians and patients. Additionally, the availability of generic formulations further supports their widespread use. Despite the emergence of newer therapeutic options, the reliability, proven effectiveness, and familiarity of bisphosphonates contribute to their continued dominance in the osteoporosis treatment landscape. This sustained market leadership is expected to persist due to the established trust in the therapeutic benefits of this drug class.

By Route of Administration, Oral segment held the largest market share of 52,9% in 2022

- The Oral segment has consistently held the largest market share in the osteoporosis treatment market. This dominance is attributed to the convenience, patient preference, and widespread acceptance of oral administration for osteoporosis medications. Oral medications, particularly bisphosphonates, and other antiresorptive agents, offer a user-friendly and non-invasive approach to treatment, contributing to high patient compliance.

- The ease of self-administration, coupled with the familiarity of oral tablets, has made this route of administration the go-to choose for both healthcare providers and patients. Moreover, the well-established safety profile of orally administered osteoporosis drugs has further reinforced the popularity of this segment.

- While other administration routes such as injections are available, the Oral segment's sustained prominence is indicative of the enduring confidence in the efficacy, accessibility, and patient-friendly nature of orally administered osteoporosis treatments in the market.

Osteoporosis Treatment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is poised to dominate the osteoporosis treatment market over the forecast period. This regional dominance is driven by several factors, including a well-established healthcare infrastructure, high awareness levels about bone health, and a rapidly aging population. The prevalence of osteoporosis-related conditions, coupled with a proactive approach to early diagnosis and treatment, contributes to the region's significant market share.

- Furthermore, continuous advancements in medical research, technological innovation, and a robust regulatory framework support the development and adoption of new osteoporosis treatments in North America. Strong collaborations between pharmaceutical companies, research institutions, and healthcare organizations also contribute to the region's leadership in the market. The presence of key market players, along with a favourable reimbursement landscape, further solidifies North America's position as a major hub for osteoporosis treatment, making it the dominant region in terms of market share.

Osteoporosis Treatment Market Top Key Players:

- Amgen Inc. (U.S.)

- Eli Lilly And Company (U.S.)

- Merck & Co., Inc. (U.S.)

- Novartis International Ag (Switzerland)

- Glaxosmithkline Plc (U.K.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Pfizer Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd (Israel)

- Actavis (Now Part Of Teva) (United States)

- Radius Health, Inc. (U.S.)

- Johnson & Johnson (U.S.)

- Amgen Australia Pty Ltd (Australia)

- Astellas Pharma Inc. (Japan)

- Ucb S.A. (Belgium)

- Sun Pharmaceutical Industries Ltd (India)

- Cadila Healthcare Ltd (India)

- Torrent Pharmaceuticals Ltd (India)

- Strides Pharma Science Limited (India)

- Cipla Limited (India)

- Dr. Reddy's Laboratories Ltd (India) And Other Major Players

Key Industry Developments in the Osteoporosis Treatment Market:

- In November 2023, Teva Pharmaceuticals Inc., a U.S. affiliate of Teva Pharmaceutical Industries Ltd., announced the approval of a generic version of Forteo®1, in the United States. Market availability of the product in the U.S. is expected in the coming weeks. Teriparatide injection is indicated to treat osteoporosis among certain women and men. Please see the below “What is?” section for more information.

- In February 2023, Sandoz, a global leader in off-patent (generic and biosimilar) medicines, announced that the US Food and Drug Administration (FDA) has accepted its Biologics License Application (BLA) for proposed biosimilar denosumab. The application includes all indications covered by the reference medicines Prolia® (denosumab)* and Xgeva® (denosumab)* for treating a variety of conditions, including osteoporosis in postmenopausal women and in men at increased risk of fractures, treatment-induced bone loss, prevention of skeletal-related complications in cancer that has spread to the bone, giant cell tumor of the bone, and treatment of hypercalcemia of malignancy refractory to bisphosphonate therapy.

|

Global Osteoporosis Treatment Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 13.20 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.7 % |

Market Size in 2030: |

USD 19.06 Bn. |

|

Segments Covered: |

By Drug Class |

|

|

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- OSTEOPOROSIS TREATMENT MARKET BY DRUG CLASS (2016-2030)

- OSTEOPOROSIS TREATMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BISPHOSPHONATES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PARATHYROID HORMONE THERAPY

- RANK LIGAND INHIBITORS

- OSTEOPOROSIS TREATMENT MARKET BY ROUTE OF ADMINISTRATION (2016-2030)

- OSTEOPOROSIS TREATMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ORAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INJECTABLE

- OSTEOPOROSIS TREATMENT MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- OSTEOPOROSIS TREATMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITAL PHARMACIES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RETAIL PHARMACIES & STORES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- OSTEOPOROSIS TREATMENT Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AMGEN INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ELI LILLY AND COMPANY (U.S.)

- MERCK & CO., INC. (U.S.)

