Oilfield Services Market Synopsis

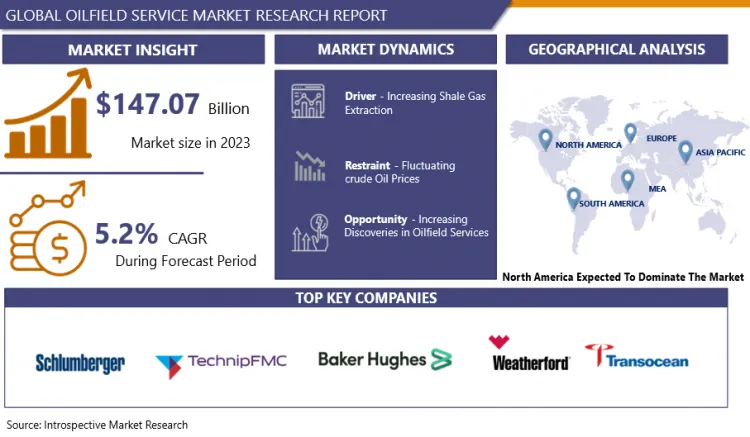

Oilfield Services Market Size Was Valued at USD 147.07 Billion in 2023, and is Projected to Reach USD 232.09 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032

Oilfield services involve specialized services that are essential for hydrocarbon exploration, drilling, well management, well completion, intervention, production enhancement, and reservoir evaluation to ensure efficient operation of oil & gas fields around the world.

- Oilfield services are designed to meet a range of obstacles, adjusting to different geological conditions, depth complexities, and well formations. Their ability to adapt is clear in their assistance, which ranges from traditional drilling to unorthodox shale operations, offshore deep-water initiatives, and improved oil recovery techniques. Additionally, they have a crucial function in optimizing the recovery of hydrocarbons. Their skill in utilizing new technologies and innovative methods helps improve well productivity and prolong the lifespan of aging fields.

- These services improve total production efficiency by utilizing techniques like hydraulic fracturing, directional drilling, and reservoir stimulation to access reserves that were previously unreachable. The increase in energy demand is the main factor driving the growth of the Oilfield Services Market. With the continued high demand for hydrocarbons, especially in developing countries, and changes in energy transition trends, oilfield services continue to play a crucial role in meeting these demands.

- Moreover, the incorporation of digital technology, data analytics, and automation has changed these services, enhancing operational efficiency and safety. Nevertheless, the growing worries about operational safety and emissions stemming from activities in the oil & gas industry are major obstacles to the worldwide market. Drilling activities present risks to both the environment and the safety of workers.

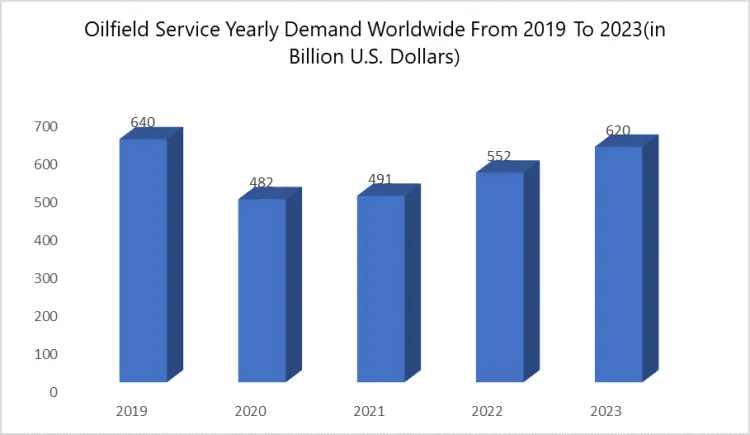

- The oilfield services industry includes all services associated with the exploration and production of oil and gas. From this graph, it is depicting the yearly demand of oilfield services from 2019 to 2023. It shows how Covid-19 influenced demand in 2020 compared to2019.

Oilfield Services Market Trend Analysis

Increasing Shale Gas Extraction

- Shale gas reserves are typically located in unconventional reservoirs that require advanced drilling technologies and techniques to extract. This has led to an increased demand for drilling services from oilfield service companies, including directional drilling, hydraulic fracturing, and other advanced drilling methods. The growth in shale gas extraction has created new opportunities for drilling service providers. Shale gas reserves require hydraulic fracturing and completion services to enhance production.

