Pharmaceutical Lecithin Market Synopsis

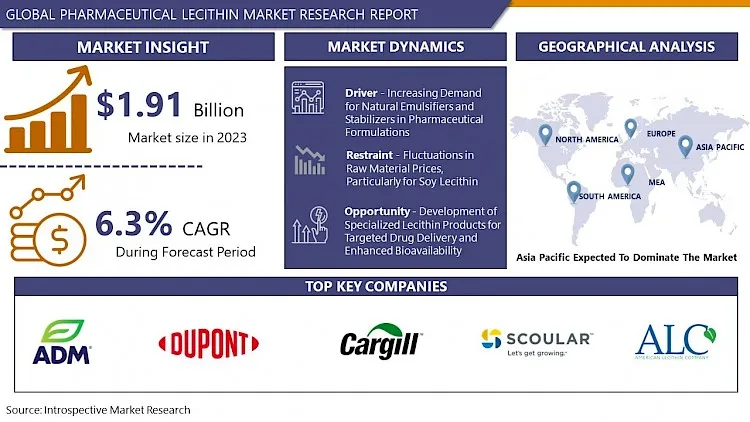

Pharmaceutical Lecithin Market Size Was Valued at USD 2.03 Billion in 2024, and is Projected to Reach USD 4.06 Billion by 2035, Growing at a CAGR of 6.5% From 2025-2035.

Pharmaceutical lecithin refers to a natural substance derived from soybeans or sunflower seeds, widely used in the pharmaceutical industry for its emulsifying and stabilizing properties. It acts as a vital ingredient in various medications, aiding in the uniform distribution of active compounds and enhancing their absorption and effectiveness in the body.

Pharmaceutical lecithin has diverse applications in the medical field, making it a valuable component in drug formulations. Its primary application lies in serving as an emulsifier and stabilizer in pharmaceutical products, helping to blend oil and water-based substances in medications such as capsules, creams, and ointments. Additionally, lecithin acts as a delivery agent, improving the solubility and absorption of active pharmaceutical ingredients (APIs) in the body, thereby enhancing the efficacy of medications.

Pharmaceutical lecithin is its natural origin, often derived from soybeans or sunflower seeds. Being a natural substance, lecithin is generally well-tolerated by patients and is considered safe for use in pharmaceutical formulations. Furthermore, its emulsifying properties contribute to the stability and shelf-life of medications, ensuring consistent quality over time. This makes lecithin a preferred choice for pharmaceutical companies aiming to develop safe and effective drug products.

Pharmaceutical lecithin is anticipated to be robust, driven by the increasing demand for innovative drug delivery systems and formulations. As pharmaceutical research advances, there is a growing focus on enhancing the bioavailability and efficacy of drugs, which can be achieved through the strategic use of lecithin. Moreover, the rising prevalence of chronic diseases and the need for improved therapeutic outcomes are driving pharmaceutical companies to explore new technologies and ingredients like lecithin, fueling the market's growth prospects.

Pharmaceutical Lecithin Market Trend Analysis:

Increasing Demand for Natural Emulsifiers and Stabilizers in Pharmaceutical Formulations

- The pharmaceutical lecithin market is experiencing substantial growth, primarily due to the increasing demand for natural emulsifiers and stabilizers in pharmaceutical formulations. Natural ingredients like lecithin, derived from soybeans or sunflower seeds, are gaining popularity among pharmaceutical companies seeking safer and more sustainable alternatives to synthetic additives. Lecithin's ability to emulsify and stabilize oil-in-water and water-in-oil mixtures makes it a valuable ingredient in various drug delivery systems, including capsules, creams, and suspensions.

- The pharmaceutical lecithin market is the rising consumer preference for natural and organic products. With growing awareness of health and environmental concerns, there is a shift towards using natural ingredients in pharmaceutical formulations. Lecithin's natural origin, coupled with its functional properties as an emulsifier and stabilizer, positions it as a key ingredient in meeting this demand for cleaner-label products in the pharmaceutical industry.

