Global Disposable Medical Sensors Market Synopsis

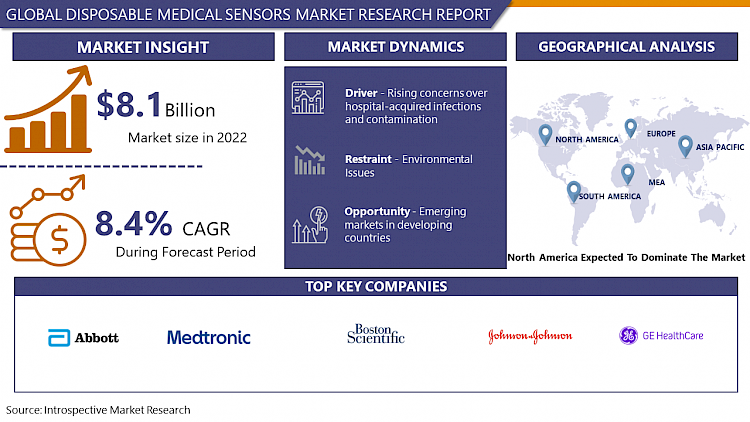

Global Disposable Medical Sensors Market Size Was Valued at USD 8.1Billion in 2022, and is Projected to Reach USD 15.44 Billion by 2030, Growing at a CAGR of 8.4%% From 2023-2030.

The technological advancement in nanotechnology, biotechnology, information technology, and semiconductor technology, has given rise to disposable medical sensors. Medical sensors are electronic devices that convert various forms of stimuli into electrical signals for analysis.

- Medical sensors can increase the intelligence of medical devices, such as life-supporting implants, and can enable bedside and remote monitoring of vital signs and other health factors of an individual. Medical sensors are manufactured by combining many different components and are generally comprised of a circuit, patient attachment layer, and electronic components. In addition, for a disposable medical sensor to function efficiently it must adhere directly to a patient's skin.

- Disposable medical sensors are widely administered to monitor the heart condition, and brain functioning. Control of the spread of infectious diseases from one patient to another is the main factor that promoted the development of disposable medical sensors. Furthermore, medical sensors are widely being used in remote patient monitoring programs. Disposable medical sensors continuously monitor the vital signs of the patient such as oxygen level, pulse rate, and temperature, thus, supporting the growth of the disposable medical sensors market during the forecast period.

Global Disposable Medical Sensors Market Trend Analysis

Rising Concerns Over Hospital-Acquired Infections And Contamination

- The escalating apprehension regarding hospital-acquired infections and contamination has emerged as a potent catalyst propelling the growth of the Disposable Medical Sensors Market. Hospitals, being critical healthcare settings, encounter a constant challenge in managing infections and ensuring patient safety.

- In response, the demand for disposable medical sensors has surged significantly. These sensors offer a one-time use solution, mitigating the risk of cross-contamination and infections associated with reusable medical devices. As healthcare facilities prioritize infection control measures, the adoption of disposable sensors becomes indispensable to safeguard patients and improve overall healthcare outcomes.

- The prevalence of healthcare-associated infections (HAIs) has become a pressing concern worldwide, compelling healthcare providers to emphasize stringent infection prevention protocols. Disposable medical sensors play a pivotal role in this endeavor by offering a hygienic alternative to traditional reusable sensors.

- Their single-use nature eliminates the need for reprocessing, reducing the chances of microbial transmission and contamination in healthcare settings. As hospitals strive to minimize the risk of infections, the Disposable Medical Sensors Market experiences a notable upsurge due to the indispensable role these sensors play in enhancing patient safety

Emerging Markets In Developing Countries

- The Disposable Medical Sensors Market holds promising opportunities within emerging markets of developing countries. These regions are witnessing a significant surge in healthcare infrastructure development, driven by escalating healthcare needs, rising chronic diseases, and an increasing focus on improving healthcare accessibility. Disposable medical sensors, owing to their cost-effectiveness, convenience, and hygiene, are gaining traction in these markets.

- These sensors cater to the demand for affordable yet advanced medical devices. Emerging markets often face budget constraints in healthcare, making cost-effective solutions crucial. Disposable sensors offer a viable option, enabling healthcare facilities to upgrade without substantial capital investment. Their single-use nature reduces the risk of infections, aligning with the emphasis on maintaining stringent hygiene standards, especially in resource-limited settings.

