Persistent Threat Detection Systems (PTDS) Market Synopsis

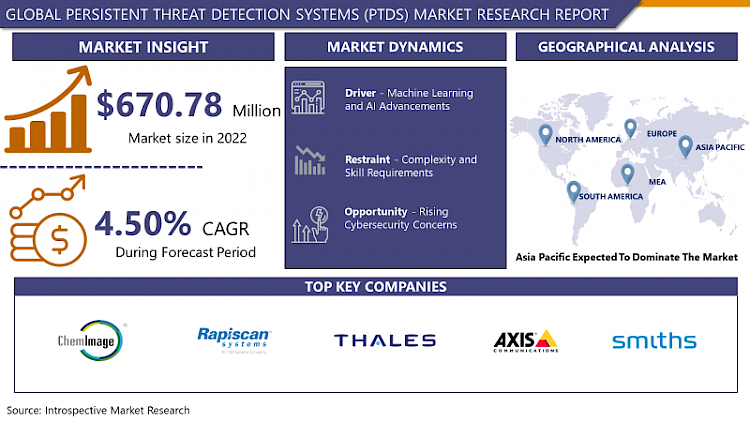

Global Persistent Threat Detection Systems (PTDS) Market Size Was Valued at USD 670.78 Million in 2022 and is Projected to Reach USD 953.92 Million by 2030, Growing at a CAGR of 4.50% From 2023-2030.

Persistent Threat Detection Systems (PTDS) represent sophisticated cybersecurity solutions designed to continually monitor and detect ongoing advanced cyber threats within an organizational network. By leveraging advanced technologies like machine learning and threat intelligence, PTDS focuses on identifying and responding to persistent threats, including advanced malware, zero-day attacks, and insider threats, thereby strengthening overall cybersecurity resilience.

- Persistent Threat Detection Systems (PTDS) are instrumental in strengthening cybersecurity through continuous monitoring and identifying sophisticated threats in an organization's network. Employing advanced technologies like machine learning and threat intelligence, PTDS detects persistent threats such as advanced malware, zero-day attacks, and insider threats.

- PTDS offers real-time threat analysis, enabling swift responses to emerging cyber threats. By leveraging machine learning, PTDS adapts to evolving threat landscapes, enhancing its ability to counter novel attack vectors. The multifaceted benefits include proactive threat detection, minimized dwell time of attackers, and improved incident response capabilities, contributing to overall cybersecurity resilience against persistent threats.

Persistent Threat Detection Systems (PTDS) Market Trend Analysis

Machine Learning and AI Advancements

- The growth of Persistent Threat Detection Systems (PTDS) is significantly propelled by advancements in Machine Learning (ML) and Artificial Intelligence (AI). In response to the escalating complexity of cyber threats, ML and AI technologies empower PTDS to augment its capabilities in detecting and responding to potential security breaches. These technological strides empower PTDS solutions to analyze extensive datasets, recognize patterns, and identify anomalies indicative of security threats. The adaptive nature of ML and AI is particularly advantageous for PTDS, enabling it to stay abreast of emerging cyber threats.

- Moreover, ML and AI contribute to a reduction in false positives, enhancing the precision and efficiency of threat detection. Through the application of machine learning algorithms, PTDS continually refines its understanding of normal network behavior, thereby becoming proficient in identifying deviations that may signal malicious activities. The automation features intrinsic to ML and AI play a pivotal role in accelerating incident response times and facilitating swift risk mitigation. As organizations prioritize proactive cybersecurity measures, integrating ML and AI into PTDS not only fortifies defenses against persistent threats but also positions these systems as integral components of contemporary cybersecurity strategies.

Rising Cybersecurity Concerns

- The growing global apprehension about cybersecurity issues represents a substantial prospect for the expansion and advancement of Persistent Threat Detection Systems (PTDS). The dynamic nature of cyber threats, encompassing sophisticated malware, ransomware, and state-sponsored attacks, has intensified the demand for proactive and advanced security solutions. Across various industries, organizations are increasingly acknowledging the necessity for resilient cybersecurity measures to protect sensitive data, and vital infrastructure, and ensure uninterrupted business operations.

- As cyber incidents of significant magnitude continue to attract attention, businesses are compelled to invest in state-of-the-art technologies, making PTDS solutions a focal point in their security strategies. The intricate and expansive nature of contemporary cyber threats necessitates continual monitoring and adaptive threat detection capabilities, precisely the strengths offered by PTDS. Players in the PTDS market have the opportunity to position their solutions as integral components in comprehensive cybersecurity frameworks, equipping organizations to identify and counteract persistent threats in real time. This trend not only underscores the pivotal role of PTDS in mitigating cybersecurity risks but also propels innovation in the sector, as vendors strive to anticipate emerging threats and provide effective solutions addressing the ever-evolving landscape of cyber-attacks.

