Botnet Detection Market Synopsis

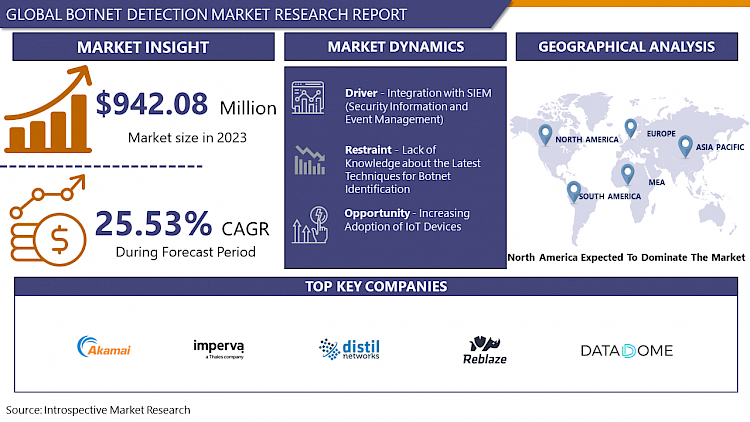

Botnet Detection Market Size Was Valued at USD 942.08 Million in 2023 and is Projected to Reach USD 7291.48 Million by 2032, Growing at a CAGR of 25.53% From 2024-2032.

A botnet is a collection of bots used by one or more hackers for malevolent purposes on a device that has malware on it. Computers, laptops, servers, cellphones, and other Internet of Things devices with security flaws can all become infected by botnets. Because it serves the hacker's best interests for the victim to be unaware that his device is infected, botnets are challenging to identify. Certain top-notch systems for combating advertising fraud, like Anura, continuously analyze traffic to identify visitors who are fraudulent and who are not. When fraud is detected, bots and other sources of fraud are used to send messages. notification of erroneously produced traffic and the completion of a data report outlining the reasons the activity was suspected of being fraudulent.

- The frequency and complexity of cyber threats, including botnet attacks, have escalated in recent years. As more businesses and individuals rely on digital platforms and services, the potential for malicious actors to exploit vulnerabilities and launch botnet-based attacks has increased. This heightened risk has driven organizations to invest in advanced botnet detection solutions to safeguard their networks and data.

- Botnets are becoming more sophisticated, employing advanced techniques to evade traditional security measures. Modern botnets can dynamically adapt their behavior, making them challenging to detect using conventional methods. To combat this, organizations are turning to specialized botnet detection solutions that leverage machine learning, artificial intelligence, and behavioural analytics to identify and mitigate evolving threats.

- The ongoing global digital transformation has expanded the attack surface for cybercriminals. With the proliferation of connected devices, cloud services, and IoT (Internet of Things) devices, the need for comprehensive botnet detection solutions has become paramount to identify and neutralize threats across diverse digital environments.

Botnet Detection Market Trend Analysis

Integration with SIEM (Security Information and Event Management)

- SIEM platforms play a pivotal role in enhancing an organization's cybersecurity posture by aggregating and analyzing security event data from various sources. Integration with SIEM allows for a centralized and comprehensive approach to monitoring, detecting, and responding to potential botnet activities. This integration facilitates the correlation of diverse data sets, enabling security professionals to identify patterns and anomalies indicative of botnet behavior.

- SIEM integration enables the incorporation of threat feeds and intelligence sources, providing organizations with up-to-the-minute information on emerging botnet threats. This real-time awareness is essential for proactive threat mitigation, allowing security teams to respond swiftly to evolving botnet tactics.

- Furthermore, automation and machine learning are gaining prominence in Botnet Detection. Integrating with SIEM platforms allows organizations to leverage advanced analytics and machine learning algorithms for more accurate and efficient botnet detection. The SIEM system acts as a centralized hub for collecting and analyzing data, while machine learning models can identify subtle patterns indicative of botnet activities.

