Needles Market Synopsis

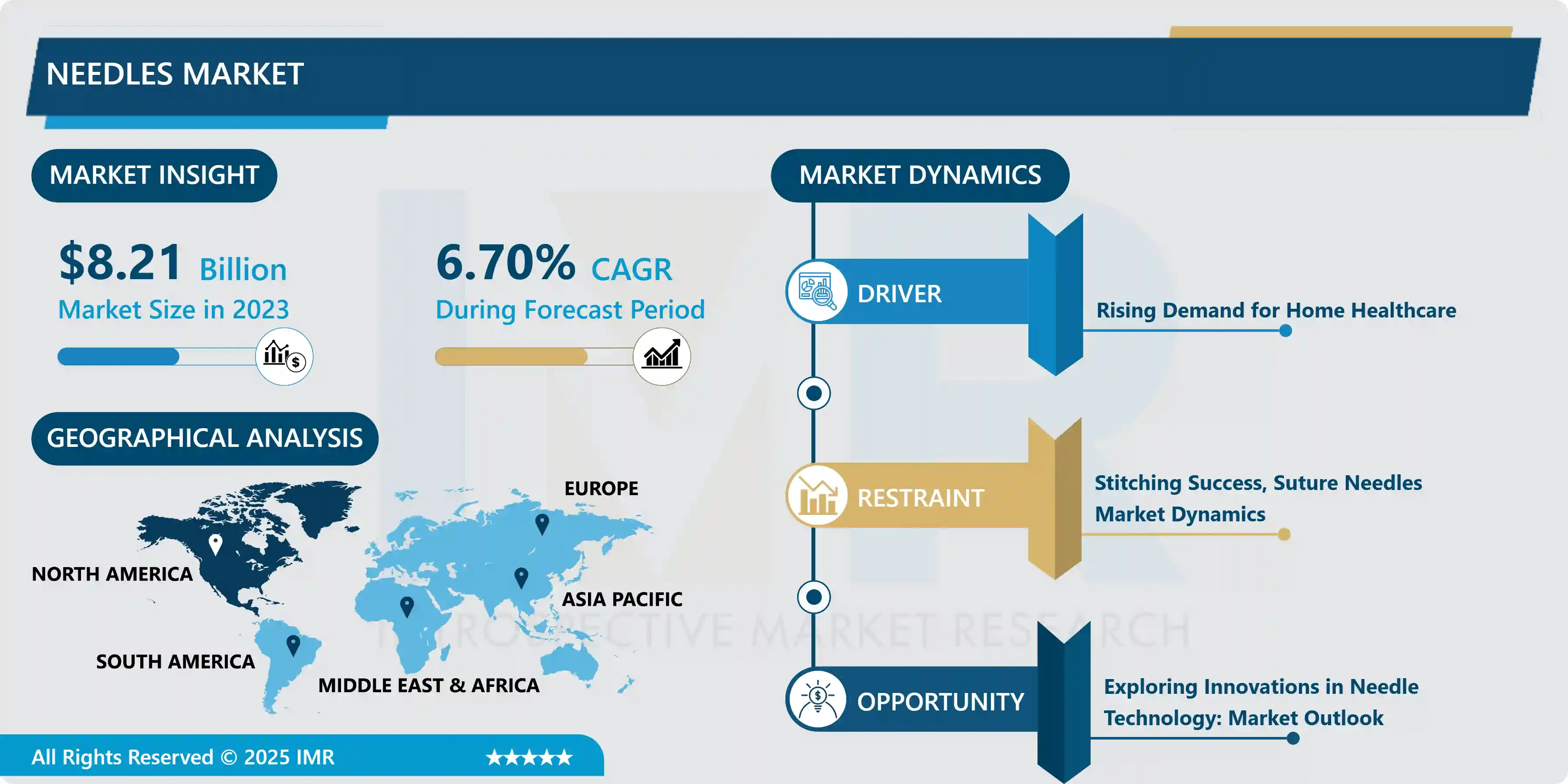

Needles Market Size is Valued at USD 8.21 Billion in 2023, and is Projected to Reach USD 14.72 Billion by 2032, Growing at a CAGR of 6.70% From 2024-2032.

