Malonic Acid Market Overview

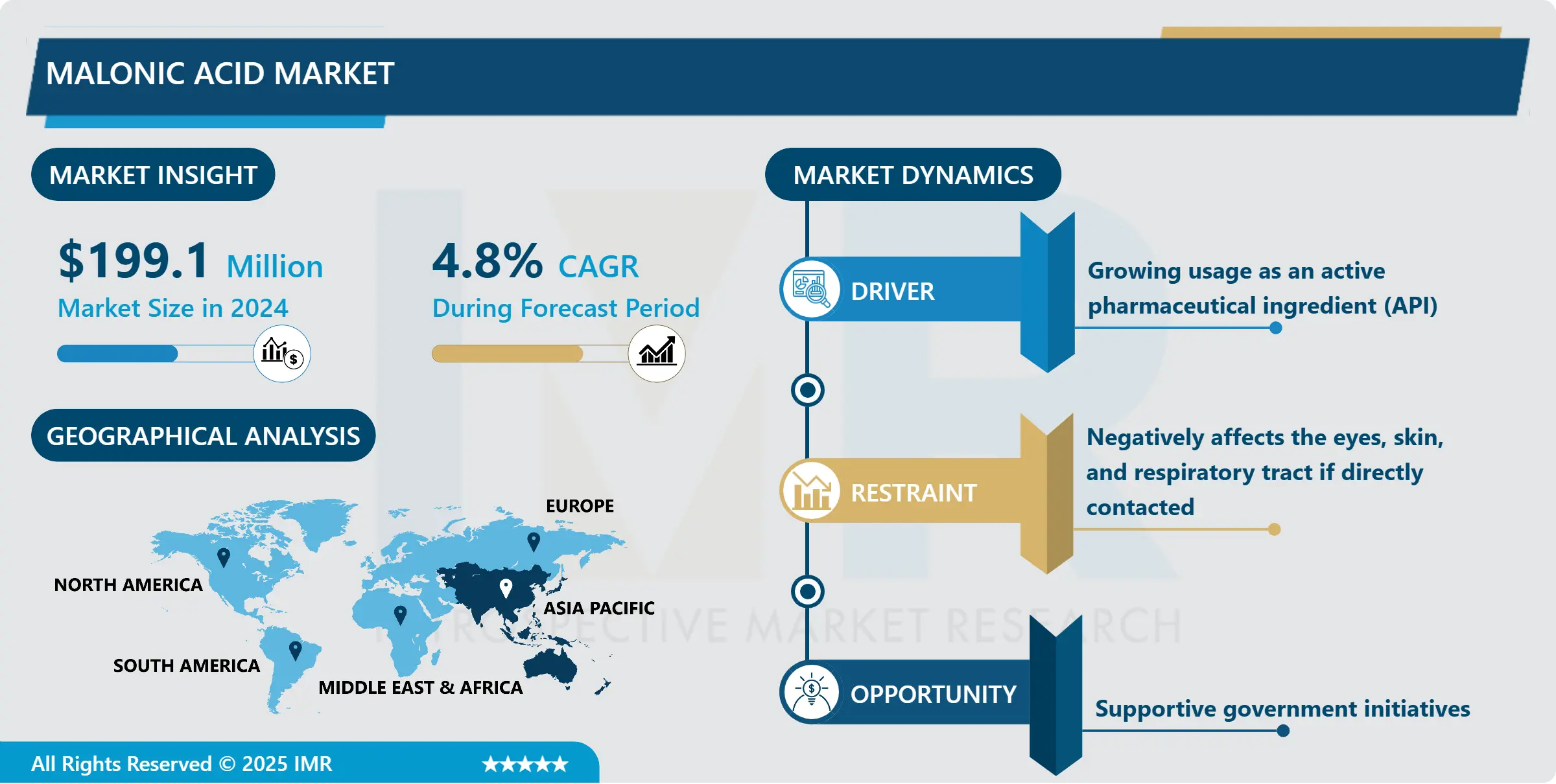

The Malonic Acid Market size was valued at USD 199.1 Million in 2024 and is projected to reach USD 333.46 Million by 2035, growing at a CAGR of 4.70% from 2025 to 2035.

