Neurological Biomarkers Market Synopsis

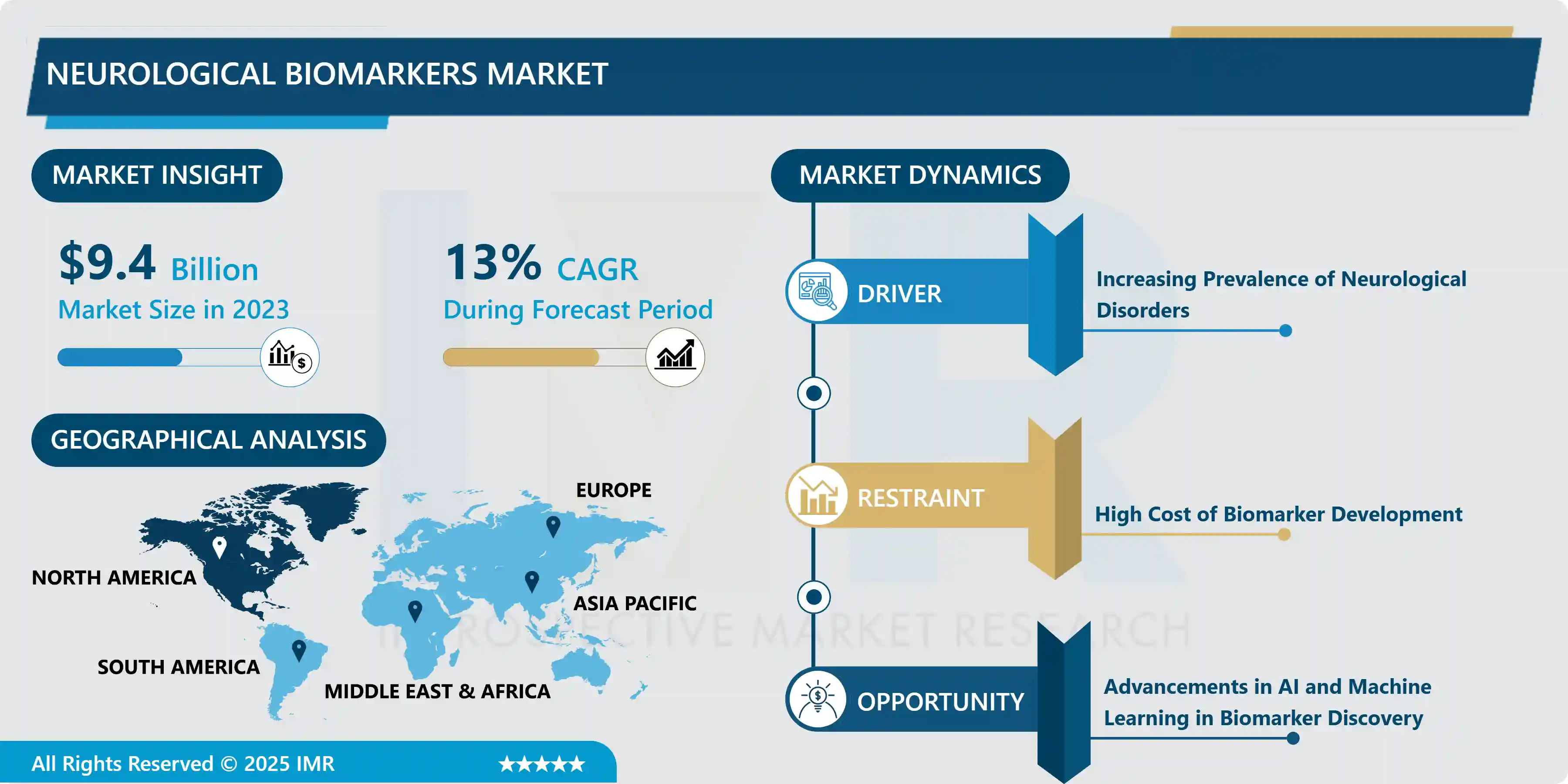

Neurological Biomarkers Market Size Was Valued at USD 9.40 Billion in 2023, and is Projected to Reach USD 28.97 Billion by 2032, Growing at a CAGR of 13% From 2024-2032.

