Nanoscale Chemicals and Materials Market Synopsis

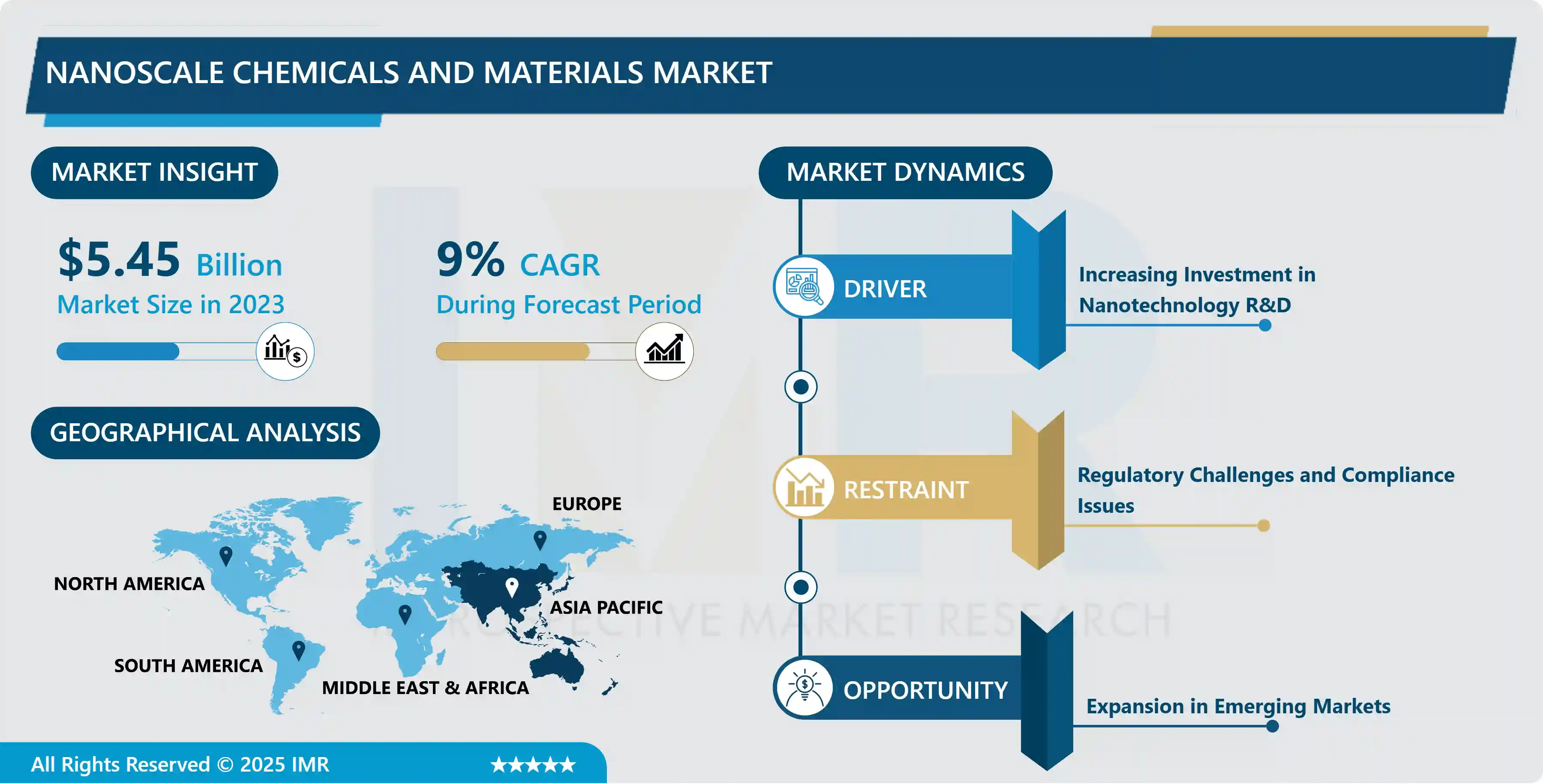

Nanoscale Chemicals and Materials Market Size is Valued at USD 5.45 Billion in 202, and is Projected to Reach USD 11.83 Billion by 2032, Growing at a CAGR of 9% From 2024-2032.

