Multi-Factor Authentication (MFA) Market Synopsis

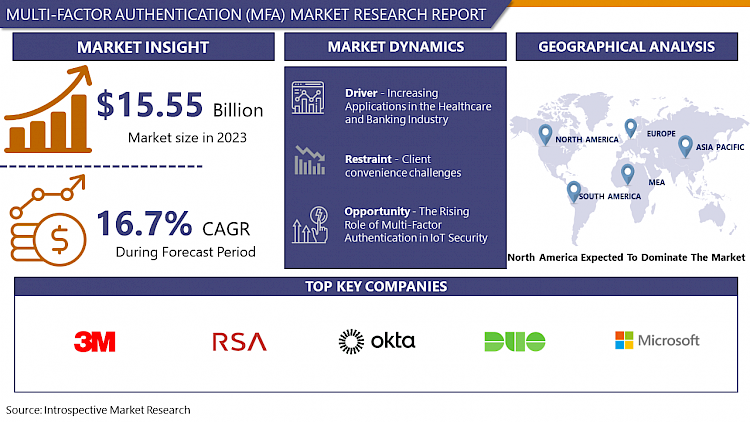

Multi-Factor Authentication (MFA) Market Size Was Valued at USD 15.55 Billion in 2023, and is Projected to Reach USD 61.47 Billion by 2032, Growing at a CAGR of 16.7 % From 2024-2032.

Multi-factor Authentication (MFA) is an authentication measure that demands the user to present two or more distinct mechanisms verification factors in order to validate resources such as an application, online account, or a VPN rather than relying on just a simple username and password combination. Multi-factor authentication (MFA) needs users to provide at least 2 forms of evidence, like their password and a temporary passcode, to approve their identity. MFA is essential to a strong identity and access management (IAM) strategy. MFA consists of one or more extra verification factors Instead of only demanding a username -password, reducing the probability of a cyber-attack. In a digital age characterized by frequent cyber threats and increasingly sophisticated coding techniques, Dependency only on passwords is not enough, as they can be easily compromised and hacked. MFA eliminates and decreases that risk by demanding users to provide at least two authentication methods, such as a password with fingerprint recognition, a code sent to a mobile phone, or facial recognition. This added protection significantly reduces the likelihood of unauthorized use, improves overall data protection and increases trust in digital communications across platforms and devices.

- The core benefit of MFA is it will enhance and improves the organization's security by requiring users to identify themselves by more than a username and password. While important, usernames and passwords are vulnerable to brute force attacks and can be stolen by third parties. Enforcing the use of an MFA factor like a thumbprint or physical hardware key means increased confidence that your organization will stay safe from cyber criminals. MFA helps to avoid unauthorized access to applications and sensitive data, assisting organizations to defend against identity theft, cyberattacks, and data breaches.

- The core benefit of MFA is to enhance and improve the security of an organization by requesting consumers to identify them with something other than a username - and password. While usernames and passwords are crucial, they are susceptible to Cyber-Attacks and can be stolen or misused by third parties and cyber attackers. Implementing the use of an MFA factor such as a thumbprint or physical hardware key increases confidence that the organization is protected from cybercriminals. MFA works by requiring additional authentication information (factors). One of the most common MFA problems users encounter is one-time passwords (OTPs). OTPs are those 4-8-digit codes that customers often receive via email, text message, or some mobile app. With OTP, a new code is generated periodically or every time an authentication request is sent. The code is generated based on the initial value assigned to the user when they first sign in, and some other factor, which could simply be an incremented counter or time value.

Multi-Factor Authentication (MFA) Market Trend Analysis

Increasing Applications in the Healthcare and Banking Industry

- The growing demand for multi-factor authentication systems which confirm the security of businesses and other organizations and their customers is rising due to the development of the healthcare, retail, banking, finance, and insurance (BFSI) sectors. As banks perform various functions such as core banking, trade finance, international payments, and online banking, all of which require secure connections to ensure a smooth user experience and smooth operations.

- Also, according to Global Data Systems, “Healthcare is the most targeted industry for cyberattacks because the black-market value of medical data is exceptionally high.” Under these circumstances, for healthcare technology to continue advancing, the industry needed a secure solution that protected healthcare data and allowed authorized access.