- As organizations increasingly adopt cloud-based infrastructures, another trend is the integration of SIEM with cloud-native security solutions. This ensures that botnet detection capabilities extend seamlessly across on-premises and cloud environments, providing a holistic approach to security.

Increasing Adoption of IoT Devices creates an opportunity for Botnet Detection Market

- The increasing adoption of Internet of Things (IoT) devices has significantly contributed to the growth and opportunities in Botnet Detection. IoT refers to the interconnected network of physical devices that communicate and exchange data with each other through the internet. While IoT devices offer numerous benefits, such as improved efficiency and convenience, they also pose significant security challenges, making the need for robust botnet detection solutions more crucial than ever.

- Smart homes, industrial automation, healthcare, transportation, and smart cities are just a few examples of sectors that have embraced IoT technologies. As the number of connected devices continues to skyrocket, so does the potential for malicious activities, including botnet attacks.

- The opportunities in Botnet Detection arise from the pressing need for effective solutions to safeguard the expanding IoT ecosystem. Botnet detection tools and technologies play a crucial role in identifying and mitigating potential threats posed by botnets. These solutions utilize advanced algorithms, machine learning, and behavioural analytics to detect anomalous patterns of activity that may indicate a botnet presence.

- Companies operating in the Botnet Detection market can capitalize on the growing demand for sophisticated and adaptive solutions to counter the evolving tactics of cybercriminals. Moreover, as regulations surrounding data protection and cybersecurity become more stringent, organizations are compelled to invest in comprehensive botnet detection systems to safeguard sensitive information and maintain the trust of their customers.

Botnet Detection Market Segment Analysis:

Botnet Detection Market Segmented on the basis of offering, deployment, organization size, application, and end-use industry.

By Offering, Services segment is expected to dominate the market during the forecast period

- The escalating sophistication of cyber threats, particularly in the form of botnets, has led organizations to seek specialized expertise for effective detection and mitigation. As botnets become more advanced, traditional security measures may prove insufficient, driving the demand for professional services that offer cutting-edge solutions. Furthermore, the dynamic nature of cyber threats requires continuous monitoring and adaptation, making managed services a valuable asset for businesses aiming to stay ahead of evolving botnet tactics. The Services offering segment, therefore, serves as a crucial component in the comprehensive approach organizations take to fortify their cybersecurity posture.

By Deployment, Cloud-based segment held the largest share in 2022

- Cloud-based solutions are expected to dominate the botnet detection market over the projected period. Utilizing cloud-based provisioning offers businesses improved speed, scalability, 24/7 support, and IT security. There has been a noticeable surge in demand for cloud-based botnet detection solutions since the central delivery approach offers security needs. With the proliferation of cloud-based botnet detection solutions, large enterprises, and small and medium-sized businesses are moving away from traditional local botnet detection solutions and toward cloud-based solutions. Most likely, this will spur growth in the botnet detection industry.

Botnet Detection Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America currently holds the biggest proportion of the global botnet detection market, accounting for over 47% of it. For both the US and Canada, innovation and research and development (R&D) are top priorities. Given the increase in investment in botnet detection solutions to protect websites, APIs, and mobile apps against bot assaults, the region is expected to become the best-selling region in the global market. The threat presented by botnets is increasing along with government demand. For instance, the US Department of Defense (DoD) is keeping a careful eye on the swift spread of malware that infiltrates public and private networks and is looking for highly automated methods to thwart attacks. This is a result of people's growing awareness of the need to protect their privacy.

- This is expected to increase demand for botnet detection solutions across North America. The United States government has consistently implemented strict measures to counteract widespread and widespread botnet attacks. The US Department of Justice revealed in April 2022 details of a court-authorized operation carried out in March 2022 to take down a global botnet consisting of two tiers, comprising thousands of compromised network hardware devices, which was controlled by a threat actor known as Sandworm. The process replicated and eliminated malicious software from susceptibly situated firewalls linked to the internet, which Sandworm employed for the command and control (C2) of the underlying botnet.

