Booster Compressor Market Synopsis

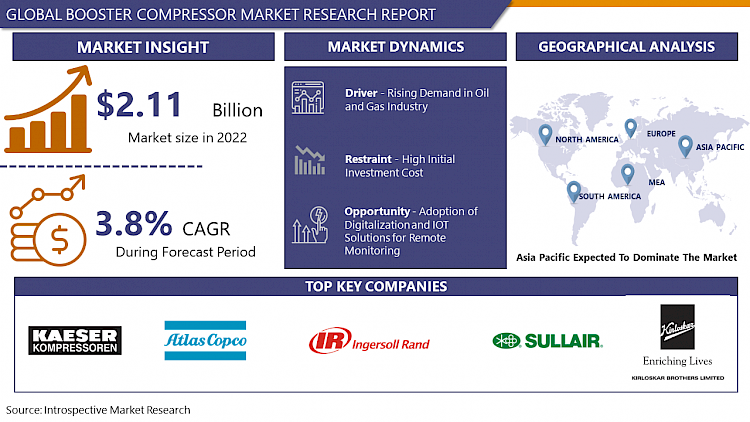

Booster Compressor Market Size Was Valued at USD 2.11 Billion in 2022, and is Projected to Reach USD 2.84 Billion by 2030, Growing at a CAGR of 3.8% From 2023-2030.

A booster compressor is a machine that increases the pressure of an existing compressor by approximately three to five times the regular pressure produced. A booster compressor, also known as a plunger or piston compressor, is a type of compressor using a plunger or piston.

- The booster compressor is used in industries to maintain high pressures for brief periods. Pneumatic booster compressors make up many booster compressors. Some industrial applications necessitate high pressure and power, which can be difficult to achieve with standard compressors. In such cases, a booster compressor is used to enhance the operation's pressure. A booster compressor may produce pressures of 400 to 600 pounds per square inch. Some sectors can enhance pressure using traditional methods, but they cannot maintain the pressure for lengthy periods, or the process is inconvenient.

- The increase in pressure necessitates additional labor to power up the machinery, and the entire operation is inefficient. The booster compressor aids in the maintenance and production of increased pressure. The pressure can only be sustained for a short time and is not suitable for regular or continuous operations. The temperature of the system rises when gas or air is compressed.

Booster Compressor Market Trend Analysis

Rising Demand in Oil & Gas Industry

- The rising demand in the oil and gas industry serves as a significant driver for the booster compressor market. As the global energy demand continues to grow, particularly in emerging economies, there is an increased need for the extraction and transportation of oil and gas. Booster compressors play a crucial role in enhancing the pressure of natural gas and oil during various stages of production and transportation.

- Advancements in technology and exploration techniques have led to the discovery of remote and challenging oil and gas reserves. These reserves often require specialized equipment, including booster compressors, to overcome the challenges posed by harsh environmental conditions and long-distance transportation.

- Extraction and transportation, the increasing focus on environmental sustainability, and regulatory compliance in the oil and gas sector further drive the demand for booster compressors. Efficient compression technology can contribute to reducing greenhouse gas emissions and improving overall operational efficiency.

The global increase in oil production, as depicted in the below graph, has spurred a corresponding growth in the utilization of booster compressors. As oil extraction operations expand to meet rising demand, the need for efficient compression systems becomes imperative. Booster compressors play a crucial role in enhancing the pressure of extracted gases and facilitating the transportation and processing of oil and gas products. This surge in oil production worldwide underscores the vital role booster compressors play in optimizing extraction processes, ensuring operational efficiency, and meeting the escalating demands of the ever-expanding energy market.

Adoption of Digitalization and IOT Solutions for Remote Monitoring

- The booster compressor market is witnessing a substantial opportunity with the growing adoption of digitalization and Internet of Things (IoT) solutions for remote monitoring in the oil and gas industry. Digitalization has become a transformative force, allowing operators to optimize their operations, enhance efficiency, and minimize downtime.

