Satellite Enabled IoT Software Market Synopsis

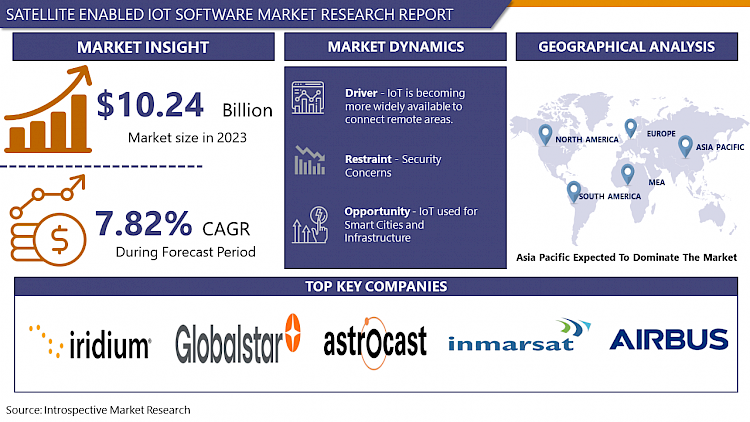

Satellite Enabled IoT Software Market Size Was Valued at USD 10.24 Billion in 2023, and is Projected to Reach USD 20.16 Billion by 2032, Growing at a CAGR of 7.82% From 2024-2032.

Satellite IoT denotes to the use of satellite communication expertise to enable the connectivity of IoT strategies. The Internet of Things includes linking various devices and sensors to the Internet to gather and exchange data, allowing remote monitoring, control, and automation of several procedures. Satellite IoT gives a solution to join devices located in remote or difficult surroundings, where traditional global networks may be unreachable, impractical, or exclusive.

- The Internet of Things has become a transformative force in technology, providing a network of interconnected physical devices that can collect and exchange data. The development of satellite IoT created a significant leap forward and expanded IoT connections beyond the limitations of terrestrial networks.

- Satellite IoT extends the capabilities of the traditional Internet of Things as it relies on communication protocols such as Wi-Fi, Bluetooth, and cellular networks using satellites to extend coverage. This approach is particularly important in remote or rural areas where land infrastructure is limited, opening up many possibilities, from real-time agricultural monitoring in isolated areas to marine navigation.

- The guide discusses overcoming the challenges of satellite IoT and its practical applications in various industries, combining technical knowledge with real-world examples. This is an essential resource for those looking to adopt this technology or keep up with its innovations. It tries to unravel the mystery of satellite IoT and emphasizes its importance in the digital age.

Satellite Enabled IoT Software Market Trend Analysis

IoT is becoming more widely available to connect remote areas.

- In the digital world, few things are fairly as unsatisfying as losing signal or seeing the feared “spinning wheel of death” on laptop or smartphone screens. Through so much of everyday lives dependent on being online, it can be really disruptive. Despite great leaps in connectivity technology from last three decades around 95% of the world’s population has access to a cellular network many rural areas still lack sufficient network infrastructure.

- It makes intelligence to prioritize network coverage in remote areas, where the most individuals live and work, the rapid growth of IoT in recent years has increased the need to extend coverage to more urban regions that are outside the range of cellular networks. This creates attention gap that limits the possible of some IoT applications.

IoT used for Smart Cities and Infrastructure

- Developed cities are town areas that influence technology and data to advance the quality of the life for people, growth effectiveness and sustainability, and improve economic growth. These cities use consistent technologies to gather and examine the data in real time, allowing them to make informed choices and enhance source. Smart cities trust on a change of technologies, for instance sensors, IoT devices, artificial intelligence (AI), and machine learning. This can be used to advance city facilities, such as transportation, energy, waste management, and public safety.

- Smart Transportation use IoT sensors to collect data on traffic flow, parking, and public transportation, optimizing routes and reducing overcrowding. This data will be used to improve safety by detecting and notifying drivers of possible coincidences.