Malonic acid has the formula CH2(COOH)2 and is a dicarboxylic acid. Malonates are the ionized form of malonic acid, as well as its esters and salts. Diethyl malonate, for instance, is the diethyl ester of malonic acid. Malonic acid is a chemical that is used to make specialized polyesters. For the application in polyesters and polymers, it can be transformed to 1,3-propanediol (whose usefulness is unclear though). It may also be found as a component in alkyd resins, which are utilized in a variety of coatings to protect against UV rays, oxidation, and corrosion.

Malonic acid is used in the coatings industry as a crosslinker for low-temperature cure powder coatings, which are becoming more popular as heat-sensitive substrates and the desire to speed up the coatings process become more important. It is employed as a high-value specialty chemical in a variety of production processes, including electronics, tastes & perfumes, specialized solvents, polymer crosslinking, and pharmaceuticals. Malonic acid is a building block chemical that is used to make a variety of useful chemicals, including gamma-nonalactone, cinnamic acid, and valproate, a medicinal molecule. Malonic acid (up to 37.5 percent w/w) was utilized to cross-link corn and potato starches to create a biodegradable thermoplastic, which was done in water with non-toxic catalysts. Food packaging, foam packaging, and compost bags were the most common end-use categories for starch-based polymers, accounting for 38 percent of the worldwide biodegradable polymers market. Malonic acid and derivatives are used as surgical adhesives by Eastman Kodak and others.

Market Dynamics and Factors for the Malonic Acid Market:

Drivers:

- Due to the increased application of the concoction, the worldwide malonic acid market has grown significantly in recent years. The expanding interest in acid in the covering and pharmaceutical industries is to blame for the increased usage. Malonic acid's ability to transport Diclazuril and a variety of nutrients, including B6, B2, and B1, has sparked a surge in interest for its usage as an active pharmaceutical ingredient (API). Diclazuril is a non-steroidal, mitigating specialist. During the forecast period, this aspect is likely to influence the worldwide malonic acid market's growth. The worldwide malonic acid market will benefit from the acceptance of organic and inorganic development techniques, as well as increased demand from end-use industries such as polymer and plastics, coatings, and pharmaceuticals, among others. Guidelines for the use of bio-based synthetic chemicals in Europe and the United States will help controllable development since certain players are focusing on the development of bio-courses for the production of malonic acid. Malonic acid was identified as one of the recognizable synthetics in a study released by the US Department of Energy on the Top 30 worth of synthetic compounds that may be generated from biomass-inferred sugar. To comply with government rules, a few players are focusing on the development of bio-based courses for the assembly of malonic corrosive.

Restraints:

- When exposed to malonic acid, it can cause a range of symptoms in the eyes, skin, and respiratory tract. It may irritate the eyes and skin. The chemical might irritate the respiratory tract if inhaled. It has the potential to inflict serious harm or pain to the eyes. As a result, if your eyes are exposed, rinse them with simple water or a saline solution. If there are any symptoms of redness or irritation on the affected skin, it should be washed with water very soon. It's crucial to get rid of the contaminated garments. If ingested, it may cause gastrointestinal distress such as nausea, vomiting, and other symptoms. The mouth should be cleaned with water many times as soon as possible, and medical help should be sought. It's a strong irritant that can cause serious damage to the skin and mucous membranes. When the chemical is heated, it produces hazardous carbon dioxide and monoxide fumes, as well as other chemicals that can irritate the respiratory system if inhaled. These factors are expected to be responsible for hindering the growth of the malonic acid market during the forecast period.

