Precision Parts Market Synopsis

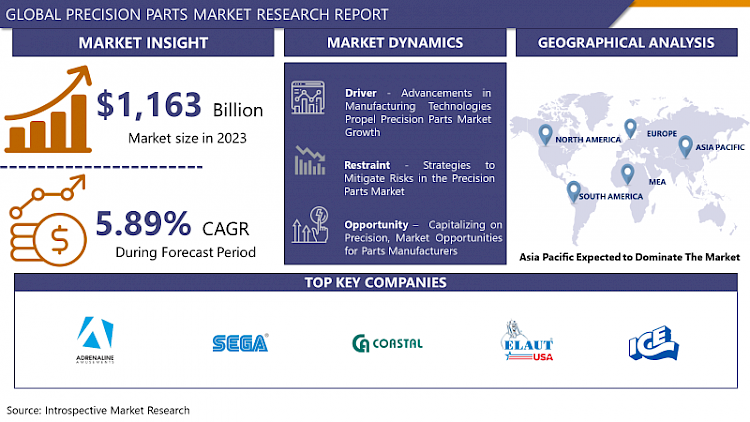

Precision Parts Market Size is Valued at USD 1163.91 Million in 2023, and is Projected to Reach USD 2407.5 Billion by 2032, Growing at a CAGR of 8.41% From 2024-2032.

Mass production implies the use of components that have precise dimensions and usually very accurate functional performance. These parts are mostly applied in the industries where accuracy is highly required thus; in the aerospace; automobiles; electronic and medical devices industries. They are usually produced by using machining processes which are sophisticated and/or are made of high-quality materials in order to conform to the high requirements that are usually associated with this kind of products.

- Growing market need for high-quality goods: For executing and ensuring the high-quality performance of their products, some industries, such as aerospace, automotive, electronics, and healthcare, require accurate parts.

- Technological developments: This is due to advances in other manufacturing technologies such as automation, 3D printing, and CNC machining for producing more complex and precise components.

- Growing emphasis on miniaturization: There is an increasing demand for accurate parts owing to the fact that products are now becoming smaller and more compact while still retaining their operation efficiency in confined spaces.

- Growing need for customized components: With the increased number of customers who have specific needs the market is growing with exact parts that would be able to fit a specific requirement.

- Tight quality criteria: This is the demand for precision parts that have better quality demands of applications within aerospace or medical devices industries.

- Growing popularity of electric vehicles: The market continues growing due to the growing necessity for accurate parts for parts like motors, battery systems, and electronic control systems.

Global Precision Parts Market – Trend, Analysis & Forecast.

Industry 4.0: Dynamics Disrupting the Precise Parts Industry.

- Technological Advancements: In particular, the label ‘Industry 4. 0 rises there is a growing demand for high accurate components that complement advanced production technologies that include 3D printing, Robots, and CNC machines. This tendency implies that more intricate and accurate pieces are developed.

- Personalization & Customization: Customers need more and more parts that are customized to meet their demands and specifications. This tendency is forcing producers to invest in qualities that are affordable to produce and that are characterized by production flexibility – a quality that can efficiently manufacture a variety of customer-tailored parts.

- Emphasis on Quality and Reliability: In fields such as aerospace, automotive, and medical devices, among others, the importance and impact of quality and the reliability of accurate parts are increasing. Manufacturers are therefore burning their pockets with purchase of such certifications and quality control measures to meet these strict regulations.

- Supply Chain Optimization: Companies are focusing on streamlining the supply chain as an approach to reduce costs and time required to move materials and products. This trend is driving the adoption of technologies such as digital twin simulations for increased visibility into operations; advanced inventory optimization algorithms; and predictive maintenance.

- Sustainable Practices: What is more important for the market for precision parts is that the manufacturing sector today is paying much more attention to the sustainability issues. Environment-friendly practices like recycling, saving energy, and the use of raw materials that do not harm the environment are some of the changes seen in manufacturers.

- Globalization: The world wide market for the precision parts is increasing because of the fact that the businesses are importing substitutes and component from any part of the world. This is necessitating the demand for proper supply chain management and logistics systems.

- Digitalization: Technological advancements such as big data analytics, artificial intelligence, and the internet of things are transforming the precision components industry. These are technologies that are helping manufacturers enhance productions shift improvement and quality.

Industry 4. 0 in Precision Parts – Reimagining Manufacturing with IIoT and AI.

- Advanced Manufacturing Techniques: accuracy, rapidness, and productivity may be raised, especially if the items produced are of high accuracy, with the help of contemporary manufacturing processes including 3-D printing, computer numerically controlled (CNC) machining, and automating the manufacturing procedure.

- Materials Innovation: The development of new materials with enhanced properties such as strength, stiffness, and resistance to fatigue and corrosion can potentially generate new markets and specific applications for precision components.

