Missile Guidance Radar Market Synopsis

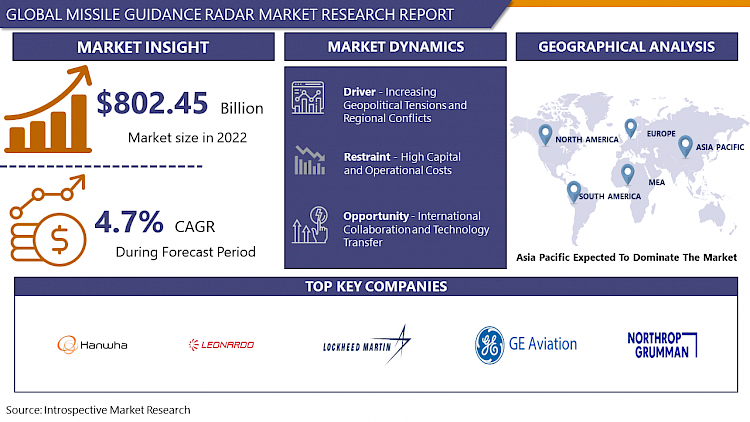

Missile Guidance Radar Market Size Was Valued at USD 802.45 Million in 2022 and is Projected to Reach USD 1158.75 Million by 2030, Growing at a CAGR of 4.7 % From 2023-2030.

Missile Guidance Radar is a specialized radar system used to track and guide missiles during various stages of flight. A Missile Guidance Radar's primary functions include detecting the target, tracking its movement, and sending guidance commands to the missile to ensure precise navigation to its intended destination.

- The missile guidance radar employs advanced technologies such as phased-array radar, which allows for faster beam steering and greater flexibility in tracking fast-moving targets such as missiles. The radar continuously monitors the position and velocity of both the launching platform and the target, providing critical data for the guidance system to make real-time changes to the missile's flight path.

- The growing geopolitical tensions and the need for strong defense capabilities have resulted in significant investments in missile guidance radar technologies. Nations are modernizing their defense systems to counter evolving threats, including the integration of sophisticated missile guidance radar to improve the accuracy and effectiveness of missile systems.

- The market's growth is further supported by rising global defense budgets, with countries prioritizing the development and deployment of cutting-edge missile guidance radar systems. As the threat landscape changes, the market remains poised for steady growth, providing critical technologies that aid in the defense and security of nations around the world.

Missile Guidance Radar Market Trend Analysis

Increasing Geopolitical Tensions and Regional Conflicts

- Countries facing geopolitical uncertainty are making significant investments in missile guidance radar technologies to strengthen their military capabilities. The escalating threat landscape and the possibility of regional conflicts have prompted an increase in defense spending, driving demand for advanced missile guidance radar systems capable of effectively detecting, tracking, and guiding missiles, ensuring an early response to possible dangers.

- The ongoing conflicts and the emergence of new security challenges contribute to the continued demand for advanced radar technologies. In response to geopolitical uncertainties, nations are prioritizing defense capability enhancement. The integration of advanced radar systems into comprehensive missile defense networks ensures a steady market growth trajectory, as defense agencies strive to stay ahead of evolving threats in an ever-changing geopolitical landscape.

- Geopolitical tensions and regional conflicts continue to have an impact on the growth of the Missile Guidance Radar market. the ongoing demand for advanced defense technologies that can effectively address evolving security threats, the ongoing investment in missile guidance radar systems reflects the global commitment to maintaining strategic superiority, ensuring a steady market demand driven by geopolitical considerations.

International Collaboration and Technology Transfer

- There is an increasing trend of countries collaborating on defense projects to improve their collective security. International partnerships enable the pooling of resources, expertise, and technological capabilities for the development and deployment of advanced missile guidance radar systems. Nations are recognizing the benefits of collaborative efforts in addressing common security challenges, increasing in demand for radar technologies that can seamlessly integrate into multinational defense networks.

- The exchange of expertise and technologies between nations not only reduces costs but also speeds up the development and deployment of advanced radar systems. The collaborative approach ensures a steady flow of investments and advancements, laying a solid foundation for the ongoing evolution of missile guidance radar technologies.

