Aerospace Cyber Security Market Synopsis

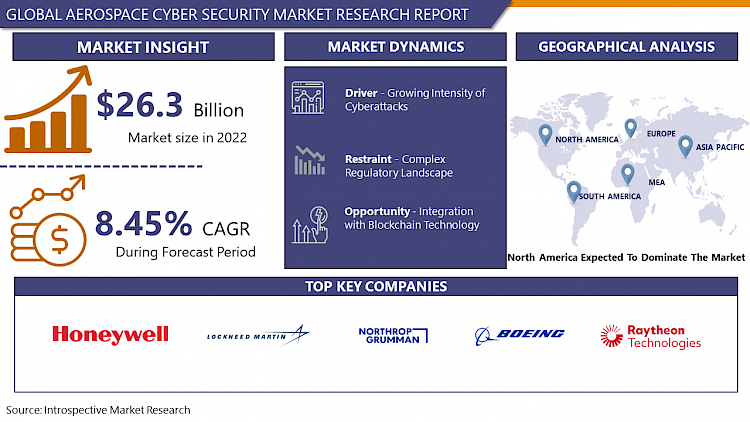

Aerospace Cyber Security Market Size Was Valued at USD 26.3 Billion in 2022, and is Projected to Reach USD 50.33 Billion by 2030, Growing at a CAGR of 8.45% From 2023-2030.

Aerospace cyber security refers to the protection of important information systems, networks, and technologies in the aerospace sector against cyber threats and assaults. It includes the adoption of strong security mechanisms, protocols, and technologies to protect aircraft, spacecraft, ground control systems, and related infrastructure against unauthorized access, data breaches, malware, and other cyber threats. Aerospace cyber security seeks to protect the confidentiality, integrity, and availability of critical data and operations.

- The aerospace industry, which includes some industries like commercial aviation, defense, and space exploration, depends heavily on aerospace cyber security to protect sensitive equipment and data. It may be used in many aspects of the aerospace ecosystem, such as ground control systems, satellites, aircraft, and communication networks. Aerospace companies may reduce the risks of cyberattacks, including unauthorized access, data breaches, and system disruptions.

- It protects sensitive data, such as flight information, passenger information, and military intelligence, for integrity and confidentiality. national security interests are also protected, especially when it comes to defense-related applications, in addition to aerospace firms' interests. strengthening aerospace systems' resistance to cyberattacks, cyber security measures help to minimize the possible effects on reputation, safety, and operations. Enhancing confidence among stakeholders and consumers is another benefit of facilitating compliance with industry norms and standards surrounding data protection and system security.

- The growing digital and global integration of the aircraft sector is expected to increase the need for cyber security. The rise of IoT devices, cloud computing, and autonomous technologies in aerospace necessitates advanced security solutions. Proactive cyber security tactics are crucial as automation and data-driven decision-making become more reliant. As a result, there will be a greater demand for experts in threat intelligence, penetration testing, and incident response in the aerospace cyber security industry.

Aerospace Cyber Security Market Trend Analysis

Growing Intensity of Cyberattacks

- Cyberattacks that affect all sectors of the economy and nations frequently make news due to their unprecedented financial effects, irreversible harm to their reputations, and major interruptions to their daily operations. Cyberattacks are among the top ten global hazards that should worry people the most over the next ten years, according to a World Economic Forum report from just last year. The aerospace sector is a prime target for cybercriminals worldwide. In the last few years. For Instance, The European Aviation Security Agency (EASA) estimates a monthly average of 1,000 airport cyberattacks. Some aerospace actors have been affected by cyberattacks ranging from theft of personal data to operations disruption and even supply chain corruption.

- The aerospace industry is prioritizing cybersecurity measures to protect critical infrastructure and ensure safety. Cyberattacks can lead to flight disruptions, data breaches, financial losses, and compromised national security. As a result, the industry is investing heavily in cybersecurity solutions to mitigate risks and enhance resilience against evolving cyber threats. and the global considering commercial technologies like eLoran, which would broadcast low-frequency radio signals that are 1.3 million times stronger than GPS signals. This technology adoption in Autonomous Integrity Monitoring software prevents GPS satellites from transmitting bad data to airplanes by cross-checking it against other satellite data.