Satellite Enabled IoT Software Market Segment Analysis:

Satellite Enabled IoT Software Market is Segmented on the basis of type end-use Industry and Region

By Type, L Band segment is expected to dominate the market during the forecast period

- L-band has traditionally been viewed as the ideal option for narrowband connectivity, due to the small quantities of data transfer and, low promotion charges. Ku band, will show a growing role as the M2M and IoT phenomenon advances drive.

- As information is produced from billions of sensors, there will be a need to collective and backhaul that data from inaccessible locations to the main network. For many M2M and IoT applications, L-band will be a less attractive plan given data capacity With Ku-band, service providers can influence the huge number of open Ku-band satellites, which usually offer lower range cost than L-band.

- Ku-band remote incurable equipment can function on any open Ku-band satellite platform, offering full end-to-end controller, with the ability to select range providers on the basis of best reporting and cost.

By End Use Industry, Military and Transportation & Logistics segment held the largest share in 2023

The inaccessibility of network services in remote lands, deserts, oceans, and mountains has extended a strong need to accept satellite allowed IoT in the defence sector. These linked devices contain GPS and tracking systems, health and personnel monitoring devices, along with just-in-time apparatus maintenance to care strategic investigation.

Through the object to achieve greater competence, constant attention, better safety, and advanced reliability, the logistic industry trusts deeply on satellite-enabled IoT technology. Transportation and Cargo carriers leverage use these devices in tracking the vehicles or containers and spotting the location in case of any coincidences.

Satellite Enabled IoT Software Market Regional Insights:

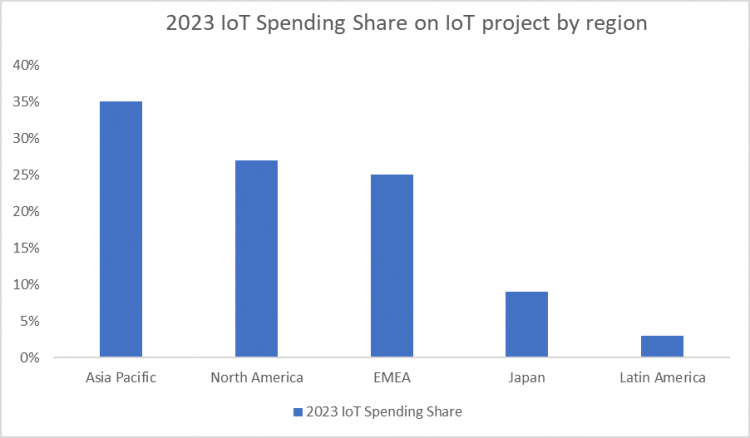

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia Pacific region is experiencing a boom in industrial growth, mainly in countries like China and India. These industries need robust explanations for advantage tracking, remote monitoring, and data gathering in often geographically stimulating locations. Satellite-enabled IoT perfectly fits this essential, donation consistent connectivity where traditional solutions might fall short.

Economies in Asia Pacific grow, the demand for dependable internet connectivity is heaving. This is particularly correct in remote areas where traditional terrestrial networks are inadequate or inaccessible. Satellite-enabled IoT offers a compelling solution, linking the connectivity gap and allowing businesses and individuals to contribute in the digital economy.

Satellite Enabled IoT Software Market Active key players

- Orbcomm (US)

- Iridium Communication (US)

- Globalstar (US)

- Astrocast (Switzerland)

- Inmarsat Global (UK),

- Airbus (Netherlands)

- Intelsat (US)

- Thales (France)

- Eutelsat (France)

- Northrop Grumman (US)

- Thuraya (Singapore)

- Vodafone (UK)

- Surrey Satellite Technology (UK)

- Head Aerospace (China)

- I.M.T. SRL (Italy)

- Fleetspace Technologies (Australia)

- Swarm Technologies (US)

- Alenspace (Spain)

- OQ Technology (Luxembourg)

- Fossa Systems (Spain)

- Kepler Communications (Canada

- Sateliot (Spain)

- Myriota (Australia)

- Kineis (France)

- Nanoavionics (Lithuania), and Other Active Players.

