Global Mushroom Cultivation Market Overview

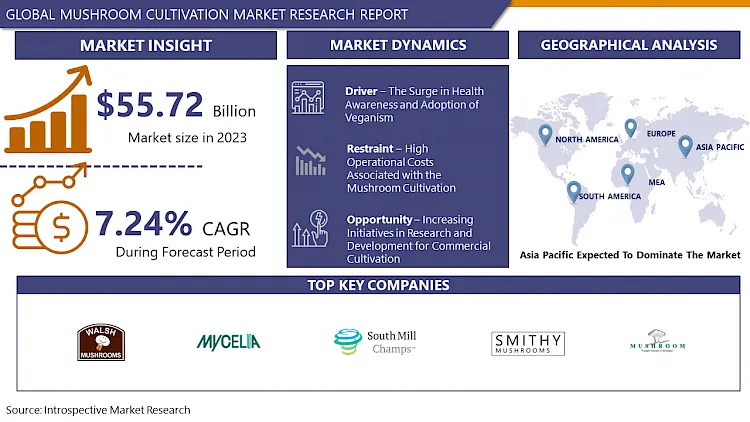

The Mushroom Cultivation market estimated at USD 55.72 Billion in the year 2023, is projected to reach a revised size of USD 104.53 Billion by 2032, growing at a CAGR of 7.2% over the analysis period 2024-2032.

Mushrooms are a macro fungus or edible fungus that are large enough to be seen by the naked eye and can provide several essential nutrients. From puffballs to truffles, mushrooms are cultivated widely and can range from regular fare to costly delicacy. While their growth, mushrooms can decompose all the organic nutrients and can absorb nutrients from them. Mushrooms are a good source of proteins that includes all essential amino acids and can be purchased fresh, dried, or canned. Button mushroom is the major cultivated and consumed variety all across the world. With the availability of appropriate climatic conditions in temperate areas, and with the development of technologies to cultivate them throughout the year, mushroom cultivation is witnessing rapid growth and a rise in demand from consumers. Mushrooms are termed as a low-calorie food that caters to several health benefits thereby boosting the requirement for the cultivation of mushrooms. The increasing demand of the consumers for processed food items and varied mushroom dishes is expected to drive the market for mushroom cultivation in the forthcoming years.

Market Dynamics And Factors For Mushroom Cultivation Market

Drivers:

The Surge in Health Awareness and Adoption of Veganism

Rising health-conscious people have fueled the growth and demand for mushroom cultivation in recent years. Mushrooms are a rich source of proteins, antioxidants, vitamins, and minerals. The antioxidant properties in mushrooms can prevent various types of cancers such as breast, lung, prostate, and others. Also, it is rich in dietary fiber which helps in reducing Type-2 Diabetes and lowering blood sugar levels. Potassium content in the mushroom is essential to regulate blood pressure and diminish the risk of cardiovascular diseases and hypertension. Consumers all across the world are aware of the rising lifestyle and health diseases, and also about the health benefits offered by mushrooms. This rising concern among the health-conscious population fuels the market growth of mushroom cultivation. Additionally, owing to the rising animal brutality, many individuals are adopting veganism and healthy food products that are not animal-based. This rising concern and rapid adoption of veganism is another primary factor that drives the market growth of mushroom cultivation.

Rapidly Growing Demand for Fresh Mushrooms from the Food Industry

Mushrooms have always been high in demand for many centuries, but in recent years, due to the rising awareness regarding the health benefits of consuming fresh and processed mushrooms, they have gained huge popularity in the food industry. Consumers demand foods with low cholesterol and fat levels, along with added nutrients, and thus food industry innovates and utilizes mushrooms in different forms to meet the demand. Further, the digestive and fiber enzymes present in mushrooms escalate the market growth as it supports the immune health of the human body. The rapidly elevating foodservice industry is fueling the demand for fresh mushrooms across the HoReCa which is the hotels, restaurants, and cafeterias sector. The edible fungus powder that can be utilized in the making of sauces, smoothies, and soups, is also high in demand from the food industry as they are beneficial for human health and offer essential nutrients. Furthermore, the rising adoption of mushrooms as a substitute for meat, coupled with the increasing veganism, is expected to further boost the market growth in the forecast years. The rich and umami flavor of fungi acts as a perfect meat alternative and an efficient way of decreasing calories and fat thereby driving the rising demand in the food industry.

