IOT Payments Market Overview

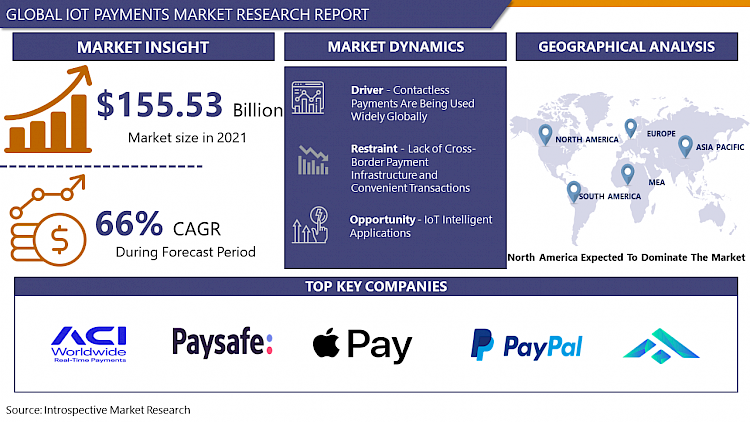

The Global IOT Payments Market size is expected to grow from USD 258.18 billion in 2022 to USD 14886.31 billion by 2030, at a CAGR of 66% during the forecast period (2023-2030).

Consumers and retailers are rapidly adopting technology and using the IoT to further digitize their relationships. Internet of Things (IoT) is designed as the best form of integration between people and communication devices and devices. It is a network of devices, machines, vehicles, and buildings connected via communication networks such as the Internet, RFID, and NFC, with microprocessors, sensors, and corresponding software for data acquisition, processing, and real-time delivery. The purpose of establishing this network is to create automated living and working conditions that allow individuals to easily navigate and perform routine processes quickly through an intelligent environment. Payment is one of the key issues in IoT development as many of the relationships that emerge are business-related and require payment for services and products. Integration of AI and Machine Learning in IoT has pushed the new developments of secured payment getaways making safe transactions globally. The role and importance of electronic payments in the development of IoT concepts are constantly growing and further pushing the global IoT payments market.

Covid19 Impact on IoT Payments Market

Covid19 pandemic caused a major shift to cashless transactions as the world goes into lockdown and social distancing norms have become new normal which have created a major impact on physical transactions. IoT technology can monitor and manage these online transactions electronically, helping to streamline payments. Electronic payments are already benefiting from the long-standing trend that physical cash is rapidly becoming a thing of the past and the outbreak of COVID 19 is expected to accelerate the use of electronic payment methods. Moreover, the total number of transactions is declining, but most shops around the world only accept digital payments. Cash is rapidly becoming a thing of the past, but some traditional generations are still resisting the use of digital currencies.

Digital payments continue to evolve, adding solvent IoT devices that extend the browser and mobile payment experience. Consumers can pay on a variety of newly connected devices, including connected cars, appliances, and more recently wearables. At the same time, the IoT is also changing retail point-of-sale (PoS) with several new touchpoints such as parking meters, changing room mirrors, and vending machines. IoT devices range from small portable devices and shopping carts to home appliances and automobiles. The IoT device uses the connection channel to initiate a payment transaction. Thus, Covid19 has certainly caused a dimensional shift in terms of payment methods which is beneficial for the IoT payments market.

Market Dynamics and Factors:

Drivers

Contactless payments are being used widely in all parts of the world which helps reduce customer queues and hassles and provides transparent transactions which yield higher revenue for retailers. Contactless transactions are much faster than traditional cash and conventional card transactions. The reduced transactional time creates a great outcome in shorter queues, growth in revenue, and improved customer satisfaction. Due to increased output at each Point of Sale (PoS), a minimum workforce is required during peak hours. Visa claims that the acceptance of contactless smart cards has grown globally as the transaction process becomes easy and hassle-free. Europe and the Asia Pacific are the leading regions in terms of adopting contactless smart cards.