Key Industry Developments in the Satellite Enabled IoT Software Market:

- In February 2023, Hispasat, a Spanish communications satellite provider, launched the Amazonas Nexus, bringing a new era in satellite communications. It is a high-performance geostationary satellite that will enable high-speed internet connectivity throughout the Americas, the northern and southern Atlantic corridors, and off-the-grid locations like Greenland and the Amazon rainforest. It was specifically created to provide connections on ships and airplanes and would significantly aid in bridging the digital gap in Latin America quickly and effectively.

- In February 2023, Cobham Satcom and RBC Signals, a global satellite data communication solutions provider, have announced an extended agreement to deploy Cobham Satcom's adaptable Tracker 6000 and 3700 series ground stations globally. The collaborative partnership between the two parties will dramatically expand RBC Signals' vast owned and partner ground network, providing integrated communication services to NGSO missions and constellations for Earth Observation, IoT, and Space Situational Awareness.

|

Global Satellite Enabled IoT Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.24 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.82 % |

Market Size in 2032: |

USD 20.16 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SATELLITE ENABLED IOT SOFTWARE BY TYPE (2017-2030)

- SATELLITE ENABLED IOT SOFTWARE SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- L BAND

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2030F)

- Historic And Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- KU-BAND

- KA-BAND

- SATELLITE ENABLED IOT SOFTWARE BY END USE INDUSTRY (2017-2030)

- SATELLITE ENABLED IOT SOFTWARE SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MILITARY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2030F)

- Historic And Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AEROSPACE

- TELECOMMUNICATION

- TRANSPORTATION & LOGISTICS

- HEALTHCARE AGRICULTURE

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- SATELLITE ENABLED IOT SOFTWARE Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ORBCOMM (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- IRIDIUM COMMUNICATION (US)

- GLOBALSTAR (US)

- ASTROCAST (SWITZERLAND)

- INMARSAT GLOBAL (UK),

- AIRBUS (NETHERLANDS)

- INTELSAT (US)

- THALES (FRANCE)

- EUTELSAT (FRANCE)

- NORTHROP GRUMMAN (US)

- THURAYA (SINGAPORE)

- VODAFONE (UK)

- SURREY SATELLITE TECHNOLOGY (UK)

- HEAD AEROSPACE (CHINA)

- I.M.T. SRL (ITALY)

- FLEETSPACE TECHNOLOGIES (AUSTRALIA)

- SWARM TECHNOLOGIES (US)

- ALENSPACE (SPAIN)

- OQ TECHNOLOGY (LUXEMBOURG)

- FOSSA SYSTEMS (SPAIN)

- KEPLER COMMUNICATIONS (CANADA

- SATELIOT (SPAIN)

- MYRIOTA (AUSTRALIA)

- KINEIS (FRANCE)

- NANOAVIONICS (LITHUANIA)

- COMPETITIVE LANDSCAPE

- GLOBAL SATELLITE ENABLED IOT SOFTWARE BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segment1

- Historic And Forecasted Market Size By Segment2

- Historic And Forecasted Market Size By Segment3

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Satellite Enabled IoT Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.24 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.82 % |

Market Size in 2032: |

USD 20.16 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SATELLITE ENABLED IOT SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SATELLITE ENABLED IOT SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SATELLITE ENABLED IOT SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. SATELLITE ENABLED IOT SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. SATELLITE ENABLED IOT SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. SATELLITE ENABLED IOT SOFTWARE MARKET BY TYPE

TABLE 008. L BAND MARKET OVERVIEW (2016-2028)

TABLE 009. KU-BAND MARKET OVERVIEW (2016-2028)

