Ovulation Test Market Synopsis

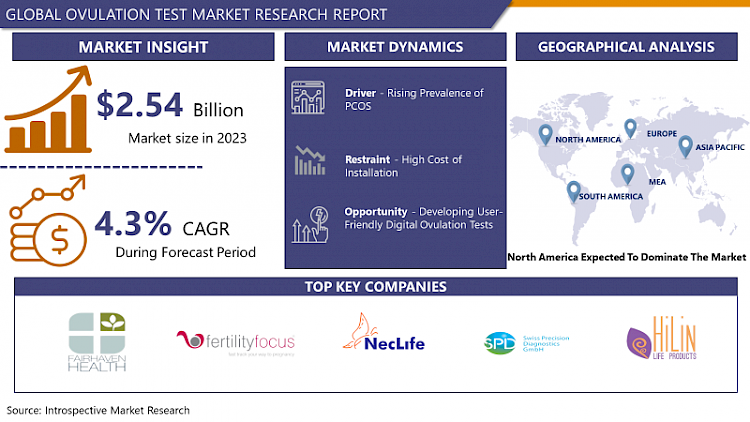

Ovulation Test Market Size Was Valued at USD 2.54 Billion in 2023, and is Projected to Reach USD 4.04 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032

An indicating ovulation test, or ovulation predictor kit (OPK) is a utilitarian tool employed by individuals who want to get pregnant to identify the most fertile days in a menstrual cycle. An LH lift (LH), generally (48-24 hours before ovulation), is found by the test. Radar detects it usually by level pee sample, consequently plays a role in the plot of the right time to get pregnant. These tests can be a great help for those whose periods are unreliable or who aim to increase the chance of becoming pregnant by perfecting the timing of sexual activity.

- Ovulation tests that are often seen in retail stores as self-help outlets for the couples seek to give them freedom of doing thing themselves outside the clinic set up to enable the partners to be vigilant and improve prospects of conception.

- An understanding of the ovulation is the essential aspect for the individuals who are seeking child, and ovulation devices marks out such useful devices to monitor it in a woman menstrual cycle. By detecting the increase of LH, these tests grant an excellent way of confining the storming period which starts immediately before ovulation, hence making conception much easier for every couple.

- Ovulation tests, regardless of whether they are used in isolation or in company with other fertility monitoring techniques, are vital indicators to the tremendous task of parenthood which gives empowerment to individuals to take proactive measures to improve their chances of conception and to be able to acquire apart from other things their desired family objectives.

Ovulation Test Market Trend Analysis

Increasing focus on family planning

- The shift in focus of family planning towards fertility planning is arguably the strongest market driver that supports sales of ovulation test kits through many interrelated factors. In the first place, as the society’s attitude changes, more and more couples are deciding to delay starting a family till they have attained some specific milestones such as a personal or a professional target or they are able to handle emotionally or they have good provision.

- The timing of ovulation can be easily determined with the use of ovulation kits. The kits provide appropraite aids that greatly increase a couple's chances of conceiving as quickly as possible during the waiting period. These home pregnancy tests ensure women are on their cycle through the exact timing of ovulation and after they become pregnant the probability of the actual pregnancy roughly increase.

- Next, we cannot open it now: more and more people are paying attention to woman’s reproductive health and fertility monitoring so that there would be higher demand for ovulation tests. Publicly people have the information that is conceiving and menstrual cycle is connected to each other and some people actively pursue to get the reliable guide to ovulation monitoring and optimal conception.

- The ovulation tests provide individuals with the solution which is practical and instantly accessible to them, thus the persons may be allowed to use them to proactively manage their reproductive trajectory. Moreover, the high surge of interest in the family planning and fertility management disciplines was spurred by the lifestyle change, the environmental stressor and the worsening causes of infertility; these developments expanded the ovulation test market. Overall having family planning processing as an individual commitment and the desire to try and make perfect choices regarding reproductive health care were found to be the main drivers for the ovulation test market growth..