- The implementation of IoT solutions in the booster compressor market offers remote monitoring capabilities that enable operators to access critical operational data from anywhere in the world. This is particularly valuable in the context of oil and gas operations that often involve remote and challenging environments.

- Digitalization of booster compressors aligns with broader industry trends toward smart and interconnected systems. The ability to integrate booster compressors into larger digital ecosystems allows for comprehensive data analysis and optimization of entire oil and gas production processes.

Booster Compressor Market Segment Analysis:

Booster Compressor Market Segmented based on Cooling Type, Compression Stage, Power Source, and end-users.

By Cooling Type, Water-cooled segment is expected to dominate the market during the forecast period

- Water-cooled systems are known for their superior heat dissipation capabilities compared to air-cooled alternatives. In industrial applications, particularly in the oil and gas sector where booster compressors are extensively employed, effective heat dissipation is critical to maintaining optimal operating temperatures. Water-cooled systems excel in efficiently removing heat generated during compression processes, ensuring the equipment operates within safe temperature ranges and mitigating the risk of overheating-related issues.

- The water-cooled booster compressors are often favored for their suitability in high-capacity and continuous-duty applications. The cooling efficiency of water-cooled systems allows for sustained and reliable performance even under heavy workloads. Industries such as petrochemicals, refining, and natural gas processing, where large volumes of gas need to be compressed consistently, find water-cooled booster compressors to be a reliable choice. The dominance of the water-cooled segment underscores the importance of efficient heat management in industrial settings, driving its preference in applications where reliability and performance are paramount.

By End-Users, Oil and gas segment held the largest share of 37.76% in 2022.

- The substantial dominance of the oil and gas segment in the booster compressor market can be attributed to the indispensable role these compressors play in various stages of the oil and gas value chain. In the exploration and extraction phase, booster compressors are crucial for maintaining optimal wellhead pressure, ensuring efficient and continuous extraction of hydrocarbons. Furthermore, during the transportation of oil and gas through pipelines, booster compressors are essential for overcoming pressure drops and maintaining the flow of these valuable resources over long distances.

- The global energy demand continues to rise, the oil and gas sector is under constant pressure to enhance production efficiency. Booster compressors facilitate the compression of gases in these energy-intensive processes, contributing to the overall efficiency and productivity of oil and gas operations. Additionally, booster compressors in the oil and gas segment often operate in harsh and remote environments, and their robust design and performance make them well-suited for these challenging conditions.

Booster Compressor Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific (APAC) region, comprising nations like China, India, Japan, and South Korea, stands as a powerhouse in the booster compressor market. The exponential growth in industrialization and infrastructure development in these countries has fueled an unprecedented demand for compressed air across various sectors. The booming manufacturing sector, coupled with expanding construction activities and increasing urbanization and disposable incomes, collectively propels the need for booster compressors to power essential industrial processes and tools.

- Government initiatives promoting clean energy and efficiency further drive the adoption of booster compressors in APAC. These countries are actively investing in renewable energy sources, creating a substantial market for booster compressors in applications such as wind and solar power generation. The region's strategic economic importance, driven by its position as a manufacturing hub and major contributor to the global supply chain, solidifies its dominance in the booster compressor market. Overall, the Asia-Pacific region emerges as a key player, showcasing sustained demand and growth prospects for booster compressors across diverse industries.

Booster Compressor Market Top Key Players:

- Gardner Denver (US)

- Ingersoll Rand (US)

- Kaeser Compressors (US)

- Sullair (US)

- Atlas Copco(Sweden)

- Kaeser Kompressoren (Germany)

- Boge Kompressoren (Germany)

- Almig Kompressoren (Germany)

- CompAir (UK)

- Ingersoll Rand (Ireland)

- Fusheng (China)

- Qinhuangdao Yongjie Compressor (China)

- Shanghai Lingke Compressor (China)

- Shenyang Yuanda Compressor (China)

- Hitachi (Japan)

- Mitsui Seiki (Japan)

- Kobe Steel (Japan)

- Elgi Equipments (India)

- Kirloskar Brothers (India)

- Hwang Sung Machinery (South Korea)

