Global DevSecOps Market Overview

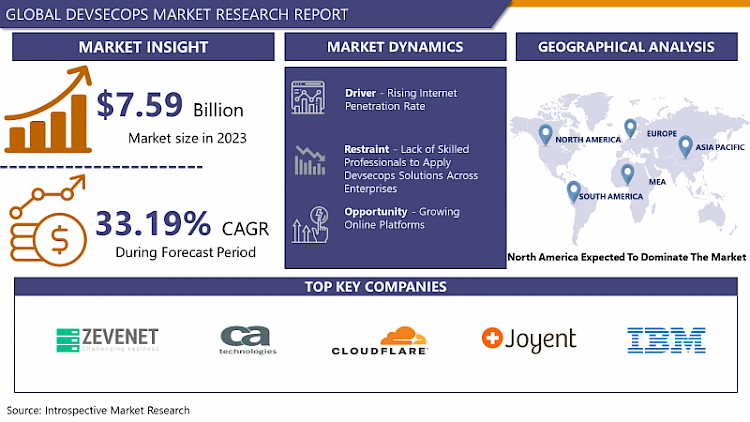

The Global DevSecOps Market size is expected to grow from USD 7.59 billion in 2023 to USD 100.11 billion by 2032, at a CAGR of 33.19% during the forecast period (2024-2032).

DevOps includes software development methods that make operations and interactions in software development more efficient. Automation can shorten the systems development life cycle by distributing updates, features, and patches/fixes at a higher frequency. Conversely, DevSecOps is about incorporating security practices into DevOps. The acronym stands for operations, security, and development. In an agile setting, the priority is to generate creative solutions for challenging software development procedures.

DevSecOps focuses on improving customer results and mission worth through. Automating, monitoring, and implementing security across every phase of the software development lifecycle. Participating in DevSecOps requires a range of specific tools and a variety of tasks. Rely on these instruments. This document elaborates on the interconnectedness of each phase in DevSecOps. Categorization of tools that help in a particular step, along with the variety of tasks that occur in each stage associated with the tool that supports the task. By including security testing throughout the entire software development life cycle, DevSecOps helps identify and fix security flaws early. This can help prevent costly security breaches. Automating security testing with DevSecOps can speed up the software delivery process. DevSecOps promotes strong teamwork between development, security, and operations groups. This can help break down barriers and improve communication. Discovering security vulnerabilities earlier through DevSecOps can result in reduced costs for addressing issues.

Key Factors And Market Dynamic In DevSecOps Market

Drivers:

Improved, proactive security

DevSecOps starts the development cycle with cybersecurity processes in place. The code is reviewed, audited, scanned, and tested for security concerns throughout the development cycle. As soon as these issues are detected, they are addressed. Before adding more dependencies, security issues are addressed. When protective technology is identified and applied early in the cycle, security vulnerabilities become less expensive to resolve. Furthermore, increased collaboration across development, security, and operations teams enhances an organization's response time to incidences and problems. DevSecOps practices shorten the time it takes to patch vulnerabilities, allowing security teams to focus on other important tasks. These practices also ensure and simplify compliance, avoiding the need to retrofit application development projects for security thus, strengthening the expansion of the DevSecOps market.

Automation compatible with modern development

If a firm employs a continuous integration/continuous delivery pipeline to deploy its software, cybersecurity testing can be integrated into an automated test suite for operations teams. Security check automation is heavily influenced by project and organizational goals. Automated testing can verify that incorporated software dependencies have been patched to the right levels and that security unit testing has been completed successfully. It may also verify and secure code using static and dynamic analysis before releasing it to production, therefore, boosting the expansion of the DevSecOps market during the projected timeframe.

Restraints:

Difficult to find design vulnerabilities

The DevSecOps methodology is largely based on the Agile system and employs many of its techniques, with one of the agile development method's main principles being is to focus on generating the initial app as fast as possible. This is because the app is improved based on client feedback. As a result, developers do not create documentation throughout the early stages of the development process. Furthermore, the app developers do not create a design before beginning development. As a result, identifying design flaws is becoming increasingly difficult and time-consuming thereby, hampering the expansion of the DevSecOps market over the projected timeframe.