- Industry 4. 0 Integration: Industry 4.0 Technology Integration in Precision Parts Organizations technologies including IoT, AI & Data analytics may help improve manufacturing processes, reduce downtime and manage inventory.

- Personalization and Customization: Offering quality parts with additional options for individualization and more specific solutions to fulfill certain client’s requests may become one of the key distinguishing factors and serve as the primary factor of increasing client’s loyalty.

- Extension into Developing Markets: Exploring opportunities in emerging economies in which the demand for Precision parts is increasing due to expansion of the industries such as electronic, Automotive, and Aerospace.

- Collaborations and Partnerships: Strategic management can be achieved by collaborating with other businesses, universities, and information systems vendors to identify new solutions and markets.

- Aftermarket Services: Post-sale services like some accurate part support and repair as well as renovation are exceptional techniques for growing revenue or enhancing client service.

- Emphasis on Sustainability: A competitive advantage and the potential for attracting environmentally conscious customers are possible through the introduction of sustainable manufacturing principles and the use of environmentally friendly raw materials.

Precision Parts Market Segment Analysis: Precision Parts Market Segment Analysis:

Global precision Parts market is Segmented into type of precision parts, and applications.

By Type, the Metal segment will lead the market during the forecast period.

- Based on the materials used, precision parts can be broadly divided into two categories: metal and plastic Consequently, it has been found that the materials that are available include metal and plastic.

- Precision metal parts are identifiable for their sturdiness, high temperatures resistance, and durability. They are often employed in industries requiring high-performance such as manufacturing, automobile and aeronautics. Metals such as titanium, steel, and aluminium are commonly used to create precision parts because of the mechanical properties as well as the ability to withstand extreme conditions.

- While the precise benefits of precision plastic parts include light weight, resistance to corrosion and design freedom. They are often employed in industries which demand for more complex shapes of lighter components such as electronics, consumer products and medical technology industries. Plastics such as nylons, ABS, and polycarbonates are commonly used to manufacture precision parts for their low costs and the relative ease by which plastics can be molded.

- Plastic or metal precision parts are crucial for a lot of industries because they are factors of innovation and technological advancement.

Based on the type of application, the Automotive segment captured the highest market share in 2023

- Many applications such as the electronics, auto and aeronautical industries rely on precision parts.

- This is because the precision parts are very crucial in the aerospace industry because with the help of these parts the aircrafts can perform efficiently and are safe. These parts are used in critical areas such as flight control systems and avionics, landing gear, and engines. High quality control and precision machining are very important when it comes to aerospace applications since high safety and reliability standards are expected.

- Precision parts employed in automotive industry include parts of engines and gear boxes, as well as brake systems and chassis. These components are crucial in preventing the deterioration of the efficacy, functionality, or security of automobiles. Automotive industry requires precise parts that are stronger, lighter in weight, and capable of withstanding challenging conditions in which they operate.

- The electronics industry also used precision parts to produce such gadgets as computers, smart phones, and medical equipment. These components are required to ensure stipulated performance and/or operation of electronic equipment. In the electronics segment, efficient machining and assembly techniques play an important role in ensuring that the technological expectations of today’s electronic products in terms of performance and size reduction are met.

- Taking all of this into consideration, it is easy to note that precision parts are crucial to the field of electronics, automobiles, and aeronautical engineering, as well as to the development of modern technology connected with these industries.

Precision Parts Market Regional Insights: Precision Parts Market Regional Insights:

The Market is Likely to be Led by North America During the Forecast Period.

- Technological Developments: Currently, there has been great development of the manufacturing technologies used in the industry for production of parts with improvement of part production efficiency and precision of used tools which includes the CNC machining, robots, and the additive manufacturing.

- need from End-Use Industries: The main industries where the precision parts are highly demanded include the aerospace, automotive, electronics and the medical fields. This is due to the fact that these industries require components that are of high quality because they are tailored to meet specialized needs.

- Put Quality and Compliance First: Implementation of modern manufacturing techniques and effective quality control strategies is increasingly encouraged by the strict quality requirements and controls as experienced in industries such as medical devices and aerospace.

- Growing Adoption of Automation: This is due to the fact that productivity increases, labour costs are reduced, and especially the quality control of the precision parts production is enhanced due to automation of the processes.

- Change Towards Sustainable methods: There is a lot of development in the sector That is because of the pressure for sustainable manufacturing, for example use of renewable materials and energy efficient procedures.

- Market Consolidation and M&A Activity: Drives like this one where companies seek to expand their products and markets lead to the market concentration through the mergers and acquisition.

- Supply Chain Disruptions and Resilience: Because the industry has continued to face challenges in the supply chains, there is increased focus on developing the supply chains in ways that make them more responsive and agile.