- The rise of connected devices and the Internet of Things (IoT) in the aerospace sector has increased cyber threats, exposing every aspect of operations to potential attacks. Aerospace companies are deploying advanced cybersecurity technologies like intrusion detection systems, encryption protocols, and threat intelligence platforms to detect and respond to cyber threats in real time. The digitization of aircraft systems and the adoption of cloud computing and AI technologies further emphasize the need for robust cybersecurity measures. Aerospace companies are collaborating with cybersecurity experts and technology providers to develop tailored solutions to address unique challenges in the industry. By investing in cybersecurity infrastructure and adopting proactive security measures, aerospace companies can mitigate risks and ensure the safety, reliability, and resilience of their systems in a digitally dependent environment.

According to the graph, the aerospace industry's exports have grown significantly, increasing the threat of cyberattacks. The European _ shows that cyber-attacks have increased rapidly in recent years, raising the risk of aerospace cyber-attacks and requiring countries to take appropriate precautions. The United States has the highest export industry, and as a result, the country has taken more precautions and invested heavily in security, i.e., the market for cyber-attacks has grown significantly.

Integration with Blockchain Technology

- A blockchain is a distributed ledger technology that stores data in blocks that are chronologically connected and cryptographically protected. Instead of a central server, data is kept across a network of computers, and any changes to the data require agreement from all network members. Blockchain technology maintains a permanent record of transactions, enhancing data integrity and creating a transparent system, reducing reliance on centralized controls and mitigating cyber threats. Blockchain technology is rapidly gaining popularity in multidisciplinary industries, managing numerous assets and distributed processes. Its unique characteristics have enabled organizations like the Defense Advanced Research Projects Agency (DARPA) and the North Atlantic Treaty Organization (NATO) to perform secure, transparent, economical, and auditable military operations.

- The aerospace and military sectors use manual procedures and paper-based documentation for record-keeping, which is error-prone and challenging to maintain. Furthermore, this storage strategy raises the danger of data duplication owing to concurrent processing across different groups. and Blockchain technology provides secure, synchronized, and unchangeable data records, removing the need for delegation authorization for transactions, and making it an appealing and cost-effective choice. Blockchain-based registration processes can be used in aerospace and defense applications to register battle-field entities, including sensors, drones, combat equipment, vehicles, aircraft, smart weapons, and warfighters.

- Blockchain technology can improve aerospace cybersecurity by enabling secure identity management and access control. By implementing robust authentication systems, aerospace organizations can restrict access to sensitive systems and data to authorized personnel. Blockchain mitigates insider threats and unauthorized access by managing user identities on a decentralized ledger. Additionally, blockchain can enhance supply chain management and compliance by tracking the provenance of components and materials, ensuring authenticity and regulatory compliance. Transparent and auditable documentation of supply chain transactions enhances visibility and accountability across the entire ecosystem. Overall, blockchain integration in aerospace cybersecurity offers significant opportunities for improved security and compliance.

Aerospace Cyber Security Market Segment Analysis:

Aerospace Cyber Security Market Segmented on the basis of Type, Deployment, and Application

By Deployment, Cloud-Based segment is expected to dominate the market during the forecast period

- The Cloud-Based category is predicted to lead the Aerospace cybersecurity market due to its scalability, flexibility, cost-effectiveness, and resource optimisation. Cloud-based solutions enable aerospace firms to manage and secure their data and systems from several locations, allowing them to successfully safeguard a large network of endpoints and data sources. cloud-based solutions minimize the need for substantial maintenance and upgrades, freeing up internal IT resources to devote to strategic objectives.

- Cloud-based cybersecurity solutions offer enhanced visibility and threat intelligence, enabling aerospace companies to detect and respond to cyber threats more effectively. These platforms use advanced analytics, machine learning, and AI-driven algorithms to analyze vast data and identify anomalous behavior or potential security incidents in real time. This proactive approach helps aerospace organizations stay ahead of emerging threats and mitigate risks before they escalate into serious security breaches or disruptions to operations. The increasing regulatory scrutiny and compliance requirements in the aerospace industry are driving the adoption of cloud-based cybersecurity solutions. Cloud service providers adhere to stringent security and compliance standards, assuring aerospace companies' data and systems. The Cloud-Based segment is expected to dominate the Aerospace Cyber Security market due to its scalability, cost-effectiveness, advanced threat detection capabilities, and alignment with regulatory requirements.