The Rising Role of Multi-Factor Authentication in IoT Security

- Multi-factor authentication (MFA) is gaining momentum in the Internet of Things (IoT) ecosystem due to vulnerabilities in traditional single-factor methods such as weak passwords and lack of direct user interaction on IoT devices. MFA provides a higher level of security by requiring multiple credentials to authenticate users, which extends the scope of authentication.

- MFA includes factors such as passwords, unique identifiers, biometric fingerprints, retina scans, vein scans, voice recognition, signature recognition, and contextual information like login location and time. Multiple authentication factors in these dimensions significantly raise the bar for MFA to potential attackers, eliminating and reducing the risks associated with cyber-attacks. Due to continues growth of Internet of Things (IoT) in various industries, the importance and need for strong security measures are increasingly emphasized.

Multi-Factor Authentication (MFA) Market Segment Analysis:

Multi-Factor Authentication (MFA) Market is Segmented on the Authentication Type, by Component, by Model Type and by End User.

By Type, Two - Factor Authentication segment is expected to dominate the market during the forecast period

- In Two Factor Authentication Use of smart cards is rising. Smart card as a physical component delivers multi-layered security. Cards shaped with advanced encryption features are highly resistant to hacking, cloning or counterfeiting. Their anti-knock design, reinforced by built-in security elements such as metal layers and sensors that detect and sense various attacks, guarantees the integrity of the authentication process. Smart cards integrate encryption elements that protect stored information and require secure search methods.

- The demand and necessity for smart cards in two-factor authentications is because of their effectiveness in reducing and eliminating the risks of unauthorized use and identity theft. In an environment where cyber threats are increasing rapidly, organizations and individuals alike understand the importance of strong security actions. Smart cards not only reliably verify the user's identity, but also provide security against various attack vectors. Associating a physical thing (smart card) with something known (PIN) creates a strong defense against unauthorized access and protects sensitive digital assets in a cybersecurity environment. Therefore, the introduction of smart cards and 2FA represents a proactive response to evolving threats and highlights their central role in strengthening digital security frameworks.

By End User, Banking and financial institutions segment dominates the market.

- Banks and financial institutions are endlessly under threat from cybercriminals. They aim to take advantage of weaknesses in Bank and financial systems. The banking and finance industry's uncompromising nature leads to the popularity of MFA due to the possibility for significant financial loss along with reputational damage by compromising sensitive information. It is projected that each company in the banking sector is facing a cost of 15.4 million euros per year due to cyber-attacks.

- In the arena of banking and finance, individuals use passwords, biometrics, or one-time codes prior for accessing accounts and conducting transactions. Mostly purpose of the attack is to acquire private user information such as usernames, passwords, credit card numbers, and social security numbers, regardless of the variety of attacks.

- The main problem with old-style logins using usernames and passwords is that hackers can easily access and steal passwords, leading to potential millions of dollars in damage. Automated password cracking tools are a significant worry due to the possibility of brute force cyberattacks, where cybercriminals systematically test various login and password combinations until successful. Rules like FFIEC guidelines commanded that financial institutions need to have robust security measures like MFA to safeguard and protect customer data and stay in accordance.

- Various applications utilize biometric authentication, fingerprint, facial recognition, Voice recognition, Retina scanner in banking apps and ATMs. Banks and financial institutions utilize token-based authentication systems that require customers to use physical tokens or mobile applications to produce unique passwords for account access or transaction approval.

Multi-Factor Authentication (MFA) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Cyberattacks, particularly identity-related crimes, have a significant impact on the Unite States compared to other regions globally. Growing cyber threats in the region are leading to a higher need for strong security solutions. More strict regulations like GDPR and HIPAA are prompting organizations to implement MFA for regulatory compliance.

- Governments in North America recognize cybersecurity as the most critical economic and national security threat. The rising risk of identity theft is a robust promoter for executing MFA in multiple sectors. As traditional authentication methods are acknowledged to have limitations, MFA provides a strong way to increase security and prevent unauthorized access and identity theft for both organizations and individuals.

- MFA is mandatory in the United States for government agencies, individuals who utilize tokens and PINs for remote entry, and for those who access government websites.

- The Government has directed the NCSA, along with public-private and non-profit groups, to collaborate with technology companies like Google, Microsoft, and Facebook to encourage the adoption of two-factor authentication.

Multi-Factor Authentication (MFA) Market Top Key Players:

- 3M (U.S.)

- RSA Security (U.S.)

- Okta, Inc. (U.S.)