Integration with wearable technology

- Ovulation test market is expected to enjoy huge benefits from the development of wearable technologies; these technologies increase convenience and accuracy of the test and improve user’s experience. Among people who are interested of tracking health parameters there has been a manifestation smartwatches, fitness trackers and fertility monitors that are often used as wearable technology. The function of adding ovulation kits to most prevalent wearable devices implies the manufacturers to furnish the users with a solution that is holistically and fully encompassing as long as they are doing their duty to monitor their fertility.

- With tech universally integrated ovulation testing instant real-time monitoring and syncing of data has seen a positive stride in the advancement. Fitness monitors record data on different physiological dimensions among them are pulse rate, temperature and activity levels that can be done for extended period of time.

- Ovulation test kits that come available in these devices allow users to carry out their fertility status the moment needed and make the right decision on whether to have a baby or not. Besides, for better synchronisation of data and accessing the fertility data through the online platforms and the apps, the cloud based technology is essential, which leads to a comprehensive fertility management with insights from user’s data.

- Additionally, the monitoring system will be enhanced by wearable sensors that play an important role in users’ involvement and effective execution of ovulation tracking protocols. This kind of device associating the ovulation testing functionalities with a-one-wear-a-day kind of device that users normally wear increases the likelihood of the users adhering to the regimen without requiring an extra gadget.

- Moreover, the integration of features like individual assessments, forecasting analytics, and algorithm that may induce a person to follow particular routes based on her or his fertility seasons is another issue that can be added to improve the overall experience of the user by giving personalized suggestions and indications. Specifically, mobile technology as a part of FDA-approved ovulation test kits is a very welcome development for the industry to deal with the rising need of people of keeping track of family planning and monitoring of ovulation through the use of mobile devices..

Ovulation Test Market Segment Analysis:

Ovulation Test Market is segmented on the basis of Type, and End User.

By Type, the urine-based segment is expected to dominate the market during the forecast period

- The overall EquityAccommodating of the Urine Test segment may be such because it appeals to various factors that drive consumers. The Ovulation Predictor kits (OPKs), which are urine-based ovulation tests, are simply available the online stores and secure pharmacies. However, it is a great feature which helps users who want to keep track of their pregnancy.

- The spike in LH (luteinizing hormone) content that gets into urine from 6-7 days before ovulation (the egg is released) and signals the most fertile period of a woman's menstrual cycle is what these tests detect. Owing to their usage without any discomfort and their delivery by urine, a large number of people give preference to urine-based tests that are non-invasive and predict ovulation avoiding any kind of on-time checking.

- Ovulation tests differ from other kinds ones in that they are cheaper, which makes them more reachable to the wider segment of consumers. Enough money that getting a test is affordable to anyone who wants to use it when necessary ensures multiple cycles of monitoring fertility. This can increase the chances of successful conception by considering more cycles.

- On the other hands it has earned the reputation of such a kit for its outstanding precision and reliability that assists people to grow their confidence in themselves and to have informed decisions on the right timing to have sex for the purpose of conceiving the baby.

- Although the ovulation test market has demonstrated that urine-based approach clearly enjoys lead in terms of being the preferred choice for persons who want to track their fertility and, ultimately, get pregnant through this, owing to its convenience, cheapness, correctness, and user-friendliness, it still dominates..

By End User, home care segment held the largest share

- · The home care segment is the leading contributor in the ovulation test market. Such prevalence is rooted in the fact that these devices are very convenient, private and can be easily accessible. These packages are not formulated to necessitate either hospital consultations or outpatient visits as this is specifically designed to be used by an individual or couple within their private residences.

- OPKs becoming widely available over-the-counter at pharmacies and online retailers is enabled. As a result, consumers don’t need prescription to purchase and use them. The intimate nature of home-based ovulation testing tools lead to regular monitoring of ovulation and adoption of a proactive family planning;as a result,they play a great role in their massive spread.

- Moreover, self-care awareness and sense of control accompanying health management make consumers seek the home ovulation testing products even more in a growing bunch. Implantation of a number of fertility monitoring kits enable people to have more self-confidence and independence in family planning.

- Similarly, the anonymous design of such devices at home keeps the privacy and confidence of individuals while erasing the apprehension or uneasiness that patients have while discussing fertility problems in a clinical environment. The increased demand for private, easily accessible, and user-friendly options likely explains the overwhelming segment of the home care settings that command the ovulation test market overall...