Global Disposable Medical Sensors Market Segment Analysis:

Global Disposable Medical Sensors Market Segmented on the basis of type, application, and end-users.

By Product Type Biosensor segment is expected to dominate the market during the forecast period

- Biosensors offer unparalleled advantages in terms of accuracy and specificity in detecting biomolecules, making them pivotal in diagnostics and continuous monitoring. With advancements in technology, biosensors have become more sensitive, reliable, and capable of detecting even minute changes in biological substances. This precision is instrumental in early disease detection and personalized medicine, driving their widespread adoption across diverse healthcare applications.

- Biosensors' versatility enables their integration into various medical devices for multiple purposes. They are utilized in glucose monitoring for diabetic patients, detecting specific proteins or DNA sequences for cancer diagnosis, monitoring cardiac biomarkers for heart conditions, and even in drug delivery systems. Their adaptability across a spectrum of medical needs positions them as indispensable tools in modern healthcare, augmenting their market dominance.

By Sensor Type, wearable segment held the largest share of 33.76% in 2022

- The wearable segment is expected to dominate the medical sensor disposable market over the forecast period. Research and development activities have promoted the usage of wearable medical sensors. These sensors provide real-time data and provide early detection of disease. Additionally, they can detect sudden changes in chronic conditions and alert the user way before a vital health risk. Moreover, monitoring certain health biometrics for a long period, provides essential information to medical professionals about the patient's condition thus, strengthening the expansion of this segment in the forecast period.

Global Disposable Medical Sensors Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America was one of the leading regions in this market, with the United States playing a dominant role within the continent. The US has a robust healthcare sector, advanced technology adoption, and significant investments in medical research and development, which contribute to its dominance in the disposable medical sensors market within North America. Additionally, the presence of key market players, along with supportive government initiatives and favorable reimbursement policies, has further strengthened the US market's position in this industry.

Global Disposable Medical Sensors Market Top Key Players:

- Abbott Laboratories (US)

- Medtronic (Ireland)

- Boston Scientific (US)

- Johnson & Johnson (US)

- GE Healthcare (US)

- Masimo (US)

- Nova Biomedical (US)

- ACON Laboratories (US)

- AliveCor (US)

- McAfee Corp. (US)

- Dexcom (US)

- Cardinal Health (US)

- iRhythm Technologies (US)

- Kenzen (US)

- Roche Diagnostics (Switzerland)

- Siemens Healthineers (Germany)

- Spital Radiometer A/S (Denmark)

- Drägerwerk AG & Co. KGaA (Germany)

- GEA Group (Germany)

- Philips Healthcare (Netherlands)

- Nihon Kohden (Japan)

- Terumo Corporation (Japan)

- Omron Healthcare (Kyoto, Japan)

- Mindray (China)

- Yuyue Medical Group (China)

Key Industry Developments in the Global Disposable Medical Sensors Market:

In April 2022, Variohm EuroSensor has developed a new NTC thermistor especially designed for medical equipment use and particularly aimed at sensing small temperature changes in the body and ambient medical area temperatures.

In February 2022, EnSilica has launched the ENS62020, an ultra-low-power healthcare sensor interface IC for monitoring vital signs in wearable healthcare and medical devices

|

Global Disposable Medical Sensors Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 8.1 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.4% |

Market Size in 2030: |

USD 15.44 Bn. |

|

Segments Covered: |

By product Type |

|

|

|

By Sensor Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DISPOSABLE MEDICAL SENSORS MARKET BY PRODUCT TYPE (2016-2030)

- DISPOSABLE MEDICAL SENSORS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BIOSENSORS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ACCELEROMETERS

- PRESSURE SENSORS

- TEMPERATURE SENSORS

- IMAGE SENSORS

- DISPOSABLE MEDICAL SENSORS MARKET BY SENSOR TYPE (2016-2030)

- DISPOSABLE MEDICAL SENSORS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STRIP

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WEARABLE

- INVASIVE

- INGESTIBLE

- DISPOSABLE MEDICAL SENSORS MARKET BY APPLICATION (2016-2030)

- DISPOSABLE MEDICAL SENSORS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIAGNOSTIC TESTING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PATIENT MONITORING

- THERAPEUTICS

- APPLICATIOND

- IMAGING

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- DISPOSABLE MEDICAL SENSORS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABBOTT LABORATORIES

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- Medtronic

- Boston Scientific

- Johnson & Johnson

- GE Healthcare

- Masimo

- Nova Biomedical

- ACON Laboratories

- AliveCor

- McAfee Corp.