The needles market needs to be understood as the global market that deals with the production and distribution of different types of needles which are used in medical practice as injectable devices, in diagnostic processes, during operations, and in acupuncture. It covers hypodermic needles, pen needles, suturing needles, biopsy needles, cannula needles, and others. The market is expected to have a broad customer base across the end-users, namely hospitals, clinics, diagnostic centers, ambulatory surgical centers, and home healthcare. It is affected by factors such as developments in technology, rising incidence of chronic diseases and customer preference shifting toward less invasive procedures.

The market for needles is majorly catalysed owing to the increasing incidence of chronic diseases like diabetes, cancer, and cardiovascular diseases that need frequent diagnostic tests and injection. Furthermore, the growth of the geriatric population, which is more sensitive to such chronic diseases, will contribute to the growth of needle usage. Other factors, which are also contributing to the growth of the market are new and improved needle types like the safety needles to reduce the instances of needle stick injuries to the health care providers. Furthermore, increasing usage of needles in different specialties of medicine due to the rising requirement of minimum invasive procedures is also driving the market growth. In addition, the increasing the number of healthcare facilities across the emerging nations and the overall rising healthcare outlay across the world are also driving the needles market. COVID-19 has speed up the need for needles especially for purposes such as vaccine and diagnostic tests. Still, regulatory policies that govern the production of needles for supplying drugs could pose a challenge to the market’s growth to some extent due to the availability of other drug delivery mechanisms such as oral and transdermal drug delivery systems.

Needles Market Trend Analysis

Innovations Driving Growth in the Needles Market

- There are vast changes occurring in the market that are moving towards the creation of new, improved, and technologically enhanced needles. This involves the use of safety needles to reduce accidents affecting health care personnel while administering treatments, and use of siliconized needles to reduce discomfort to patients when receiving injections. Also, the demand for microneedles in drug delivery system is increasing due to its non-invasive and efficient nature as compared to the conventional methods of needle.

- Another trend that can be outlined in the case of needles is the growing popularity of self-injection systems, especially in the context of diabetes management. The main factors contributing to the situation are the increase of diabetes incidence worldwide and the shift towards home care. For this reason, there is growing interest by manufacturers in the introduction of pen needles and other self-injection systems that are convenient for the patient, safer and easier to use.

Seizing Opportunities in the Evolving Landscape of the Needles Market

- Several opportunities exist to expand and diversify in the needles market. The first of these openings relates to the fact that there is a steadily rising incidence of chronic diseases and hence, the demand for drug delivery systems. People around the globe are aging and leading different lifestyles which have a pull on the use of needles especially in administering various medications for instance insulin for diabetes, various arthritic and cancer treatments among others. This is a trend which is increasing the demand for enhanced needle technologies which have to have better patient friendly features, ease of use and safety.

- Another opportunity in the needles market is in the area of home health care. In light of the increased adoption of home care treatments and remote health monitoring solutions, there is a demand for needles that can be used at home. It also embraces pen needles for insulin or any other injectable type, safety needles to help reduce instances of needle stick injuries. The companies that are able to come up with new ideas on how to deliver relatively complicated needles for use at home, with relative safety, will be the winners in the medium to long term.

Needles Market Segment Analysis:

Needles Market Segmented on the basis of by Product, By Type, By Material, and end-users.

By Type, Conventional Needles segment is expected to dominate the market during the forecast period

- Based on the products, the market of needles can be classified into two categories, namely the conventional needles and the safety needles. The general or standard needles are the common types of needles that doctors use in their practice whereas safety needles are developed to reduce the incidences of needlestick and improve the safety of the user. Examples of the safety needles are the retracting needles, shields, and other protection mechanisms that will guard the healthcare practitioners and patients. The increasing awareness of needlestick injuries and rising standards for needle safety are some of the factors that have led to the implementation of safety needles in healthcare facilities.

By Material, Glass Needles segment held the largest share in 2024

- Based on the products, the market of needles can be classified into two categories, namely the conventional needles and the safety needles. The general or standard needles are the common types of needles that doctors use in their practice whereas safety needles are developed to reduce the incidences of needlestick and improve the safety of the user. Examples of the safety needles are the retracting needles, shields, and other protection mechanisms that will guard the healthcare practitioners and patients. The increasing awareness of needlestick injuries and rising standards for needle safety are some of the factors that have led to the implementation of safety needles in healthcare facilities.