TABLE 010. KA-BAND MARKET OVERVIEW (2016-2028)

TABLE 011. SATELLITE ENABLED IOT SOFTWARE MARKET BY END USE INDUSTRY

TABLE 012. MILITARY MARKET OVERVIEW (2016-2028)

TABLE 013. AEROSPACE MARKET OVERVIEW (2016-2028)

TABLE 014. TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

TABLE 015. TRANSPORTATION & LOGISTICS MARKET OVERVIEW (2016-2028)

TABLE 016. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 017. AGRICULTURE MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA SATELLITE ENABLED IOT SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA SATELLITE ENABLED IOT SOFTWARE MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 021. N SATELLITE ENABLED IOT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE SATELLITE ENABLED IOT SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE SATELLITE ENABLED IOT SOFTWARE MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 024. SATELLITE ENABLED IOT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC SATELLITE ENABLED IOT SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC SATELLITE ENABLED IOT SOFTWARE MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 027. SATELLITE ENABLED IOT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA SATELLITE ENABLED IOT SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA SATELLITE ENABLED IOT SOFTWARE MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 030. SATELLITE ENABLED IOT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA SATELLITE ENABLED IOT SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 032. SOUTH AMERICA SATELLITE ENABLED IOT SOFTWARE MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 033. SATELLITE ENABLED IOT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 034. EUTELSAT S.A.: SNAPSHOT

TABLE 035. EUTELSAT S.A.: BUSINESS PERFORMANCE

TABLE 036. EUTELSAT S.A.: PRODUCT PORTFOLIO

TABLE 037. EUTELSAT S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. INMARSAT PLC: SNAPSHOT

TABLE 038. INMARSAT PLC: BUSINESS PERFORMANCE

TABLE 039. INMARSAT PLC: PRODUCT PORTFOLIO

TABLE 040. INMARSAT PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. MAXAR TECHNOLOGIES LTD: SNAPSHOT

TABLE 041. MAXAR TECHNOLOGIES LTD: BUSINESS PERFORMANCE

TABLE 042. MAXAR TECHNOLOGIES LTD: PRODUCT PORTFOLIO

TABLE 043. MAXAR TECHNOLOGIES LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. ORBITAL ATK INC.: SNAPSHOT

TABLE 044. ORBITAL ATK INC.: BUSINESS PERFORMANCE

TABLE 045. ORBITAL ATK INC.: PRODUCT PORTFOLIO

TABLE 046. ORBITAL ATK INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. SES S.A: SNAPSHOT

TABLE 047. SES S.A: BUSINESS PERFORMANCE

TABLE 048. SES S.A: PRODUCT PORTFOLIO

TABLE 049. SES S.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. LOCKHEAD MARTIN: SNAPSHOT

TABLE 050. LOCKHEAD MARTIN: BUSINESS PERFORMANCE

TABLE 051. LOCKHEAD MARTIN: PRODUCT PORTFOLIO

TABLE 052. LOCKHEAD MARTIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. SPACE EXPLORATION TECHNOLOGIES CORP: SNAPSHOT

TABLE 053. SPACE EXPLORATION TECHNOLOGIES CORP: BUSINESS PERFORMANCE

TABLE 054. SPACE EXPLORATION TECHNOLOGIES CORP: PRODUCT PORTFOLIO

TABLE 055. SPACE EXPLORATION TECHNOLOGIES CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. THALES ALENIA SPACE: SNAPSHOT

TABLE 056. THALES ALENIA SPACE: BUSINESS PERFORMANCE

TABLE 057. THALES ALENIA SPACE: PRODUCT PORTFOLIO

TABLE 058. THALES ALENIA SPACE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. THURAYA TELECOMMUNICATIONS COMPANY: SNAPSHOT