- The demand for services has grown in tandem with the shale gas extraction trend, creating new business opportunities for oilfield service companies to specialize in these areas. This type of extraction requires significant amounts of water for hydraulic fracturing operations, leading to challenges in water sourcing, transportation, and disposal. Oilfield service companies offering water management and treatment services have the opportunity to support operators in managing these challenges, which creates a specialized market segment within the oilfield service market.

- Shale gas extraction often requires the development and expansion of infrastructure such as pipelines, storage facilities, and processing plants. Service providers offering engineering, procurement, construction, and project management services have the opportunity to support infrastructure development and expansion, which cater to the growing shale gas extraction trend. Oilfield service providers specializing in technologies such as data analytics, automation, and predictive maintenance have the opportunity to partner with operators and provide innovative solutions to meet the industry's evolving needs.

Opportunity

Increasing Discoveries in Oilfield Services

- The new oilfield discoveries require extensive exploration activities to assess their potential reserves and commercial viability. Oilfield service companies offering seismic data acquisition, interpretation, and analysis play a crucial role in identifying promising areas for exploration. As new discoveries are made, the demand for these services increases, creating opportunities for service providers. Once an oilfield is discovered, drilling and well services become essential for reservoir evaluation and hydrocarbon extraction. Oilfield service companies involved in engineering, procurement, construction, and project management services find lucrative opportunities in supporting the construction and development of such infrastructure.

- Service providers offering drilling equipment, rig operations, well construction, and completion services witness increased demand as new fields are developed. The growth in drilling and well services present significant opportunities for oilfield service companies. Understanding the characteristics of the newly discovered reservoirs is vital for optimizing production and maximizing recovery. Oilfield service providers specializing in reservoir evaluation, well testing, and formation evaluation techniques contribute to the accurate assessment of reservoir properties. The demand for such services spikes with new discoveries, providing opportunities for service providers.

- The development of new oilfields often requires enhanced production techniques to maximize output. Oilfield service companies offering production optimization services, including well stimulation, artificial lift systems, and other enhanced oil recovery methods, witness increased demand as operators seek to optimize production from newly discovered fields. This creates opportunities for service providers to apply their expertise. New oilfield discoveries often require the development of infrastructure and facilities, such as pipelines, storage tanks, and processing facilities.

Oilfield Services Market Segment Analysis:

Oilfield Services Market is segmented on the basis of Type, Service, Application, And Region.

By Service, Production Segment Is Expected to Dominate the Market During the Forecast Period

- The production sector is the increasingly focus on oil recovery and well testing in current oil and gas fields. This section provides a range of oilfield services such as artificial lift systems, floating production vessels, support vessels, well testing services, subsea equipment, Christmas trees, enhanced oil recovery, digital oilfield, and other production services. Because of a rise in offshore drilling for petroleum and natural gas exploration, extraction, storage, and processing, the drilling industry is projected to have the second-highest market share.

- These services generate continuous revenue streams for service providers. Production services are vital for optimizing the output of oil and gas wells. They focus on enhancing production rates, improving reservoir management, and implementing technologies to maximize recovery rates. Operators heavily rely on production services to maintain efficient and profitable operations.

- Production services often involve long-term contracts between service providers and oil and gas operators. These contracts ensure the availability of services throughout the lifecycle of oilfield operations, creating stable revenue streams for service providers. The production segment encompasses various services that address the diverse needs of oil and gas production. This includes well testing, stimulation techniques, artificial lift systems, and production optimization strategies. The wide range of services offered increases the dominance of the production segment.

By Application, Onshore Segment Held the Largest Share In 2023

- The onshore oilfield operations benefit from easier accessibility compared to offshore or remote locations. Onshore fields are typically located on land and have existing infrastructure such as pipelines, roads, and storage facilities. This accessibility simplifies logistics, reduces costs, and enhances the efficiency of oilfield operations. Onshore operations tend to be more cost-effective compared to offshore operations. The proximity to infrastructure and services reduces transportation costs, offshore maintenance requirements, and complex offshore installation expenses.

- This type of cost advantage makes onshore operations attractive to companies and drives the dominance of the onshore segment. Many regions around the world have substantial onshore oil and gas reserves. These reserves often have significant production potential, which attracts oil and gas operators to focus on onshore development. The high production output from these onshore fields strengthens the dominance of the onshore segment.