- considering all factors, the market is well-positioned to benefit from shared knowledge and resources. The ongoing collaboration fosters an environment conducive to innovation and efficiency, contributing to the continued expansion of the missile guidance radar market as a critical component of international defense.

Missile Guidance Radar Market Segment Analysis:

Missile Guidance Radar Market Segmented based on type, technology, frequency, range, and end-user.

By Type, Surface-to-Air Missiles (SAM) segment is expected to dominate the market during the forecast period

- Surface-to-air missiles (SAMs) are expected to be the fastest-growing segment due to increasing threats from drones and hypersonic missiles, necessitating advanced air defense systems. Nations around the world are investing heavily in powerful missile defense systems to protect themselves from aerial threats.

- Additionally, Surface-to-air missiles equipped with advanced guidance radar technologies play an important role in intercepting and neutralizing incoming airborne threats, driving demand for sophisticated missile guidance radar systems. SAM systems' adaptability and versatility in countering a wide range of airborne threats, including enemy aircraft and ballistic missiles, contribute to their widespread use.

- Defense strategies are evolving to address a variety of challenges, and the consistent demand for effective and precise guidance radar technologies to support SAMs ensures that this application will continue to dominate the market. As Surface-to-Air Missile systems remain integral components of modern military arsenals, there is a high demand for advanced missile guidance radar technologies, positioning SAMs as key contributors to the market's ongoing expansion.

By End-User, Defence Department segment is expected to dominate the market during the forecast period

- Defense agencies around the world work constantly to modernize their military capabilities. The Defense Department's investment in modern missile guidance radar systems is prompted by the growing threat created by various adversaries, including the spread of advanced missile technologies. The need to maintain strategic superiority and effectively counter evolving security threats is a major factor driving demand for sophisticated radar technologies in the defense sector.

- Defense agencies prioritize the integration of cutting-edge radar systems into their arsenals to improve threat detection, tracking, and interception capabilities. As geopolitical tensions rise and the global security landscape changes, the Defense Department remains a key market driver, ensuring a steady demand for innovative and effective missile guidance radar systems.

- Taking everything into account, the market's growth is supported by the Defense Department's commitment to staying ahead of emerging threats and ensuring national security. As defense strategies evolve, the Defense Department's demand for advanced missile guidance radar systems remains strong, establishing it as a cornerstone of the market's continued growth.

Missile Guidance Radar Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- With escalating geopolitical tensions and increased defense spending across the region, Asia Pacific has emerged as the fastest-growing region in the Missile Guidance Radar Market, with significant contributions from countries such as India and China. Countries in Asia Pacific are increasing their military capabilities in response to changing security challenges, and there is a greater demand for advanced missile defense systems, including sophisticated guidance radar technologies.

- The region's strategic location, combined with its growing economic influence, highlights the importance of investing in a strong defense infrastructure to protect national interests. India and China, with their rapidly expanding economies and defense budgets, are investing heavily in the development of domestic missile guidance radar systems. The emphasis on indigenous defense production ensures the market's long-term growth trajectory, driven by investments in R&D and innovation.

- The region's strong economic growth, combined with rising security threats, creates a favorable environment for the expansion of defense-related industries. As Asia Pacific countries, particularly India and China, prioritize strengthening their defense capabilities, demand for missile guidance radar systems is expected to rise steadily, cementing their position as major contributors to the global missile guidance radar market.

Missile Guidance Radar Market Top Key Players:

- Lockheed Martin (US)

- Raytheon Technologies (US)

- Northrop Grumman (US)

- L3Harris Technologies (US)

- BAE Systems (US)

- General Electric Aviation (US)

- Honeywell Aerospace (US)

- Thales Group (France)

- MBDA France (France)

- Leonardo SpA (Italy)

- Airbus Defence and Space (Germany)

- Saab AB (Sweden)

- Indra Sistemas (Spain)

- Selex ES (Italy)

- Almaz-Antey (Russia)

- Bharat Electronics Limited (India)

- Hanwha Systems (South Korea)

- Mitsubishi Electric Corporation (Japan)

- China Electronics Technology Group Corporation (China)

- Norinco (China)

- Rafael Advanced Defense Systems (Israel)

- IAI (Israel Aerospace Industries) (Israel)

- Elta Systems (Israel)

- Aselsan (Turkey)

- Denel Land Systems (South Africa), and Other major Players.