Restraints:

High Operational Costs Associated with the Mushroom Cultivation

Production of mushrooms requires a high level of management skills and plenty of initial inputs. Mushrooms need specified treatment to achieve high-quality yields, consistency in production, and better nutritional value. They may get affected strongly by environmental conditions such as light, temperature, and humidity. Also, animal pests, insects, and some diseases can pose hurdles for mushroom growers, especially in field cultivation. This creates an immediate urge among the growers to make use of appropriate pest controls, which further leads to an increase in production costs. For instance, some insects such as fungus gnats are known to breed under the same conditions, thus the use of pest control becomes critical. Moreover, the allergic reactions that occur while producing an oyster variety of mushrooms are anticipated to restrain the market growth.

Opportunities:

Increasing Initiatives in Research and Development for Commercial Cultivation

Major investments and initiatives for producing high-quality and new varieties of mushrooms are been taken by governments across many countries in the world. Cultivating such varieties from edible fungi that are not only exported to maximize profit but are also safe for regular human consumption, creates lucrative growth opportunities in the foreseeable years. Moreover, rapid adoption of the advanced pest management system that helps in controlling loss or damage can ensure high-quality varieties and higher yields, which, in turn, fuels the market growth. Also, the common edible button fungi Agaricus bisporus is a widely cultivated and consumed mushroom in the world that can offer growth opportunities in the upcoming years. Its rising recognition and utilization in the diet have augmented its market performance rapidly. Also, with the expansion of its presence in the global industry, its commercial production, as well as distribution, have majorly improved which can be a profitable opportunity for growth in the forthcoming years.

Segmentation Analysis Of Mushroom Cultivation Market

By Type, the button segment is anticipated to dominate the growth of the mushroom cultivation market over the analysis period. The button mushroom is a major consumed mushroom type in all types of the world as it offers potential health benefits. Increasing investments in research and development of white mushrooms to find the potential to prevent diseases such as diabetes and cancer, as well as its availability at reasonable prices as compared to other types of mushroom varieties, is anticipated to elevate the segment growth in the forthcoming years.

By Phase, the composting segment dominates the growth of the mushroom cultivation market. It is essential for almost all garden plants as it is a good soil amendment for vegetable gardens. The composting segment has high growth potential as it retains excess water, offers essential nutrients for plants, and is used widely by gardeners as the compost has more nitrogen content than any other compost. Along with other usages in the food industry, mushrooms are majorly cultivated for compost preparation which further drives the market growth.

By Form, the fresh mushroom segment is expected to witness rapid growth and dominate the market over the forecasted years. Fresh mushrooms are witnessing a rise in demand due to the rising number of consumers that are focused on organic and unprocessed food consumption that offers maximum health benefits. The distribution of fresh forms is challenging for the distributors as well as the manufacturers because they have a limited shelf life. However, rapid advancements in technologies such as the use of modified atmosphere packaging have overcome such challenges, thereby propelling the segment growth.

By Distribution channel, the supermarkets/hypermarkets segment dominates the mushroom cultivation market. The penetration of supermarkets or hypermarkets is higher in developed countries such as North America and Europe, rather than the developing regions, which is the major for the segment growth. Also, the ease and convenience of availability of mushrooms are more in supermarkets which drives the market growth. Further, the online segment is expected to witness faster growth in the upcoming years owing to the discounts and offers provided by the segment.

Regional Analysis of Mushroom Cultivation Market

The Asia Pacific region is the major dominating region of mushroom cultivation in recent years and is further anticipated to dominate the market growth over the projected period. The Asia Pacific region has the largest per capita consumption of mushrooms as compared to other countries which fuel the rapid growth. According to the China Business Research Institute, China is the largest edible mushroom producer out of all the regions which adds to the dominance of the Asia Pacific region. Moreover, the CCCFNA Edible Mushroom Branch also reported that the export of edible mushrooms is more from China. Mushrooms are also cultivated largely by other Asian regions like India, and Japan owing to the increasing veganism, rapid adoption of modern techniques for cultivation, and shifting consumer patterns towards nutrition-rich food.

The North American region is anticipated to have the second highest share of the mushroom cultivation market over the analysis period. The US is the major region that cultivates mushrooms on a large scale. The US government is continuously focusing on increasing import duties that further contribute to the higher prices of mushrooms. Mushrooms are proved to be one of the protein-rich vegan sources as they provide nearly 3.3 g of protein per 100 g of serving. Consumers in this region are ready to pay higher prices for premium products that are cultivated with organic and natural ingredients, which boosts the growth of mushroom cultivation in North America. Moreover, meat is a major source of protein in the western diet and the rising adoption of the population for a vegan diet is estimated to drive the growth of mushroom cultivation in the forecasted years.

