Marine Big Data Market Synopsis

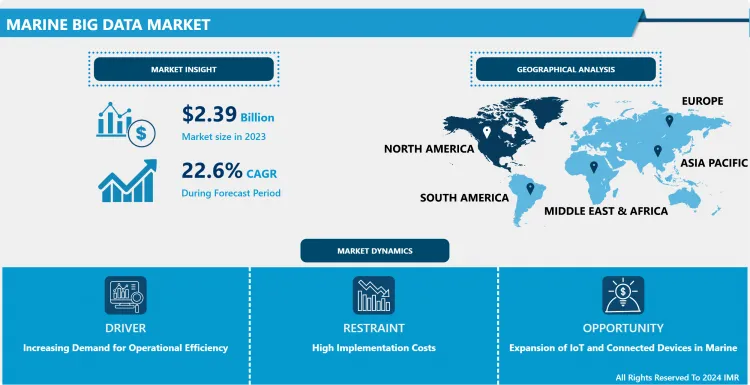

Marine Big Data Market Size is Valued at USD 2.39 Billion in 2023, and is Projected to Reach USD 12.22 Billion by 2032, Growing at a CAGR of 22.60% From 2024-2032.

Marine Big Data Market is further defined as the subset of the market that is involved in the acquisition, management, and analysis of large quantities of information associated with marine operations including shipping, fishing, and offshore oil and drilling. This market includes technologies and methods that to help decision makers improve the functionality and sustainability of operations in marine environments, while also adhering to regulatory requirements.

- Marine Big Data Market research shows that to meet the need of increasing operating efficiency, maritime companies are driving the market. Increasing costs of fuel and growing regulatory concerns have forced organizations to invest in big data space to obtain insights in the right management of their operations. Integrating this data from multiple sources such as sensors on the ships and environmental monitoring systems to this structure provides the companies with valuable insights in order to bring about cost effective solutions and productivity improvements.

- The other is the increasing concerns towards sustainable and environmental friendly practices in the marine industry. Following the current trend of increasing regulation and greater emphasis from stakeholders on the environmental cost of operations, marine operators are now turning to big data for solutions to measure and reduce their environmental issues. Big data analysis will allow finding solutions to such problems as emissions, waste treatment, and assessing the effects of sea activities on the environment, which will lead to sustainable changes.

Marine Big Data Market Trend Analysis

Increasing adoption of artificial intelligence (AI) and machine learning technologies.

- Artificial intelligence and machine learning technologies are becoming prominent trends of the Marine Big Data Market. These tools are then empowering maritime businessmen to extract even larger qualitative value from the data they collect; for the improvement of effective decision making procedures such as that which underpins predictive analytics. This trend is making operational processes to become more efficient, make safety measures to be easily implemented, and minimal disruptions to happen in marine operations.

- Also, the increased adoption of IoT devices for Marine application is contributing to the growth of the Marine Big Data Market. Conveyor IoT systems are streaming real time data, ranging from the status of the vessel down to the weather and oceanographic conditions which are crucial in navigation, or the schedule for maintenance and significantly in enhancing safety features. Deer is making the marine environment more connected and making efficient use of data.

Developing Predictive Maintenance Solutions.

- The Marine Big Data Market has great possibilities for the new opportunities and expansion, especially in establishing accurate predictive maintenance systems. There are always specific conditions at which maintenance is required and by such assessment, one is able to identify when it is required without having to wait for failure occurrences which not only affect the lifespan of the assets but also the entire company’s performance. This kind of approach not only supports cost effective, but also the dependability of marine operation, which gives a large advantage over the competitors.

- The second area involves new services associated with environmental control and monitoring that has a potential for expansion. With the raise of conscience in ecological problems in the world, the desire of clients to use services that allow marine operators to navigate regulatory requirements and reduce environmental impacts also increases. There will be great business opportunities for those firms developing big data solutions for emissions monitoring, marine ecosystem evaluation, and climate change impact analysis.

Marine Big Data Market Segment Analysis:

Marine Big Data Market Segmented on the basis of Component, application, and end-users.

By Component, Services segment is expected to dominate the market during the forecast period

- The Marine Big Data Market component segmentation is further based on hardware, software, and services all are important in the ecosystem. Hardware encompasses tangible elements needed for data acquisition and analysis, including sensors, servers, networking devices required for live data acquisition from ships and seas. Software covers tools for data analysis and systems that support the interpretation of the results as helpful for improving organizational functions and meeting compliance requirements. Supports are the various propositions that are existent to help the organizations to manage and implement their big data solutions in an efficient manner inclusive of consulting, system integration, and maintenance among others. Such components make a rounded structure that forms the basis for the application of big data in the marine industry.