Needles Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is also considered more innovative and technological than other regions due to the presence of major market players and robust healthcare systems. The major product that is currently being marketed in the region is the hypodermic needle, which has numerous applications in drug delivery and blood sampling. The rising cases of chronic diseases as well as the need for more vaccination and other injectable drugs also contribute to the growth of the needles market in North America.

- Furthermore, the growth in the application of minimal invasive surgical procedures and the shift in focus towards home health care also contributes to the market. The United States dominates the North American needs market as the country is home to leading manufacturers and has a higher healthcare spend as compared to Canada or Mexicio. Canada is also growing at a fast rate due to the increasing elderly population and growth in health care facilities in the region. In sum, it is for these reasons that the North American needles market is anticipated to proceed on the growth path, prompted by such factors as technology and the rising need for health care.

Active Key Players in the Needles Market

- Medtronic (Ireland)

- Becton, Dickinson and Company (US)

- B. Braun Melsungen AG (Germany)

- Stryker Corporation (US)

- Ethicon, Inc. (Subsidiary of Johnson and Johnson) (US)

- Boston Scientific Corporation (US)

- Terumo Corporation (Japan)

- Olympus Corporation (US)

- Merit Medical (US)

- Greiner Holding AG (Austria)

- Merck KgA (Germany)

- Hamilton Company (US)

- Unimed SA

- Argon Medical Devices Inc. (US)

- Nipro Corporation (Japan)

- Smith’s Medical (US)

- Ultimed Inc. (US)

- Hakko Co.Ltd. (Japan)

- Creganna (Ireland)

- DTR Medical (UK)

- Rocket Medical (UK)

- Others

|

Needles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.70 % |

Market Size in 2032: |

USD 14.72 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Type |

|

||

|

By Material |

|

||

|

End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Needles Market by Product (2018-2032)

4.1 Needles Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Suture Needles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Blood Collection Needles

4.5 Ophthalmic Needles

4.6 Dental Needles

4.7 Insufflation Needles

4.8 Others

Chapter 5: Needles Market by Type (2018-2032)

5.1 Needles Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Conventional Needles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Safety Needles

Chapter 6: Needles Market by Material (2018-2032)

6.1 Needles Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Glass Needles

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Plastic Needles

6.5 Stainless Steel Needles

6.6 Polyetheretherketone (PEEK) Needles

6.7 End-User

6.8 Hospitals and Clinics

6.9 Diagnostic Centers

6.10 Home Healthcare

6.11 Other

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Needles Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BECTON

7.4 DICKINSON AND COMPANY (US)

7.5 B. BRAUN MELSUNGEN AG (GERMANY)

7.6 STRYKER CORPORATION (US)

7.7 ETHICON INC. (SUBSIDIARY OF JOHNSON AND JOHNSON) (US)

7.8 BOSTON SCIENTIFIC CORPORATION (US)

7.9 TERUMO CORPORATION (JAPAN)

7.10 OLYMPUS CORPORATION (US)

7.11 MERIT MEDICAL (US)

7.12 GREINER HOLDING AG (AUSTRIA)

7.13 MERCK KGA (GERMANY)

7.14 HAMILTON COMPANY (US)

7.15 UNIMED SA

7.16 ARGON MEDICAL DEVICES INC. (US)

7.17 NIPRO CORPORATION (JAPAN)

7.18 SMITH’S MEDICAL (US)

7.19 ULTIMED INC. (US)

7.20 HAKKO CO.LTD. (JAPAN)

7.21 CREGANNA (IRELAND)

7.22 DTR MEDICAL (UK)

7.23 ROCKET MEDICAL (UK)

7.24 OTHERS

Chapter 8: Global Needles Market By Region

8.1 Overview

8.2. North America Needles Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Suture Needles

8.2.4.2 Blood Collection Needles

8.2.4.3 Ophthalmic Needles

8.2.4.4 Dental Needles

8.2.4.5 Insufflation Needles

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size by Type

8.2.5.1 Conventional Needles

8.2.5.2 Safety Needles

8.2.6 Historic and Forecasted Market Size by Material

8.2.6.1 Glass Needles

8.2.6.2 Plastic Needles

8.2.6.3 Stainless Steel Needles

8.2.6.4 Polyetheretherketone (PEEK) Needles

8.2.6.5 End-User

8.2.6.6 Hospitals and Clinics

8.2.6.7 Diagnostic Centers

8.2.6.8 Home Healthcare

8.2.6.9 Other

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Needles Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Suture Needles

