Global Industry 5.0 Market Overview:

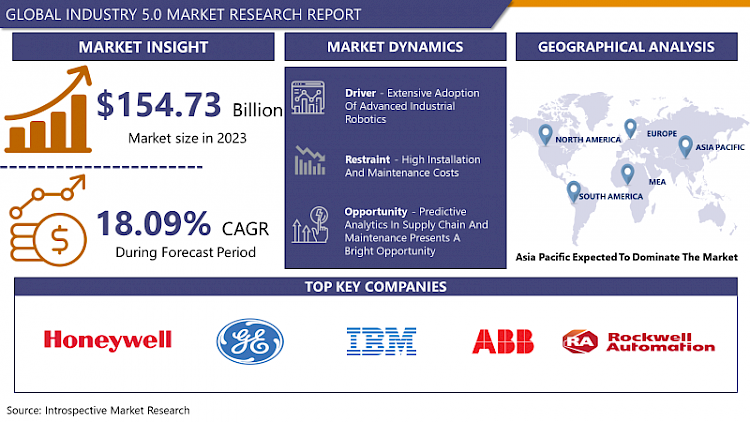

Industry 5.0 Market Size Was Valued at USD 154.73 Billion in 2023, and is Projected to Reach USD 691.02 Billion by 2032, Growing at a CAGR of 18.09% From 2024-2032

Industry 5.0 is a new manufacturing paradigm that places a premium on human-machine interaction. The rise of the digital industry preceded Industry 5.0 with innovations such as the Industrial Internet of Things or the merging of Artificial Intelligence and Big Data created a new form of technology that can provide firms with data-based knowledge. The objective of this phase of Industry 4.0 has been to reduce human participation as much as possible while prioritizing process automation. To some extent, humans have been forced to compete against robots, with the latter being pushed aside in a variety of situations. The tendency is reversing in Industry 5.0, intending to strike a balance where machine-human interaction can provide the most advantages. This approach provides businesses with the ability to produce more effectively, sustainably, and safely by combining the capabilities of more powerful machines with better-trained professionals. Industry 5.0 is a new way of thinking about manufacturing that has implications for productivity, economics, and business. As a result, enterprises that do not adapt their production to the factory 5.0 model will quickly become outdated, unable to take advantage of the competitive benefits it provides and expected to boost the Industry 5.0 Market.

Market Dynamics And Factors Of Industry 5.0 Market

Drivers:

Extensive Adoption Of Advanced Industrial Robotics

The rise of advanced technologies, such as the industrial internet of things (IIoT) and artificial intelligence, can be attributed to the market's growth, as these are essential for effective data collection, analysis, and feeding the gathered insights into the manufacturing process to create better products. Along with this, the globe is seeing an increase in demand for industrial processes that strike a good balance between automation and human interaction. As the industry 5.0 trend focuses on the collaboration of people and collaborative robots, this is projected to boost market development. None of the previous industrial revolutions, including Industry 4.0, had an environmental concern. Industry 5.0, on the other hand, permits the implementation of sustainable industrial practices including reduced waste creation and cost-cutting. As a consequence, it is expected to be a critical element shortly, providing profitable chances to the industry. The growing use of industrial robots in a variety of industries, growth in the number of linked devices, and rising government spending on industrialization are all expected to help the market grow. According to the International Federation of Robotics, 2.7 million industrial robots will be installed worldwide by 2021, a 12 percent increase over the previous year. Furthermore, the automobile industry was the greatest buyer of the device that year, accounting for 30% of all robot installations.

Restraints:

High Installation And Maintenance Costs

One of the pressing issues in industry 5.0 is high installation cost and maintenance costs. With the innovation in advanced robotics and high-performing sensors, the recurring cost is also high as the adoption rate of advanced robotics and high-performance sensors and software. As this new industrial revolution is at its early stage, less competition makes scares availability of such machines and components as well as regarding spares, maintenance, and operating technician. For small and medium-scale companies, high investment cost presents a major barrier that certainly impedes the growth of the Industry 5.0 market.