Botnet Detection Market Top Key Players:

- Akamai Technologies (Us)

- Imperva (Us)

- White Ops (Us)

- Shape Security (Us)

- Integral Ad Science (Us)

- Distil Networks (Us)

- Perimeterx (Us)

- Digital Hands (Us)

- Stealth Security (Us)

- Shieldsquare (India,

- Unfraud (Us)

- Zenedge (Us)

- Instart Logic (Us)

- Pixalate (Us)

- White Diagnostic (Us)

- Appsflyer (Us)

- Intechnica (Uk)

- Reblaze (Israel)

- Infisecure (India)

- Mfilterit (India)

- Datadome (France)

- Criticalblue (Uk)

- Variti (Switzerland)

- Unbotify (Israel)

- Kasada (Australia)

Key Industry Development: -

In April 2024, Fastly, Inc., a leader in global cloud platforms, introduced Fastly Bot Management, which helps organizations combat automated bot attacks and significantly reduce fraud, DDoS attacks, account takeovers, and other online abuse. Fastly Bot Management is a significant cybersecurity milestone for the company, based on its proven bot mitigation expertise and capabilities currently available in next-generation WAF.

In January 2023, Forter announced the acquisition of Immue, a bot detection company in Tel Aviv, Israel. The most sophisticated fraud operations use bots to track and automate purchases from commercial websites. It’s often-automated systems compete with legitimate customers for the most desirable products.

|

Global Botnet Detection Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 942.08 Mn. |

|

Forecast Period 2024-32 CAGR: |

25.53% |

Market Size in 2032: |

USD 7291.48 Mn. |

|

Segments Covered: |

By Offering |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Application |

|

||

|

By End Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BOTNET DETECTION MARKET BY OFFERING (2017-2032)

- BOTNET DETECTION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STANDALONE SOLUTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- BOTNET DETECTION MARKET BY DEPLOYMENT (2017-2032)

- BOTNET DETECTION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD-BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISES

- BOTNET DETECTION MARKET BY SEGMENT3 (2017-2032)

- BOTNET DETECTION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ORGANIZATION SIZE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- LARGE ENTERPRISES

- BOTNET DETECTION MARKET BY APPLICATION (2017-2032)

- BOTNET DETECTION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MOBILE SECURITY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- App Security

- Database Security

- Others

- BOTNET DETECTION MARKET BY END USE INDUSTRY (2017-2032)

- BOTNET DETECTION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- Retail & eCommerce

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BFSI

- Travel & Hospitality

- Media & Entertainment

- Others

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BOTNET DETECTION Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- Akamai Technologies (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- IMPERVA (US)

- WHITE OPS (US)

- SHAPE SECURITY (US)

- INTEGRAL AD SCIENCE (US)

- DISTIL NETWORKS (US)

- PERIMETERX (US)

- DIGITAL HANDS (US)

- STEALTH SECURITY (US)

- SHIELDSQUARE (INDIA,

- UNFRAUD (US)

- ZENEDGE (US)

- INSTART LOGIC (US)

- PIXALATE (US)

- WHITE DIAGNOSTIC (US)

- APPSFLYER (US)

- INTECHNICA (UK)

- REBLAZE (ISRAEL)

- INFISECURE (INDIA)

- MFILTERIT (INDIA)

- DATADOME (FRANCE)

- CRITICALBLUE (UK)

- VARITI (SWITZERLAND)

- UNBOTIFY (ISRAEL)

- KASADA (AUSTRALIA)

- COMPETITIVE LANDSCAPE

- GLOBAL BOTNET DETECTION MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segment1

- Historic And Forecasted Market Size By Segment2

- Historic And Forecasted Market Size By Segment3

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Botnet Detection Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 942.08 Mn. |

|

Forecast Period 2024-32 CAGR: |

25.53% |

Market Size in 2032: |

USD 7291.48 Mn. |

|

Segments Covered: |

By Offering |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Application |

|

||

|

By End Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BOTNET DETECTION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BOTNET DETECTION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BOTNET DETECTION MARKET COMPETITIVE RIVALRY

