Power Electronics for Electric Vehicle Market Synopsis

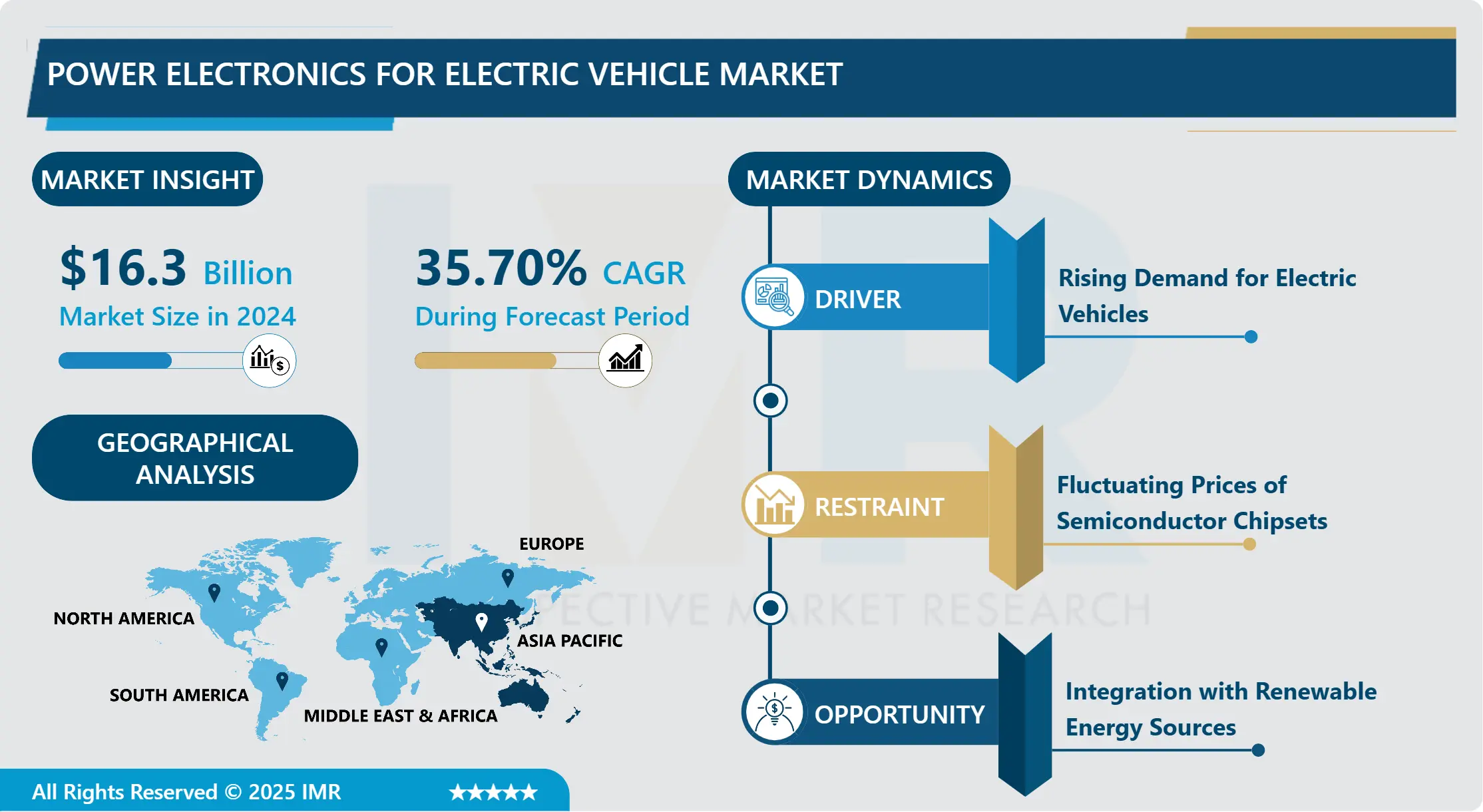

The Global Power Electronics for Electric Vehicle Market size is expected to grow from USD 16.3 billion in 2024 to USD 187.42 billion by 2032, at a CAGR of 35.70% during the forecast period (2025-2032).

Power electronics in electric vehicles are in charge of converting and managing the system's supply of electric power. The electric vehicle system uses some of the main power electronic components and functionality. These include onboard chargers, converters, and inverters. Power electronic devices can be used to efficiently carry out operations at high voltage or current because they provide a quicker switching rate a better efficiency.

Increasing government initiatives to promote electric mobility, rising environmental concerns, and advancements in power electronics technology. The market is characterized by a surge in research and development activities, with companies focusing on innovations to develop compact, efficient, and cost-effective power electronics solutions for EVs.

Major players in the industry are competing to introduce cutting-edge technologies, such as silicon carbide (SiC) and gallium nitride (GaN) semiconductors, to improve power conversion efficiency. Additionally, partnerships between automotive manufacturers and power electronics suppliers are becoming prevalent to accelerate product development and market penetration.

