Oilseed Market Synopsis

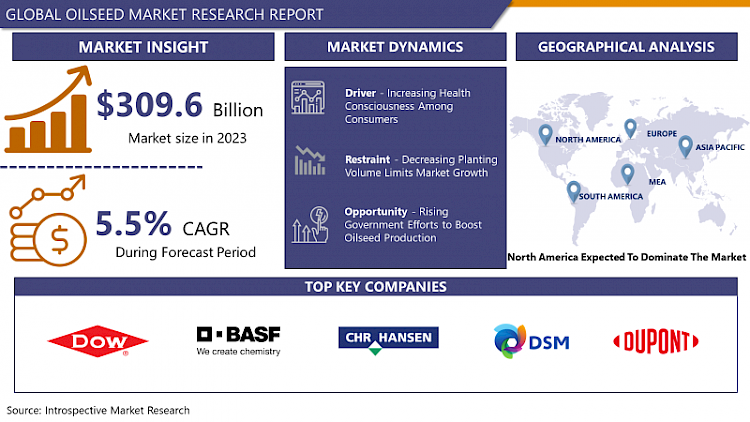

Oilseed Market Size Was Valued at USD 309.6 Billion in 2023, and is Projected to Reach USD 501.3 Billion by 2032, Growing at a CAGR of 5.5% From 2024-2032.

Oilseeds are the product of these plants which are cultivated to produce cooking oils for our daily use, processing food for manufacturing, and the industry. Oil seeds include soybeans, sunflower seeds, canola (rapeseed), cotton seeds, sesame seeds, groundnuts, and such. The seeds contain a lot of oil which you can recover either by a mechanical or a chemical project. High oleic vegetable oils extracted from oilseeds give many nutrients and their products are employed in many food categories as biodiesel, cosmetics and industrial lubricant.

- The productivity of oilseeds depends on that rainfall or sunshine to give its anticipated levels of productivity into food supply in the future. Sunflower, palm and other seeds are used to produce any number of consumable and non-consumable oils. They are what contain glutamates, fat-soluble antioxidants, phospholipids, phytonutrients, potassium, protein, magnesium, calcium, vitamin E, K, and so on, and used in animal feed, pharmaceuticals, biofuels, wholesome oils, and other oleochemical industries.

- Copra, cottonseed, palm kernel, peanut, rapeseed, soybean, and sunflower seeds are major sources of oil that is produced from these edible products. The raw material for animal feed is oil, whereas oil is the key accessory of human food. Oil from oilseeds is turned into edible oils, which are in turn used to produce biodiesel.

- Developing state interventions are a crucial factor in the advancement of oilseeds market sector. Other nations are encouraging oilseeds which are used to replace and also the prices of expensive vegetable oil markets are being cut.

- Increased market reach and acceptance as well as a significant rise on GM oilseeds should improve the oilseeds industry. The bio-instruction of commercial oilseed farmers consequently employs biotech characteristics to breed the soybean, cottonseed, rapeseed, and others crops with higher productivity. Through production of GM seeds that act as effective biotic stress managers in agriculture reducing unnecessary input costs at the same time helping avoid unnecessary crop pest and disease control, agricultural biotechnology aids in farm economics improvement. Biotech features of herbicide tolerance and insect resistance have entered the market, such crops are protected and the replacement of seeds is reduced while the valued oilseeds are maintained.

Oilseed Market Trend Analysis

Growing oilseed use in animal feed

- Higher proportions of oil seeds in animal feedings can render greater input. Among oilseeds fatty acids are prevailing components, also oil, minerals, protein, vitamins, and dietary fiber are used for oil extraction. With oil extraction from oilseeds done, nutrients from pulp then become meals or oilcake used in dairy farms for quality of milk, reducing feed requirements. In 2021, the USDA revealed that there were 18 farm workers injured or killed while operating on or around farm machinery. 30 000 grams of oil meal production. The grain crushing makes about 70-80% of oilseeds India's use. For supplied to farm animals, meal is used.

Increasing oilseed demand for multiple uses

- While oil seeds are well liked for their numerous uses such as cooking and frying, they are often considered commonplace. Sunflower oil, used as a moisturiser in cosmetics, is one of the ingredients. Second in the hierarchy of Indian agricultural export after food grains is oil seeds. Our consumers may pick vegetable oil from over animal fat by their desire to keep their health. Alongside the Linseed Oil that is identified as a vegetable oil is employed as a varnish purpose, paste and lubricants. With this, we may anticipate that the increasing consumption of oilseeds for various uses such as, edible oil, feed and other fallouts will be the main cause of market growth

Oilseed Market Segment Analysis:

Oilseed Market is segmented based on oilseed type, product, breeding type and biotech trait.