TABLE 005. BOTNET DETECTION MARKET THREAT OF NEW ENTRANTS

TABLE 006. BOTNET DETECTION MARKET THREAT OF SUBSTITUTES

TABLE 007. BOTNET DETECTION MARKET BY OFFERING

TABLE 008. STANDALONE SOLUTION MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. BOTNET DETECTION MARKET BY DEPLOYMENT

TABLE 011. CLOUD-BASED MARKET OVERVIEW (2016-2028)

TABLE 012. ON-PREMISES MARKET OVERVIEW (2016-2028)

TABLE 013. BOTNET DETECTION MARKET BY APPLICATION

TABLE 014. MOBILE SECURITY MARKET OVERVIEW (2016-2028)

TABLE 015. APP SECURITY MARKET OVERVIEW (2016-2028)

TABLE 016. DATABASE SECURITY MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. BOTNET DETECTION MARKET BY END USE INDUSTRY

TABLE 019. RETAIL & ECOMMERCE MARKET OVERVIEW (2016-2028)

TABLE 020. BFSI MARKET OVERVIEW (2016-2028)

TABLE 021. TRAVEL & HOSPITALITY MARKET OVERVIEW (2016-2028)

TABLE 022. MEDIA & ENTERTAINMENT MARKET OVERVIEW (2016-2028)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA BOTNET DETECTION MARKET, BY OFFERING (2016-2028)

TABLE 025. NORTH AMERICA BOTNET DETECTION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 026. NORTH AMERICA BOTNET DETECTION MARKET, BY APPLICATION (2016-2028)

TABLE 027. NORTH AMERICA BOTNET DETECTION MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 028. N BOTNET DETECTION MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE BOTNET DETECTION MARKET, BY OFFERING (2016-2028)

TABLE 030. EUROPE BOTNET DETECTION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 031. EUROPE BOTNET DETECTION MARKET, BY APPLICATION (2016-2028)

TABLE 032. EUROPE BOTNET DETECTION MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 033. BOTNET DETECTION MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC BOTNET DETECTION MARKET, BY OFFERING (2016-2028)

TABLE 035. ASIA PACIFIC BOTNET DETECTION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 036. ASIA PACIFIC BOTNET DETECTION MARKET, BY APPLICATION (2016-2028)

TABLE 037. ASIA PACIFIC BOTNET DETECTION MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 038. BOTNET DETECTION MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA BOTNET DETECTION MARKET, BY OFFERING (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA BOTNET DETECTION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA BOTNET DETECTION MARKET, BY APPLICATION (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA BOTNET DETECTION MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 043. BOTNET DETECTION MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA BOTNET DETECTION MARKET, BY OFFERING (2016-2028)

TABLE 045. SOUTH AMERICA BOTNET DETECTION MARKET, BY DEPLOYMENT (2016-2028)

TABLE 046. SOUTH AMERICA BOTNET DETECTION MARKET, BY APPLICATION (2016-2028)

TABLE 047. SOUTH AMERICA BOTNET DETECTION MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 048. BOTNET DETECTION MARKET, BY COUNTRY (2016-2028)

TABLE 049. AKAMAI TECHNOLOGIES: SNAPSHOT

TABLE 050. AKAMAI TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 051. AKAMAI TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 052. AKAMAI TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. IMPERVA: SNAPSHOT

TABLE 053. IMPERVA: BUSINESS PERFORMANCE

TABLE 054. IMPERVA: PRODUCT PORTFOLIO

TABLE 055. IMPERVA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. PERIMETERX: SNAPSHOT

TABLE 056. PERIMETERX: BUSINESS PERFORMANCE

TABLE 057. PERIMETERX: PRODUCT PORTFOLIO

TABLE 058. PERIMETERX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. INSTART LOGIC: SNAPSHOT

TABLE 059. INSTART LOGIC: BUSINESS PERFORMANCE

TABLE 060. INSTART LOGIC: PRODUCT PORTFOLIO

TABLE 061. INSTART LOGIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. INTECHNICA: SNAPSHOT