- Dexcom

- Cardinal Health

- iRhythm Technologies

- Kenzen

- Roche Diagnostics

- Siemens Healthineers

- Spital Radiometer A/S

- Drägerwerk AG & Co. KGaA

- GEA Group

- Philips Healthcare

- COMPETITIVE LANDSCAPE

GLOBAL DISPOSABLE MEDICAL SENSORS MARKET BY REGION

-

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Sensor Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Disposable Medical Sensors Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 8.1 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.4% |

Market Size in 2030: |

USD 15.44 Bn. |

|

Segments Covered: |

By product Type |

|

|

|

By Sensor Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DISPOSABLE MEDICAL SENSORS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DISPOSABLE MEDICAL SENSORS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DISPOSABLE MEDICAL SENSORS MARKET COMPETITIVE RIVALRY

TABLE 005. DISPOSABLE MEDICAL SENSORS MARKET THREAT OF NEW ENTRANTS

TABLE 006. DISPOSABLE MEDICAL SENSORS MARKET THREAT OF SUBSTITUTES

TABLE 007. DISPOSABLE MEDICAL SENSORS MARKET BY PRODUCT TYPE

TABLE 008. BIOSENSORS MARKET OVERVIEW (2016-2028)

TABLE 009. ACCELEROMETERS MARKET OVERVIEW (2016-2028)

TABLE 010. PRESSURE SENSORS MARKET OVERVIEW (2016-2028)

TABLE 011. TEMPERATURE SENSORS MARKET OVERVIEW (2016-2028)

TABLE 012. IMAGE SENSORS MARKET OVERVIEW (2016-2028)

TABLE 013. OTHER SENSORS MARKET OVERVIEW (2016-2028)

TABLE 014. DISPOSABLE MEDICAL SENSORS MARKET BY SENSOR TYPE

TABLE 015. STRIP MARKET OVERVIEW (2016-2028)

TABLE 016. WEARABLE MARKET OVERVIEW (2016-2028)

TABLE 017. INVASIVE MARKET OVERVIEW (2016-2028)

TABLE 018. INGESTIBLE MARKET OVERVIEW (2016-2028)

TABLE 019. DISPOSABLE MEDICAL SENSORS MARKET BY APPLICATION

TABLE 020. DIAGNOSTIC TESTING MARKET OVERVIEW (2016-2028)

TABLE 021. PATIENT MONITORING MARKET OVERVIEW (2016-2028)

TABLE 022. THERAPEUTICS MARKET OVERVIEW (2016-2028)

TABLE 023. IMAGING MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA DISPOSABLE MEDICAL SENSORS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 025. NORTH AMERICA DISPOSABLE MEDICAL SENSORS MARKET, BY SENSOR TYPE (2016-2028)

TABLE 026. NORTH AMERICA DISPOSABLE MEDICAL SENSORS MARKET, BY APPLICATION (2016-2028)

TABLE 027. N DISPOSABLE MEDICAL SENSORS MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE DISPOSABLE MEDICAL SENSORS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. EUROPE DISPOSABLE MEDICAL SENSORS MARKET, BY SENSOR TYPE (2016-2028)

TABLE 030. EUROPE DISPOSABLE MEDICAL SENSORS MARKET, BY APPLICATION (2016-2028)

TABLE 031. DISPOSABLE MEDICAL SENSORS MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC DISPOSABLE MEDICAL SENSORS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 033. ASIA PACIFIC DISPOSABLE MEDICAL SENSORS MARKET, BY SENSOR TYPE (2016-2028)

TABLE 034. ASIA PACIFIC DISPOSABLE MEDICAL SENSORS MARKET, BY APPLICATION (2016-2028)

TABLE 035. DISPOSABLE MEDICAL SENSORS MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA DISPOSABLE MEDICAL SENSORS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA DISPOSABLE MEDICAL SENSORS MARKET, BY SENSOR TYPE (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA DISPOSABLE MEDICAL SENSORS MARKET, BY APPLICATION (2016-2028)

TABLE 039. DISPOSABLE MEDICAL SENSORS MARKET, BY COUNTRY (2016-2028)