Opportunities:

Predictive Analytics In Supply Chain And Maintenance Presents A Bright Opportunity

Predictive maintenance is a new method to reduce maintenance downtown and improve production performance. It refers to predictive maintenance, as opposed to the current preventative maintenance. Smart sensors, IoT devices, and bespoke software aid in the early detection and prediction of potential faults. Only the machines that are most prone to break down will be halted for maintenance. Sustainability. Manufacturing in Industry 5.0 promises to use resources effectively and adapt to the present requirement. Flexible business models are the result of human-machine collaboration. As a result, waste and overproduction can be drastically minimized, if not eliminated. Local production and new jobs will also contribute to the long-term viability of local economies.

Predictive analytics in the supply chain presents a resourceful opportunity which expected to boost productivity overall. Finding or designing a mathematical model that works well when tested with historical data is a common task in supply chain predictive analytics. However, finding a technique to illustrate what you're learning in a degree of detail that accurately reflects reality might be difficult. In certain situations, simulation software can be useful. When systems are difficult to define mathematically or when data is unavailable for study, simulation can help. Simulations create dynamic models by describing the components of a system and their relationships, rather than representing the entire system as an expression. Running a simulation model evaluates the system's behavior, and simulation models can provide accurate predictions if they are tested to match the real world.

Challenges:

High Training And Development Costs For Specialized Equipment Handling

Training and development can be a major challenge as new technologies require a high level of understanding of the technology and hands-on experience to run it smoothly. Not many companies use advanced technology on a large scale, and even certain use is handled by specialized personnel with substantial experience. Hiring a skilled workforce for specialized jobs can be a challenging factor. New advanced robotics and sensors which improve the overall performance of the industrial process require heavy investment. Due to the use of high-end technology improving the performance with that, it also presents high background maintenance costs. New Cobot is highly-priced and involves expert engineers to work and fix situations if maintenance occurred in a non-routine schedule Training people for the new jobs is also the major challenge with new technology adaptability issue with the existing workforce. Some companies may find it difficult to upgrade their production lines for Industry 5.0. Even if money is not a problem, the rhythm of change could be. Those who cannot afford it or are too slow in adopting industry 5.0 may be left behind in the trend.

Segmentation Analysis Of Industry 5.0 Market

By Technology, the Industrial Robotics segment is expected to be dominating the Industry 5.0 market during the forecasted period. COVID-19 has a significant influence on 2020 globally, but it also provides an opportunity for modernization and digitization of industry on the road to recovery. The advantages of increased robot deployments in the long term are the same: The key motivators are quick manufacturing and delivery of customized items at cheap pricing. Manufacturers can maintain production in developed economies - or re-shore it - without compromising cost-effectiveness thanks to automation. The United States is the Americas' largest industrial robot user, with a new operating stock record of roughly 293.200 units, up 7%. Mexico comes in second with 40,300 units, an increase of 11%, followed by Canada with 28,600 units, an increase of 2%. Human-robot cooperation is becoming more popular. The number of co-bots installed increased by 11%. In contrast to the overall trend with traditional industrial robots in 2019, this dynamic sales performance stood out. As more companies provide collaborative robots and the number of applications available expands.

By End-User Vertical, the Manufacturing segment is expected to dominate in the Industry 5.0 Market. The manufacturing sector is the most potential area to implement industry 5.0 elements. To boost efficiency and reduce resources wastage, manufacturing plant management is one of the essential factors which got solved by elements from industry 5.0, such as industrial robotics, machine sensors, high-performance software, Integration of AI, ML, and Digital Twin. In that regard, Intelligent Plant Process Management is game-changing connect falls under industry 5.0 A safe and efficient plant is ensured when machine data is harmonized with human context. This necessitates a well-managed communications mechanism like PPM, which can be deployed across an organization regardless of the sophistication of their local IoT systems. PPM's capacity to acquire and analyze data at any stage in the production process is a critical feature. At intervals such as shift handover or inspection processes, knowledge is gathered from workers involved in the manufacturing process. The process information is instantly given to all constituencies in the manufacturing process, from the plant floor to the higher echelons of the organization, after it has been digitally documented, ensuring total transparency for everyone. Hence, the segment's growth is expected to boost the overall Industry 5.0 market globally.