- Duo Security (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Giesecke+Devrient Mobile Security GmbH (Brazil)

- IDTECH (Brazil)

- Auth0 (Czech Republic)

- Yubico (Sweden)

- Nok Nok Labs (Slovakia)

- Gemalto NV (Netherlands)

- Vasco Data Security International, Inc. (Belgium)

- Thales Group (France)

- Ping Identity (U.K)

- OneSpan (Switzerland)

- Entersekt (South Africa)

- NEC Corporation (Japan)

- Fujitsu Ltd. (Japan)

- HID Global Corporation (Singapore)

- Symantec Corporation (India)

- NetIQ Corporation (India)

- RSA Security (India)

- MFA Security (Australia)

- SecureAuth Corporation (Australia)

Key Industry Developments in the Multi-Factor Authentication (MFA) Market:

- In May 2024, RSA is working with Microsoft to secure environments with new external authentication methods. RSA announced that it is strengthening Microsoft environments through an ongoing collaboration that brings additional security to Office environments. With the new External Authentication Methods (EAM) feature, more customers can extend the use of RSA solutions, including RSA authentication and access capabilities, to many other Microsoft environments.

- In September 2023, Microsoft and Oracle are expanding their partnership to offer Oracle database services on Microsoft Azure, Oracle's cloud infrastructure. Oracle Corp and Microsoft Corp announced Oracle Database Azure, which offers customers direct access to Oracle database services running on Oracle Cloud Infrastructure (OCI) and deployed in Microsoft Azure data centers.

|

Global Multi-Factor Authentication (MFA) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.7 % |

Market Size in 2032: |

USD 61.47 Bn. |

|

Segments Covered: |

By Authentication Type |

|

|

|

By Component |

|

||

|

By Model Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MULTI - FACTOR AUTHENTICATION (MFA) MARKET BY AUTHENTICATION TYPE (2017-2032)

- MULTI - FACTOR AUTHENTICATION (MFA) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PASSWORD - BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PASSWORD LESS

- MULTI - FACTOR AUTHENTICATION (MFA) MARKET BY COMPONENT (2017-2032)

- MULTI - FACTOR AUTHENTICATION (MFA) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HARDWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOFTWARE

- SERVICES

- MULTI - FACTOR AUTHENTICATION (MFA) MARKET BY MODEL TYPE (2017-2032)

- MULTI - FACTOR AUTHENTICATION (MFA) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TWO-FACTOR AUTHENTICATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- THREE-FACTOR AUTHENTICATION

- FOUR-FACTOR AUTHENTICATION

- FIVE-FACTOR AUTHENTICATION

- MULTI - FACTOR AUTHENTICATION (MFA) MARKET BY END USER (2017-2032)

- MULTI - FACTOR AUTHENTICATION (MFA) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BANKING AND FINANCIAL INSTITUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MILITARY AND DEFENSE

- COMMERCIAL SECURITY

- TRAVEL AND IMMIGRATION

- GOVERNMENT

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- 3AM

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- RSA Security (U.S.)

- Okta, Inc. (U.S.)

- Duo Security (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Giesecke+Devrient Mobile Security GmbH (Brazil)

- IDTECH (Brazil)

- Auth0 (Czech Republic)

- Yubico (Sweden)

- Nok Nok Labs (Slovakia)

- Gemalto NV (Netherlands)

- Vasco Data Security International, Inc. (Belgium)

- Thales Group (France)

- Ping Identity (U.K)

- OneSpan (Switzerland)

- Entersekt (South Africa)

- NEC Corporation (Japan)

- Fujitsu Ltd. (Japan)

- HID Global Corporation (Singapore)

- Symantec Corporation (India)

- NetIQ Corporation (India)

- RSA Security (India)

- MFA Security (Australia)

- SecureAuth Corporation (Australia)

- COMPETITIVE LANDSCAPE

- GLOBAL MULTI - FACTOR AUTHENTICATION (MFA) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Authentication Type

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Model Type

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Multi-Factor Authentication (MFA) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.7 % |

Market Size in 2032: |

USD 61.47 Bn. |

|

Segments Covered: |

By Authentication Type |

|

|

|

By Component |

|

||

|

By Model Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MULTIFACTOR AUTHENTICATION (MFA) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MULTIFACTOR AUTHENTICATION (MFA) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MULTIFACTOR AUTHENTICATION (MFA) MARKET COMPETITIVE RIVALRY