- The pharmaceutical lecithin market is driven by the need for improved drug delivery systems and enhanced bioavailability of medications. Lecithin plays a crucial role in improving the solubility and absorption of active pharmaceutical ingredients (APIs) in the body, leading to better therapeutic outcomes. As pharmaceutical research continues to focus on developing more effective and patient-friendly drug formulations, the demand for natural emulsifiers and stabilizers like lecithin is expected to witness sustained growth, driving innovation and market expansion in the pharmaceutical industry.

Development of Specialized Lecithin Products for Targeted Drug Delivery and Enhanced Bioavailability

- The pharmaceutical lecithin market is witnessing significant growth opportunities, particularly through the development of specialized lecithin products tailored for targeted drug delivery and enhanced bioavailability. Pharmaceutical companies are increasingly exploring the potential of lecithin as a versatile ingredient in formulating drug delivery systems that can precisely target specific areas of the body or improve the absorption and effectiveness of medications.

- The development of liposomal formulations using lecithin. Liposomes are lipid-based vesicles that can encapsulate drugs, allowing for targeted delivery to specific tissues or cells. Lecithin, with its emulsifying and stabilizing properties, plays a crucial role in forming and stabilizing liposomes. This technology enables the controlled release of drugs, improved therapeutic efficacy, and reduced side effects, making it a promising avenue for enhancing drug delivery systems.

- These are colloidal systems where lecithin acts as an emulsifier to disperse insoluble drugs or enhance the solubility of poorly soluble drugs. Nanoemulsions and microemulsions offer advantages such as increased drug absorption, rapid onset of action, and improved patient compliance. As pharmaceutical research continues to focus on developing innovative drug delivery solutions, the demand for specialized lecithin-based products for targeted delivery and enhanced bioavailability is expected to drive market growth and foster advancements in treatments.

Pharmaceutical Lecithin Market Segment Analysis:

Pharmaceutical Lecithin Market Segmented on the basis of Type, Source, Form and Application.

By Application, Emulsifier segment is expected to dominate the market during the forecast period

- The emulsifier segment is poised to emerge as the dominant driver of growth in the pharmaceutical lecithin market. Emulsifiers play a crucial role in pharmaceutical formulations by facilitating the blending of oil and water-based substances, ensuring stability, and enhancing the overall efficacy of medications. Pharmaceutical companies are increasingly recognizing the importance of emulsifiers like lecithin in developing advanced drug delivery systems that offer improved bioavailability and targeted action.

- The emulsifier segment is the growing demand for innovative drug delivery solutions. Emulsifiers such as lecithin are essential in creating nanoemulsions, liposomal formulations, and microemulsions, which enable the controlled release of drugs, enhanced absorption, and reduced side effects. As pharmaceutical research advances and the need for personalized medicine grows, the role of emulsifiers in drug delivery is becoming increasingly significant, leading to rising demand for pharmaceutical-grade lecithin in the emulsifier segment.

By Source, Soy Lecithin segment held the largest share of 46.27% in 2024

- The soy lecithin segment has consistently held the largest share in driving the growth of the pharmaceutical lecithin market. This dominance is attributed to several factors, including the widespread availability and cost-effectiveness of soy-derived lecithin compared to other sources. Soy lecithin is a natural and versatile emulsifier derived from soybeans, making it highly desirable for pharmaceutical applications due to its emulsifying, stabilizing, and solubilizing properties.

- Furthermore, soy lecithin's compatibility with a wide range of pharmaceutical formulations, including tablets, capsules, creams, and suspensions, has contributed to its significant market share. Its ability to enhance the bioavailability and efficacy of active pharmaceutical ingredients (APIs) while ensuring product stability has made soy lecithin a preferred choice for pharmaceutical companies. As the demand for advanced drug delivery systems and improved therapeutic outcomes continues to grow, the soy lecithin segment is expected to maintain its leading position in driving the expansion of the pharmaceutical lecithin market.