Opportunities:

Connected Cars

With most new models featuring wireless Apple CarPlay or Android Auto, AUX cords are nearly obsolete. Malicious actors will target hyperconnected cars since they can hold large amounts of valuable data captured by cameras, lasers, and other sensors for ransom. The demand for smart car data is already significant, and supply is keeping up; Toyota estimates that connected cars will generate 10 exabytes of data per month. To secure and future-proof connected cars, a solid vendor partnership is essential. Initiatives like the Mobility in Harmony (MIH) Consortium's Open EV Software Platform, backed by Arm, Microsoft, and Trend Micro, are laying the groundwork for the car industry to establish a specific operating system for smart vehicles. As the number of connected cars is expected to reach 400 million by 2025 (Statista), the demand for data security will also increase thus, creating a lucrative opportunity for the market players.

Market Segmentation

Segmentation Analysis of DevSecOps Market:

By Component, the services segment is anticipated to lead the growth of the DevSecOps market during the projected period. This segment is anticipated to register a CAGR of 34.4% over the forecast period. The purpose of employing DevSecOps services is to patch holes between IT and security while ensuring that code is delivered safely and quickly. It is possible to remedy the holes at an early stage and a low cost by integrating the Static Application Security Testing (SAST) and Dynamic Application Security Testing (DAST) tools into the Continuous Delivery procedures. thus, supporting the development of the segment.

By Security, the cloud segment is predicted to dominate the DevSecOps market. The majority of prominent companies strive to provide high-performance, highly-scalable digital services that are built on tailored modern architectures. Modern architecture models are being built on a stack of advanced tiers, technologies, and microservices, backed by market-leading cloud platforms like AWS, GCP, and Azure. Above and beyond all of these modern services, security remains a major issue for the majority of them. DevSecOps for Cloud Security is a quite certain way to solve the problem thus, propelling the growth of the segment in the forecasted timeframe.

By Industry Vertical, the BFSI sector is projected to have the lion's share of the DevSecOps market over the projected period. Companies in the banking sector are experiencing a variety of digital transformation projects, which, while necessary to remain competitive, can also cause issues. If not addressed, using new application design methodologies and navigating cloud migrations might result in intelligence gaps, threatening the security and reliability of all digital banking services. These issues can be mitigated with the usage of DevSecOps as well it can help the banking sector to detect the errors way before they arise thus, strengthening the development of the segment.

Regional Analysis of DevSecOps Market:

The North American region is anticipated to have the highest share of the DevSecOps market over the forecast period attributed to the growing cyber security concern. Companies were compelled to migrate to the cloud, due to the fast shift to the work-from-home (WFH) model. According to Gartner, global cloud services investment would exceed USD 482 billion in 2022, up 54% from 2020. Cybercriminals will undoubtedly transfer their attacks to the cloud as their spending and users rise. To prevent cloud breaches, tech companies are investing heavily. IBM, Microsoft, Oracle, Amazon, Block, Apple, Facebook, and Alphabet are some of the tech giants headquartered in the United States. To prevent cybercrimes these market giants are developing innovative DevSecOps solutions thus, propelling the growth of the market in this region.

The European region is anticipated to have the second-highest share of the DevSecOps market during the projected timeframe. Industry 4.0 revolution compelled industries to automate most of the manufacturing as well as other processes. The automation resulted in the integration of sensors and other IoT devices. The data generated by these devices was mainly stored on the cloud as it eliminates the expenses on hardware storage options. To protect the data stored on the cloud, service providers started utilizing DevSecOps thus, boosting the growth of the market in this region.

The DevSecOps market in the Asia-Pacific region is anticipated to develop at the highest CAGR during the forecasted timeframe attributed to the developing IT sector. The growing IT sector and the integration of digital services by banking institutions are the two main factors stimulating the high growth of the DevSecOps market. As the integration of technology increases the demand for the secure transmission of data also rises. The data generated by the banking sector is highly sensitive and any loss of data may pose a threat thus, the banking sector is investing heavily in DevSecOps to secure data. The IT sector utilizes DevSecOps to test the functioning of the newly developed application and to resolve the issue even before it rises thus, strengthening the development of the market in this region.