Opportunities:

- Demand in the worldwide market will be supported by the adoption of organic and inorganic growth strategies, as well as increased demand from end-use industries such as polymer and plastics, coatings, and pharmaceuticals, among others. Regulations governing the use of bio-based chemicals in Europe and the United States will aid in the development of sustainable development, which is why various players are focusing on the development of bio-routes for the synthesis of malonic acid. Malonic acid was listed as one of the top 30 value-added compounds that may be made from biomass-derived sugar in research issued by the US Department of Energy. As a result, various firms are concentrating their efforts on developing bio-based pathways for the production of malonic acid to comply with regulatory requirements.

Market Segmentation

- Based on the function, the API segment is expected to capture maximum market share over the forecast period. Growth in demand for malonic acid as an active pharmaceutical ingredient (API), helped by its rising application for manufacturing Diclazuril, non-steroidal anti-inflammatory agents, and different vitamins, such as B1, B2, B6, among others, have been the major factors responsible for the growth of this segment.

- Based on the application, the paints & coatings segment is anticipated to dominate the malonic acid market over the forecast period. Malonic acid discovers its application as a crosslinking agent in low-temperature powder coatings. With the paints & coatings industry switching towards water-based and powder coating systems, from traditional solvent-borne coatings, the demand for malonic acid is anticipated to observe a healthy upsurge. These non-conventional paints and coatings significantly overcome the volatile organic compound (VOC) emissions, in turn, causing raised traction across various parts of the globe.

Regional Analysis for the Malonic Acid Market:

- The market for malonic acid is likely to be dominated by the Asia Pacific. China is the world's and the region's top chemical manufacturer. The region's growth is due to increased interest from the pharmaceutical industry in the area. The Chemical Dialogue of the Asia-Pacific Economic Cooperation (APEC) hosted a discussion on the region's strategic framework for 2020-2023. The Chemical Dialogue is the primary platform for the chemical sector in Asia and the Pacific, which accounts for nearly 45 percent of world chemical manufacturing, 7% of global GDP, and 69 percent of global chemical jobs.

- Over the projected period, the malonic acid market in North America is predicted to rise at a high rate. Much research has been done on biobased malonic acid synthesis during the last two decades. Lygos, a venture-capital firm based in Berkeley, California, has received US$13 million to scale up a technique that employs bioengineered yeast strains to create malonic acid from carbohydrates.

- The European Commission has acknowledged the chemical industry's critical role in assisting society in achieving the new European Green Deal goals. Cefic has said unequivocally that business supports the Green Deal and Europe's goal of being carbon neutral by 2050. The development of the malonic acid market in Europe is expected to be aided by guidelines relating to the use of bio-based synthetic chemicals in European countries. The chemical sector is an important element of Europe's economy, and its creative solutions are critical for achieving a low-carbon, circular economy both within and outside of Europe's borders.

Players Covered in Malonic Acid market are :

- Lonza

- Lygos

- Silworld

- Shanghai Nanxiang Reagent Co. Ltd.

- Trace Zero

- Tateyamakasei

- Bramha Scientific

- Lianyungang Huasheng and other major players.

- Alfa Aesar (USA)

- Zhengzhou Huaqiang (China)

- Shandong Kunda Biotechnology Co., Ltd. (China)

- Lianmeng Chemical (China)

- Jiangsu Zhongtai International (China)

- Hubei Jusheng Technology Co., Ltd. (China)

- Shaanxi Top Pharm Chemical Co., Ltd. (China)

- Wuhan Youji Industries Co., Ltd. (China)

- Jiangxi Hengcheng Pharmaceutical Co., Ltd. (China)

- Hangzhou Fanda Chemical Co., Ltd. (China)

- Suzhou Sunho Chemical Co., Ltd. (China)

- Kraton Polymers (USA)

- Arkema Group (France)

- Merck KGaA (Germany)

- Shandong Xinhua Pharmaceutical Co., Ltd. (China)

- Other Major Players.