By Application, Aircraft and Drone Security segment is expected to dominate the market during the forecast period

- The growing reliance on digital technology in airplanes and drones has made cybersecurity a primary issue for manufacturers, operators, and regulatory bodies. The growth of onboard devices, sensors, communication networks, and data linkages increases the attack surface for cyber threats. Malicious actors may use vulnerabilities to obtain illegal access, interrupt operations, or jeopardize safety-critical services. Aerospace firms are substantially investing in cybersecurity solutions to guard against possible attacks while also ensuring the integrity and safety of aircraft and drone operations.

- The aerospace industry has seen a boom in the use of unmanned aerial vehicles (UAVs) for both military and commercial purposes, which has made cybersecurity more crucial. Drones are becoming more and more popular targets for cyberattacks because of their usage in infrastructure inspection, freight delivery, surveillance, and reconnaissance. A drone cyberattack might have a variety of unintended effects, such as data theft, bodily harm, or weaponization. Therefore, maintaining public confidence in drone technology and protecting against attacks require that drone systems be cybersecurity resilient. Aerospace regulations are changing quickly, with authorities enforcing strict rules and regulations to improve cybersecurity resilience. Strong cybersecurity solutions suited to the difficulties and complexities of the aircraft industry are necessary for compliance with these standards.

Aerospace Cyber Security Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American region is predicted to dominate the aerospace cybersecurity market due to its significant presence in the global aerospace industry, a robust ecosystem of aerospace companies, research institutions, and government agencies, and advanced technological capabilities. The region's skilled workforce, including threat intelligence, vulnerability assessment, and incident response, enables North American companies to develop advanced cybersecurity solutions and services for the aerospace sector. These solutions range from securing aircraft systems and networks to protecting critical infrastructure and data. The region's strong foundation in innovation and investment in cybersecurity solutions is expected to drive innovation and investment in the aerospace sector.

- The North American region is known for its proactive regulatory environment and stringent compliance standards for cybersecurity in aerospace. Government agencies like the FAA and DOD set guidelines for companies, driving demand for cybersecurity solutions. North America's dominance in the aerospace cybersecurity market is further reinforced by its strong focus on research and development, fostering collaboration between industry stakeholders, academia, and government entities. Public-private partnerships and research grants provide resources and support for advancing cybersecurity technologies, accelerating innovation, and driving the adoption of cutting-edge solutions. This collaborative ecosystem solidifies the region's leadership position in the aerospace cybersecurity market.

Aerospace Cyber Security Market Top Key Players:

- Honeywell International, Inc. (U.S)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- Boeing (U.S.)

- Raytheon Technologies Corporation (U.S.)

- The Aerospace Corporation (U.S.)

- BAE Systems (U.S.)

- Leidos (U.S.)

- Astronautics Corporation of America (U.S.)

- DXC Technology Company (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Collins Aerospace (U.S.)

- CAE Inc. (Canada)

- MTU Aero Engines AG (Germany)

- Rohde & Schwarz (Germany)

- Siemens (Germany)

- Eurocontrol (Belgium)

- Thales Group (France)

- Airbus (France)

- Atos SE (France), and Other Major Players

Key Industry Developments in the Aerospace Cyber Security Market:

- In October 2021, Atos was awarded a contract by the European Space Agency (ESA) under the ARTES C&G program to develop a product to improve the cybersecurity of Electrical Ground Support Equipment (EGSE) platforms that test the electrical system of satellites.

- In November 2022, Honeywell announced the release of its new operational technology (OT) cybersecurity solutions, designed to assist customers in defending the availability, reliability, and safety of their industrial control systems and operations. The offerings, which include a new Advanced Monitoring and Incident Response (AMIR) dashboard and updated Cyber App Control, are designed to empower organizations with 24/7 intelligent threat detection across the expanding attack surface of their industrial control systems (ICS).

