Market Synopsis:

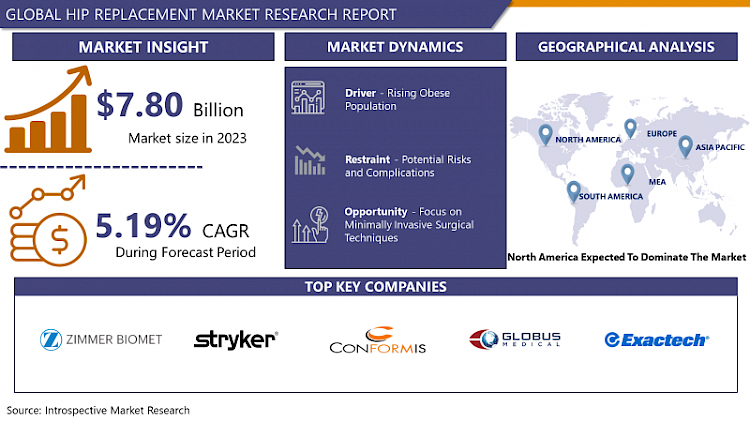

Global Hip Replacement Market size is expected to grow from USD 7.80 Billion in 2023 to USD 12.30 Billion by 2032, at a CAGR of 5.19% during the forecast period (2024-2032).

A hip replacement, also known as hip arthroplasty, is a surgical procedure where a damaged or worn-out hip joint is replaced with an artificial joint, called a prosthesis. This procedure is typically done to relieve pain and improve mobility in individuals with severe hip arthritis or other conditions that cause significant hip joint damage.

- Hip replacement, referred to medically as total hip arthroplasty, is a surgical intervention designed to reduce pain and improve movement for individuals experiencing significant hip joint damage or conditions like osteoarthritis. This operation entails extracting the impaired or diseased segments of the hip joint, such as the femoral head and the affected socket, and substituting them with synthetic components crafted from metal, plastic, or ceramic materials.

- Hip replacement surgery serves as a solution for a range of conditions leading to hip joint deterioration, such as arthritis, fractures, avascular necrosis, and other musculoskeletal disorders. It is usually contemplated when conservative treatments like medication, physical therapy, or lifestyle adjustments prove ineffective in alleviating discomfort or enhancing mobility.

- Hip replacement offers a multitude of benefits. Most notably, it effectively diminishes persistent pain, thereby improving the patient's quality of life through the restoration of mobility and function. Furthermore, advancements in surgical methods and materials have bolstered the resilience and lifespan of artificial hip joints, leading to better long-term results and decreased instances of additional surgeries. Following the procedure, individuals commonly encounter heightened joint stability and expanded range of motion, enabling a seamless transition back to daily routines and a more active way of life.

Global Hip Replacement Market Trend Analysis:

Rising Geriatric Population

- The global market for hip replacement has experienced significant influence from the increasing elderly population across the globe. As demographics undergo a shift, the aging demographic becomes more prone to degenerative joint conditions, particularly osteoarthritis, which stands as a primary cause of hip joint degradation. This demographic shift has led to a substantial surge in hip replacement surgery requests.

- Elderly individuals commonly face hip joint wear and tear over time, resulting in diminished mobility and persistent discomfort. This has consequently generated a heightened necessity for hip replacement procedures to alleviate pain and reinstate functional abilities within this specific age group. With a larger portion of the population entering old age, instances of hip-related conditions have escalated, consequently driving the global demand for hip replacement surgeries.

- Moreover, advancements in healthcare technologies, materials used in implants, and surgical methodologies have played a role in encouraging the adoption of hip replacement surgeries among the elderly. The ongoing enhancements in implant durability, along with improved surgical precision and faster recovery periods, have made this procedure more attractive to older individuals seeking an improved standard of living and increased mobility. As the elderly population continues to grow, the demand for hip replacement surgeries is anticipated to sustain its upward trajectory in the global market.

Growing Demand for Outpatient Surgery

- The increasing preference for outpatient surgery, particularly in the realm of hip replacement operations, stands as a significant opportunity within the global hip replacement market. This trend primarily stems from concerted efforts within healthcare systems to manage expenses while upholding superior patient care standards. Outpatient hip replacements, conducted in ambulatory surgery centers or outpatient facilities, present distinct advantages compared to traditional inpatient surgeries, thereby creating favorable prospects within the market.

- The focus on reducing healthcare costs has spurred the development and enhancement of outpatient hip replacement methods. Contrasted with inpatient procedures, outpatient surgeries often lead to shorter hospital stays or, in many instances, discharge on the same day. This streamlined approach not only diminishes healthcare expenses associated with prolonged hospitalization but also lessens the overall financial burden on healthcare systems.