The market under consideration is the Nanoscale Chemicals and Materials Market which implies the field of chemicals and materials production and usage on a nanoscale, frequently measuring from one to one hundred nanometers. Such materials have enhanced properties compared to their bulk counterparts and to have potential uses in electronics, pharmaceuticals, energy and the environment. It involves nanoparticle, nanotubes, nanocomposites and other nanostructures are used as a result of their high performance and activities within the market.

The Nanoscale Chemicals and Materials Market is mainly motivated by the growing need for superior materials across versatile applications. The got specific properties such us high strength, low density and improved conductivity make them attractive in various uses in industries such as electronics and healthcare. For example, in electronics application, nanoscale materials have been used to make smaller and more efficient electronics; in pharmaceutical application, the application of nanoscale materials results to targeted drug delivery as well as increased therapeutic effect. Market expansion is driven considerably by a progressive miniaturization and increasing performance rates in technology.

Another also migrating factor is evident from increased incidences of research and development expenditure in the realm of nanotechnology. Specifically, overspending on federal budgets as well as private funding has been devoted toward research of nanoscale material in multidisciplinary applications. It is also noticeable that this investment stimulates the formation of new materials and technologies through the cooperation between universities and companies. Many new breakthroughs are being reported in the development of nanoscale chemicals and materials; as such, the commercial applications are becoming increasingly a viable market segment, thus fueling the growth of the market.

Nanoscale Chemicals and Materials Market Trend Analysis

Growing emphasis on sustainability and green chemistry

- One of the most important shifts in the Nanoscale Chemicals and Materials Market is the focus on sustainability and green chemistry. With increasing emphasis on the ecological impact of products the concept of sustainability in the materials and processes is gaining prominence. Currently, companies are constantly on the lookout for mechanisms to engender sustainability into the materials they use in nanoscale fabrication including the use of renewable resources and development of processes that reduce or eliminate waste. Such a trend is not only positive for the environment, but for customer’s demand for eco-friendly products, it will stimulate the growth of the market.

- Furthermore, nanotechnology has been adopted to advance the knowledge of smart materials technology. These are materials in which the property of their shape, size or colour changes when affected by external changes such as temperature or pressure making them useful in applications involving sensors, actuators and self-healing materials. They mentioned that in combination with other progressing technologies like IoT and AI, nanotechnology is expected to release new possibilities in the market and to help find and develop new solutions for various industries.

The Nanoscale Chemicals and Materials Market

- The main necessary opportunity in the market segment of Nanoscale Chemicals and Materials is the growth of industrialization of emerging economies. They found out that currently most of the countries in Asia Pacific, Latin America and the Middle East are applying nanotechnology not only in health care facilities but also in construction and electronics. These elements in combination with the constantly increasing market potential for nanoscale materials, positive government regulations and intensified investments in R&D create new opportunities for the manufacturers and suppliers of nanoscale materials. However, by increasing their coverage area to these regions, firms can harness the increasing client and market base.

- Furthermore, an ascending opportunity in the constitutional architecture of individualized medicine is seen through the utilization of nanoscale materials. With the focus in healthcare shifting to personalized medicine, nanotechnology brings the possibility to create site specific drug delivery and sensitive detections systems on a patient-by-patient basis. It also has the benefit of enhancing the effectiveness of the treatment and minimizing side effects, all of which create the groundwork for new solutions for enhancing patient care across the healthcare market.

Nanoscale Chemicals and Materials Market Segment Analysis:

Nanoscale Chemicals and Materials Market Segmented on the basis of type, Form, and end-users.