Active Key Players in the Precision Parts Market

- Barnes Group (USA)

- NN Inc. (USA)

- Martinrea International (Canada)

- Linamar International (Canada)

- WM Berg (USA)

- Renishaw Group (UK)

- ARC Group Worldwide (USA)

- Beyonics (Singapore)

- Others

|

Global Precision Parts Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1163.91 Mn. |

|

Forecast Period 2023-32 CAGR: |

8.41 % |

Market Size in 2032: |

USD 2407.5 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PRECISION PARTS MARKET BY TYPE (2017-2032)

- PRECISION PARTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- METAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PLASTIC

- PRECISION PARTS MARKET BY APPLICATION (2017-2032)

- PRECISION PARTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AEROSPACE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMOTIVE

- ELECTRONICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BARNES GROUP (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- NN INC. (USA)

- MARTINREA INTERNATIONAL (CANADA)

- LINAMAR INTERNATIONAL (CANADA)

- WM BERG (USA)

- RENISHAW GROUP (UK)

- ARC GROUP WORLDWIDE (USA)

- BEYONICS (SINGAPORE)

- COMPETITIVE LANDSCAPE

- GLOBAL PRECISION PARTS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Precision Parts Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1163.91 Mn. |

|

Forecast Period 2023-32 CAGR: |

8.41 % |

Market Size in 2032: |

USD 2407.5 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PRECISION PARTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PRECISION PARTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PRECISION PARTS MARKET COMPETITIVE RIVALRY

TABLE 005. PRECISION PARTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. PRECISION PARTS MARKET THREAT OF SUBSTITUTES

TABLE 007. PRECISION PARTS MARKET BY TYPE

TABLE 008. METAL MARKET OVERVIEW (2016-2028)

TABLE 009. PLASTIC MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. PRECISION PARTS MARKET BY APPLICATION

TABLE 012. AEROSPACE MARKET OVERVIEW (2016-2028)

TABLE 013. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 014. ELECTRONICS MARKET OVERVIEW (2016-2028)

TABLE 015. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 016. WATCHES MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA PRECISION PARTS MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA PRECISION PARTS MARKET, BY APPLICATION (2016-2028)

TABLE 020. N PRECISION PARTS MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE PRECISION PARTS MARKET, BY TYPE (2016-2028)

TABLE 022. EUROPE PRECISION PARTS MARKET, BY APPLICATION (2016-2028)

TABLE 023. PRECISION PARTS MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC PRECISION PARTS MARKET, BY TYPE (2016-2028)

TABLE 025. ASIA PACIFIC PRECISION PARTS MARKET, BY APPLICATION (2016-2028)

TABLE 026. PRECISION PARTS MARKET, BY COUNTRY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA PRECISION PARTS MARKET, BY TYPE (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA PRECISION PARTS MARKET, BY APPLICATION (2016-2028)

TABLE 029. PRECISION PARTS MARKET, BY COUNTRY (2016-2028)

TABLE 030. SOUTH AMERICA PRECISION PARTS MARKET, BY TYPE (2016-2028)

TABLE 031. SOUTH AMERICA PRECISION PARTS MARKET, BY APPLICATION (2016-2028)

TABLE 032. PRECISION PARTS MARKET, BY COUNTRY (2016-2028)

TABLE 033. BARNES GROUP: SNAPSHOT

TABLE 034. BARNES GROUP: BUSINESS PERFORMANCE

TABLE 035. BARNES GROUP: PRODUCT PORTFOLIO

TABLE 036. BARNES GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. ARC GROUP WORLDWIDE: SNAPSHOT

TABLE 037. ARC GROUP WORLDWIDE: BUSINESS PERFORMANCE

TABLE 038. ARC GROUP WORLDWIDE: PRODUCT PORTFOLIO

TABLE 039. ARC GROUP WORLDWIDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. MARTINREA INTERNATIONAL: SNAPSHOT

TABLE 040. MARTINREA INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 041. MARTINREA INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 042. MARTINREA INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. NN INC.: SNAPSHOT

TABLE 043. NN INC.: BUSINESS PERFORMANCE

TABLE 044. NN INC.: PRODUCT PORTFOLIO

TABLE 045. NN INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. RENISHAW GROUP: SNAPSHOT

TABLE 046. RENISHAW GROUP: BUSINESS PERFORMANCE

TABLE 047. RENISHAW GROUP: PRODUCT PORTFOLIO

TABLE 048. RENISHAW GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ARMOR MECA: SNAPSHOT

TABLE 049. ARMOR MECA: BUSINESS PERFORMANCE

TABLE 050. ARMOR MECA: PRODUCT PORTFOLIO

TABLE 051. ARMOR MECA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. GUDEL: SNAPSHOT

TABLE 052. GUDEL: BUSINESS PERFORMANCE

TABLE 053. GUDEL: PRODUCT PORTFOLIO

TABLE 054. GUDEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. W M BERG: SNAPSHOT

