Pea Fiber Market Synopsis

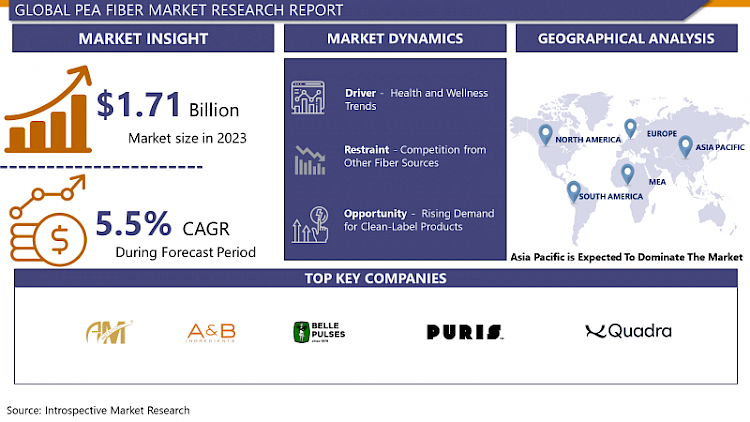

Pea Fiber Market Size Was Valued at USD 1.71 Billion in 2023 and is Projected to Reach USD 2.78 Billion by 2032, Growing at a CAGR of 5.5 % From 2024-2032.

- Pea fiber is a dietary fiber extracted from peas, specifically the outer husk or shell of the pea. Rich in soluble and insoluble fiber, it offers various health benefits. Soluble fiber aids digestion and helps manage blood sugar levels, while insoluble fiber promotes bowel regularity and overall gut health. Pea fiber is low in calories and cholesterol-free, making it a nutritious addition to diets. Its ability to absorb water contributes to a feeling of fullness, aiding in weight management. Pea fiber supports heart health by lowering cholesterol levels. It is a versatile, plant-based ingredient with positive impacts on both digestive and cardiovascular wellness. Health-conscious consumers are increasingly seeking plant-based, natural ingredients to enhance their diets. Pea fiber, derived from peas, fits this demand, as it is a rich source of soluble and insoluble fiber, supporting digestive health and offering a low-calorie, cholesterol-free option for well-being. Its versatile applications in food products, including baked goods, cereals, and snacks, make it an interesting choice for manufacturers directing to supply the growing market for functional and health-oriented foods.

- The global trend towards sustainable and environmentally friendly practices is boosting the popularity of pea fiber. Pea fiber, a plant-derived ingredient, is gaining popularity due to its potential to replace synthetic additives in various industries like food, pharmaceuticals, and cosmetics. As consumers prioritize health, sustainability, and clean-label products, the demand for pea fiber is expected to continue growing, promoting innovation and market expansion. Pea Fiber’s benefits and alignment with health and sustainability trends are driving its growing demand. Manufacturers can cater to evolving consumer preferences by offering products promoting health benefits with environmentally conscious choices boosting the market.

Pea Fiber Market Trend Analysis

Increasing Applications in the Automotive Industry

- The Pea Fiber market is experiencing substantial growth in health and wellness trends as consumers increasingly prioritize healthier lifestyles. Pea fiber, being a natural source of both soluble and insoluble fiber, aligns perfectly with these health-conscious preferences. Its digestive benefits, including endorsing core movements and stabilizing blood sugar levels, make it an attractive choice for consumers seeking dietary enhancements.

- The rising awareness of the importance of plant-based nutrition is driving the demand for pea fiber. As a plant-derived ingredient, it caters to the growing population of vegans, vegetarians, and flexitarians looking for sustainable and ethical alternatives. Pea fiber's versatility allows its use in various food products, catering to the growing demand for functional and clean-label items. The health and wellness standard shift is driving the pea fiber market, as consumers seek dietary choices and holistic health goals.