All major governments are introducing the new regulation on IoT-related potential verticals to streamline the process of IT and cyber security as the growing digitalization in every sector creates room for an improved regulatory framework. UK and Australia are among the leading countries to ensure the top cyber security laws and implementation. The United States also made notable additions in the regulation adding reasonable security features in IoT devices and special provisions made for IoT-based payment getaways. Acknowledgment from the government boosted the IoT payment market.

Restraints

IoT is a fairly new concept that has the fastest adoption rate among customers as well as service providers. IoT can be utilized in any part of the world with desired verticals which makes it globally accessible. One of the major restraining factors of IoT is the lack of cross-border payment infrastructure and convenient transactions for the common user. Limited payment getaways and higher processing charges make it slightly expensive for small transactions.

Opportunities

IoT Intelligent Applications have a tremendous opportunity in IoT-based payment getaways as the integration of AI and Machine learning technologies into the IoT Payment market. IoT Intelligent Applications are software-as-a-service (SaaS) applications that analyse, process, and present IoT sensor data to business users through dashboards. IoT applications run through machine learning algorithms to analyse huge amounts of linked sensor data in the cloud. Using IoT dashboards alerts provides visibility into KPIs, statistics for mean time between failures, transactional data, internal documentation, and other information. Machine learning-based algorithms identify abnormal anomalies and provide alerts to users and even proceed with automated fixes or suitable countermeasures. Application of AI and Machine Learning have potential growth opportunities in the IoT payment market in the coming years.

Challenges

Currently, sophisticated cyber-attacks are the main challenge to face by the IoT payment market as cross-border transactions are generally carried out online and the growing trend of IoT-based transactions in large volume has to be ultra secured due to threats of cyber-attacks on such occasions.Capacity and Scalability are considered to be the main challenges faced by the IoT payment platforms due to the large transaction volume and capacity of processing it from the payment companies. Such transaction often sees heavy traffic on the servers as well as a breakdown of the system which is the cause of concern. Protection of personal data which is required for IoT transactions is the key challenge for payment companies need to address to attract the general population which holds a large number of shares in the market.

Market Segmentation

Segmentation Analysis of IOT Payments Market:

By Component, Solution is the dominating component segment of the IoT payments market. Digital payment wallet is one of the fastest-growing platforms in contactless payment in the solution segment which allows keeping money in the secured virtual container which is generally used for payments, money transfers. Currently, digital payment wallets are being used at large in mobile with the constant mobile-friendly application is being introduced by blue ocean and red ocean companies which makes it a very competitive market. Payment getaway solutions and payment processing solutions are the traditional transaction methods that are generally used by the banking and finance sector for security purposes with large amounts of transactions. Nonetheless, these solutions are still the preferred choice in many organizations for large volume transactions.

By Deployment Type, Cloud is dominating in the deployment segment of the IoT payments market and is anticipated to grow during the forecasted period. Cloud bases Software as a service (SaaS) is growing at a swift pace in the BFSI and IT sector allowing businesses to streamline their payment structure to be a seamless experience for customers as well as vendors and stakeholders of the organization. Cloud-based IoT payment applications allow the data to be processed, manage and secure on massive cloud platforms using real-time IoT dashboards which provide visibility in transactions. Companies like Oracle and Google are the major cloud computing service provider to leading companies and governments globally.

By Organisation Size, Large enterprises are leading in the organization size segment of the IoT payments market. Enterprise with more than 1500 workforce considered as the large enterprise which adopts the digital payment solutions for flawless payment landscape, dynamic customer trends and streamlines business operations across the organization which creates market competitiveness. The Omnichannel approach used by large enterprises for delightful customer experience drives the organization for digital payment solutions, E-wallets and easy payment process create which drives the market growth of IoT payment market.

By Verticals, Retail and Ecommerce is the dominating in a vertical segment in IoT payment market. Retail and Ecommerce are anticipated to grow during the forecasted period as the integration of the online market, digital payment, and synchronization of electronic devices with the internet makes it the smoother option of payment for goods and services. Retails and Ecommerce also integrated digital wallet systems and loyalty points for digital payments to boost online transactions and utilize the massive opportunity with a larger customer base for IoT payment options. Retail and Ecommerce is the major contributor to the growth of the IoT payment market.