- In April 2023, Raytheon Technologies' BBN division and SpiderOak announced a strategic partnership to develop and field a new generation of zero-trust security systems for satellite communications in proliferated low-Earth orbit, or pLEO.

|

Global Aerospace Cyber Security Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 26.3 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.45% |

Market Size in 2030: |

USD 50.33 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- AEROSPACE CYBER SECURITY MARKET BY TYPE (2017-2030)

- AEROSPACE CYBER SECURITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- THREAT INTELLIGENCE AND RESPONSE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IDENTITY AND ACCESS MANAGEMENT (IAM)

- DATA LOSS PREVENTION (DLP)

- SECURITY AND VULNERABILITY MANAGEMENT (SVM)

- MANAGED SECURITY SERVICES (MSS)

- AEROSPACE CYBER SECURITY MARKET BY DEPLOYMENT (2017-2030)

- AEROSPACE CYBER SECURITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD-BASED

- HYBRID

- AEROSPACE CYBER SECURITY MARKET BY APPLICATION (2017-2030)

- AEROSPACE CYBER SECURITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AIRLINE MANAGEMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AIR CARGO MANAGEMENT

- AIRPORT MANAGEMENT

- AIRCRAFT AND DRONE SECURITY

- SATELLITE SECURITY

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Aerospace Cyber Security Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HONEYWELL INTERNATIONAL, INC. (U.S)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- LOCKHEED MARTIN CORPORATION (U.S.)

- NORTHROP GRUMMAN CORPORATION (U.S.)

- BOEING (U.S.)

- RAYTHEON TECHNOLOGIES CORPORATION (U.S.)

- THE AEROSPACE CORPORATION (U.S.)

- BAE SYSTEMS (U.S.)

- LEIDOS (U.S.)

- ASTRONAUTICS CORPORATION OF AMERICA (U.S.)

- DXC TECHNOLOGY COMPANY (U.S.)

- L3HARRIS TECHNOLOGIES, INC. (U.S.)

- COLLINS AEROSPACE (U.S.)

- CAE INC. (CANADA)

- MTU AERO ENGINES AG (GERMANY)

- ROHDE & SCHWARZ (GERMANY)

- SIEMENS (GERMANY)

- EUROCONTROL (BELGIUM)

- THALES GROUP (FRANCE)

- AIRBUS (FRANCE)

- ATOS SE (FRANCE)

- COMPETITIVE LANDSCAPE

- GLOBAL AEROSPACE CYBER SECURITY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Aerospace Cyber Security Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 26.3 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.45% |

Market Size in 2030: |

USD 50.33 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Aerospace Cyber Security Market research report is 2023-2030.

Honeywell International, Inc. (U.S), Lockheed Martin Corporation (U.S.), Northrop Grumman Corporation (U.S.), Boeing (U.S.), Raytheon Technologies Corporation (U.S.), The Aerospace Corporation (U.S.), BAE Systems (U.S.), Leidos (U.S.), Astronautics Corporation of America (U.S.), DXC Technology Company (U.S.), L3Harris Technologies, Inc. (U.S.), Collins Aerospace (U.S.), CAE Inc. (Canada), MTU Aero Engines AG (Germany), Rohde & Schwarz (Germany), Siemens (Germany), Eurocontrol (Belgium), Thales Group (France), Airbus (France), Atos SE (France), and Other Major Players.

The Aerospace Cyber Security Market is segmented into Type, Deployment, Application, and region. By Type, the market is categorized into Threat Intelligence and Response, Identity and Access Management (IAM), Data Loss Prevention (DLP), Security and Vulnerability Management (SVM), and Managed Security Services (MSS). By Deployment, the market is categorized into On-Premises, Cloud-Based, and Hybrid. By Application, the market is categorized into Airline Management, Air Cargo Management, Airport Management, Aircraft and Drone Security, and Satellite Security. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Aerospace cyber security refers to the protection of important information systems, networks, and technologies in the aerospace sector against cyber threats and assaults. It includes the adoption of strong security mechanisms, protocols, and technologies to protect aircraft, spacecraft, ground control systems, and related infrastructure against unauthorized access, data breaches, malware, and other cyber threats. Aerospace cyber security seeks to protect the confidentiality, integrity, and availability of critical data and operations.

Aerospace Cyber Security Market Size Was Valued at USD 26.3 Billion in 2022, and is Projected to Reach USD 50.33 Billion by 2030, Growing at a CAGR of 8.45% From 2023-2030.