Key Industry Developments in the Missile Guidance Radar Market:

In November 2023, Lockheed introduced the Advanced Patriot Missile with LTAMDS Radar. The integration of the Patriot Advanced Capability-3 (PAC-3) missile with the Lower Tier Air and Missile Defense Sensor (LTAMDS) radar will improve the US Army's defense against air-breathing threats.

In September 2023, Raytheon and the US Department of Defense signed a $7 million agreement to continue production and testing of the GhostEye MR radar for the National Advanced Surface-to-Air Missile System.

|

Global Missile Guidance Radar Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 802.45 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.7 % |

Market Size in 2030: |

USD 1158.75 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Frequency |

|

||

|

By Range |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MISSILE GUIDANCE RADAR MARKET BY TYPE (2017-2030)

- MISSILE GUIDANCE RADAR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SURFACE-TO-SURFACE MISSILES (SSM)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SURFACE-TO-AIR MISSILES (SAM)

- AIR-TO-AIR MISSILES (AAM)

- AIR-TO-SURFACE MISSILES (ASM)

- MISSILE GUIDANCE RADAR MARKET BY TECHNOLOGY (2017-2030)

- MISSILE GUIDANCE RADAR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PULSE RADARS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONTINUOUS WAVE RADARS

- ACTIVE ELECTRONICALLY SCANNED ARRAYS (AESAS)

- MISSILE GUIDANCE RADAR MARKET BY FREQUENCY (2017-2030)

- MISSILE GUIDANCE RADAR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- X-BAND

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- KU-BAND

- KA-BAND

- MILLIMETRE WAVE

- MISSILE GUIDANCE RADAR MARKET BY RANGE (2017-2030)

- MISSILE GUIDANCE RADAR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LESS THAN 20

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 20 KM TO 150 KM

- OVER 150 KM

- MISSILE GUIDANCE RADAR MARKET BY END-USER (2017-2030)

- MISSILE GUIDANCE RADAR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DEFENCE DEPARTMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPACE AGENCIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Missile Guidance Radar Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- LOCKHEED MARTIN (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- RAYTHEON TECHNOLOGIES (US)

- NORTHROP GRUMMAN (US)

- L3HARRIS TECHNOLOGIES (US)

- BAE SYSTEMS (US)

- GENERAL ELECTRIC AVIATION (US)

- HONEYWELL AEROSPACE (US)

- THALES GROUP (FRANCE)

- MBDA FRANCE (FRANCE)

- LEONARDO SPA (ITALY)

- AIRBUS DEFENCE AND SPACE (GERMANY)

- SAAB AB (SWEDEN)

- INDRA SISTEMAS (SPAIN)

- SELEX ES (ITALY)

- ALMAZ-ANTEY (RUSSIA)

- BHARAT ELECTRONICS LIMITED (INDIA)

- HANWHA SYSTEMS (SOUTH KOREA)

- MITSUBISHI ELECTRIC CORPORATION (JAPAN)

- CHINA ELECTRONICS TECHNOLOGY GROUP CORPORATION (CHINA)

- NORINCO (CHINA)

- RAFAEL ADVANCED DEFENSE SYSTEMS (ISRAEL)

- IAI (ISRAEL AEROSPACE INDUSTRIES) (ISRAEL)

- ELTA SYSTEMS (ISRAEL)

- ASELSAN (TURKEY)

- DENEL LAND SYSTEMS (SOUTH AFRICA)

- COMPETITIVE LANDSCAPE

- GLOBAL MISSILE GUIDANCE RADAR MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Frequency

- Historic And Forecasted Market Size By Range

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Missile Guidance Radar Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 802.45 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.7 % |

Market Size in 2030: |

USD 1158.75 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Frequency |

|

||

|

By Range |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MISSILE GUIDANCE RADAR MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MISSILE GUIDANCE RADAR MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MISSILE GUIDANCE RADAR MARKET COMPETITIVE RIVALRY