Rising Demand for Clean-Label Products

- The rising demand for clean-label products presents a significant opportunity for the pea fiber market. Consumers are increasingly analyzing product labels, seeking transparency and natural ingredients in the foods they consume. Pea fiber, being a plant-based, minimally processed ingredient, aligns well with the clean-label trend. Its inclusion in various food products provides manufacturers with a path to meet consumer preferences for recognizable and wholesome ingredients.

- As consumers associate clean labels with health and authenticity, pea fiber's natural origin positions it favorably in the market. Its use in food formulations allows manufacturers to enhance nutritional profiles without compromising on the simplicity and clarity of product labels. This demand for clean-label products extends beyond traditional health foods, reaching into mainstream markets, and the versatility of pea fiber makes it an attractive choice for food producers looking to capitalize on this growing consumer trend. The rising preference for clean-label products creates a strategic opportunity for the pea fiber market, promotion innovation and growth as manufacturers respond to the evolving demands of perceptive consumers.

Pea Fiber Market Segment Analysis:

Pea Fiber Market is Segmented based on Product, Nature, End-User, and Distribution Channel.

By Product Type, Pea Hull Fiber segment is expected to dominate the market during the forecast period

- Pea hulls, the outer layer of peas, are rich in dietary fiber, both soluble and insoluble. This high-fiber content contributes significantly to digestive health, making pea hull fiber a sought-after ingredient in the food industry. Its insoluble fiber aids in promoting regular bowel movements, while soluble fiber helps in managing cholesterol levels and supporting overall gut health.

- The Pea Hull Fiber segment's dominance is reinforced by its wide-ranging applications across various food products. It is commonly utilized in the formulation of baked goods, cereals, snacks, and other food items to enhance their fiber content without compromising taste or texture. As consumers increasingly prioritize functional foods that contribute to their well-being, the nutritional benefits and versatility of pea hull fiber position it as a preferred choice for manufacturers, thereby driving its dominance in the pea fiber market during the forecast period.

By Nature, the Conventional Pea Fiber segment held the largest share of 76.8% in 2022

- Conventional pea fiber caters to a broader consumer base seeking familiar ingredients and traditional reliability. Its minimal processing retains peas' nutritional benefits, appealing adapted to traditional dietary choices. This aligns with the growing demand for natural, minimally processed food products.

- The conventional pea fiber segment is likely to dominate due to its cost-effectiveness. As a well-established ingredient, the production processes for conventional pea fiber are often streamlined, resulting in a more economical product. The affordability makes it an attractive choice for manufacturers seeking to incorporate fiber into their products without significantly impacting production costs. The dominance of the conventional pea fiber segment is driven by consumer familiarity, perceived authenticity, and cost-effectiveness, positioning it as a preferred choice in the evolving landscape of dietary fiber ingredients.

Pea Fiber Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- There is a Growing awareness of health and wellness, along with an increasing preference for plant-based and natural ingredients, positions pea fiber as a highly sought-after dietary supplement in this region. Markets with substantial populations, such as China, India, and Vietnam, are witnessing a significant shift towards healthier lifestyles, influencing dietary choices and fostering a heightened demand for functional foods. Pea fiber, prominent for its digestive health benefits and adaptability in various food applications, aligns well with the changing consumer preferences.

- The agricultural landscape in the Asia Pacific region, particularly in countries like China and India, supports the cultivation and sourcing of peas, the primary raw material for pea fiber. This contributes to a more strong and cost-effective supply chain, further boosting the market's growth. The increasing adoption of Western dietary patterns, with the rise of plant-based diets and a surge in demand for clean-label products, positions pea fiber as an essential ingredient in the food and beverage industry of the region. The Asia Pacific's dominance in the pea fiber market reflects the connection between health-conscious consumer trends, abundant raw material availability, and an increasing market for functional and natural ingredients.