8.3.4.2 Blood Collection Needles

8.3.4.3 Ophthalmic Needles

8.3.4.4 Dental Needles

8.3.4.5 Insufflation Needles

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size by Type

8.3.5.1 Conventional Needles

8.3.5.2 Safety Needles

8.3.6 Historic and Forecasted Market Size by Material

8.3.6.1 Glass Needles

8.3.6.2 Plastic Needles

8.3.6.3 Stainless Steel Needles

8.3.6.4 Polyetheretherketone (PEEK) Needles

8.3.6.5 End-User

8.3.6.6 Hospitals and Clinics

8.3.6.7 Diagnostic Centers

8.3.6.8 Home Healthcare

8.3.6.9 Other

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Needles Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Suture Needles

8.4.4.2 Blood Collection Needles

8.4.4.3 Ophthalmic Needles

8.4.4.4 Dental Needles

8.4.4.5 Insufflation Needles

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size by Type

8.4.5.1 Conventional Needles

8.4.5.2 Safety Needles

8.4.6 Historic and Forecasted Market Size by Material

8.4.6.1 Glass Needles

8.4.6.2 Plastic Needles

8.4.6.3 Stainless Steel Needles

8.4.6.4 Polyetheretherketone (PEEK) Needles

8.4.6.5 End-User

8.4.6.6 Hospitals and Clinics

8.4.6.7 Diagnostic Centers

8.4.6.8 Home Healthcare

8.4.6.9 Other

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Needles Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Suture Needles

8.5.4.2 Blood Collection Needles

8.5.4.3 Ophthalmic Needles

8.5.4.4 Dental Needles

8.5.4.5 Insufflation Needles

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size by Type

8.5.5.1 Conventional Needles

8.5.5.2 Safety Needles

8.5.6 Historic and Forecasted Market Size by Material

8.5.6.1 Glass Needles

8.5.6.2 Plastic Needles

8.5.6.3 Stainless Steel Needles

8.5.6.4 Polyetheretherketone (PEEK) Needles

8.5.6.5 End-User

8.5.6.6 Hospitals and Clinics

8.5.6.7 Diagnostic Centers

8.5.6.8 Home Healthcare

8.5.6.9 Other

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Needles Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Suture Needles

8.6.4.2 Blood Collection Needles

8.6.4.3 Ophthalmic Needles

8.6.4.4 Dental Needles

8.6.4.5 Insufflation Needles

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size by Type

8.6.5.1 Conventional Needles

8.6.5.2 Safety Needles

8.6.6 Historic and Forecasted Market Size by Material

8.6.6.1 Glass Needles

8.6.6.2 Plastic Needles

8.6.6.3 Stainless Steel Needles

8.6.6.4 Polyetheretherketone (PEEK) Needles

8.6.6.5 End-User

8.6.6.6 Hospitals and Clinics

8.6.6.7 Diagnostic Centers

8.6.6.8 Home Healthcare

8.6.6.9 Other

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Needles Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Suture Needles

8.7.4.2 Blood Collection Needles

8.7.4.3 Ophthalmic Needles

8.7.4.4 Dental Needles

8.7.4.5 Insufflation Needles

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size by Type

8.7.5.1 Conventional Needles

8.7.5.2 Safety Needles

8.7.6 Historic and Forecasted Market Size by Material

8.7.6.1 Glass Needles

8.7.6.2 Plastic Needles

8.7.6.3 Stainless Steel Needles

8.7.6.4 Polyetheretherketone (PEEK) Needles

8.7.6.5 End-User

8.7.6.6 Hospitals and Clinics

8.7.6.7 Diagnostic Centers

8.7.6.8 Home Healthcare

8.7.6.9 Other

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Needles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.70 % |

Market Size in 2032: |

USD 14.72 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Type |

|

||

|

By Material |

|

||

|

End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||