TABLE 005. MULTIFACTOR AUTHENTICATION (MFA) MARKET THREAT OF NEW ENTRANTS

TABLE 006. MULTIFACTOR AUTHENTICATION (MFA) MARKET THREAT OF SUBSTITUTES

TABLE 007. MULTIFACTOR AUTHENTICATION (MFA) MARKET BY TYPE

TABLE 008. TWO-FACTOR AUTHENTICATION MARKET OVERVIEW (2016-2028)

TABLE 009. THREE-FACTOR AUTHENTICATION MARKET OVERVIEW (2016-2028)

TABLE 010. FOUR-FACTOR AUTHENTICATION MARKET OVERVIEW (2016-2028)

TABLE 011. FIVE-FACTOR AUTHENTICATION MARKET OVERVIEW (2016-2028)

TABLE 012. MULTIFACTOR AUTHENTICATION (MFA) MARKET BY APPLICATION

TABLE 013. BFSI MARKET OVERVIEW (2016-2028)

TABLE 014. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 015. TRAVEL AND IMMIGRATION MARKET OVERVIEW (2016-2028)

TABLE 016. MILITARY AND DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 017. COMMERCIAL SECURITY MARKET OVERVIEW (2016-2028)

TABLE 018. IT MARKET OVERVIEW (2016-2028)

TABLE 019. TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

TABLE 020. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 021. MEDIA AND ENTERTAINMENT MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY APPLICATION (2016-2028)

TABLE 024. N MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY TYPE (2016-2028)

TABLE 026. EUROPE MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY APPLICATION (2016-2028)

TABLE 027. MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY TYPE (2016-2028)

TABLE 029. ASIA PACIFIC MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY APPLICATION (2016-2028)

TABLE 030. MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY APPLICATION (2016-2028)

TABLE 033. MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY TYPE (2016-2028)

TABLE 035. SOUTH AMERICA MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY APPLICATION (2016-2028)

TABLE 036. MULTIFACTOR AUTHENTICATION (MFA) MARKET, BY COUNTRY (2016-2028)

TABLE 037. MICROSOFT: SNAPSHOT

TABLE 038. MICROSOFT: BUSINESS PERFORMANCE

TABLE 039. MICROSOFT: PRODUCT PORTFOLIO

TABLE 040. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. DUO SECUIRTY: SNAPSHOT

TABLE 041. DUO SECUIRTY: BUSINESS PERFORMANCE

TABLE 042. DUO SECUIRTY: PRODUCT PORTFOLIO

TABLE 043. DUO SECUIRTY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. APERSONA,INC: SNAPSHOT

TABLE 044. APERSONA,INC: BUSINESS PERFORMANCE

TABLE 045. APERSONA,INC: PRODUCT PORTFOLIO

TABLE 046. APERSONA,INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BIOMIO: SNAPSHOT

TABLE 047. BIOMIO: BUSINESS PERFORMANCE

TABLE 048. BIOMIO: PRODUCT PORTFOLIO

TABLE 049. BIOMIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. EMC CORP.: SNAPSHOT

TABLE 050. EMC CORP.: BUSINESS PERFORMANCE

TABLE 051. EMC CORP.: PRODUCT PORTFOLIO

TABLE 052. EMC CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. ENTRUST INC.: SNAPSHOT

TABLE 053. ENTRUST INC.: BUSINESS PERFORMANCE

TABLE 054. ENTRUST INC.: PRODUCT PORTFOLIO

TABLE 055. ENTRUST INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. GEMALTO NV: SNAPSHOT

TABLE 056. GEMALTO NV: BUSINESS PERFORMANCE

TABLE 057. GEMALTO NV: PRODUCT PORTFOLIO

TABLE 058. GEMALTO NV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. DEEPNET SECURITY: SNAPSHOT

TABLE 059. DEEPNET SECURITY: BUSINESS PERFORMANCE

TABLE 060. DEEPNET SECURITY: PRODUCT PORTFOLIO

TABLE 061. DEEPNET SECURITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. VASCO DATA SECURITY INTERNATIONAL INC.: SNAPSHOT

TABLE 062. VASCO DATA SECURITY INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 063. VASCO DATA SECURITY INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 064. VASCO DATA SECURITY INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. SAFENET INC.: SNAPSHOT