Players Covered in IOT Payments Market are :

- ACI Worldwide

- Adyen

- Aurus

- Aliant Payments

- Alipay

- Apple Pay

- Due

- Dwolla

- FattMerchant

- FIS

- Fiserv

- Global Payments

- Intuit

- JPMorgan Chase

- Mastercard

- PayPal

- Paysafe

- PayTrace

- PayU

- Spreedly

- Square

- Stripe

- Visa

- WEX

- Worldline

- 2Checkout and other major players.

Regional Analysis of IoT Payments Market

- North America holds the largest share in the IoT payment market. North America has a robust digital infrastructure that has vast connectivity throughout the region. Government policies on digital payments and constantly upgrading digital infrastructure creates an open space for companies to integrate digital transaction into a variety of business verticals which adds growth in Digital and IoT payment options. The New IoT regulatory framework allows for secured and hassle-free transactions makes the North America a dominating region in the IoT payment market.

- The European region is the second leading region in terms of IoT payments as countries like the UK, Germany, and France boost the investment into creating seamless digital infrastructure and cross-border payment getaways.

- Asia Pacific is the fastest-growing region and is expected to surpass the European region by 2027 as massive FDI in developing countries like India, Philippines, Malaysia, and other southeast Asian countries and growing IT infrastructure provides a huge opportunity in the growth of the IoT payment market.

Key Developments of IoT Payments Market

- July 2020, B2B API Tracker allows billing and processing of B2B payments can be simplified through open banking. Using the API, accounting platforms can accelerate payments by issuing invoices with built-in money orders and acceptance features. The open banking mechanism gives third-party providers secure and real-time access to customer financial information through application programming interfaces. This approach allows banks to offer bespoke financial products, especially payment solutions, to existing customers For B2B payments, you can also use an API that integrates payment data to minimize card processing charges, resulting in near-zero processing charges.

|

Global IoT Payments Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 258.18 Bn. |

|

Forecast Period 2023-30 CAGR: |

66% |

Market Size in 2030: |

USD 14886.31 Bn. |

|

Segments Covered: |

By Components |

|

|

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Component

3.2 By Deployment

3.3 By Enterprise Size

3.4 By Verticals

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: IOT Payments Market by Component

4.1 IOT Payments Market Overview Snapshot and Growth Engine

4.2 IOT Payments Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Solutions: Grographic Segmentation

4.4 Services

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Services: Grographic Segmentation

Chapter 5: IOT Payments Market by Deployment

5.1 IOT Payments Market Overview Snapshot and Growth Engine

5.2 IOT Payments Market Overview

5.3 Cloud-Based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cloud-Based: Grographic Segmentation

5.4 On-Premise

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 On-Premise: Grographic Segmentation

Chapter 6: IOT Payments Market by Enterprise Size

6.1 IOT Payments Market Overview Snapshot and Growth Engine

6.2 IOT Payments Market Overview

6.3 Large Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Large Enterprises: Grographic Segmentation

6.4 SMEs

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 SMEs: Grographic Segmentation

Chapter 7: IOT Payments Market by Verticals

7.1 IOT Payments Market Overview Snapshot and Growth Engine

7.2 IOT Payments Market Overview

7.3 BFSI

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 BFSI: Grographic Segmentation

7.4 Retail and Ecommerce

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Retail and Ecommerce: Grographic Segmentation

7.5 Healthcare

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Healthcare: Grographic Segmentation

7.6 Travel and Hospitality

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Travel and Hospitality: Grographic Segmentation

7.7 Transportation and logistics

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Transportation and logistics: Grographic Segmentation

7.8 Others

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size (2016-2028F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 IOT Payments Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 IOT Payments Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 IOT Payments Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 ACI WORLDWIDE