- Furthermore, outpatient hip replacements benefit from advancements in minimally invasive surgical techniques, anaesthesia protocols, and postoperative care strategies. These innovations contribute to swifter recovery periods, reduced risks of complications, and heightened levels of patient satisfaction.

- The shift toward outpatient procedures aligns with patient preferences for convenience and faster rehabilitation, further bolstering the market's potential for growth. As healthcare systems persist in prioritizing cost-effective solutions without compromising patient outcomes, the adoption of outpatient hip replacement procedures is expected to offer significant opportunities for expansion within the global hip replacement market.

Global Hip Replacement Market Segment Analysis:

By Type, Total Hip Replacement is the dominant segment in Global Hip Replacement Market

- The total hip replacement has indeed been a significant segment within the global hip replacement market. This procedure involves replacing a damaged or diseased hip joint with an artificial joint or implant. Total hip replacement surgery is commonly performed to relieve pain and improve function in individuals suffering from conditions like osteoarthritis, rheumatoid arthritis, fractures, or other hip-related issues.

- The demand for total hip replacement surgeries is rising due to several factors. Primarily, there's an increase in hip-related conditions owing to aging populations, sedentary lifestyles, obesity, and sports injuries. Furthermore, continuous advancements in implant materials, surgical techniques, and prosthetic designs have improved the success rates of hip replacements, attracting patients and surgeons. Additionally, greater awareness among patients about the benefits of hip replacement, such as pain relief and improved mobility, has increased acceptance of this surgical procedure.

- Moreover, the surge in healthcare spending and favorable reimbursement policies in many regions have enhanced patient access to these surgeries, further driving market growth.

Global Hip Replacement Market Regional Insights:

North America Region Dominate the Market

- North America remained a dominant force in the global hip replacement market, representing a significant share. The region's prominence was attributed to several factors, including a robust healthcare infrastructure, technological advancements, a rising geriatric population, and high healthcare expenditure.

- The United States and Canada boasted advanced medical facilities and a higher acceptance rate of innovative medical technologies. Moreover, an aging population in these countries increased the prevalence of hip-related ailments, thereby driving the demand for hip replacement surgeries. Accessibility to specialized healthcare services and favorable reimbursement policies also contributed to the region's market dominance.

- The ongoing research and development initiatives, coupled with the presence of key market players and collaborations between medical institutions and manufacturers, continued to propel the growth of hip replacement technologies in North America.

- The landscape might have evolved since then, potentially influenced by emerging trends such as the increased adoption of outpatient procedures, advancements in implant materials and surgical techniques, and a continued focus on cost-effectiveness in healthcare delivery. These factors could further impact the distribution of market shares among regions, potentially altering the dominance of North America in the global hip replacement market.

Global Hip Replacement Market Key Players:

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Exactech, Inc. (U.S.)

- Conformis (U.S.)

- Globus Medical, Inc. (U.S)

- ConforMIS Inc. (U.S)

- Integra LifeSciences (U.S)

- Smith & Nephew (U.K.)

- Corin Group PLC (U.K)

- GRUPPO BIOIMPIANTI s.r.l. (Italy)

- B. Braun Melsungen AG (Germany)

- Merete GmbH (Germany)

- Medacta International (Switzerland)

- MicroPort Scientific Corporation (China)

- Kyocera Corporation (Japan), and Other Major Players

Key Industry Developments in the Global Hip Replacement Market:

- In February 2024, Zimmer Biomet Holdings, Inc. announced U.S. Food and Drug Administration (FDA) 510(k) clearance of the ROSA Shoulder System for robotic-assisted shoulder replacement surgery. ROSA Shoulder is the world's first robotic surgery system for shoulder replacement, and the fourth application for the Company's comprehensive ROSA® Robotics portfolio, which includes the ROSA® Knee System for total knee arthroplasty and ROSA® Hip System for total hip replacement.

- In August 2023, Smith+Nephew announced the launch of its OR3O Dual Mobility System for use in primary and revision hip arthroplasty in India. Compared with traditional solutions, dual mobility implants have a small diameter femoral head that locks into a larger polyethylene insert - increasing stability, reducing dislocation risk, and offering improved range of motion.

|

Global Hip Replacement Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 7.80 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.19 % |

Market Size in 2032: |

USD 12.30 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Implant Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HIP REPLACEMENT MARKET BY TYPE (2016-2030)

- HIP REPLACEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TOTAL HIP REPLACEMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PARTIAL HIP REPLACEMENT

- HIP RESURFACING

- REVISION HIP REPLACEMENT

- HIP REPLACEMENT MARKET BY IMPLANT TYPE (2016-2030)

- HIP REPLACEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- METAL ON METAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- METAL ON POLYETHYLENE

- CERAMIC ON METAL

- OTHERS

- HIP REPLACEMENT MARKET BY END-USERS (2016-2030)

- HIP REPLACEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS & SURGERY CENTERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ORTHOPAEDIC CLINICS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- HIP REPLACEMENT Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ZIMMER BIOMET (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- STRYKER (U.S.)