Power Electronics for Electric Vehicle Market Trend Analysis

Rising Demand for Electric Vehicles

- The rising demand for electric vehicles (EVs) is a pivotal driving force behind the growth of the Power Electronics for Electric Vehicle Market. As global awareness of environmental issues increases and governments push for sustainable transportation solutions, the automotive industry is undergoing a significant shift towards electric mobility.

- Power electronics play a crucial role in the functioning of electric vehicles, serving as key components in electric drivetrains, battery management systems, and charging infrastructure. The surge in EV adoption has led to an increased need for efficient power electronics to manage power distribution, control, and conversion within these vehicles. Manufacturers are innovating to develop advanced power electronics solutions that enhance the performance, efficiency, and range of electric vehicles.

- Moreover, the growing emphasis on reducing carbon emissions and the development of supportive regulatory frameworks are accelerating the transition to electric transportation.

Integration with Renewable Energy Sources creates an Opportunity for Power Electronics for Electric Vehicle Market

- The integration of renewable energy sources presents a significant opportunity for power electronics in the electric vehicle (EV) market. As the world transitions towards a sustainable energy future, the demand for electric vehicles continues to grow, driving the need for efficient and reliable power electronic systems.

- Renewable energy sources, such as solar and wind, can be harnessed to charge electric vehicles, offering a cleaner and more sustainable alternative to traditional grid-based charging. Power electronics play a crucial role in this integration by facilitating the conversion, control, and management of electrical energy between the renewable sources and EV batteries.

- In particular, power electronic converters and inverters are essential components that enable the efficient transfer of energy from renewable sources to electric vehicle batteries, optimizing charging processes and enhancing overall system performance. This integration not only contributes to the reduction of carbon emissions but also promotes energy independence and resilience in the transportation sector.

Power Electronics for Electric Vehicle Market Segment Analysis:

Power Electronics for Electric Vehicle Market Segmented on the basis of application, and end-users.

By Application, Inverter segment is expected to dominate the market during the forecast period

- Electric Vehicle Market is witnessing a significant surge, with the inverter segment poised to take the lead in shaping the industry. The inverter plays a pivotal role in converting direct current (DC) from the vehicle's battery into alternating current (AC) for the electric motor, facilitating the vehicle's propulsion.

- Several factors contribute to the dominance of the inverter segment. Firstly, the increasing adoption of electric vehicles globally has led to a surge in demand for efficient and high-performance inverters. As automakers strive to enhance the driving range, efficiency, and overall performance of EVs, the inverter emerges as a critical component

- Moreover, advancements in inverter technology, such as the development of silicon carbide (SiC) and gallium nitride (GaN) materials, have contributed to improved power conversion efficiency and reduced energy losses. These technological enhancements make the inverter segment a key focus for manufacturers and investors alike

By End-Use, Automotive segment held the largest share in 2024

- The dominance of the automotive segment in the Power Electronics for Electric Vehicle (EV) market is a result of the rapid growth and adoption of electric vehicles worldwide. The automotive sector has been a key driver of the demand for power electronics in EVs due to the critical role these components play in managing and controlling electrical power within the vehicle.

- The shift towards electric mobility has gained momentum, driven by increasing awareness of environmental issues, government initiatives promoting sustainable transportation, and advancements in battery technology. Power electronics in EVs are essential for functions such as power conversion, motor control, and battery management, contributing to improved energy efficiency and overall vehicle performance.

- Automotive manufacturers are investing heavily in developing electric and hybrid vehicles, leading to a surge in the demand for power electronics systems. This trend is likely to continue as countries set ambitious targets for reducing carbon emissions and promoting the adoption of electric vehicles.

Power Electronics for Electric Vehicle Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to dominate the Power Electronics for Electric Vehicle (EV) market, reflecting the region's dynamic role in the global automotive industry. As the demand for electric vehicles surges worldwide, Asia Pacific, home to key automotive manufacturing hubs and leading technology players, is positioned as a frontrunner in the development and adoption of power electronics for EVs.

- Countries like China, Japan, and South Korea are at the forefront of this trend, with robust government initiatives, significant investments in research and development, and a strong focus on sustainable transportation solutions. China, in particular, has emerged as a major player in the electric vehicle market, fostering an environment conducive to the growth of power electronics technologies.

- The Asia Pacific's dominance in the Power Electronics for Electric Vehicle Market is driven by a combination of factors, including a well-established manufacturing infrastructure, a rapidly expanding electric vehicle market, and a proactive approach to adopting green technologies.