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 ADYEN

8.4 AURUS

8.5 ALIANT PAYMENTS

8.6 ALIPAY

8.7 APPLE PAY

8.8 DUE

8.9 DWOLLA

8.10 FATTMERCHANT

8.11 FIS

8.12 FISERV

8.13 GLOBAL PAYMENTS

8.14 INTUIT

8.15 JPMORGAN CHASE

8.16 MASTERCARD

8.17 PAYPAL

8.18 PAYSAFE

8.19 PAYTRACE

8.20 PAYU

8.21 SPREEDLY

8.22 SQUARE

8.23 STRIPE

8.24 VISA

8.25 WEX

8.26 WORLDLINE

8.27 2CHECKOUT

Chapter 9: Global IOT Payments Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Component

9.2.1 Solutions

9.2.2 Services

9.3 Historic and Forecasted Market Size By Deployment

9.3.1 Cloud-Based

9.3.2 On-Premise

9.4 Historic and Forecasted Market Size By Enterprise Size

9.4.1 Large Enterprises

9.4.2 SMEs

9.5 Historic and Forecasted Market Size By Verticals

9.5.1 BFSI

9.5.2 Retail and Ecommerce

9.5.3 Healthcare

9.5.4 Travel and Hospitality

9.5.5 Transportation and logistics

9.5.6 Others

Chapter 10: North America IOT Payments Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Component

10.4.1 Solutions

10.4.2 Services

10.5 Historic and Forecasted Market Size By Deployment

10.5.1 Cloud-Based

10.5.2 On-Premise

10.6 Historic and Forecasted Market Size By Enterprise Size

10.6.1 Large Enterprises

10.6.2 SMEs

10.7 Historic and Forecasted Market Size By Verticals

10.7.1 BFSI

10.7.2 Retail and Ecommerce

10.7.3 Healthcare

10.7.4 Travel and Hospitality

10.7.5 Transportation and logistics

10.7.6 Others

10.8 Historic and Forecast Market Size by Country

10.8.1 U.S.

10.8.2 Canada

10.8.3 Mexico

Chapter 11: Europe IOT Payments Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Component

11.4.1 Solutions

11.4.2 Services

11.5 Historic and Forecasted Market Size By Deployment

11.5.1 Cloud-Based

11.5.2 On-Premise

11.6 Historic and Forecasted Market Size By Enterprise Size

11.6.1 Large Enterprises

11.6.2 SMEs

11.7 Historic and Forecasted Market Size By Verticals

11.7.1 BFSI

11.7.2 Retail and Ecommerce

11.7.3 Healthcare

11.7.4 Travel and Hospitality

11.7.5 Transportation and logistics

11.7.6 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 Germany

11.8.2 U.K.

11.8.3 France

11.8.4 Italy

11.8.5 Russia

11.8.6 Spain

Chapter 12: Asia-Pacific IOT Payments Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Component

12.4.1 Solutions

12.4.2 Services

12.5 Historic and Forecasted Market Size By Deployment

12.5.1 Cloud-Based

12.5.2 On-Premise

12.6 Historic and Forecasted Market Size By Enterprise Size

12.6.1 Large Enterprises

12.6.2 SMEs

12.7 Historic and Forecasted Market Size By Verticals

12.7.1 BFSI

12.7.2 Retail and Ecommerce

12.7.3 Healthcare

12.7.4 Travel and Hospitality

12.7.5 Transportation and logistics

12.7.6 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 China

12.8.2 India

12.8.3 Japan

12.8.4 Southeast Asia

Chapter 13: South America IOT Payments Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Component

13.4.1 Solutions

13.4.2 Services

13.5 Historic and Forecasted Market Size By Deployment

13.5.1 Cloud-Based

13.5.2 On-Premise

13.6 Historic and Forecasted Market Size By Enterprise Size

13.6.1 Large Enterprises

13.6.2 SMEs

13.7 Historic and Forecasted Market Size By Verticals

13.7.1 BFSI

13.7.2 Retail and Ecommerce

13.7.3 Healthcare

13.7.4 Travel and Hospitality

13.7.5 Transportation and logistics

13.7.6 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 Brazil

13.8.2 Argentina

Chapter 14: Middle East & Africa IOT Payments Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Component