By oilseed type, soybean segment is expected to dominate the market during the forecast period

- One of the primary factors which positively impact global soybean production include an increase in animal feed demand and consumption of meat by emerging economies, especially countries like China, Brazil, India, Korea, and so on. Therefore, production output in this case soybean it is very likely to advance further. Furthermore, the high demand for biosynthesis, which is based oni soybean-based vegetable oil also be expected to increase soybeans production and oilseeds market growth.

By biotech trait, herbicide tolerant segment held the largest share in 2023

- Herbicide-tolerant oil crops or those vegetables can have multiple herbicides property that will kill weeds. Herbicide-tolerant crops allow farmers to employ herbicides when there is a population boom in a particular weed, destroying the weed and enhancing crop safety. Such amount of R&D investments are being done to produce according to the needs, which for example, include new herbicide-tolerant seeds and crops, and they are being meant for usage worldwide. Above factors are very likely to make market of herbicide-tolerant oilseeds to be capitalized.

Oilseed Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Oilseeds market in terms of overall share and sales revenue in North America is anticipated to be the strongest one considering development of the edible oil market and more substantial research and development activities.

- By the particulars that follows, North America would secure the pole position of the oilseeds industry in terms of revenue and market share. There is a local level of growth in the regional economy, which is due to the rising consumption of cooking oil because of changing diets and widespread use of oil-based products in industrial processing and kitchen work.

- Advancement in research and development leading to high-yielding oilseed varieties and protein diversification is mainly targeted on increasing crop yield and quality. The recent North America's relevant strengths, such an outstanding agricultural infrastructure and some outstanding achievements in technology, make the North American continent the biggest player in the oilseeds industry on the global market, with further expansion predicted.

Active Key Players in the Oilseed Market

- Cargill, Incorporated (U.S.)

- Dow (U.S.)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Alltech (Nicholasville)

- Associated British Foods plc (U.K.)

- Charoen Pokphand Foods PCL (Thailand)

- Nutreco (Netherlands)

- ForFarmers. (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- Land O'Lakes (U.S.)

- Kent Nutrition Group (U.S.)

- J. D. HEISKELL & CO. (U.S.)

- Perdue Farms (U.S.)

- SunOpta (Canada)

- Scratch Peck Feeds (U.S.)

- De Heus Animal Nutrition (Netherlands)

- MEGAMIX (Russia)

- Agrofeed (Hungary)

- Other Key Players

Key Industry Developments in the Oilseed Market:

Indian agrochemical company Crystal Crop Protection Limited bought Bayer AG's seeds business in December 2021 for an unknown value. This purchase includes mustard, pearl millet, cotton, and grain sorghum hybrid seeds. Crystal Crop hopes to become a major seed company with this acquisition. Furthermore, the acquisition would boost its integrated Agri-Input business and field crop seed business.

|

Global Oilseed Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 309.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.5% |

Market Size in 2032: |

USD 501.3 Bn. |

|

Segments Covered: |

By Oilseed Type |

|

|

|

By Product |

|

||

|

By Breeding Type |

|

||

|

By Biotech Trait |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- OILSEED MARKET BY OILSEED TYPE (2017-2032)

- OILSEED MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COPRA

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COTTONSEED

- PALM KERNEL

- PEANUT

- RAPESEED

- SOYBEAN

- SUNFLOWER SEED

- OILSEED MARKET BY PRODUCT (2017-2032)

- OILSEED MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ANIMAL FEED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- EDIBLE OIL

- OILSEED MARKET BY BREEDING TYPE (2017-2032)

- OILSEED MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GENETICALLY MODIFIED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONVENTIONAL

- OILSEED MARKET BY BIOTECH TRAIT (2017-2032)

- OILSEED MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HERBICIDE TOLERANT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INSECTICIDE RESISTANT

- OTHER STACKED TRAIT

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Oilseed Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CARGILL, INCORPORATED (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- DOW (U.S.)

- BASF SE (GERMANY)

- CHR. HANSEN HOLDING A/S (DENMARK)

- DSM (NETHERLANDS)

- DUPONT (U.S.)

