N-Butyllithium Market Synopsis

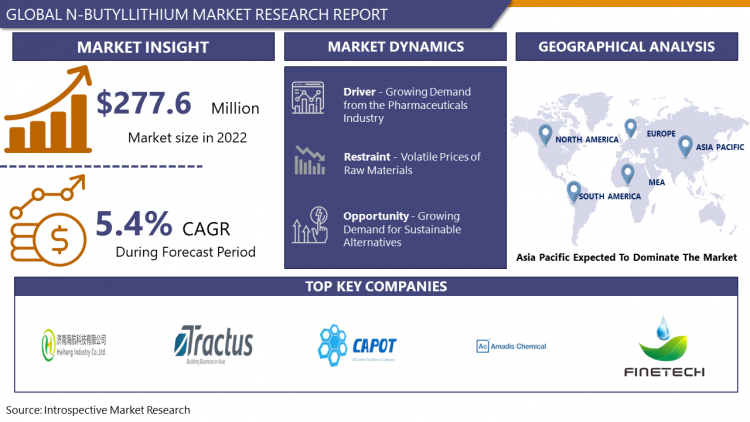

N-Butyllithium Market Size Was Valued at USD 277.6 Million in 2022, and is Projected to Reach USD 422.81 Million by 2030, Growing at a CAGR of 5.4 % From 2023-2030.

N-Butyllithium is a highly reactive chemical compound used in organic synthesis and as a strong base in laboratory settings. It exists as a colorless to yellowish liquid and is composed of lithium atoms bonded to four butyl groups. Due to its extreme reactivity with air and moisture, it must be handled with extreme caution, often stored under inert atmospheres. It is primarily utilized in the synthesis of organic compounds and as a polymerization initiator in the production of polymers like rubber.

- The n-butyllithium market is a crucial segment within the global lithium compounds industry. N-butyllithium, a highly reactive organolithium compound, is primarily used as a strong base and as an initiator in polymerization reactions, particularly in the production of synthetic rubber and elastomers. Its properties make it indispensable in various industrial processes, including pharmaceuticals, agrochemicals, and electronics.

- The market for n-butyllithium is influenced by several factors. Growth in the automotive and construction industries, particularly in emerging economies, drives demand for synthetic rubber, thereby boosting the market for n-butyllithium. Additionally, advancements in polymer science and technology continue to create new applications, further stimulating market growth.

- Geographically, Asia Pacific dominates the n-butyllithium market, led by countries like China and India, owing to their burgeoning industrial sectors and increasing investments in infrastructure. North America and Europe also hold significant shares due to the presence of well-established automotive and electronics industries.

- The n-butyllithium market is poised for steady growth, driven by expanding industrial applications and technological advancements, albeit with challenges related to regulations and market competition.

N-Butyllithium Market Trend Analysis

Growing Demand for High-Performance Materials

- N-Butyllithium, a versatile organometallic compound, finds extensive applications in polymerization reactions, pharmaceuticals, and chemical synthesis processes. Its unique properties, including high reactivity and excellent solubility in non-polar solvents, make it indispensable in the production of specialty chemicals and advanced materials.

- The rising need for high-performance materials in sectors such as automotive, electronics, and healthcare is a key driving force behind the increasing demand for N-Butyllithium. In the automotive industry, for instance, N-Butyllithium is utilized in the manufacturing of specialty elastomers and plastics, enhancing the performance and durability of automotive components. Similarly, in electronics, it facilitates the synthesis of conductive polymers and advanced coatings, crucial for electronic devices' efficiency and longevity.

- The growing emphasis on sustainable and eco-friendly materials is further propelling the adoption of N-Butyllithium, as it enables the development of innovative, energy-efficient products with reduced environmental impact. As industries continue to prioritize performance and sustainability, the N-Butyllithium market is poised for continuous expansion, driving innovation and advancement in materials science and technology.

Growing Adoption in Organic Synthesis

- N-butyllithium, a strong base and nucleophile, is widely utilized in various organic synthesis processes due to its exceptional reactivity and versatility. Its ability to efficiently initiate polymerization reactions, such as anionic polymerization of monomers like styrene and butadiene, makes it indispensable in the production of synthetic rubbers and elastomers.