Regional Analysis Of Industry 5.0 Market

The Asia Pacific is dominating the Industry 5.0 market and excels during the forecasted period. The majority of the share in the market is held by China with the largest industrial robotics installation in the last five years. The development of robot density in China is the most dynamic in the world: the density rate increased from 49 units in 2015 to 246 units in 2020, owing to a considerable increase in robot installations. China's robot density is now ranked 9th in the world, up from 25th just five years ago. The Republic of Korea has a maximum robot density that is seven times higher than the world average (932 units per 10,000 workers). In 2020, Singapore is ranked second, with 605 robots per 10,000 employees. In the industrial business, Japan ranked third in the world in 2020, with 390 robots installed per 10,000 employees. In addition, the growing digitization of manufacturing in India, Bangladesh, Vietnam, and Malaysia is fueling the expansion of the Industry 5.0 market.

North America is expected to be dominating the Industry 5.0 Market. North America is the largest user of advanced industrial robotics as well as a practitioner of such new technologies in its manufacturing sector. Most of the major manufacturing hubs in the United States have gone completely digital with highly integrated robotics and sensors which allowed them to reduce wastage and increase productivity. North America region is highly lucrative for industrial automated robots. With 33,300 units shipped, sales are still at an all-time high, ranking as the second-best of all time. The majority of robots in the United States come from Japan and Europe. Although there aren't many robot producers in North America, there are a lot of prominent robot system integrators. Mexico comes in second in North America with about 4,600 units, a 20 percent decrease. In Canada, sales are up 1% to over 3,600 shipping units, a new high. The United States is the Americas' largest industrial robot user, with a new operating stock record of roughly 293.200 units, up 7%. Mexico comes in second with 40,300 units, an increase of 11%, followed by Canada with 28,600 units, an increase of 2%.

Top Key Players Analyzed In Industry 5.0 Market:

- KUKA AG

- ENSAI INGENIERIA S.L.

- Siemens AG

- Rockwell Automation Inc.

- Schneider Electric

- ABB Ltd.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems

- Inc.

- General Electric Company and other major players.

Key Industry Developments in The Industry 5.0 Market

- In January 2024, Siemens unveiled innovations that are combining the real world and the digital worlds to redefine reality at the CES 2024 exhibition, the world’s leading technology gathering. Siemens announced the breakthroughs in AI and immersive engineering to enable the industrial metaverse and highlighted how these technologies are empowering the world’s innovators to thrive using its open digital business platform, Siemens Xcelerator.

- In May 2023, IBM, announced IBM Watsonx, a new AI and data platform to be released that will enable enterprises to scale and accelerate the impact of the most advanced AI with trusted data. Enterprises turning to AI need access to a full technology stack that enables them to train, tune, and deploy AI models, including foundation models and machine learning capabilities, across their organization with trusted data, speed, and governance - all in one place and to run across any cloud environment.

|

Global Industry 5.0 Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 154.73 Bn |

|

Forecast Period 2024-32 CAGR: |

18.09% |

Market Size in 2032: |

USD 691.02 Bn |

|

Segments Covered: |

By Technology |

|

|

|

By End-Use Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Technology

3.2 By End-Use

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Industry 5.0 Market by Technology

4.1 Industry 5.0 Market Overview Snapshot and Growth Engine

4.2 Industry 5.0 Market Overview

4.3 Industrial Robotics (Collaborative Robots

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Industrial Robotics (Collaborative Robots: Grographic Segmentation

4.4 SCARA Robots

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 SCARA Robots: Grographic Segmentation

4.5 and Others)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 and Others): Grographic Segmentation

4.6 Internet of Things (IoT)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Internet of Things (IoT): Grographic Segmentation

4.7 Cyber Security

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size (2016-2028F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Cyber Security: Grographic Segmentation

4.8 Advanced Human-Machine Interface (HMI)

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size (2016-2028F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Advanced Human-Machine Interface (HMI): Grographic Segmentation

4.9 3D Printing

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size (2016-2028F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 3D Printing: Grographic Segmentation

4.10 Big Data

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size (2016-2028F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Big Data: Grographic Segmentation

4.11 Cloud Computing

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size (2016-2028F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 Cloud Computing: Grographic Segmentation

