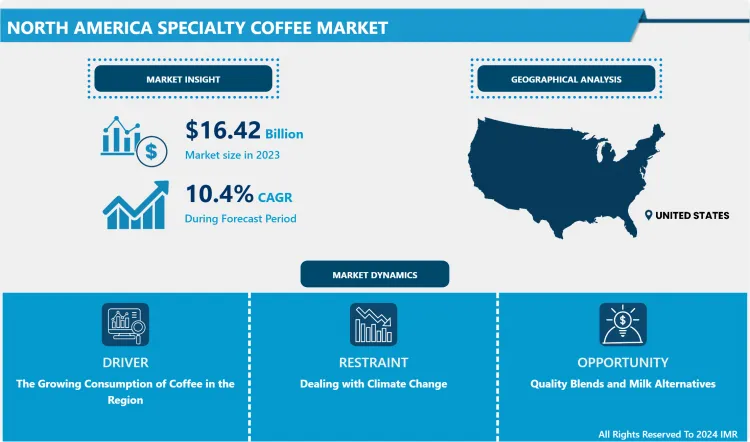

North America Specialty Coffee Market Overview

North America Specialty Coffee Market Size Was Valued at USD 16.42 Billion in 2023 and is Projected to Reach USD 40 Billion by 2032, Growing at a CAGR of 10.4 % From 2024-2032.

- The North America specialty coffee market is experiencing significant growth, driven by evolving consumer preferences and health-conscious trends. As households increasingly opt for homemade coffee, the demand for specialty coffee products is rising. The surge in health and wellness awareness has prompted many consumers to seek premium coffee offerings that emphasize quality, flavor, and traceability. High-end global coffee chains like Starbucks and The Coffee Bean & Tea Leaf have further fueled this demand by popularizing the culture of artisanal and specialty coffee beverages. These factors, coupled with innovations in brewing systems, are redefining the coffee market landscape across North America.

- One of the primary drivers of this market is the growing preference for certified and sustainably sourced coffee products. Single-serve coffee systems, such as pods and capsules, have become a hallmark of convenience and premium experiences for consumers. These systems are particularly popular in away-from-home settings, where advancements like tabletop machines and bean-to-cup solutions enhance the specialty coffee experience. Major players in the industry are leveraging these trends by embracing technological innovations and strengthening direct-to-consumer channels, enabling them to cater to a broader audience online.

- In parallel, instant coffee retains its steady foothold in the North American market, driven by hectic lifestyles and the need for quick, flavorful options. The availability of diverse and premium flavors, ranging from French vanilla to organic instant coffee, appeals to a wide consumer base. This dual growth in specialty and instant coffee markets underscores North America’s dynamic coffee landscape, where quality, convenience, and consumer-centric innovation remain at the forefront. As the market evolves, it is poised for continued expansion, aligning with the increasing demand for unique and high-quality coffee experiences.

Market Dynamics And Factors For North America Specialty Coffee Market

Drivers:

The Growing Consumption of Coffee in the Region

- The growing demand for the growing popularity and easy availability of coffee is helping to drive the growth of the market. North America is currently experiencing significant growth in the specialty coffee market due to socioeconomic conditions. People's busy and stressful lifestyles have fueled the demand for instant coffee in the region. In addition, the availability of a wide range of new flavors, such as cappuccino, mocha, French vanilla, Italian roasted coffee, organic instant coffee, and green bean instant coffee, will continue to drive demand. demand in the coming years. According to data from the Spring 2022 National Coffee Data Trends (NCDT) report by the National Coffee Association (NCA), more Americans consume coffee than any other beverage, including water. machine. Americans also report a growing interest in specialty coffee drinks, with 43% saying they choose a special coffee drink in the past day, a 20% increase since January 2021 and the highest level since the NCA started monitoring. As a result, the growing use of coffee will continue to drive the specialty coffee market over the forecast period.