- EXACTECH, INC. (U.S.)

- CONFORMIS (U.S.)

- GLOBUS MEDICAL, INC. (U.S)

- CONFORMIS INC. (U.S)

- INTEGRA LIFESCIENCES (U.S)

- SMITH & NEPHEW (U.K.)

- CORIN GROUP PLC (U.K)

- GRUPPO BIOIMPIANTI S.R.L. (ITALY)

- B. BRAUN MELSUNGEN AG (GERMANY)

- MERETE GMBH (GERMANY)

- MEDACTA INTERNATIONAL (SWITZERLAND)

- MICROPORT SCIENTIFIC CORPORATION (CHINA)

- KYOCERA CORPORATION (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL HIP REPLACEMENT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By IMPLANT TYPE

- Historic And Forecasted Market Size By End-Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Hip Replacement Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 7.80 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.19 % |

Market Size in 2032: |

USD 12.30 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Implant Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HIP REPLACEMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HIP REPLACEMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HIP REPLACEMENT MARKET COMPETITIVE RIVALRY

TABLE 005. HIP REPLACEMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. HIP REPLACEMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. HIP REPLACEMENT MARKET BY TYPE

TABLE 008. TOTAL HIP REPLACEMENT MARKET OVERVIEW (2016-2028)

TABLE 009. PARTIAL HIP REPLACEMENT MARKET OVERVIEW (2016-2028)

TABLE 010. HIP RESURFACING MARKET OVERVIEW (2016-2028)

TABLE 011. REVISION HIP REPLACEMENT MARKET OVERVIEW (2016-2028)

TABLE 012. HIP REPLACEMENT MARKET BY IMPLANT TYPE

TABLE 013. METAL ON METAL MARKET OVERVIEW (2016-2028)

TABLE 014. METAL ON POLYETHYLENE MARKET OVERVIEW (2016-2028)

TABLE 015. CERAMIC ON METAL MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. HIP REPLACEMENT MARKET BY END USERS

TABLE 018. HOSPITALS & SURGERY CENTERS MARKET OVERVIEW (2016-2028)

TABLE 019. ORTHOPAEDIC CLINICS MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA HIP REPLACEMENT MARKET, BY TYPE (2016-2028)

TABLE 022. NORTH AMERICA HIP REPLACEMENT MARKET, BY IMPLANT TYPE (2016-2028)

TABLE 023. NORTH AMERICA HIP REPLACEMENT MARKET, BY END USERS (2016-2028)

TABLE 024. N HIP REPLACEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE HIP REPLACEMENT MARKET, BY TYPE (2016-2028)

TABLE 026. EUROPE HIP REPLACEMENT MARKET, BY IMPLANT TYPE (2016-2028)

TABLE 027. EUROPE HIP REPLACEMENT MARKET, BY END USERS (2016-2028)

TABLE 028. HIP REPLACEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC HIP REPLACEMENT MARKET, BY TYPE (2016-2028)

TABLE 030. ASIA PACIFIC HIP REPLACEMENT MARKET, BY IMPLANT TYPE (2016-2028)

TABLE 031. ASIA PACIFIC HIP REPLACEMENT MARKET, BY END USERS (2016-2028)

TABLE 032. HIP REPLACEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA HIP REPLACEMENT MARKET, BY TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA HIP REPLACEMENT MARKET, BY IMPLANT TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA HIP REPLACEMENT MARKET, BY END USERS (2016-2028)

TABLE 036. HIP REPLACEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA HIP REPLACEMENT MARKET, BY TYPE (2016-2028)

TABLE 038. SOUTH AMERICA HIP REPLACEMENT MARKET, BY IMPLANT TYPE (2016-2028)

TABLE 039. SOUTH AMERICA HIP REPLACEMENT MARKET, BY END USERS (2016-2028)

TABLE 040. HIP REPLACEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 041. CONMED CORPORATION: SNAPSHOT

TABLE 042. CONMED CORPORATION: BUSINESS PERFORMANCE

TABLE 043. CONMED CORPORATION: PRODUCT PORTFOLIO

TABLE 044. CONMED CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. DJO LLC: SNAPSHOT

TABLE 045. DJO LLC: BUSINESS PERFORMANCE

TABLE 046. DJO LLC: PRODUCT PORTFOLIO

TABLE 047. DJO LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. B. BRAUN MELSUNGEN AG: SNAPSHOT