4.12 Augmented Reality & Virtual Reality

4.12.1 Introduction and Market Overview

4.12.2 Historic and Forecasted Market Size (2016-2028F)

4.12.3 Key Market Trends, Growth Factors and Opportunities

4.12.4 Augmented Reality & Virtual Reality: Grographic Segmentation

4.13 Cognitive Computing

4.13.1 Introduction and Market Overview

4.13.2 Historic and Forecasted Market Size (2016-2028F)

4.13.3 Key Market Trends, Growth Factors and Opportunities

4.13.4 Cognitive Computing: Grographic Segmentation

4.14 Others

4.14.1 Introduction and Market Overview

4.14.2 Historic and Forecasted Market Size (2016-2028F)

4.14.3 Key Market Trends, Growth Factors and Opportunities

4.14.4 Others: Grographic Segmentation

Chapter 5: Industry 5.0 Market by End-Use

5.1 Industry 5.0 Market Overview Snapshot and Growth Engine

5.2 Industry 5.0 Market Overview

5.3 Healthcare

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Healthcare: Grographic Segmentation

5.4 Manufacturing

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Manufacturing: Grographic Segmentation

5.5 Automotive

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Automotive: Grographic Segmentation

5.6 Supply Chain Management

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Supply Chain Management: Grographic Segmentation

5.7 Electrical & Electronics Equipment

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Electrical & Electronics Equipment: Grographic Segmentation

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Grographic Segmentation

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Positioning

6.1.2 Industry 5.0 Sales and Market Share By Players

6.1.3 Industry BCG Matrix

6.1.4 Ansoff Matrix

6.1.5 Industry 5.0 Industry Concentration Ratio (CR5 and HHI)

6.1.6 Top 5 Industry 5.0 Players Market Share

6.1.7 Mergers and Acquisitions

6.1.8 Business Strategies By Top Players

6.2 KUKA AG

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Operating Business Segments

6.2.5 Product Portfolio

6.2.6 Business Performance

6.2.7 Key Strategic Moves and Recent Developments

6.2.8 SWOT Analysis

6.3 ENSAI INGENIERIA S.L.

6.4 SIEMENS AG

6.5 ROCKWELL AUTOMATION INC.

6.6 SCHNEIDER ELECTRIC

6.7 ABB LTD.

6.8 IBM CORPORATION

6.9 MICROSOFT CORPORATION

6.10 CISCO SYSTEMS INC.

6.11 GENERAL ELECTRIC COMPANY

Chapter 7: Global Industry 5.0 Market Analysis, Insights and Forecast, 2016-2028

7.1 Market Overview

7.2 Historic and Forecasted Market Size By Technology

7.2.1 Industrial Robotics (Collaborative Robots

7.2.2 SCARA Robots

7.2.3 and Others)

7.2.4 Internet of Things (IoT)

7.2.5 Cyber Security

7.2.6 Advanced Human-Machine Interface (HMI)

7.2.7 3D Printing

7.2.8 Big Data

7.2.9 Cloud Computing

7.2.10 Augmented Reality & Virtual Reality

7.2.11 Cognitive Computing

7.2.12 Others

7.3 Historic and Forecasted Market Size By End-Use

7.3.1 Healthcare

7.3.2 Manufacturing

7.3.3 Automotive

7.3.4 Supply Chain Management

7.3.5 Electrical & Electronics Equipment

7.3.6 Others

Chapter 8: North America Industry 5.0 Market Analysis, Insights and Forecast, 2016-2028

8.1 Key Market Trends, Growth Factors and Opportunities

8.2 Impact of Covid-19

8.3 Key Players

8.4 Key Market Trends, Growth Factors and Opportunities

8.4 Historic and Forecasted Market Size By Technology

8.4.1 Industrial Robotics (Collaborative Robots

8.4.2 SCARA Robots

8.4.3 and Others)

8.4.4 Internet of Things (IoT)

8.4.5 Cyber Security

8.4.6 Advanced Human-Machine Interface (HMI)

8.4.7 3D Printing

8.4.8 Big Data

8.4.9 Cloud Computing

8.4.10 Augmented Reality & Virtual Reality

8.4.11 Cognitive Computing

8.4.12 Others

8.5 Historic and Forecasted Market Size By End-Use

8.5.1 Healthcare

8.5.2 Manufacturing

8.5.3 Automotive

8.5.4 Supply Chain Management

8.5.5 Electrical & Electronics Equipment

8.5.6 Others

8.6 Historic and Forecast Market Size by Country

8.6.1 U.S.

8.6.2 Canada

8.6.3 Mexico

Chapter 9: Europe Industry 5.0 Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Technology