- Samhwa Industrial (South Korea)

- Taiwan Air Compressor (Taiwan)

- Tung Yu Compressor (Taiwan)

Key Industry Developments in the Booster Compressor Market:

- In May 2023 Atlas Copco has taken a significant step in its commitment to sustainability with the introduction of the B-Air 185-12, a ground-breaking battery-powered portable screw air compressor. This innovative product marks a noteworthy milestone in Atlas Copco's global industrial offerings and signifies the company's dedication to a more sustainable future. Maarten Vermeiren, the Product Marketing Manager of Sustainability and Digitalization at Atlas Copco's Portable Air Division, emphasizes the company's role in driving the transition from carbon dependency to renewable energy sources. The B-Air 185-12 exemplifies Atlas Copco's commitment to fostering a sustainable transformation for the benefit of both society and the planet.

- In November 2022 Sullair Introduced the "Sullair Advantage" initiative, our program is designed to offer customers a host of advantages, encompassing extended warranties and prioritized service. This strategic program aims to enhance the overall customer experience, providing added value and assurance. Through the "Sullair Advantage," we are dedicated to fostering lasting partnerships with our customers by delivering exceptional benefits, ensuring peace of mind and priority support.

|

Global Booster Compressor Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.11 Bn. |

|

|

CAGR (2023-2030): |

3.8% |

Market Size in 2030: |

USD 2.84 Bn. |

|

|

Segments Covered: |

By Cooling Type |

|

|

|

|

By Compression Stage |

|

|

||

|

By Pressure |

|

|

||

|

By Power Source |

|

|

||

|

By End Users |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BOOSTER COMPRESSOR MARKET BY COOLING TYPE (2016-2030)

- BOOSTER COMPRESSOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AIR-COOLED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WATER-COOLED

- BOOSTER COMPRESSOR MARKET BY COMPRESSION STAGE (2016-2030)

- BOOSTER COMPRESSOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SINGLE STAGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DOUBLE-STAGE

- MULTISTAGE

- BOOSTER COMPRESSOR MARKET BY PRESSURE (2016-2030)

- BOOSTER COMPRESSOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- 14–40 BAR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 41–100 BAR

- 101–350 BAR

- ABOVE 351 BAR

- BOOSTER COMPRESSOR MARKET BY POWER SOURCE (2016-2030)

- BOOSTER COMPRESSOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ELECTRIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMBUSTION ENGINE

- BOOSTER COMPRESSOR MARKET BY END USERS (2016-2030)

- BOOSTER COMPRESSOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- OIL & GAS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PROCESS INDUSTRY

- CHEMICAL & PETROCHEMICAL

- POWER GENERATION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BOOSTER COMPRESSOR Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- GARDNER DENVER

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- INGERSOLL RAND

- KAESER COMPRESSORS

- SULLAIR

- ATLAS COPCO

- KAESER KOMPRESSOREN

- BOGE KOMPRESSOREN

- ALMIG KOMPRESSOREN

- COMPAIR

- INGERSOLL RAND

- FUSHENG

- QINHUANGDAO YONGJIE COMPRESSOR

- SHANGHAI LINGKE COMPRESSOR

- SHENYANG YUANDA COMPRESSOR

- HITACHI

- MITSUI SEIKI

- KOBE STEEL

- ELGI EQUIPMENTS

- KIRLOSKAR BROTHERS

- HWANG SUNG MACHINERY

- SAMHWA INDUSTRIAL

- TAIWAN AIR COMPRESSOR

- TUNG YU COMPRESSOR

- COMPETITIVE LANDSCAPE

- GLOBAL BOOSTER COMPRESSOR MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By COOLING TYPE

