Platelets and Plasma Market Synopsis

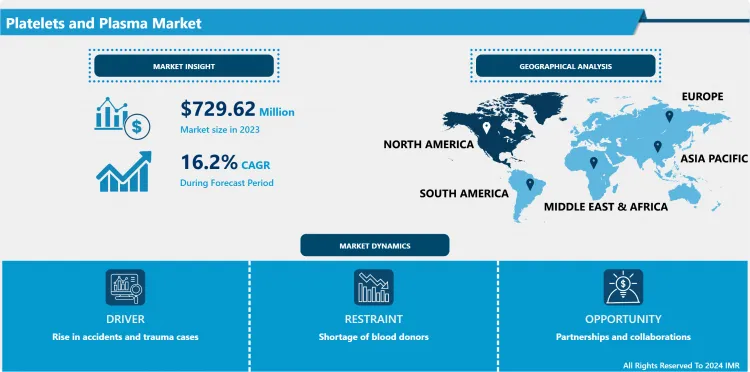

Platelets and Plasma Market Size Was Valued at USD 729.62 Million in 2023, and is Projected to Reach USD 2818.07 Billion by 2032, Growing at a CAGR of 16.2% From 2024-2032.

Blood platelets also called as thrombocytes are small coloured in the shade of green disc-shaped cell plugs that have a very important role in blood clotting and also in all kinds of wounds.

- Platelets are the blood cells originate from large bone marrow cells, in particular, megakaryocytes, which play a crucial role in maintaining haemostasis. Should a blood vessel get damaged, within a short span of time the platelet count starts to increase at the site and sticks to both the sides of the vessel and one another to establish a preliminary barrier. An important function is platelet aggregation, which, although is the first step in the formation of a blood clot to prevent excessive blood loss. Platelets have receptors on their surface for different molecules; these enable the platelets to attach to the damaged tissue and other platelets. They discharge substances including adenosine diphosphate (ADP) and thromboxane A2, which boosts the aggregation procedure. Platelets offer a terrain where several clotting factors gather and where the conversion of fibrinogen to fibrin which makes the clot more firm is activated.

- Apart from the well-known functionality of forming blood clots, platelets were also found to be involved in other processes, such as inflammation, and immunity response. They release cytokines and growth factors which plays a vital role in healing of the respective tissue and cell proliferation. There are tendencies for platelets to either have altered function or count; therefore, low count is called thrombocytopenia, and high count is termed thrombocytosis hence leading to bleedings or clotting.

- It is the pale yellow liquid portion of blood which contains dissolved proteins and lipids and is fully charged with blood cells through which it conveys nutrients hormones and waste matters to and from body cells. Having an approximate total blood volume of 5 L, plasma constitutes 55% total blood volume and is 90% water and 10% protein, electrolytes, nutrients, gases and waste products. The different plasma proteins include albumin, globulin, fibrinogen, prothrombin, clotting factors, and others which play different important roles. Albumin aids in regulation of osmotic pressure and maintenance of fluid, globulins are involved in transport and immunity, while fibrinogen is part of blood clotting.

- Plasma acts as a transport medium for glucose, lipids, amino acids, hormones, carbon dioxide, and urea etc. It also transports electrolytes like sodium, potassium, & calcium that are crucial for cell and intercellular signaling. Thus, Plasma is vital for homeostasis for it it functions for maintaining the body’s pH level and blood pressure.

- It is also very essential in medical treatments as can be attest by any medical doctor. Plasma is collected and utilized on the preparation of treatments for patients with coagulation problems, immune deficiencies, and other problems. Fresh frozen plasma.

Platelets and Plasma Market Trend Analysis

Increasing demand for blood components

- Blood components such as platelets and plasma are other emergent demands in the healthcare industry due to the following reasons. One of them is the growing incidence of chronic diseases or conditions which entail frequent use of blood transfusion or therapies containing blood products. Some of the examples are Cancer, Hemophilia, Liver diseases, Severe Anemia, and others for which Platelets and Plasma are required constantly. Another factor which has raised the usage of the blood components is the enhanced usage and developments in the medical treatments and techniques, particularly in surgeries and emergency treatments which is other boost to the use of blood components.