Persistent Threat Detection Systems (PTDS) Market Segment Analysis:

Persistent Threat Detection Systems (PTDS) Market Segmented on the basis of Deployment Type, Component, Organization Size, application, and Vertical

By Vertical, Government and Defense segment is expected to dominate the market during the forecast Period

- The anticipated dominance of the Government and Defense segment in the Persistent Threat Detection Systems (PTDS) market stems from the escalating cybersecurity priorities and the evolving threat landscape confronting government agencies and defense organizations globally. Governments worldwide are increasingly acknowledging the strategic significance of advanced threat detection capabilities in safeguarding sensitive data, critical infrastructure, and national security interests. The growing frequency and sophistication of cyber threats targeting government entities underscore the need for substantial investments in robust cybersecurity solutions.

- Tailored Persistent Threat Detection Systems designed to address the distinctive challenges encountered by government and defense sectors, such as advanced persistent threats (APTs) and state-sponsored cyber-attacks, are poised for significant adoption. The demand for real-time threat analysis, incident response capabilities, and continuous monitoring aligns with the specific security requirements of government agencies.

By Deployment Type, Cloud-based segment held the largest share of xx% in 2022

- The Cloud-based segment has asserted its dominance in the Persistent Threat Detection Systems (PTDS) market, capturing the largest share. This dominance is attributable to the widespread adoption of cloud computing across industries, leveraging its inherent benefits such as scalability, flexibility, and cost-effectiveness. Organizations are transitioning from conventional on-premises solutions to cloud-based PTDS to address the dynamic cybersecurity requirements of contemporary digital environments.

- The deployment of PTDS in the cloud facilitates seamless integration with cloud infrastructures, enabling organizations to centrally manage and monitor security measures across diverse networks. The scalability inherent in cloud solutions ensures the adaptability of PTDS to the expanding volume and complexity of cyber threats. With businesses increasingly recognizing the strategic significance of cloud-based security, this segment is poised to sustain its leadership position, offering an effective and scalable approach to persistent threat detection amidst the continually evolving cyber threat landscape.

Persistent Threat Detection Systems (PTDS) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is positioned to establish dominance in the Persistent Threat Detection Systems (PTDS) market, emerging as a pivotal growth centre. The region's swift embrace of digital technologies, combined with the increasing complexity of cyber threats, has generated a heightened demand for robust cybersecurity solutions. Governments and enterprises across the Asia Pacific recognize the critical need for advanced threat detection capabilities to safeguard crucial data and infrastructure amid the evolving landscape of cyber risks.

- The rapid economic development, expanding IT infrastructure, and growing awareness of cybersecurity's significance are propelling the PTDS market's growth in the Asia Pacific region. With a burgeoning market for PTDS solutions, driven by a proactive cybersecurity approach, The region's emphasis on real-time threat monitoring, incident response, and continuous adaptation to emerging threats positions it as a dominant force shaping the trajectory of the PTDS market within the global cybersecurity landscape.

Persistent Threat Detection Systems (PTDS) Market Top Key Players:

- Chemimage Sensor Systems (U.S.)

- Rapiscan Systems Inc. (U.S.)

- Lockheed Martin (U.S.)

- Northrop Grumman (U.S.)

- Mirion Technologies Inc. (U.S.)

- Flir Systems Inc. (U.S.)

- Rae Systems Inc. (U.S.)

- Chemring Group Plc (U.K.)

- Smiths Group Plc (U.K.)

- Thales S.A. (France)

- Safran S.A. (France)

- Axis Communication Ab (Sweden), and Other Major Players.

Key Industry Developments in the Persistent Threat Detection Systems (PTDS) Market:

- In November 2022, Ambient.ai, the computer vision intelligence company transforming physical security announced a partnership with Axis Communications, a leading provider of solutions improving security and business performance, to seamlessly integrate the Ambient.ai Platform and Axis Network Cameras. The partnership, extending from Axis’ Technology Integration Partner Program, provides advanced threat detection and response solutions to enhance physical security for numerous joint Axis and Ambient.ai customers, including many Fortune 500 companies.

|

Global Persistent Threat Detection Systems (PTDS) Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 670.78 Mn. |

|

Forecast Period 2023-30 CAGR: |

4.50% |

Market Size in 2030: |

USD 953.92 Mn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Component |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET BY DEPLOYMENT TYPE (2016-2030)

- PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD-BASED

- HYBRID

- PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET BY COMPONENT (2016-2030)

- PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET BY ORGANIZATION SIZE (2016-2030)

- PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISES

- PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET BY VERTICAL (2016-2030)

- PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GOVERNMENT AND DEFENSE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- HEALTHCARE

- IT AND TELECOM

- ENERGY AND UTILITIES

- MANUFACTURING

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Persistent Threat Detection Systems (PTDS) Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CHEMIMAGE SENSOR SYSTEMS (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- RAPISCAN SYSTEMS INC. (U.S.)

- LOCKHEED MARTIN (U.S.)

- NORTHROP GRUMMAN (U.S.)

- MIRION TECHNOLOGIES INC. (U.S.)

- FLIR SYSTEMS INC. (U.S.)

- RAE SYSTEMS INC. (U.S.)