Key Industry Developments in the Malonic Acid Market:

- In February 2019, Lygos, Inc., a full-stack producer of petroleum-free specialty chemicals that deliver high-value performance without environmental toxicity, today announced a new partnership with the Center for University of Massachusetts Industry Research on Polymers (CUMIRP), to Expand Applications of its Bio-Malonic Acid Product Family. The nation's oldest National Science Foundation Industry / University Cooperative Research Center is dedicated to polymer research.

|

Global Malonic Acid Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2035 |

Market Size in 2024: |

USD 199.1 Mn. |

|

Forecast Period 2025-35 CAGR: |

4.8% |

Market Size in 2035: |

USD 333.46 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Malonic Acid Market by Type (2018-2035)

4.1 Malonic Acid Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Technical Grade

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pharmaceutical grade

Chapter 5: Malonic Acid Market by Function (2018-2035)

5.1 Malonic Acid Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Additive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 API

5.5 Precursor

5.6 Other

Chapter 6: Malonic Acid Market by Application (2018-2035)

6.1 Malonic Acid Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pharmaceutical

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Flavor & Fragrance

6.5 Paint & Coating

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Malonic Acid Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SCHLEUNIGER (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 KOMAX (SWITZERLAND)

7.4 ERASER (UNITED STATES)

7.5 KODERA (JAPAN)

7.6 MK ELECTRONICS LTD (JAPAN)

7.7 ARTOS ENGINEERING (UNITED STATES)

7.8 CARPENTER MANUFACTURING COMPANY INC. (UNITED STATES)

7.9 MACHINE MAKERS R.S. (INDIA)

7.10 METZNER MASCHINENBAU GMBH (GERMANY)

7.11 MAPLE LEGEND INC. (CANADA)OTHER KEY PLAYERS

Chapter 8: Global Malonic Acid Market By Region

8.1 Overview

8.2. North America Malonic Acid Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Technical Grade

8.2.4.2 Pharmaceutical grade

8.2.5 Historic and Forecasted Market Size by Function

8.2.5.1 Additive

8.2.5.2 API

8.2.5.3 Precursor

8.2.5.4 Other

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Pharmaceutical

8.2.6.2 Flavor & Fragrance

8.2.6.3 Paint & Coating

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Malonic Acid Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Technical Grade

8.3.4.2 Pharmaceutical grade

8.3.5 Historic and Forecasted Market Size by Function

8.3.5.1 Additive

8.3.5.2 API

8.3.5.3 Precursor

8.3.5.4 Other

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Pharmaceutical

8.3.6.2 Flavor & Fragrance

8.3.6.3 Paint & Coating

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Malonic Acid Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Technical Grade

8.4.4.2 Pharmaceutical grade

8.4.5 Historic and Forecasted Market Size by Function

8.4.5.1 Additive

8.4.5.2 API

8.4.5.3 Precursor

8.4.5.4 Other

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Pharmaceutical

8.4.6.2 Flavor & Fragrance

8.4.6.3 Paint & Coating

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Malonic Acid Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Technical Grade

8.5.4.2 Pharmaceutical grade

8.5.5 Historic and Forecasted Market Size by Function

8.5.5.1 Additive

8.5.5.2 API

8.5.5.3 Precursor

8.5.5.4 Other

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Pharmaceutical

8.5.6.2 Flavor & Fragrance

8.5.6.3 Paint & Coating

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Malonic Acid Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Technical Grade

8.6.4.2 Pharmaceutical grade

8.6.5 Historic and Forecasted Market Size by Function

8.6.5.1 Additive

8.6.5.2 API

8.6.5.3 Precursor

8.6.5.4 Other

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Pharmaceutical

8.6.6.2 Flavor & Fragrance

8.6.6.3 Paint & Coating

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Malonic Acid Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Technical Grade

8.7.4.2 Pharmaceutical grade

8.7.5 Historic and Forecasted Market Size by Function

8.7.5.1 Additive

8.7.5.2 API

8.7.5.3 Precursor

8.7.5.4 Other

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Pharmaceutical

8.7.6.2 Flavor & Fragrance

8.7.6.3 Paint & Coating

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Malonic Acid Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2035 |

Market Size in 2024: |

USD 199.1 Mn. |

|

Forecast Period 2025-35 CAGR: |

4.8% |

Market Size in 2035: |

USD 333.46 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||