Mobile Satellite Services Market Synopsis

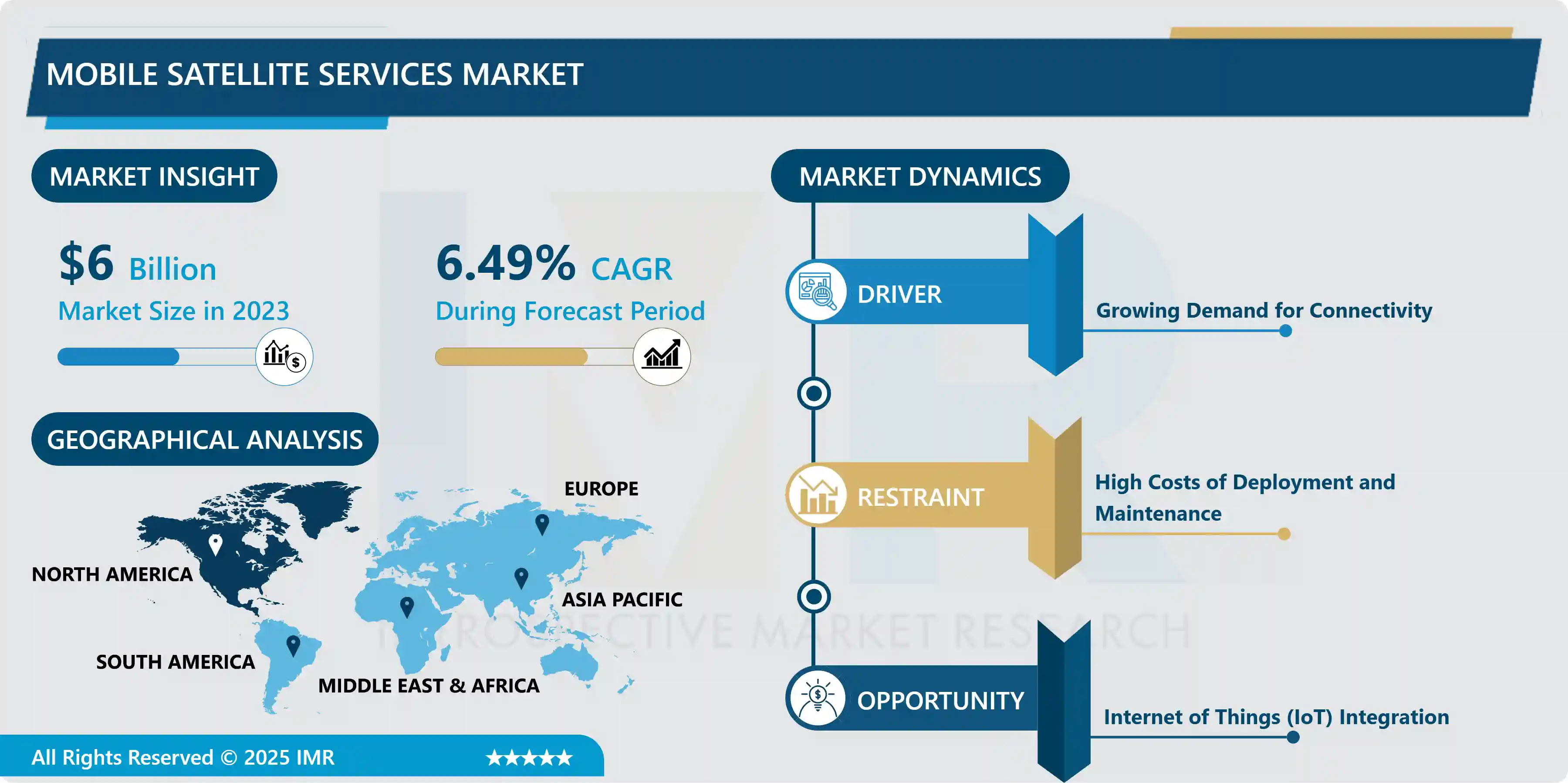

Mobile Satellite Services Market Size Was Valued at USD 6.0 Billion in 2023, and is Projected to Reach USD 10.5 Billion by 2032, Growing at a CAGR of 6.49% From 2024-2032.