Restraints:

Dealing with Climate Change

- Climate change affects the harvest season of specialty and single-origin cultivars. As a result, roasters and cafe owners are forced to tailor their seasonal offerings accordingly. Customers of these varieties will also have to adapt. These changes also make the prices of specific varieties more volatile and unpredictable. At the same time, climate change is also changing the quality of coffee. Intermittent rain and heavy rainfall during harvesting and drying can be detrimental to coffee and lead to fungal contamination of coffee beans during storage. Regarding the drying process, intermittent rains can cause reheating, which leads to the decomposition of soluble compounds in the seeds. These compounds influence the flavor and aromatic qualities sought by drinkers. Often, slightly browned green coffees fall victim to re-cooking and lack certain characteristics that roasters have paid for and are loved by customers. Now, these cultural influences are likely to hold back the growth of the specialty coffee market in North America during the forecast period.

Opportunity:

Quality Blends and Milk Alternatives

- Coffee expert opinion has long believed that the finest, highest quality coffee comes from single-origin beans. It's been the same at specialty stores and top coffee shops for years. Recently, mixtures of grains from different origins have begun to dominate. Mixing different types of coffee used to be a way to improve taste and cut costs. However, some of the best baristas in the world use their blends so effectively that they have gained more recognition and appreciation. As the future of coffee production is uncertain, blends seem to be a trend that will last. In addition, another not-so-new trend is the use of non-dairy milk in coffee. The use of plant-based milk goes hand in hand with a health trend that has been prevalent for many years. Most coffee shops and cafes already offer milk alternatives such as oat and soy. It doesn't look like this trend will slow down. Milk coffee alternatives are becoming increasingly innovative, with companies making plant-based flavored creamers that make it easier to mix with coffee. In addition, potato milk is also gaining momentum as a new alternative to cow's milk.

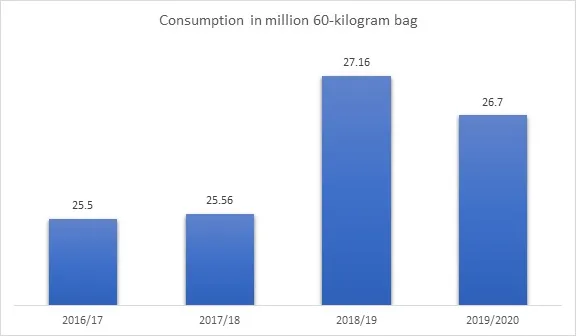

Domestic Consumption of Coffee in the United States from 2016/17 to 2019/2020 (in million 60-kilogram bags)

Segmentation Analysis Of the North America Specialty Coffee Market

- By Grade, the 90-100 grade segment is expected to dominate the segment owing to the chrematistics associated with these grade points. Furthermore, a coffee grade helps buyers & sellers globally align their anticipations with each other. This factor also helps to drive the segment's growth.

- By Product Type, instant coffee segments are expected to have the maximum market share from this segment over the forecast period. Several major consumer coffee brands have begun offering instant coffee to enter this lucrative market. After announcing their partnership in 2018, Starbucks and Nestlé launched a line of "premium" instant coffees in February 2020. Growing demand for instant coffee could also benefit. useful for manufacturers. As the pandemic forces many cafes to temporarily close and cancel orders from roasters, many roasters find themselves stuck with their green coffee stocks from the first quarter of 2020. Source This abundance of goods means that they cannot buy new imports from the producing countries. Therefore, many gardeners have been forced to price specialty lots.

- By Application, the commercial segment is expected to dominate the market over the forecast period. The commercial segment led the market due to the rising intake of coffee and the increasing count of workplaces globally employing commercial capsule machines. Further, by 2028, the home application segment will likely dominate the market due to the increasing number of double-income households.

- By Distribution Channel, the retail distribution channel is expected to hold the maximum market share over the forecast period. Retail is selling products directly to consumers. Additionally, when roasters are involved in the end-to-end sales process, they can better understand consumers and their preferences. For example, instant feedback allows roasters to learn and adapt quickly to market needs. During the Covid-19 pandemic, retail commerce has grown significantly, especially in the form of e-commerce. Total e-commerce sales in the US alone are expected to reach $4.9 trillion by 2023, while coffee subscription sales have grown about 109% over the past year.