9.4.1 Industrial Robotics (Collaborative Robots

9.4.2 SCARA Robots

9.4.3 and Others)

9.4.4 Internet of Things (IoT)

9.4.5 Cyber Security

9.4.6 Advanced Human-Machine Interface (HMI)

9.4.7 3D Printing

9.4.8 Big Data

9.4.9 Cloud Computing

9.4.10 Augmented Reality & Virtual Reality

9.4.11 Cognitive Computing

9.4.12 Others

9.5 Historic and Forecasted Market Size By End-Use

9.5.1 Healthcare

9.5.2 Manufacturing

9.5.3 Automotive

9.5.4 Supply Chain Management

9.5.5 Electrical & Electronics Equipment

9.5.6 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 Germany

9.6.2 U.K.

9.6.3 France

9.6.4 Italy

9.6.5 Russia

9.6.6 Spain

Chapter 10: Asia-Pacific Industry 5.0 Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Technology

10.4.1 Industrial Robotics (Collaborative Robots

10.4.2 SCARA Robots

10.4.3 and Others)

10.4.4 Internet of Things (IoT)

10.4.5 Cyber Security

10.4.6 Advanced Human-Machine Interface (HMI)

10.4.7 3D Printing

10.4.8 Big Data

10.4.9 Cloud Computing

10.4.10 Augmented Reality & Virtual Reality

10.4.11 Cognitive Computing

10.4.12 Others

10.5 Historic and Forecasted Market Size By End-Use

10.5.1 Healthcare

10.5.2 Manufacturing

10.5.3 Automotive

10.5.4 Supply Chain Management

10.5.5 Electrical & Electronics Equipment

10.5.6 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 China

10.6.2 India

10.6.3 Japan

10.6.4 Southeast Asia

Chapter 11: South America Industry 5.0 Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Technology

11.4.1 Industrial Robotics (Collaborative Robots

11.4.2 SCARA Robots

11.4.3 and Others)

11.4.4 Internet of Things (IoT)

11.4.5 Cyber Security

11.4.6 Advanced Human-Machine Interface (HMI)

11.4.7 3D Printing

11.4.8 Big Data

11.4.9 Cloud Computing

11.4.10 Augmented Reality & Virtual Reality

11.4.11 Cognitive Computing

11.4.12 Others

11.5 Historic and Forecasted Market Size By End-Use

11.5.1 Healthcare

11.5.2 Manufacturing

11.5.3 Automotive

11.5.4 Supply Chain Management

11.5.5 Electrical & Electronics Equipment

11.5.6 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 Brazil

11.6.2 Argentina

Chapter 12: Middle East & Africa Industry 5.0 Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Technology

12.4.1 Industrial Robotics (Collaborative Robots

12.4.2 SCARA Robots

12.4.3 and Others)

12.4.4 Internet of Things (IoT)

12.4.5 Cyber Security

12.4.6 Advanced Human-Machine Interface (HMI)

12.4.7 3D Printing

12.4.8 Big Data

12.4.9 Cloud Computing

12.4.10 Augmented Reality & Virtual Reality

12.4.11 Cognitive Computing

12.4.12 Others

12.5 Historic and Forecasted Market Size By End-Use

12.5.1 Healthcare

12.5.2 Manufacturing

12.5.3 Automotive

12.5.4 Supply Chain Management

12.5.5 Electrical & Electronics Equipment

12.5.6 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Saudi Arabia

12.6.2 South Africa

Chapter 13 Investment Analysis

Chapter 14 Analyst Viewpoint and Conclusion

|

Global Industry 5.0 Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 154.73 Bn |

|

Forecast Period 2024-32 CAGR: |

18.09% |

Market Size in 2032: |

USD 691.02 Bn |

|

Segments Covered: |

By Technology |

|

|

|

By End-Use Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. INDUSTRY 5.0 MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. INDUSTRY 5.0 MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. INDUSTRY 5.0 MARKET COMPETITIVE RIVALRY