The Mobile Satellite Services (MSS) market is a critical segment of the global telecommunications industry, offering critical communication solutions in situations where terrestrial networks are insufficient or unavailable. MSS employs satellites to deliver voice, data, and video services to users, catering to a range of applications such as personal communications and disaster response. This technology is essential in the maritime, aviation, and military sectors, as it guarantees uninterrupted connectivity in difficult environments, including remote and rural areas. The market is expanding due to the growing demand for dependable communication services in remote regions, the advancements in satellite technology, and the increasing number of connected devices. The proliferation of Internet of Things (IoT) devices and the necessity for secure communication networks have also facilitated the adoption of MSS. Furthermore, the increasing emphasis on disaster preparedness and response has underscored the significance of satellite communication systems, particularly in regions that are susceptible to natural disasters.

The MSS market is divided into service types, such as voice, data, surveillance and monitoring, and video services. The market is dominated by data services as a result of the growing demand for high-speed internet and IoT applications. Fleet management, asset tracking, and environmental monitoring are also dependent on tracking and monitoring services, which enhance operational efficiency and provide real-time data. The military and maritime sectors are the primary drivers of high adoption rates in North America, which is the geographic region that dominates the MSS market. Additionally, Europe and the Asia-Pacific region are substantial markets, as they are experiencing an increase in investments in satellite infrastructure and the expansion of use cases across a variety of industries. The Middle East and Africa exhibit promising development potential as a result of the necessity for robust communication networks in remote and underserved regions. High costs associated with satellite launches, regulatory obstacles, and competition from terrestrial communication networks are among the challenges in the MSS market. Nevertheless, it is anticipated that these obstacles will be alleviated by ongoing technological advancements and strategic partnerships, which will promote market expansion. The MSS market is expected to experience sustained growth, thereby playing a critical role in the global communication landscape, as the demand for ubiquitous connectivity continues to increase.

Mobile Satellite Services Market Trend Analysis

Integration with Terrestrial Networks

- The Mobile Satellite Services (MSS) market has experienced substantial development as a result of the growing demand for seamless communication in remote and underserved regions. In this market, the integration of MSS with terrestrial networks is a prominent trend. The goal of this integration is to provide a ubiquitous connectivity solution that combines the high capacity and low latency of terrestrial systems with the extensive coverage of satellite networks. Service providers can provide improved communication services that are suitable for a diverse range of applications, such as emergency response, maritime, aviation, and rural connectivity, by capitalizing on the strengths of both networks.

- The implementation of 5G technology is expediting this integration. 5G's advanced capabilities, including edge computing and network slicing, facilitate the more efficient and adaptable utilization of terrestrial and satellite resources. Consequently, users may encounter enhanced service quality and dependability. Furthermore, the standardization of protocols and interfaces between satellite and terrestrial networks enables more seamless interoperability, which is critical for the widespread adoption of integrated solutions.

- An additional motivating factor is the growing partnership between terrestrial network providers and satellite operators. These partnerships are essential for the development and deployment of hybrid networks that can seamlessly transition between satellite and terrestrial connections. In order to improve coverage and capacity, companies are investing in innovative technologies, including low-earth orbit (LEO) satellites and multi-orbit satellite constellations. We anticipate that this collaborative approach will create new business opportunities and expand the reach of mobile satellite services.

- In summary, the integration of MSS with terrestrial networks significantly influences the future of the mobile satellite services market. This integration is poised to transform the manner in which we communicate, providing dependable and resilient communication solutions in a variety of industries. The MSS market is on the brink of significant growth, propelled by the demand for resilient and comprehensive connectivity solutions as technology continues to advance and industry players fortify their partnerships.

Advancements in Satellite Technology

- Innovations in communication, propulsion, and miniaturization are driving the rapid advancement of the satellite technology landscape. Because of their affordability and adaptability, CubeSats and other smaller, more cost-effective satellites are gaining popularity as a result of their affordability and adaptability. By deploying these miniaturized satellites in constellations for enhanced coverage and redundancy, we can revolutionize the collection and dissemination of data from space. Furthermore, improvements in electric propulsion systems are extending the lifespans of satellites and enhancing their maneuverability, thereby reducing operational costs and enhancing the reliability of satellite networks.