- Historic And Forecasted Market Size By COMPRESSION STAGE

- Historic And Forecasted Market Size By PRESSURE

- Historic And Forecasted Market Size By POWER SOURCE

- Historic And Forecasted Market Size By END USERS

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Booster Compressor Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.11 Bn. |

|

|

CAGR (2023-2030): |

3.8% |

Market Size in 2030: |

USD 2.84 Bn. |

|

|

Segments Covered: |

By Cooling Type |

|

|

|

|

By Compression Stage |

|

|

||

|

By Pressure |

|

|

||

|

By Power Source |

|

|

||

|

By End Users |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BOOSTER COMPRESSOR MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BOOSTER COMPRESSOR MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BOOSTER COMPRESSOR MARKET COMPETITIVE RIVALRY

TABLE 005. BOOSTER COMPRESSOR MARKET THREAT OF NEW ENTRANTS

TABLE 006. BOOSTER COMPRESSOR MARKET THREAT OF SUBSTITUTES

TABLE 007. BOOSTER COMPRESSOR MARKET BY COOLING TYPE

TABLE 008. AIR-COOLED MARKET OVERVIEW (2016-2028)

TABLE 009. WATER-COOLED MARKET OVERVIEW (2016-2028)

TABLE 010. BOOSTER COMPRESSOR MARKET BY COMPRESSION STAGE

TABLE 011. SINGLE STAGE MARKET OVERVIEW (2016-2028)

TABLE 012. DOUBLE-STAGE MARKET OVERVIEW (2016-2028)

TABLE 013. MULTISTAGE MARKET OVERVIEW (2016-2028)

TABLE 014. BOOSTER COMPRESSOR MARKET BY PRESSURE

TABLE 015. 14–40 BAR MARKET OVERVIEW (2016-2028)

TABLE 016. 41–100 BAR MARKET OVERVIEW (2016-2028)

TABLE 017. 101–350 BAR MARKET OVERVIEW (2016-2028)

TABLE 018. ABOVE 351 BAR MARKET OVERVIEW (2016-2028)

TABLE 019. BOOSTER COMPRESSOR MARKET BY END USERS

TABLE 020. OIL & GAS MARKET OVERVIEW (2016-2028)

TABLE 021. PROCESS INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 022. CHEMICAL & PETROCHEMICAL MARKET OVERVIEW (2016-2028)

TABLE 023. POWER GENERATION MARKET OVERVIEW (2016-2028)

TABLE 024. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 025. NORTH AMERICA BOOSTER COMPRESSOR MARKET, BY COOLING TYPE (2016-2028)

TABLE 026. NORTH AMERICA BOOSTER COMPRESSOR MARKET, BY COMPRESSION STAGE (2016-2028)

TABLE 027. NORTH AMERICA BOOSTER COMPRESSOR MARKET, BY PRESSURE (2016-2028)

TABLE 028. NORTH AMERICA BOOSTER COMPRESSOR MARKET, BY END USERS (2016-2028)

TABLE 029. N BOOSTER COMPRESSOR MARKET, BY COUNTRY (2016-2028)

TABLE 030. EUROPE BOOSTER COMPRESSOR MARKET, BY COOLING TYPE (2016-2028)

TABLE 031. EUROPE BOOSTER COMPRESSOR MARKET, BY COMPRESSION STAGE (2016-2028)

TABLE 032. EUROPE BOOSTER COMPRESSOR MARKET, BY PRESSURE (2016-2028)

TABLE 033. EUROPE BOOSTER COMPRESSOR MARKET, BY END USERS (2016-2028)

TABLE 034. BOOSTER COMPRESSOR MARKET, BY COUNTRY (2016-2028)

TABLE 035. ASIA PACIFIC BOOSTER COMPRESSOR MARKET, BY COOLING TYPE (2016-2028)

TABLE 036. ASIA PACIFIC BOOSTER COMPRESSOR MARKET, BY COMPRESSION STAGE (2016-2028)

TABLE 037. ASIA PACIFIC BOOSTER COMPRESSOR MARKET, BY PRESSURE (2016-2028)

TABLE 038. ASIA PACIFIC BOOSTER COMPRESSOR MARKET, BY END USERS (2016-2028)