TABLE 065. SAFENET INC.: BUSINESS PERFORMANCE

TABLE 066. SAFENET INC.: PRODUCT PORTFOLIO

TABLE 067. SAFENET INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. SYMANTEC CORPORATION: SNAPSHOT

TABLE 068. SYMANTEC CORPORATION: BUSINESS PERFORMANCE

TABLE 069. SYMANTEC CORPORATION: PRODUCT PORTFOLIO

TABLE 070. SYMANTEC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CA TECHNOLOGY: SNAPSHOT

TABLE 071. CA TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 072. CA TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 073. CA TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. CENSORNET LTD: SNAPSHOT

TABLE 074. CENSORNET LTD: BUSINESS PERFORMANCE

TABLE 075. CENSORNET LTD: PRODUCT PORTFOLIO

TABLE 076. CENSORNET LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. SYMITAR: SNAPSHOT

TABLE 077. SYMITAR: BUSINESS PERFORMANCE

TABLE 078. SYMITAR: PRODUCT PORTFOLIO

TABLE 079. SYMITAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. CROSSMATCH: SNAPSHOT

TABLE 080. CROSSMATCH: BUSINESS PERFORMANCE

TABLE 081. CROSSMATCH: PRODUCT PORTFOLIO

TABLE 082. CROSSMATCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OKTA: SNAPSHOT

TABLE 083. OKTA: BUSINESS PERFORMANCE

TABLE 084. OKTA: PRODUCT PORTFOLIO

TABLE 085. OKTA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. FUJITSU: SNAPSHOT

TABLE 086. FUJITSU: BUSINESS PERFORMANCE

TABLE 087. FUJITSU: PRODUCT PORTFOLIO

TABLE 088. FUJITSU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. AMAZON: SNAPSHOT

TABLE 089. AMAZON: BUSINESS PERFORMANCE

TABLE 090. AMAZON: PRODUCT PORTFOLIO

TABLE 091. AMAZON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. SECUGEN CORPORATION: SNAPSHOT

TABLE 092. SECUGEN CORPORATION: BUSINESS PERFORMANCE

TABLE 093. SECUGEN CORPORATION: PRODUCT PORTFOLIO

TABLE 094. SECUGEN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. IOVATION INC: SNAPSHOT

TABLE 095. IOVATION INC: BUSINESS PERFORMANCE

TABLE 096. IOVATION INC: PRODUCT PORTFOLIO

TABLE 097. IOVATION INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. SAFRAN: SNAPSHOT

TABLE 098. SAFRAN: BUSINESS PERFORMANCE

TABLE 099. SAFRAN: PRODUCT PORTFOLIO

TABLE 100. SAFRAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. RSA SECURITY LLC: SNAPSHOT

TABLE 101. RSA SECURITY LLC: BUSINESS PERFORMANCE

TABLE 102. RSA SECURITY LLC: PRODUCT PORTFOLIO

TABLE 103. RSA SECURITY LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. VASCO DATA SECURITY INTERNATIONAL,INC.: SNAPSHOT

TABLE 104. VASCO DATA SECURITY INTERNATIONAL,INC.: BUSINESS PERFORMANCE

TABLE 105. VASCO DATA SECURITY INTERNATIONAL,INC.: PRODUCT PORTFOLIO

TABLE 106. VASCO DATA SECURITY INTERNATIONAL,INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. ZK SOFTWARE: SNAPSHOT

TABLE 107. ZK SOFTWARE: BUSINESS PERFORMANCE

TABLE 108. ZK SOFTWARE: PRODUCT PORTFOLIO

TABLE 109. ZK SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. HID GLOBAL CORPORATION/ASSA ABLOY AB: SNAPSHOT

TABLE 110. HID GLOBAL CORPORATION/ASSA ABLOY AB: BUSINESS PERFORMANCE

TABLE 111. HID GLOBAL CORPORATION/ASSA ABLOY AB: PRODUCT PORTFOLIO

TABLE 112. HID GLOBAL CORPORATION/ASSA ABLOY AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. NEC CORPORATION: SNAPSHOT

TABLE 113. NEC CORPORATION: BUSINESS PERFORMANCE

TABLE 114. NEC CORPORATION: PRODUCT PORTFOLIO

TABLE 115. NEC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. NEXUS GROUP: SNAPSHOT