Players Covered In DevSecOps Market are:

- Zevenet (Spain)

- CA Technologies (US)

- Cloudflare Inc. (US)

- Joyent (US)

- IBM (US)

- Synopsys (US)

- Microsoft (US)

- Inlab Software (Germany)

- Google (US)

- Dome9 (US)

- Riverbed Technologies (US)

- MicroFocus (UK)

- Fastly (US)

- Avi Networks (US)

- Dialogic (US)

- Array Networks (US)

- keyfactor (US)

- Nous Infosystems (US) and other major players.

Recent Industry Developments in DevSecOps Market

- In March 2024, Microsoft Corp. is partnering with NVIDIA to leverage generative AI, cloud computing, and advanced computing capabilities in healthcare and life sciences organizations. The partnership will combine Microsoft Azure's global scale, security, and advanced computing capabilities with NVIDIA DGX Cloud and NVIDIA Clara suite of computing platforms, software, and services. The goal is to accelerate clinical research, enhance medical image-based diagnostic technology, and increase access to precision medicine.

- In August 2023, Synopsys, Inc. announced the details around two new collaboration agreements with NowSecure, recognized experts in mobile security and privacy, and Secure Code Warrior, provider of the leading agile learning platform for developer-driven security, to expand its Software Integrity Group’s industry-leading portfolio of application security testing (AST) solutions.

|

Global DevSecOps Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 7.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

33.19% |

Market Size in 2032: |

USD 100.11 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Enterprise Size |

|

||

|

By Deployment Type |

|

||

|

By Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Component

3.2 By Enterprise Size

3.3 By Deployment Type

3.4 By Verticals

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: DevSecOps Market by Component

5.1 DevSecOps Market Overview Snapshot and Growth Engine

5.2 DevSecOps Market Overview

5.3 Solution

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Solution: Grographic Segmentation

5.4 Service

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Service: Grographic Segmentation

Chapter 6: DevSecOps Market by Enterprise Size

6.1 DevSecOps Market Overview Snapshot and Growth Engine

6.2 DevSecOps Market Overview

6.3 SMEs

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 SMEs: Grographic Segmentation

6.4 Large Enterprises

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Large Enterprises: Grographic Segmentation

Chapter 7: DevSecOps Market by Deployment Type

7.1 DevSecOps Market Overview Snapshot and Growth Engine

7.2 DevSecOps Market Overview

7.3 On-premise

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 On-premise: Grographic Segmentation

7.4 Cloud

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Cloud: Grographic Segmentation

Chapter 8: DevSecOps Market by Verticals

8.1 DevSecOps Market Overview Snapshot and Growth Engine

8.2 DevSecOps Market Overview

8.3 IT

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 IT: Grographic Segmentation

8.4 BFSI

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 BFSI: Grographic Segmentation

8.5 Government & Public Sector

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Government & Public Sector: Grographic Segmentation

8.6 Media & Entertainment

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Media & Entertainment: Grographic Segmentation

8.7 Healthcare

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2016-2028F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Healthcare: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 DevSecOps Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 DevSecOps Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 DevSecOps Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 ZEVENET

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 CA TECHNOLOGIES

9.4 CLOUDFLARE INC.

9.5 JOYENT

9.6 IBM

9.7 SYNOPSYS

9.8 MICROSOFT

9.9 INLAB SOFTWARE

9.10 GOOGLE

9.11 DOME9

9.12 RIVERBED TECHNOLOGIES

9.13 MICROFOCUS

9.14 FASTLY

9.15 AVI NETWORKS

9.16 DIALOGIC

9.17 ARRAY NETWORKS

9.18 KEYFACTOR

9.19 NOUS INFOSYSTEMS

9.20 OTHER MAJOR PLAYERS

Chapter 10: Global DevSecOps Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Component

10.2.1 Solution

10.2.2 Service

10.3 Historic and Forecasted Market Size By Enterprise Size

10.3.1 SMEs

10.3.2 Large Enterprises

10.4 Historic and Forecasted Market Size By Deployment Type

10.4.1 On-premise

10.4.2 Cloud

10.5 Historic and Forecasted Market Size By Verticals

10.5.1 IT

10.5.2 BFSI

10.5.3 Government & Public Sector

10.5.4 Media & Entertainment

10.5.5 Healthcare

Chapter 11: North America DevSecOps Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Component