- Other reasons include increased rate of surgical procedures and the increasing world population especially of the elderly who require platelets and plasma. Due to increased and early occurrence of diseases that call for transfusion, elderly individuals are more susceptible to some diseases such as cardiovascular diseases, orthopedic surgeries and different types of cancers. The elderly people are also vulnerable to blood related ailments, and hence the use of platelets, and plasma when required is vital for the patient. Also, the increased rate of trauma and accidental cases that would necessitate blood transfusion also adds to it.

- Demand of platelet and plasma is also affected by advances in the method of blood collection and processing. Recent developments in technology have improve the process of separation of blood components with a lot of ease and safety hence providing quality platelets and plasma from the unsuspecting donors. However, through awareness of blood donation and other relevant measures, the blood supply has risen to meet the experimental demands. Most governments and health facilities have stepped up on the crusade to foster a culture of the voluntary blood donation to help stock up on the supply chain. Altogether, all these factors give a stimulus of the growing consumption of platelets and plasma in the healthcare market.

Expanding applications of platelets and plasma

- The increasing usage of platelets and plasma is a major driving force or a strong market opportunity for Platelets and Plasma Market. Conventional uses of platelets and plasma have been in patients with bleeding disorders, trauma and during operation. Originally, they were only used in a limited number of situations since their effectiveness was limited, but over the years medical science and technology has expanded their use to virtually any type of medical therapy or clinical application. For example, application of platelet rich plasma (PRP) in regenerative medicine and orthopedics has been realized for its curative characteristics. Presently, their applications include the treatment of osteoarthritis, tendon injuries, and chronic wound, which provides the patients with a minimally invasive form of treatment instead of undergoing surgeries.

- Furthermore, the application of plasma derivatives has also grown hugely in the management of different immune disorders, neuronal dysfunctions, and even infections. It is very essential in the treatment of primary immunodeficiency disorders and autoimmune disorders since immunoglobulins obtained from plasma play a vital role. The overal need for plasma derived products has risen increases tremendously, as they provide effective treatment solutions to various complicated health complications ranging from CIDP and Guillain-Barré syndromes. Moreover, in a specific context of COVID-19, convalescent plasma therapy was established as one of the candidates for treatment for the severe cases, and plasma proved to be a significant tool in the management of the new emerging viral infections.

- Research and development investment has been on the rise in the production of Platelets and Plasma hence boosting innovations in the market. Moreover, organizations within the sphere of pharma & biopharmaceuticals, as well as research institutions, are considering new opportunities for platelets and plasma application. For instance, new solutions such as synthetic platelets and plasma are being made possible by Biotechnology by overcoming supply constraints and risks. Further, the combination of platelet and plasma products in individual patient management including interventions in precision medicine is discovering other horizons for modifying the treatment. This widening application range not only improves the conditions of patients but also guarantees the development of the Platelets and Plasma Market, which has many attractive prospects for investors and thus stimulating the overall growth in the Platelets and Plasma Market.

Platelets and Plasma Market Segment Analysis:

Platelets and Plasma Market Segmented based on Product, Application, and End-user.

By Type, Pure Platelet Rich Plasma (P-PRP) segment is expected to dominate the market during the forecast period

- In the organization of the platelets and plasmas market, there is always a room for Pure Platelet Rich Plasma (P-PRP) to be the largest of the market shares. Leukocyte-poor PRP or P-PRP consists of significant platelet concentration accompanied by remarkably low leukocytes and red blood cells. The reason this form of PRP is well appreciated in the various medical and cosmetic procedures is because it minimises inflammation and healing and tissue regeneration is efficiently facilitated. The high platelets in P-PRP release growth factors and cytokines which enhance the rate of tissue repair, this makes P-PRP desirable in sports medicine, orthopedics and aesthetic medicine.

- The demand of P-PRP is high because of its versatility in the treatment that has been showed to decrease the recovery time and enhance the clinical results. For example, in orthopedic- sports medicine P-PRP is applied in treatment of joint injuries, tendonitis as well as muscle strains. They apply it in aesthetic medicine for skin lifting and hair restoration because of the positivity it has on tissue remodeling and skin quality. Thus, the growth of the number of patients with musculoskeletal disorders and the continuously expanding demand for minimally invasive aesthetic procedures are the primary reasons for the superiority of this segment.