- EVONIK INDUSTRIES AG (GERMANY)

- NOVUS INTERNATIONAL (U.S.)

- ALLTECH (NICHOLASVILLE)

- ASSOCIATED BRITISH FOODS PLC (U.K.)

- CHAROEN POKPHAND FOODS PCL (THAILAND)

- NUTRECO (NETHERLANDS)

- FORFARMERS. (NETHERLANDS)

- DE HEUS ANIMAL NUTRITION (NETHERLANDS)

- LAND O'LAKES (U.S.)

- KENT NUTRITION GROUP (U.S.)

- J. D. HEISKELL & CO. (U.S.)

- PERDUE FARMS (U.S.)

- SUNOPTA (CANADA)

- SCRATCH PECK FEEDS (U.S.)

- DE HEUS ANIMAL NUTRITION (NETHERLANDS)

- MEGAMIX (RUSSIA)

- AGROFEED (HUNGARY)

- COMPETITIVE LANDSCAPE

- GLOBAL OILSEED MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Oilseed Type

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Breeding Type

- Historic And Forecasted Market Size By Biotech Trait

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Oilseed Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 309.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.5% |

Market Size in 2032: |

USD 501.3 Bn. |

|

Segments Covered: |

By Oilseed Type |

|

|

|

By Product |

|

||

|

By Breeding Type |

|

||

|

By Biotech Trait |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. OILSEED MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. OILSEED MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. OILSEED MARKET COMPETITIVE RIVALRY

TABLE 005. OILSEED MARKET THREAT OF NEW ENTRANTS

TABLE 006. OILSEED MARKET THREAT OF SUBSTITUTES

TABLE 007. OILSEED MARKET BY TYPE

TABLE 008. RAPESEED MARKET OVERVIEW (2016-2028)

TABLE 009. COTTONSEE MARKET OVERVIEW (2016-2028)

TABLE 010. GROUNDNUTS MARKET OVERVIEW (2016-2028)

TABLE 011. SUNFLOWER SEED MARKET OVERVIEW (2016-2028)

TABLE 012. PALM KERNELS MARKET OVERVIEW (2016-2028)

TABLE 013. COPRA SEED MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. OILSEED MARKET BY APPLICATION

TABLE 016. HOUSEHOLD CONSUMPTION MARKET OVERVIEW (2016-2028)

TABLE 017. FOOD-SERVICE MARKET OVERVIEW (2016-2028)

TABLE 018. BIO-FUELS MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA OILSEED MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA OILSEED MARKET, BY APPLICATION (2016-2028)

TABLE 022. N OILSEED MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE OILSEED MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE OILSEED MARKET, BY APPLICATION (2016-2028)

TABLE 025. OILSEED MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC OILSEED MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC OILSEED MARKET, BY APPLICATION (2016-2028)

TABLE 028. OILSEED MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA OILSEED MARKET, BY TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA OILSEED MARKET, BY APPLICATION (2016-2028)

TABLE 031. OILSEED MARKET, BY COUNTRY (2016-2028)

TABLE 032. SOUTH AMERICA OILSEED MARKET, BY TYPE (2016-2028)

TABLE 033. SOUTH AMERICA OILSEED MARKET, BY APPLICATION (2016-2028)

TABLE 034. OILSEED MARKET, BY COUNTRY (2016-2028)

TABLE 035. BAYER: SNAPSHOT

TABLE 036. BAYER: BUSINESS PERFORMANCE

TABLE 037. BAYER: PRODUCT PORTFOLIO

TABLE 038. BAYER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. LIMAGRAIN: SNAPSHOT

TABLE 039. LIMAGRAIN: BUSINESS PERFORMANCE

TABLE 040. LIMAGRAIN: PRODUCT PORTFOLIO

TABLE 041. LIMAGRAIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. MONSANTO: SNAPSHOT

TABLE 042. MONSANTO: BUSINESS PERFORMANCE

TABLE 043. MONSANTO: PRODUCT PORTFOLIO

TABLE 044. MONSANTO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. BURRUS SEED: SNAPSHOT