- The N-butyllithium plays a crucial role as a substance in the synthesis of complex organic molecules, including pharmaceuticals, agrochemicals, and specialty chemicals. Its unique properties enable chemists to carry out reactions that would otherwise be challenging or impossible to achieve, leading to the development of novel compounds and materials.

- The increasing demand for custom-designed molecules in industries such as pharmaceuticals and electronics fuels the need for advanced synthetic methodologies, where N-butyllithium stands out as a key reagent. Its effectiveness in facilitating selective transformations and its compatibility with a wide range of functional groups make it an indispensable tool for chemists striving for efficient and sustainable synthetic routes.

- The growing adoption of N-butyllithium in organic synthesis not only enhances process efficiency and product quality but also drives innovation and expands the scope of chemical synthesis, thereby creating lucrative opportunities for the N-butyllithium market.

N-Butyllithium Market Segment Analysis:

N-Butyllithium Market Segmented on the basis of Application, End-Users, and Distribution Channel.

By Application, Polymerization segment is expected to dominate the market during the forecast period

- N-Butyllithium, a strong base and powerful reducing agent, initiates polymerization reactions by reacting with monomers, leading to the formation of polymers with desired properties.

- In the Polymerization segment, N-Butyllithium is extensively used in the production of polymers such as synthetic rubbers, plastics, and elastomers. Its ability to efficiently initiate polymerization reactions makes it indispensable in industries ranging from automotive to healthcare. For instance, in the automotive sector, N-Butyllithium-initiated polymerization processes contribute to the production of high-performance tires and other rubber components, enhancing vehicle safety and performance.

- Furthermore, in the healthcare sector, N-Butyllithium finds application in the synthesis of specialized polymers used in medical devices and drug delivery systems. The versatility and reliability of N-Butyllithium in initiating polymerization reactions underscore its pivotal role in driving innovation and meeting the diverse demands of industries reliant on advanced polymer materials.

By End-User, Pharmaceutical industry segment held the largest share of xx% in 2022

- N-Butyllithium (NBL) is a crucial mixture in the pharmaceutical industry, primarily used for synthesis of complex molecules and pharmaceutical intermediates, and is widely used in the production of active pharmaceutical ingredients and drug formulations.

- Within the pharmaceutical segment, NBL is utilized in the synthesis of compounds for drugs targeting a range of therapeutic areas, including oncology, cardiovascular diseases, central nervous system disorders, and others. Its unique chemical properties make it indispensable for pharmaceutical research and development, enabling the creation of novel drug candidates and improving the efficiency of synthetic processes.

- The market for N-Butyllithium in the pharmaceutical sector is driven by the continual demand for innovative drugs, stringent quality standards, and the need for efficient synthetic methodologies. With pharmaceutical companies focusing on expanding their product pipelines and enhancing manufacturing capabilities, the demand for NBL is expected to remain robust in the foreseeable future, driving growth and innovation within the pharmaceutical industry.

N-Butyllithium Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific's industrial infrastructure and chemical manufacturing sector, backed by countries like China, Japan, and South Korea, are crucial for the production and distribution of n-butyllithium, fostering innovation and global competitiveness.

- Furthermore, the region boasts abundant reserves of raw materials essential for n-butyllithium production, ensuring a stable and cost-effective supply chain. This strategic advantage enhances the region's attractiveness as a manufacturing hub for n-butyllithium and related products.

- The Asia Pacific's rapidly expanding automotive and electronics industries are driving significant demand for n-butyllithium, which serves as a crucial catalyst in the production of polymers, elastomers, and specialty chemicals used in these sectors. As the region continues to experience economic growth and urbanization, the demand for n-butyllithium is expected to surge further, consolidating Asia Pacific's position as a dominant player in the global market.

- Additionally, favorable government policies and initiatives aimed at promoting industrial growth and innovation provide further impetus to the n-butyllithium market in the region. These policies incentivize investment in research and development, fostering technological advancements and ensuring the continued competitiveness of Asia Pacific's chemical industry on the world stage.