14.4.1 Solutions

14.4.2 Services

14.5 Historic and Forecasted Market Size By Deployment

14.5.1 Cloud-Based

14.5.2 On-Premise

14.6 Historic and Forecasted Market Size By Enterprise Size

14.6.1 Large Enterprises

14.6.2 SMEs

14.7 Historic and Forecasted Market Size By Verticals

14.7.1 BFSI

14.7.2 Retail and Ecommerce

14.7.3 Healthcare

14.7.4 Travel and Hospitality

14.7.5 Transportation and logistics

14.7.6 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Saudi Arabia

14.8.2 South Africa

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global IoT Payments Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 258.18 Bn. |

|

Forecast Period 2023-30 CAGR: |

66% |

Market Size in 2030: |

USD 14886.31 Bn. |

|

Segments Covered: |

By Components |

|

|

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. IOT PAYMENTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. IOT PAYMENTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. IOT PAYMENTS MARKET COMPETITIVE RIVALRY

TABLE 005. IOT PAYMENTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. IOT PAYMENTS MARKET THREAT OF SUBSTITUTES

TABLE 007. IOT PAYMENTS MARKET BY COMPONENT

TABLE 008. SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. IOT PAYMENTS MARKET BY DEPLOYMENT

TABLE 011. CLOUD-BASED MARKET OVERVIEW (2016-2028)

TABLE 012. ON-PREMISE MARKET OVERVIEW (2016-2028)

TABLE 013. IOT PAYMENTS MARKET BY ENTERPRISE SIZE

TABLE 014. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 015. SMES MARKET OVERVIEW (2016-2028)

TABLE 016. IOT PAYMENTS MARKET BY VERTICALS

TABLE 017. BFSI MARKET OVERVIEW (2016-2028)

TABLE 018. RETAIL AND ECOMMERCE MARKET OVERVIEW (2016-2028)

TABLE 019. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 020. TRAVEL AND HOSPITALITY MARKET OVERVIEW (2016-2028)

TABLE 021. TRANSPORTATION AND LOGISTICS MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA IOT PAYMENTS MARKET, BY COMPONENT (2016-2028)

TABLE 024. NORTH AMERICA IOT PAYMENTS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 025. NORTH AMERICA IOT PAYMENTS MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 026. NORTH AMERICA IOT PAYMENTS MARKET, BY VERTICALS (2016-2028)

TABLE 027. N IOT PAYMENTS MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE IOT PAYMENTS MARKET, BY COMPONENT (2016-2028)

TABLE 029. EUROPE IOT PAYMENTS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 030. EUROPE IOT PAYMENTS MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 031. EUROPE IOT PAYMENTS MARKET, BY VERTICALS (2016-2028)

TABLE 032. IOT PAYMENTS MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC IOT PAYMENTS MARKET, BY COMPONENT (2016-2028)

TABLE 034. ASIA PACIFIC IOT PAYMENTS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 035. ASIA PACIFIC IOT PAYMENTS MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 036. ASIA PACIFIC IOT PAYMENTS MARKET, BY VERTICALS (2016-2028)

TABLE 037. IOT PAYMENTS MARKET, BY COUNTRY (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA IOT PAYMENTS MARKET, BY COMPONENT (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA IOT PAYMENTS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA IOT PAYMENTS MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA IOT PAYMENTS MARKET, BY VERTICALS (2016-2028)

TABLE 042. IOT PAYMENTS MARKET, BY COUNTRY (2016-2028)

TABLE 043. SOUTH AMERICA IOT PAYMENTS MARKET, BY COMPONENT (2016-2028)

TABLE 044. SOUTH AMERICA IOT PAYMENTS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 045. SOUTH AMERICA IOT PAYMENTS MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 046. SOUTH AMERICA IOT PAYMENTS MARKET, BY VERTICALS (2016-2028)

TABLE 047. IOT PAYMENTS MARKET, BY COUNTRY (2016-2028)