- NOVARTIS INTERNATIONAL AG (SWITZERLAND)

- GLAXOSMITHKLINE PLC (U.K.)

- F. HOFFMANN-LA ROCHE LTD (SWITZERLAND)

- PFIZER INC. (U.S.)

- TEVA PHARMACEUTICAL INDUSTRIES LTD (ISRAEL)

- ACTAVIS (NOW PART OF TEVA) (UNITED STATES)

- RADIUS HEALTH, INC. (U.S.)

- JOHNSON & JOHNSON (U.S.)

- AMGEN AUSTRALIA PTY LTD (AUSTRALIA)

- ASTELLAS PHARMA INC. (JAPAN)

- UCB S.A. (BELGIUM)

- SUN PHARMACEUTICAL INDUSTRIES LTD (INDIA)

- CADILA HEALTHCARE LTD (INDIA)

- TORRENT PHARMACEUTICALS LTD (INDIA)

- STRIDES PHARMA SCIENCE LIMITED (INDIA)

- CIPLA LIMITED (INDIA)

- DR. REDDY'S LABORATORIES LTD (INDIA) AND OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL OSTEOPOROSIS TREATMENT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By DRUG CLASS

- Historic And Forecasted Market Size By ROUTE OF ADMINISTRATION

- Historic And Forecasted Market Size By DISTRIBUTION CHANNEL

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

Potential Market Strategies

|

Global Osteoporosis Treatment Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 13.20 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.7 % |

Market Size in 2030: |

USD 19.06 Bn. |

|

Segments Covered: |

By Drug Class |

|

|

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. OSTEOPOROSIS TREATMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. OSTEOPOROSIS TREATMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. OSTEOPOROSIS TREATMENT MARKET COMPETITIVE RIVALRY

TABLE 005. OSTEOPOROSIS TREATMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. OSTEOPOROSIS TREATMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. OSTEOPOROSIS TREATMENT MARKET BY DRUG CLASS

TABLE 008. BISPHOSPHONATES MARKET OVERVIEW (2016-2028)

TABLE 009. PARATHYROID HORMONE THERAPY MARKET OVERVIEW (2016-2028)

TABLE 010. RANK LIGAND INHIBITORS MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. OSTEOPOROSIS TREATMENT MARKET BY ROUTE OF ADMINISTRATION

TABLE 013. ORAL MARKET OVERVIEW (2016-2028)

TABLE 014. INJECTABLE MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA OSTEOPOROSIS TREATMENT MARKET, BY DRUG CLASS (2016-2028)

TABLE 017. NORTH AMERICA OSTEOPOROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION (2016-2028)

TABLE 018. N OSTEOPOROSIS TREATMENT MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE OSTEOPOROSIS TREATMENT MARKET, BY DRUG CLASS (2016-2028)

TABLE 020. EUROPE OSTEOPOROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION (2016-2028)

TABLE 021. OSTEOPOROSIS TREATMENT MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC OSTEOPOROSIS TREATMENT MARKET, BY DRUG CLASS (2016-2028)

TABLE 023. ASIA PACIFIC OSTEOPOROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION (2016-2028)

TABLE 024. OSTEOPOROSIS TREATMENT MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA OSTEOPOROSIS TREATMENT MARKET, BY DRUG CLASS (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA OSTEOPOROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION (2016-2028)

TABLE 027. OSTEOPOROSIS TREATMENT MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA OSTEOPOROSIS TREATMENT MARKET, BY DRUG CLASS (2016-2028)

TABLE 029. SOUTH AMERICA OSTEOPOROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION (2016-2028)

TABLE 030. OSTEOPOROSIS TREATMENT MARKET, BY COUNTRY (2016-2028)