- These technological advancements are having a substantial impact on mobile satellite services (MSS). The growing demand for seamless global connectivity has led to the development of MSS, which provides communication services to mobile users via satellites. Enhanced satellite capabilities are facilitating more reliable connections, reduced latency, and higher data transmission rates, even in remote or underserved regions. This is especially important for industries that require consistent communication, such as maritime, aviation, and emergency response.

- The integration of satellite technology with emerging 5G networks is a significant trend that is on the brink of revolutionizing global communications. Satellites can enhance terrestrial 5G infrastructure by offering coverage in rural and remote regions where conventional cell towers are unfeasible. This symbiosis guarantees a network that is more resilient and ubiquitous, thereby accommodating the growing data requirements of contemporary applications, such as the Internet of Things (IoT), autonomous vehicles, and smart cities.

- As the mobile satellite services market expands, it encounters both opportunities and challenges. The necessity for international cooperation, regulatory hurdles, and spectrum allocation issues are substantial impediments. However, the potential of satellites to bridge the digital divide, support disaster recovery efforts, and enhance global communication networks underscores the critical importance of continuous advancements in satellite technology. Continuous innovation and the increasing demand for dependable, global connectivity are the driving forces behind the promising future of MSS.

Mobile Satellite Services Market Segment Analysis:

Mobile Satellite Services Market Segmented on the basis of By Type , By Sales Channel and By Application

By Type, Land MSS is expected to dominate the market during the forecast period.

- The Mobile Satellite Services (MSS) market is a dynamic sector that provides a variety of service types to meet the communication requirements of a wide range of individuals. These service types include land MSS, aeronautical MSS, broadband MSS, maritime MSS, and personal MSS. In regions where terrestrial networks are unavailable or unreliable, these services utilize satellite technology to establish connectivity. The specific applications and industries that each form of MSS serves ensure seamless communication across various environments and user requirements.

- Land MSS dedicates itself to providing communication solutions for underserved or remote land areas. This service is essential for industries that require reliable connectivity for operations and safety, such as mining, agriculture, and emergency response. Land MSS facilitates voice and data communication, enhancing coordination and productivity in these industries.

- The Aeronautical MSS provides connectivity for both commercial and private aircraft, catering to the aviation industry. This service guarantees that passengers and personnel members have access to high-speed internet, which facilitates real-time communication and the retrieval of critical information during flights. Aeronautical MSS enhances the in-flight experience and operational efficacy by supporting activities like navigation, weather updates, and passenger entertainment.

- Maritime MSS, specifically designed for vessels operating at sea, provides critical communication connections for the shipping, fishing, and offshore industries. This service guarantees that ships can remain in communication with onshore operations and other vessels, thereby facilitating navigation, safety, and logistics. On the other hand, broadband MSS provides high-speed internet services to a variety of sectors, such as mobile users and remote areas, thereby enabling the efficient transmission of data and communication.

- Finally, Personal MSS concentrates on the needs of individual users, providing them with dependable and portable communication solutions. This service is especially beneficial for travellers, correspondents, and adventurers who are in remote areas, as it guarantees their safety and connectivity. In general, the MSS market is critical for bridging communication gaps across various sectors and terrains as a result of the increasing demand for ubiquitous and dependable connectivity.

By Sales Channel, Offline segment held the largest share in 2024

- The Mobile Satellite Services (MSS) market is a critical element of the global telecommunications landscape, as it facilitates communication in remote and inaccessible regions where terrestrial networks are unavailable. Based on the sales channel, we divide this market into two principal categories: offline and online.

- Offline distribution channels have historically dominated the MSS market. Direct sales, distributors, and value-added resellers comprise this category. Established relationships and a robust network of industry contacts are frequently advantageous to companies that utilize offline channels when negotiating substantial contracts with governmental and corporate clients. This approach also enables the provision of customized solutions and personalized customer service, which are crucial in high-risk environments such as maritime, aviation, and military operations.

