Paper Packaging Market Synopsis

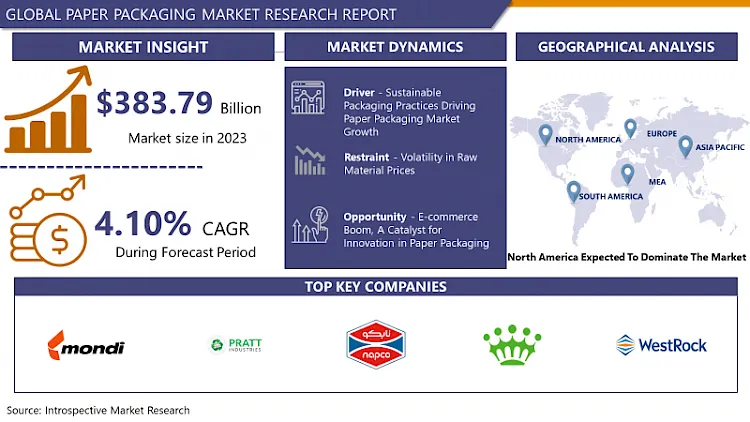

Paper Packaging Market Size is Valued at USD 399.53 Billion in 2024, and is Projected to Reach USD 551.0 Billion by 2032, Growing at a CAGR of 4.10% From 2025-2032.

The paper packaging market encompasses the production and distribution of various types of packaging made predominantly from paper and paperboard materials. This market includes packaging solutions for a wide range of industries such as food and beverage, healthcare, personal care, and others. The demand for paper packaging is driven by its eco-friendly nature, recyclability, and biodegradability, aligning with increasing consumer and regulatory focus on sustainability. Market growth is further propelled by innovations in packaging design, material development, and technological advancements in printing and manufacturing processes.

The factors that have led to the growth of driver paper packaging market in the global market are the rising eco-consciousness of people and the consequent demand for paper-based packaging solutions. This means the shift in consumer behaviour is leading to concerns on the recyclability of the material, the biodegradable nature of the material and availability of the material from renewable resources. Driver paper which is produced from agricultural waste products such as wheat straw or sugar cane has become the most used packaging material due to its biodegradable nature and has little effect on the environment. Furthermore, increasing stringency in regulatory norms towards packaging applications that are sustainable, ecofriendly, and possess high recycled content, increases the demand for the driver paper packaging.

However, it has some threats like increased cost of driver paper compared to conventional materials used for packaging and the higher capital investment in new technologies of manufacturing. However, it is noted that this market could potentially face several challenges in the near future and yet the driver paper packaging market could indeed grow in the future due to the rising implementation of green packaging solutions across a number of sectors.

.webp)

Paper Packaging Market Trend Analysis

Paper Packaging Market Growth Driver-Driving Forces, The Transformative Trends Shaping the Paper Packaging Market

- The paper packaging market is going through a steady change due to the following factors. Sustainability has become one of the key trends that have developed over the years, with consumers and businesses in search of more environmentally friendly solutions than conventional packaging. This has resulted in increased preference for paper-based packaging materials since paper is renewable, recyclable, and biodegradable. Moreover, the constant technological changes have led to the unveiling of new types of paper packaging that are more functional and durable than the previous ones, thus contributing to the growth of the market.

- In addition, factors such as shifts in consumers’ buying habits and their life styles, have brought about the need for convenience-oriented packaging. This paper looks at how paper packaging is suitable for these changing requirements because of the flexibility and ease of modification. In addition, the increasing focus on the use of environmentally friendly packaging materials, including paper packaging, due to regulatory actions and policies to minimize the use of plastics is a factor that is likely to propel the growth of this market. These factors are envisaged to persist in their influence towards the growth of the paper packaging market in the future years.

Paper Packaging Market Expansion Opportunity- Unwrapping Opportunities, The Bright Future of Paper Packaging Market

- The market for paper packaging is a promising one due to the following factors: Firstly, awareness of the depletion of natural resources and the shift towards the use of eco-friendly packaging materials are driving the growth of paper-based packaging. The paper packaging market is well-positioned to receive the support of the consumers and regulatory bodies as they shift their focus towards the use of recyclable and biodegradable materials instead of plastics. Secondly, the advancements in technology in the production of paper packaging have made it possible for companies to produce better looking and more functional paper-based packaging materials that would help in driving the market forward.

- Also, global e-commerce sales are rising, which creates the need for paper-based packaging materials. With the increase in the number of people shopping online, there is a greater demand for stronger and more environmentally friendly packaging materials for the protection of the products during shipment. In addition, the changing retail environment, such as the increasing focus on premiumization and customization of packaging, is also creating new market opportunities for the players in the paper packaging market to address the emerging trends. In general, the paper packaging business is expected to expand in the future due to factors such as the growing consciousness of the environment, the use of new technologies, and shifting consumer preferences.