TABLE 031. AMGEN INC.: SNAPSHOT

TABLE 032. AMGEN INC.: BUSINESS PERFORMANCE

TABLE 033. AMGEN INC.: PRODUCT PORTFOLIO

TABLE 034. AMGEN INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. F. HOFFMANN-LA ROCHE AG: SNAPSHOT

TABLE 035. F. HOFFMANN-LA ROCHE AG: BUSINESS PERFORMANCE

TABLE 036. F. HOFFMANN-LA ROCHE AG: PRODUCT PORTFOLIO

TABLE 037. F. HOFFMANN-LA ROCHE AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. RADIUS HEALTH INC.: SNAPSHOT

TABLE 038. RADIUS HEALTH INC.: BUSINESS PERFORMANCE

TABLE 039. RADIUS HEALTH INC.: PRODUCT PORTFOLIO

TABLE 040. RADIUS HEALTH INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. MERCK & CO. INC.: SNAPSHOT

TABLE 041. MERCK & CO. INC.: BUSINESS PERFORMANCE

TABLE 042. MERCK & CO. INC.: PRODUCT PORTFOLIO

TABLE 043. MERCK & CO. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. NOVARTIS INTERNATIONAL AG: SNAPSHOT

TABLE 044. NOVARTIS INTERNATIONAL AG: BUSINESS PERFORMANCE

TABLE 045. NOVARTIS INTERNATIONAL AG: PRODUCT PORTFOLIO

TABLE 046. NOVARTIS INTERNATIONAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. PFIZER INC.: SNAPSHOT

TABLE 047. PFIZER INC.: BUSINESS PERFORMANCE

TABLE 048. PFIZER INC.: PRODUCT PORTFOLIO

TABLE 049. PFIZER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. SUN PHARMACEUTICAL INDUSTRIES LTD.: SNAPSHOT

TABLE 050. SUN PHARMACEUTICAL INDUSTRIES LTD.: BUSINESS PERFORMANCE

TABLE 051. SUN PHARMACEUTICAL INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 052. SUN PHARMACEUTICAL INDUSTRIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. TAKEDA PHARMACEUTICAL COMPANY LIMITED: SNAPSHOT

TABLE 053. TAKEDA PHARMACEUTICAL COMPANY LIMITED: BUSINESS PERFORMANCE

TABLE 054. TAKEDA PHARMACEUTICAL COMPANY LIMITED: PRODUCT PORTFOLIO

TABLE 055. TAKEDA PHARMACEUTICAL COMPANY LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. TEVA PHARMACEUTICAL INDUSTRIES LTD: SNAPSHOT

TABLE 056. TEVA PHARMACEUTICAL INDUSTRIES LTD: BUSINESS PERFORMANCE

TABLE 057. TEVA PHARMACEUTICAL INDUSTRIES LTD: PRODUCT PORTFOLIO

TABLE 058. TEVA PHARMACEUTICAL INDUSTRIES LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ALLERGAN PLC: SNAPSHOT

TABLE 059. ALLERGAN PLC: BUSINESS PERFORMANCE

TABLE 060. ALLERGAN PLC: PRODUCT PORTFOLIO

TABLE 061. ALLERGAN PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ELI LILY & COMPANY: SNAPSHOT

TABLE 062. ELI LILY & COMPANY: BUSINESS PERFORMANCE

TABLE 063. ELI LILY & COMPANY: PRODUCT PORTFOLIO

TABLE 064. ELI LILY & COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 065. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 066. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 067. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. OSTEOPOROSIS TREATMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. OSTEOPOROSIS TREATMENT MARKET OVERVIEW BY DRUG CLASS

FIGURE 012. BISPHOSPHONATES MARKET OVERVIEW (2016-2028)

FIGURE 013. PARATHYROID HORMONE THERAPY MARKET OVERVIEW (2016-2028)

FIGURE 014. RANK LIGAND INHIBITORS MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. OSTEOPOROSIS TREATMENT MARKET OVERVIEW BY ROUTE OF ADMINISTRATION

FIGURE 017. ORAL MARKET OVERVIEW (2016-2028)

FIGURE 018. INJECTABLE MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA OSTEOPOROSIS TREATMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE OSTEOPOROSIS TREATMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC OSTEOPOROSIS TREATMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA OSTEOPOROSIS TREATMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA OSTEOPOROSIS TREATMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Osteoporosis Treatment Market research report is 2023-2030.

Amgen Inc. (U.S.),Eli Lilly and Company (U.S.),Merck & Co., Inc. (U.S.),Novartis International AG (Switzerland),GlaxoSmithKline plc (U.K.),F. Hoffmann-La Roche Ltd (Switzerland),Pfizer Inc. (U.S.),Teva Pharmaceutical Industries Ltd (Israel),Actavis (now part of Teva) (United States),Radius Health, Inc. (U.S.),Johnson & Johnson (U.S.),Amgen Australia Pty Ltd (Australia),Astellas Pharma Inc. (Japan),UCB S.A. (Belgium),Sun Pharmaceutical Industries Ltd (India),Cadila Healthcare Ltd (India),Torrent Pharmaceuticals Ltd (India),Strides Pharma Science Limited (India),Cipla Limited (India),Dr. Reddy's Laboratories Ltd (India) and Other Major Players.

The Osteoporosis Treatment Market is segmented into Drug Class, Route of Administration, Distribution Channel, and region. By Drug Class, the market is categorized into Bisphosphonates, Parathyroid Hormone Therapy, and Rank Ligand Inhibitors. By Route of Administration, the market is categorized into Oral and injectable. By Distribution Channel the market is categorized into Hospital Pharmacies, Retail Pharmacies & Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Osteoporosis treatment refers to therapeutic interventions aimed at managing and preventing the progression of osteoporosis, a medical condition characterized by weakened bones and increased susceptibility to fractures. The primary goal of treatment is to enhance bone density and strength, reducing the risk of fractures and improving overall bone health.

The Osteoporosis Treatment Market Size Was Valued at USD 13.20 Billion in 2022 and is Projected to Reach USD 19.06 Billion by 2030, Growing at a CAGR of 4.7% From 2023-2030.