- Onshore operations typically face less stringent regulations and permitting requirements compared to offshore operations. This smoother regulatory process and reduced complexity allow for quicker project approvals, enabling faster development and production activities. This regulatory advantage reinforces the dominance of the onshore segment. The onshore segment benefits from technological advancements that have made it more efficient and cost-effective. Technologies such as horizontal drilling, hydraulic fracturing, and enhanced oil recovery techniques have revolutionized onshore operations, unlocked previously inaccessible reserves and enhanced production rates.

Oilfield Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, particularly the United States and Canada, is rich in oil and natural gas reserves. The U.S. has vast shale oil deposits, and the technological advancements in hydraulic fracturing (fracking) have unlocked significant production potential. Canada, with its substantial oil sands, also contributes to the region's resource wealth. The U.S. is a global leader in oilfield technology and innovation. The development and refinement of techniques like fracking and horizontal drilling have revolutionized the industry, making previously inaccessible reserves economically viable.

- The region benefits from robust investment in oil and gas infrastructure. This includes extensive networks of pipelines, refineries, and export terminals that support large-scale production and distribution. Investment in research and development further bolsters the sector's capabilities. The U.S., being one of the largest consumers of oil and gas globally, ensures a steady demand for exploration, drilling, and production services.

- In many parts of North America, particularly in the U.S., the regulatory environment has been conducive to the growth of the oil and gas industry. Policies that support energy independence and favourable tax regimes for oilfield services companies encourage investment and development. North America's ability to export oil and gas has grown substantially, particularly with the U.S. becoming a net exporter of oil and liquefied natural gas (LNG). This export capacity supports the global supply chain and reinforces the region's strategic importance in the oilfield service market.

Oilfield Services Market Active Players

- Schlumberger Limited (USA)

- Halliburton Company (USA)

- Baker Hughes Company (USA)

- Weatherford International plc (USA)

- National Oilwell Varco, Inc. (NOV) (USA)

- TechnipFMC plc (UK)

- Transocean Ltd. (Switzerland)

- Saipem S.p.A. (Italy)

- China Oilfield Services Limited (COSL) (China)

- Petrofac Limited (Jersey)

- Oceaneering International, Inc. (USA)

- Wood Group (John Wood Group plc) (UK)

- Superior Energy Services, Inc. (USA)

- Expro Group (UK)

- Valaris plc (USA)

- Ensco Rowan plc (UK)

- Helmerich & Payne, Inc. (USA)

- Nabors Industries Ltd. (Bermuda)

- Weatherford International plc (USA)

- Patterson-UTI Energy, Inc. (USA)

- Liberty Oilfield Services Inc. (USA)

- Basic Energy Services, Inc. (USA)

- Key Energy Services, Inc. (USA)

- Trican Well Service Ltd. (Canada)

- Calfrac Well Services Ltd. (Canada)

- NexTier Oilfield Solutions Inc. (USA)

- Archer Limited (Bermuda)

Key Industry Developments in the Oilfield Services Market:

- In April 2024,

|

Global Oilfield Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 147.07 Bn |

|

Forecast Period 2024-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 232.09 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Service |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oilfield Services Market by Type (2018-2032)

4.1 Oilfield Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Equipment Rental

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Field Operation

4.5 Analytics

4.6 Consulting Service

Chapter 5: Oilfield Services Market by Service (2018-2032)

5.1 Oilfield Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Workover and Completion Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Production

5.5 Drilling Services

5.6 Subsea Services

5.7 Seismic Services

5.8 Processing and Separation Services

Chapter 6: Oilfield Services Market by Application (2018-2032)

6.1 Oilfield Services Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Onshore

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offshore

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Oilfield Services Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SCHLUMBERGER LIMITED (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HALLIBURTON COMPANY (USA)