TABLE 005. MISSILE GUIDANCE RADAR MARKET THREAT OF NEW ENTRANTS

TABLE 006. MISSILE GUIDANCE RADAR MARKET THREAT OF SUBSTITUTES

TABLE 007. MISSILE GUIDANCE RADAR MARKET BY TYPE

TABLE 008. SURFACE-TO-SURFACE MISSILES (SSM) MARKET OVERVIEW (2016-2028)

TABLE 009. SURFACE-TO-AIR MISSILES (SAM) MARKET OVERVIEW (2016-2028)

TABLE 010. AIR-TO-AIR MISSILES (AAM) MARKET OVERVIEW (2016-2028)

TABLE 011. AIR-TO-SURFACE MISSILES (ASM) MARKET OVERVIEW (2016-2028)

TABLE 012. MISSILE GUIDANCE RADAR MARKET BY APPLICATION

TABLE 013. DEFENSE DEPARTMENT MARKET OVERVIEW (2016-2028)

TABLE 014. SPACE AGENCIES MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA MISSILE GUIDANCE RADAR MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA MISSILE GUIDANCE RADAR MARKET, BY APPLICATION (2016-2028)

TABLE 017. N MISSILE GUIDANCE RADAR MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE MISSILE GUIDANCE RADAR MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE MISSILE GUIDANCE RADAR MARKET, BY APPLICATION (2016-2028)

TABLE 020. MISSILE GUIDANCE RADAR MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC MISSILE GUIDANCE RADAR MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC MISSILE GUIDANCE RADAR MARKET, BY APPLICATION (2016-2028)

TABLE 023. MISSILE GUIDANCE RADAR MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA MISSILE GUIDANCE RADAR MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA MISSILE GUIDANCE RADAR MARKET, BY APPLICATION (2016-2028)

TABLE 026. MISSILE GUIDANCE RADAR MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA MISSILE GUIDANCE RADAR MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA MISSILE GUIDANCE RADAR MARKET, BY APPLICATION (2016-2028)

TABLE 029. MISSILE GUIDANCE RADAR MARKET, BY COUNTRY (2016-2028)

TABLE 030. LOCKHEED MARTIN CORPORATION: SNAPSHOT

TABLE 031. LOCKHEED MARTIN CORPORATION: BUSINESS PERFORMANCE

TABLE 032. LOCKHEED MARTIN CORPORATION: PRODUCT PORTFOLIO

TABLE 033. LOCKHEED MARTIN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. BHARAT ELECTRONICS LIMITED: SNAPSHOT

TABLE 034. BHARAT ELECTRONICS LIMITED: BUSINESS PERFORMANCE

TABLE 035. BHARAT ELECTRONICS LIMITED: PRODUCT PORTFOLIO

TABLE 036. BHARAT ELECTRONICS LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. NORTHROP GRUMMAN CORPORATION: SNAPSHOT

TABLE 037. NORTHROP GRUMMAN CORPORATION: BUSINESS PERFORMANCE

TABLE 038. NORTHROP GRUMMAN CORPORATION: PRODUCT PORTFOLIO

TABLE 039. NORTHROP GRUMMAN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. RAYTHEON COMPANY: SNAPSHOT

TABLE 040. RAYTHEON COMPANY: BUSINESS PERFORMANCE

TABLE 041. RAYTHEON COMPANY: PRODUCT PORTFOLIO

TABLE 042. RAYTHEON COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. SAAB: SNAPSHOT

TABLE 043. SAAB: BUSINESS PERFORMANCE

TABLE 044. SAAB: PRODUCT PORTFOLIO

TABLE 045. SAAB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. THALES GROUP: SNAPSHOT

TABLE 046. THALES GROUP: BUSINESS PERFORMANCE

TABLE 047. THALES GROUP: PRODUCT PORTFOLIO

TABLE 048. THALES GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. BAE SYSTEMS: SNAPSHOT