Pea Fiber Market Top Key Players:

- AM Nutrition (US)

- A&B Ingredients Inc. (US)

- Belle Pulses (US)

- Puris Protein LLC (US)

- Quadra Chemicals (US)

- Ingredion Incorporated (US)

- Organicway (US)

- G.S. DUNN DRY MUSTARD MILLERS (US)

- InterFiber (US)

- Farbest Brands (US)

- AGT Foods & Ingredients (Canada)

- Avena Foods Limited (Canada)

- Parrish & Heimbecker Limited (Canada)

- Vestkorn Milling AS (Norway)

- CFF GmbH & Co. KG (Germany)

- Emsland Group (Germany)

- Emsland Group (Germany)

- Parrheim Foods (Germany)

- Roquette Freres SA (France)

- Nutraonly (Xi'an) Nutritions Inc. (China)

- Shandong Jianyuan Bioengineering (China)

- Mrida Greens and Development Private Limited (India)

- OMG Labs Private Limited (India), and Other major Players.

Key Industry Developments in the Pea Fiber Market:

In October 2023, in a significant move, Ingredion, a prominent global ingredient solutions provider, is set to acquire Roquette's pea protein and starch operations in France, Canada, and China. This strategic acquisition enhances Ingredion's foothold in the plant-based protein market and broadens its offerings in pea Fiber.

In October 2023, The partnership revolves around the joint development of innovative textured meat alternatives utilizing Roquette's pea protein and Ingredia's proficiency in texturizing solutions. The objective is to expedite the creation of more authentic and sustainable plant-based meat products.

In October 2023, the introduction of NutraPea by Cosucra showcases a novel pea Fiber ingredient with high protein content and exceptional water absorption properties. This makes it well-suited for various applications, including meat alternatives, bakery products, and nutritional bars.

|

Global Pea Fiber Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.71 Billion. |

|

Forecast Period 2024-32 CAGR: |

5.5 % |

Market Size in 2032: |

USD 2.78 Billion. |

|

Segments Covered: |

By Type |

|

|

|

By Nature |

|

||

|

By End-user |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PEA FIBRE MARKET BY PRODUCT (2016-2030)

- PEA FIBRE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PRODUCT PEA HULL FIBER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PRODUCT PEA COTYLEDON FIBER

- PEA FIBRE MARKET BY NATURE (2016-2030)

- PEA FIBRE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ORGANIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONVENTIONAL

- PEA FIBRE MARKET BY END-USER (2016-2030)

- PEA FIBRE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD INDUSTRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIETARY SUPPLEMENTS

- PHARMACEUTICAL INDUSTRY

- NUTRACEUTICALS

- ANIMAL FEED

- PEA FIBRE MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- PEA FIBRE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIRECT SALES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WHOLESALERS

- DISTRIBUTION CHANNELC

- ONLINE RETAIL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Pea Fibre Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AM NUTRITION (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- A&B INGREDIENTS INC. (US)

- BELLE PULSES (US)

- PURIS PROTEIN LLC (US)

- QUADRA CHEMICALS (US)

- INGREDION INCORPORATED (US)

- ORGANICWAY (US)

- G.S. DUNN DRY MUSTARD MILLERS (US)

- INTERFIBER (US)

- FARBEST BRANDS (US)

- AGT FOODS & INGREDIENTS (CANADA)

- AVENA FOODS LIMITED (CANADA)

- PARRISH & HEIMBECKER LIMITED (CANADA)

- VESTKORN MILLING AS (NORWAY)

- CFF GMBH & CO. KG (GERMANY)

- EMSLAND GROUP (GERMANY)

- EMSLAND GROUP (GERMANY)

- PARRHEIM FOODS (GERMANY)

- ROQUETTE FRERES SA (FRANCE)

- NUTRAONLY (XI'AN) NUTRITIONS INC. (CHINA)

- SHANDONG JIANYUAN BIOENGINEERING (CHINA)

- MRIDA GREENS AND DEVELOPMENT PRIVATE LIMITED (INDIA)

- OMG LABS PRIVATE LIMITED (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL PEA FIBRE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Nature

