LTCC and HTCC Market Synopsis

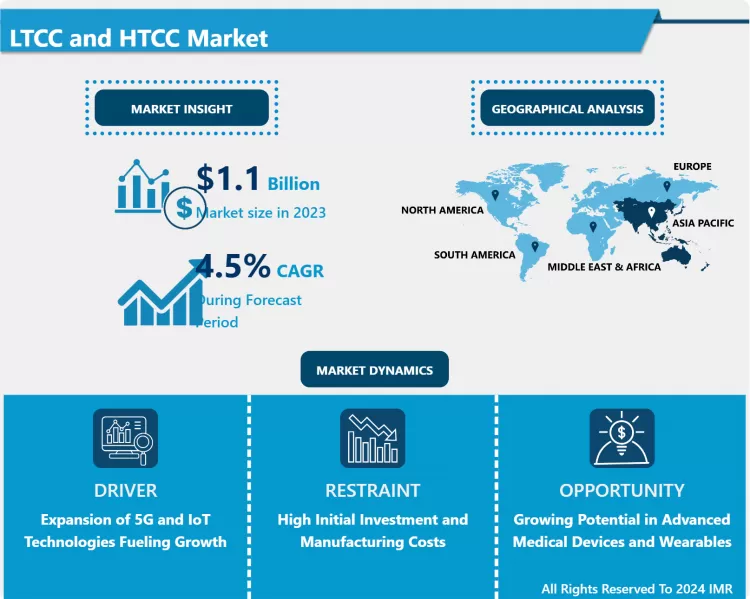

LTCC and HTCC Market Size is Valued at USD 1.1 Billion in 2023, and is Projected to Reach USD 1.56 Billion by 2032, Growing at a CAGR of 4.50% From 2024-2032.

Low and High-Temperature Co-Fired Ceramic (LTCC and HTCC) are important material type in electronics industry especially for substrate type packaging for integration of several elements in compact electronic devices. Although firing temperatures vary, LTCC has lower temperatures below 900°C in which it can incorporate silver or copper conductors while HTCC has firing temperatures above 1600°C, employing tungsten or molybdenum conductors. Both technologies are essential in hi-rel applications to automotive, telecommunication, aircraft, aerospace, and consumer electronics markets because of their high thermal & electrical integrity, mechanical ruggedness and fine line patterning.

- The miniaturization and high-performance electronic products are the main factors aiding the growth of both LTCC and HTCC markets. In automotive and telecommunication industries for example, the requirement of small and integrated modules has pushed the use of LTCC and HTCC in the ECU, sensors, and RF. This need has been further propelled by the increasing move towards self-driving vehicles, and electric cars that would need superior quality electronic systems. Furthermore, the development of 5G technology and increasing the sales of IoT devices have greatly increased the use of LTCC in telecommunication equipment due to its high-frequency performance.

- The other driver is the sprit of new technological innovation in such sectors as medical equipment and aircraft industries. LTCC and HTCC components are used in healthcare industry particularly in medical imaging, diagnosing devices, and implants since high-reliability components are required and since the components possess excellent thermal properties. Likewise, the growing utilization of sensors, radar and interconnected communication systems that demand rebellious and high temperature successive components in aerospace & defense industry have also fueled the utilization of HTCC technology. As end user industries seek less costly and smaller alternatives, the LTCC and HTCC markets remain vibrant.

LTCC and HTCC Market Trend Analysis

Increased Integration Of These Materials In 5G Infrastructure.

- One clear emerging market trend is the drive towards utilization of LTCC and HTCC components in the construction of 5G networks. progressing in the global scale, the requirement of high-frequency performance from RF modules, filters, and antennas has led to the use of LTCC technology. Because of its capacity to deliver stable performance on high-frequency, high-temperature situations, in addition to miniaturization, the technology is well-suited for 5G base stations and mobile applications. This trend is expected to build up further as the adoption of 5G network increases coupled with development of smart cities and IoT.