N-Butyllithium Market Top Key Players:

- FMC (United States)

- Rockwood (United States)

- JIANGXI GANFENG LITHIUM (China)

- Triveni Chemicals (India)

- Yixing City Changjili Chemicals (China)

- Quzhou Aokai Chemical (China), and Other Major Players.

Key Industry Developments in the N-Butyllithium Market:

In November 2023, FMC Corporation unveiled its new strategic growth plan, outlining preliminary 2024 expectations with revenue ranging from $4.65 billion to $4.85 billion and adjusted EBITDA between $1.025 billion and $1.125 billion. The company initiated a three-year rolling financial goals program, projecting 2026 revenue to hit $5.5 billion to $6.0 billion, with adjusted EBITDA of $1.3 billion to $1.5 billion. FMC also announced a strategic review of non-core assets, potentially including the sale of its Global Specialty Solutions non-crop product line. Their ten-year revenue goal includes $2 billion from the Plant Health business and approximately $2 billion from four new active ingredients in the R&D pipeline.

|

Global N-Butyllithium Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 277.6 Mn. |

|

Forecast Period 2023-30 CAGR: |

5.4 % |

Market Size in 2030: |

USD 422.81 Mn. |

|

Segments Covered: |

By Application |

|

|

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- N-BUTYLLITHIUM MARKET BY APPLICATION (2017-2030)

- N-BUTYLLITHIUM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POLYMERIZATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACEUTICAL SYNTHESIS

- CHEMICAL SYNTHESIS

- N-BUTYLLITHIUM MARKET BY END-USER (2017-2030)

- N-BUTYLLITHIUM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POLYMER MANUFACTURING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACEUTICAL INDUSTRY

- CHEMICAL SYNTHESIS

- N-BUTYLLITHIUM MARKET BY DISTRIBUTION CHANNEL (2017-2030)

- N-BUTYLLITHIUM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIRECT SALES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DISTRIBUTORS

- ONLINE SALES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- N-Butyllithium Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- FMC (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ROCKWOOD (UNITED STATES)

- JIANGXI GANFENG LITHIUM (CHINA)

- TRIVENI CHEMICALS (INDIA)

- YIXING CITY CHANGJILI CHEMICALS (CHINA)

- QUZHOU AOKAI CHEMICAL (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL N-BUTYLLITHIUM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

Potential Market Strategies

|

Global N-Butyllithium Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 277.6 Mn. |

|

Forecast Period 2023-30 CAGR: |

5.4 % |

Market Size in 2030: |

USD 422.81 Mn. |

|

Segments Covered: |

By Application |

|

|

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. N-BUTYLLITHIUM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. N-BUTYLLITHIUM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. N-BUTYLLITHIUM MARKET COMPETITIVE RIVALRY

TABLE 005. N-BUTYLLITHIUM MARKET THREAT OF NEW ENTRANTS

TABLE 006. N-BUTYLLITHIUM MARKET THREAT OF SUBSTITUTES

TABLE 007. N-BUTYLLITHIUM MARKET BY TYPE

TABLE 008. PRODUCT 1 MARKET OVERVIEW (2016-2028)

TABLE 009. PRODUCT 2 MARKET OVERVIEW (2016-2028)

TABLE 010. OTHER MARKET OVERVIEW (2016-2028)

TABLE 011. N-BUTYLLITHIUM MARKET BY APPLICATION

TABLE 012. CHEMICAL INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 013. PHARMACY MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA N-BUTYLLITHIUM MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA N-BUTYLLITHIUM MARKET, BY APPLICATION (2016-2028)

TABLE 017. N N-BUTYLLITHIUM MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE N-BUTYLLITHIUM MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE N-BUTYLLITHIUM MARKET, BY APPLICATION (2016-2028)

TABLE 020. N-BUTYLLITHIUM MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC N-BUTYLLITHIUM MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC N-BUTYLLITHIUM MARKET, BY APPLICATION (2016-2028)