By Application, Predictive Maintenance segment held the largest share in 2024

- The Marine Big Data Market is segmented by application into several key areas: s includes predictive maintenance, fleet management and planning, voyage optimization, risk management and environmental management. The primary difference between Preventative and Predictive maintenance is that the latter relies on data analysis to estimate the time in advance a certain piece of equipment will fail and thus will enable planned maintenance and reduce possibility of equipment breakdowns. Fleet management concerns itself with the best ways of utilising the vessels, ensuring the improvement of the operational effectiveness by using real-time consideration of activities and status of the fleet.

- Voyage optimization is a concept which focuses on how best to plan its voyage, and how to avoid incidents which may lead to wastage of time and fuel. Risk management use risk analysis in a maritime setting and analyze some of the risks surrounding the operations in order to enhance safety. In its last component, environmental monitoring aims at monitoring ecological effects, legal compliance and advocating for environmental friendly practices in the marine industry. In so doing, these applications empower big data to boost decision-making and performance for the maritime sector.

Marine Big Data Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has emerged as the leading region within the Marine Big Data Market that is majorly governed by the presence of a significant number of marine shipping and logistics industries in this region and an established technological platform. The application of big data analytics in the marine industry has been most actively implemented in the United States due to its strong economy and experience in the use of new technologies.

- Due to a deeper focus on investing in technology as well as a focus on boosting efficacy, North America has embraced the market aggressively. Moreover, the rules and regulations of the North American countries support the integration of sophisticated data analysis solutions. Due to intense regulation of the environmental costs and safe operations at sea, marine organizations have no choice but to incorporate big data systems into their business environment. This dynamic is not only creating expansion in the region but also standards for the global marine industry.

Active Key Players in the Marine Big Data Market

- IBM (United States)

- Microsoft (United States)

- SAP (Germany)

- Oracle (United States)

- MarineTraffic (Greece)

- Kongsberg Gruppen (Norway)

- Wärtsilä (Finland)

- DNV GL (Norway)

- ExactEarth (Canada)

- Inmarsat (United Kingdom)

- Others

|

Global Marine Big Data Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.60 % |

Market Size in 2032: |

USD 12.22 Bn. |

|

Segments Covered: |

By component |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Marine Big Data Market by Component

4.1 Marine Big Data Market Snapshot and Growth Engine

4.2 Marine Big Data Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hardware: Geographic Segmentation Analysis

4.4 Software

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Software: Geographic Segmentation Analysis

4.5 Services

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Services: Geographic Segmentation Analysis

Chapter 5: Marine Big Data Market by Application

5.1 Marine Big Data Market Snapshot and Growth Engine

5.2 Marine Big Data Market Overview

5.3 Predictive Maintenance

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Predictive Maintenance: Geographic Segmentation Analysis

5.4 Fleet Management

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Fleet Management: Geographic Segmentation Analysis

5.5 Voyage Optimization

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Voyage Optimization: Geographic Segmentation Analysis

5.6 Risk Management

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Risk Management: Geographic Segmentation Analysis

5.7 Environmental Monitoring

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Environmental Monitoring: Geographic Segmentation Analysis

Chapter 6: Marine Big Data Market by End-User

6.1 Marine Big Data Market Snapshot and Growth Engine

6.2 Marine Big Data Market Overview

6.3 Shipping Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Shipping Companies: Geographic Segmentation Analysis

6.4 Marine Transportation

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Marine Transportation: Geographic Segmentation Analysis

6.5 Oil & Gas Industry

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Oil & Gas Industry: Geographic Segmentation Analysis

6.6 Fisheries

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Fisheries: Geographic Segmentation Analysis

6.7 Government Agencies

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Government Agencies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Marine Big Data Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 IBM (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MICROSOFT (UNITED STATES)

7.4 SAP (GERMANY)

7.5 ORACLE (UNITED STATES)

7.6 MARINETRAFFIC (GREECE)

7.7 KONGSBERG GRUPPEN (NORWAY)

7.8 WÄRTSILÄ (FINLAND)

7.9 DNV GL (NORWAY)

7.10 EXACTEARTH (CANADA)

7.11 INMARSAT (UNITED KINGDOM)

7.12 OTHERS

Chapter 8: Global Marine Big Data Market By Region

8.1 Overview

8.2. North America Marine Big Data Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Component

8.2.4.1 Hardware

8.2.4.2 Software

8.2.4.3 Services

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Predictive Maintenance

8.2.5.2 Fleet Management

8.2.5.3 Voyage Optimization

8.2.5.4 Risk Management

8.2.5.5 Environmental Monitoring

8.2.6 Historic and Forecasted Market Size By End-User

8.2.6.1 Shipping Companies

8.2.6.2 Marine Transportation

8.2.6.3 Oil & Gas Industry

8.2.6.4 Fisheries

8.2.6.5 Government Agencies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Marine Big Data Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Component