Neurological biomarkers are bio-active markers that may be detected in the brain, blood or cereal fluid to establish diagnosis of neurological disorders including Alzhiemers disease, Parkinson’s disease, Multiple sclerosis among other injuries. These biomarkers help in delineation of the disease process, diagnosis, prognostic assessment, and therapeutic outcome prediction.

Considering the effectiveness of biomarkers, the Neurological Biomarkers Market is experiencing a proportional growth trend, backed by the growing incidence of neurological disorders, the demand for personalized medicine and improvements in biomarker technologies. As the worlds population ages, diseases such as Alzheimer’s diseases, Parkinson’s diseases, multiple Sclerosis and other diseases that affect the brains and nervous system are on the rise, making it very important to diagnose the diseases early enough to have proper treatment strategies for those that affect the brains and nervous systems. Neuronal biomarkers are vital in early detection of these diseases which in turn improve prognosis. Also, governments and research institutions are spending a lot of money in conducting biomarker research and developing diagnostic as well as therapeutic modalities. This market is also steadily developing thanks to the rising demand for minimally invasive diagnostic methods, including imaging biomarkers, which give doctors a better vision of surgeries without the need for operations on the affected area of the body, in this case, the brain.

Neurological biomarkers are now being integrated into most phases of the clinical trial process to speed up drug development and guarantee that therapies provided to individuals with neurological conditions are more precise. Biomarkers are being used to sub categorize patients according to disease susceptibility and prognosis, in order to allow for customized treatment. Of the identified biomarkers, proteomic and genomic biomarkers have recently attracted increased interest from scientists because of the possibility to unravel the molecular-genetic basis of disease. As a consequence, there grows a demand in the determination of biomarkers for response to a particular treatment, which may call for a more elaborate treatment plan.

However, the market has its set of barriers such as; high costs associated with biomarker discovery, research and development, condensed regulatory approval processes, and sometimes low access to well-developed healthcare systems in certain territories. But digital innovations for biomarker identification which comprise artificial intelligence and machine learning are anticipated to foster the market ahead. Another strategy that has also been noted is the establishment of relationship between corporate entities and academic institutions and research institutions with the view of enhancing innovation in biomarker offers.

Neurological Biomarkers Market Trend Analysis

Growth in Genomic and Proteomic Biomarkers

- Biomarkers discovered through genomics and proteomics are two critical trends that have define the neurological biomarkers market. They give tremendous background about Gene and protein changes involved in neurological disorders, which makes them important in personalized medicine.

- Genomic biomarkers also make it possible to define targeted genetic alterations that may increase the risk of developing neurological diseases. This trend is especially realized with disease s that critically have genetic influences such as the Alzheimer’s and Parkinson’s diseases. While, the proteomic biomarkers give data on the proteins involved in the disease process of the body. This is very important in determination of the disease process and development of disease specific treatments. The use of these biomarkers in these condition diagnoses is expected to transform diagnostics and the approaches taken to therapy, improving the specificity and efficacy of medical management.

Advancements in AI and Machine Learning in Biomarker Discovery

- The combination of product wise artificial intelligence (AI) and machine learning (ML) technologies is a significant chance in the neurological biomarkers market. Such technologies are making a shift in the discovery, analysis and utilization of biomarkers in clinic.

- Integrating AI and ML models can help evaluate big amounts of data in comparison with traditional methods, which will speed up the process of finding new biomarkers. This is especially the case when the specific disease involves several neurological biomarkers and these interact in one way or another. In corresponding manner, self-learning algorithms of AI platforms are also improving the biomarker risk probability models to make treatment being adjusted according to the probability rate of the particular subject. So, it makes sense that both healthcare organizations and pharmaceutical companies are turning to AI in order to enhance diagnostic capabilities and subsequent patient prognoses. The implementation of both AI &ML in biomarker discovery also cuts down down the time spent on research itself and the costs incurred are relatively low making it a favorable business proposition for both the researchers and companies in this particular field.

Neurological Biomarkers Market Segment Analysis:

Neurological Biomarkers Market Segmented based on Type, Application, and End User.