TABLE 049. BAE SYSTEMS: BUSINESS PERFORMANCE

TABLE 050. BAE SYSTEMS: PRODUCT PORTFOLIO

TABLE 051. BAE SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. ISRAEL AEROSPACE INDUSTRIES: SNAPSHOT

TABLE 052. ISRAEL AEROSPACE INDUSTRIES: BUSINESS PERFORMANCE

TABLE 053. ISRAEL AEROSPACE INDUSTRIES: PRODUCT PORTFOLIO

TABLE 054. ISRAEL AEROSPACE INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. FINMECCANICA: SNAPSHOT

TABLE 055. FINMECCANICA: BUSINESS PERFORMANCE

TABLE 056. FINMECCANICA: PRODUCT PORTFOLIO

TABLE 057. FINMECCANICA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. AIRBUS GROUP: SNAPSHOT

TABLE 058. AIRBUS GROUP: BUSINESS PERFORMANCE

TABLE 059. AIRBUS GROUP: PRODUCT PORTFOLIO

TABLE 060. AIRBUS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MISSILE GUIDANCE RADAR MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MISSILE GUIDANCE RADAR MARKET OVERVIEW BY TYPE

FIGURE 012. SURFACE-TO-SURFACE MISSILES (SSM) MARKET OVERVIEW (2016-2028)

FIGURE 013. SURFACE-TO-AIR MISSILES (SAM) MARKET OVERVIEW (2016-2028)

FIGURE 014. AIR-TO-AIR MISSILES (AAM) MARKET OVERVIEW (2016-2028)

FIGURE 015. AIR-TO-SURFACE MISSILES (ASM) MARKET OVERVIEW (2016-2028)

FIGURE 016. MISSILE GUIDANCE RADAR MARKET OVERVIEW BY APPLICATION

FIGURE 017. DEFENSE DEPARTMENT MARKET OVERVIEW (2016-2028)

FIGURE 018. SPACE AGENCIES MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA MISSILE GUIDANCE RADAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE MISSILE GUIDANCE RADAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC MISSILE GUIDANCE RADAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA MISSILE GUIDANCE RADAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA MISSILE GUIDANCE RADAR MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Missile Guidance Radar Market research report is 2023-2030.

Lockheed Martin (US), Raytheon Technologies (US), Northrop Grumman (US), L3Harris Technologies (US), BAE Systems (US), General Electric Aviation (US), Honeywell Aerospace (US), Thales Group (France), MBDA France (France), Leonardo SpA (Italy), Airbus Defence and Space (Germany), Saab AB (Sweden), Indra Sistemas (Spain), Selex ES (Italy), Almaz-Antey (Russia), Bharat Electronics Limited (India), Hanwha Systems (South Korea), Mitsubishi Electric Corporation (Japan), China Electronics Technology Group Corporation (China), Norinco (China), Rafael Advanced Defense Systems (Israel), IAI (Israel Aerospace Industries) (Israel), Elta Systems (Israel), Aselsan (Turkey), Denel Land Systems (South Africa) and Other Major Players.

The Missile Guidance Radar Market is segmented into Type, Technology, Frequency, Range, End-User, and region. By Type, the market is categorized into Surface-to-Surface Missiles (SSM), Surface-to-Air Missiles (SAM), Air-to-Air Missiles (AAM), and Air-to-Surface Missiles (ASM). By Technology, the market is categorized into Pulse Radars, Continuous Wave Radars, and Active Electronically Scanned Arrays (AESAs). By Frequency, the market is categorized into X-Band, Ku-Band, Ka-Band, and Millimeter Wave. By Range, the market is categorized into less than 20, 20 km to 150 km, and Over 150 km. By End-User, the market is categorized into Defense Departments and Space Agencies. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Missile Guidance Radar is a specialized radar system used to track and guide missiles during various stages of flight. A Missile Guidance Radar's primary functions include detecting the target, tracking its movement, and sending guidance commands to the missile to ensure precise navigation to its intended destination

Missile Guidance Radar Market Size Was Valued at USD 802.45 Million in 2022 and is Projected to Reach USD 1158.75 Million by 2030, Growing at a CAGR of 4.7 % From 2023-2030.