TABLE 055. W M BERG: BUSINESS PERFORMANCE

TABLE 056. W M BERG: PRODUCT PORTFOLIO

TABLE 057. W M BERG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. LINAMAR INTERNATIONAL: SNAPSHOT

TABLE 058. LINAMAR INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 059. LINAMAR INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 060. LINAMAR INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. AEQUS: SNAPSHOT

TABLE 061. AEQUS: BUSINESS PERFORMANCE

TABLE 062. AEQUS: PRODUCT PORTFOLIO

TABLE 063. AEQUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. TESSA PRECISION PRODUCTS: SNAPSHOT

TABLE 064. TESSA PRECISION PRODUCTS: BUSINESS PERFORMANCE

TABLE 065. TESSA PRECISION PRODUCTS: PRODUCT PORTFOLIO

TABLE 066. TESSA PRECISION PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. BONFIGLIOLIRIDUTTORI: SNAPSHOT

TABLE 067. BONFIGLIOLIRIDUTTORI: BUSINESS PERFORMANCE

TABLE 068. BONFIGLIOLIRIDUTTORI: PRODUCT PORTFOLIO

TABLE 069. BONFIGLIOLIRIDUTTORI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. HOPPE TECHNOLOGIES: SNAPSHOT

TABLE 070. HOPPE TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 071. HOPPE TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 072. HOPPE TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. GREYSTONE: SNAPSHOT

TABLE 073. GREYSTONE: BUSINESS PERFORMANCE

TABLE 074. GREYSTONE: PRODUCT PORTFOLIO

TABLE 075. GREYSTONE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. WSI INDUSTRIES: SNAPSHOT

TABLE 076. WSI INDUSTRIES: BUSINESS PERFORMANCE

TABLE 077. WSI INDUSTRIES: PRODUCT PORTFOLIO

TABLE 078. WSI INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. SIGMA COMPONENTS: SNAPSHOT

TABLE 079. SIGMA COMPONENTS: BUSINESS PERFORMANCE

TABLE 080. SIGMA COMPONENTS: PRODUCT PORTFOLIO

TABLE 081. SIGMA COMPONENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. MECACHROME GROUP: SNAPSHOT

TABLE 082. MECACHROME GROUP: BUSINESS PERFORMANCE

TABLE 083. MECACHROME GROUP: PRODUCT PORTFOLIO

TABLE 084. MECACHROME GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. DANA BREVINI POWER TRANSMISSION: SNAPSHOT

TABLE 085. DANA BREVINI POWER TRANSMISSION: BUSINESS PERFORMANCE

TABLE 086. DANA BREVINI POWER TRANSMISSION: PRODUCT PORTFOLIO

TABLE 087. DANA BREVINI POWER TRANSMISSION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. BEYONICS: SNAPSHOT

TABLE 088. BEYONICS: BUSINESS PERFORMANCE

TABLE 089. BEYONICS: PRODUCT PORTFOLIO

TABLE 090. BEYONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. PRECISION CASTPARTS CORP (PCC): SNAPSHOT

TABLE 091. PRECISION CASTPARTS CORP (PCC): BUSINESS PERFORMANCE

TABLE 092. PRECISION CASTPARTS CORP (PCC): PRODUCT PORTFOLIO

TABLE 093. PRECISION CASTPARTS CORP (PCC): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PRECISION PARTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PRECISION PARTS MARKET OVERVIEW BY TYPE

FIGURE 012. METAL MARKET OVERVIEW (2016-2028)

FIGURE 013. PLASTIC MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. PRECISION PARTS MARKET OVERVIEW BY APPLICATION

FIGURE 016. AEROSPACE MARKET OVERVIEW (2016-2028)

FIGURE 017. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 018. ELECTRONICS MARKET OVERVIEW (2016-2028)

FIGURE 019. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 020. WATCHES MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA PRECISION PARTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE PRECISION PARTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC PRECISION PARTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA PRECISION PARTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA PRECISION PARTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Precision Parts Market research report is 2024-2032.

Barnes Group (USA), NN Inc. (USA), Martinrea International (Canada), Linamar International (Canada), WM Berg (USA), Renishaw Group (UK), ARC Group Worldwide (USA), Beyonics (Singapore), and Other Major Players.

The Precision Parts Market is segmented by Type (Metal, Plastic), Application (Aerospace, Automotive, Electronics),. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Precision parts are components manufactured to extremely tight tolerances, ensuring high accuracy and consistency in their dimensions and performance. These parts are often used in industries where precision is critical, such as aerospace, automotive, electronics, and medical devices. They are typically made using advanced machining techniques and high-quality materials to meet exacting standards.

Precision Parts Market Size is Valued at USD 1261.8 Million in 2024, and is Projected to Reach USD 2407.5 Billion by 2032, Growing at a CAGR of 8.41% From 2024-2032