- Historic And Forecasted Market Size By End-user

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- US

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Pea Fiber Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.71 Billion. |

|

Forecast Period 2024-32 CAGR: |

5.5 % |

Market Size in 2032: |

USD 2.78 Billion. |

|

Segments Covered: |

By Type |

|

|

|

By Nature |

|

||

|

By End-user |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PEA FIBRE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PEA FIBRE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PEA FIBRE MARKET COMPETITIVE RIVALRY

TABLE 005. PEA FIBRE MARKET THREAT OF NEW ENTRANTS

TABLE 006. PEA FIBRE MARKET THREAT OF SUBSTITUTES

TABLE 007. PEA FIBRE MARKET BY TYPE

TABLE 008. ORGANIC PEA FIBER MARKET OVERVIEW (2016-2028)

TABLE 009. CONVENTIONAL PEA FIBER MARKET OVERVIEW (2016-2028)

TABLE 010. PEA FIBRE MARKET BY APPLICATION

TABLE 011. FOOD INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 012. DIETARY SUPPLEMENTS MARKET OVERVIEW (2016-2028)

TABLE 013. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA PEA FIBRE MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA PEA FIBRE MARKET, BY APPLICATION (2016-2028)

TABLE 017. N PEA FIBRE MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE PEA FIBRE MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE PEA FIBRE MARKET, BY APPLICATION (2016-2028)

TABLE 020. PEA FIBRE MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC PEA FIBRE MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC PEA FIBRE MARKET, BY APPLICATION (2016-2028)

TABLE 023. PEA FIBRE MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA PEA FIBRE MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA PEA FIBRE MARKET, BY APPLICATION (2016-2028)

TABLE 026. PEA FIBRE MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA PEA FIBRE MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA PEA FIBRE MARKET, BY APPLICATION (2016-2028)

TABLE 029. PEA FIBRE MARKET, BY COUNTRY (2016-2028)

TABLE 030. EMSLAND GROUP: SNAPSHOT

TABLE 031. EMSLAND GROUP: BUSINESS PERFORMANCE

TABLE 032. EMSLAND GROUP: PRODUCT PORTFOLIO

TABLE 033. EMSLAND GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. SHANDONG JIANYUAN BIOENGINEERING: SNAPSHOT

TABLE 034. SHANDONG JIANYUAN BIOENGINEERING: BUSINESS PERFORMANCE

TABLE 035. SHANDONG JIANYUAN BIOENGINEERING: PRODUCT PORTFOLIO

TABLE 036. SHANDONG JIANYUAN BIOENGINEERING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. BELLE PULSES: SNAPSHOT

TABLE 037. BELLE PULSES: BUSINESS PERFORMANCE

TABLE 038. BELLE PULSES: PRODUCT PORTFOLIO

TABLE 039. BELLE PULSES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. COSUCRA GROUPE WARCOING: SNAPSHOT

TABLE 040. COSUCRA GROUPE WARCOING: BUSINESS PERFORMANCE

TABLE 041. COSUCRA GROUPE WARCOING: PRODUCT PORTFOLIO

TABLE 042. COSUCRA GROUPE WARCOING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. OMG LABS PRIVATE LIMITED: SNAPSHOT

TABLE 043. OMG LABS PRIVATE LIMITED: BUSINESS PERFORMANCE

TABLE 044. OMG LABS PRIVATE LIMITED: PRODUCT PORTFOLIO

TABLE 045. OMG LABS PRIVATE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. MRIDA GREENS AND DEVELOPMENT PRIVATE LIMITED: SNAPSHOT

TABLE 046. MRIDA GREENS AND DEVELOPMENT PRIVATE LIMITED: BUSINESS PERFORMANCE

TABLE 047. MRIDA GREENS AND DEVELOPMENT PRIVATE LIMITED: PRODUCT PORTFOLIO

TABLE 048. MRIDA GREENS AND DEVELOPMENT PRIVATE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. VESTKORN: SNAPSHOT

TABLE 049. VESTKORN: BUSINESS PERFORMANCE

TABLE 050. VESTKORN: PRODUCT PORTFOLIO

TABLE 051. VESTKORN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. ORGANICWAY: SNAPSHOT