TABLE 023. N-BUTYLLITHIUM MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA N-BUTYLLITHIUM MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA N-BUTYLLITHIUM MARKET, BY APPLICATION (2016-2028)

TABLE 026. N-BUTYLLITHIUM MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA N-BUTYLLITHIUM MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA N-BUTYLLITHIUM MARKET, BY APPLICATION (2016-2028)

TABLE 029. N-BUTYLLITHIUM MARKET, BY COUNTRY (2016-2028)

TABLE 030. FMC: SNAPSHOT

TABLE 031. FMC: BUSINESS PERFORMANCE

TABLE 032. FMC: PRODUCT PORTFOLIO

TABLE 033. FMC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. ROCKWOOD: SNAPSHOT

TABLE 034. ROCKWOOD: BUSINESS PERFORMANCE

TABLE 035. ROCKWOOD: PRODUCT PORTFOLIO

TABLE 036. ROCKWOOD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. JIANGXI GANFENG LITHIUM: SNAPSHOT

TABLE 037. JIANGXI GANFENG LITHIUM: BUSINESS PERFORMANCE

TABLE 038. JIANGXI GANFENG LITHIUM: PRODUCT PORTFOLIO

TABLE 039. JIANGXI GANFENG LITHIUM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. TRIVENI CHEMICALS: SNAPSHOT

TABLE 040. TRIVENI CHEMICALS: BUSINESS PERFORMANCE

TABLE 041. TRIVENI CHEMICALS: PRODUCT PORTFOLIO

TABLE 042. TRIVENI CHEMICALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. YIXING CITY CHANGJILI CHEMICALS: SNAPSHOT

TABLE 043. YIXING CITY CHANGJILI CHEMICALS: BUSINESS PERFORMANCE

TABLE 044. YIXING CITY CHANGJILI CHEMICALS: PRODUCT PORTFOLIO

TABLE 045. YIXING CITY CHANGJILI CHEMICALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. QUZHOU AOKAI CHEMICAL: SNAPSHOT

TABLE 046. QUZHOU AOKAI CHEMICAL: BUSINESS PERFORMANCE

TABLE 047. QUZHOU AOKAI CHEMICAL: PRODUCT PORTFOLIO

TABLE 048. QUZHOU AOKAI CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. N-BUTYLLITHIUM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. N-BUTYLLITHIUM MARKET OVERVIEW BY TYPE

FIGURE 012. PRODUCT 1 MARKET OVERVIEW (2016-2028)

FIGURE 013. PRODUCT 2 MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 015. N-BUTYLLITHIUM MARKET OVERVIEW BY APPLICATION

FIGURE 016. CHEMICAL INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 017. PHARMACY MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA N-BUTYLLITHIUM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE N-BUTYLLITHIUM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC N-BUTYLLITHIUM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA N-BUTYLLITHIUM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA N-BUTYLLITHIUM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the N-Butyllithium Market research report is 2023-2030.

FMC (United States), Rockwood (United States), JIANGXI GANFENG LITHIUM (China), Triveni Chemicals (India), Yixing City Changjili Chemicals (China), Quzhou Aokai Chemical (China), and Other Major Players.

The N-Butyllithium Market is segmented into Application, End-User, Distribution Channel, and region. By Application, the market is categorized into Polymerization, Pharmaceutical synthesis, and Chemical synthesis. By End-User, the market is categorized into Polymer manufacturing, Pharmaceutical industry, Chemical manufacturing, and Agrochemicals. By Distribution Channel, the market is categorized into Direct sales, Distributors, and Online sales. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

N-Butyllithium is a highly reactive chemical compound used in organic synthesis and as a strong base in laboratory settings. It exists as a colorless to yellowish liquid and is composed of lithium atoms bonded to four butyl groups. Due to its extreme reactivity with air and moisture, it must be handled with extreme caution, often stored under inert atmospheres. It is primarily utilized in the synthesis of organic compounds and as a polymerization initiator in the production of polymers like rubber.

N-Butyllithium Market Size Was Valued at USD 277.6 Million in 2022, and is Projected to Reach USD 422.81 Million by 2030, Growing at a CAGR of 5.4 % From 2023-2030.