11.4.1 Solution

11.4.2 Service

11.5 Historic and Forecasted Market Size By Enterprise Size

11.5.1 SMEs

11.5.2 Large Enterprises

11.6 Historic and Forecasted Market Size By Deployment Type

11.6.1 On-premise

11.6.2 Cloud

11.7 Historic and Forecasted Market Size By Verticals

11.7.1 IT

11.7.2 BFSI

11.7.3 Government & Public Sector

11.7.4 Media & Entertainment

11.7.5 Healthcare

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe DevSecOps Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Component

12.4.1 Solution

12.4.2 Service

12.5 Historic and Forecasted Market Size By Enterprise Size

12.5.1 SMEs

12.5.2 Large Enterprises

12.6 Historic and Forecasted Market Size By Deployment Type

12.6.1 On-premise

12.6.2 Cloud

12.7 Historic and Forecasted Market Size By Verticals

12.7.1 IT

12.7.2 BFSI

12.7.3 Government & Public Sector

12.7.4 Media & Entertainment

12.7.5 Healthcare

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific DevSecOps Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Component

13.4.1 Solution

13.4.2 Service

13.5 Historic and Forecasted Market Size By Enterprise Size

13.5.1 SMEs

13.5.2 Large Enterprises

13.6 Historic and Forecasted Market Size By Deployment Type

13.6.1 On-premise

13.6.2 Cloud

13.7 Historic and Forecasted Market Size By Verticals

13.7.1 IT

13.7.2 BFSI

13.7.3 Government & Public Sector

13.7.4 Media & Entertainment

13.7.5 Healthcare

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa DevSecOps Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Component

14.4.1 Solution

14.4.2 Service

14.5 Historic and Forecasted Market Size By Enterprise Size

14.5.1 SMEs

14.5.2 Large Enterprises

14.6 Historic and Forecasted Market Size By Deployment Type

14.6.1 On-premise

14.6.2 Cloud

14.7 Historic and Forecasted Market Size By Verticals

14.7.1 IT

14.7.2 BFSI

14.7.3 Government & Public Sector

14.7.4 Media & Entertainment

14.7.5 Healthcare

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America DevSecOps Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Component

15.4.1 Solution

15.4.2 Service

15.5 Historic and Forecasted Market Size By Enterprise Size

15.5.1 SMEs

15.5.2 Large Enterprises

15.6 Historic and Forecasted Market Size By Deployment Type

15.6.1 On-premise

15.6.2 Cloud

15.7 Historic and Forecasted Market Size By Verticals

15.7.1 IT

15.7.2 BFSI

15.7.3 Government & Public Sector

15.7.4 Media & Entertainment

15.7.5 Healthcare

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global DevSecOps Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 7.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

33.19% |

Market Size in 2032: |

USD 100.11 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Enterprise Size |

|

||

|

By Deployment Type |

|

||

|

By Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DEVSECOPS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DEVSECOPS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DEVSECOPS MARKET COMPETITIVE RIVALRY

TABLE 005. DEVSECOPS MARKET THREAT OF NEW ENTRANTS

TABLE 006. DEVSECOPS MARKET THREAT OF SUBSTITUTES

TABLE 007. DEVSECOPS MARKET BY COMPONENT

TABLE 008. SOLUTION MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICE MARKET OVERVIEW (2016-2028)

TABLE 010. DEVSECOPS MARKET BY ENTERPRISE SIZE

TABLE 011. SMES MARKET OVERVIEW (2016-2028)

TABLE 012. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 013. DEVSECOPS MARKET BY DEPLOYMENT TYPE

TABLE 014. ON-PREMISE MARKET OVERVIEW (2016-2028)

TABLE 015. CLOUD MARKET OVERVIEW (2016-2028)

TABLE 016. DEVSECOPS MARKET BY VERTICALS

TABLE 017. IT MARKET OVERVIEW (2016-2028)

TABLE 018. BFSI MARKET OVERVIEW (2016-2028)

TABLE 019. GOVERNMENT & PUBLIC SECTOR MARKET OVERVIEW (2016-2028)

TABLE 020. MEDIA & ENTERTAINMENT MARKET OVERVIEW (2016-2028)

TABLE 021. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA DEVSECOPS MARKET, BY COMPONENT (2016-2028)