By Type, Metabolomic segment is expected to dominate the market during the forecast period

-

Based on the type, the neurological biomarkers market includes genomic, proteomic, metabolomic, imaging, and other types of neurological biomarkers. Focus toward genomic and proteomic biomarkers is gradually shifting from simply identifying potential targets to offering molecular details on the disease process essential for tailoring therapies. Genomic biomarkers, especially, enable the identification of traditional predisposing genetic bases to neurological diseases that are suggestive of early interventions.

- Imaging biomarkers, on the other hand, has applied broadly for the diagnosis without the need for biopsy, which gives comprehensive information about structural and function changes in brain. Imaging procedures like the MRI and PET scans help the clinicians to early detect changes in brain activity helping them to diagnose diseases like Alzheimer’s and multiple sclerosis at an early stage. Hence, imaging biomarkers should be expected to account for a large market share due to the increased focus on minimally invasive diagnostic techniques.

By Application , Alzheimer's Disease segment held the largest share in 2023

- By application, neurological biomarkers are categorized by Alzheimer’s disease, Parkinson’s disease, multiple sclerosis, autism spectrum disorder, and others. Alzheimer’s disease has the highest market share in this segment because of the rising incidence of the disease, and the critical necessity of early diagnosis and treatment. These are proteins that are commonly used in diagnosis of Alzheimer’s when they’re produced early and also to track the advancement of the illness.

- The biomarkers for Parkinson are also being considered These mainly consist of a biomolecular protein known as alpha synuclein . These biomarkers serve to define validation care populations at risk and to devise intervention strategies that may suggest points of disease progression slowdown. Likewise, multiple sclerosis biomarkers for example, the neurofilament light chain is employed in monitoring disease activity and treatment outcomes. In summary, biomarkers are clearly assuming a position of growing relevance in an ever-increasing range of neurological disorders, promoting diagnosis, and otherwise improving patient management.

Neurological Biomarkers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has the largest market for neurological biomarkers due to high incidence of neurological disorders, well established healthcare system, and healthy spending on research. The region also enjoys a developed healthcare sector and presence of leading drug makers that have made biomarkers central to their research.

- The United States dominates this market owing to a rich body of clinical literature and the subsequent governmental support for biomarkers in neurological disorders. Besides, regulatory requirements are well developed in this country, as the result, population gained early access to the advanced biomarker technologies. Of all the regions, North America currently occupies the largest market share due to the growing understanding of neurological diseases as well as the need for early detection.

Active Key Players in the Neurological Biomarkers Market

- Thermo Fisher Scientific (USA)

- Merck KGaA (Germany)

- Bio-Rad Laboratories (USA)

- F. Hoffmann-La Roche (Switzerland)

- Qiagen (Germany)

- Siemens Healthineers (Germany)

- Abbott Laboratories (USA)

- Myriad Genetics (USA)

- Banyan Biomarkers (USA)

- Olink Proteomics (Sweden)

- Cisbio Bioassays (France)

- Quanterix Corporation (USA)

- PerkinElmer (USA)

- Becton, Dickinson and Company (USA)

- Genewiz (China)

- Others Key Player

Key Industry Developments in the Neurological Biomarkers Market

- In October 2023, C2N Diagnostics unveiled a cutting-edge fluid biomarker for Alzheimer's Disease, aiming to assist researchers in monitoring neurofibrillary "Tau" tangle pathology. This innovative test represents a major stride forward, providing valuable tools to understand and track the progression of Alzheimer's disease by focusing on Tau protein abnormalities

- In July 2023, Quanterix Corporation announced the launch of LucentAD, a biomarker blood test to assist in the diagnosis of Alzheimer’s disease in individuals.

|

Global Neurological Biomarkers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 9.40 Bn. |

|

Forecast Period 2024-32 CAGR: |

13% |

Market Size in 2032: |

USD 28.97 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Neurological Biomarkers Market by Type (2018-2032)

4.1 Neurological Biomarkers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Genomic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Proteomic

4.5 Metabolomic

4.6 Imaging

4.7 Others

Chapter 5: Neurological Biomarkers Market by Application (2018-2032)

5.1 Neurological Biomarkers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Alzheimer's Disease

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Parkinson's Disease

5.5 Multiple Sclerosis

5.6 Autism Spectrum Disorder

5.7 Others

Chapter 6: Neurological Biomarkers Market by End User (2018-2032)