Regional Analysis of North America Specialty Coffee Market

- The United States is the largest market for specialty coffee in North America. The market expansion in this region will be faster than in Europe and Latin America. A significant portion of consumers in the United States, especially millennials, are looking for personalization. So, customers can customize coffee or other drinks at specialty cafes according to their preferences. During the forecast period, this will contribute to the expansion of the specialty coffee market in the United States. For example, more than half of adults in the United States consume coffee daily. That's nearly 150 million people every day. Every day, 30 million adults in the United States consume specialty coffee drinks like mocha, espresso, latte, cappuccino, mocha coffee, coffee drinks, and more. The United States imports more than $4 billion worth of coffee each year. The United States consumes 400 million cups of coffee a day, making it the largest coffee consumer in the world.

- Coffee is one of the most popular beverages in Canada and around the world. Prized for its rich flavor and aroma, specialty coffee can also act as a mild stimulant due to its caffeine content. While coffee is usually served hot, there are now a wide variety of coffees and specialties, including iced and ready-to-drink coffees. Additionally, under Canada's Guiding Rules, unsweetened coffee is listed as a healthy beverage option. Increasing the adoption of balanced and healthy consumption patterns is helping to accelerate the related growth in this market. Moreover, this drink is also widely served at events and social occasions. Now it acts as a medium of industrial networking. People have also invested in options like ready-to-drink coffee.

Top Key Players Covered In North America Specialty Coffee Market

- Caribou Coffee Company

- Blue Bottle

- Starbucks Corporation

- Bulletproof

- Costa Coffee

- Dunkin' Donuts LLC

- Eight O’Clock Coffee

- Don Francisco’s Coffee

- Caffè Nero Group Ltd.

- JAB Holding Company

- Luigi Lavazza S.p.A.

- Strauss Group Ltd. and other major players.

Key Industry Development In The North America Specialty Coffee Market

- In May 2024, Costa Coffee, one of the world’s largest coffee chains, announces the nationwide expansion of its popular iced coffee latte range in the U.S. Known for its rich, smooth flavors, the new offerings promise to delight coffee lovers seeking refreshing options. To celebrate, Costa Coffee is partnering with fitness enthusiasts by hosting a bespoke yoga experience, combining wellness with the perfect coffee moment.

|

North America Specialty Coffee Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.42 Mn. |

|

Forecast Period 2024-32 CAGR: |

10.4 % |

Market Size in 2032: |

USD 40 Mn. |

|

Segments Covered: |

By Grade |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Grade

3.2 By Product Type

3.3 By Application

3.4 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: North America Specialty Coffee Market by Grade

5.1 North America Specialty Coffee Market Overview Snapshot and Growth Engine

5.2 North America Specialty Coffee Market Overview

5.3 80-84.99

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 80-84.99: Geographic Segmentation

5.4 85-89.99

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 85-89.99: Geographic Segmentation

5.5 90-100

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 90-100: Geographic Segmentation

Chapter 6: North America Specialty Coffee Market by Product Type

6.1 North America Specialty Coffee Market Overview Snapshot and Growth Engine

6.2 North America Specialty Coffee Market Overview

6.3 Instant Coffee

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Instant Coffee: Geographic Segmentation

6.4 Ground Coffee

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Ground Coffee: Geographic Segmentation

6.5 Whole Beans

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Whole Beans: Geographic Segmentation

6.6 Single-Cup

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Single-Cup: Geographic Segmentation

6.7 Blends

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Blends: Geographic Segmentation

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation

Chapter 7: North America Specialty Coffee Market by Application

7.1 North America Specialty Coffee Market Overview Snapshot and Growth Engine

7.2 North America Specialty Coffee Market Overview

7.3 Home

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Home: Geographic Segmentation

7.4 Commercial

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial: Geographic Segmentation