Pharmaceutical Lecithin Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is anticipated to emerge as the dominant region for the growth of the pharmaceutical lecithin market. This projection is based on several factors, including the increasing investments in healthcare infrastructure, rising pharmaceutical manufacturing activities, and growing awareness about the benefits of using lecithin in drug formulations across countries in the region.

- Moreover, the expanding population base, particularly in countries like China and India, is driving the demand for pharmaceutical products, thereby creating a conducive environment for the growth of the pharmaceutical lecithin market. Additionally, the presence of key market players and ongoing research and development efforts focused on enhancing drug delivery systems further contribute to Asia Pacific's expected dominance in the pharmaceutical lecithin market. As pharmaceutical companies in the region continue to invest in technological advancements and strategic collaborations, Asia Pacific is poised to play a pivotal role in driving innovation and market expansion in the pharmaceutical lecithin segments.

Pharmaceutical Lecithin Market Top Key Players:

- Cargill (U.S.)

- ADM (U.S.)

- DuPont (U.S.)

- Scoular Company (U.S.)

- American Lecithin Company (U.S.)

- NOW Foods (U.S.)

- Bunge (U.S.)

- LECICO GmbH (Germany)

- Fishmer Lecithin (Germany)

- Lipoid GmbH (Germany)

- Sternchemie Gmbh & Co. Kg (Germany)

- Avril Group (France)

- Novastell (France)

- Sodrugestvo Group S.A (Luxembourg)

- Denofa AS (Norway)

- Weleda (Switzerland)

- Wilmar International Ltd. (Singapore)

- Sonic Biochem (India)

- Sun Nutrafoods (India)

- VAV Life Sciences Pvt. Ltd. (India), and other Major Players

Key Industry Developments in the Pharmaceutical Lecithin Market:

- In November 2022, Novastell introduced a variety of lecithin granules for application in food and beverage applications. In contrast to Suncithin G96, created from sunflower lecithin and is likewise non-GMO and allergen-free, Soycithin G97 IP is a classic soy lecithin that is non-GMO and fully traceable.

-

In December 2022, In North America, Lecico and Ciranda began a distribution partnership for lecithin and phospholipids with an emphasis on regional commercial and technical support as well as clean-label food trends.

|

Global Pharmaceutical Lecithin Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.03 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.3% |

Market Size in 2035: |

USD 4.06 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pharmaceutical Lecithin Market by Type (2018-2035)

4.1 Pharmaceutical Lecithin Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Standard Lecithin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Modified Lecithin

Chapter 5: Pharmaceutical Lecithin Market by Source (2018-2035)

5.1 Pharmaceutical Lecithin Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Soy Lecithin

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Egg Lecithin

5.5 Sunflower Lecithin

Chapter 6: Pharmaceutical Lecithin Market by Form (2018-2035)

6.1 Pharmaceutical Lecithin Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Liquid

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Powdered

6.5 Granular

Chapter 7: Pharmaceutical Lecithin Market by Application (2018-2035)

7.1 Pharmaceutical Lecithin Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Stabilizer

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Lubricant

7.5 Release Agent

7.6 Emulsifier

7.7 Surfactant

7.8 Wetting Agent

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Pharmaceutical Lecithin Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MITSUBISHI CHEMICAL FOODS CORPORATION

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 TRI-K INDUSTRIES INCBASF SE