- Moreover, there has been increased technical support by professionals where by there is quality experimental evidence showing that P-PRP was superior to other types of platelet-rich plasma with more acceptance. The segment’s leadership is also strengthened by the improvements in the methods for preparing PRP, as the creation of the high-quality P-PRP is becoming faster and easier. The clinical effectiveness of P-PRP, the range of potential applications, and the constant development of the technology guarantee the segment’s leadership in the Platelets and Plasma Market.

By Application, the Orthopedics segment held the largest share in 2023

- In the context of the Platelets and Plasma Market, the Orthopedics segment is usually the most significant. There is an increased interest in the orthopedic uses of platelets and plasma especially the PRP therapy because of its efficiency in managing different musculoskeletal diseases. PRP is widely applied in the treatment of injured tendons, ligaments, muscles and joint injuries as a procedure to enhance the process of healing. It is especially useful in cases of chronic disease like osteoarthritis, tendinitis, and ligament injuries that affect elderly people and sportspersons.

- The orthopedic segment has thus emerged as the most dominant due to the rising prevalence of orthopedic problems and related traumas by way of bone fractures, joint diseases, and other complications in elderly people and active sportspersons. When a certain age is reached certain conditions such as osteoarthritis become more and more common meaning that more patient could benefit from PRP. Also the increase in the number of sports and health conscious people the probability of sport injuries increases and this will continue to drive the market for these practical and non invasive therapies like PRP. The capability of the technique to offer definite tissue repair and at the same time minimizing post-operative period required makes it a more favored technique among the orthopedic surgeons and the patients.

- However, there has been an evolution in the technology of PRP and how the latter is prepared in a way that enhances the effectiveness and availability of these procedures. Due to the introduction of set procedures, the ready-to-use PRP preparation kits have enhanced the practicality of this therapy in orthopedic clinics. The elements of scientific literature and clinical trials prove the effectiveness of PRP in orthopedic, which will be an increasing trend in recognition and implementation in the therapeutic process. Thus the actual demand for the treatment in the clinical orthopedics coupled with latest available technological support and the efficacy of Platelets and Plasma makes this segment unchallenged leader in the application domain of the market.

Platelets and Plasma Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The platelets and plasma market in North America remains dominant due to factors such as sound and favourable policies on healthcare, efficient healthcare infrastructure, a focus on research and development, and strong regulatory systems. The region has some of the best hospital and research facilities with adequate machinery and brillian personnel. Such an environment promotes innovation and guarantees the company that new treatments and products are created and introduced to the market as soon as possible. Moreover, the engagement of big biopharmaceutical firms and significantly high attention to the healthcare spending also contributes to North America’s leadership in this market.

- The other factor is the fact that many diseases and conditions which entail platelets and plasma use exist in the market. There is a large patient need in North America mainly in the USA for these chronic disease, cancer and haemophilia patients where platelet and plasma products are required. The region also has many organized blood donation centers and has a very culture of blood donation hence avails a constant flow of raw materials or ingredients for these products. In addition to that, sensitization of the public and engagements that promote donations of blood and plasma enable the permanent availability of these medical components.

- Last but not least, the level of regulation in North America also has a great influence on the platelets and plasma market. Authorities like the Food and Drugs Administration in USA have strict set performance standards that have set down on blood products collection, processing and distribution. These guarantee safety and quality and thus its consumption is trusted by the providers and patients. Third, various policies are expensive governmental initiatives that promote the research and advancements in this field to develop better therapies. Thus, the presence of such regulatory and governmental support mechanisms forms a stable legal environment for the development of investment activity in the sphere of platelets and plasma.