By Type, Nanoparticles segment is expected to dominate the market during the forecast period

- The Nanoscale Chemicals and Materials Market can also be categorized according to type as nanoparticles, nanotubes, nanowires, nanosheets or nanocomposites. Nanoparticles are particles with dimensions on the nanometer scale: Due to their small size, they exhibit several unusual characteristics that particularize them for uses such as drug delivery and catalysis. Though only a few microns in diameter, these nanotubes, essentially long cylinders, are over 100 times stronger than steel, and are excellent conductors of electricity: they are on the cutting edge of materials and electronic engineering. Nanowires are ultra fine wires which have special electrical properties that enable them to be used in sensor uses and energy storage devices. Due to their thin size, high surface area, and high reactivity, nanosheets can be used in electronics, energy storage devices, as well as catalysis. Finally, nanocomposites can be described as the combination of nanoscale and conventional matrices to improve characteristics including strength, endurance and thermal resistance for vital applications including automotive and construction. Altogether such types embrace a broad spectrum of materials that perform nanoscale characteristics for enhanced application in the various fields.

By Form, Powder segment held the largest share in 2024

- The global Nanoscale Chemicals and Materials Market is also categorized according to its form, which can be Powders, Liquids, and Others. The use of powder stock forms, especially at the nanoscale range of sizes, is favored due to its convenience as it readily dispersible within a formulation or used in various processing techniques. It find their usage in coatings, composites, as well as in the catalyst field. The major applications of liquid forms of nanoscale materials include uses where dilute and homogeneous distribution of particles is desired most often in dyes, pigments that is paints and in some drug delivery system. Such liquid formulations enable the promoting of the nanoscale materials’ distribution and engagement with a medium. Finally, the “others” form includes gels, films, and pastes used in specific applications including biomedical applications like the development of devices, sensors, and various electronics applications. This segmentation shows that nanoscale materials come in many types depending on the need of the industry and the application for the nanotechnology.

Nanoscale Chemicals and Materials Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- As it is evident from the analysis the Asia Pacific region is the leading market in the global Nanoscale Chemicals and Materials Market due to its high growth industrial base and considerably increasing investments in the field of nanotechnology. Asia has emerged as the leading contributor to nanotechnology development, particularly China, Japan, and India, which provide an enabling environment for nanoscale material. With the advance in electronics and healthcare industries in such nations, the consumption of nanoscale chemicals and materials is also high, thus, strengthening the region’s position in the market.

- Furthermore, many important players and research entities located in the Asia Pacific region provide for further nanotechnology development and partnership. Due to this environment, there is encouragement of development of new products and applications that make the region continue to be a frontier for nanoscale material developments. The best approach for the Asia Pacific market is to gaze into the future because as global competition rises the Asia Pacific is set for further growth depending on the mix of technology and sustainable efforts.

Active Key Players in the Nanoscale Chemicals and Materials Market

- Nanosys (USA)

- eSpin Technologies (USA)

- NanoComposix (USA)

- American Elements (USA)

- SABIC (Saudi Arabia)

- SkyNano (USA)

- XG Sciences (USA)

- Applied Nanotech (USA)

- Nanophase Technologies (USA)

- BASF (Germany)

- Others

|

Global Nanoscale Chemicals and Materials Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

9 % |

Market Size in 2032: |

USD 11.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Nanoscale Chemicals and Materials Market by Type (2018-2032)

4.1 Nanoscale Chemicals and Materials Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Nanoparticles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Nanotubes

4.5 Nanowires

4.6 Nanosheets

4.7 Nanocomposites

Chapter 5: Nanoscale Chemicals and Materials Market by Form (2018-2032)

5.1 Nanoscale Chemicals and Materials Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Powder

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Liquid

5.5 Others

Chapter 6: Nanoscale Chemicals and Materials Market by End User (2018-2032)