- CHEMRING GROUP PLC (U.K.)

- SMITHS GROUP PLC (U.K.)

- THALES S.A. (FRANCE)

- SAFRAN S.A. (FRANCE)

- AXIS COMMUNICATION AB (SWEDEN)

- COMPETITIVE LANDSCAPE

- GLOBAL PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Deployment Type

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Persistent Threat Detection Systems (PTDS) Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 670.78 Mn. |

|

Forecast Period 2023-30 CAGR: |

4.50% |

Market Size in 2030: |

USD 953.92 Mn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Component |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET COMPETITIVE RIVALRY

TABLE 005. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET THREAT OF NEW ENTRANTS

TABLE 006. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET THREAT OF SUBSTITUTES

TABLE 007. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET BY TYPE

TABLE 008. B-PTDS MARKET OVERVIEW (2016-2028)

TABLE 009. T-PTDS MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET BY APPLICATION

TABLE 012. DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 013. AEROSPACE MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY APPLICATION (2016-2028)

TABLE 016. N PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY APPLICATION (2016-2028)

TABLE 019. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY APPLICATION (2016-2028)

TABLE 022. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY APPLICATION (2016-2028)

TABLE 025. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY APPLICATION (2016-2028)

TABLE 028. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET, BY COUNTRY (2016-2028)

TABLE 029. LOCKHEED MARTIN: SNAPSHOT

TABLE 030. LOCKHEED MARTIN: BUSINESS PERFORMANCE

TABLE 031. LOCKHEED MARTIN: PRODUCT PORTFOLIO

TABLE 032. LOCKHEED MARTIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. SMITHS GROUP: SNAPSHOT

TABLE 033. SMITHS GROUP: BUSINESS PERFORMANCE

TABLE 034. SMITHS GROUP: PRODUCT PORTFOLIO

TABLE 035. SMITHS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. FLIR SYSTEMS: SNAPSHOT

TABLE 036. FLIR SYSTEMS: BUSINESS PERFORMANCE

TABLE 037. FLIR SYSTEMS: PRODUCT PORTFOLIO

TABLE 038. FLIR SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. THALES: SNAPSHOT

TABLE 039. THALES: BUSINESS PERFORMANCE

TABLE 040. THALES: PRODUCT PORTFOLIO

TABLE 041. THALES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. NORTHROP GRUMMAN: SNAPSHOT

TABLE 042. NORTHROP GRUMMAN: BUSINESS PERFORMANCE

TABLE 043. NORTHROP GRUMMAN: PRODUCT PORTFOLIO

TABLE 044. NORTHROP GRUMMAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. AXIS COMMUNICATIONS: SNAPSHOT

TABLE 045. AXIS COMMUNICATIONS: BUSINESS PERFORMANCE

TABLE 046. AXIS COMMUNICATIONS: PRODUCT PORTFOLIO

TABLE 047. AXIS COMMUNICATIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET OVERVIEW BY TYPE

FIGURE 012. B-PTDS MARKET OVERVIEW (2016-2028)

FIGURE 013. T-PTDS MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET OVERVIEW BY APPLICATION

FIGURE 016. DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 017. AEROSPACE MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA PERSISTENT THREAT DETECTION SYSTEMS (PTDS) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Persistent Threat Detection Systems (PTDS) Market research report is 2023-2030.

Chemimage Sensor Systems (U.S.), Rapiscan Systems Inc. (U.S.), Lockheed Martin (U.S.), Northrop Grumman (U.S.), Mirion Technologies Inc. (U.S.), Flir Systems Inc. (U.S.), Rae Systems Inc. (U.S.), Chemring Group Plc (U.K.), Smiths Group Plc (U.K.), Thales S.A. (France), Safran S.A. (France), Axis Communication Ab (Sweden)and Other Major Players.

The Persistent Threat Detection Systems (PTDS) Market is segmented into Deployment Type, Component, Organization Size, Vertical, and Region. By Deployment Type, the market is categorized into On-Premises, Cloud-based, and Hybrid. By Component, the market is categorized into Solutions and Services. By Organization Size, the market is categorized into Small and Medium-sized Enterprises (SMEs), and Large Enterprises. By Vertical, the market is categorized into Government and Defense, Banking, Financial Services, and Insurance (BFSI), Healthcare, IT and Telecom, Energy and Utilities, and Manufacturing. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Persistent Threat Detection Systems (PTDS) represent sophisticated cybersecurity solutions designed to continually monitor and detect ongoing advanced cyber threats within an organizational network. By leveraging advanced technologies like machine learning and threat intelligence, PTDS focuses on identifying and responding to persistent threats, including advanced malware, zero-day attacks, and insider threats, thereby strengthening overall cybersecurity resilience.

Global Persistent Threat Detection Systems (PTDS) Market Size Was Valued at USD 670.78 Million in 2022 and is Projected to Reach USD 953.92 Million by 2030, Growing at a CAGR of 4.50% From 2023-2030.