TABLE 023. NORTH AMERICA DEVSECOPS MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 024. NORTH AMERICA DEVSECOPS MARKET, BY DEPLOYMENT TYPE (2016-2028)

TABLE 025. NORTH AMERICA DEVSECOPS MARKET, BY VERTICALS (2016-2028)

TABLE 026. N DEVSECOPS MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE DEVSECOPS MARKET, BY COMPONENT (2016-2028)

TABLE 028. EUROPE DEVSECOPS MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 029. EUROPE DEVSECOPS MARKET, BY DEPLOYMENT TYPE (2016-2028)

TABLE 030. EUROPE DEVSECOPS MARKET, BY VERTICALS (2016-2028)

TABLE 031. DEVSECOPS MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC DEVSECOPS MARKET, BY COMPONENT (2016-2028)

TABLE 033. ASIA PACIFIC DEVSECOPS MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 034. ASIA PACIFIC DEVSECOPS MARKET, BY DEPLOYMENT TYPE (2016-2028)

TABLE 035. ASIA PACIFIC DEVSECOPS MARKET, BY VERTICALS (2016-2028)

TABLE 036. DEVSECOPS MARKET, BY COUNTRY (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA DEVSECOPS MARKET, BY COMPONENT (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA DEVSECOPS MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA DEVSECOPS MARKET, BY DEPLOYMENT TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA DEVSECOPS MARKET, BY VERTICALS (2016-2028)

TABLE 041. DEVSECOPS MARKET, BY COUNTRY (2016-2028)

TABLE 042. SOUTH AMERICA DEVSECOPS MARKET, BY COMPONENT (2016-2028)

TABLE 043. SOUTH AMERICA DEVSECOPS MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 044. SOUTH AMERICA DEVSECOPS MARKET, BY DEPLOYMENT TYPE (2016-2028)

TABLE 045. SOUTH AMERICA DEVSECOPS MARKET, BY VERTICALS (2016-2028)

TABLE 046. DEVSECOPS MARKET, BY COUNTRY (2016-2028)

TABLE 047. ZEVENET: SNAPSHOT

TABLE 048. ZEVENET: BUSINESS PERFORMANCE

TABLE 049. ZEVENET: PRODUCT PORTFOLIO

TABLE 050. ZEVENET: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CA TECHNOLOGIES: SNAPSHOT

TABLE 051. CA TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 052. CA TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 053. CA TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. CLOUDFLARE INC.: SNAPSHOT

TABLE 054. CLOUDFLARE INC.: BUSINESS PERFORMANCE

TABLE 055. CLOUDFLARE INC.: PRODUCT PORTFOLIO

TABLE 056. CLOUDFLARE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. JOYENT: SNAPSHOT

TABLE 057. JOYENT: BUSINESS PERFORMANCE

TABLE 058. JOYENT: PRODUCT PORTFOLIO

TABLE 059. JOYENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. IBM: SNAPSHOT

TABLE 060. IBM: BUSINESS PERFORMANCE

TABLE 061. IBM: PRODUCT PORTFOLIO

TABLE 062. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. SYNOPSYS: SNAPSHOT

TABLE 063. SYNOPSYS: BUSINESS PERFORMANCE

TABLE 064. SYNOPSYS: PRODUCT PORTFOLIO

TABLE 065. SYNOPSYS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. MICROSOFT: SNAPSHOT

TABLE 066. MICROSOFT: BUSINESS PERFORMANCE

TABLE 067. MICROSOFT: PRODUCT PORTFOLIO

TABLE 068. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. INLAB SOFTWARE: SNAPSHOT

TABLE 069. INLAB SOFTWARE: BUSINESS PERFORMANCE

TABLE 070. INLAB SOFTWARE: PRODUCT PORTFOLIO

TABLE 071. INLAB SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. GOOGLE: SNAPSHOT

TABLE 072. GOOGLE: BUSINESS PERFORMANCE

TABLE 073. GOOGLE: PRODUCT PORTFOLIO

TABLE 074. GOOGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. DOME9: SNAPSHOT