6.1 Nanoscale Chemicals and Materials Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Healthcare

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Consumer Goods

6.5 Manufacturing

6.6 Information Technology

6.7 Aerospace

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Nanoscale Chemicals and Materials Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NANOSYS (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ESPIN TECHNOLOGIES (USA)

7.4 NANOCOMPOSIX (USA)

7.5 AMERICAN ELEMENTS (USA)

7.6 SABIC (SAUDI ARABIA)

7.7 SKYNANO (USA)

7.8 XG SCIENCES (USA)

7.9 APPLIED NANOTECH (USA)

7.10 NANOPHASE TECHNOLOGIES (USA)

7.11 BASF (GERMANY)

7.12 OTHERS

7.13

Chapter 8: Global Nanoscale Chemicals and Materials Market By Region

8.1 Overview

8.2. North America Nanoscale Chemicals and Materials Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Nanoparticles

8.2.4.2 Nanotubes

8.2.4.3 Nanowires

8.2.4.4 Nanosheets

8.2.4.5 Nanocomposites

8.2.5 Historic and Forecasted Market Size by Form

8.2.5.1 Powder

8.2.5.2 Liquid

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Healthcare

8.2.6.2 Consumer Goods

8.2.6.3 Manufacturing

8.2.6.4 Information Technology

8.2.6.5 Aerospace

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Nanoscale Chemicals and Materials Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Nanoparticles

8.3.4.2 Nanotubes

8.3.4.3 Nanowires

8.3.4.4 Nanosheets

8.3.4.5 Nanocomposites

8.3.5 Historic and Forecasted Market Size by Form

8.3.5.1 Powder

8.3.5.2 Liquid

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Healthcare

8.3.6.2 Consumer Goods

8.3.6.3 Manufacturing

8.3.6.4 Information Technology

8.3.6.5 Aerospace

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Nanoscale Chemicals and Materials Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Nanoparticles

8.4.4.2 Nanotubes

8.4.4.3 Nanowires

8.4.4.4 Nanosheets

8.4.4.5 Nanocomposites

8.4.5 Historic and Forecasted Market Size by Form

8.4.5.1 Powder

8.4.5.2 Liquid

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Healthcare

8.4.6.2 Consumer Goods

8.4.6.3 Manufacturing

8.4.6.4 Information Technology

8.4.6.5 Aerospace

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Nanoscale Chemicals and Materials Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Nanoparticles

8.5.4.2 Nanotubes

8.5.4.3 Nanowires

8.5.4.4 Nanosheets

8.5.4.5 Nanocomposites

8.5.5 Historic and Forecasted Market Size by Form

8.5.5.1 Powder

8.5.5.2 Liquid

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Healthcare

8.5.6.2 Consumer Goods

8.5.6.3 Manufacturing

8.5.6.4 Information Technology

8.5.6.5 Aerospace

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Nanoscale Chemicals and Materials Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Nanoparticles

8.6.4.2 Nanotubes

8.6.4.3 Nanowires

8.6.4.4 Nanosheets

8.6.4.5 Nanocomposites

8.6.5 Historic and Forecasted Market Size by Form

8.6.5.1 Powder

8.6.5.2 Liquid

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Healthcare

8.6.6.2 Consumer Goods

8.6.6.3 Manufacturing

8.6.6.4 Information Technology

8.6.6.5 Aerospace

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Nanoscale Chemicals and Materials Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Nanoparticles

8.7.4.2 Nanotubes

8.7.4.3 Nanowires

8.7.4.4 Nanosheets

8.7.4.5 Nanocomposites

8.7.5 Historic and Forecasted Market Size by Form

8.7.5.1 Powder

8.7.5.2 Liquid

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Healthcare

8.7.6.2 Consumer Goods

8.7.6.3 Manufacturing

8.7.6.4 Information Technology

8.7.6.5 Aerospace

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Nanoscale Chemicals and Materials Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

9 % |

Market Size in 2032: |

USD 11.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||