7.4 BAKER HUGHES COMPANY (USA)

7.5 WEATHERFORD INTERNATIONAL PLC (USA)

7.6 NATIONAL OILWELL VARCO INC. (NOV) (USA)

7.7 TECHNIPFMC PLC (UK)

7.8 TRANSOCEAN LTD. (SWITZERLAND)

7.9 SAIPEM S.P.A. (ITALY)

7.10 CHINA OILFIELD SERVICES LIMITED (COSL) (CHINA)

7.11 PETROFAC LIMITED (JERSEY)

7.12 OCEANEERING INTERNATIONAL INC. (USA)

7.13 WOOD GROUP (JOHN WOOD GROUP PLC) (UK)

7.14 SUPERIOR ENERGY SERVICES INC. (USA)

7.15 EXPRO GROUP (UK)

7.16 VALARIS PLC (USA)

7.17 ENSCO ROWAN PLC (UK)

7.18 HELMERICH & PAYNE INC. (USA)

7.19 NABORS INDUSTRIES LTD. (BERMUDA)

7.20 WEATHERFORD INTERNATIONAL PLC (USA)

7.21 PATTERSON-UTI ENERGY INC. (USA)

7.22 LIBERTY OILFIELD SERVICES INC. (USA)

7.23 BASIC ENERGY SERVICES INC. (USA)

7.24 KEY ENERGY SERVICES INC. (USA)

7.25 TRICAN WELL SERVICE LTD. (CANADA)

7.26 CALFRAC WELL SERVICES LTD. (CANADA)

7.27 NEXTIER OILFIELD SOLUTIONS INC. (USA)

7.28 ARCHER LIMITED (BERMUDA)

Chapter 8: Global Oilfield Services Market By Region

8.1 Overview

8.2. North America Oilfield Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Equipment Rental

8.2.4.2 Field Operation

8.2.4.3 Analytics

8.2.4.4 Consulting Service

8.2.5 Historic and Forecasted Market Size by Service

8.2.5.1 Workover and Completion Services

8.2.5.2 Production

8.2.5.3 Drilling Services

8.2.5.4 Subsea Services

8.2.5.5 Seismic Services

8.2.5.6 Processing and Separation Services

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Onshore

8.2.6.2 Offshore

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Oilfield Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Equipment Rental

8.3.4.2 Field Operation

8.3.4.3 Analytics

8.3.4.4 Consulting Service

8.3.5 Historic and Forecasted Market Size by Service

8.3.5.1 Workover and Completion Services

8.3.5.2 Production

8.3.5.3 Drilling Services

8.3.5.4 Subsea Services

8.3.5.5 Seismic Services

8.3.5.6 Processing and Separation Services

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Onshore

8.3.6.2 Offshore

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Oilfield Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Equipment Rental

8.4.4.2 Field Operation

8.4.4.3 Analytics

8.4.4.4 Consulting Service

8.4.5 Historic and Forecasted Market Size by Service

8.4.5.1 Workover and Completion Services

8.4.5.2 Production

8.4.5.3 Drilling Services

8.4.5.4 Subsea Services

8.4.5.5 Seismic Services

8.4.5.6 Processing and Separation Services

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Onshore

8.4.6.2 Offshore

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Oilfield Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Equipment Rental

8.5.4.2 Field Operation

8.5.4.3 Analytics

8.5.4.4 Consulting Service

8.5.5 Historic and Forecasted Market Size by Service

8.5.5.1 Workover and Completion Services

8.5.5.2 Production

8.5.5.3 Drilling Services

8.5.5.4 Subsea Services

8.5.5.5 Seismic Services

8.5.5.6 Processing and Separation Services

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Onshore

8.5.6.2 Offshore

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Oilfield Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Equipment Rental

8.6.4.2 Field Operation

8.6.4.3 Analytics

8.6.4.4 Consulting Service

8.6.5 Historic and Forecasted Market Size by Service

8.6.5.1 Workover and Completion Services

8.6.5.2 Production

8.6.5.3 Drilling Services

8.6.5.4 Subsea Services

8.6.5.5 Seismic Services

8.6.5.6 Processing and Separation Services

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Onshore

8.6.6.2 Offshore

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Oilfield Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Equipment Rental

8.7.4.2 Field Operation

8.7.4.3 Analytics

8.7.4.4 Consulting Service

8.7.5 Historic and Forecasted Market Size by Service

8.7.5.1 Workover and Completion Services

8.7.5.2 Production

8.7.5.3 Drilling Services

8.7.5.4 Subsea Services

8.7.5.5 Seismic Services

8.7.5.6 Processing and Separation Services

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Onshore

8.7.6.2 Offshore

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Oilfield Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 147.07 Bn |

|

Forecast Period 2024-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 232.09 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Service |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||