Ovulation Test Market Regional Insights:

In North America the Market is Forecasted to Lead Over the Predicted Period.

- The ovulation test market in North America is likely to account for a larger share because of the higher consumer adoption rates and higher number of planned pregnancies. Not only that, but the factor of the growing number of people with fertility problems and the emergence of digital ovulation test kits is a significant factor of the market extension. Furthermore, a market demand proliferation is predicted arising from the improvements in digital ovulation test device technology.

- Firms are likely to be more interested in developing new products with simple and reliable outputs while producing superior results at a lower unit cost today. Major companies leaders have participating in partnerships and collaborations to cover the wide region.

- For example, in 2022 the major producer of digital ovulation test devices, which is Sugentech, has an alliance with CGETC Inc., a U. S. –based consumption fulfillment and marketing firm. Some digital gadgets owned by people today are pretty advanced with Bluetooth connectivity and countdown reporters. It was the market where I noticed a number of popular brands such as Clearblue, First Response, and E. P. T dealing with digital ovulation test products.

Active Key Players in the Ovulation Test Market

- Accuquik (South Korea)

- Church & Dwight Co. Inc. (USA)

- Clearblue (United Kingdom)

- Fairhaven Health LLC (USA)

- Fertility Focus Limited (United Kingdom)

- Geratherm Medical AG (Germany)

- HiLin Life Products Inc. (USA)

- NecLife (India)

- Piramal Healthcare (India)

- Prestige Brands Holdings Inc. (USA)

- Swiss Precision Diagnostics GmbH (Switzerland)

- Other Major Players

|

Global Ovulation Test Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.54 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 4.04 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- OVULATION TEST MARKET BY TYPE (2017-2032)

- OVULATION TEST MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- URINE-BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SALIVA-BASED

- OVULATION TEST MARKET BY END USER (2017-2032)

- OVULATION TEST MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HOME CARE SETTINGS

- CLINICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Ovulation Test Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ACCUQUIK (SOUTH KOREA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CHURCH & DWIGHT CO. INC. (USA)

- CLEARBLUE (UNITED KINGDOM)

- FAIRHAVEN HEALTH LLC (USA)

- FERTILITY FOCUS LIMITED (UNITED KINGDOM)

- GERATHERM MEDICAL AG (GERMANY)

- HILIN LIFE PRODUCTS INC. (USA)

- NECLIFE (INDIA)

- PIRAMAL HEALTHCARE (INDIA)

- PRESTIGE BRANDS HOLDINGS INC. (USA)

- SWISS PRECISION DIAGNOSTICS GMBH (SWITZERLAND)

- COMPETITIVE LANDSCAPE

- GLOBAL OVULATION TEST MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Ovulation Test Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.54 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 4.04 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. OVULATION TEST MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. OVULATION TEST MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. OVULATION TEST MARKET COMPETITIVE RIVALRY

TABLE 005. OVULATION TEST MARKET THREAT OF NEW ENTRANTS

TABLE 006. OVULATION TEST MARKET THREAT OF SUBSTITUTES

TABLE 007. OVULATION TEST MARKET BY TYPE

TABLE 008. CLASSIFICATION OF OVULATION TEST BY THE RESULT RETRIEVAL: COLORATION OVULATION TEST MARKET OVERVIEW (2016-2028)

TABLE 009. DIGITAL OVULATION TEST MARKET OVERVIEW (2016-2028)

TABLE 010. CLASSIFICATION OF OVULATION TEST BY USE: TEST STRIPS MARKET OVERVIEW (2016-2028)

TABLE 011. MIDSTREAM TESTS MARKET OVERVIEW (2016-2028)

TABLE 012. BEST TIME TO PREDICT CONTRACEPTIVE MARKET OVERVIEW (2016-2028)

TABLE 013. OVULATION TEST MARKET BY APPLICATION

TABLE 014. PREDICT THE BEST TIME TO CONCEIVE MARKET OVERVIEW (2016-2028)