TABLE 075. DOME9: BUSINESS PERFORMANCE

TABLE 076. DOME9: PRODUCT PORTFOLIO

TABLE 077. DOME9: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. RIVERBED TECHNOLOGIES: SNAPSHOT

TABLE 078. RIVERBED TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 079. RIVERBED TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 080. RIVERBED TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. MICROFOCUS: SNAPSHOT

TABLE 081. MICROFOCUS: BUSINESS PERFORMANCE

TABLE 082. MICROFOCUS: PRODUCT PORTFOLIO

TABLE 083. MICROFOCUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. FASTLY: SNAPSHOT

TABLE 084. FASTLY: BUSINESS PERFORMANCE

TABLE 085. FASTLY: PRODUCT PORTFOLIO

TABLE 086. FASTLY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. AVI NETWORKS: SNAPSHOT

TABLE 087. AVI NETWORKS: BUSINESS PERFORMANCE

TABLE 088. AVI NETWORKS: PRODUCT PORTFOLIO

TABLE 089. AVI NETWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. DIALOGIC: SNAPSHOT

TABLE 090. DIALOGIC: BUSINESS PERFORMANCE

TABLE 091. DIALOGIC: PRODUCT PORTFOLIO

TABLE 092. DIALOGIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. ARRAY NETWORKS: SNAPSHOT

TABLE 093. ARRAY NETWORKS: BUSINESS PERFORMANCE

TABLE 094. ARRAY NETWORKS: PRODUCT PORTFOLIO

TABLE 095. ARRAY NETWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. KEYFACTOR: SNAPSHOT

TABLE 096. KEYFACTOR: BUSINESS PERFORMANCE

TABLE 097. KEYFACTOR: PRODUCT PORTFOLIO

TABLE 098. KEYFACTOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. NOUS INFOSYSTEMS: SNAPSHOT

TABLE 099. NOUS INFOSYSTEMS: BUSINESS PERFORMANCE

TABLE 100. NOUS INFOSYSTEMS: PRODUCT PORTFOLIO

TABLE 101. NOUS INFOSYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 102. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 103. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 104. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DEVSECOPS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DEVSECOPS MARKET OVERVIEW BY COMPONENT

FIGURE 012. SOLUTION MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 014. DEVSECOPS MARKET OVERVIEW BY ENTERPRISE SIZE

FIGURE 015. SMES MARKET OVERVIEW (2016-2028)

FIGURE 016. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 017. DEVSECOPS MARKET OVERVIEW BY DEPLOYMENT TYPE

FIGURE 018. ON-PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 019. CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 020. DEVSECOPS MARKET OVERVIEW BY VERTICALS

FIGURE 021. IT MARKET OVERVIEW (2016-2028)

FIGURE 022. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 023. GOVERNMENT & PUBLIC SECTOR MARKET OVERVIEW (2016-2028)

FIGURE 024. MEDIA & ENTERTAINMENT MARKET OVERVIEW (2016-2028)

FIGURE 025. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA DEVSECOPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE DEVSECOPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC DEVSECOPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA DEVSECOPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA DEVSECOPS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the DevSecOps Market research report is 2024-2032.

Zevenet (Spain), CA Technologies (US), Cloudflare Inc. (US), Joyent (US), IBM (US), Synopsys (US), Microsoft (US), Inlab Software (Germany), Google (US), Dome9 (US), Riverbed Technologies (US), MicroFocus (UK), Fastly (US), Avi Networks (US), Dialogic (US), Array Networks (US), and other major players.

The DevSecOps Market is segmented into Component, Enterprise Size, Deployment Type, Verticals, and region. By Component, the market is categorized into Solutions, Services. By Enterprise Size, the market is categorized into SMEs and Large Enterprises. By Deployment Type, the market is categorized into On-premise, Cloud. By Verticals, the market is categorized into IT, BFSI, Media & Entertainment, Government & Public Sector, Media & Entertainment, and Healthcare. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

DevSecOps is the short term for development, security, and operations. DevSecOps automates the integration of security at every stage of the software development lifecycle, from initial design to integration, testing, deployment, and software delivery. DevSecOps, like DevOps, is about culture and shared responsibility as much as it is about technology or tactics.

The Global DevSecOps Market size is expected to grow from USD 7.59 billion in 2023 to USD 100.11 billion by 2032, at a CAGR of 33.19% during the forecast period (2024-2032).