Chapter 8: North America Specialty Coffee Market by Distribution Channel

8.1 North America Specialty Coffee Market Overview Snapshot and Growth Engine

8.2 North America Specialty Coffee Market Overview

8.3 Food Service

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Food Service: Geographic Segmentation

8.4 Specialty Stores

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Specialty Stores: Geographic Segmentation

8.5 Supermarkets & Hypermarkets

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Supermarkets & Hypermarkets: Geographic Segmentation

8.6 Retail

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Retail: Geographic Segmentation

8.7 Online Stores

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Online Stores: Geographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 North America Specialty Coffee Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 North America Specialty Coffee Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 North America Specialty Coffee Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 CARIBOU COFFEE COMPANY

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 BLUE BOTTLE

9.4 STARBUCKS CORPORATION

9.5 BULLETPROOF

9.6 COSTA COFFEE

9.7 DUNKIN' DONUTS LLC

9.8 EIGHT O’CLOCK COFFEE

9.9 DON FRANCISCO’S COFFEE

9.10 CAFFÈ NERO GROUP LTD

9.11 JAB HOLDING COMPANY

9.12 LUIGI LAVAZZA S.P.A.

9.13 STRAUSS GROUP LTD

9.14 OTHER MAJOR PLAYERS

Chapter 10:North America Specialty Coffee Market Analysis, Insights and Forecast, 2017-2032

10.1 Market Overview

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Grade

10.4.1 80-84.99

10.4.2 85-89.99

10.4.3 90-100

10.5 Historic and Forecasted Market Size By Product Type

10.5.1 Instant Coffee

10.5.2 Ground Coffee

10.5.3 Whole Beans

10.5.4 Single-Cup

10.5.5 Blends

10.5.6 Others

10.6 Historic and Forecasted Market Size By Application

10.6.1 Home

10.6.2 Commercial

10.7 Historic and Forecasted Market Size By Distribution Channel

10.7.1 Food Service

10.7.2 Specialty Stores

10.7.3 Supermarkets & Hypermarkets

10.7.4 Retail

10.7.5 Online Stores

10.8 Historic and Forecast Market Size by Country

10.8.1 U.S.

10.8.2 Canada

10.8.3 Mexico

Chapter 11 Investment Analysis

Chapter 12 Analyst Viewpoint and Conclusion

|

North America Specialty Coffee Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.42 Mn. |

|

Forecast Period 2024-32 CAGR: |

10.4 % |

Market Size in 2032: |

USD 40 Mn. |

|

Segments Covered: |

By Grade |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the North America Specialty Coffee Market research report is 2024-2032.

Caribou Coffee Company, Blue Bottle, Starbucks Corporation, Bulletproof, Costa Coffee, Dunkin' Donuts LLC, Eight O’Clock Coffee, Don Francisco’s Coffee, Caffè Nero Group Ltd., JAB Holding Company, Luigi Lavazza S.p.A., Strauss Group Ltd. and other major players.

The North America Specialty Coffee Market is segmented into Grade, Product Type, Application, Distribution Channel and region. By Grade, the market is categorized into 80-84.99, 85-89.99, 90-100. By Product Type, the market is categorized into Instant Coffee, Ground Coffee, Whole Beans, Single-Cup, Blends, Others. By Application, the market is categorized into Home, Commercial. By Distribution Channel, the market is categorized into Food Service, Specialty Stores, Supermarkets & Hypermarkets, Retail, Online Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico).

The term specialty coffee is used to refer to coffee that is rated 80 points or more on a 100-point scale by either a Certified Coffee Tester (SCAA) or a Certified Q Grader (CQI). Specialty coffee is coffee at its peak and is different from other coffees because specialty coffees are grown at the perfect height, at the right time of year, in the best soil, and then picked at the right time.

North America Specialty Coffee Market Size Was Valued at USD 16.42 Billion in 2023 and is Projected to Reach USD 40 Billion by 2032, Growing at a CAGR of 10.4 % From 2024-2032.