Active Key Players in the Platelets and Plasma Market

- Baxter International Inc (USA)

- Bio Products Laboratory Ltd(UK)

- Biotest AG (Germany)

- BPL Plasma (USA)

- China Biologic Products Holdings Inc (China)

- CSL Limited (Australia)

- Emergent BioSolutions Inc. (USA)

- Green Cross Corporation (South Korea)

- Grifols, S.A. (Spain)

- Hemarus Therapeutics Limited (India)

- Hualan Biological Engineering Inc. (China)

- Kamada Ltd. (Israel)

- Kedrion Biopharma Inc. (Italy)

- LFB S.A. (France)

- Macopharma (France)

- Octapharma AG (Switzerland)

- Sanquin (Netherlands)

- Shanghai RAAS Blood Products Co., Ltd. (China)

- Shire (now part of Takeda Pharmaceutical Company Limited) (Japan)

- Terumo BCT Inc. (USA) and Other Major Players

Key Industry Developments in the Platelets and Plasma Market:

- In April 2020, due to COVID-19 one blood not-for-profit blood center started to collect both platelets and plasma from customers who have recovered from the coronavirus. The collected plasma is then used to transfuse the COVID-19-affected patients who in turn help their body to recover. Active participation will elicit growth in the company’s activities within the industry.

|

Global Platelets and Plasma Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 729.62 Mn. |

|

Forecast Period 2024-32 CAGR: |

16.2 % |

Market Size in 2032: |

USD 2818.07 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Platelets and Plasma Market by Type (2018-2032)

4.1 Platelets and Plasma Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pure Platelet Rich Plasma

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Leukocyte Rich Platelet Rich Plasma

4.5 Others

Chapter 5: Platelets and Plasma Market by Application (2018-2032)

5.1 Platelets and Plasma Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Orthopedics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Sports Medicine

5.5 Cosmetic Surgery

5.6 Dermatology

5.7 Ophthalmic Surgery

5.8 Neurosurgery

5.9 General Surgery

5.10 Others

Chapter 6: Platelets and Plasma Market by End-user (2018-2032)

6.1 Platelets and Plasma Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Platelets and Plasma Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAXTER INTERNATIONAL INC (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BIO PRODUCTS LABORATORY LTD(UK)

7.4 BIOTEST AG (GERMANY)

7.5 BPL PLASMA (USA)

7.6 CHINA BIOLOGIC PRODUCTS HOLDINGS INC (CHINA)

7.7 CSL LIMITED (AUSTRALIA)

7.8 EMERGENT BIOSOLUTIONS INC. (USA)

7.9 GREEN CROSS CORPORATION (SOUTH KOREA)

7.10 GRIFOLS

7.11 S.A. (SPAIN)

7.12 HEMARUS THERAPEUTICS LIMITED (INDIA)

7.13 HUALAN BIOLOGICAL ENGINEERING INC. (CHINA)

7.14 KAMADA LTD. (ISRAEL)

7.15 KEDRION BIOPHARMA INC. (ITALY)

7.16 LFB S.A. (FRANCE)

7.17 MACOPHARMA (FRANCE)

7.18 OCTAPHARMA AG (SWITZERLAND)

7.19 SANQUIN (NETHERLANDS)

7.20 SHANGHAI RAAS BLOOD PRODUCTS COLTD. (CHINA)

7.21 SHIRE (NOW PART OF TAKEDA PHARMACEUTICAL COMPANY LIMITED) (JAPAN)

7.22 TERUMO BCT INC. (USA)

Chapter 8: Global Platelets and Plasma Market By Region

8.1 Overview

8.2. North America Platelets and Plasma Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Pure Platelet Rich Plasma

8.2.4.2 Leukocyte Rich Platelet Rich Plasma

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Orthopedics

8.2.5.2 Sports Medicine

8.2.5.3 Cosmetic Surgery

8.2.5.4 Dermatology

8.2.5.5 Ophthalmic Surgery

8.2.5.6 Neurosurgery

8.2.5.7 General Surgery

8.2.5.8 Others

8.2.6 Historic and Forecasted Market Size by End-user

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Platelets and Plasma Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Pure Platelet Rich Plasma

8.3.4.2 Leukocyte Rich Platelet Rich Plasma

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Orthopedics

8.3.5.2 Sports Medicine

8.3.5.3 Cosmetic Surgery

8.3.5.4 Dermatology

8.3.5.5 Ophthalmic Surgery

8.3.5.6 Neurosurgery

8.3.5.7 General Surgery

8.3.5.8 Others

8.3.6 Historic and Forecasted Market Size by End-user

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Platelets and Plasma Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Pure Platelet Rich Plasma