TABLE 062. INTECHNICA: BUSINESS PERFORMANCE

TABLE 063. INTECHNICA: PRODUCT PORTFOLIO

TABLE 064. INTECHNICA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ZENEDGE (ORACLE): SNAPSHOT

TABLE 065. ZENEDGE (ORACLE): BUSINESS PERFORMANCE

TABLE 066. ZENEDGE (ORACLE): PRODUCT PORTFOLIO

TABLE 067. ZENEDGE (ORACLE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. WHITE OPS: SNAPSHOT

TABLE 068. WHITE OPS: BUSINESS PERFORMANCE

TABLE 069. WHITE OPS: PRODUCT PORTFOLIO

TABLE 070. WHITE OPS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. SHIELDSQUARE: SNAPSHOT

TABLE 071. SHIELDSQUARE: BUSINESS PERFORMANCE

TABLE 072. SHIELDSQUARE: PRODUCT PORTFOLIO

TABLE 073. SHIELDSQUARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. KASADA: SNAPSHOT

TABLE 074. KASADA: BUSINESS PERFORMANCE

TABLE 075. KASADA: PRODUCT PORTFOLIO

TABLE 076. KASADA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. REBLAZE: SNAPSHOT

TABLE 077. REBLAZE: BUSINESS PERFORMANCE

TABLE 078. REBLAZE: PRODUCT PORTFOLIO

TABLE 079. REBLAZE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. INFISECURE: SNAPSHOT

TABLE 080. INFISECURE: BUSINESS PERFORMANCE

TABLE 081. INFISECURE: PRODUCT PORTFOLIO

TABLE 082. INFISECURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. UNBOTIFY: SNAPSHOT

TABLE 083. UNBOTIFY: BUSINESS PERFORMANCE

TABLE 084. UNBOTIFY: PRODUCT PORTFOLIO

TABLE 085. UNBOTIFY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. DIGITAL HANDS: SNAPSHOT

TABLE 086. DIGITAL HANDS: BUSINESS PERFORMANCE

TABLE 087. DIGITAL HANDS: PRODUCT PORTFOLIO

TABLE 088. DIGITAL HANDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. INTEGRAL AD SCIENCE: SNAPSHOT

TABLE 089. INTEGRAL AD SCIENCE: BUSINESS PERFORMANCE

TABLE 090. INTEGRAL AD SCIENCE: PRODUCT PORTFOLIO

TABLE 091. INTEGRAL AD SCIENCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. SHAPE SECURITY: SNAPSHOT

TABLE 092. SHAPE SECURITY: BUSINESS PERFORMANCE

TABLE 093. SHAPE SECURITY: PRODUCT PORTFOLIO

TABLE 094. SHAPE SECURITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. UNFRAUD: SNAPSHOT

TABLE 095. UNFRAUD: BUSINESS PERFORMANCE

TABLE 096. UNFRAUD: PRODUCT PORTFOLIO

TABLE 097. UNFRAUD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. PIXALATE: SNAPSHOT

TABLE 098. PIXALATE: BUSINESS PERFORMANCE

TABLE 099. PIXALATE: PRODUCT PORTFOLIO

TABLE 100. PIXALATE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. APPSFLYER: SNAPSHOT

TABLE 101. APPSFLYER: BUSINESS PERFORMANCE

TABLE 102. APPSFLYER: PRODUCT PORTFOLIO

TABLE 103. APPSFLYER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. VARITI: SNAPSHOT

TABLE 104. VARITI: BUSINESS PERFORMANCE

TABLE 105. VARITI: PRODUCT PORTFOLIO

TABLE 106. VARITI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. MFILTERIT: SNAPSHOT

TABLE 107. MFILTERIT: BUSINESS PERFORMANCE

TABLE 108. MFILTERIT: PRODUCT PORTFOLIO

TABLE 109. MFILTERIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. CRITICALBLUE: SNAPSHOT