- On the other hand, the MSS market is experiencing significant growth in the online sales channel. The proliferation of digital marketplaces and e-commerce platforms has made it easier for customers to access a diverse selection of MSS products and services. The advantages of online channels include the ability to rapidly compare products and prices, lower overhead costs, and a wider reach. This channel is particularly appealing to smaller enterprises and individual consumers who prefer the convenience and accessibility of online purchasing.

- The increasing significance of online sales channels in the MSS market is stimulating innovation and competition. In order to improve the online purchasing experience, businesses are progressively investing in digital marketing strategies, user-friendly websites, and customer support systems. We anticipate a more equitable distribution of sales between online and offline channels in the MSS market due to the ongoing digital transformation, catering to a wider range of customers and requirements.

Mobile Satellite Services Market Regional Insights:

Asia-Pacific Mobile Satellite Service Market is expected to grow at the fastest CAGR.

- The Asia-Pacific Mobile Satellite Service (MSS) market is on the brink of experiencing the highest compound annual growth rate (CAGR) among all global regions. We can attribute this dynamic growth to several factors, including the rapid technological advancements in satellite communication technologies, the increasing adoption of mobile satellite services in remote and underserved areas, and government initiatives to enhance communication infrastructure.

- The increase in demand for secure and dependable communication systems in rural and remote regions is one of the primary drivers of growth in the Asia-Pacific MSS market. Satellite services are a critical solution for ensuring connectivity in these regions, as they frequently lack sufficient terrestrial communication infrastructure. Governments in countries such as India, China, and Japan are making significant investments in satellite technology to improve connectivity for both civilian and military applications and bridge the communication divide.

- Moreover, the growing demand for real-time data access in a variety of industries, including maritime, aviation, and defense, as well as the expansion of the Internet of Things (IoT), is driving the demand for MSS. Satellite services ensure the seamless transmission of data across vast distances and challenging terrains, providing a robust platform for IoT devices. This capability is especially important for the maritime and aviation sectors, as they rely on consistent and dependable communication to ensure operational efficiency and safety.

Active Key Players in the Mobile Satellite Services Market

- Iridium Communications Inc. (U.S.)

- Thuraya Telecommunications Company (UAE)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Tesacom (Argentina)

- EchoStar Corporation (U.S.)

- Inmarsat Limited (U.K.)

- Intelsat (U.S.)

- LOBALSTAR (U.S.)

- ViaSat Inc. (U.S.)

- Telstra (Australia)

- ORBCOMM (U.S.)

- Others

Key Industry Developments in the Mobile Satellite Services Market:

- March 2022, S.A. Intelsat and Kymeta Corporation, a satellite communications company, have announced the successful testing of satellite-enabled 5G services on Kymeta's electronic-steered flat-panel u8 antenna. The services were enabled by Intelsat's worldwide integrated satellite and terrestrial network. The demonstration was conducted by Fraunhofer's Institute for Integrated Circuits (IIS) in order to facilitate the advancement of mobile 5G satellite communication technology

|

Mobile Satellite Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.0 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.49% |

Market Size in 2032: |

USD 10.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Sales Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mobile Satellite Services Market by Type (2018-2032)

4.1 Mobile Satellite Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Land MSS

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Aeronautical MSS

4.5 Broadband MSS

4.6 Maritime MSS

4.7 Personal MSS

Chapter 5: Mobile Satellite Services Market by Sales Channel (2018-2032)

5.1 Mobile Satellite Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Offline

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Online

Chapter 6: Mobile Satellite Services Market by Application (2018-2032)

6.1 Mobile Satellite Services Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Military & Defense

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aviation

6.5 Oil & Gas

6.6 Media & Entertainment

6.7 Transportation & Automotive

6.8 Government

6.9 Mining

6.10 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Mobile Satellite Services Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 IRIDIUM COMMUNICATIONS INC. (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 THURAYA TELECOMMUNICATIONS COMPANY (UAE)