TABLE 048. ACI WORLDWIDE: SNAPSHOT

TABLE 049. ACI WORLDWIDE: BUSINESS PERFORMANCE

TABLE 050. ACI WORLDWIDE: PRODUCT PORTFOLIO

TABLE 051. ACI WORLDWIDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. ADYEN: SNAPSHOT

TABLE 052. ADYEN: BUSINESS PERFORMANCE

TABLE 053. ADYEN: PRODUCT PORTFOLIO

TABLE 054. ADYEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. AURUS: SNAPSHOT

TABLE 055. AURUS: BUSINESS PERFORMANCE

TABLE 056. AURUS: PRODUCT PORTFOLIO

TABLE 057. AURUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ALIANT PAYMENTS: SNAPSHOT

TABLE 058. ALIANT PAYMENTS: BUSINESS PERFORMANCE

TABLE 059. ALIANT PAYMENTS: PRODUCT PORTFOLIO

TABLE 060. ALIANT PAYMENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ALIPAY: SNAPSHOT

TABLE 061. ALIPAY: BUSINESS PERFORMANCE

TABLE 062. ALIPAY: PRODUCT PORTFOLIO

TABLE 063. ALIPAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. APPLE PAY: SNAPSHOT

TABLE 064. APPLE PAY: BUSINESS PERFORMANCE

TABLE 065. APPLE PAY: PRODUCT PORTFOLIO

TABLE 066. APPLE PAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. DUE: SNAPSHOT

TABLE 067. DUE: BUSINESS PERFORMANCE

TABLE 068. DUE: PRODUCT PORTFOLIO

TABLE 069. DUE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. DWOLLA: SNAPSHOT

TABLE 070. DWOLLA: BUSINESS PERFORMANCE

TABLE 071. DWOLLA: PRODUCT PORTFOLIO

TABLE 072. DWOLLA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. FATTMERCHANT: SNAPSHOT

TABLE 073. FATTMERCHANT: BUSINESS PERFORMANCE

TABLE 074. FATTMERCHANT: PRODUCT PORTFOLIO

TABLE 075. FATTMERCHANT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. FIS: SNAPSHOT

TABLE 076. FIS: BUSINESS PERFORMANCE

TABLE 077. FIS: PRODUCT PORTFOLIO

TABLE 078. FIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. FISERV: SNAPSHOT

TABLE 079. FISERV: BUSINESS PERFORMANCE

TABLE 080. FISERV: PRODUCT PORTFOLIO

TABLE 081. FISERV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. GLOBAL PAYMENTS: SNAPSHOT

TABLE 082. GLOBAL PAYMENTS: BUSINESS PERFORMANCE

TABLE 083. GLOBAL PAYMENTS: PRODUCT PORTFOLIO

TABLE 084. GLOBAL PAYMENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. INTUIT: SNAPSHOT

TABLE 085. INTUIT: BUSINESS PERFORMANCE

TABLE 086. INTUIT: PRODUCT PORTFOLIO

TABLE 087. INTUIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. JPMORGAN CHASE: SNAPSHOT

TABLE 088. JPMORGAN CHASE: BUSINESS PERFORMANCE

TABLE 089. JPMORGAN CHASE: PRODUCT PORTFOLIO

TABLE 090. JPMORGAN CHASE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. MASTERCARD: SNAPSHOT

TABLE 091. MASTERCARD: BUSINESS PERFORMANCE

TABLE 092. MASTERCARD: PRODUCT PORTFOLIO

TABLE 093. MASTERCARD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. PAYPAL: SNAPSHOT

TABLE 094. PAYPAL: BUSINESS PERFORMANCE

TABLE 095. PAYPAL: PRODUCT PORTFOLIO

TABLE 096. PAYPAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. PAYSAFE: SNAPSHOT

TABLE 097. PAYSAFE: BUSINESS PERFORMANCE

TABLE 098. PAYSAFE: PRODUCT PORTFOLIO

TABLE 099. PAYSAFE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. PAYTRACE: SNAPSHOT

TABLE 100. PAYTRACE: BUSINESS PERFORMANCE

TABLE 101. PAYTRACE: PRODUCT PORTFOLIO

TABLE 102. PAYTRACE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. PAYU: SNAPSHOT