TABLE 052. ORGANICWAY: BUSINESS PERFORMANCE

TABLE 053. ORGANICWAY: PRODUCT PORTFOLIO

TABLE 054. ORGANICWAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. A&B INGREDIENTS: SNAPSHOT

TABLE 055. A&B INGREDIENTS: BUSINESS PERFORMANCE

TABLE 056. A&B INGREDIENTS: PRODUCT PORTFOLIO

TABLE 057. A&B INGREDIENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. PARRHEIM FOODS: SNAPSHOT

TABLE 058. PARRHEIM FOODS: BUSINESS PERFORMANCE

TABLE 059. PARRHEIM FOODS: PRODUCT PORTFOLIO

TABLE 060. PARRHEIM FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. INGREDION INCORPORATED: SNAPSHOT

TABLE 061. INGREDION INCORPORATED: BUSINESS PERFORMANCE

TABLE 062. INGREDION INCORPORATED: PRODUCT PORTFOLIO

TABLE 063. INGREDION INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PEA FIBRE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PEA FIBRE MARKET OVERVIEW BY TYPE

FIGURE 012. ORGANIC PEA FIBER MARKET OVERVIEW (2016-2028)

FIGURE 013. CONVENTIONAL PEA FIBER MARKET OVERVIEW (2016-2028)

FIGURE 014. PEA FIBRE MARKET OVERVIEW BY APPLICATION

FIGURE 015. FOOD INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 016. DIETARY SUPPLEMENTS MARKET OVERVIEW (2016-2028)

FIGURE 017. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA PEA FIBRE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE PEA FIBRE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC PEA FIBRE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA PEA FIBRE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA PEA FIBRE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Pea Fiber Market research report is 2024-2032.

AM Nutrition (US) , A&B Ingredients Inc. (US), Belle Pulses (US), Puris Protein LLC (US), Quadra Chemicals (US), Ingredion Incorporated (US), Organicway (US), G.S. DUNN DRY MUSTARD MILLERS (US), InterFiber (US), Farbest Brands (US), AGT Foods & Ingredients (Canada), Avena Foods Limited (Canada), Parrish & Heimbecker Limited (Canada), Vestkorn Milling AS (Norway), CFF GmbH & Co. KG (Germany), Emsland Group (Germany), Emsland Group (Germany), Parrheim Foods (Germany), Roquette Freres SA (France), Nutraonly (Xi'an) Nutritions Inc. (China), Shandong Jianyuan Bioengineering (China), Mrida Greens and Development Private Limited (India), OMG Labs Private Limited (India), and Other Major Players.

The Pea Fiber Market is segmented into Type, Nature, End-User, Distribution Channel, and region. By Type, the market is categorized into Pea Hull Fiber and Pea Cotyledon Fiber. By Nature, the market is categorized into Organic and Conventional. By End-User, the market is categorized into Food Industry, Dietary Supplements, Pharmaceutical Industry, Nutraceuticals, and Animal feed. By Distribution Channel, the market is categorized into Direct Sales, Wholesalers, Specialty Stores, and Online Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Pea fiber is a dietary fiber extracted from peas, specifically the outer husk or shell of the pea. Rich in soluble and insoluble fiber, it offers various health benefits. Soluble fiber aids digestion and helps manage blood sugar levels, while insoluble fiber promotes bowel regularity and overall gut health. Pea fiber is low in calories and cholesterol-free, making it a nutritious addition to diets. Its ability to absorb water contributes to a feeling of fullness, aiding in weight management. Pea fiber supports heart health by lowering cholesterol levels. It is a versatile, plant-based ingredient with positive impacts on both digestive and cardiovascular wellness.

Pea Fiber Market Size Was Valued at USD 1.71 Billion in 2023 and is Projected to Reach USD 2.78 Billion by 2032, Growing at a CAGR of 5.5 % From 2024-2032.