TABLE 059. THURAYA TELECOMMUNICATIONS COMPANY: BUSINESS PERFORMANCE

TABLE 060. THURAYA TELECOMMUNICATIONS COMPANY: PRODUCT PORTFOLIO

TABLE 061. THURAYA TELECOMMUNICATIONS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. MDA: SNAPSHOT

TABLE 062. MDA: BUSINESS PERFORMANCE

TABLE 063. MDA: PRODUCT PORTFOLIO

TABLE 064. MDA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ORBITAL ATK: SNAPSHOT

TABLE 065. ORBITAL ATK: BUSINESS PERFORMANCE

TABLE 066. ORBITAL ATK: PRODUCT PORTFOLIO

TABLE 067. ORBITAL ATK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. KEPLER COMMUNICATIONS: SNAPSHOT

TABLE 068. KEPLER COMMUNICATIONS: BUSINESS PERFORMANCE

TABLE 069. KEPLER COMMUNICATIONS: PRODUCT PORTFOLIO

TABLE 070. KEPLER COMMUNICATIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. NANOAVIONICS: SNAPSHOT

TABLE 071. NANOAVIONICS: BUSINESS PERFORMANCE

TABLE 072. NANOAVIONICS: PRODUCT PORTFOLIO

TABLE 073. NANOAVIONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 074. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 075. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 076. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SATELLITE ENABLED IOT SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SATELLITE ENABLED IOT SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. L BAND MARKET OVERVIEW (2016-2028)

FIGURE 013. KU-BAND MARKET OVERVIEW (2016-2028)

FIGURE 014. KA-BAND MARKET OVERVIEW (2016-2028)

FIGURE 015. SATELLITE ENABLED IOT SOFTWARE MARKET OVERVIEW BY END USE INDUSTRY

FIGURE 016. MILITARY MARKET OVERVIEW (2016-2028)

FIGURE 017. AEROSPACE MARKET OVERVIEW (2016-2028)

FIGURE 018. TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

FIGURE 019. TRANSPORTATION & LOGISTICS MARKET OVERVIEW (2016-2028)

FIGURE 020. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 021. AGRICULTURE MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA SATELLITE ENABLED IOT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE SATELLITE ENABLED IOT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC SATELLITE ENABLED IOT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA SATELLITE ENABLED IOT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA SATELLITE ENABLED IOT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Satellite Enabled IoT Software Market research report is 2024-2032.

Orbcomm (US), Iridium Communication (US), Globalstar (US), Astrocast (Switzerland), Inmarsat Global (UK), Airbus (Netherlands), Intelsat (US), Thales (France) , Eutelsat (France), Northrop Grumman (US), Thuraya (Singapore), Vodafone (UK), Surrey Satellite Technology (UK),Head Aerospace (China), I.M.T. SRL (Italy), Fleetspace Technologies (Australia), Swarm Technologies (US), Alenspace (Spain), OQ Technology (Luxembourg), Fossa Systems (Spain),Kepler Communications (Canada), Sateliot (Spain), Myriota (Australia), Kineis (France), Nanoavionics (Lithuania). and OtherActive Players.

The Satellite Enabled IoT Software Market is segmented into Type, Nature, Application, and region. By Type, the market is categorized into L Band, Ku-Band, Ka-Band. By End Use Industry (Military, Aerospace, Telecommunication, Transportation & Logistics, Healthcare Agriculture, Others, By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Satellite IoT denotes to the use of satellite communication expertise to enable the connectivity of IoT strategies. The Internet of Things includes linking various devices and sensors to the Internet to gather and exchange data, allowing remote monitoring, control, and automation of several procedures. Satellite IoT delivers a solution to connect devices located in remote or difficult surroundings, where traditional terrestrial networks may be inaccessible, impractical, or expensive.

Satellite Enabled IoT Software Market Size Was Valued at USD 10.24 Billion in 2023, and is Projected to Reach USD 20.16 Billion by 2032, Growing at a CAGR of 7.82% From 2024-2032.