TABLE 040. SOUTH AMERICA DISPOSABLE MEDICAL SENSORS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 041. SOUTH AMERICA DISPOSABLE MEDICAL SENSORS MARKET, BY SENSOR TYPE (2016-2028)

TABLE 042. SOUTH AMERICA DISPOSABLE MEDICAL SENSORS MARKET, BY APPLICATION (2016-2028)

TABLE 043. DISPOSABLE MEDICAL SENSORS MARKET, BY COUNTRY (2016-2028)

TABLE 044. NUOVA GMBH: SNAPSHOT

TABLE 045. NUOVA GMBH: BUSINESS PERFORMANCE

TABLE 046. NUOVA GMBH: PRODUCT PORTFOLIO

TABLE 047. NUOVA GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. AMBU A/S: SNAPSHOT

TABLE 048. AMBU A/S: BUSINESS PERFORMANCE

TABLE 049. AMBU A/S: PRODUCT PORTFOLIO

TABLE 050. AMBU A/S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ANALOG DEVICES: SNAPSHOT

TABLE 051. ANALOG DEVICES: BUSINESS PERFORMANCE

TABLE 052. ANALOG DEVICES: PRODUCT PORTFOLIO

TABLE 053. ANALOG DEVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. FIRST SENSOR: SNAPSHOT

TABLE 054. FIRST SENSOR: BUSINESS PERFORMANCE

TABLE 055. FIRST SENSOR: PRODUCT PORTFOLIO

TABLE 056. FIRST SENSOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. GE HEALTHCARE: SNAPSHOT

TABLE 057. GE HEALTHCARE: BUSINESS PERFORMANCE

TABLE 058. GE HEALTHCARE: PRODUCT PORTFOLIO

TABLE 059. GE HEALTHCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. HONEYWELL INTERNATIONAL INC.: SNAPSHOT

TABLE 060. HONEYWELL INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 061. HONEYWELL INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 062. HONEYWELL INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MEDTRONIC PLC: SNAPSHOT

TABLE 063. MEDTRONIC PLC: BUSINESS PERFORMANCE

TABLE 064. MEDTRONIC PLC: PRODUCT PORTFOLIO

TABLE 065. MEDTRONIC PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. NXP SEMICONDUCTORS N.V: SNAPSHOT

TABLE 066. NXP SEMICONDUCTORS N.V: BUSINESS PERFORMANCE

TABLE 067. NXP SEMICONDUCTORS N.V: PRODUCT PORTFOLIO

TABLE 068. NXP SEMICONDUCTORS N.V: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. OMNIVISION TECHNOLOGIES: SNAPSHOT

TABLE 069. OMNIVISION TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 070. OMNIVISION TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 071. OMNIVISION TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. PHILIPS HEALTHCARE: SNAPSHOT

TABLE 072. PHILIPS HEALTHCARE: BUSINESS PERFORMANCE

TABLE 073. PHILIPS HEALTHCARE: PRODUCT PORTFOLIO

TABLE 074. PHILIPS HEALTHCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SMITHS MEDICAL INC.: SNAPSHOT

TABLE 075. SMITHS MEDICAL INC.: BUSINESS PERFORMANCE

TABLE 076. SMITHS MEDICAL INC.: PRODUCT PORTFOLIO

TABLE 077. SMITHS MEDICAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. STMICROELECTRONICS: SNAPSHOT

TABLE 078. STMICROELECTRONICS: BUSINESS PERFORMANCE

TABLE 079. STMICROELECTRONICS: PRODUCT PORTFOLIO

TABLE 080. STMICROELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. TE CONNECTIVITY LTD.: SNAPSHOT

TABLE 081. TE CONNECTIVITY LTD.: BUSINESS PERFORMANCE

TABLE 082. TE CONNECTIVITY LTD.: PRODUCT PORTFOLIO

TABLE 083. TE CONNECTIVITY LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. SENSIRION AG: SNAPSHOT

TABLE 084. SENSIRION AG: BUSINESS PERFORMANCE

TABLE 085. SENSIRION AG: PRODUCT PORTFOLIO

TABLE 086. SENSIRION AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. ABBOTT: SNAPSHOT

