N-Butyl Acetate Market Synopsis

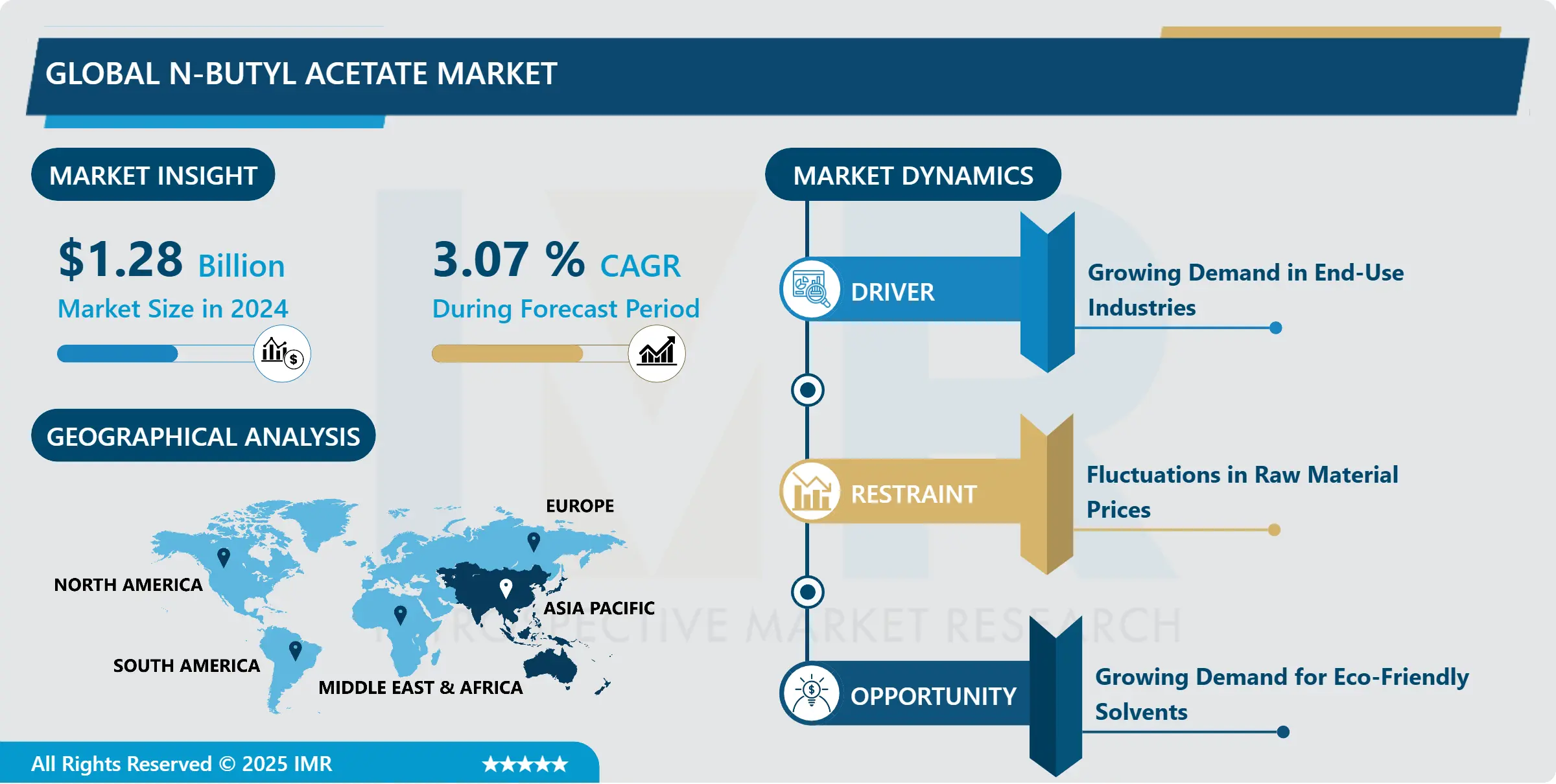

N-Butyl Acetate Market Size Was Valued at USD 1.28 Billion in 2024 and is Projected to Reach USD 1.63 Billion by 2032, Growing at a CAGR of 3.07% From 2025-2032.