- Further, the LTCC and HTCC market trends show that environmental sustainability is gradually emerging as a key aspect. There is more emphasis put on managing the environmental footprint of both processes and materials used in production processes of manufacturers. The campaign to employ environmentally friendly and recyclable materials in the manufacture of products aimed for the market together with the efficient energy use manufacturing techniques is picking up frenzy. This is especially the case in areas of the world where environmental standards are on the increase, thus exposing manufacturing companies to the need to look at materials and methods in new ways.

Rising Adoption Of Electric Vehicles (EVs) And Autonomous Driving Technology.

- The LTCC and HTCC markets have the major potential in the growth, mainly in automotive applications. The market drivers such as the use of EVs and autonomous driving cars require high-performance electronic control units, sensors, and power electronics. LTCC and HTCC technologies suits this demanding application due to the high thermal stability, as well as the required electrical performance which has application in the advance driver assistance system and battery management systems.

- One of these is in the field of health care where there is increasing need for small and very reliable electronic which are used in operation of different medical facilities. As more money is being put into wearables and implantables in healthcare and medicine, LTCC and HTCC material should experience increased usage in sensors, wireless communication modules, and diagnostics. These properties of engineering materials make it possible to achieve high performance and reliable components in compact size enhancing the future technological development in the medical field.

LTCC and HTCC Market Segment Analysis:

- LTCC Market and HTCC Market Segmented on the basis of Material type, application, and end-users.

By Material Type, Glass-Ceramic segment is expected to dominate the market during the forecast period

- The LTCC and HTCC material is further segmented into glass-ceramic, ceramic and other material in the global market. LTCC technology incorporates glass-ceramic materials because they melt at lower temperatures allowing the use of metal conductors such as silver and copper. These materials provide good dielectric constants, and resist heat which makes them appropriate for use in high frequency circuits. Dutch ceramics, seen mainly in HTCC, involve usage of high firing temperatures and are usually associated with noble metals inclusive of tungsten and molybdenum. They give improved mechanical properties, thermal stability and dependability which is paramount in peripheral functions that require materiFast stable performance under arduous conditions. The remaining portion comprises other composites, including hybrids, which are created for certain applications to possess unique characteristics like improved electrical conductivity, thermal dissipation or mechanical character.

By Application, Automotive segment held the largest share in 2024

- In the LTCC and HTCC markets, applications span several key industries. In automotive, these materials are used for electronic control units, sensors, and power modules, especially in electric and autonomous vehicles, where compact, heat-resistant components are essential. In telecommunications, LTCC technology is integral for high-frequency devices such as antennas, filters, and RF modules, particularly in 5G infrastructure. Aerospace and defense sectors utilize HTCC components for high-temperature applications like radar systems and missile guidance, where durability and reliability are crucial. Medical devices benefit from the miniaturization and reliability offered by LTCC and HTCC in diagnostic equipment, implants, and wearable technology. Consumer electronics, including smartphones and laptops, rely on these materials for miniaturized components that improve performance while reducing size. In industrial applications, LTCC and HTCC are employed in sensors, control systems, and power modules for enhanced operational efficiency and durability. The "others" category includes emerging applications such as renewable energy and smart infrastructure, where these materials provide reliability and performance.

LTCC and HTCC Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The LTCC and HTCC market is headed by Asia-Pacific region due to the huge electronics industries and automotive industries. China, Japan and South Korea are leading the technological advancement worldwide in electronic products, communication technology, and automobile industries. High usage of LTCC and HTCC in these industries for developing small electronic parts has attracted tremendous investments in manufacturing plants of LTCC and HTCC in the region. Moreover, the rising number of electric vehicles and the development of the 5G network in these countries increases market demand.

- Added to this, government policies encouraging technological growth and manufacturing industry especially across the Asia-Pacific is another factor that gives this market a strong lead in the LTCC and HTCC market. China aspiration to become a leader in the production of electric vehicles and Japan expertise in telecommunications and electronics is one of the attributes that drive the sustained domination of the Asia-Pacific in these markets.