6.1 Neurological Biomarkers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospital & Hospital Laboratories

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Independent clinical diagnostic centers

6.5 Research Organizations and Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Neurological Biomarkers Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 THERMO FISHER SCIENTIFIC (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MERCK KGAA (GERMANY)

7.4 BIO-RAD LABORATORIES (USA)

7.5 F. HOFFMANN-LA ROCHE (SWITZERLAND)

7.6 QIAGEN (GERMANY)

7.7 SIEMENS HEALTHINEERS (GERMANY)

7.8 ABBOTT LABORATORIES (USA)

7.9 MYRIAD GENETICS (USA)

7.10 BANYAN BIOMARKERS (USA)

7.11 OLINK PROTEOMICS (SWEDEN)

7.12 CISBIO BIOASSAYS (FRANCE)

7.13 QUANTERIX CORPORATION (USA)

7.14 PERKINELMER (USA)

7.15 BECTON

7.16 DICKINSON AND COMPANY (USA)

7.17 GENEWIZ (CHINA)

7.18 OTHERS KEY PLAYER

Chapter 8: Global Neurological Biomarkers Market By Region

8.1 Overview

8.2. North America Neurological Biomarkers Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Genomic

8.2.4.2 Proteomic

8.2.4.3 Metabolomic

8.2.4.4 Imaging

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Alzheimer's Disease

8.2.5.2 Parkinson's Disease

8.2.5.3 Multiple Sclerosis

8.2.5.4 Autism Spectrum Disorder

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospital & Hospital Laboratories

8.2.6.2 Independent clinical diagnostic centers

8.2.6.3 Research Organizations and Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Neurological Biomarkers Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Genomic

8.3.4.2 Proteomic

8.3.4.3 Metabolomic

8.3.4.4 Imaging

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Alzheimer's Disease

8.3.5.2 Parkinson's Disease

8.3.5.3 Multiple Sclerosis

8.3.5.4 Autism Spectrum Disorder

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospital & Hospital Laboratories

8.3.6.2 Independent clinical diagnostic centers

8.3.6.3 Research Organizations and Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Neurological Biomarkers Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Genomic

8.4.4.2 Proteomic

8.4.4.3 Metabolomic

8.4.4.4 Imaging

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Alzheimer's Disease

8.4.5.2 Parkinson's Disease

8.4.5.3 Multiple Sclerosis

8.4.5.4 Autism Spectrum Disorder

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospital & Hospital Laboratories

8.4.6.2 Independent clinical diagnostic centers

8.4.6.3 Research Organizations and Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Neurological Biomarkers Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Genomic

8.5.4.2 Proteomic

8.5.4.3 Metabolomic

8.5.4.4 Imaging

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Alzheimer's Disease

8.5.5.2 Parkinson's Disease

8.5.5.3 Multiple Sclerosis

8.5.5.4 Autism Spectrum Disorder

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospital & Hospital Laboratories

8.5.6.2 Independent clinical diagnostic centers

8.5.6.3 Research Organizations and Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Neurological Biomarkers Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Genomic

8.6.4.2 Proteomic

8.6.4.3 Metabolomic

8.6.4.4 Imaging

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Alzheimer's Disease

8.6.5.2 Parkinson's Disease

8.6.5.3 Multiple Sclerosis

8.6.5.4 Autism Spectrum Disorder

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospital & Hospital Laboratories

8.6.6.2 Independent clinical diagnostic centers

8.6.6.3 Research Organizations and Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Neurological Biomarkers Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Genomic

8.7.4.2 Proteomic

8.7.4.3 Metabolomic

8.7.4.4 Imaging

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Alzheimer's Disease

8.7.5.2 Parkinson's Disease

8.7.5.3 Multiple Sclerosis

8.7.5.4 Autism Spectrum Disorder

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospital & Hospital Laboratories

8.7.6.2 Independent clinical diagnostic centers

8.7.6.3 Research Organizations and Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Neurological Biomarkers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 9.40 Bn. |

|

Forecast Period 2024-32 CAGR: |

13% |

Market Size in 2032: |

USD 28.97 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||