N-butyl acetate is a colorless, flammable liquid with a fruity odor, commonly used as a solvent in various industries such as paints, coatings, adhesives, and pharmaceuticals. It is derived from the esterification of butanol with acetic acid, offering excellent solvency properties and low volatility. N-butyl acetate serves as a key ingredient in formulations requiring fast drying, good flow, and high gloss finishes, making it valuable in numerous industrial and commercial applications. N-butyl acetate is a chemical compound extensively used as a solvent in various applications and is witnessing increasing demand across industries such as automotive, coatings, adhesives, and pharmaceuticals. This surge in demand can be attributed to its favorable properties such as high solvency power, low toxicity, and pleasant odor.

The automotive sector's expansion, fuelled by rising consumer purchasing power and technological advancements, is further boosting the market for N-butyl acetate. The compound finds significant use in automotive paints and coatings, contributing to the overall market growth.Furthermore, the construction industry's steady growth worldwide is augmenting the demand for N-butyl acetate, particularly in paints and coatings applications. The compound's excellent performance characteristics make it a preferred choice in architectural coatings, further propelling market expansion.The pharmaceutical sector's increasing reliance on N-butyl acetate as a solvent for drug formulation is bolstering market growth. Its compatibility with a wide range of active pharmaceutical ingredients (APIs) and its ability to improve drug stability are key factors driving its adoption in pharmaceutical applications. The market is witnessing technological advancements and innovations aimed at enhancing the production process and improving product quality, thereby powering market growth.

N-Butyl Acetate Market Trend Analysis

Growing Demand in End-Use Industries

- N-butyl acetate, a solvent with a fruity odor, finds extensive applications in coatings, adhesives, inks, and other chemical processes. Its versatility and effectiveness make it a sought-after component in these sectors.

- The coatings industry, in particular, is witnessing a significant uptick in demand for N-butyl acetate. This is attributed to its excellent solvent properties, which contribute to the formulation of high-quality paints, varnishes, and lacquers. Its fast evaporation rate and low toxicity make it a preferred choice for coatings manufacturers looking to meet stringent environmental regulations without compromising on performance.

- Furthermore, the adhesives and ink industries are also driving demand for N-butyl acetate. Its ability to dissolve various resins and polymers makes it an indispensable solvent in the formulation of adhesives and printing inks, facilitating strong bonds and vibrant colors in the final products.

- As these end-use industries continue to expand, fuelled by factors such as urbanization, infrastructure development, and technological advancements, the demand for N-butyl acetate is expected to soar even higher. Market players are actively responding to this trend by ramping up production capacities and innovating to meet the evolving needs of their customers, thereby capitalizing on the lucrative opportunities presented by the growing demand in these sectors.

Growing Demand for Eco-Friendly Solvents

- Consumers and industries alike are increasingly seeking alternatives that minimize environmental impact while maintaining high-performance standards. N-butyl acetate, a versatile solvent commonly used in paints, coatings, adhesives, and inks, is experiencing heightened interest due to its favorable environmental profile.

- This rising demand for eco-friendly solvents stems from heightened awareness of the detrimental effects of conventional chemical substances on ecosystems and human health. As regulatory bodies impose stricter guidelines on chemical usage and emissions, industries are compelled to seek sustainable alternatives. N-butyl acetate emerges as a compelling solution, offering effective solvent properties while exhibiting lower levels of toxicity and volatility compared to traditional solvents.

- The versatility of N-butyl acetate extends its applicability across various industries, from automotive to construction, further fuelling its demand. Manufacturers and end-users recognize the importance of adopting sustainable practices to meet consumer expectations and regulatory requirements, driving the adoption of eco-friendly solvents like N-butyl acetate.

- As the global shift towards sustainability accelerates, the N-Butyl Acetate Market stands composed for substantial growth, boosted by the increasing demand for environmentally responsible solutions across industries. Companies that embrace this trend and offer eco-friendly alternatives are likely to thrive in the evolving market landscape.

N-Butyl Acetate Market Segment Analysis:

N-butyl acetate Market Segmented based on Application, End-User, and Distribution Channel.

By Application, Paints & Coatings segment is expected to dominate the market during the forecast period

- The Paints & Coatings segment is actively utilizing n-butyl acetate as a solvent in various formulations due to its excellent solvent properties and low volatility. N-butyl acetate serves as a key ingredient in paint and coating formulations, contributing to its desirable properties such as improved flow, leveling, and film formation.