TABLE 039. BOOSTER COMPRESSOR MARKET, BY COUNTRY (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA BOOSTER COMPRESSOR MARKET, BY COOLING TYPE (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA BOOSTER COMPRESSOR MARKET, BY COMPRESSION STAGE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA BOOSTER COMPRESSOR MARKET, BY PRESSURE (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA BOOSTER COMPRESSOR MARKET, BY END USERS (2016-2028)

TABLE 044. BOOSTER COMPRESSOR MARKET, BY COUNTRY (2016-2028)

TABLE 045. SOUTH AMERICA BOOSTER COMPRESSOR MARKET, BY COOLING TYPE (2016-2028)

TABLE 046. SOUTH AMERICA BOOSTER COMPRESSOR MARKET, BY COMPRESSION STAGE (2016-2028)

TABLE 047. SOUTH AMERICA BOOSTER COMPRESSOR MARKET, BY PRESSURE (2016-2028)

TABLE 048. SOUTH AMERICA BOOSTER COMPRESSOR MARKET, BY END USERS (2016-2028)

TABLE 049. BOOSTER COMPRESSOR MARKET, BY COUNTRY (2016-2028)

TABLE 050. ATLAS COPCO LTD.: SNAPSHOT

TABLE 051. ATLAS COPCO LTD.: BUSINESS PERFORMANCE

TABLE 052. ATLAS COPCO LTD.: PRODUCT PORTFOLIO

TABLE 053. ATLAS COPCO LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. GARDNER DENVER INC.: SNAPSHOT

TABLE 054. GARDNER DENVER INC.: BUSINESS PERFORMANCE

TABLE 055. GARDNER DENVER INC.: PRODUCT PORTFOLIO

TABLE 056. GARDNER DENVER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. KAESER KOMPRESSOREN: SNAPSHOT

TABLE 057. KAESER KOMPRESSOREN: BUSINESS PERFORMANCE

TABLE 058. KAESER KOMPRESSOREN: PRODUCT PORTFOLIO

TABLE 059. KAESER KOMPRESSOREN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. BAKER HUGHES: SNAPSHOT

TABLE 060. BAKER HUGHES: BUSINESS PERFORMANCE

TABLE 061. BAKER HUGHES: PRODUCT PORTFOLIO

TABLE 062. BAKER HUGHES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BOGE: SNAPSHOT

TABLE 063. BOGE: BUSINESS PERFORMANCE

TABLE 064. BOGE: PRODUCT PORTFOLIO

TABLE 065. BOGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SAUER USA: SNAPSHOT

TABLE 066. SAUER USA: BUSINESS PERFORMANCE

TABLE 067. SAUER USA: PRODUCT PORTFOLIO

TABLE 068. SAUER USA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. BAUER COMP HOLDING GMBH: SNAPSHOT

TABLE 069. BAUER COMP HOLDING GMBH: BUSINESS PERFORMANCE

TABLE 070. BAUER COMP HOLDING GMBH: PRODUCT PORTFOLIO

TABLE 071. BAUER COMP HOLDING GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. HITACHI LTD.: SNAPSHOT

TABLE 072. HITACHI LTD.: BUSINESS PERFORMANCE

TABLE 073. HITACHI LTD.: PRODUCT PORTFOLIO

TABLE 074. HITACHI LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. HASKEL: SNAPSHOT

TABLE 075. HASKEL: BUSINESS PERFORMANCE

TABLE 076. HASKEL: PRODUCT PORTFOLIO

TABLE 077. HASKEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. INGERSOLL-RAND PLC.: SNAPSHOT

TABLE 078. INGERSOLL-RAND PLC.: BUSINESS PERFORMANCE

TABLE 079. INGERSOLL-RAND PLC.: PRODUCT PORTFOLIO

TABLE 080. INGERSOLL-RAND PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. GE COMPANY LLC: SNAPSHOT

TABLE 081. GE COMPANY LLC: BUSINESS PERFORMANCE

TABLE 082. GE COMPANY LLC: PRODUCT PORTFOLIO

TABLE 083. GE COMPANY LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. IDEX: SNAPSHOT