TABLE 048. B. BRAUN MELSUNGEN AG: BUSINESS PERFORMANCE

TABLE 049. B. BRAUN MELSUNGEN AG: PRODUCT PORTFOLIO

TABLE 050. B. BRAUN MELSUNGEN AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. OMNILIFE SCIENCE INC.: SNAPSHOT

TABLE 051. OMNILIFE SCIENCE INC.: BUSINESS PERFORMANCE

TABLE 052. OMNILIFE SCIENCE INC.: PRODUCT PORTFOLIO

TABLE 053. OMNILIFE SCIENCE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. EXACTECH INC.: SNAPSHOT

TABLE 054. EXACTECH INC.: BUSINESS PERFORMANCE

TABLE 055. EXACTECH INC.: PRODUCT PORTFOLIO

TABLE 056. EXACTECH INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. MICROPORT SCIENTIFIC CORPORATION: SNAPSHOT

TABLE 057. MICROPORT SCIENTIFIC CORPORATION: BUSINESS PERFORMANCE

TABLE 058. MICROPORT SCIENTIFIC CORPORATION: PRODUCT PORTFOLIO

TABLE 059. MICROPORT SCIENTIFIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. SMITH & NEPHEW PLC: SNAPSHOT

TABLE 060. SMITH & NEPHEW PLC: BUSINESS PERFORMANCE

TABLE 061. SMITH & NEPHEW PLC: PRODUCT PORTFOLIO

TABLE 062. SMITH & NEPHEW PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. STRYKER CORPORATION: SNAPSHOT

TABLE 063. STRYKER CORPORATION: BUSINESS PERFORMANCE

TABLE 064. STRYKER CORPORATION: PRODUCT PORTFOLIO

TABLE 065. STRYKER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. JOHNSON & JOHNSON: SNAPSHOT

TABLE 066. JOHNSON & JOHNSON: BUSINESS PERFORMANCE

TABLE 067. JOHNSON & JOHNSON: PRODUCT PORTFOLIO

TABLE 068. JOHNSON & JOHNSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ZIMMER BIOMET: SNAPSHOT

TABLE 069. ZIMMER BIOMET: BUSINESS PERFORMANCE

TABLE 070. ZIMMER BIOMET: PRODUCT PORTFOLIO

TABLE 071. ZIMMER BIOMET: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. MEDACTA INTERNATIONAL: SNAPSHOT

TABLE 072. MEDACTA INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 073. MEDACTA INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 074. MEDACTA INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 075. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 076. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 077. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HIP REPLACEMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HIP REPLACEMENT MARKET OVERVIEW BY TYPE

FIGURE 012. TOTAL HIP REPLACEMENT MARKET OVERVIEW (2016-2028)

FIGURE 013. PARTIAL HIP REPLACEMENT MARKET OVERVIEW (2016-2028)

FIGURE 014. HIP RESURFACING MARKET OVERVIEW (2016-2028)

FIGURE 015. REVISION HIP REPLACEMENT MARKET OVERVIEW (2016-2028)

FIGURE 016. HIP REPLACEMENT MARKET OVERVIEW BY IMPLANT TYPE

FIGURE 017. METAL ON METAL MARKET OVERVIEW (2016-2028)

FIGURE 018. METAL ON POLYETHYLENE MARKET OVERVIEW (2016-2028)

FIGURE 019. CERAMIC ON METAL MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. HIP REPLACEMENT MARKET OVERVIEW BY END USERS

FIGURE 022. HOSPITALS & SURGERY CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 023. ORTHOPAEDIC CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA HIP REPLACEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE HIP REPLACEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC HIP REPLACEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA HIP REPLACEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA HIP REPLACEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Global Hip Replacement Market research report is 2024-2032.

Zimmer Biomet, Stryker, Exactech, Inc., Conformis, Globus Medical, Inc. and Other Major Players.

The Hip Replacement Market is segmented into Type, Implant Type, End-Users, and Region. By Type, the market is categorized into Total Hip Replacement, Partial Hip Replacement, Hip Resurfacing, Revision Hip Replacement. By Implant Type, the market is categorized into Metal on Metal, Metal on Polyethylene, Ceramic on Metal, Others. By End-Users, the market is categorized into Hospitals & Surgery Centers, Orthopaedic Clinics, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Hip replacement, medically known as total hip arthroplasty, is a surgical procedure involving the removal of a damaged or diseased hip joint and replacing it with an artificial joint or prosthesis. This procedure aims to relieve pain, improve mobility, and restore function in the hip joint affected by conditions like arthritis, fractures, or other degenerative diseases.

Global Hip Replacement Market size is expected to grow from USD 7.80 Billion in 2023 to USD 12.30 Billion by 2032, at a CAGR of 5.19% during the forecast period (2024-2032).