TABLE 005. INDUSTRY 5.0 MARKET THREAT OF NEW ENTRANTS

TABLE 006. INDUSTRY 5.0 MARKET THREAT OF SUBSTITUTES

TABLE 007. INDUSTRY 5.0 MARKET BY TECHNOLOGY

TABLE 008. INDUSTRIAL ROBOTICS (COLLABORATIVE ROBOTS MARKET OVERVIEW (2016-2028)

TABLE 009. SCARA ROBOTS MARKET OVERVIEW (2016-2028)

TABLE 010. AND OTHERS) MARKET OVERVIEW (2016-2028)

TABLE 011. INTERNET OF THINGS (IOT) MARKET OVERVIEW (2016-2028)

TABLE 012. CYBER SECURITY MARKET OVERVIEW (2016-2028)

TABLE 013. ADVANCED HUMAN-MACHINE INTERFACE (HMI) MARKET OVERVIEW (2016-2028)

TABLE 014. 3D PRINTING MARKET OVERVIEW (2016-2028)

TABLE 015. BIG DATA MARKET OVERVIEW (2016-2028)

TABLE 016. CLOUD COMPUTING MARKET OVERVIEW (2016-2028)

TABLE 017. AUGMENTED REALITY & VIRTUAL REALITY MARKET OVERVIEW (2016-2028)

TABLE 018. COGNITIVE COMPUTING MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. INDUSTRY 5.0 MARKET BY END-USE

TABLE 021. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 022. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 023. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 024. SUPPLY CHAIN MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 025. ELECTRICAL & ELECTRONICS EQUIPMENT MARKET OVERVIEW (2016-2028)

TABLE 026. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 027. NORTH AMERICA INDUSTRY 5.0 MARKET, BY TECHNOLOGY (2016-2028)

TABLE 028. NORTH AMERICA INDUSTRY 5.0 MARKET, BY END-USE (2016-2028)

TABLE 029. N INDUSTRY 5.0 MARKET, BY COUNTRY (2016-2028)

TABLE 030. EUROPE INDUSTRY 5.0 MARKET, BY TECHNOLOGY (2016-2028)

TABLE 031. EUROPE INDUSTRY 5.0 MARKET, BY END-USE (2016-2028)

TABLE 032. INDUSTRY 5.0 MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC INDUSTRY 5.0 MARKET, BY TECHNOLOGY (2016-2028)

TABLE 034. ASIA PACIFIC INDUSTRY 5.0 MARKET, BY END-USE (2016-2028)

TABLE 035. INDUSTRY 5.0 MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA INDUSTRY 5.0 MARKET, BY TECHNOLOGY (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA INDUSTRY 5.0 MARKET, BY END-USE (2016-2028)

TABLE 038. INDUSTRY 5.0 MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA INDUSTRY 5.0 MARKET, BY TECHNOLOGY (2016-2028)

TABLE 040. SOUTH AMERICA INDUSTRY 5.0 MARKET, BY END-USE (2016-2028)

TABLE 041. INDUSTRY 5.0 MARKET, BY COUNTRY (2016-2028)

TABLE 042. KUKA AG: SNAPSHOT

TABLE 043. KUKA AG: BUSINESS PERFORMANCE

TABLE 044. KUKA AG: PRODUCT PORTFOLIO

TABLE 045. KUKA AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ENSAI INGENIERIA S.L.: SNAPSHOT

TABLE 046. ENSAI INGENIERIA S.L.: BUSINESS PERFORMANCE

TABLE 047. ENSAI INGENIERIA S.L.: PRODUCT PORTFOLIO

TABLE 048. ENSAI INGENIERIA S.L.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. SIEMENS AG: SNAPSHOT

TABLE 049. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 050. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 051. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. ROCKWELL AUTOMATION INC.: SNAPSHOT

TABLE 052. ROCKWELL AUTOMATION INC.: BUSINESS PERFORMANCE

TABLE 053. ROCKWELL AUTOMATION INC.: PRODUCT PORTFOLIO

TABLE 054. ROCKWELL AUTOMATION INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. SCHNEIDER ELECTRIC: SNAPSHOT

TABLE 055. SCHNEIDER ELECTRIC: BUSINESS PERFORMANCE

TABLE 056. SCHNEIDER ELECTRIC: PRODUCT PORTFOLIO

TABLE 057. SCHNEIDER ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ABB LTD.: SNAPSHOT