Power Electronics for Electric Vehicle Market Top Key Players:

- Eaton Corporation(United States)

- On Semiconductor (United States)

- Vicor Corporation (United States)

- Vishay Intertechnology (United States)

- ABB (Switzerland)

- Aptiv (Ireland)

- Bosch (Germany)

- Continental AG (Germany)

- Infineon Technologies (Germany)

- STMicroelectronics (Switzerland)

- Valeo (France)

- Weidmüller (Germany)

- ZF Friedrichshafen AG (Germany)

- Denso (Japan)

- Fuji Electric (Japan)

- Mitsubishi Electric (Japan)

- NXP Semiconductors (Netherlands)

- Omron (Japan)

- Panasonic (Japan)

- Rohm Semiconductor (Japan)

- Toshiba (Japan)

- Yazaki (Japan)

- Other active Players

Key Industry Developments in the Power Electronics for Electric Vehicle Market:

- In September 2023, Infineon Technologies Launched its CoolSiC MOSFET Gen5 series, boasting 30% lower switching losses and higher efficiency compared to previous generations. This translates to extended battery range and faster charging times for EVs.

- In February 2023, Rohm Semiconductor Unveiled its SiC Schottky Barrier Diodes with industry-leading low leakage current and reverse recovery charge.

|

Global Power Electronics for Electric Vehicle Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.3 Bn. |

|

Forecast Period 2025-32 CAGR: |

35.70% |

Market Size in 2032: |

USD 187.42 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Power Electronics for Electric Vehicle Market by Application (2018-2032)

4.1 Power Electronics for Electric Vehicle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Inverter

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Converter

4.5 On-Board Charger

Chapter 5: Power Electronics for Electric Vehicle Market by End-Use (2018-2032)

5.1 Power Electronics for Electric Vehicle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Automotive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Railways

5.5 Marine

5.6 Electrically Powered Airborne Vehicles

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Power Electronics for Electric Vehicle Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 NOVOZYMES A/S (DENMARK)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BAYERS(GERMANY)

6.4 UPL LIMITED (INDIA)

6.5 GUJARAT STATE FERTILIZERS & CHEMICALS LTD (INDIA)

6.6 RIZOBACTER ARGENTINA S.A. (ARGENTINA)

6.7 RASHTRIYA CHEMICALS & FERTILIZERS LIMITED (INDIA)

6.8 T. STANES & COMPANY LIMITED INDIA

6.9 NATIONAL FERTILIZERS LIMITED (INDIA)

6.10 MADRAS FERTILIZERS LIMITED (INDIA)

6.11 ALLTECH INC (KENTUCKY)

6.12 BLACKSMITH BIOSCIENCE (US)

6.13 ENVIROKURE LIQUID ORGANIC FERTILIZER (PHILADELPHIA)

Chapter 7: Global Power Electronics for Electric Vehicle Market By Region

7.1 Overview

7.2. North America Power Electronics for Electric Vehicle Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Application

7.2.4.1 Inverter

7.2.4.2 Converter

7.2.4.3 On-Board Charger

7.2.5 Historic and Forecasted Market Size by End-Use

7.2.5.1 Automotive

7.2.5.2 Railways

7.2.5.3 Marine

7.2.5.4 Electrically Powered Airborne Vehicles

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Power Electronics for Electric Vehicle Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Application

7.3.4.1 Inverter

7.3.4.2 Converter

7.3.4.3 On-Board Charger

7.3.5 Historic and Forecasted Market Size by End-Use

7.3.5.1 Automotive

7.3.5.2 Railways

7.3.5.3 Marine

7.3.5.4 Electrically Powered Airborne Vehicles

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Power Electronics for Electric Vehicle Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Application

7.4.4.1 Inverter

7.4.4.2 Converter

7.4.4.3 On-Board Charger

7.4.5 Historic and Forecasted Market Size by End-Use

7.4.5.1 Automotive

7.4.5.2 Railways

7.4.5.3 Marine

7.4.5.4 Electrically Powered Airborne Vehicles

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Power Electronics for Electric Vehicle Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Application

7.5.4.1 Inverter

7.5.4.2 Converter

7.5.4.3 On-Board Charger

7.5.5 Historic and Forecasted Market Size by End-Use

7.5.5.1 Automotive

7.5.5.2 Railways

7.5.5.3 Marine

7.5.5.4 Electrically Powered Airborne Vehicles

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Power Electronics for Electric Vehicle Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Application

7.6.4.1 Inverter

7.6.4.2 Converter

7.6.4.3 On-Board Charger

7.6.5 Historic and Forecasted Market Size by End-Use

7.6.5.1 Automotive

7.6.5.2 Railways

7.6.5.3 Marine

7.6.5.4 Electrically Powered Airborne Vehicles

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Power Electronics for Electric Vehicle Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Application

7.7.4.1 Inverter

7.7.4.2 Converter

7.7.4.3 On-Board Charger

7.7.5 Historic and Forecasted Market Size by End-Use

7.7.5.1 Automotive

7.7.5.2 Railways

7.7.5.3 Marine

7.7.5.4 Electrically Powered Airborne Vehicles

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Power Electronics for Electric Vehicle Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.3 Bn. |

|

Forecast Period 2025-32 CAGR: |

35.70% |

Market Size in 2032: |

USD 187.42 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||