Paper Packaging Market Segment Analysis:

Paper Packaging Market is segmented on the basis of Product type, Packaging Type, End-user, and Region..

By Product Type, Boxboard segment is expected to dominate the market during the forecast period

- The paper packaging market is a broad category that can include a number of different products, each of which has specific uses and applications. Corrugated boxes are very strong and thus commonly used in transportation and shipping since they are able to protect items from being damaged. On the other hand, Boxboard is commonly used in consumer packaging, such as cereal boxes and cosmetic packaging, due to its rigidity and printing capabilities.

- Some of the products that fall under flexible paper packaging are paper bags and pouches, which are non-plastic packaging that is lightweight and environmentally friendly. This segment is now on the rise and commonly used in the food industry because of its durability and ease of use. The ‘Others’ section contains products such as paper cups, cartons, and trays, all of which meet different packaging requirements in different industries.

- These product types collectively constitute a vast network of paper packaging products that meet the various requirements of business and consumers and is in tandem with the growing trend of eco-friendly packaging materials.

By Packaging Format, Primary Packaging segment held the largest share in 2024

- The paper packaging market is classified based on packaging type as primary packaging, secondary packaging, and tertiary packaging, all of which have their distinctive purpose in the packaging domain.

- Primary packaging is the packaging that comes into physical contact with the packaged product, and its chief function is to safeguard the product. This consist of paper bags, pouches, and wrappers which are important in preserving the quality of the products and extending their shelf life.

- Secondary packaging organizes the primary packages into groups to offer further protection and marketing appeal. Examples include the cardboard shoe covers used while packaging multiple units of products for shipment or display.

- Tertiary packaging is the final packaging used to store and transport goods from one place to another. It is meant for safeguarding the products during transport and movement and comes with features such as pallets, stretch wrap, and other large packaging accessories.

Paper Packaging Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The United States paper packaging market has a stable growth due to the continuously increasing demand from the food and beverages, pharmaceuticals, and consumer products industry. This is because the consumer trend of sustainable packaging is on the rise in the global market. There is a new trend in the packaging industry to focus on the use of paper-based packaging material rather than the conventional plastic material. This is even compounded by the increased regulation that encourages the use of environmentally sustainable packaging. Also, the development and introduction of new features in paper packaging like better barrier coatings and new designs are also boosting the growth of the market which makes this segment more suitable for investment and development.

- The United States paper packaging market has experienced a steady increase in the demand for packaging for e-commerce solutions in the recent past. The increasing trend of internet-based shopping has led to a demand for durable, protective and appealing packaging. This has given rise to the demand for corrugated boxes, folding cartons, and other paper-based packaging materials. In addition, the outbreak of the COVID-19 pandemic has increased the use of e-commerce and, therefore, paper packaging. The increasing focus on sustainable packaging and the rapidly expanding e-commerce industry in the United States signal strong future growth and opportunities for innovation in the paper packaging market.

Active Key Players in the Paper Packaging Market

- Smurfit Kappa Group Plc (Ireland)

- Napco National Paper Products Company (Saudi Arabia)

- Billerud (Sweden)

- WestRock Company (United States)

- Georgia Pacific LLC (United States)

- Pratt Industries, Inc. (United States)

- DS Smith Packaging Limited (United Kingdom)

- Stora Enso Oyj (Finland)

- Mondi Group Plc (United Kingdom)

- WestRock Company (United States)

- Huhtamaki Oyj (Finland)

- Pactiv LLC (United States)

- Sonoco Products Company (United States)

- KapStone Paper and Packaging Corp (United States)

- Rengo Co. Ltd. (Japan)

- US Corrugated Inc. (United States)

- Reynolds Group Holdings (New Zealand)

- Stora Enso (Finland)

- UFP Technologies (United States)

- ESCO Technologies Inc (United States)

- Brodrene Hartmann (Denmark)

- Others Active Players.

|

Global Paper Packaging Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 399.53 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.10 % |

Market Size in 2032: |

USD 551.0 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging Format |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Paper Packaging Market by Product Type (2018-2032)

4.1 Paper Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Corrugated Boxes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Boxboard

4.5 Flexible Paper Packaging

4.6 Others

Chapter 5: Paper Packaging Market by Packaging Format (2018-2032)

5.1 Paper Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Primary Packaging

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Secondary Packaging

5.5 Tertiary Packaging

5.6 End User

5.7 Food & Beverage

5.8 Healthcare

5.9 Personal Care & Homecare

5.10 Retail & E-commerce

5.11 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Paper Packaging Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 SMURFIT KAPPA GROUP PLC (IRELAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NAPCO NATIONAL PAPER PRODUCTS COMPANY (SAUDI ARABIA)