8.3.4.1 Hardware

8.3.4.2 Software

8.3.4.3 Services

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Predictive Maintenance

8.3.5.2 Fleet Management

8.3.5.3 Voyage Optimization

8.3.5.4 Risk Management

8.3.5.5 Environmental Monitoring

8.3.6 Historic and Forecasted Market Size By End-User

8.3.6.1 Shipping Companies

8.3.6.2 Marine Transportation

8.3.6.3 Oil & Gas Industry

8.3.6.4 Fisheries

8.3.6.5 Government Agencies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Bulgaria

8.3.7.2 The Czech Republic

8.3.7.3 Hungary

8.3.7.4 Poland

8.3.7.5 Romania

8.3.7.6 Rest of Eastern Europe

8.4. Western Europe Marine Big Data Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Component

8.4.4.1 Hardware

8.4.4.2 Software

8.4.4.3 Services

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Predictive Maintenance

8.4.5.2 Fleet Management

8.4.5.3 Voyage Optimization

8.4.5.4 Risk Management

8.4.5.5 Environmental Monitoring

8.4.6 Historic and Forecasted Market Size By End-User

8.4.6.1 Shipping Companies

8.4.6.2 Marine Transportation

8.4.6.3 Oil & Gas Industry

8.4.6.4 Fisheries

8.4.6.5 Government Agencies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 Netherlands

8.4.7.5 Italy

8.4.7.6 Russia

8.4.7.7 Spain

8.4.7.8 Rest of Western Europe

8.5. Asia Pacific Marine Big Data Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Component

8.5.4.1 Hardware

8.5.4.2 Software

8.5.4.3 Services

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Predictive Maintenance

8.5.5.2 Fleet Management

8.5.5.3 Voyage Optimization

8.5.5.4 Risk Management

8.5.5.5 Environmental Monitoring

8.5.6 Historic and Forecasted Market Size By End-User

8.5.6.1 Shipping Companies

8.5.6.2 Marine Transportation

8.5.6.3 Oil & Gas Industry

8.5.6.4 Fisheries

8.5.6.5 Government Agencies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Marine Big Data Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Component

8.6.4.1 Hardware

8.6.4.2 Software

8.6.4.3 Services

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Predictive Maintenance

8.6.5.2 Fleet Management

8.6.5.3 Voyage Optimization

8.6.5.4 Risk Management

8.6.5.5 Environmental Monitoring

8.6.6 Historic and Forecasted Market Size By End-User

8.6.6.1 Shipping Companies

8.6.6.2 Marine Transportation

8.6.6.3 Oil & Gas Industry

8.6.6.4 Fisheries

8.6.6.5 Government Agencies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkey

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Marine Big Data Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Component

8.7.4.1 Hardware

8.7.4.2 Software

8.7.4.3 Services

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Predictive Maintenance

8.7.5.2 Fleet Management

8.7.5.3 Voyage Optimization

8.7.5.4 Risk Management

8.7.5.5 Environmental Monitoring

8.7.6 Historic and Forecasted Market Size By End-User

8.7.6.1 Shipping Companies

8.7.6.2 Marine Transportation

8.7.6.3 Oil & Gas Industry

8.7.6.4 Fisheries

8.7.6.5 Government Agencies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Marine Big Data Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.60 % |

Market Size in 2032: |

USD 12.22 Bn. |

|

Segments Covered: |

By component |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Marine Big Data Market research report is 2024-2032.

IBM (United States), Microsoft (United States), SAP (Germany), Oracle (United States), MarineTraffic (Greece), Kongsberg Gruppen (Norway), Wärtsilä (Finland), DNV GL (Norway), ExactEarth (Canada), Inmarsat (United Kingdom) and Other Major Players.

The Marine Big Data Market is segmented into by Component (Hardware, Software, Services), By Application (Predictive Maintenance, Fleet Management, Voyage Optimization, Risk Management, Environmental Monitoring), End-User (Shipping Companies, Marine Transportation, Oil & Gas Industry, Fisheries, Government Agencies). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Marine Big Data Market is further defined as the subset of the market that is involved in the acquisition, management, and analysis of large quantities of information associated with marine operations including shipping, fishing, and offshore oil and drilling. This market includes technologies and methods that to help decision makers improve the functionality and sustainability of operations in marine environments, while also adhering to regulatory requirements.

Marine Big Data Market Size is Valued at USD 2.39 Billion in 2023, and is Projected to Reach USD 12.22 Billion by 2032, Growing at a CAGR of 22.60% From 2024-2032.