TABLE 045. BURRUS SEED: BUSINESS PERFORMANCE

TABLE 046. BURRUS SEED: PRODUCT PORTFOLIO

TABLE 047. BURRUS SEED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. GANSU DUNHUANG SEED: SNAPSHOT

TABLE 048. GANSU DUNHUANG SEED: BUSINESS PERFORMANCE

TABLE 049. GANSU DUNHUANG SEED: PRODUCT PORTFOLIO

TABLE 050. GANSU DUNHUANG SEED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. DOWDUPONT: SNAPSHOT

TABLE 051. DOWDUPONT: BUSINESS PERFORMANCE

TABLE 052. DOWDUPONT: PRODUCT PORTFOLIO

TABLE 053. DOWDUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. HEFEI FENGLE SEED: SNAPSHOT

TABLE 054. HEFEI FENGLE SEED: BUSINESS PERFORMANCE

TABLE 055. HEFEI FENGLE SEED: PRODUCT PORTFOLIO

TABLE 056. HEFEI FENGLE SEED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. LAND O'LAKES: SNAPSHOT

TABLE 057. LAND O'LAKES: BUSINESS PERFORMANCE

TABLE 058. LAND O'LAKES: PRODUCT PORTFOLIO

TABLE 059. LAND O'LAKES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ARCHER DANIELS MIDLAND: SNAPSHOT

TABLE 060. ARCHER DANIELS MIDLAND: BUSINESS PERFORMANCE

TABLE 061. ARCHER DANIELS MIDLAND: PRODUCT PORTFOLIO

TABLE 062. ARCHER DANIELS MIDLAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BUNGE: SNAPSHOT

TABLE 063. BUNGE: BUSINESS PERFORMANCE

TABLE 064. BUNGE: PRODUCT PORTFOLIO

TABLE 065. BUNGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. GREEN BIOFUELS: SNAPSHOT

TABLE 066. GREEN BIOFUELS: BUSINESS PERFORMANCE

TABLE 067. GREEN BIOFUELS: PRODUCT PORTFOLIO

TABLE 068. GREEN BIOFUELS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. KRISHIDHAN SEEDS: SNAPSHOT

TABLE 069. KRISHIDHAN SEEDS: BUSINESS PERFORMANCE

TABLE 070. KRISHIDHAN SEEDS: PRODUCT PORTFOLIO

TABLE 071. KRISHIDHAN SEEDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. OILSEED MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. OILSEED MARKET OVERVIEW BY TYPE

FIGURE 012. RAPESEED MARKET OVERVIEW (2016-2028)

FIGURE 013. COTTONSEE MARKET OVERVIEW (2016-2028)

FIGURE 014. GROUNDNUTS MARKET OVERVIEW (2016-2028)

FIGURE 015. SUNFLOWER SEED MARKET OVERVIEW (2016-2028)

FIGURE 016. PALM KERNELS MARKET OVERVIEW (2016-2028)

FIGURE 017. COPRA SEED MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. OILSEED MARKET OVERVIEW BY APPLICATION

FIGURE 020. HOUSEHOLD CONSUMPTION MARKET OVERVIEW (2016-2028)

FIGURE 021. FOOD-SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 022. BIO-FUELS MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA OILSEED MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE OILSEED MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC OILSEED MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA OILSEED MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA OILSEED MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Oilseed Market research report is 2024-2032.

Dow (U.S.), BASF SE (Germany), Chr. Hansen Holding A/S (Denmark), DSM (Netherlands), DuPont (U.S.), Evonik Industries AG (Germany), NOVUS INTERNATIONAL (U.S.), Alltech (Nicholasville), Associated British Foods plc (U.K.), and Other Major Players.

The Oilseed Market is segmented into oilseed types, product, breeding type, biotech trait, and region. By oilseed type, the market is categorized into copra, cottonseed, palm kernel, peanut, rapeseed, soybean and sunflower seed. By product, the market is categorized into animal feed and edible oil. By breeding type, the market is categorized into genetically modified and conventional. By biotech trait, the market is categorized into herbicide tolerant, insecticide resistant and other stacked trait. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Oil crops including canola, sunflower, soybean, and cotton require oilseeds. These oil crops' seeds, nuts, and fruits are eaten or crushed to extract oil for biofuel, oleo chemicals, food, and other sectors. Due to rising demand for oilseed extracts, farmers are spending more in high-quality oilseed crops.

Oilseed Market Size Was Valued at USD 309.6 Billion in 2023, and is Projected to Reach USD 501.3 Billion by 2032, Growing at a CAGR of 5.5% From 2024-2032.