8.4 ARCHER DANIELS MIDLAND COMPANY (ADM)

8.5 WILMAR INTERNATIONAL LIMITED

8.6 VITAE NATURALS

8.7 PMC GROUP

8.8

Chapter 9: Global Pharmaceutical Lecithin Market By Region

9.1 Overview

9.2. North America Pharmaceutical Lecithin Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Standard Lecithin

9.2.4.2 Modified Lecithin

9.2.5 Historic and Forecasted Market Size by Source

9.2.5.1 Soy Lecithin

9.2.5.2 Egg Lecithin

9.2.5.3 Sunflower Lecithin

9.2.6 Historic and Forecasted Market Size by Form

9.2.6.1 Liquid

9.2.6.2 Powdered

9.2.6.3 Granular

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Stabilizer

9.2.7.2 Lubricant

9.2.7.3 Release Agent

9.2.7.4 Emulsifier

9.2.7.5 Surfactant

9.2.7.6 Wetting Agent

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Pharmaceutical Lecithin Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Standard Lecithin

9.3.4.2 Modified Lecithin

9.3.5 Historic and Forecasted Market Size by Source

9.3.5.1 Soy Lecithin

9.3.5.2 Egg Lecithin

9.3.5.3 Sunflower Lecithin

9.3.6 Historic and Forecasted Market Size by Form

9.3.6.1 Liquid

9.3.6.2 Powdered

9.3.6.3 Granular

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Stabilizer

9.3.7.2 Lubricant

9.3.7.3 Release Agent

9.3.7.4 Emulsifier

9.3.7.5 Surfactant

9.3.7.6 Wetting Agent

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Pharmaceutical Lecithin Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Standard Lecithin

9.4.4.2 Modified Lecithin

9.4.5 Historic and Forecasted Market Size by Source

9.4.5.1 Soy Lecithin

9.4.5.2 Egg Lecithin

9.4.5.3 Sunflower Lecithin

9.4.6 Historic and Forecasted Market Size by Form

9.4.6.1 Liquid

9.4.6.2 Powdered

9.4.6.3 Granular

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Stabilizer

9.4.7.2 Lubricant

9.4.7.3 Release Agent

9.4.7.4 Emulsifier

9.4.7.5 Surfactant

9.4.7.6 Wetting Agent

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Pharmaceutical Lecithin Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Standard Lecithin

9.5.4.2 Modified Lecithin

9.5.5 Historic and Forecasted Market Size by Source

9.5.5.1 Soy Lecithin

9.5.5.2 Egg Lecithin

9.5.5.3 Sunflower Lecithin

9.5.6 Historic and Forecasted Market Size by Form

9.5.6.1 Liquid

9.5.6.2 Powdered

9.5.6.3 Granular

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Stabilizer

9.5.7.2 Lubricant

9.5.7.3 Release Agent

9.5.7.4 Emulsifier

9.5.7.5 Surfactant

9.5.7.6 Wetting Agent

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Pharmaceutical Lecithin Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Standard Lecithin

9.6.4.2 Modified Lecithin

9.6.5 Historic and Forecasted Market Size by Source

9.6.5.1 Soy Lecithin

9.6.5.2 Egg Lecithin

9.6.5.3 Sunflower Lecithin

9.6.6 Historic and Forecasted Market Size by Form

9.6.6.1 Liquid

9.6.6.2 Powdered

9.6.6.3 Granular

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Stabilizer

9.6.7.2 Lubricant

9.6.7.3 Release Agent

9.6.7.4 Emulsifier

9.6.7.5 Surfactant

9.6.7.6 Wetting Agent

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Pharmaceutical Lecithin Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Standard Lecithin

9.7.4.2 Modified Lecithin

9.7.5 Historic and Forecasted Market Size by Source

9.7.5.1 Soy Lecithin

9.7.5.2 Egg Lecithin

9.7.5.3 Sunflower Lecithin

9.7.6 Historic and Forecasted Market Size by Form

9.7.6.1 Liquid

9.7.6.2 Powdered

9.7.6.3 Granular

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Stabilizer

9.7.7.2 Lubricant

9.7.7.3 Release Agent

9.7.7.4 Emulsifier

9.7.7.5 Surfactant

9.7.7.6 Wetting Agent

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Pharmaceutical Lecithin Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.03 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.3% |

Market Size in 2035: |

USD 4.06 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||