Covid 19 Impact Analysis On Mushroom Cultivation Market

The COVID-19 pandemic had a strong impact on numerous agriculture and food industries. The entire lockdown situation in major countries has directly or indirectly influenced negative growth and impacted several industries causing a shift in activities like supply chain operations, vendor operations, product commercialization, etc. Mushroom cultivation was hampered negatively due to the imposed shutdown, lockdown, and various pandemic guidelines. However, the release of four new high-yielding strains of mushrooms majorly for commercial use is cushioning the employment loss in the emergence of the novel coronavirus disease COVID-19 outbreak.

Top Key Players Covered In Mushroom Cultivation Market

- Monaghan Mushrooms (Ireland)

- Walsh Mushrooms Group (Ireland)

- Mycelia (Belgium)

- South Mill Mushrooms Sales (US)

- Smithy Mushrooms Ltd. (UK)

- Rheinische Pilz Zentrale GmbH (Germany)

- Italspwan (Italy)

- Mushroom SAS (Italy)

- Hirano Mushroom LLC (Kosovo)

- Fujishukin Co. Ltd. (Japan)

- Lambert Spawn (US)

- Mycoterra Farm (US)

- Commercial Mushroom Producers (Europe)

- Societa Agricola Porretta (Italy)

- Bluff City Fungi (US) and other major players.

Key industry development in the Mushroom Cultivation Market

- In December 2023, Applied Food Sciences, Inc., an American supplementary product manufacturer, launched its new organic functional mushroom line, including Lion's Mane, Cordyceps, Reishi, and Chaga mushroom varieties sourced from Finland.

- In November 2023, Sempera Organics, a global biotechnology company, expanded its mushroom product portfolio by launching six new mushrooms - Black Hoof, Tiger Milk, Poria, Enoki, Wood Ear, and Split Gill.

|

Global Mushroom Cultivation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 55.72 Bn. |

|

Forecast Period 2023-30 CAGR: |

7.2% |

Market Size in 2032: |

USD 104.53 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Phase |

|

||

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mushroom Cultivation Market by Type (2018-2032)

4.1 Mushroom Cultivation Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Button

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Oyster

4.5 Shiitake

4.6 Porcini

4.7 Chanterelle

4.8 Shimeji

Chapter 5: Mushroom Cultivation Market by Phase (2018-2032)

5.1 Mushroom Cultivation Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Composting

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Spawning

5.5 Casing

5.6 Pinning

5.7 Harvesting

Chapter 6: Mushroom Cultivation Market by Form (2018-2032)

6.1 Mushroom Cultivation Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Fresh

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Dried

6.5 Canned

Chapter 7: Mushroom Cultivation Market by Distribution Channel (2018-2032)

7.1 Mushroom Cultivation Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Direct to customers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Supermarkets/Hypermarkets

7.5 Online stores

7.6 Convenience stores

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Mushroom Cultivation Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SYNGENTA AG(SWITZERLAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BAYER AG(GERMANY)

8.4 CORTEVA INC. (U.S)

8.5 VILMORIN & CIE (FRANCE)

8.6 HARRIS SEEDS (U.S)

8.7 SCHLESSMAN SEED COMPANY (USA)

8.8 MAY SEED (TURKEY)

8.9 ADVANTA SEEDS ((U.S)

8.10 JOHNNY'S SELECTED SEEDS (USA)

8.11 DOWDUPONT (U.S)

8.12 KWS(KENYA)

8.13 MONSANTO (U.S)

8.14 LIMAGRAIN (FRANCE)

8.15 NUZIWEEDU SEED (INDIA)

8.16 SAKATA SEED (JAPAN)

Chapter 9: Global Mushroom Cultivation Market By Region

9.1 Overview

9.2. North America Mushroom Cultivation Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Button

9.2.4.2 Oyster

9.2.4.3 Shiitake

9.2.4.4 Porcini

9.2.4.5 Chanterelle

9.2.4.6 Shimeji

9.2.5 Historic and Forecasted Market Size by Phase

9.2.5.1 Composting

9.2.5.2 Spawning

9.2.5.3 Casing

9.2.5.4 Pinning

9.2.5.5 Harvesting

9.2.6 Historic and Forecasted Market Size by Form

9.2.6.1 Fresh

9.2.6.2 Dried

9.2.6.3 Canned

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Direct to customers

9.2.7.2 Supermarkets/Hypermarkets

9.2.7.3 Online stores

9.2.7.4 Convenience stores

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Mushroom Cultivation Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Button

9.3.4.2 Oyster

9.3.4.3 Shiitake

9.3.4.4 Porcini

9.3.4.5 Chanterelle

9.3.4.6 Shimeji

9.3.5 Historic and Forecasted Market Size by Phase

9.3.5.1 Composting

9.3.5.2 Spawning

9.3.5.3 Casing

9.3.5.4 Pinning

9.3.5.5 Harvesting

9.3.6 Historic and Forecasted Market Size by Form

9.3.6.1 Fresh

9.3.6.2 Dried

9.3.6.3 Canned

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Direct to customers

9.3.7.2 Supermarkets/Hypermarkets

9.3.7.3 Online stores

9.3.7.4 Convenience stores

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Mushroom Cultivation Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Button