TABLE 103. PAYU: BUSINESS PERFORMANCE

TABLE 104. PAYU: PRODUCT PORTFOLIO

TABLE 105. PAYU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. SPREEDLY: SNAPSHOT

TABLE 106. SPREEDLY: BUSINESS PERFORMANCE

TABLE 107. SPREEDLY: PRODUCT PORTFOLIO

TABLE 108. SPREEDLY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. SQUARE: SNAPSHOT

TABLE 109. SQUARE: BUSINESS PERFORMANCE

TABLE 110. SQUARE: PRODUCT PORTFOLIO

TABLE 111. SQUARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. STRIPE: SNAPSHOT

TABLE 112. STRIPE: BUSINESS PERFORMANCE

TABLE 113. STRIPE: PRODUCT PORTFOLIO

TABLE 114. STRIPE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. VISA: SNAPSHOT

TABLE 115. VISA: BUSINESS PERFORMANCE

TABLE 116. VISA: PRODUCT PORTFOLIO

TABLE 117. VISA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117. WEX: SNAPSHOT

TABLE 118. WEX: BUSINESS PERFORMANCE

TABLE 119. WEX: PRODUCT PORTFOLIO

TABLE 120. WEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 120. WORLDLINE: SNAPSHOT

TABLE 121. WORLDLINE: BUSINESS PERFORMANCE

TABLE 122. WORLDLINE: PRODUCT PORTFOLIO

TABLE 123. WORLDLINE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 123. 2CHECKOUT: SNAPSHOT

TABLE 124. 2CHECKOUT: BUSINESS PERFORMANCE

TABLE 125. 2CHECKOUT: PRODUCT PORTFOLIO

TABLE 126. 2CHECKOUT: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. IOT PAYMENTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. IOT PAYMENTS MARKET OVERVIEW BY COMPONENT

FIGURE 012. SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. IOT PAYMENTS MARKET OVERVIEW BY DEPLOYMENT

FIGURE 015. CLOUD-BASED MARKET OVERVIEW (2016-2028)

FIGURE 016. ON-PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 017. IOT PAYMENTS MARKET OVERVIEW BY ENTERPRISE SIZE

FIGURE 018. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 019. SMES MARKET OVERVIEW (2016-2028)

FIGURE 020. IOT PAYMENTS MARKET OVERVIEW BY VERTICALS

FIGURE 021. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 022. RETAIL AND ECOMMERCE MARKET OVERVIEW (2016-2028)

FIGURE 023. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 024. TRAVEL AND HOSPITALITY MARKET OVERVIEW (2016-2028)

FIGURE 025. TRANSPORTATION AND LOGISTICS MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA IOT PAYMENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE IOT PAYMENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC IOT PAYMENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA IOT PAYMENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA IOT PAYMENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the IoT Payments Market research report is 2023-2030.

ACI Worldwide, Adyen, Aurus, Aliant Payments, Alipay, Apple Pay, Due, Dwolla, FattMerchant, FIS, Fiserv, Global Payments, Intuit, JPMorgan Chase, Mastercard, PayPal, Paysafe, PayTrace, PayU, Spreedly, Square, Stripe, Visa, WEX, Worldline, 2Checkout and other major players.

The IoT Payments Market is segmented into Components, Deployment, Organisation Size, Verticals and region. By Components, the market is categorized into Solution, Service. By Deployment, the market is categorized into Cloud, On-Premises. By Organisation Size, the market is categorized into SMEs, Large Enterprise. By Verticals, the market is categorized into BFSI, Retail, Ecommerce, Healthcare, Travel, Hospitality, Transportation, Logistics, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Consumers and retailers are rapidly adopting technology and using the IoT to further digitize their relationships. Internet of Things (IoT) is designed as the best form of integration between people and communication devices and devices.

The Global IOT Payments Market size is expected to grow from USD 258.18 billion in 2022 to USD 14886.31 billion by 2030, at a CAGR of 66% during the forecast period (2023-2030).