TABLE 116. NEXUS GROUP: BUSINESS PERFORMANCE

TABLE 117. NEXUS GROUP: PRODUCT PORTFOLIO

TABLE 118. NEXUS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. RCG HOLDINGS LIMITED: SNAPSHOT

TABLE 119. RCG HOLDINGS LIMITED: BUSINESS PERFORMANCE

TABLE 120. RCG HOLDINGS LIMITED: PRODUCT PORTFOLIO

TABLE 121. RCG HOLDINGS LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 121. SECURENVOY LTD: SNAPSHOT

TABLE 122. SECURENVOY LTD: BUSINESS PERFORMANCE

TABLE 123. SECURENVOY LTD: PRODUCT PORTFOLIO

TABLE 124. SECURENVOY LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 124. SUPREMA HQ INC.: SNAPSHOT

TABLE 125. SUPREMA HQ INC.: BUSINESS PERFORMANCE

TABLE 126. SUPREMA HQ INC.: PRODUCT PORTFOLIO

TABLE 127. SUPREMA HQ INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MULTIFACTOR AUTHENTICATION (MFA) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MULTIFACTOR AUTHENTICATION (MFA) MARKET OVERVIEW BY TYPE

FIGURE 012. TWO-FACTOR AUTHENTICATION MARKET OVERVIEW (2016-2028)

FIGURE 013. THREE-FACTOR AUTHENTICATION MARKET OVERVIEW (2016-2028)

FIGURE 014. FOUR-FACTOR AUTHENTICATION MARKET OVERVIEW (2016-2028)

FIGURE 015. FIVE-FACTOR AUTHENTICATION MARKET OVERVIEW (2016-2028)

FIGURE 016. MULTIFACTOR AUTHENTICATION (MFA) MARKET OVERVIEW BY APPLICATION

FIGURE 017. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 018. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 019. TRAVEL AND IMMIGRATION MARKET OVERVIEW (2016-2028)

FIGURE 020. MILITARY AND DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 021. COMMERCIAL SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 022. IT MARKET OVERVIEW (2016-2028)

FIGURE 023. TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

FIGURE 024. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 025. MEDIA AND ENTERTAINMENT MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA MULTIFACTOR AUTHENTICATION (MFA) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE MULTIFACTOR AUTHENTICATION (MFA) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC MULTIFACTOR AUTHENTICATION (MFA) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA MULTIFACTOR AUTHENTICATION (MFA) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA MULTIFACTOR AUTHENTICATION (MFA) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Multi-Factor Authentication (MFA) Market research report is 2024-2032.

3M (U.S.), RSA Security (U.S.), Okta, Inc. (U.S.), Duo Security (U.S.), Microsoft Corporation (U.S.), IBM Corporation (U.S.), Giesecke+Devrient Mobile Security GmbH (Brazil), IDTECH (Brazil), Auth0 (Czech Republic), Yubico (Sweden), Nok Nok Labs (Slovakia), Gemalto NV (Netherlands), Vasco Data Security International, Inc. (Belgium), Thales Group (France), Ping Identity (U.K), OneSpan (Switzerland), Entersekt (South Africa), NEC Corporation (Japan), Fujitsu Ltd. (Japan), HID Global Corporation (Singapore), Symantec Corporation (India), NetIQ Corporation (India), RSA Security (India), MFA Security (Australia), SecureAuth Corporation (Australia) and Other Major Players.

The Multi-Factor Authentication (MFA) Market is segmented into Authentication Type, Component, Model Type, End User. By Type, the market is categorized into Password-Based, Password less. By Component, the market is categorized into Hardware, Software, Services. By Model Type, the market is categorized into Two-factor Authentication, Three-factor Authentication, Four-factor Authentication, Five-factor Authentication. By End User, the market categorized into Government, Military and Defense, Commercial Security, Travel and Immigration, Banking and Financial Institutions, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Multi-factor Authentication (MFA) is an authentication measure that demands the user to present two or more distinct mechanisms verification factors in order to validate resources such as an application, online account, or a VPN rather than relying on just a simple username and password combination. Multi-factor authentication (MFA) needs users to provide at least 2 forms of evidence, like their password and a temporary passcode, to approve their identity. MFA is essential to a strong identity and access management (IAM) strategy.

Multi-Factor Authentication (MFA) Market Size Was Valued at USD 15.55 Billion in 2023, and is Projected to Reach USD 61.47 Billion by 2032, Growing at a CAGR of 16.7% From 2024-2032.