- In the paints and coatings industry, n-butyl acetate plays a crucial role in achieving the desired viscosity and consistency of the final product. Its ability to dissolve a wide range of resins and polymers makes it a preferred solvent for both solvent-based and water-based formulations.

- The n-butyl acetate offers advantages such as fast evaporation rates, which facilitate quicker drying times in coatings applications. This attribute enhances productivity and efficiency in painting processes, contributing to cost savings for manufacturers.

- The n-butyl acetate exhibits low toxicity and a mild odor, making it safer and more pleasant to work with compared to alternative solvents. These characteristics further bolster its appeal in the paints and coatings segment, driving its continued growth and demand in the market.

By Distribution Channel, the Direct Sales segment held the largest share in 2024

- The Direct Sales segment plays a pivotal role in distributing the product to end-users. Direct sales involve manufacturers or producers selling their N-butyl acetate directly to consumers without intermediaries. This channel offers several advantages, including streamlined communication, efficient order processing, and the ability to tailor products to specific customer needs.

- Direct sales teams typically engage in proactive outreach and relationship-building with potential clients, showcasing the benefits and applications of N-Butyl Acetate. They provide comprehensive product information, technical support, and after-sales services, ensuring customer satisfaction and loyalty.

- The direct sales enable manufacturers to maintain greater control over pricing strategies and brand positioning, enhancing their competitive edge in the market. By establishing direct relationships with end-users, companies gather valuable feedback and insights to continually improve their products and services.

- The Direct Sales segment in the N-butyl acetate Market serves as a direct link between producers and consumers, facilitating efficient distribution and fostering strong customer relationships.

N-Butyl Acetate Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is experiencing a growing industrial sector and increasing demand for various chemical compounds. Asia Pacific has emerged as a key player in the production and consumption of N-butyl acetate. Several factors contribute to the region's dominance in this market. Rapid industrialization across countries like China, India, and Southeast Asian nations has led to a surge in manufacturing activities, consequently driving the demand for solvents and chemicals like N-butyl acetate.

- The presence of a vast consumer base and the expansion of end-use industries such as automotive, paints and coatings, and electronics further fuel the market growth. The favorable government policies and investments in infrastructure development have created a conducive environment for the chemical industry to thrive in the Asia Pacific region.

- Furthermore, advancements in technology and research capabilities have enabled manufacturers in the region to enhance production processes, improve product quality, and remain competitive in the global market. The availability of skilled labor and relatively lower production costs compared to other regions also contribute to the market dominance of Asia Pacific in the N-butyl acetate sector.

- The Asia Pacific region's robust economic growth, with supportive factors such as industrial development, favorable policies, and technological advancements, position it as a leader in the global N-butyl acetate market.

N-Butyl Acetate Market Top Key Players:

- DOW (USA)

- Eastman (USA)

- Celanese Corporation (USA)

- OXEA (Germany)

- BASF (Germany)

- Carbohim (Russia)

- Baichuan (China)

- Handsome (China)

- Jinyinmeng (China)

- Sanmu (China)

- Yankuang (China)

- Longtian (China)

- Shiny Chemical (China)

- Jidong Solvent (China)

- Chang Chun Petrochemical (Taiwan)

- Korea Alcohol Industrial (South Korea)

- PETRONAS (Malaysia)

- KH Neochem (Japan), and Other Major Players.

Key Industry Developments in the N-Butyl Acetate Market:

- In May 2023, Dow and New Energy Blue announced a pioneering long-term supply agreement in North America. Under this agreement, New Energy Blue will produce bio-based ethylene from renewable agricultural residues, particularly corn stover, for Dow's U.S. Gulf Coast assets. This innovative venture aims to reduce carbon emissions from plastic production while meeting the rising demand for renewable plastics across various industries. The collaboration signifies a significant step towards building sustainable material ecosystems.

|

Global N-Butyl Acetate Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024 : |

USD 1.28 Bn. |

|

Forecast Period 2023-30 CAGR: |

3.07 % |

Market Size in 2032 : |

USD 1.63 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: N-Butyl Acetate Market by Application (2018-2032)