TABLE 058. ABB LTD.: BUSINESS PERFORMANCE

TABLE 059. ABB LTD.: PRODUCT PORTFOLIO

TABLE 060. ABB LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. IBM CORPORATION: SNAPSHOT

TABLE 061. IBM CORPORATION: BUSINESS PERFORMANCE

TABLE 062. IBM CORPORATION: PRODUCT PORTFOLIO

TABLE 063. IBM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. MICROSOFT CORPORATION: SNAPSHOT

TABLE 064. MICROSOFT CORPORATION: BUSINESS PERFORMANCE

TABLE 065. MICROSOFT CORPORATION: PRODUCT PORTFOLIO

TABLE 066. MICROSOFT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. CISCO SYSTEMS INC.: SNAPSHOT

TABLE 067. CISCO SYSTEMS INC.: BUSINESS PERFORMANCE

TABLE 068. CISCO SYSTEMS INC.: PRODUCT PORTFOLIO

TABLE 069. CISCO SYSTEMS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. GENERAL ELECTRIC COMPANY: SNAPSHOT

TABLE 070. GENERAL ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 071. GENERAL ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 072. GENERAL ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. INDUSTRY 5.0 MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. INDUSTRY 5.0 MARKET OVERVIEW BY TECHNOLOGY

FIGURE 012. INDUSTRIAL ROBOTICS (COLLABORATIVE ROBOTS MARKET OVERVIEW (2016-2028)

FIGURE 013. SCARA ROBOTS MARKET OVERVIEW (2016-2028)

FIGURE 014. AND OTHERS) MARKET OVERVIEW (2016-2028)

FIGURE 015. INTERNET OF THINGS (IOT) MARKET OVERVIEW (2016-2028)

FIGURE 016. CYBER SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 017. ADVANCED HUMAN-MACHINE INTERFACE (HMI) MARKET OVERVIEW (2016-2028)

FIGURE 018. 3D PRINTING MARKET OVERVIEW (2016-2028)

FIGURE 019. BIG DATA MARKET OVERVIEW (2016-2028)

FIGURE 020. CLOUD COMPUTING MARKET OVERVIEW (2016-2028)

FIGURE 021. AUGMENTED REALITY & VIRTUAL REALITY MARKET OVERVIEW (2016-2028)

FIGURE 022. COGNITIVE COMPUTING MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. INDUSTRY 5.0 MARKET OVERVIEW BY END-USE

FIGURE 025. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 026. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 027. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 028. SUPPLY CHAIN MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 029. ELECTRICAL & ELECTRONICS EQUIPMENT MARKET OVERVIEW (2016-2028)

FIGURE 030. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 031. NORTH AMERICA INDUSTRY 5.0 MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. EUROPE INDUSTRY 5.0 MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. ASIA PACIFIC INDUSTRY 5.0 MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. MIDDLE EAST & AFRICA INDUSTRY 5.0 MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. SOUTH AMERICA INDUSTRY 5.0 MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Industry 5.0 Market research report is 2024-2032.

Siemens AG, IBM Corporation, KUKA AG, Rockwell Automation Inc, NSAI INGENIERIA S.L., ABB Ltd., Microsoft Corporation, Cisco Systems, and Other major players.

The Industry 5.0 Market is segmented into Technology, End-Use Vertical, and Region. By Technology, the market is categorized into Industrial Robotics, Cyber Security, Internet of Things (IoT), 3D Printing, Advanced Human-Machine Interface (HMI), Big Data, Augmented Reality & Virtual Reality, Cloud Computing, Cognitive Computing, and Others. By End-Use Vertical, the market is categorized into Manufacturing, Supply Chain Management, Automotive, Healthcare, Electrical & Electronic Equipment, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Industry 5.0 is a new manufacturing paradigm that places a premium on human-machine interaction. The rise of the digital industry preceded Industry 5.0 with innovations such as the Industrial Internet of Things or the merging of Artificial Intelligence and Big Data created a new form of technology that can provide firms with data-based knowledge.

Industry 5.0 Market Size Was Valued at USD 154.73 Billion in 2023, and is Projected to Reach USD 691.02 Billion by 2032, Growing at a CAGR of 18.09% From 2024-2032