TABLE 084. IDEX: BUSINESS PERFORMANCE

TABLE 085. IDEX: PRODUCT PORTFOLIO

TABLE 086. IDEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. MAXIMATOR GMBH: SNAPSHOT

TABLE 087. MAXIMATOR GMBH: BUSINESS PERFORMANCE

TABLE 088. MAXIMATOR GMBH: PRODUCT PORTFOLIO

TABLE 089. MAXIMATOR GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 090. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 091. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 092. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BOOSTER COMPRESSOR MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BOOSTER COMPRESSOR MARKET OVERVIEW BY COOLING TYPE

FIGURE 012. AIR-COOLED MARKET OVERVIEW (2016-2028)

FIGURE 013. WATER-COOLED MARKET OVERVIEW (2016-2028)

FIGURE 014. BOOSTER COMPRESSOR MARKET OVERVIEW BY COMPRESSION STAGE

FIGURE 015. SINGLE STAGE MARKET OVERVIEW (2016-2028)

FIGURE 016. DOUBLE-STAGE MARKET OVERVIEW (2016-2028)

FIGURE 017. MULTISTAGE MARKET OVERVIEW (2016-2028)

FIGURE 018. BOOSTER COMPRESSOR MARKET OVERVIEW BY PRESSURE

FIGURE 019. 14–40 BAR MARKET OVERVIEW (2016-2028)

FIGURE 020. 41–100 BAR MARKET OVERVIEW (2016-2028)

FIGURE 021. 101–350 BAR MARKET OVERVIEW (2016-2028)

FIGURE 022. ABOVE 351 BAR MARKET OVERVIEW (2016-2028)

FIGURE 023. BOOSTER COMPRESSOR MARKET OVERVIEW BY END USERS

FIGURE 024. OIL & GAS MARKET OVERVIEW (2016-2028)

FIGURE 025. PROCESS INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 026. CHEMICAL & PETROCHEMICAL MARKET OVERVIEW (2016-2028)

FIGURE 027. POWER GENERATION MARKET OVERVIEW (2016-2028)

FIGURE 028. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 029. NORTH AMERICA BOOSTER COMPRESSOR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. EUROPE BOOSTER COMPRESSOR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. ASIA PACIFIC BOOSTER COMPRESSOR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. MIDDLE EAST & AFRICA BOOSTER COMPRESSOR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. SOUTH AMERICA BOOSTER COMPRESSOR MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Booster Compressor Market research report is 2023-2030.

Gardner Denver, Ingersoll Rand, Kaeser Compressors, Sullair, Atlas Copco, Kaeser Kompressoren, Boge Kompressoren, Almig Kompressoren, CompAir, Ingersoll Rand, Fusheng, Qinhuangdao Yongjie Compressor, Shanghai Lingke Compressor, Shenyang Yuanda Compressor, Hitachi, Mitsui Seiki, Kobe Steel, Elgi Equipments, Kirloskar Brothers, Hwang Sung Machinery, Samhwa Industrial, Taiwan Air Compressor, Tung Yu Compressor and Other Major Players.

The Booster Compressor Market is segmented into Cooling Type, Compression Stage, Pressure, Power Source, End Users, and region. By Cooling Type, the market is categorized into Air-cooled and water-cooled. By Compression Stage, the market is categorized into Single-stage, Double-stage, and Multistage. By Pressure, the market is categorized into 14–40 bar, 41–100 bar, 101–350 bar, and Above 351 bar. By Power Source, the market is categorized into Electric and combustion Engine. By End Users, the market is categorized into Oil and gas, Process Industry, Chemical and petrochemical, Power Generation, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A booster compressor is a device that increases the pressure of an existing compressor by approximately three to five times the regular pressure produced. A booster compressor, also known as a plunger or piston compressor, is a type of compressor using a plunger or piston. The booster compressor is used in industries to maintain high pressures for brief periods. Pneumatic booster compressors make up many booster compressors.

Booster Compressor Market Size Was Valued at USD 2.11 Billion in 2022, and is Projected to Reach USD 2.84 Billion by 2030, Growing at a CAGR of 3.8% From 2023-2030.