TABLE 110. CRITICALBLUE: BUSINESS PERFORMANCE

TABLE 111. CRITICALBLUE: PRODUCT PORTFOLIO

TABLE 112. CRITICALBLUE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. DATADOME: SNAPSHOT

TABLE 113. DATADOME: BUSINESS PERFORMANCE

TABLE 114. DATADOME: PRODUCT PORTFOLIO

TABLE 115. DATADOME: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. STEALTH SECURITY: SNAPSHOT

TABLE 116. STEALTH SECURITY: BUSINESS PERFORMANCE

TABLE 117. STEALTH SECURITY: PRODUCT PORTFOLIO

TABLE 118. STEALTH SECURITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. WHITE DIAGNOSTIC: SNAPSHOT

TABLE 119. WHITE DIAGNOSTIC: BUSINESS PERFORMANCE

TABLE 120. WHITE DIAGNOSTIC: PRODUCT PORTFOLIO

TABLE 121. WHITE DIAGNOSTIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 121. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 122. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 123. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 124. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BOTNET DETECTION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BOTNET DETECTION MARKET OVERVIEW BY OFFERING

FIGURE 012. STANDALONE SOLUTION MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. BOTNET DETECTION MARKET OVERVIEW BY DEPLOYMENT

FIGURE 015. CLOUD-BASED MARKET OVERVIEW (2016-2028)

FIGURE 016. ON-PREMISES MARKET OVERVIEW (2016-2028)

FIGURE 017. BOTNET DETECTION MARKET OVERVIEW BY APPLICATION

FIGURE 018. MOBILE SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 019. APP SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 020. DATABASE SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. BOTNET DETECTION MARKET OVERVIEW BY END USE INDUSTRY

FIGURE 023. RETAIL & ECOMMERCE MARKET OVERVIEW (2016-2028)

FIGURE 024. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 025. TRAVEL & HOSPITALITY MARKET OVERVIEW (2016-2028)

FIGURE 026. MEDIA & ENTERTAINMENT MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA BOTNET DETECTION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE BOTNET DETECTION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC BOTNET DETECTION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA BOTNET DETECTION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA BOTNET DETECTION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Botnet Detection Market research report is 2024-2032.

Akamai Technologies (US), Imperva (US), White Ops (US), Shape Security (US), Integral Ad Science (US), Distil Networks (US), PerimeterX (US), Digital Hands (US), Stealth Security (US), ShieldSquare (India, Unfraud (US), Zenedge (US), Instart Logic (US), Pixalate (US), White Diagnostic (US), AppsFlyer (US), Intechnica (UK), Reblaze (Israel), InfiSecure (India), MfilterIt (India), DataDome (France), CriticalBlue (UK), Variti (Switzerland), Unbotify (Israel), Kasada (Australia), and Other Major Players.

The Botnet Detection Market is segmented into Offering, Deployment, Organization Size, Application, End Use Industry, and region. By Offering, the market is categorized into Standalone Solution, Services. By Deployment, the market is categorized into Cloud-based, On-premises. By Organization Size, the market is categorized into Small and Medium-sized Enterprises (SMEs) and Large Enterprises. By Application, the market is categorized into Mobile Security, App Security, Database Security, Others. By End Use Industry, the market is categorized into End Use Industry. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A botnet is a collection of bots used by one or more hackers for malevolent purposes on a device that has malware on it. Computers, laptops, servers, cellphones, and other Internet of Things devices with security flaws can all become infected by botnets. Because it serves the hacker's best interests for the victim to be unaware that his device is infected, botnets are challenging to identify. Certain top-notch systems for combating advertising fraud, like Anura, continuously analyze traffic to identify visitors who are fraudulent and who are not. When fraud is detected, bots and other sources of fraud are used to send messages. notification of erroneously produced traffic and the completion of a data report outlining the reasons the activity was suspected of being fraudulent.

Botnet Detection Market Size Was Valued at USD 942.08 Million in 2023, and is Projected to Reach USD 7291.48 Million by 2032, Growing at a CAGR of 25.53% From 2024-2032.