TABLE 015. PREDICT THE BEST TIME TO CONTRACEPTION MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA OVULATION TEST MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA OVULATION TEST MARKET, BY APPLICATION (2016-2028)

TABLE 018. N OVULATION TEST MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE OVULATION TEST MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE OVULATION TEST MARKET, BY APPLICATION (2016-2028)

TABLE 021. OVULATION TEST MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC OVULATION TEST MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC OVULATION TEST MARKET, BY APPLICATION (2016-2028)

TABLE 024. OVULATION TEST MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA OVULATION TEST MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA OVULATION TEST MARKET, BY APPLICATION (2016-2028)

TABLE 027. OVULATION TEST MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA OVULATION TEST MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA OVULATION TEST MARKET, BY APPLICATION (2016-2028)

TABLE 030. OVULATION TEST MARKET, BY COUNTRY (2016-2028)

TABLE 031. CLEARBLUE: SNAPSHOT

TABLE 032. CLEARBLUE: BUSINESS PERFORMANCE

TABLE 033. CLEARBLUE: PRODUCT PORTFOLIO

TABLE 034. CLEARBLUE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. THE FIRST RESPONSE: SNAPSHOT

TABLE 035. THE FIRST RESPONSE: BUSINESS PERFORMANCE

TABLE 036. THE FIRST RESPONSE: PRODUCT PORTFOLIO

TABLE 037. THE FIRST RESPONSE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. THE STORK OTC.: SNAPSHOT

TABLE 038. THE STORK OTC.: BUSINESS PERFORMANCE

TABLE 039. THE STORK OTC.: PRODUCT PORTFOLIO

TABLE 040. THE STORK OTC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. PRESTIGE BRANDS HOLDINGS INC.: SNAPSHOT

TABLE 041. PRESTIGE BRANDS HOLDINGS INC.: BUSINESS PERFORMANCE

TABLE 042. PRESTIGE BRANDS HOLDINGS INC.: PRODUCT PORTFOLIO

TABLE 043. PRESTIGE BRANDS HOLDINGS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. OVULATION TEST MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. OVULATION TEST MARKET OVERVIEW BY TYPE

FIGURE 012. CLASSIFICATION OF OVULATION TEST BY THE RESULT RETRIEVAL: COLORATION OVULATION TEST MARKET OVERVIEW (2016-2028)

FIGURE 013. DIGITAL OVULATION TEST MARKET OVERVIEW (2016-2028)

FIGURE 014. CLASSIFICATION OF OVULATION TEST BY USE: TEST STRIPS MARKET OVERVIEW (2016-2028)

FIGURE 015. MIDSTREAM TESTS MARKET OVERVIEW (2016-2028)

FIGURE 016. BEST TIME TO PREDICT CONTRACEPTIVE MARKET OVERVIEW (2016-2028)

FIGURE 017. OVULATION TEST MARKET OVERVIEW BY APPLICATION

FIGURE 018. PREDICT THE BEST TIME TO CONCEIVE MARKET OVERVIEW (2016-2028)

FIGURE 019. PREDICT THE BEST TIME TO CONTRACEPTION MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA OVULATION TEST MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE OVULATION TEST MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC OVULATION TEST MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA OVULATION TEST MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA OVULATION TEST MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Ovulation Test Market research report is 2024-2032.

Fairhaven Health LLC, Fertility Focus Limited, NecLife, Swiss Precision Diagnostics GmbH, HiLin Life Products Inc., Geratherm Medical AG, Accuquik, Church & Dwight Co. Inc., Prestige Brands Holdings Inc., Clearblue, Piramal Healthcare and Other Major Players.

The Ovulation Test Market is segmented into Type, End-Users, and region. By Type, the market is categorized into Urine-based, Saliva-based. By End User, the market is categorized into Hospitals, Home Care Settings, Clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An ovulation test is a diagnostic tool used to predict the fertile window in a woman's menstrual cycle. It typically detects the surge in luteinizing hormone (LH) levels, which occurs about 24-48 hours before ovulation. This helps individuals identify the optimal time for conception by indicating when ovulation is likely to occur.

Ovulation Test Market Size Was Valued at USD 2.54 Billion in 2023, and is Projected to Reach USD 4.04 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032.