9.4.4.2 Oyster

9.4.4.3 Shiitake

9.4.4.4 Porcini

9.4.4.5 Chanterelle

9.4.4.6 Shimeji

9.4.5 Historic and Forecasted Market Size by Phase

9.4.5.1 Composting

9.4.5.2 Spawning

9.4.5.3 Casing

9.4.5.4 Pinning

9.4.5.5 Harvesting

9.4.6 Historic and Forecasted Market Size by Form

9.4.6.1 Fresh

9.4.6.2 Dried

9.4.6.3 Canned

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Direct to customers

9.4.7.2 Supermarkets/Hypermarkets

9.4.7.3 Online stores

9.4.7.4 Convenience stores

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Mushroom Cultivation Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Button

9.5.4.2 Oyster

9.5.4.3 Shiitake

9.5.4.4 Porcini

9.5.4.5 Chanterelle

9.5.4.6 Shimeji

9.5.5 Historic and Forecasted Market Size by Phase

9.5.5.1 Composting

9.5.5.2 Spawning

9.5.5.3 Casing

9.5.5.4 Pinning

9.5.5.5 Harvesting

9.5.6 Historic and Forecasted Market Size by Form

9.5.6.1 Fresh

9.5.6.2 Dried

9.5.6.3 Canned

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Direct to customers

9.5.7.2 Supermarkets/Hypermarkets

9.5.7.3 Online stores

9.5.7.4 Convenience stores

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Mushroom Cultivation Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Button

9.6.4.2 Oyster

9.6.4.3 Shiitake

9.6.4.4 Porcini

9.6.4.5 Chanterelle

9.6.4.6 Shimeji

9.6.5 Historic and Forecasted Market Size by Phase

9.6.5.1 Composting

9.6.5.2 Spawning

9.6.5.3 Casing

9.6.5.4 Pinning

9.6.5.5 Harvesting

9.6.6 Historic and Forecasted Market Size by Form

9.6.6.1 Fresh

9.6.6.2 Dried

9.6.6.3 Canned

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Direct to customers

9.6.7.2 Supermarkets/Hypermarkets

9.6.7.3 Online stores

9.6.7.4 Convenience stores

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Mushroom Cultivation Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Button

9.7.4.2 Oyster

9.7.4.3 Shiitake

9.7.4.4 Porcini

9.7.4.5 Chanterelle

9.7.4.6 Shimeji

9.7.5 Historic and Forecasted Market Size by Phase

9.7.5.1 Composting

9.7.5.2 Spawning

9.7.5.3 Casing

9.7.5.4 Pinning

9.7.5.5 Harvesting

9.7.6 Historic and Forecasted Market Size by Form

9.7.6.1 Fresh

9.7.6.2 Dried

9.7.6.3 Canned

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Direct to customers

9.7.7.2 Supermarkets/Hypermarkets

9.7.7.3 Online stores

9.7.7.4 Convenience stores

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Mushroom Cultivation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 55.72 Bn. |

|

Forecast Period 2023-30 CAGR: |

7.2% |

Market Size in 2032: |

USD 104.53 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Phase |

|

||

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Mushroom Cultivation Market research report is 2024-2032.

Monaghan Mushrooms (Ireland), Walsh Mushrooms Group (Ireland), Mycelia (Belgium), South Mill Mushrooms Sales (US), Smithy Mushrooms Ltd. (UK), and other major players.

The Mushroom Cultivation Market is segmented into Type, Phase, Form, Distribution channel, and region. By Type, the market is categorized into Button, Oyster, Shiitake, Porcini, Chanterelle, and Shimeji. By Phase, the market is categorized into Composting, Spawning, Casing, Pinning, and Harvesting. By Form, the market is categorized into Fresh, Dried, and Canned. By Distribution channel, the market is categorized into Direct to customers, Supermarkets/Hypermarkets, Online Stores, and Convenience stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Mushrooms are a macro fungus or a type of edible fungus that are large enough to be seen by the naked eye and can provide several essential nutrients. From puffballs to truffles, mushrooms are cultivated widely and can range from regular fare to costly delicacy.

The Mushroom Cultivation market estimated at USD 55.72 Billion in the year 2023, is projected to reach a revised size of USD 104.53 Billion by 2032, growing at a CAGR of 7.2% over the analysis period 2024-2032.