TABLE 087. ABBOTT: BUSINESS PERFORMANCE

TABLE 088. ABBOTT: PRODUCT PORTFOLIO

TABLE 089. ABBOTT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. F. HOFFMANN-LA ROCHE LTD.: SNAPSHOT

TABLE 090. F. HOFFMANN-LA ROCHE LTD.: BUSINESS PERFORMANCE

TABLE 091. F. HOFFMANN-LA ROCHE LTD.: PRODUCT PORTFOLIO

TABLE 092. F. HOFFMANN-LA ROCHE LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. GENERAL ELECTRIC COMPANY: SNAPSHOT

TABLE 093. GENERAL ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 094. GENERAL ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 095. GENERAL ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. STARBOARD MEDICAL INC: SNAPSHOT

TABLE 096. STARBOARD MEDICAL INC: BUSINESS PERFORMANCE

TABLE 097. STARBOARD MEDICAL INC: PRODUCT PORTFOLIO

TABLE 098. STARBOARD MEDICAL INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. LIFESIGNALS: SNAPSHOT

TABLE 099. LIFESIGNALS: BUSINESS PERFORMANCE

TABLE 100. LIFESIGNALS: PRODUCT PORTFOLIO

TABLE 101. LIFESIGNALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 102. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 103. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 104. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DISPOSABLE MEDICAL SENSORS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DISPOSABLE MEDICAL SENSORS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. BIOSENSORS MARKET OVERVIEW (2016-2028)

FIGURE 013. ACCELEROMETERS MARKET OVERVIEW (2016-2028)

FIGURE 014. PRESSURE SENSORS MARKET OVERVIEW (2016-2028)

FIGURE 015. TEMPERATURE SENSORS MARKET OVERVIEW (2016-2028)

FIGURE 016. IMAGE SENSORS MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHER SENSORS MARKET OVERVIEW (2016-2028)

FIGURE 018. DISPOSABLE MEDICAL SENSORS MARKET OVERVIEW BY SENSOR TYPE

FIGURE 019. STRIP MARKET OVERVIEW (2016-2028)

FIGURE 020. WEARABLE MARKET OVERVIEW (2016-2028)

FIGURE 021. INVASIVE MARKET OVERVIEW (2016-2028)

FIGURE 022. INGESTIBLE MARKET OVERVIEW (2016-2028)

FIGURE 023. DISPOSABLE MEDICAL SENSORS MARKET OVERVIEW BY APPLICATION

FIGURE 024. DIAGNOSTIC TESTING MARKET OVERVIEW (2016-2028)

FIGURE 025. PATIENT MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 026. THERAPEUTICS MARKET OVERVIEW (2016-2028)

FIGURE 027. IMAGING MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA DISPOSABLE MEDICAL SENSORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE DISPOSABLE MEDICAL SENSORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC DISPOSABLE MEDICAL SENSORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA DISPOSABLE MEDICAL SENSORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA DISPOSABLE MEDICAL SENSORS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Global Disposable Medical Sensors Market research report is 2023-2030.

Abbott Laboratories, Medtronic, Boston Scientific, Johnson & Johnson, GE Healthcare, Masimo, Nova Biomedical, ACON Laboratories, AliveCor, McAfee Corp., Dexcom, Cardinal Health, iRhythm Technologies, Kenzen, Roche Diagnostics, Siemens Healthineers, Spital Radiometer A/S, Drägerwerk AG & Co. KGaA, GEA Group, Philips Healthcare, Nihon Kohden, Terumo Corporation, Omron Healthcare, Mindray, Yuyue Medical Group and Other Major Players.

The Disposable Medical Sensors Market is segmented into Product Type, Sensor Type, Application, and region. By Product Type, the market is categorized into Biosensors, Accelerometers, Pressure Sensors, Temperature Sensors, Image Sensors, Other Sensors. By Sensor Type, the market is categorized into Strip, Wearable, Invasive, Ingestible. By Application, the market is categorized into Diagnostic Testing, Patient Monitoring, Therapeutics, Imaging. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The technological advancement in nanotechnology, biotechnology, information technology, and semiconductor technology, has given rise to disposable medical sensors. Medical sensors are electronic devices that convert various forms of stimuli into electrical signals for analysis.

Global Disposable Medical Sensors Market Size Was Valued at USD 8.1Billion in 2022, and is Projected to Reach USD 15.44 Billion by 2030, Growing at a CAGR of 8.4%% From 2023-2030.