6.4 BILLERUD (SWEDEN)

6.5 WESTROCK COMPANY (UNITED STATES)

6.6 GEORGIA PACIFIC LLC (UNITED STATES)

6.7 PRATT INDUSTRIES INC. (UNITED STATES)

6.8 DS SMITH PACKAGING LIMITED (UNITED KINGDOM)

6.9 STORA ENSO OYJ (FINLAND)

6.10 MONDI GROUP PLC (UNITED KINGDOM)

6.11 WESTROCK COMPANY (UNITED STATES)

6.12 HUHTAMAKI OYJ (FINLAND)

6.13 PACTIV LLC (UNITED STATES)

6.14 SONOCO PRODUCTS COMPANY (UNITED STATES)

6.15 KAPSTONE PAPER AND PACKAGING CORP (UNITED STATES)

6.16 RENGO CO. LTD. (JAPAN)

6.17 US CORRUGATED INC. (UNITED STATES)

6.18 REYNOLDS GROUP HOLDINGS (NEW ZEALAND)

6.19 STORA ENSO (FINLAND)

6.20 UFP TECHNOLOGIES (UNITED STATES)

6.21 ESCO TECHNOLOGIES INC (UNITED STATES)

6.22 BRODRENE HARTMANN (DENMARK)

6.23 AND OTHERS MAJOR PLAYERS

Chapter 7: Global Paper Packaging Market By Region

7.1 Overview

7.2. North America Paper Packaging Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Corrugated Boxes

7.2.4.2 Boxboard

7.2.4.3 Flexible Paper Packaging

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size by Packaging Format

7.2.5.1 Primary Packaging

7.2.5.2 Secondary Packaging

7.2.5.3 Tertiary Packaging

7.2.5.4 End User

7.2.5.5 Food & Beverage

7.2.5.6 Healthcare

7.2.5.7 Personal Care & Homecare

7.2.5.8 Retail & E-commerce

7.2.5.9 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Paper Packaging Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Corrugated Boxes

7.3.4.2 Boxboard

7.3.4.3 Flexible Paper Packaging

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size by Packaging Format

7.3.5.1 Primary Packaging

7.3.5.2 Secondary Packaging

7.3.5.3 Tertiary Packaging

7.3.5.4 End User

7.3.5.5 Food & Beverage

7.3.5.6 Healthcare

7.3.5.7 Personal Care & Homecare

7.3.5.8 Retail & E-commerce

7.3.5.9 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Paper Packaging Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Corrugated Boxes

7.4.4.2 Boxboard

7.4.4.3 Flexible Paper Packaging

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size by Packaging Format

7.4.5.1 Primary Packaging

7.4.5.2 Secondary Packaging

7.4.5.3 Tertiary Packaging

7.4.5.4 End User

7.4.5.5 Food & Beverage

7.4.5.6 Healthcare

7.4.5.7 Personal Care & Homecare

7.4.5.8 Retail & E-commerce

7.4.5.9 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Paper Packaging Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Corrugated Boxes

7.5.4.2 Boxboard

7.5.4.3 Flexible Paper Packaging

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size by Packaging Format

7.5.5.1 Primary Packaging

7.5.5.2 Secondary Packaging

7.5.5.3 Tertiary Packaging

7.5.5.4 End User

7.5.5.5 Food & Beverage

7.5.5.6 Healthcare

7.5.5.7 Personal Care & Homecare

7.5.5.8 Retail & E-commerce

7.5.5.9 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Paper Packaging Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Corrugated Boxes

7.6.4.2 Boxboard

7.6.4.3 Flexible Paper Packaging

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size by Packaging Format

7.6.5.1 Primary Packaging

7.6.5.2 Secondary Packaging

7.6.5.3 Tertiary Packaging

7.6.5.4 End User

7.6.5.5 Food & Beverage

7.6.5.6 Healthcare

7.6.5.7 Personal Care & Homecare

7.6.5.8 Retail & E-commerce

7.6.5.9 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Paper Packaging Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Corrugated Boxes

7.7.4.2 Boxboard

7.7.4.3 Flexible Paper Packaging

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size by Packaging Format

7.7.5.1 Primary Packaging

7.7.5.2 Secondary Packaging

7.7.5.3 Tertiary Packaging

7.7.5.4 End User

7.7.5.5 Food & Beverage

7.7.5.6 Healthcare

7.7.5.7 Personal Care & Homecare

7.7.5.8 Retail & E-commerce

7.7.5.9 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Paper Packaging Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 399.53 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.10 % |

Market Size in 2032: |

USD 551.0 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging Format |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||