7.4 TELEFONAKTIEBOLAGET LM ERICSSON (SWEDEN)

7.5 TESACOM (ARGENTINA)

7.6 ECHOSTAR CORPORATION (U.S.)

7.7 INMARSAT LIMITED (U.K.)

7.8 INTELSAT (U.S.)

7.9 LOBALSTAR (U.S.)

7.10 VIASAT INC. (U.S.)

7.11 TELSTRA (AUSTRALIA)

7.12 ORBCOMM (U.S.)

7.13 OTHERS

Chapter 8: Global Mobile Satellite Services Market By Region

8.1 Overview

8.2. North America Mobile Satellite Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Land MSS

8.2.4.2 Aeronautical MSS

8.2.4.3 Broadband MSS

8.2.4.4 Maritime MSS

8.2.4.5 Personal MSS

8.2.5 Historic and Forecasted Market Size by Sales Channel

8.2.5.1 Offline

8.2.5.2 Online

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Military & Defense

8.2.6.2 Aviation

8.2.6.3 Oil & Gas

8.2.6.4 Media & Entertainment

8.2.6.5 Transportation & Automotive

8.2.6.6 Government

8.2.6.7 Mining

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Mobile Satellite Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Land MSS

8.3.4.2 Aeronautical MSS

8.3.4.3 Broadband MSS

8.3.4.4 Maritime MSS

8.3.4.5 Personal MSS

8.3.5 Historic and Forecasted Market Size by Sales Channel

8.3.5.1 Offline

8.3.5.2 Online

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Military & Defense

8.3.6.2 Aviation

8.3.6.3 Oil & Gas

8.3.6.4 Media & Entertainment

8.3.6.5 Transportation & Automotive

8.3.6.6 Government

8.3.6.7 Mining

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Mobile Satellite Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Land MSS

8.4.4.2 Aeronautical MSS

8.4.4.3 Broadband MSS

8.4.4.4 Maritime MSS

8.4.4.5 Personal MSS

8.4.5 Historic and Forecasted Market Size by Sales Channel

8.4.5.1 Offline

8.4.5.2 Online

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Military & Defense

8.4.6.2 Aviation

8.4.6.3 Oil & Gas

8.4.6.4 Media & Entertainment

8.4.6.5 Transportation & Automotive

8.4.6.6 Government

8.4.6.7 Mining

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Mobile Satellite Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Land MSS

8.5.4.2 Aeronautical MSS

8.5.4.3 Broadband MSS

8.5.4.4 Maritime MSS

8.5.4.5 Personal MSS

8.5.5 Historic and Forecasted Market Size by Sales Channel

8.5.5.1 Offline

8.5.5.2 Online

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Military & Defense

8.5.6.2 Aviation

8.5.6.3 Oil & Gas

8.5.6.4 Media & Entertainment

8.5.6.5 Transportation & Automotive

8.5.6.6 Government

8.5.6.7 Mining

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Mobile Satellite Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Land MSS

8.6.4.2 Aeronautical MSS

8.6.4.3 Broadband MSS

8.6.4.4 Maritime MSS

8.6.4.5 Personal MSS

8.6.5 Historic and Forecasted Market Size by Sales Channel

8.6.5.1 Offline

8.6.5.2 Online

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Military & Defense

8.6.6.2 Aviation

8.6.6.3 Oil & Gas

8.6.6.4 Media & Entertainment

8.6.6.5 Transportation & Automotive

8.6.6.6 Government

8.6.6.7 Mining

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Mobile Satellite Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Land MSS

8.7.4.2 Aeronautical MSS

8.7.4.3 Broadband MSS

8.7.4.4 Maritime MSS

8.7.4.5 Personal MSS

8.7.5 Historic and Forecasted Market Size by Sales Channel

8.7.5.1 Offline

8.7.5.2 Online

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Military & Defense

8.7.6.2 Aviation

8.7.6.3 Oil & Gas

8.7.6.4 Media & Entertainment

8.7.6.5 Transportation & Automotive

8.7.6.6 Government

8.7.6.7 Mining

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Mobile Satellite Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.0 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.49% |

Market Size in 2032: |

USD 10.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Sales Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||