Active Key Players in the LTCC Market and HTCC Market

- Murata Manufacturing Co., Ltd. (Japan)

- Kyocera Corporation (Japan)

- TDK Corporation (Japan)

- Yokowo Co., Ltd. (Japan)

- Hitachi Metals, Ltd. (Japan)

- KOA Corporation (Japan)

- NGK Spark Plug Co., Ltd. (Japan)

- DuPont de Nemours, Inc. (United States)

- Bosch GmbH (Germany)

- Mini-Systems, Inc. (United States)

- Others

|

Global LTCC and HTCC Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.50 % |

Market Size in 2032: |

USD 1.56 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: LTCC and HTCC Market by Material Type

4.1 LTCC and HTCC Market Snapshot and Growth Engine

4.2 LTCC and HTCC Market Overview

4.3 Wafer

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Wafer: Geographic Segmentation Analysis

4.4 Substrate Materials

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Substrate Materials: Geographic Segmentation Analysis

4.5 Epitaxial Materials

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Epitaxial Materials: Geographic Segmentation Analysis

4.6 Phosphor

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Phosphor: Geographic Segmentation Analysis

Chapter 5: LTCC and HTCC Market by Application

5.1 LTCC and HTCC Market Snapshot and Growth Engine

5.2 LTCC and HTCC Market Overview

5.3 General Lighting

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 General Lighting: Geographic Segmentation Analysis

5.4 Automotive Lighting

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Automotive Lighting: Geographic Segmentation Analysis

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 LTCC and HTCC Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 MURATA MANUFACTURING CO LTD (JAPAN)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 KYOCERA CORPORATION (JAPAN)

6.4 TDK CORPORATION (JAPAN)

6.5 YOKOWO CO LTD (JAPAN)

6.6 HITACHI METALS LTD (JAPAN)

6.7 KOA CORPORATION (JAPAN)

6.8 NGK SPARK PLUG CO LTD (JAPAN)

6.9 DUPONT DE NEMOURS INC (UNITED STATES)

6.10 BOSCH GMBH (GERMANY)

6.11 MINI-SYSTEMS INC (UNITED STATES)

6.12 OTHERS

Chapter 7: Global LTCC and HTCC Market By Region

7.1 Overview

7.2 . North America LTCC and HTCC Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Material Type

7.2.4.1 Wafer

7.2.4.2 Substrate Materials

7.2.4.3 Epitaxial Materials

7.2.4.4 Phosphor

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 General Lighting

7.2.5.2 Automotive Lighting

7.2.5.3 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3 . Eastern Europe LTCC and HTCC Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Material Type

7.3.4.1 Wafer

7.3.4.2 Substrate Materials

7.3.4.3 Epitaxial Materials

7.3.4.4 Phosphor

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 General Lighting

7.3.5.2 Automotive Lighting

7.3.5.3 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Bulgaria

7.3.6.2 The Czech Republic

7.3.6.3 Hungary

7.3.6.4 Poland

7.3.6.5 Romania

7.3.6.6 Rest of Eastern Europe

7.4 . Western Europe LTCC and HTCC Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Material Type

7.4.4.1 Wafer

7.4.4.2 Substrate Materials

7.4.4.3 Epitaxial Materials

7.4.4.4 Phosphor

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 General Lighting

7.4.5.2 Automotive Lighting

7.4.5.3 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 Netherlands

7.4.6.5 Italy

7.4.6.6 Russia

7.4.6.7 Spain

7.4.6.8 Rest of Western Europe

7.5 . Asia Pacific LTCC and HTCC Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Material Type

7.5.4.1 Wafer

7.5.4.2 Substrate Materials

7.5.4.3 Epitaxial Materials

7.5.4.4 Phosphor

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 General Lighting

7.5.5.2 Automotive Lighting

7.5.5.3 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6 . Middle East & Africa LTCC and HTCC Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Material Type

7.6.4.1 Wafer

7.6.4.2 Substrate Materials

7.6.4.3 Epitaxial Materials

7.6.4.4 Phosphor

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 General Lighting

7.6.5.2 Automotive Lighting

7.6.5.3 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkey

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7 . South America LTCC and HTCC Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Material Type

7.7.4.1 Wafer

7.7.4.2 Substrate Materials

7.7.4.3 Epitaxial Materials

7.7.4.4 Phosphor

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 General Lighting

7.7.5.2 Automotive Lighting

7.7.5.3 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global LTCC and HTCC Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.50 % |

Market Size in 2032: |

USD 1.56 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||