4.1 N-Butyl Acetate Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Paints & Coatings

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Adhesives & Sealants

4.5 Chemical Intermediates

4.6 Pharmaceuticals

Chapter 5: N-Butyl Acetate Market by End-User (2018-2032)

5.1 N-Butyl Acetate Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Automotive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Construction

5.5 Packaging

5.6 Electronics

Chapter 6: N-Butyl Acetate Market by Distribution Channel (2018-2032)

6.1 N-Butyl Acetate Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Direct Sales

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Distributors

6.5 Online Retail

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 N-Butyl Acetate Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ETIMINE USA (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SIGMA-ALDRICH (USA)

7.4 GRAHAM CHEMICAL (USA)

7.5 ROSE MILL CO. (USA)

7.6 KEMCORE (HONG KONG)

7.7 BORAX (USA)

7.8 SEARLES VALLEY MINERALS (USA)

7.9 LIAOBIN (CHINA)

7.10

Chapter 8: Global N-Butyl Acetate Market By Region

8.1 Overview

8.2. North America N-Butyl Acetate Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Application

8.2.4.1 Paints & Coatings

8.2.4.2 Adhesives & Sealants

8.2.4.3 Chemical Intermediates

8.2.4.4 Pharmaceuticals

8.2.5 Historic and Forecasted Market Size by End-User

8.2.5.1 Automotive

8.2.5.2 Construction

8.2.5.3 Packaging

8.2.5.4 Electronics

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Direct Sales

8.2.6.2 Distributors

8.2.6.3 Online Retail

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe N-Butyl Acetate Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Application

8.3.4.1 Paints & Coatings

8.3.4.2 Adhesives & Sealants

8.3.4.3 Chemical Intermediates

8.3.4.4 Pharmaceuticals

8.3.5 Historic and Forecasted Market Size by End-User

8.3.5.1 Automotive

8.3.5.2 Construction

8.3.5.3 Packaging

8.3.5.4 Electronics

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Direct Sales

8.3.6.2 Distributors

8.3.6.3 Online Retail

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe N-Butyl Acetate Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Application

8.4.4.1 Paints & Coatings

8.4.4.2 Adhesives & Sealants

8.4.4.3 Chemical Intermediates

8.4.4.4 Pharmaceuticals

8.4.5 Historic and Forecasted Market Size by End-User

8.4.5.1 Automotive

8.4.5.2 Construction

8.4.5.3 Packaging

8.4.5.4 Electronics

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Direct Sales

8.4.6.2 Distributors

8.4.6.3 Online Retail

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific N-Butyl Acetate Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Application

8.5.4.1 Paints & Coatings

8.5.4.2 Adhesives & Sealants

8.5.4.3 Chemical Intermediates

8.5.4.4 Pharmaceuticals

8.5.5 Historic and Forecasted Market Size by End-User

8.5.5.1 Automotive

8.5.5.2 Construction

8.5.5.3 Packaging

8.5.5.4 Electronics

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Direct Sales

8.5.6.2 Distributors

8.5.6.3 Online Retail

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa N-Butyl Acetate Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Application

8.6.4.1 Paints & Coatings

8.6.4.2 Adhesives & Sealants

8.6.4.3 Chemical Intermediates

8.6.4.4 Pharmaceuticals

8.6.5 Historic and Forecasted Market Size by End-User

8.6.5.1 Automotive

8.6.5.2 Construction

8.6.5.3 Packaging

8.6.5.4 Electronics

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Direct Sales

8.6.6.2 Distributors

8.6.6.3 Online Retail

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America N-Butyl Acetate Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Application

8.7.4.1 Paints & Coatings

8.7.4.2 Adhesives & Sealants

8.7.4.3 Chemical Intermediates

8.7.4.4 Pharmaceuticals

8.7.5 Historic and Forecasted Market Size by End-User

8.7.5.1 Automotive

8.7.5.2 Construction

8.7.5.3 Packaging

8.7.5.4 Electronics

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Direct Sales

8.7.6.2 Distributors

8.7.6.3 Online Retail

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global N-Butyl Acetate Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024 : |

USD 1.28 Bn. |

|

Forecast Period 2023-30 CAGR: |

3.07 % |

Market Size in 2032 : |

USD 1.63 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||