8.4.4.2 Leukocyte Rich Platelet Rich Plasma

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Orthopedics

8.4.5.2 Sports Medicine

8.4.5.3 Cosmetic Surgery

8.4.5.4 Dermatology

8.4.5.5 Ophthalmic Surgery

8.4.5.6 Neurosurgery

8.4.5.7 General Surgery

8.4.5.8 Others

8.4.6 Historic and Forecasted Market Size by End-user

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Platelets and Plasma Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Pure Platelet Rich Plasma

8.5.4.2 Leukocyte Rich Platelet Rich Plasma

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Orthopedics

8.5.5.2 Sports Medicine

8.5.5.3 Cosmetic Surgery

8.5.5.4 Dermatology

8.5.5.5 Ophthalmic Surgery

8.5.5.6 Neurosurgery

8.5.5.7 General Surgery

8.5.5.8 Others

8.5.6 Historic and Forecasted Market Size by End-user

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Platelets and Plasma Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Pure Platelet Rich Plasma

8.6.4.2 Leukocyte Rich Platelet Rich Plasma

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Orthopedics

8.6.5.2 Sports Medicine

8.6.5.3 Cosmetic Surgery

8.6.5.4 Dermatology

8.6.5.5 Ophthalmic Surgery

8.6.5.6 Neurosurgery

8.6.5.7 General Surgery

8.6.5.8 Others

8.6.6 Historic and Forecasted Market Size by End-user

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Platelets and Plasma Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Pure Platelet Rich Plasma

8.7.4.2 Leukocyte Rich Platelet Rich Plasma

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Orthopedics

8.7.5.2 Sports Medicine

8.7.5.3 Cosmetic Surgery

8.7.5.4 Dermatology

8.7.5.5 Ophthalmic Surgery

8.7.5.6 Neurosurgery

8.7.5.7 General Surgery

8.7.5.8 Others

8.7.6 Historic and Forecasted Market Size by End-user

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Platelets and Plasma Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 729.62 Mn. |

|

Forecast Period 2024-32 CAGR: |

16.2 % |

Market Size in 2032: |

USD 2818.07 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Platelets and Plasma Market research report is 2024-2032.

Baxter International Inc. (USA), Bio Products Laboratory Ltd. (UK), Biotest AG (Germany), BPL Plasma (USA), China Biologic Products Holdings, Inc. (China), CSL Limited (Australia), Emergent BioSolutions Inc. (USA), Green Cross Corporation (South Korea), Grifols, S.A. (Spain), Hemarus Therapeutics Limited (India), Hualan Biological Engineering Inc. (China), Kamada Ltd. (Israel), Kedrion Biopharma Inc. (Italy), LFB S.A. (France), Macopharma (France), Octapharma AG (Switzerland), Sanquin (Netherlands), Shanghai RAAS Blood Products Co., Ltd. (China), Shire (now part of Takeda Pharmaceutical Company Limited) (Japan), Terumo BCT, Inc. (USA) and Other Major Players.

The Platelets and Plasma Market is segmented into Type, Applications, End Users, and region. By Type, the market is categorized into Pure platelet-rich plasma, Leukocyte Rich Platelet Rich Plasma, and Others. By Applications, the market is categorized into Orthopedics, Sports Medicine, Cosmetic Surgery, Dermatology, Ophthalmic Surgery, Neurosurgery, General Surgery, and Others. By End Users, the market is categorized into Hospitals, Clinics, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Blood is made up of platelets and plasma and both are very vital in the body for healing and clotting. Platelets are small cells or cell fragments that play an important role in clotting of blood and hence, in the healing of wounds. Blood plasma is the liquid part of blood through which nutrients, hormones, and proteins such as clotting factors are transported in the body. Both of them are applied in different medical treatments such as in the treatment of bleeding disorders, trauma and regenerative medicine.

Platelets and Plasma Market Size Was Valued at USD 729.62 Million in 2023, and is Projected to Reach USD 2818.07 Billion by 2032, Growing at a CAGR of 16.2% From 2024-2032.